Bankruptcy? Your Down Payment Just Got Fired.

Table of Contents

- Key Takeaways: Your Fast Track to No Money Down Car Loan Clarity

- The Phoenix Rises: Your Path to a Car Loan After Bankruptcy (Without a Down Payment)

- Myth vs. Reality: Why Your Down Payment Isn't Always Essential Post-Bankruptcy

- The 'Bankruptcy Stigma' and Why Lenders See You Differently (and How to Leverage It)

- The Down Payment Dilemma: Why 'No Money Down' is a Double-Edged Sword for Post-Bankruptcy Borrowers

- Decoding the Lenders: Who Will Say 'Yes' When Others Say 'No'?

- The Subprime Superheroes: Understanding Specialized Auto Lenders

- Beyond the Banks: Dealership Financing vs. Direct Lenders

- The Elusive 'Big Bank' Loan: Why It's a Long Shot (and How to Get There Eventually)

- Your Approval Arsenal: Building a Bulletproof Application (Without Cash Upfront)

- The Power of Proof: What Lenders Really Want to See

- The Co-Signer Compass: Navigating the Path with Support

- The Art of the Budget: Proving You Can Afford the Payments (and More)

- The Interest Rate Gauntlet: How to Fight for a Fair Deal (Even Without a Down Payment)

- Understanding APR: Why Your Rate Will Be Higher (and How to Mitigate It)

- Negotiation Tactics: It's Not Just About the Car Price

- Rebuilding with Every Payment: How This Loan Can Be Your Credit Catalyst

- Choosing Your Ride: Realistic Expectations for Your Post-Bankruptcy Vehicle

- New vs. Used: The Practical Choice for Your Situation

- The 'No Money Down' Car Selection: What's Available and What to Avoid?

- Beyond the First Loan: Your Roadmap to Financial Freedom and Better Rates

- The Refinancing Advantage: When and How to Lower Your Payments/Interest

Key Takeaways: Your Fast Track to No Money Down Car Loan Clarity

- Securing a 'no money down' car loan after bankruptcy is challenging but absolutely achievable with the right strategy and realistic expectations.

- Understand that 'no money down' often means higher interest rates and potentially longer loan terms, impacting the total cost.

- Specialized subprime lenders are your primary allies; traditional banks are less likely to approve such loans immediately after bankruptcy.

- This loan is a powerful tool for credit rebuilding; consistent, on-time payments are crucial.

- Prioritize practical, reliable used vehicles over expensive new or luxury models.

- Thorough preparation (documents, budget, research) is paramount to successful approval.

The Phoenix Rises: Your Path to a Car Loan After Bankruptcy (Without a Down Payment)

Bankruptcy. The word alone can feel like a financial guillotine, severing ties to your past debts but also, seemingly, to future opportunities like securing a car loan. If you’ve recently gone through this challenging process in Canada, you might feel like your dreams of a reliable vehicle, especially with no money down, have been completely "fired." We get it. The road back can seem daunting, filled with closed doors and skeptical glances from lenders.

But here’s the empowering truth: your down payment didn't get fired; it just took a temporary leave of absence. And you, the phoenix, are ready to rise. At SkipCarDealer.com, we believe that past financial struggles shouldn't indefinitely block your access to essential transportation. Securing a car loan after bankruptcy, even without a down payment, is not just a pipe dream – it's an actionable possibility. This comprehensive guide will illuminate the path, demystify the process, and equip you with the knowledge to drive away in a vehicle that fits your needs and helps rebuild your financial future.

We're going to explore who will lend to you, what they look for, and how you can maximize your chances of approval, all while understanding the nuances of 'no money down' financing in a post-bankruptcy landscape. Your journey to a car starts now.

Myth vs. Reality: Why Your Down Payment Isn't Always Essential Post-Bankruptcy

The common wisdom dictates that after bankruptcy, you absolutely must have a substantial down payment to even be considered for a car loan. This perception, while rooted in some truth about risk mitigation for lenders, isn't the full story. For many Canadians emerging from bankruptcy, a significant lump sum for a down payment simply isn't feasible. The good news is that specialized lenders understand this reality and have developed financing solutions that don't always require an upfront cash injection.

The "down payment just got fired" metaphor in our title speaks to this very challenge. It acknowledges the immediate aftermath of bankruptcy where liquid assets might be scarce. However, it also sets the stage for debunking the myth that a down payment is an unshakeable prerequisite. While a down payment always offers benefits, its absence doesn't automatically disqualify you, especially when you know where to look and what factors truly matter to lenders.

The 'Bankruptcy Stigma' and Why Lenders See You Differently (and How to Leverage It)

Bankruptcy is a double-edged sword in the eyes of a lender. On one hand, it clears your previous unsecured debts, theoretically making you "less risky" in terms of outstanding obligations. You're starting with a clean slate, free from the burden of overwhelming credit card balances or unsecured lines of credit. This fresh start can be a powerful narrative for your application.

On the other hand, the bankruptcy filing itself leaves a significant mark on your credit report. In Canada, a first-time bankruptcy typically remains on your credit report for 6 to 7 years from the date of discharge, depending on the province and credit bureau. This visible record signals to lenders that there was a period of financial distress, and it will inevitably lower your credit score. Lenders interpret this as a higher risk profile, as your past indicates a potential inability to manage debt.

However, the key for post-bankruptcy borrowers is understanding how to shift the lender's focus. Reputable specialized lenders don't dwell solely on the past. Instead, they pivot to your current income stability and future payment capacity. They want to see that you are employed, have a steady income, and have a realistic budget that demonstrates your ability to make consistent, on-time car loan payments moving forward. Your bankruptcy, while a historical event, can be presented as a reset, and your current financial discipline as proof of your readiness to rebuild.

For more on how your post-bankruptcy status affects loans, check out our guide on Discharged? Your Car Loan Starts Sooner Than You're Told.

The Down Payment Dilemma: Why 'No Money Down' is a Double-Edged Sword for Post-Bankruptcy Borrowers

In a perfect world, a down payment is always beneficial. It reduces the total amount you need to borrow, which in turn means less interest paid over the life of the loan, lower monthly payments, and often, better interest rates and terms from lenders. A down payment also signals to lenders that you have some financial stability and are invested in the purchase, reducing their risk.

However, for many individuals post-bankruptcy, having a significant down payment simply isn't an option. Whether it's due to depleted savings, the need to rebuild an emergency fund, or simply not having the cash readily available, 'no money down' becomes a necessity rather than a choice. This is where the double-edged sword comes into play.

The trade-offs for a 'no money down' loan are important to understand. You should expect:

- Higher Interest Rates: Without a down payment, the lender is taking on more risk, and they compensate for this by charging a higher Annual Percentage Rate (APR).

- Increased Total Cost of the Loan: A larger principal amount borrowed, combined with a higher interest rate, means you will pay significantly more over the life of the loan.

- Potential for Longer Terms: To make monthly payments more affordable, lenders might offer longer loan terms (e.g., 72 or 84 months). While this reduces the monthly burden, it also extends the period over which you pay interest, further increasing the total cost.

- Higher Monthly Payments (if terms aren't extended): If you opt for a shorter term to save on interest, your monthly payments will be higher without a down payment to reduce the principal.

Decoding the Lenders: Who Will Say 'Yes' When Others Say 'No'?

Navigating the lending landscape after bankruptcy can feel like trying to find a needle in a haystack. Traditional banks, with their stringent credit score requirements, are often out of reach. But that doesn't mean all doors are closed. A specialized ecosystem of lenders exists specifically to serve individuals with challenging credit histories, including those who have recently gone through bankruptcy.

The Subprime Superheroes: Understanding Specialized Auto Lenders

What exactly defines a subprime lender? Simply put, they are financial institutions or departments within dealerships that specialize in lending to borrowers with lower credit scores or challenging credit histories. Unlike prime lenders (traditional banks), subprime lenders have a higher risk tolerance and employ different underwriting criteria. They understand that life happens and that a bankruptcy doesn't define your future financial responsibility.

Their business model is designed to cater to individuals who might not qualify for conventional loans. Instead of focusing solely on your credit score, they place significant emphasis on your current income stability, employment history, debt-to-income ratio, and your ability to demonstrate a renewed commitment to financial responsibility. They see a car loan as an opportunity for you to rebuild your credit, and they structure their loans accordingly.

However, it's crucial to identify reputable subprime lenders. The market can, unfortunately, attract predatory lenders who exploit vulnerable borrowers. Here are red flags to watch out for:

- Guaranteed Approval Without Checks: No legitimate lender can guarantee approval without reviewing your financial situation. Be wary of anyone promising a loan with "no questions asked."

- Excessive Fees: Watch out for unusually high administrative fees, application fees, or hidden charges that inflate the cost of the loan.

- Pressure Tactics: Reputable lenders will give you time to review terms and ask questions. Avoid those who rush you into signing or refuse to provide clear explanations.

- Lack of Transparency: Ensure all terms, including interest rates, total cost, and any penalties, are clearly outlined in writing.

Beyond the Banks: Dealership Financing vs. Direct Lenders

When seeking a post-bankruptcy, no money down car loan, you'll primarily encounter two avenues:

- Dealership Finance Departments: Many dealerships have dedicated finance departments that work with a network of lenders, including subprime specialists. This can be a convenient "one-stop shop" as they can help you find a vehicle and secure financing all in one place. They often have established relationships with multiple lenders, increasing your chances of finding an approval. They act as intermediaries, presenting your application to various suitable lenders.

- Direct Lenders (Online or Specialized Finance Companies): These are companies that specialize in auto loans for individuals with less-than-perfect credit. You can apply directly with them online or in person. They might offer a pre-approval, which gives you a strong negotiating tool when you visit a dealership. SkipCarDealer.com, for instance, connects you with a network of lenders and dealerships ready to work with your unique situation.

A specific model to be cautious with is the 'Buy Here, Pay Here' (BHPH) dealership. These dealerships finance the loan themselves, cutting out third-party lenders. While they offer easy approval, especially for those with severe credit challenges, they often come with significant drawbacks:

- Very High Interest Rates: BHPH loans typically have some of the highest interest rates in the market.

- Limited Reporting to Credit Bureaus: Many BHPH dealers do not report your payments to the major credit bureaus, which means your consistent, on-time payments won't help you rebuild your credit score. This defeats a major purpose of getting a loan after bankruptcy.

- Potential for Predatory Terms: Contracts can sometimes contain unfavourable clauses, and vehicles might be older or have higher mileage.

BHPH should generally be considered a last resort if all other options have been exhausted and reliable transportation is absolutely critical for employment. Even then, ensure you understand every term of the agreement.

Many dealerships specialize in bad credit or bankruptcy financing. When working with them, expect a more thorough review of your income, employment history, and budget, rather than just your credit score. They understand the nuances of your situation and are equipped to match you with appropriate lenders.

The Elusive 'Big Bank' Loan: Why It's a Long Shot (and How to Get There Eventually)

Immediately after bankruptcy, securing a car loan from a traditional "big bank" (like RBC, TD, CIBC, etc.) is highly unlikely, especially with no money down. Their lending criteria are typically geared towards borrowers with strong credit scores and established credit histories. They prioritize minimal risk and often have strict internal policies regarding recent bankruptcies.

However, the goal isn't to get a prime bank loan today. The goal is to get a reliable car today and work towards a prime bank loan in the future. The importance of rebuilding credit cannot be overstated. By successfully managing your subprime car loan with consistent, on-time payments, you will gradually improve your credit score. Over time, as your credit history strengthens and the bankruptcy ages on your report, you will become eligible for better rates and terms from traditional banks, potentially through refinancing your current loan or for future purchases.

Your Approval Arsenal: Building a Bulletproof Application (Without Cash Upfront)

Since you won't have a down payment to bolster your application, your focus must shift to other critical areas that lenders prioritize. Think of your application as a comprehensive financial resume, showcasing your stability, responsibility, and ability to repay the loan. The more thoroughly you prepare, the stronger your case will be.

The Power of Proof: What Lenders Really Want to See

Lenders, especially subprime ones, are looking for evidence that your financial situation has stabilized since your bankruptcy. They want confidence that you are a reliable borrower today. Here's what they'll scrutinize:

- Stable Income: This is paramount. Lenders need to see a consistent, verifiable source of income. This means recent pay stubs (typically 3-6 months' worth), a letter of employment confirming your position and salary, and a clear employment history. If you're self-employed, this might involve bank statements, tax returns, or invoices. For more on this, consider reading Self-Employed? Your Bank Statement is Our 'Income Proof'. Even if you're on EI, there are options available, as detailed in Denied a Car Loan on EI? They Lied. Get Approved Here.

- Proof of Residence: Demonstrating stability in your living situation is another key indicator of reliability. Lenders will ask for utility bills (electricity, gas, internet), a current lease agreement, or mortgage statements. They want to see that you have a fixed address and are not constantly moving.

- Debt-to-Income Ratio (DTI): This ratio compares your total monthly debt payments (including the proposed car loan) to your gross monthly income. Post-bankruptcy, your DTI might look favourable because many old debts have been discharged. However, lenders will calculate your new DTI, ensuring that the car payment, along with any other existing obligations (rent/mortgage, other small loans), doesn't consume too large a percentage of your income. Generally, a DTI below 40-45% is considered manageable, but this can vary by lender.

- References: While not always required for a standard auto loan, some specialized lenders, particularly those dealing with higher-risk borrowers, might ask for personal or professional references. These are typically used to verify your character and reliability, especially if your credit file is thin post-bankruptcy.

The Co-Signer Compass: Navigating the Path with Support

If you're finding it difficult to secure a 'no money down' loan on your own after bankruptcy, a co-signer can be a game-changer. A co-signer, typically someone with good credit and a stable income, agrees to be equally responsible for the loan if you default. This significantly mitigates the risk for the lender, making them much more likely to approve your application and potentially offer better terms or a lower interest rate.

Who can be a co-signer? Usually, it's a trusted family member or close friend who understands the responsibility involved. They must have strong credit, a stable income, and a clear understanding that if you miss payments, their credit will be negatively affected, and they will be legally obligated to make those payments. It’s a serious commitment for them, so open and honest communication is vital.

While a co-signer can be a powerful tool, it's not always an option or a necessity. Many specialized lenders will approve loans based solely on your post-bankruptcy income stability and ability to pay. However, if you have a co-signer available, it's worth exploring as it can open doors to more favourable financing.

The Art of the Budget: Proving You Can Afford the Payments (and More)

Lenders don't just care if you can afford the monthly car payment; they care if you can afford the total cost of vehicle ownership. This is a crucial distinction, especially for post-bankruptcy borrowers who need to demonstrate robust financial planning. Beyond the loan payment itself, you need to budget for:

- Insurance: Auto insurance premiums can be higher for post-bankruptcy borrowers due to their credit history, which insurers often consider. Get quotes before committing to a vehicle.

- Fuel: Calculate your estimated monthly fuel costs based on your commute and driving habits.

- Maintenance and Repairs: Even reliable used cars need regular oil changes, tire rotations, and occasional repairs. Allocate a monthly amount for this.

- Registration and Licensing: Annual fees vary by province but are a recurring cost.

- Parking: If applicable, factor in monthly parking fees.

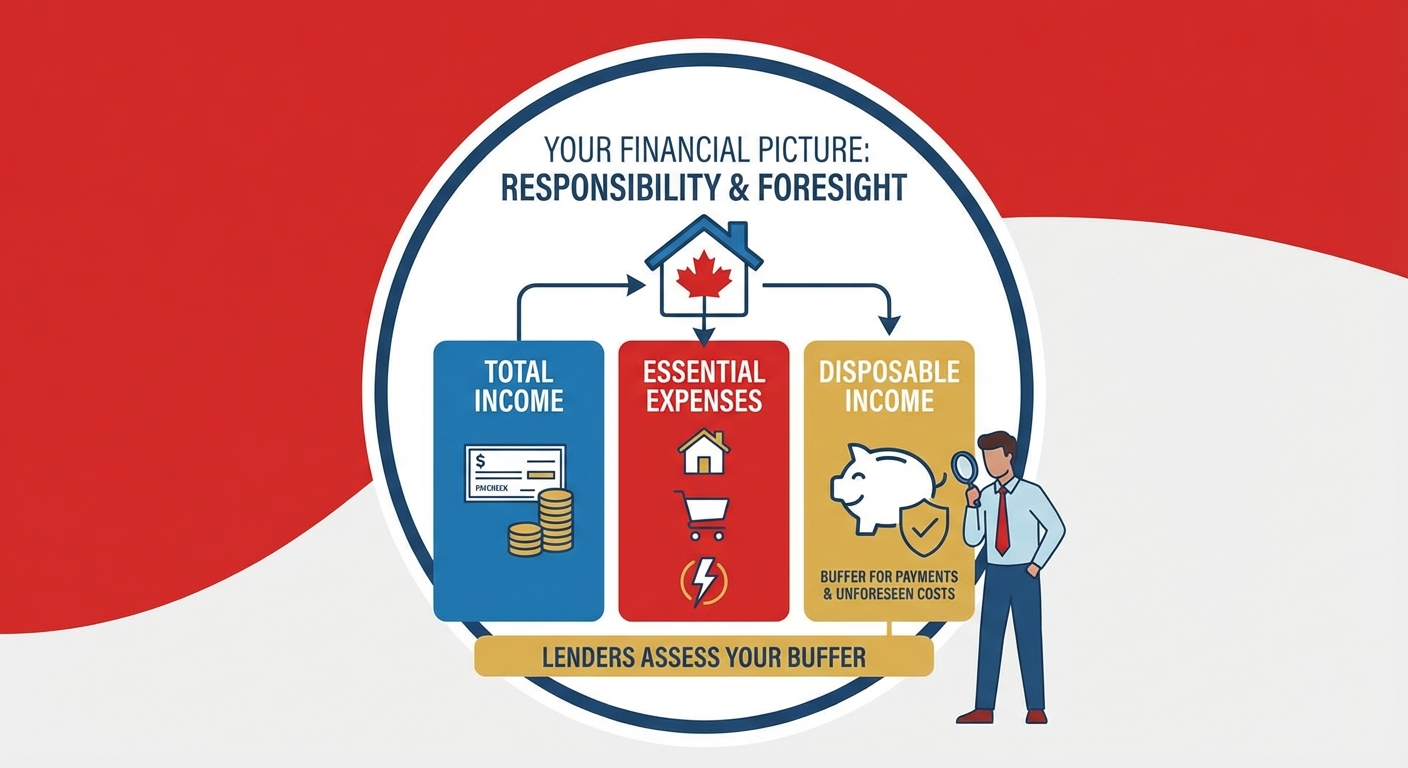

Creating a realistic, detailed post-bankruptcy budget is not just for your benefit; it's a powerful tool to present to lenders. It demonstrates that you've thought through all the financial implications of car ownership and that the loan payment is a manageable part of your overall financial picture. This shows responsibility and foresight. Lenders will assess your disposable income – what's left after all essential expenses – to ensure you have enough buffer to comfortably make payments and handle unforeseen costs.

An infographic illustrating a comprehensive breakdown of total monthly car ownership costs (loan, insurance, fuel, maintenance, parking, etc.), emphasizing the need for a detailed budget for post-bankruptcy approval beyond just the loan payment itself.

The Interest Rate Gauntlet: How to Fight for a Fair Deal (Even Without a Down Payment)

Let's be upfront: securing a car loan after bankruptcy with no money down will almost certainly come with a higher interest rate than someone with excellent credit. This is simply a reflection of the increased risk lenders perceive. However, "higher" doesn't mean "unreasonable" or "unnegotiable." Understanding how interest rates work and employing smart strategies can help you secure the best possible deal given your circumstances.

Understanding APR: Why Your Rate Will Be Higher (and How to Mitigate It)

The Annual Percentage Rate (APR) is the true annual cost of borrowing, expressed as a percentage. It includes not only the nominal interest rate but also any additional fees or charges rolled into the loan. For post-bankruptcy borrowers, several factors contribute to a higher APR:

- Risk Assessment: Your recent bankruptcy signals a higher risk of default to lenders. To compensate for this risk, they charge a higher premium (interest).

- Lack of Collateral (Down Payment): Without an upfront payment, the lender is financing 100% of the vehicle's value, increasing their exposure if you default and the car depreciates rapidly.

- Limited Credit History Post-Bankruptcy: Immediately after discharge, your credit file might be thin, making it harder for lenders to assess your current repayment behaviour.

While a higher rate is expected, there are strategies to mitigate its impact:

- Shorter Loan Terms (If Affordable): While a longer term lowers monthly payments, a shorter term (e.g., 48 or 60 months instead of 72 or 84) will significantly reduce the total interest paid over the life of the loan. If your budget allows for higher monthly payments, this is a strong consideration.

- Strong Income and Low DTI: A robust, stable income that comfortably covers the proposed payments and keeps your debt-to-income ratio low can still impress lenders and might lead to a slightly better rate.

- Co-Signer: As discussed, a co-signer with excellent credit dramatically reduces the lender's risk, often resulting in a lower interest rate than you could obtain on your own.

Negotiation Tactics: It's Not Just About the Car Price

Many people focus solely on negotiating the purchase price of the car. While important, for post-bankruptcy, no money down loans, you need to broaden your negotiation scope to the entire loan package.

- Leveraging Multiple Pre-Approvals: Don't settle for the first offer. Apply to a few reputable specialized lenders or through a service like SkipCarDealer.com to get multiple pre-approvals. Use these offers as leverage to negotiate. If Lender A offers 18% and Lender B offers 16%, you can go back to Lender A and see if they can beat or match the 16%.

- Focusing on the Total Cost of the Loan: Instead of just the monthly payment, always ask for the total amount you will pay over the life of the loan (principal + interest). A slightly lower monthly payment might mask a much longer term and significantly more interest paid overall.

- Understanding Add-ons and Extended Warranties: Dealerships often offer additional products like extended warranties, rustproofing, or paint protection. While some might offer legitimate value, others can significantly inflate your loan amount and, consequently, the total interest paid. Carefully evaluate if these are truly necessary or if they're just increasing your debt burden. Often, it's best to decline them and budget for maintenance separately.

Rebuilding with Every Payment: How This Loan Can Be Your Credit Catalyst

This 'no money down' car loan isn't just about getting transportation; it's a powerful tool for credit rebuilding. The mechanism is straightforward: when you make consistent, on-time payments, the lender reports this positive payment history to the major credit bureaus (Equifax and TransUnion in Canada). This new, positive data slowly but surely begins to counteract the negative impact of your bankruptcy.

The critical importance of consistent, on-time payments cannot be overstated. Even a single missed or late payment can severely undermine your credit rebuilding efforts. Set up automatic payments, mark your calendar, and ensure you always have sufficient funds in your account. This is your chance to demonstrate renewed financial responsibility.

Monitoring your credit score regularly is also crucial. Services like Credit Karma or your bank might offer free credit score access. Watching your score gradually improve will provide motivation and allow you to track your progress, informing future financial decisions like refinancing.

Choosing Your Ride: Realistic Expectations for Your Post-Bankruptcy Vehicle

When you're navigating a 'no money down' car loan after bankruptcy, your vehicle selection needs to be driven by practicality, reliability, and affordability, not aspiration. This isn't the time to splurge on a luxury SUV or a brand-new sports car. This is about securing dependable transportation that helps you rebuild your credit without overextending your finances.

New vs. Used: The Practical Choice for Your Situation

For almost all post-bankruptcy borrowers, a used car is the unequivocally smarter financial play. Here's why:

- Avoiding Rapid Depreciation: New cars lose a significant portion of their value (often 20-30%) in the first year alone. When you have no money down, this means you'll be "upside down" on your loan (owing more than the car is worth) almost immediately. This makes it difficult to sell or trade in the car without losing money. Used cars have already taken the biggest depreciation hit.

- Lower Purchase Price: Used cars are simply less expensive, meaning you'll need to borrow a smaller amount. This reduces your principal, your monthly payments, and the total interest you'll pay.

- Lower Insurance Costs: Insurance premiums are generally lower for used vehicles compared to new ones.

Consider Certified Pre-Owned (CPO) vehicles. These are used cars that have undergone a rigorous inspection process by the manufacturer and often come with an extended warranty. While slightly more expensive than a regular used car, they offer a balance of reliability and peace of mind, making them a wise choice for borrowers looking to minimize unexpected repair costs.

The 'No Money Down' Car Selection: What's Available and What to Avoid?

When lenders approve a 'no money down' loan after bankruptcy, they are often more conservative about the type of vehicle they're willing to finance. They prefer assets that hold their value reasonably well and are easy to resell if necessary. This means:

- Focus on Reliable, Fuel-Efficient Models: Think compact sedans, smaller SUVs, or hatchbacks from reputable brands known for reliability and lower maintenance costs. Honda Civic, Toyota Corolla, Hyundai Elantra, Mazda3, and Kia Forte are often good candidates.

- Easily Insurable Vehicles: Some vehicles are more expensive to insure due to higher theft rates, repair costs, or performance characteristics. Always get an insurance quote before falling in love with a car.

- Avoid Luxury Brands, High-Performance Vehicles, or Models with Known High Maintenance Costs: Lenders will be hesitant to finance these with no money down for a high-risk borrower. They depreciate faster, have higher repair bills, and are more expensive to insure.

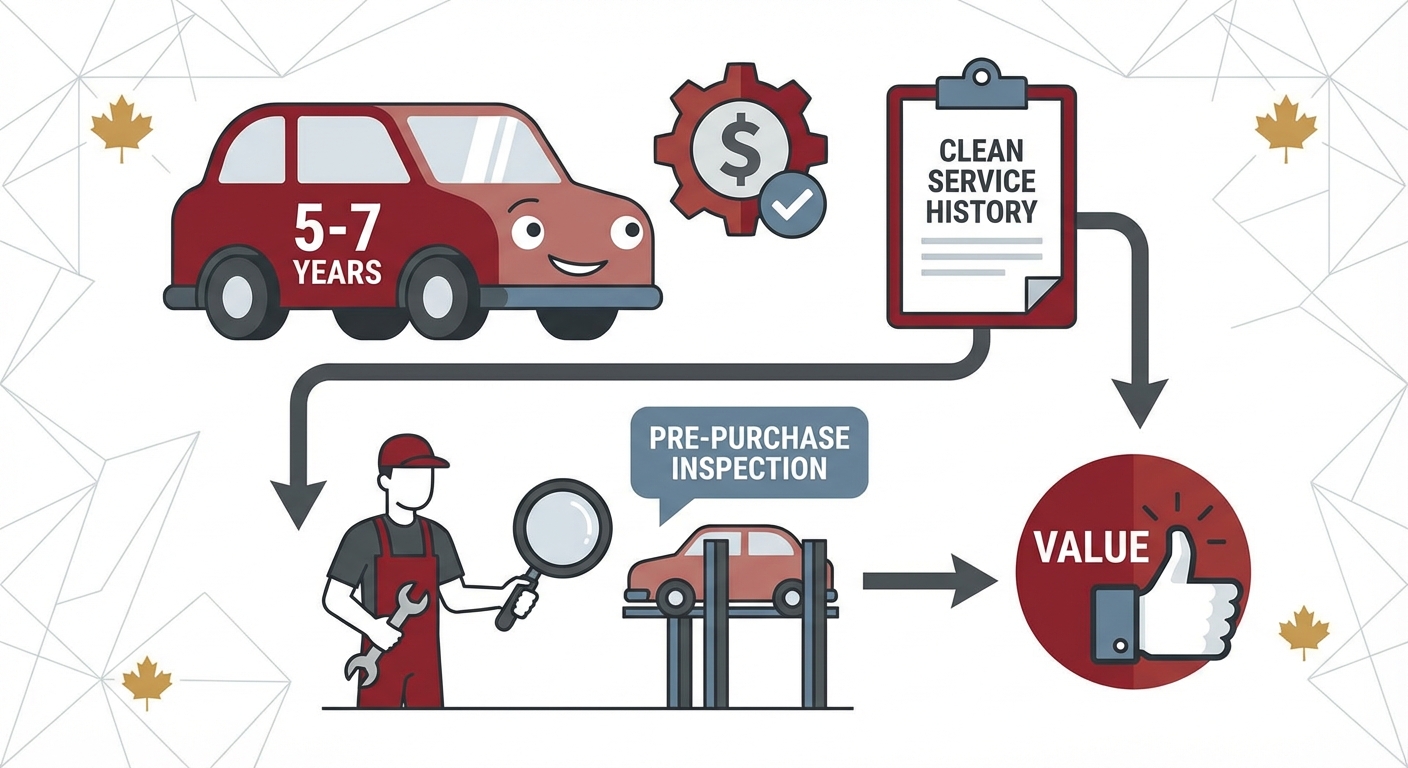

- Consider Older, Well-Maintained Vehicles: A 5-7 year old vehicle with reasonable kilometres (e.g., under 150,000 km) that has a clean service history can be an excellent value. The key is "well-maintained" – always get a pre-purchase inspection from an independent mechanic.

A comparison chart or infographic showing examples of realistic vehicle types/price ranges (e.g., compact sedans, older SUVs) that are typically approved for 'no money down' loans after bankruptcy, contrasted with aspirational or high-risk vehicles.

| Realistic Choices (Post-Bankruptcy, No Down) | Aspirational/High-Risk Choices to Avoid |

|---|---|

| Vehicle Type: Compact Sedans (e.g., Honda Civic, Toyota Corolla, Hyundai Elantra) | Vehicle Type: Luxury Sedans (e.g., BMW 3 Series, Mercedes-Benz C-Class) |

| Vehicle Type: Small to Mid-Size SUVs (e.g., Honda CR-V, Toyota RAV4, Mazda CX-5) | Vehicle Type: High-Performance Sports Cars (e.g., Ford Mustang GT, Subaru WRX STI) |

| Age/Mileage: 3-7 years old, 60,000 - 150,000 km | Age/Mileage: Brand New or Very Old/High Mileage (risky for different reasons) |

| Reliability: Known for durability, low maintenance costs | Reliability: Known for complex systems, expensive parts, higher repair rates (e.g., some European luxury brands) |

| Insurance: Generally affordable premiums | Insurance: Significantly higher premiums due to value, performance, or theft risk |

| Financing Appeal: Lenders see these as lower risk, easier to resell if needed | Financing Appeal: High depreciation, higher risk for lenders, harder to justify "no money down" |

Beyond the First Loan: Your Roadmap to Financial Freedom and Better Rates

Congratulations, you've secured your 'no money down' car loan after bankruptcy! But this isn't the finish line; it's a crucial stepping stone. This first loan is your opportunity to demonstrate consistent financial responsibility and set yourself up for a future of improved credit and better financial opportunities. Your focus now shifts to long-term financial planning.

The Refinancing Advantage: When and How to Lower Your Payments/Interest

One of the most powerful strategies for post-bankruptcy borrowers is refinancing. Once you've established a solid payment history – typically 12 to 24 months of consistent, on-time payments – your credit score will have improved significantly. This makes you a more attractive borrower to a wider range of lenders, including potentially traditional banks.

The process of refinancing involves taking out a new loan to pay off your existing car loan. If your credit score has improved, the new loan will likely come with a much lower interest rate, which can dramatically reduce your monthly payments and the total interest you pay over the remaining term. It's essentially a reward for your responsible financial behaviour.

When should you consider refinancing?

- Improved Credit Score: Check your credit score regularly. Once it shows significant improvement, start exploring refinancing options.

- Lower Interest Rates Available: Keep an eye on the market. If general interest rates have dropped, or if your improved credit now qualifies you for a much lower rate, it's time to act.

- After 12-24 Months: This timeframe usually provides enough positive payment history to make a meaningful difference to your credit profile.