Alberta: They See Bankruptcy. We See Your Next Car. Drive Today.

Table of Contents

- Key Takeaways

- Opening the Driver's Door: Your Immediate Path to a Car Loan in Alberta After Bankruptcy

- The Alberta Advantage: Why Your Bankruptcy Story Doesn't End Your Car Ownership Dream

- Navigating the Post-Bankruptcy Road Map: What Alberta Lenders Truly Look For Beyond Your Credit Score

- Dealerships vs. Traditional Banks in Alberta: Unlocking Your Best Approval Odds

- Comparing Financing Options Post-Bankruptcy in Alberta

- Decoding the Dollar Signs: Interest Rates, Terms, and Avoiding Hidden Costs in Alberta Auto Loans

- Your Application Toolkit: Crafting a Winning Case for an Alberta Car Loan

- The Right Ride for Your Rebound: Vehicle Selection After Bankruptcy in Alberta

- New vs. Used: Which is Better Post-Bankruptcy in Alberta?

- Spotlight on Alberta's Cities: Finding Approved Dealerships Near You

- Calgary: The Hub of Opportunity

- Edmonton: Navigating the Capital's Car Loan Landscape

- Red Deer, Lethbridge, Fort McMurray: Regional Insights

- Beyond the Purchase: How Your Alberta Car Loan Can Rebuild Your Financial Future

- Your Next Steps to Approval: Driving Away Confidently in Alberta

- Frequently Asked Questions About Car Loans After Bankruptcy in Alberta (FAQ)

Life in Alberta moves at its own pace, a pace that often requires reliable transportation. Whether you're commuting to a bustling office in downtown Calgary, managing a remote work schedule from your acreage near Red Deer, or navigating the vibrant streets of Edmonton, your car is more than just a convenience; it's a necessity. But what happens when financial challenges, like bankruptcy, throw a wrench in your plans for vehicle ownership? The immediate thought can be disheartening: "They see bankruptcy, they'll never approve me." At SkipCarDealer.com, we understand that sentiment, but we're here to offer a different perspective. We don't just see a past financial event; we see your future, your need, and your next car.

Bankruptcy is a chapter, not the whole book of your financial life. It's a legal process designed to give you a fresh start, and that fresh start absolutely includes the possibility of securing a car loan in Alberta. It might seem daunting, and you might assume traditional lenders will shut their doors. However, a growing number of specialized dealerships and financial institutions across Alberta are equipped and eager to help individuals just like you drive away in a dependable vehicle, using this opportunity to rebuild your credit and regain financial footing. We believe in second chances, and we're committed to guiding you through every step of the process.

Key Takeaways

- Bankruptcy is a financial reset, not a permanent roadblock to vehicle ownership in Alberta.

- Specialized dealerships in Alberta are your most effective resource for post-bankruptcy auto loans.

- Preparation is paramount: understanding your budget, gathering necessary documents, and setting realistic expectations.

- A responsibly managed car loan is a powerful tool for rapidly rebuilding your credit score.

- While initial interest rates may be higher, they are often a stepping stone to better terms over time.

Opening the Driver's Door: Your Immediate Path to a Car Loan in Alberta After Bankruptcy

The moment you're discharged from bankruptcy, or even while navigating a consumer proposal, the world can feel a little different. Many believe that all doors to credit are slammed shut indefinitely. This couldn't be further from the truth, especially when it comes to essential purchases like a vehicle in a province as vast and dynamic as Alberta. Your immediate path to a car loan isn't blocked; it simply requires a slightly different route and a partner who understands the terrain.

We approach your situation with empathy and practical solutions. We recognize that life happens, and sometimes, even the most diligent financial planning can be derailed by unforeseen circumstances. The good news? The Canadian financial landscape, particularly within the auto lending sector, has evolved. There are now numerous avenues specifically designed to assist individuals in Alberta who have experienced bankruptcy. These specialized lenders and dealerships understand that your credit score is just one piece of a larger puzzle, and often, it's not even the most important piece when it comes to getting approved for a car loan after bankruptcy.

Your journey begins not with despair, but with understanding the resources available to you. These resources are often found in dealerships that have built their business around helping people rebuild. They view a car loan as a strategic tool for your financial recovery, not just a transaction. The key is knowing where to look and what steps to take to present yourself as a reliable borrower ready for a fresh start.

The Alberta Advantage: Why Your Bankruptcy Story Doesn't End Your Car Ownership Dream

Alberta is a province of resilience, opportunity, and new beginnings. This spirit extends to its financial sector, where forward-thinking lenders and specialized dealerships recognize that a bankruptcy filing is often a strategic financial reset rather than a sign of perpetual irresponsibility. When "they see bankruptcy," it's easy to assume a negative judgment, but in Alberta's dynamic economic climate, many lenders see potential for mutual growth.

The stigma associated with bankruptcy is quickly eroding, particularly among lenders who understand the nuances of personal finance. They know that many bankruptcies result from factors outside an individual's control – job loss, illness, divorce, or unexpected economic shifts. In a province like Alberta, known for its boom-and-bust cycles, there's a greater appreciation for financial fortitude and the ability to bounce back. This understanding translates into a more accommodating lending environment.

From a lender's perspective, approving a car loan for a post-bankruptcy applicant isn't just about charity; it's about smart business. It's an opportunity to provide a crucial service to a motivated individual who is actively working to rebuild their financial profile. A car loan, especially for someone who has just completed bankruptcy, represents a low-risk, high-impact way for that individual to establish new, positive credit history. When you make consistent, on-time payments, it directly benefits both you and the lender. It's a win-win scenario.

Moreover, Alberta's robust job market and diverse economy provide a strong foundation for financial recovery. With opportunities in energy, technology, agriculture, and various service sectors, many residents can secure stable employment, which is a critical factor for lenders. This economic stability supports a quicker financial rebound and, consequently, better access to essential loans like auto financing. So, while the initial thought might be "they see bankruptcy," the reality is that many specialized lenders in Alberta see "your next car" and a strong commitment to moving forward.

Navigating the Post-Bankruptcy Road Map: What Alberta Lenders Truly Look For Beyond Your Credit Score

When you apply for a car loan after bankruptcy in Alberta, it's natural to assume your credit score is the sole determining factor. While it plays a role, specialized lenders look far beyond the numbers on a credit report. They are interested in your current financial stability and your commitment to a responsible financial future. Think of it as painting a comprehensive picture of your present and future, rather than dwelling on a past snapshot.

Lenders prioritize qualitative factors that demonstrate your ability and willingness to make consistent payments. These include:

- Job Stability: A steady employment history, ideally with the same employer for a significant period (e.g., 6 months to a year or more), signals a reliable income stream. This is often the single most important factor.

- Consistent Income: Lenders want to see verifiable income that comfortably covers your proposed car payments, living expenses, and any other debt obligations. This could be through pay stubs, employment letters, or bank statements. For those who are self-employed, demonstrating consistent income through bank statements can be crucial. For more on this, check out our guide on Self-Employed? Your Bank Account *Is* Your Proof. Get Approved.

- Length of Residency in Alberta: A stable address in Calgary, Edmonton, or any other Alberta community indicates stability and commitment to the region.

- Debt-to-Income (DTI) Ratio: While your past DTI may have been high, lenders will assess your *current* DTI. They want to ensure your monthly debt payments (including the new car loan) do not consume too large a portion of your gross monthly income, leaving you with enough disposable income.

Understanding the "why" behind your bankruptcy is also significant. Lenders distinguish between a recent bankruptcy discharge and being in active bankruptcy or a consumer proposal. If you've been discharged, it demonstrates that you've completed the process and are ready for a clean slate. If you're currently in a consumer proposal, it shows you're actively working to resolve your debts. Both situations have different implications, but neither is an automatic disqualifier. For those navigating a consumer proposal, know that securing a car loan is often possible; explore The Consumer Proposal Car Loan You Were Told Was Impossible for deeper insights.

Demonstrating a forward-looking financial plan is also key. This means having a clear budget, understanding your monthly expenses, and showing how the car loan payment fits comfortably into your new financial reality. It’s about proving that you’ve learned from the past and are committed to responsible financial management moving forward.

Dealerships vs. Traditional Banks in Alberta: Unlocking Your Best Approval Odds

After bankruptcy, the landscape of auto financing can seem confusing. Should you approach your local bank, or is there a better option? For most individuals seeking a car loan after bankruptcy in Alberta, specialized dealerships often hold the key to approval, providing a significantly higher chance of success compared to traditional banks.

Traditional banks, credit unions, and prime lenders typically adhere to stricter lending criteria. Their algorithms heavily weigh credit scores, and a recent bankruptcy or consumer proposal will often trigger an automatic denial. They prefer applicants with established, pristine credit histories, viewing anyone with past financial challenges as a higher risk. This isn't a judgment on your character, but rather a reflection of their conservative lending policies.

Specialized dealerships, on the other hand, are designed to work with a broader range of credit profiles. These are the establishments you should actively seek out, often advertising services for "bad credit car loans," "bankruptcy auto financing," or "credit rebuilding programs" in Calgary, Edmonton, and other Alberta communities. They understand that a low credit score or a bankruptcy filing doesn't mean you're unreliable; it just means you need a different kind of lending solution.

The primary reason these dealerships succeed where banks fail lies in their access to and relationships with subprime lenders and their own in-house financing programs. Subprime lenders specialize in providing loans to individuals with less-than-perfect credit. They use a more holistic underwriting process, focusing on your current income, employment stability, and ability to pay, rather than solely on your credit history. In-house financing, offered by some dealerships, means they are lending you their own money, giving them even greater flexibility in approval decisions.

Comparing Financing Options Post-Bankruptcy in Alberta

| Feature | Specialized Dealerships (Subprime/In-House) | Traditional Banks/Credit Unions |

|---|---|---|

| Approval Odds Post-Bankruptcy | High (focus on current income/stability) | Low (strict credit score requirements) |

| Interest Rates | Typically higher initially, but can improve | Lower for prime borrowers; rarely available for post-bankruptcy |

| Flexibility in Terms | High (more personalized options, diverse lenders) | Limited (standardized products) |

| Focus on Credit Rebuilding | Core business model; actively helps rebuild credit | Not a primary focus; expects strong credit already |

| Vehicle Selection | Often a wide range of reliable used vehicles; some new options | Not directly tied to vehicle selection, only financing |

| Application Process | Streamlined, often online, fast decisions | More rigorous, potentially longer waiting periods |

When comparing financing options, ask key questions:

- What are the minimum income requirements?

- Do you work with multiple lenders specializing in bad credit?

- What documents will I need to provide?

- Can you explain all fees and charges upfront?

- What are the typical interest rates for someone in my situation?

By focusing your efforts on dealerships that explicitly cater to individuals with challenging credit histories, you significantly increase your chances of not only getting approved but also finding a loan that helps you take the next step forward in your financial journey.

Decoding the Dollar Signs: Interest Rates, Terms, and Avoiding Hidden Costs in Alberta Auto Loans

Securing a car loan after bankruptcy in Alberta is a significant achievement, but it's crucial to approach the financial details with a clear understanding. One of the most common questions revolves around interest rates. It's important to set realistic expectations: your initial interest rate will likely be higher than what someone with excellent credit might receive. This is because, despite your fresh start, lenders still perceive a higher risk due to your past financial history. However, this higher rate is often a temporary stepping stone, a necessary part of the credit rebuilding process.

Interest rates for post-bankruptcy auto loans in Alberta can vary widely, typically ranging from 10% to 29.9% APR (Annual Percentage Rate), depending on factors like your income stability, down payment size, the vehicle's age, and the lender's specific policies. While these rates might seem steep, remember that consistent, on-time payments will rapidly improve your credit score, potentially allowing you to refinance for a lower rate within 12-18 months. For guidance on how to refine your loan, check out Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit.

Beyond the interest rate, negotiating better loan terms is paramount. Focus on:

- Loan Length (Amortization Period): While a longer loan term can reduce your monthly payment, it also means you pay more interest over the life of the loan. Aim for the shortest term you can comfortably afford.

- Payment Frequency: Consider bi-weekly payments. Paying every two weeks means you make 26 half-payments in a year, equivalent to 13 full monthly payments, which can help pay down the principal faster and reduce overall interest.

- Avoiding Balloon Payments: Steer clear of loans that have a large lump sum payment due at the end of the term. These can create financial distress if you're not prepared.

Identifying and safeguarding against predatory lending practices and unnecessary add-ons is equally vital. Always read the fine print carefully. Watch out for:

- Excessive Fees: Ensure all administration fees, documentation fees, and other charges are clearly itemized and reasonable. Don't be afraid to ask for explanations.

- Unnecessary Insurance Products: While some protection plans (like GAP insurance) might be beneficial, avoid being pressured into costly extended warranties or credit insurance that you don't need or understand.

- Inflated Vehicle Prices: Always research the market value of the vehicle you're interested in. A higher vehicle price translates to a larger loan and more interest.

Finally, understand the total cost of vehicle ownership beyond the loan payment. In Alberta, this includes:

- Registration and Licensing: Annual fees vary by vehicle type and region.

- Insurance: Car insurance rates in Alberta can be significant, especially with a past bankruptcy. Shop around for quotes from multiple providers.

- Maintenance and Repairs: Budget for regular servicing, tires, and unexpected repairs.

- Fuel Costs: Consider your daily commute and the vehicle's fuel efficiency.

Your Application Toolkit: Crafting a Winning Case for an Alberta Car Loan

Applying for a car loan after bankruptcy in Alberta requires preparation and a strategic approach. Think of it as assembling an "application toolkit" that showcases your current financial stability and your commitment to responsible borrowing. The more prepared you are, the smoother the process will be, and the higher your chances of approval.

The essential documents you'll need to gather typically include:

- Proof of Income: This is paramount. Bring your most recent pay stubs (usually 2-3 months), an employment letter from your employer, or bank statements showing consistent income deposits if you're self-employed.

- Proof of Residency: A utility bill, lease agreement, or mortgage statement showing your current address in Alberta. Lenders prefer stability, so a long-standing address is a plus.

- Government-Issued ID: Your valid Canadian driver's licence is essential.

- Bankruptcy Discharge Papers: This document proves you have completed the bankruptcy process and are no longer actively in bankruptcy.

- Bank Statements: Recent bank statements can provide a comprehensive overview of your financial activity, demonstrating responsible money management and cash flow.

- List of Current Debts/Expenses: While your bankruptcy cleared many debts, lenders will want to see any new or remaining obligations to calculate your current debt-to-income ratio.

The strategic power of a down payment cannot be overstated, even if you've heard otherwise. While some dealerships might offer "zero down" options, even a modest down payment can significantly impact your approval odds and the terms of your loan. A down payment demonstrates your commitment to the purchase, reduces the amount you need to borrow (and thus the interest you pay), and signals financial responsibility to the lender. It also provides immediate equity in the vehicle, reducing the lender's risk.

Understanding your current debt-to-income (DTI) ratio is crucial. This ratio compares your total monthly debt payments (including the prospective car loan) to your gross monthly income. Lenders typically prefer a DTI below 40-45%. Be ready to present your current financial picture favorably by having a clear understanding of your budget and how the new car payment will fit into it. Show that your post-bankruptcy financial plan is sound and sustainable.

Finally, prepare for the application interview. Be honest, confident, and transparent about your financial history. Lenders are not there to judge but to assess risk. Explain what led to your bankruptcy (without making excuses) and, more importantly, what steps you've taken since to improve your financial habits. Show that you have a plan for responsible payment and are committed to rebuilding your credit.

The Right Ride for Your Rebound: Vehicle Selection After Bankruptcy in Alberta

Choosing the right vehicle after bankruptcy in Alberta is a strategic decision that goes hand-in-hand with your financial recovery. While it might be tempting to eye that luxury SUV or sports car, prioritizing reliability and affordability is crucial for long-term financial stability. Your goal at this stage is to secure dependable transportation that won't add unnecessary stress to your budget, while simultaneously rebuilding your credit.

Focus on practical, dependable vehicles known for their longevity and lower operating costs. Brands like Honda, Toyota, Mazda, and certain Ford or Hyundai models often have strong reputations for reliability and fuel efficiency. These vehicles typically come with lower maintenance costs and generally hold their value well, which is beneficial if you consider upgrading in the future.

New vs. Used: Which is Better Post-Bankruptcy in Alberta?

For most individuals rebuilding credit after bankruptcy, a used vehicle is typically the more financially prudent choice. Here’s why:

| Factor | New Car | Used Car |

|---|---|---|

| Price & Depreciation | Higher price, rapid initial depreciation (20-30% in first year) | Lower price, slower depreciation, better value retention |

| Loan Amount | Higher principal, higher monthly payments | Lower principal, more manageable monthly payments |

| Insurance Costs | Generally higher due to higher replacement value | Generally lower, saving on monthly expenses |

| Interest Impact | High interest on a large loan means significant total cost | High interest on a smaller loan still adds up, but overall less |

| Credit Rebuilding | Possible, but higher risk if payments become a burden | Excellent opportunity to build credit with manageable payments |

| Lender Accessibility | More stringent requirements, less common for subprime lenders | Wider availability through specialized dealerships and subprime lenders |

While getting a brand-new car after bankruptcy isn't impossible, it's often more challenging and comes with higher costs. Used vehicles, especially those 3-5 years old with reasonable mileage, offer a sweet spot of affordability, reliability, and value. Dealerships specializing in bad credit loans often have a robust inventory of these types of vehicles because they understand their clients' needs.

The vehicle's age and mileage also directly impact loan eligibility and terms. Lenders prefer vehicles that are not too old or have excessively high mileage, as they represent a lower risk of mechanical breakdown, which could jeopardize your ability to make payments. A car that is too old might not even qualify for financing with some lenders.

Spotlight on Alberta's Cities: Finding Approved Dealerships Near You

Finding the right dealership is perhaps the most critical step in securing a car loan after bankruptcy in Alberta. Fortunately, major cities and even smaller communities across the province host dealerships that specialize in helping individuals with challenging credit histories. Knowing where to look and what to expect can make all the difference.

Calgary: The Hub of Opportunity

As Alberta's largest city, Calgary offers a wide array of options for post-bankruptcy car loans. Many dealerships in Calgary have dedicated finance departments that partner with numerous subprime lenders. When searching in Calgary, focus on dealerships that explicitly advertise "bad credit auto loans Calgary," "bankruptcy car loans Calgary," or "credit rebuilding programs." These establishments understand the unique needs of clients who have faced financial setbacks and are equipped with the expertise and resources to help you. Key areas to explore might be along major automotive strips or by using online search filters for specialized financing.

Edmonton: Navigating the Capital's Car Loan Landscape

Edmonton, Alberta's capital, is another excellent place to find accommodating lenders. Similar to Calgary, dealerships in Edmonton often have strong relationships with lenders who specialize in non-traditional credit applications. When you're in Edmonton, look for dealerships that highlight their ability to secure approvals regardless of credit history. They often emphasize a focus on your current income and stability over past credit issues. Don't be shy about calling ahead and explaining your situation; transparency builds trust and helps the finance team pre-qualify you more effectively.

Red Deer, Lethbridge, Fort McMurray: Regional Insights

- Red Deer: Situated between Calgary and Edmonton, Red Deer's auto market is also well-serviced by dealerships accustomed to various credit situations. Many offer personalized solutions, recognizing the importance of reliable transport for residents in central Alberta.

- Lethbridge: In Southern Alberta, Lethbridge provides options through local dealerships that pride themselves on community service and helping residents get back on their feet. Seek out those with a strong local reputation for customer care and flexible financing.

- Fort McMurray: Given its unique economic drivers, Fort McMurray's dealerships understand the need for reliable vehicles and often have programs tailored to residents who might have experienced fluctuating incomes or financial challenges.

Regardless of your location in Alberta, practical advice on how to research, vet, and approach dealerships is consistent. Start by using online search engines with specific keywords like "dealerships that approve car loans after bankruptcy Alberta" or "[Your City] bad credit car loans." Look for dealerships with positive online reviews that specifically mention their helpfulness with challenging credit situations. Read testimonials to gauge their commitment to customer success. Once you've identified a few potential dealerships, contact them to schedule an appointment. Be open about your bankruptcy from the outset; a reputable dealership will appreciate your honesty and will be better positioned to guide you.

Beyond the Purchase: How Your Alberta Car Loan Can Rebuild Your Financial Future

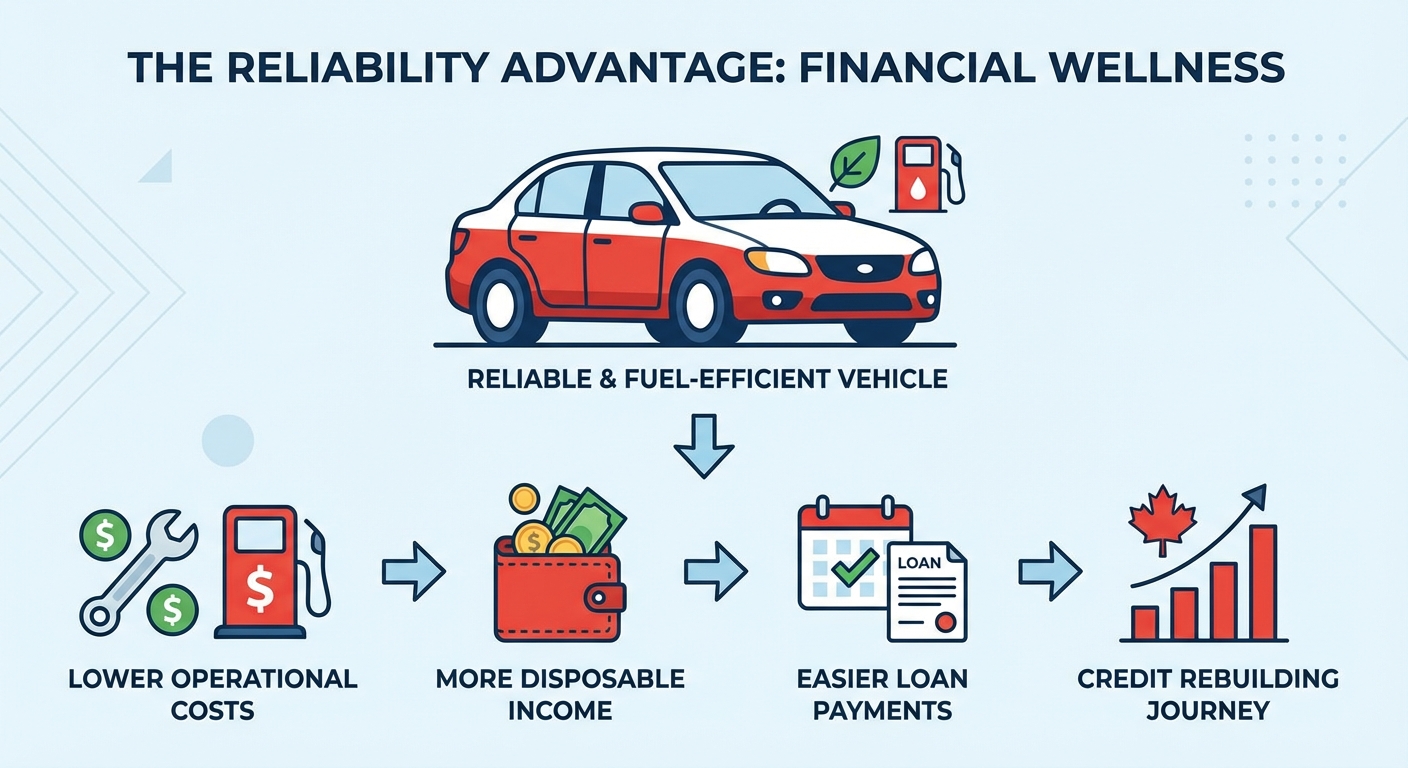

Getting approved for a car loan after bankruptcy in Alberta is more than just acquiring a vehicle; it's a powerful and tangible step towards rebuilding your financial future. This loan isn't merely a debt; it's an opportunity to establish a new, positive credit history and demonstrate your renewed commitment to financial responsibility.

The mechanics of credit reporting are fundamental here. In Canada, your auto loan payments are reported to major credit bureaus like Equifax and TransUnion. When you consistently make your car loan payments on time, every single month, these positive entries accumulate on your credit report. Over time, these on-time payments will significantly improve your credit score, gradually overshadowing the negative impact of the bankruptcy. It's a clear, measurable way to show lenders that you are a reliable borrower once again.

As your credit score improves, new opportunities arise. One of the most significant strategies for financial optimization is potentially refinancing your loan. After 12 to 18 months of consistent payments, with an improved credit score, you may qualify for a new loan with better terms and a lower interest rate. Refinancing can drastically reduce your monthly payments and the total amount of interest you pay over the life of the loan, freeing up more of your income and accelerating your financial recovery.

Beyond the car loan itself, adopting long-term financial habits is essential to sustain your credit health and avoid future setbacks. This includes:

- Strict Budgeting: Create and stick to a realistic monthly budget that accounts for all income and expenses, including your car payments, insurance, and maintenance.

- Emergency Savings: Build an emergency fund to cover unexpected expenses, preventing reliance on high-interest credit or further financial distress.

- Making Timely Payments: Extend your discipline of on-time payments to all other obligations, no matter how small. Even utility bills or cell phone payments can impact your credit if missed.

- Regular Credit Monitoring: Periodically check your credit report to ensure accuracy and track your progress.

The ripple effect of a stronger credit score extends far beyond just auto loans. It opens doors to other financial opportunities in Alberta, such as qualifying for lower interest rates on mortgages, personal loans, or even better terms on insurance policies. It can also make it easier to rent an apartment, obtain a cell phone plan, or even secure certain types of employment. Your car loan is the beginning of a powerful upward trajectory for your financial independence.

Your Next Steps to Approval: Driving Away Confidently in Alberta

Navigating life after bankruptcy in Alberta, especially when you need reliable transportation, can feel like a complex journey. But as we’ve explored, the path to a car loan is not only possible but also a powerful tool for your financial resurgence. We understand the challenges, and we're here to reinforce the message of hope and empowerment: you absolutely can get a car loan after bankruptcy in Alberta.

Here’s a concise, actionable checklist to help you implement your next steps immediately:

- Assess Your Budget: Determine what you can realistically afford for a monthly car payment, including insurance, fuel, and maintenance.

- Gather Your Documents: Collect all necessary paperwork: proof of income, residency, ID, and bankruptcy discharge papers.

- Research Specialized Dealerships: Actively seek out and contact dealerships in Calgary, Edmonton, Red Deer, Lethbridge, or Fort McMurray that specialize in bad credit or post-bankruptcy auto loans. Use online reviews and recommendations.

- Consider a Down Payment: Even a modest amount can significantly improve your odds and terms.

- Be Transparent and Honest: When speaking with lenders, be upfront about your financial history and your commitment to rebuilding.

- Prioritize Reliability: Focus on practical, dependable vehicles that won't strain your budget with ongoing costs.

- Read the Fine Print: Understand all loan terms, interest rates, and fees before signing.

- Apply with Confidence: You've done your homework. Now, take the leap.

Your journey toward financial independence and reliable transportation starts today. Don't let a past financial setback define your future. With the right approach, the right partner, and a commitment to responsible financial habits, you'll soon be driving away confidently in Alberta, with your new car representing not just a set of keys, but a fresh start and a stronger financial tomorrow.