Your Ink Is Dry. Your New Car Needs No Down Payment, Ontario.

Table of Contents

- Key Takeaways

- The Phoenix Rises: Understanding Your Post-Bankruptcy Financial Landscape in Ontario

- Beyond the Stigma: Why Personal Bankruptcy Isn't a Financial Death Sentence in Canada, and How Many Ontarians Experience It.

- The 'Right After' Reality Check: What 'Right After Bankruptcy' Truly Means for Lenders – Distinguishing Between Filing, Discharge, and the Crucial Waiting Period.

- Consumer Proposal vs. Bankruptcy: Key Differences in Ontario Law and Their Specific Impact on Your Auto Loan Eligibility and Credit Score.

- Your Credit Report's New Blueprint: How Bankruptcy Appears on Equifax and TransUnion in Canada, and What Specific Information Lenders Scrutinize.

- The 'No Down Payment' Mirage: Reality vs. Expectation in Ontario's Auto Market

- Deconstructing 'No Down Payment': What 100% Financing Actually Entails for Subprime Borrowers Post-Bankruptcy in Ontario (no cash up front, but not 'free').

- The Lender's Lens: Why Some Lenders are Willing to Offer Zero Down Loans Post-Bankruptcy, While Others Are Not – The Risk-Reward Calculation.

- The Inevitable Trade-offs: Higher Interest Rates and Longer Amortization Periods – The True Cost of 'No Down Payment' in Cities like Toronto, Hamilton, and London.

- Unmasking Hidden Costs: Beyond the Monthly Payment – Understanding Fees, Insurance Implications, and Total Cost of Ownership for a No Down Payment Loan.

- Navigating the Labyrinth of Lenders: Who Will Say 'Yes' in Canada?

- Traditional Banks and Credit Unions: Why They're Likely a 'No' (for now) for No Down Payment Loans Post-Bankruptcy in Ontario.

- The Subprime Specialists: Dedicated Lenders and Auto Finance Companies Catering Specifically to Challenged Credit in the Canadian Market.

- Dealership Finance Departments: Your Direct Pathway to Approval – How Dealerships in Brampton, Vaughan, and Across Ontario Leverage Extensive Subprime Lender Networks.

- The Role of Auto Loan Brokers: Understanding the Advantages and Disadvantages of Using a Broker vs. Approaching Lenders Directly.

- Avoiding Predatory Lenders: Identifying Red Flags, Unscrupulous Practices, and Unrealistic Promises in the Search for a No Down Payment Loan.

- Crafting Your Comeback Story: Building an Irresistible Application in Ontario

- Proof of Stability: The Golden Triad – Demonstrating Consistent Income, Stable Employment, and Established Residency (what specific documents you'll need).

- Income is King: How to Present Your Earnings to Maximize Your Chances for a No Down Payment Loan, Including Self-Employment Considerations.

- The Power of a Co-Signer: When a Trusted Friend or Family Member Can Make All the Difference (and the critical responsibilities involved for both parties).

- Leveraging Existing Assets: How a Paid-Off Vehicle or Other Collateral (if applicable) Can Sweeten a Loan Offer, Even for No Down Payment Scenarios.

- Preparing Your Paperwork: A Comprehensive Checklist for a Smooth and Efficient Application Process in Kingston, Windsor, and other Ontario communities.

- Beyond the Sticker Price: Understanding the True Cost and Avoiding Pitfalls

- The Interest Rate Reality: What to Expect for a No Down Payment Loan Post-Bankruptcy and Strategies for Negotiating the Best Possible Rate.

- APR vs. Interest Rate: Why the Annual Percentage Rate (APR) Provides the Most Accurate Picture of Your Total Borrowing Cost.

- Mandatory Add-ons and Hidden Fees: Scrutinizing the Fine Print of Your Loan Agreement to Avoid Unnecessary Expenses and Surprises.

- The Long-Term Trap: Why Shorter Loan Terms, Even with Slightly Higher Monthly Payments, Can Save You Thousands in Interest Over Time.

- Refinancing Your Future: Planning for a Better Rate Down the Road – When and How to Refinance Your Auto Loan as Your Credit Improves.

- Your First Ride to a Better Future: Realistic Vehicle Choices Post-Bankruptcy

- New vs. Used: Why a Reliable, Affordable Used Car is Almost Always Your Best Bet for a No Down Payment Loan Post-Bankruptcy.

- The 'Sweet Spot' Price Range: Identifying Attainable Vehicle Price Points (e.g., $10,000-$20,000) and Avoiding Over-Extending Your Budget.

- Reliability Over Flash: Prioritizing Car Brands and Models Known for Durability, Lower Maintenance Costs, and Good Resale Value.

- The Insurance Impact: How Your Vehicle Choice Directly Affects Your Premiums in Ontario, and Why This is Especially Crucial Post-Bankruptcy.

- Rebuilding While You Drive: Strategies for a Stronger Financial Future

- The Unseen Power of On-Time Payments: How Your Car Loan Becomes a Cornerstone of Your Credit Rebuilding Strategy.

- Beyond the Auto Loan: Complementary Credit Building Strategies (e.g., secured credit cards, small credit builder loans, utility payment reporting).

- Monitoring Your Progress: Regularly Checking Your Credit Score and Report to Track Improvements and Maintain Vigilance.

- Cultivating Financial Discipline: Budgeting, Saving, and Avoiding New Debt to Prevent Future Financial Setbacks and Ensure Loan Success.

- Ontario Specifics: Local Resources and Considerations for Your Car Loan

- Driving in the 401 Corridor: Unique Auto Loan Challenges and Opportunities in Major Ontario Cities (Toronto, Mississauga, Brampton, Vaughan, Ottawa).

- Regional Dealer Networks: How to Find Specialized Lenders and Dealerships with Strong Subprime Programs in Smaller Ontario Communities (e.g., London, Windsor, Kingston, Sudbury).

- Provincial Regulations: Understanding Ontario's Consumer Protection Act and Your Rights as a Borrower in the Auto Loan Market.

- Local Support Systems: Financial Literacy Resources and Non-Profit Credit Counselling Services Available Across Ontario.

- The Road Ahead: Your Next Steps to Approval and Financial Freedom

- Step 1: Get Your Financial House in Order (Post-Bankruptcy Review and Credit Report Analysis).

- Step 2: Research and Identify Potential Lenders (Prioritize Subprime Specialists and Dealerships).

- Step 3: Prepare Your Application with Meticulous Detail and Supporting Documentation.

- Step 4: Understand the Terms – Read Every Clause Before You Sign.

- Step 5: Drive Away Smart – And Commit to Consistent Credit Rebuilding.

- Your Journey Continues: From 'Ink Dry' to 'Credit Strong' – A Strategic Path to Financial Empowerment.

- Frequently Asked Questions (FAQ) About No Down Payment Car Loans After Bankruptcy in Canada

The ink is dry. The bankruptcy discharge papers are in your hand. For many Ontarians, this moment feels like both an ending and a beginning – a closing chapter on financial hardship and the daunting first page of a new financial story. You might be thinking: "I need a car, but my credit is in tatters. Is a no down payment car loan even possible right after bankruptcy in Ontario?"

The short answer, perhaps surprisingly, is yes. It's not just possible; for many, it's a strategic stepping stone on the path to credit rebuilding. But let's be clear: this isn't a walk in the park. It requires realistic expectations, a smart approach, and a deep understanding of the Canadian auto finance landscape, particularly in Ontario. At SkipCarDealer.com, we understand that life happens, and we believe everyone deserves a fresh start and reliable transportation. This comprehensive guide will walk you through exactly how to navigate the post-bankruptcy auto loan journey, with a specific focus on securing that crucial no down payment vehicle in the heart of Ontario.

Key Takeaways

- Immediate Possibility: Yes, securing a no down payment car loan 'right after' bankruptcy discharge in Ontario is achievable, but requires a strategic approach and realistic expectations.

- Higher Costs, Strategic Gain: Expect elevated interest rates initially. View this loan as a crucial step for credit rebuilding, with an eye towards future refinancing.

- Target Your Lenders: Traditional banks are unlikely. Focus on specialized subprime auto lenders, credit unions with specific programs, and dealerships with strong in-house finance departments or extensive subprime networks.

- Defining 'Right After': This typically means post-bankruptcy discharge, not during the active bankruptcy process. The timing significantly impacts your eligibility.

- Vehicle Selection Matters: Prioritize reliable, affordable used vehicles. Aiming for an expensive new car with no down payment immediately post-bankruptcy is generally unrealistic and ill-advised.

- Beyond the Loan: This isn't just about getting a car; it's a powerful opportunity to diligently rebuild your credit score through consistent, on-time payments.

- Ontario Advantage: Understand provincial consumer protection laws and local market dynamics in cities like Toronto, Ottawa, and Mississauga that can influence your options.

The Phoenix Rises: Understanding Your Post-Bankruptcy Financial Landscape in Ontario

Bankruptcy. The word itself can feel heavy, carrying a stigma that suggests financial ruin. However, in Canada, personal bankruptcy is designed as a legal process to help individuals overwhelmed by debt get a fresh start. It's not a financial death sentence; it's a reset button. Thousands of Ontarians, from Toronto to Thunder Bay, go through this process every year, seeking relief and a path to rebuild.

Beyond the Stigma: Why Personal Bankruptcy Isn't a Financial Death Sentence in Canada, and How Many Ontarians Experience It.

While bankruptcy certainly impacts your credit score, it's crucial to understand its purpose. It eliminates most unsecured debts, allowing you to regain control. Canadian bankruptcy laws are structured to provide a defined path to discharge, after which you are no longer legally responsible for those debts. This clean slate, while initially challenging for credit, is exactly what makes future borrowing, like a car loan, possible. For more on this critical turning point, explore our article on Bankruptcy Discharge: Your Car Loan's Starting Line.

The 'Right After' Reality Check: What 'Right After Bankruptcy' Truly Means for Lenders – Distinguishing Between Filing, Discharge, and the Crucial Waiting Period.

When we say 'right after bankruptcy,' we mean after your official bankruptcy discharge. This is the pivotal moment when you are legally released from your debts. Applying for a car loan *during* an active bankruptcy is almost impossible. Lenders need to see that the process is complete and your financial slate is wiped clean. While some might suggest waiting a year or two post-discharge, the reality is that many subprime lenders in Ontario are willing to consider applications much sooner, provided other factors are strong.

Consumer Proposal vs. Bankruptcy: Key Differences in Ontario Law and Their Specific Impact on Your Auto Loan Eligibility and Credit Score.

It's important to distinguish between a full bankruptcy and a consumer proposal. A consumer proposal is a legal agreement to pay back a portion of your debts to creditors, typically over a period of up to five years. While it also impacts your credit, it is often viewed slightly less severely by lenders than a full bankruptcy. If you've completed a consumer proposal, your path to a car loan might be even smoother. For a deeper dive into this, check out Post-Proposal Car Loan: Your Credit Score Just Got a Mulligan.

Your Credit Report's New Blueprint: How Bankruptcy Appears on Equifax and TransUnion in Canada, and What Specific Information Lenders Scrutinize.

After discharge, your credit report will show the bankruptcy for a period of time – typically six to seven years from the date of discharge for a first-time bankruptcy, depending on the credit bureau (Equifax or TransUnion). Lenders will see this. However, they will also scrutinize your current income, employment stability, and any new positive credit activity since your discharge. They're looking for signs that you've learned from the past and are committed to responsible financial behaviour moving forward.

PRO TIP:

Immediately after discharge, obtain and meticulously review your credit reports from both Equifax and TransUnion. Dispute any inaccuracies or outdated information to present the cleanest possible financial picture. Even small errors can hinder your application.

The 'No Down Payment' Mirage: Reality vs. Expectation in Ontario's Auto Market

The allure of "no money down" is powerful, especially when you're starting fresh after bankruptcy. While 100% financing is indeed achievable, it's crucial to understand what it truly means and the trade-offs involved.

Deconstructing 'No Down Payment': What 100% Financing Actually Entails for Subprime Borrowers Post-Bankruptcy in Ontario (no cash up front, but not 'free').

When a lender offers a no down payment car loan, it means you don't have to provide any cash upfront to secure the vehicle. The entire purchase price (plus taxes, fees, and interest) is financed. This is incredibly helpful when your savings are depleted post-bankruptcy. However, it doesn't mean the loan is 'free' or without implications. It simply means the total amount borrowed is higher, which directly impacts your monthly payments and the total interest you'll pay over the life of the loan.

The Lender's Lens: Why Some Lenders are Willing to Offer Zero Down Loans Post-Bankruptcy, While Others Are Not – The Risk-Reward Calculation.

For traditional banks, a no down payment loan immediately after bankruptcy is typically too risky. They prefer borrowers with established, excellent credit. Subprime lenders, however, specialize in higher-risk profiles. They understand that a bankruptcy discharge represents a fresh start and a potential for future stability. Their willingness to offer zero down loans comes with a higher risk assessment, which is compensated by higher interest rates. They are making a calculated bet on your ability to rebuild.

The Inevitable Trade-offs: Higher Interest Rates and Longer Amortization Periods – The True Cost of 'No Down Payment' in Cities like Toronto, Hamilton, and London.

This is where the rubber meets the road. With no down payment and a recent bankruptcy, expect your interest rate to be significantly higher than someone with prime credit. Rates can range from the high single digits to well into the double digits (e.g., 10% to 29.9% APR). To make monthly payments manageable despite the high interest, lenders often extend the amortization period, meaning you'll be paying off the loan for five, six, or even seven years. This dramatically increases the total amount of interest paid over time. For example, a $15,000 loan at 20% over 60 months will cost you thousands more in interest than the same loan at 10% over 48 months. This is the true cost of convenience in markets like Toronto, Hamilton, and London.

Unmasking Hidden Costs: Beyond the Monthly Payment – Understanding Fees, Insurance Implications, and Total Cost of Ownership for a No Down Payment Loan.

Beyond interest, be vigilant for other costs. Some lenders might include administrative fees, loan origination fees, or even charges for specific financial products within the loan. Additionally, your vehicle choice heavily impacts insurance premiums in Ontario, which can be substantial, especially for newer or higher-risk models. Always factor in fuel, maintenance, and insurance when calculating your true total cost of ownership. Don't just look at the monthly car payment; consider the full financial picture.

PRO TIP:

While a down payment might seem out of reach, even a modest contribution (e.g., $500-$1,000) can significantly improve your loan terms, reduce interest, and signal commitment to lenders. Explore options like selling unused assets or a temporary side hustle to gather a small sum. Every dollar down reduces the amount you finance and the interest you pay.

Navigating the Labyrinth of Lenders: Who Will Say 'Yes' in Canada?

Knowing where to apply is half the battle. Your post-bankruptcy status dictates that you need to target specific types of lenders who specialize in challenged credit situations.

Traditional Banks and Credit Unions: Why They're Likely a 'No' (for now) for No Down Payment Loans Post-Bankruptcy in Ontario.

Major banks like RBC, TD, Scotiabank, BMO, and CIBC, along with most larger credit unions, typically have stringent lending criteria. They prefer borrowers with high credit scores and a long history of responsible credit use. Immediately after bankruptcy, even with a stable income, you simply won't meet their automated scoring systems for a no down payment loan. It's best to avoid applying to these institutions initially, as multiple rejections can negatively impact your credit score further.

The Subprime Specialists: Dedicated Lenders and Auto Finance Companies Catering Specifically to Challenged Credit in the Canadian Market.

This is your primary target. Companies like concentrated auto finance arms, independent finance companies, and some credit unions with specific "fresh start" programs are built to serve borrowers with less-than-perfect credit. They assess risk differently, looking beyond just the credit score to factors like income stability, employment history, and debt-to-income ratio. They understand that a bankruptcy means a clean slate, not necessarily a future inability to pay.

Dealership Finance Departments: Your Direct Pathway to Approval – How Dealerships in Brampton, Vaughan, and Across Ontario Leverage Extensive Subprime Lender Networks.

Dealerships, especially larger ones in active markets like Brampton, Vaughan, and Mississauga, are often your best bet. They don't just work with one bank; they have relationships with dozens of lenders, including many subprime specialists. Their finance managers are experts at matching borrowers with the right lender and program. They understand the nuances of post-bankruptcy financing and can often secure approvals even when individual applications might struggle. They also have access to different inventory, which can be crucial for finding a vehicle that fits the lender's criteria for a high-risk loan.

The Role of Auto Loan Brokers: Understanding the Advantages and Disadvantages of Using a Broker vs. Approaching Lenders Directly.

Auto loan brokers can be a valuable resource. They act as intermediaries, taking your application and shopping it around to various lenders in their network, including subprime ones. This can save you time and prevent multiple credit inquiries on your report. The advantage is their expertise and access to a wide range of lenders. The disadvantage is that some brokers may charge fees, or their compensation might be built into the loan, potentially increasing your costs. Always ensure transparency about their fees and processes.

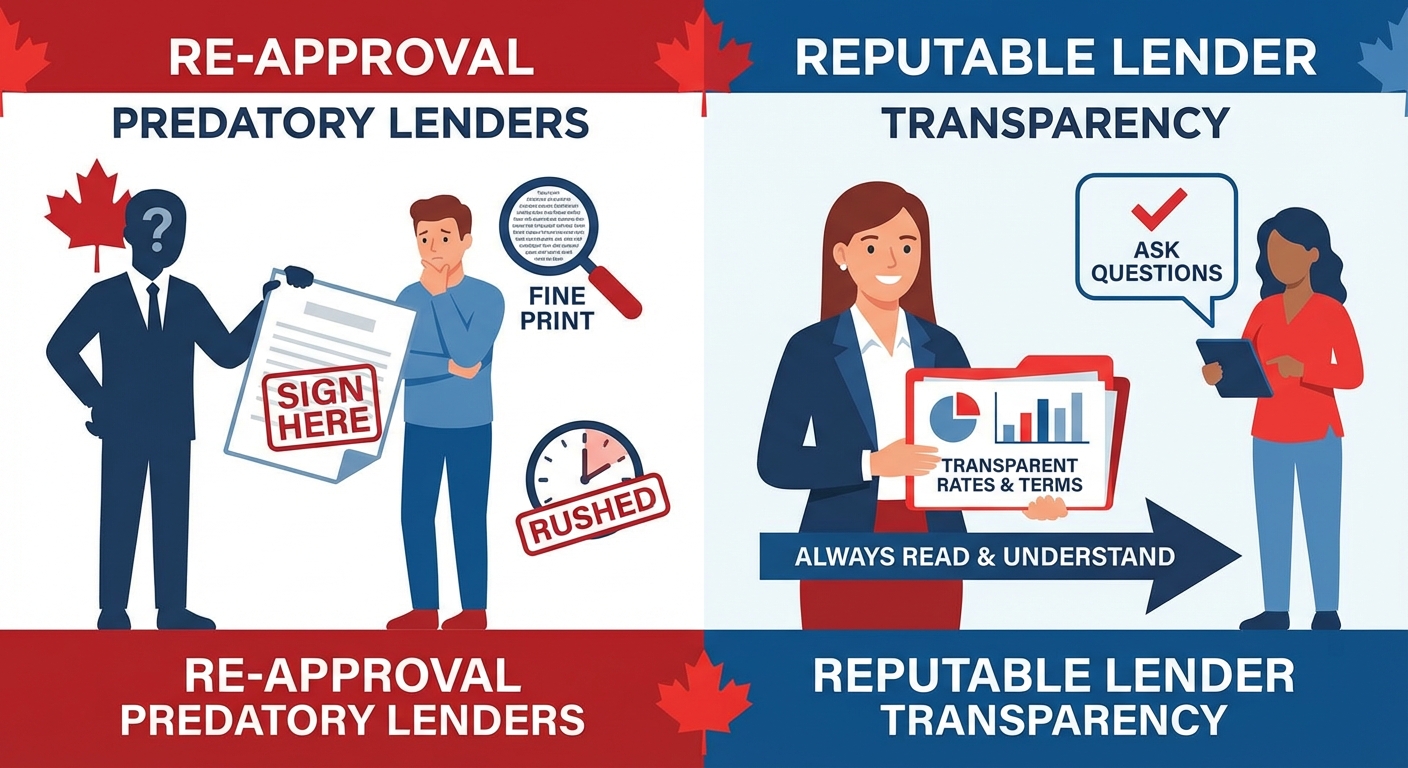

Avoiding Predatory Lenders: Identifying Red Flags, Unscrupulous Practices, and Unrealistic Promises in the Search for a No Down Payment Loan.

When your credit is challenged, you become a target for less scrupulous lenders. Be wary of promises that sound too good to be true, extremely high-pressure sales tactics, demands for upfront fees before approval, or lenders who don't seem interested in your ability to repay. Always read the fine print, ask questions, and never feel rushed into signing anything. A reputable lender will be transparent about rates, terms, and all associated costs.

Crafting Your Comeback Story: Building an Irresistible Application in Ontario

Even with bankruptcy on your record, you can present a strong case to lenders. It’s all about demonstrating stability and a renewed commitment to financial responsibility. This is where you leverage your 450 Credit score or similar into an approval.

Proof of Stability: The Golden Triad – Demonstrating Consistent Income, Stable Employment, and Established Residency (what specific documents you'll need).

Lenders want to see that you're back on your feet and have a reliable means to repay the loan. This means focusing on:

- Consistent Income: Pay stubs (2-3 most recent), employment letters, T4s, or bank statements showing regular deposits. For self-employed individuals, 2-3 years of tax assessments (NOA) and bank statements are crucial.

- Stable Employment: Lenders prefer to see at least 3-6 months, and ideally 1-2 years, at your current job. Longer tenure signals reliability.

- Established Residency: Utility bills, rental agreements, or mortgage statements showing you live at your stated address for a reasonable period (e.g., 6-12 months).

These documents collectively paint a picture of stability that can outweigh a past bankruptcy.

Income is King: How to Present Your Earnings to Maximize Your Chances for a No Down Payment Loan, Including Self-Employment Considerations.

Your ability to pay is paramount. Clearly outline all sources of verifiable income. This includes full-time employment, part-time jobs, government benefits (like CCB, EI, or disability in some cases), or self-employment income. If self-employed, ensure your financial records are meticulously organized. Lenders want to see consistent cash flow that can comfortably cover the proposed car payment and your other living expenses. For those with non-traditional income streams, our article No Down Payment? Your Gig Just Bought a Hybrid. Seriously. offers more insights.

The Power of a Co-Signer: When a Trusted Friend or Family Member Can Make All the Difference (and the critical responsibilities involved for both parties).

A co-signer with good credit can significantly strengthen your application, often leading to better approval odds and potentially lower interest rates. Their credit history essentially "backs up" your loan. However, this is a serious commitment. The co-signer is equally responsible for the loan. If you miss payments, their credit will also be negatively affected, and they could be legally pursued for the debt. Ensure open communication and a clear understanding of responsibilities before involving a co-signer.

Leveraging Existing Assets: How a Paid-Off Vehicle or Other Collateral (if applicable) Can Sweeten a Loan Offer, Even for No Down Payment Scenarios.

While we're discussing no down payment, if you happen to have a paid-off vehicle that you could trade in (even for a small amount), or other unencumbered assets, mentioning this to a lender can sometimes improve your standing. It demonstrates financial prudence and a willingness to reduce the lender's risk, even if you choose not to use it as a down payment.

Preparing Your Paperwork: A Comprehensive Checklist for a Smooth and Efficient Application Process in Kingston, Windsor, and other Ontario communities.

Gathering all necessary documents *before* you apply will streamline the process. Have these ready:

- Government-issued ID (Driver's License)

- Proof of Residency (Utility bill, lease agreement)

- Proof of Income (Recent pay stubs, employment letter, T4s, or NOAs for self-employed)

- Banking information (Void cheque or direct deposit form)

- Proof of bankruptcy discharge

- Trade-in vehicle details (if applicable)

Being prepared makes a strong impression and speeds up approval times, whether you're in Kingston, Windsor, or Sudbury.

PRO TIP:

Proactively demonstrate financial responsibility post-bankruptcy. If you've opened a secured credit card or have any positive payment history on new accounts, highlight these consistent on-time payments in your application. Even small steps show a commitment to rebuilding.

Beyond the Sticker Price: Understanding the True Cost and Avoiding Pitfalls

Securing approval is just the first step. Understanding the full financial commitment and protecting yourself from unfavourable terms is crucial for your long-term financial health.

The Interest Rate Reality: What to Expect for a No Down Payment Loan Post-Bankruptcy and Strategies for Negotiating the Best Possible Rate.

As mentioned, expect higher interest rates. While it's difficult to give an exact number without knowing your specific situation, rates for post-bankruptcy, no down payment loans in Ontario can range from 10% to 29.9% APR. Don't be discouraged by these figures; remember, this is a rebuilding loan. Strategies for the best rate include:

- Shop around: Don't take the first offer.

- Strengthen your application: Co-signer, stable income, good vehicle choice.

- Be prepared to walk away: If the terms are truly predatory, it's better to wait.

Negotiation is always possible, especially if you have competing offers.

APR vs. Interest Rate: Why the Annual Percentage Rate (APR) Provides the Most Accurate Picture of Your Total Borrowing Cost.

Always focus on the Annual Percentage Rate (APR), not just the stated interest rate. The APR includes the interest rate plus any additional fees, charges, or costs rolled into the loan, providing a more comprehensive and accurate representation of the true annual cost of borrowing. It allows for a direct, apples-to-apples comparison between different loan offers.

Mandatory Add-ons and Hidden Fees: Scrutinizing the Fine Print of Your Loan Agreement to Avoid Unnecessary Expenses and Surprises.

Be extremely diligent when reviewing your loan agreement. Some dealerships or lenders might try to include "mandatory" add-ons like extended warranties, rustproofing, or credit insurance. While some of these might offer value, they are often marked up significantly and increase the total amount you finance. Ask for a breakdown of every single charge and question anything you don't understand or didn't explicitly request. These add-ons can turn an already high-interest loan into a financial burden.

The Long-Term Trap: Why Shorter Loan Terms, Even with Slightly Higher Monthly Payments, Can Save You Thousands in Interest Over Time.

While a longer loan term (e.g., 72 or 84 months) offers lower monthly payments, it significantly increases the total interest paid. If financially feasible, opt for the shortest loan term possible, even if it means a slightly higher monthly payment. The savings in interest over time can be substantial. Here's a quick comparison:

| Loan Amount | Interest Rate | Term (Months) | Est. Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| $15,000 | 20% APR | 60 | $380 | $7,800 |

| $15,000 | 20% APR | 72 | $335 | $9,120 |

| $15,000 | 20% APR | 84 | $305 | $10,620 |

Refinancing Your Future: Planning for a Better Rate Down the Road – When and How to Refinance Your Auto Loan as Your Credit Improves.

Your initial post-bankruptcy loan is a stepping stone. As you make consistent, on-time payments for 12-18 months, your credit score will begin to improve. At this point, you should seriously consider refinancing your loan for a lower interest rate. This can save you thousands of dollars over the remaining term. Start by checking your credit score regularly and approaching other lenders (including, potentially, traditional banks or credit unions) once your score shows significant improvement. This is a key strategy for long-term financial recovery.

PRO TIP:

Always ask for the total cost of the loan (principal + total interest) over its full term, not just the monthly payment. This allows for a direct comparison between offers and reveals the true financial commitment. Don't let a low monthly payment obscure the high total cost.

Your First Ride to a Better Future: Realistic Vehicle Choices Post-Bankruptcy

Your goal immediately after bankruptcy is reliable transportation and credit rebuilding, not a luxury vehicle. Strategic vehicle selection is paramount.

New vs. Used: Why a Reliable, Affordable Used Car is Almost Always Your Best Bet for a No Down Payment Loan Post-Bankruptcy.

A new car depreciates significantly the moment it leaves the lot. For a borrower with challenged credit and no down payment, financing a new car is incredibly difficult and often financially unsound. Used cars, particularly those a few years old, offer much better value. They are easier to get approved for, have lower insurance costs, and present a more manageable financial burden. Focus on a used vehicle that meets your needs without overextending your budget.

The 'Sweet Spot' Price Range: Identifying Attainable Vehicle Price Points (e.g., $10,000-$20,000) and Avoiding Over-Extending Your Budget.

For a post-bankruptcy, no down payment loan, aiming for a vehicle in the $10,000 to $20,000 range is generally most realistic in Ontario. This price point allows for a manageable monthly payment even with higher interest rates and provides access to a good selection of reliable used cars. Attempting to finance a $30,000+ vehicle with no money down after bankruptcy will likely lead to rejection or an unmanageable financial strain.

Reliability Over Flash: Prioritizing Car Brands and Models Known for Durability, Lower Maintenance Costs, and Good Resale Value.

Focus on brands renowned for reliability and affordable maintenance, such as Honda, Toyota, Mazda, and some models from Hyundai or Kia. Research common issues, average repair costs, and parts availability. A car that constantly needs repairs will quickly derail your budget and credit rebuilding efforts. Look for vehicles with good fuel economy, as this is another significant ongoing cost.

The Insurance Impact: How Your Vehicle Choice Directly Affects Your Premiums in Ontario, and Why This is Especially Crucial Post-Bankruptcy.

Ontario has some of the highest auto insurance rates in Canada. Your vehicle choice plays a massive role in your premium. More expensive cars, sports cars, or vehicles with higher theft rates will cost significantly more to insure. As someone rebuilding credit, minimizing all monthly expenses is key. Get insurance quotes for specific models before finalizing your car purchase to avoid any unpleasant surprises. A reliable, moderately priced sedan or hatchback will likely have lower insurance costs than an SUV or luxury car.

PRO TIP:

Focus on a 'utility vehicle' – something reliable that gets you from A to B safely and affordably. This isn't the time for your dream car; it's a strategic purchase to rebuild financial stability. Think practical, not aspirational, for this first post-bankruptcy vehicle.

Rebuilding While You Drive: Strategies for a Stronger Financial Future

Your car loan is more than just transportation; it's a powerful tool for financial recovery. Every on-time payment is a step towards a healthier credit score.

The Unseen Power of On-Time Payments: How Your Car Loan Becomes a Cornerstone of Your Credit Rebuilding Strategy.

The single most impactful action you can take to rebuild your credit after bankruptcy is making all payments on time, every time. Your car loan, because it’s a significant installment loan, will be reported to credit bureaus. Consistent, positive payment history will slowly but surely start to outweigh the negative impact of the bankruptcy. This loan provides a tangible, structured way to demonstrate renewed financial responsibility.

Beyond the Auto Loan: Complementary Credit Building Strategies (e.g., secured credit cards, small credit builder loans, utility payment reporting).

While your car loan is foundational, don't put all your eggs in one basket. Consider these additional strategies:

- Secured Credit Card: These require a deposit that acts as your credit limit. Use it for small, regular purchases and pay it off in full every month.

- Credit Builder Loan: Offered by some credit unions or alternative lenders, these loans hold the funds in a savings account until you've paid them off.

- Utility Payment Reporting: Some services can report your on-time utility payments to credit bureaus, adding another positive tradeline.

Diversifying your positive credit history accelerates the rebuilding process.

Monitoring Your Progress: Regularly Checking Your Credit Score and Report to Track Improvements and Maintain Vigilance.

Make it a habit to check your credit score and report every few months. Many financial institutions and services offer free credit score monitoring. Watching your score gradually increase can be incredibly motivating. More importantly, it allows you to spot any new inaccuracies or fraudulent activity early on. Staying vigilant is key to protecting your financial progress.

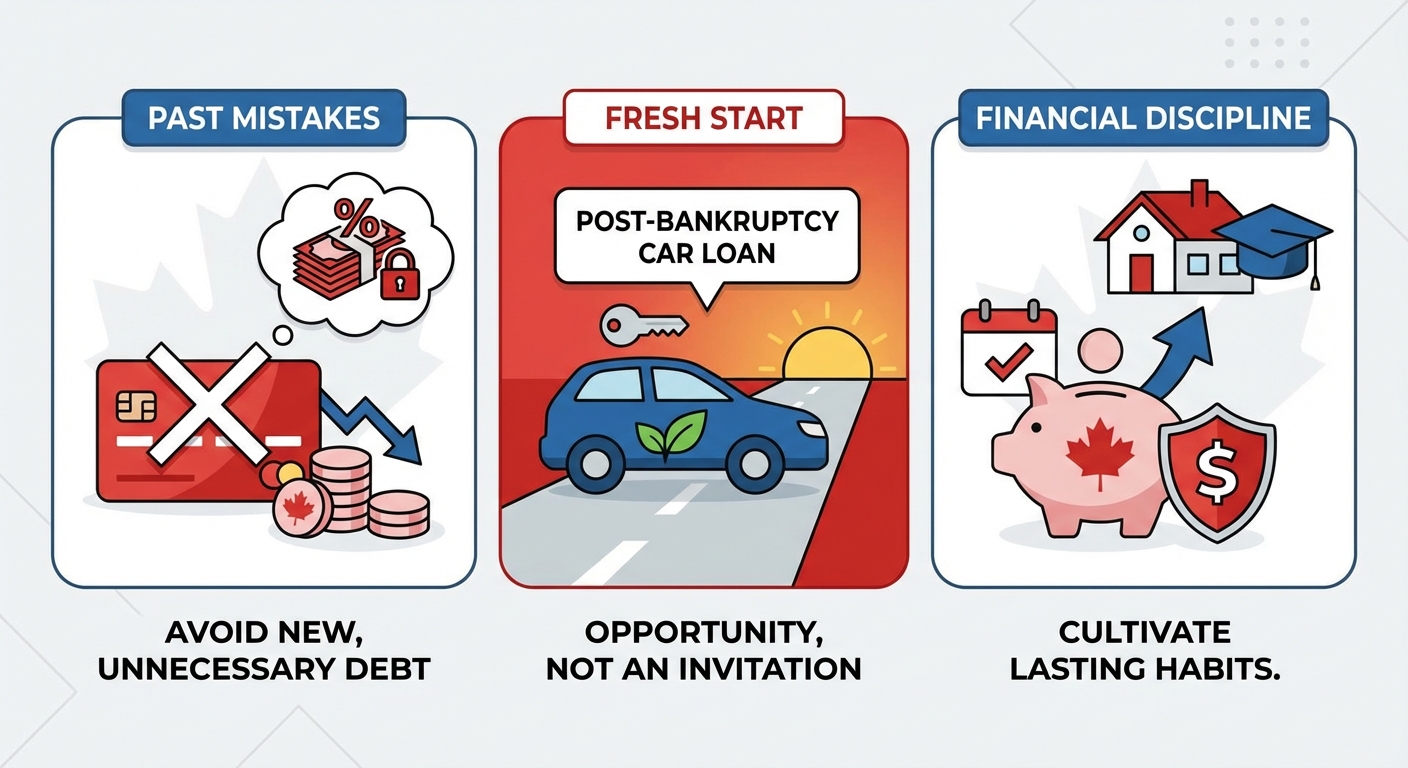

Cultivating Financial Discipline: Budgeting, Saving, and Avoiding New Debt to Prevent Future Financial Setbacks and Ensure Loan Success.

This entire process is about more than just getting a loan; it's about establishing sustainable financial habits. Create a realistic budget, stick to it, and prioritize saving. Build an emergency fund to cover unexpected expenses, preventing the need for high-interest loans. Avoid taking on new, unnecessary debt. Your post-bankruptcy car loan is a fresh start, not an invitation to repeat past mistakes. Use this opportunity to cultivate lasting financial discipline.

Ontario Specifics: Local Resources and Considerations for Your Car Loan

Ontario's diverse economic landscape and regulatory environment offer both unique challenges and opportunities for post-bankruptcy car buyers.

Driving in the 401 Corridor: Unique Auto Loan Challenges and Opportunities in Major Ontario Cities (Toronto, Mississauga, Brampton, Vaughan, Ottawa).

Major urban centres along the 401 corridor, like Toronto, Mississauga, Brampton, and Vaughan, have a higher concentration of dealerships and lenders, including many subprime specialists. This means more options but also more competition and potentially higher costs of living impacting your budget. Ottawa, while a major city, might have slightly different market dynamics due to its governmental employment base. In these areas, leveraging large dealership networks is often the most effective strategy for finding a no down payment loan.

Regional Dealer Networks: How to Find Specialized Lenders and Dealerships with Strong Subprime Programs in Smaller Ontario Communities (e.g., London, Windsor, Kingston, Sudbury).

Even in smaller cities like London, Windsor, Kingston, and Sudbury, there are dealerships and brokers specializing in challenged credit. While the sheer volume of options might be less than in the GTA, these local businesses often have strong relationships with regional subprime lenders and a deep understanding of the local economy and community needs. Researching local dealerships online and reading reviews focused on their finance departments is a good starting point.

Provincial Regulations: Understanding Ontario's Consumer Protection Act and Your Rights as a Borrower in the Auto Loan Market.

Ontario has robust consumer protection laws. The Consumer Protection Act, 2002, outlines your rights as a borrower, including requirements for clear disclosure of loan terms, interest rates, and fees. Familiarize yourself with these rights. If you feel you're being treated unfairly or subjected to deceptive practices, you have avenues for recourse through organizations like the Ontario Motor Vehicle Industry Council (OMVIC) or the Financial Services Regulatory Authority of Ontario (FSRA).

Local Support Systems: Financial Literacy Resources and Non-Profit Credit Counselling Services Available Across Ontario.

Don't hesitate to seek support. Non-profit credit counselling agencies across Ontario offer free or low-cost advice on budgeting, debt management, and financial literacy. Organizations like Credit Canada Debt Solutions or local community service agencies can provide invaluable guidance, both before and after obtaining your car loan, helping you solidify your financial foundation.

PRO TIP:

Research dealerships and lenders specifically within your city or region. Many have established relationships with local subprime lenders and a better understanding of the local economic landscape, which can work in your favour for approval.

The Road Ahead: Your Next Steps to Approval and Financial Freedom

Getting a no down payment car loan after bankruptcy in Ontario is a marathon, not a sprint. But with the right strategy, it's a finish line you can absolutely cross.

Step 1: Get Your Financial House in Order (Post-Bankruptcy Review and Credit Report Analysis).

Ensure your bankruptcy discharge is complete. Obtain and scrutinize your credit reports from Equifax and TransUnion. Dispute any errors. Understand exactly how your bankruptcy is reported and what your current financial situation looks like.

Step 2: Research and Identify Potential Lenders (Prioritize Subprime Specialists and Dealerships).

Don't waste time with traditional banks. Focus your efforts on dealerships with robust finance departments and access to multiple subprime lenders, or directly approach specialized subprime auto finance companies. Consider reputable auto loan brokers.

Step 3: Prepare Your Application with Meticulous Detail and Supporting Documentation.

Gather all required documents: ID, proof of income, proof of residency, and bankruptcy discharge papers. Present a clear, concise picture of your current stability and commitment to repayment.

Step 4: Understand the Terms – Read Every Clause Before You Sign.

Focus on the APR, total interest paid, and all fees. Question anything unclear. Do not be rushed. Ensure you understand the full financial commitment before putting your signature on the dotted line.

Step 5: Drive Away Smart – And Commit to Consistent Credit Rebuilding.

Choose a reliable, affordable used vehicle. Make every single payment on time, without fail. Use this loan as your primary tool for rebuilding a strong credit history, paving the way for better financial opportunities in the future.

Your Journey Continues: From 'Ink Dry' to 'Credit Strong' – A Strategic Path to Financial Empowerment.

Your bankruptcy discharge is not an end; it's a powerful beginning. A no down payment car loan, strategically secured and diligently managed, can be the engine that powers your credit rebuilding journey. At SkipCarDealer.com, we are here to help you navigate this path, understand your options, and drive towards a brighter financial future in Ontario.