Car Loan After Bankruptcy & 400 Credit Score 2026 Guide

Table of Contents

- Key Takeaways: Your Instant Guide to Getting a Car Loan with a 400 Credit Score Post-Bankruptcy

- The Myth vs. Reality: Can You *Really* Get a Car Loan with a 400 Credit Score After Bankruptcy in 2026?

- Understanding the '400 Credit Score' Stigma

- The Bankruptcy Aftermath: How Long Does It Haunt Your Report?

- Beyond the FICO: What Lenders *Actually* Prioritize for High-Risk Applicants

- Deconstructing Your Financial Profile: What Lenders See (And What You Can Improve)

- Your Credit Report: A Post-Bankruptcy Audit

- The Power of Stability: Income, Employment, and Residency

- Crafting Your Budget: Proving Affordability Beyond Doubt

- Pre-Flight Checklist for Your Car Loan Journey: Preparing for Approval

- The Down Payment Advantage: Why It's Non-Negotiable for High-Risk Borrowers

- Knowing Your Numbers: How Much Car Can You Truly Afford?

- The Co-Signer Conundrum: When Does It Help (And When Is It a Risk)?

- Finding Your Funding Allies: Specialized Lenders for the Comeback Story

- Subprime Auto Lenders: Your Primary Go-To

- Dealership Finance Departments: The 'Buy Here, Pay Here' Option and Beyond

- Credit Unions: A Niche for Second Chances?

- Mastering the Application & Negotiation: Getting the Best Deal Possible

- One Application at a Time: Minimizing Credit Score Impact

- Honesty is the Best Policy: Full Disclosure of Your Bankruptcy

- Negotiating Beyond the Rate: Focus on Total Cost

- The Lifecycle of a Subprime Car Loan: What to Expect and How to Manage It

- Unpacking Interest Rates: Why They're High and How to Lower Them Later

- Loan Terms and Payments: Balancing Affordability with Total Cost

- Hidden Costs and Fees: What to Watch Out For

- Beyond the Loan: Building a Stronger Financial Future with Your Car Loan

- Your Car Loan as a Credit-Building Machine

- The Refinancing Advantage: Lowering Your Rates When Your Score Recovers

- Long-Term Financial Habits: What Comes After the Car Loan?

- The 2026 Landscape: Trends and Technologies Impacting Subprime Auto Lending

- AI and Alternative Data: A New Lens for Lender Evaluation

- Personalized Lending Products: Tailored Solutions for Unique Situations

- The Digital Application Revolution: Streamlined but Still Scrutinized

- Your Next Mile: Strategic Steps to Secure Your Car Loan and Financial Future

- Recap: The Core Principles for Success

- Action Plan: Your Immediate Steps Post-Reading

- Embrace the Journey: Patience and Persistence Pay Off

- Frequently Asked Questions (FAQ) About Car Loans After Bankruptcy & 400 Credit Score

Navigating the path to a car loan after bankruptcy, especially with a credit score hovering around 400, can feel like an uphill battle. Many Canadians find themselves in this challenging position, needing reliable transportation but facing skepticism from traditional lenders. The good news? Securing a car loan in 2026, even with a past bankruptcy and a low credit score, is not an impossible dream. It requires strategy, preparation, and knowing where to look.

This comprehensive guide from SkipCarDealer.com is your definitive roadmap. We'll demystify the process, expose the realities of bad credit lending, and equip you with the knowledge and tools to drive away in a vehicle that fits your needs and your budget. Forget generic advice; we're diving deep into the mechanics of approval for 2026, giving you concrete steps and realistic expectations.

Key Takeaways: Your Instant Guide to Getting a Car Loan with a 400 Credit Score Post-Bankruptcy

- Yes, It's Possible: But Not Without Strategy

While challenging, getting approved for a car loan with a 400 credit score after bankruptcy is achievable. Success hinges on a well-thought-out strategy, realistic expectations, and a commitment to financial recovery. - Your Credit Score is Just One Piece: Lenders Look Deeper

A low credit score is a hurdle, but it's not the only factor. Lenders, especially subprime specialists, heavily weigh your income stability, employment history, debt-to-income ratio, and your ability to demonstrate a clear repayment plan. - Specialized Lenders Are Your Best Bet, Not Traditional Banks

Forget the big banks for now. Your highest probability of approval lies with subprime auto lenders and the finance departments of dealerships that specialize in bad credit car loans. These entities understand and cater to unique financial situations. - Preparation is Paramount: Don't Apply Blindly

Before you even think about applying, get your financial house in order. This means scrutinizing your credit report, creating a detailed budget, gathering proof of income and residency, and ideally, saving for a substantial down payment. - The 2026 Edge: Leveraging New Tools and Understanding Evolving Criteria

The lending landscape is continuously evolving. In 2026, artificial intelligence and alternative data sources are increasingly influencing lender decisions, potentially offering new pathways for approval. Stay informed about these trends to maximize your chances.

The Myth vs. Reality: Can You *Really* Get a Car Loan with a 400 Credit Score After Bankruptcy in 2026?

The short answer is: Yes, it is absolutely possible to get a car loan with a 400 credit score after bankruptcy in 2026, but it requires a strategic approach and understanding the specific criteria that specialized lenders prioritize. It won't be easy, and the terms will reflect the risk, but approval is within reach for determined individuals.

Understanding the '400 Credit Score' Stigma

A credit score of 400 is firmly in the "poor" or "very poor" category within Canada's credit rating system (typically FICO or VantageScore models, which range from 300-900). For lenders, this score signals a high risk of default. It indicates a history of missed payments, high debt, or, in your case, a recent bankruptcy. Traditional lenders, like major banks, often have strict minimum credit score requirements (typically 650+), making them unlikely to approve loans for applicants with a 400 score.

The Bankruptcy Aftermath: How Long Does It Haunt Your Report?

Bankruptcy is one of the most severe negative markers on your credit report, and its impact is long-lasting. In Canada, the duration depends on the type and number of bankruptcies:

- First-time Bankruptcy (Discharged): A first bankruptcy will typically remain on your Equifax credit report for 6 years from the date of discharge and on your TransUnion report for 7 years from the date of discharge.

- Second-time Bankruptcy: For a second bankruptcy, it remains on your Equifax report for 14 years from the date of discharge and on your TransUnion report for 14 years from the date of discharge.

While the bankruptcy listing itself persists for years, the immediate impact diminishes over time. Lenders are more concerned with recent financial behaviour than with events that happened several years ago. The good news is that as soon as your bankruptcy is discharged, you can begin rebuilding your credit, and many specialized lenders are willing to consider you.

Beyond the FICO: What Lenders *Actually* Prioritize for High-Risk Applicants

For applicants with a 400 credit score and a bankruptcy on file, lenders shift their focus beyond just the credit score. They delve into your current financial stability and capacity to repay. Key factors include:

- Income Stability and Amount: Do you have a steady job? How long have you been employed? Is your income sufficient to cover the car payments, insurance, and other living expenses? Lenders look for consistent, verifiable income.

- Employment History: A long, uninterrupted employment history at the same company demonstrates reliability and a steady source of income, which is a significant plus.

- Debt-to-Income (DTI) Ratio: This ratio compares your total monthly debt payments to your gross monthly income. Lenders want to see a manageable DTI, ideally below 40-45%, to ensure you're not overextended.

- Recent Credit Activity (Post-Bankruptcy): Have you shown any responsible financial behaviour since your bankruptcy discharge? This could include secured credit cards, credit builder loans, or a clean record on utility payments.

- Down Payment: A substantial down payment significantly reduces the lender's risk, making them much more likely to approve your loan.

Deconstructing Your Financial Profile: What Lenders See (And What You Can Improve)

Understanding how lenders view your financial situation after bankruptcy is the first step to presenting a stronger application. Your goal is to mitigate the perceived risk.

Your Credit Report: A Post-Bankruptcy Audit

Even after bankruptcy, your credit report remains a critical document. It's essential to obtain and scrutinize your reports from both major Canadian credit bureaus: Equifax and TransUnion. While the bankruptcy will be listed, you need to ensure all other accounts that were part of the bankruptcy are accurately reported as "discharged" or "included in bankruptcy" with a zero balance. Any errors or accounts still showing as active or overdue can further harm your chances.

- Order Your Reports: You are entitled to a free copy of your credit report annually from both Equifax and TransUnion Canada.

- Review for Accuracy: Check for any inaccuracies. Are all accounts discharged correctly? Are there any debts listed that were not part of the bankruptcy? Dispute any errors immediately.

- Understand the Details: Familiarize yourself with how the bankruptcy is reported. Knowing the exact dates and details helps you explain your situation clearly to a lender.

The Power of Stability: Income, Employment, and Residency

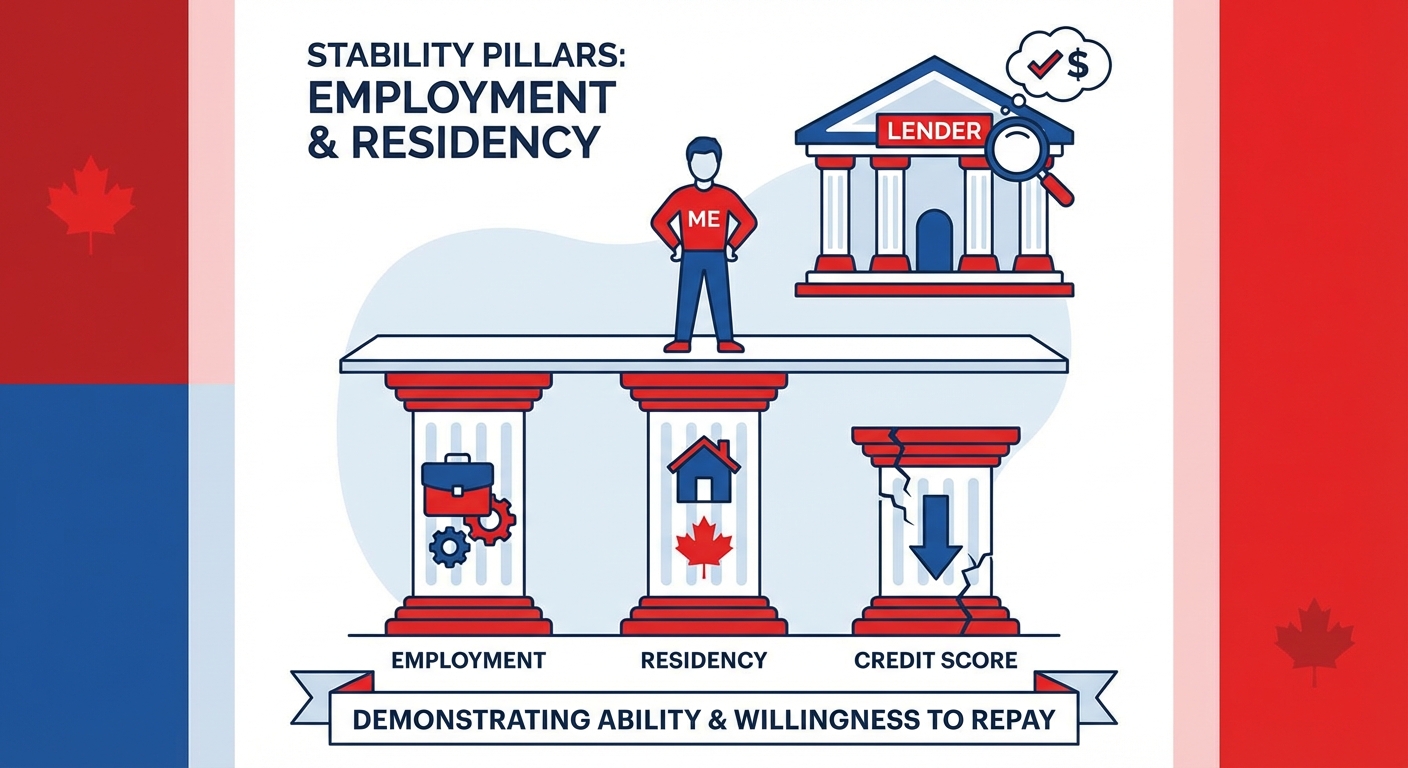

Lenders are primarily concerned with your ability and willingness to repay. With a low credit score, demonstrating stability in other areas becomes paramount. Think of these as the 'pillars' supporting your application:

(Context: Infographic showing the 'pillars' of a strong loan application: Income, Employment, Residency, Down Payment, Vehicle Choice).

(Context: Infographic showing the 'pillars' of a strong loan application: Income, Employment, Residency, Down Payment, Vehicle Choice).

- Consistent Income: Provide proof of steady income through pay stubs, employment letters, or tax returns. Self-employed? Show bank statements demonstrating consistent deposits.

- Long-Term Employment: Lenders favour applicants who have been with the same employer for a significant period (e.g., 1-2 years or more). This signals job security.

- Stable Residency: Moving frequently can be a red flag. Demonstrate a stable living situation, ideally with a history of residence at the same address for several years, through utility bills or rental agreements.

Before applying for a car loan, consider taking small, strategic steps to rebuild your credit. A secured credit card (where you provide a deposit as collateral) or a credit builder loan (a small loan held in trust until repaid) can demonstrate responsible payment behaviour. Consistent, on-time payments on these products, even for 6-12 months, can begin to slowly improve your credit score and show lenders you're committed to financial recovery.

Crafting Your Budget: Proving Affordability Beyond Doubt

A detailed personal budget isn't just for your benefit; it's a powerful tool to show lenders you've thought through your finances. It proves you can realistically afford a car payment, insurance, and maintenance costs.

- List All Income Sources: Include your net monthly income from all reliable sources.

- Detail All Expenses: Be exhaustive. Include rent/mortgage, utilities, groceries, transportation (even if it's bus fare), existing debt payments, phone, internet, and discretionary spending.

- Calculate Your Disposable Income: What's left after all essential expenses? This is the amount you can realistically allocate to a car payment.

- Account for Car Ownership Costs: Don't forget insurance (which will be higher with a 400 credit score), fuel, maintenance, and potential repairs. Presenting this to a lender shows you're responsible and have planned ahead.

Pre-Flight Checklist for Your Car Loan Journey: Preparing for Approval

The more prepared you are before you even approach a lender, the higher your chances of approval and the better terms you might secure.

The Down Payment Advantage: Why It's Non-Negotiable for High-Risk Borrowers

For an applicant with a 400 credit score and a bankruptcy, a significant down payment is often the single most impactful factor in securing approval and potentially lowering your interest rate. It directly reduces the lender's risk.

- Reduces Lender Risk: A down payment means you have equity in the vehicle from day one, making you less likely to default. It also reduces the loan amount, lessening the lender's exposure.

- Improves Approval Odds: Many subprime lenders require a down payment for high-risk applicants. It signals your commitment and ability to save.

- Potentially Lower Interest Rates: While rates will still be high, a larger down payment might push you into a slightly better rate tier, saving you thousands over the loan term.

- Strategies to Save: Start saving diligently. Even a few thousand dollars can make a big difference. Consider selling unused items, picking up extra work, or temporarily cutting discretionary spending.

Knowing Your Numbers: How Much Car Can You Truly Afford?

It's tempting to dream of a new, flashy vehicle, but post-bankruptcy, practicality is key. Determine a realistic budget that covers not just the monthly payment, but all associated costs.

- Use Online Calculators: Input potential loan amounts, interest rates (expect high ones!), and terms to estimate monthly payments.

- Factor in Insurance Costs: With a 400 credit score and potentially a new loan, your insurance premiums will be significantly higher, especially in provinces like Ontario or British Columbia. Get quotes *before* you commit to a car.

- Consider Fuel and Maintenance: Opt for a reliable, fuel-efficient used car with a good track record for low maintenance costs. An older, luxury vehicle might seem cheap upfront but can drain your budget with repairs and premium fuel.

The Co-Signer Conundrum: When Does It Help (And When Is It a Risk)?

A co-signer with excellent credit can significantly boost your chances of approval and potentially secure a lower interest rate. However, it's a decision that carries substantial risks for both parties.

- Pros: Easier approval, potentially better rates, a chance to rebuild your credit.

- Cons: The co-signer is equally responsible for the loan. If you miss payments, their credit score will suffer, and they will be legally obligated to pay. This can strain relationships.

- Responsibilities: Both you and your co-signer must understand the full legal and financial implications. Ensure you can make payments consistently to protect their credit.

Prepare a folder with all necessary documents before you apply. This not only streamlines the process but also shows lenders you are organized and serious. Essential documents typically include:

- Government-issued ID (driver's licence, passport)

- Proof of income (2-3 recent pay stubs, employment letter, T4s, notice of assessment if self-employed)

- Proof of residency (utility bill, lease agreement, mortgage statement)

- Bank statements (recent 3-6 months to show financial activity)

- Bankruptcy discharge papers

- Proof of a down payment (if applicable)

- Trade-in vehicle title (if applicable)

Finding Your Funding Allies: Specialized Lenders for the Comeback Story

Traditional banks are generally not an option for individuals with a 400 credit score post-bankruptcy. Your success lies with lenders who specialize in high-risk loans.

Subprime Auto Lenders: Your Primary Go-To

Subprime auto lenders specialize in providing financing to individuals with less-than-perfect credit, including those with bankruptcies. Their business model is built around assessing higher risk and charging higher interest rates to compensate. They look beyond just your credit score, focusing on your current income, employment stability, and ability to make payments.

- How They Operate: They use proprietary algorithms and human underwriters to evaluate a broader range of factors than traditional banks. They often work with a network of dealerships.

- Risk Mitigation: To offset the risk, they typically require higher interest rates, larger down payments, and may limit the types of vehicles you can finance (e.g., newer, lower-kilometre used cars rather than very old models).

- Across Canada: Many online and brick-and-mortar subprime lenders operate nationally, with services available whether you're looking for bad credit car loans in Calgary, Montreal, or any other major city.

Dealership Finance Departments: The 'Buy Here, Pay Here' Option and Beyond

Dealerships, especially larger ones, often have dedicated finance departments that work with a wide array of lenders, including subprime specialists. This can be a significant advantage.

- Multiple Lender Relationships: A dealership's finance manager can submit your application to several lenders simultaneously, increasing your chances of finding an approval.

- In-House Financing ('Buy Here, Pay Here'): Some dealerships offer direct financing, meaning they lend you the money themselves. This can be an option for those with very challenging credit, but it often comes with higher interest rates and less flexible terms. Be cautious and ensure transparency.

- Local Expertise: Dealerships in smaller markets like Saskatoon or Halifax are often attuned to local lending conditions and can guide you to the best options available in your area.

Credit Unions: A Niche for Second Chances?

Credit unions are member-owned financial institutions known for their community focus and potentially more flexible lending criteria than large banks. While they may not specialize in bad credit as explicitly as subprime lenders, it's worth exploring if you're already a member or meet their membership requirements.

- Relationship-Based Lending: If you have a long-standing relationship with a credit union and can demonstrate a commitment to improving your finances, they might be more willing to work with you.

- Stricter Criteria than Subprime: Generally, credit unions will still require some credit rebuilding post-bankruptcy. They are less likely to approve a 400 credit score immediately after discharge without significant mitigating factors.

- Examples: Institutions like Vancity in British Columbia or Meridian Credit Union in Ontario might offer specific programs or more personal consideration for members in financial recovery.

It's crucial to be vigilant when seeking financing. For more on identifying trustworthy lenders, read our guide on Unmasking 'Bad Credit' Car Lenders: Red Flags You Miss, Quebec.

Mastering the Application & Negotiation: Getting the Best Deal Possible

Once you've done your homework and identified potential lenders, the application and negotiation phase requires a strategic approach.

One Application at a Time: Minimizing Credit Score Impact

When you apply for a loan, lenders perform a "hard inquiry" on your credit report. Multiple hard inquiries in a short period can negatively impact your credit score. To minimize this, apply with one or two lenders within a concentrated window (e.g., 14-45 days, depending on the credit scoring model). Credit bureaus often treat multiple inquiries for the same type of loan within this period as a single inquiry, recognizing you're rate shopping.

- Targeted Approach: Don't spray and pray. Focus on lenders most likely to approve you based on your research.

- Understand Inquiry Impact: Each hard inquiry can drop your score by a few points, though the impact lessens over time.

Honesty is the Best Policy: Full Disclosure of Your Bankruptcy

Attempting to hide your bankruptcy will only backfire. Lenders will see it on your credit report. Be transparent and upfront about your past financial challenges.

- Explain Your Situation: Be prepared to discuss the circumstances that led to the bankruptcy and, more importantly, what steps you've taken since to improve your financial situation.

- Show Commitment to Recovery: Lenders want to see that you've learned from the experience and are committed to responsible financial behaviour moving forward. Highlight your budget, savings, and any credit-building efforts.

Negotiating Beyond the Rate: Focus on Total Cost

With a 400 credit score, you should expect a high interest rate. While you can try to negotiate, your primary focus should be on the total cost of the loan and the overall affordability of the vehicle.

- Vehicle Price: Negotiate the price of the car first. A lower purchase price means a smaller loan amount, which can save you money regardless of the interest rate.

- Down Payment: Be prepared to offer the largest down payment you can afford.

- Loan Term: A longer loan term (e.g., 72 or 84 months) will result in lower monthly payments but significantly higher total interest paid. Balance affordability with the overall cost.

- Avoid Add-ons: Be wary of extras like extended warranties, rustproofing, or paint protection that inflate the loan amount. Only consider essential add-ons that truly provide value.

Never feel pressured into accepting a deal that doesn't feel right or is clearly beyond your budget. If the interest rates are too high, the payments are unaffordable, or the terms are unfavourable, be prepared to walk away. There will always be other options, and patience can save you from a financially debilitating decision.

The Lifecycle of a Subprime Car Loan: What to Expect and How to Manage It

Securing a subprime car loan is just the beginning. Understanding its characteristics and how to manage it responsibly is crucial for your financial recovery.

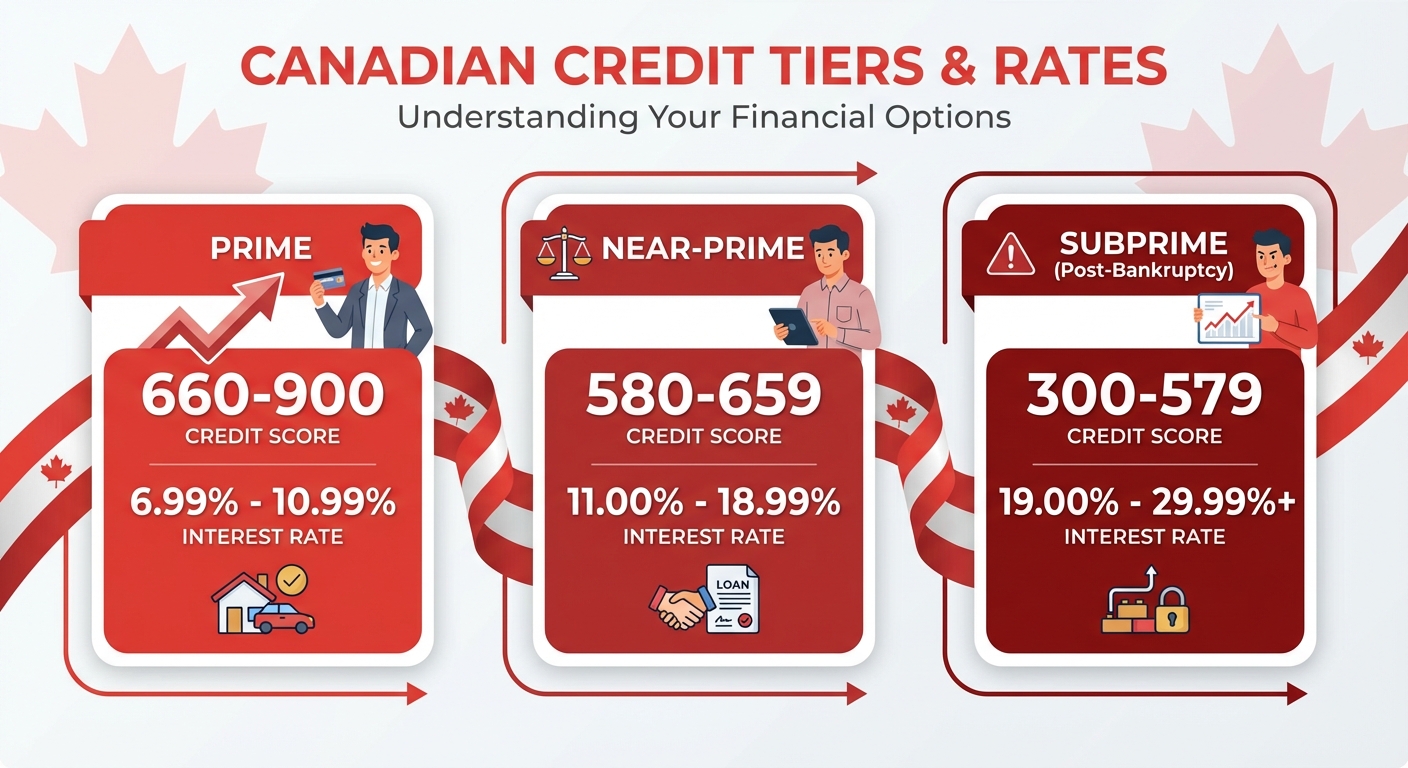

Unpacking Interest Rates: Why They're High and How to Lower Them Later

The reality for borrowers with a 400 credit score after bankruptcy is that interest rates will be substantially higher than for those with good credit. This is a direct reflection of the increased risk lenders are taking. Expect rates to be in the range of 15% to 29% or even higher, depending on your province, the lender, and other factors.

Example: Typical Auto Loan Interest Rate Ranges (Canada, 2026 Estimates)

| Credit Tier | Credit Score Range | Typical Interest Rate Range |

|---|---|---|

| Prime | 660-900 | 6.99% - 10.99% |

| Near-Prime | 580-659 | 11.00% - 18.99% |

| Subprime (Post-Bankruptcy) | 300-579 | 19.00% - 29.99%+ |

(Context: Chart comparing typical interest rates for prime, near-prime, and subprime auto loans).

(Context: Chart comparing typical interest rates for prime, near-prime, and subprime auto loans).

The good news is that this high rate isn't necessarily forever. By consistently making on-time payments, you can rebuild your credit score. Once your score improves significantly (e.g., to 600+), you can explore refinancing options to secure a lower interest rate, saving you a substantial amount of money over the remainder of the loan term.

Loan Terms and Payments: Balancing Affordability with Total Cost

To make monthly payments more affordable, subprime loans often come with longer terms, such as 60, 72, or even 84 months. While a longer term reduces your monthly outlay, it also means you'll pay significantly more in total interest over the life of the loan. It's a trade-off between immediate affordability and long-term cost.

Example: Impact of Loan Term on Total Cost (Assuming $20,000 Loan at 22% Interest)

| Loan Term (Months) | Monthly Payment (Approx.) | Total Interest Paid (Approx.) | Total Cost of Loan (Approx.) |

|---|---|---|---|

| 60 | $565 | $13,900 | $33,900 |

| 72 | $500 | $16,000 | $36,000 |

| 84 | $458 | $18,472 | $38,472 |

As you can see, extending the term by 24 months (from 60 to 84) can lower your monthly payment by over $100, but it adds nearly $4,600 to your total interest paid. Carefully consider this balance based on your budget.

Hidden Costs and Fees: What to Watch Out For

Be diligent about reviewing all paperwork before signing. High-risk loans can sometimes come with additional fees that inflate the overall cost.

- Administrative Fees: Processing fees or loan origination fees are common. Ensure they are reasonable and disclosed upfront.

- Extended Warranties & Add-ons: Dealerships may push additional products like extended warranties, rustproofing, or paint protection. While some can be valuable, evaluate if they are truly necessary or just inflating your loan.

- Prepayment Penalties: Check if your loan agreement includes any penalties for paying off the loan early. Ideally, you want a loan that allows you to pay it off faster without penalty once your finances improve.

To ensure you never miss a payment and to maximize your credit rebuilding efforts, set up automatic payments from your bank account. This eliminates the risk of human error or forgetfulness and guarantees timely payments, which is the most critical factor for improving your credit score.

Beyond the Loan: Building a Stronger Financial Future with Your Car Loan

Your car loan, when managed responsibly, is more than just transportation; it's a powerful tool for financial recovery.

Your Car Loan as a Credit-Building Machine

Every single on-time payment you make on your car loan is reported to the credit bureaus. This consistent positive activity is crucial for rebuilding your credit score after bankruptcy. It demonstrates to future lenders that you are capable of managing debt responsibly.

- Consistency is Key: Missing even one payment can set back your progress significantly.

- Diversify Your Credit Mix (Eventually): Once your car loan is established, you can gradually add other types of credit (like a secured credit card) to further diversify your credit profile.

The Refinancing Advantage: Lowering Your Rates When Your Score Recovers

Once you've made 12-18 months of consistent, on-time payments, your credit score should have improved considerably. This is the ideal time to explore refinancing your car loan.

- How Refinancing Works: You apply for a new loan (hopefully with a lower interest rate) to pay off your existing, high-interest car loan.

- Benefits: A lower interest rate means lower monthly payments or the ability to pay off the loan faster, saving you thousands in interest over the remaining term.

- When to Consider It: Aim for a credit score improvement of at least 50-100 points. Shop around with various lenders, including credit unions, as your improved score makes you a more attractive borrower.

If you find yourself with an upside-down car loan (owing more than the car is worth), refinancing can be especially beneficial. For more strategies, check out Alberta's Upside-Down Car? We're Flipping Your Refinance Story.

Long-Term Financial Habits: What Comes After the Car Loan?

The journey doesn't end when your credit score improves or your car loan is paid off. Continue to practice good financial habits:

- Maintain a Budget: Keep tracking your income and expenses.

- Build an Emergency Fund: Aim for 3-6 months of living expenses to avoid relying on credit in a crisis.

- Manage Debt Wisely: Be cautious with new credit. Only take on debt you can comfortably repay.

- Plan for Future Purchases: Use your improved financial health to plan for future large purchases, potentially with lower interest rates.

The 2026 Landscape: Trends and Technologies Impacting Subprime Auto Lending

The world of finance is constantly evolving, and 2026 brings new technologies and trends that could impact your ability to secure a car loan after bankruptcy.

AI and Alternative Data: A New Lens for Lender Evaluation

Artificial intelligence (AI) is transforming how lenders assess risk. Instead of relying solely on traditional credit scores, AI algorithms can analyze vast amounts of "alternative data," such as:

- Banking History: Consistent deposits, responsible account management, avoidance of overdrafts.

- Utility Payments: On-time payments for electricity, gas, and internet.

- Rental Payment History: Proof of consistent, on-time rent payments.

This shift could be a double-edged sword for those with low credit scores. It might offer new opportunities for approval by showcasing responsible behaviour not reflected in a 400 score. However, it also means lenders have a more comprehensive, granular view of your financial habits.

Personalized Lending Products: Tailored Solutions for Unique Situations

As technology advances, expect to see more personalized lending products. Instead of a one-size-fits-all approach, lenders may offer customized solutions designed for specific high-risk profiles. These might include:

- Graduated Payment Plans: Payments that start lower and increase over time.

- Micro-Loan Options: Smaller loan amounts for more affordable vehicles.

- Integrated Financial Coaching: Some lenders may offer resources or tools to help borrowers improve financial literacy alongside their loan.

The Digital Application Revolution: Streamlined but Still Scrutinized

The trend towards fully digital loan applications will continue to accelerate in 2026. Online platforms make it faster and more convenient to apply for a car loan, even with bad credit.

- Speed and Efficiency: You can often get pre-approved or receive a decision much faster than traditional methods.

- Required Documentation: While streamlined, these digital platforms still require thorough documentation uploads. Ensure you have all your digital copies ready.

- No Substitute for Due Diligence: Despite the speed, the need for you to research lenders, understand terms, and negotiate remains critical.

The lending environment is dynamic. Keep an eye on financial news, especially regarding subprime auto lending. New lenders, products, or government regulations could emerge that either benefit or hinder your future applications. Being informed allows you to adapt your strategy and take advantage of new opportunities.

Your Next Mile: Strategic Steps to Secure Your Car Loan and Financial Future

Securing a car loan after bankruptcy with a 400 credit score in 2026 is a journey that demands patience, diligence, and a clear strategy. But it's a journey you can successfully complete.

Recap: The Core Principles for Success

- Preparation is paramount: Get your documents, budget, and credit report in order.

- Down payment is your friend: It significantly reduces lender risk and improves your terms.

- Target specialized lenders: Subprime lenders and dealership finance departments are your best bet.

- Be transparent and realistic: Honesty about your bankruptcy and realistic expectations for rates and vehicles are key.

- Use the loan to rebuild: Consistent, on-time payments are your path to a stronger credit score.

Action Plan: Your Immediate Steps Post-Reading

- Obtain Your Credit Reports: Pull your free reports from Equifax and TransUnion Canada and review them meticulously.

- Create a Detailed Budget: Know your income, expenses, and exactly how much you can afford for a car payment (including insurance and fuel).

- Start Saving for a Down Payment: Even a small amount makes a big difference.

- Gather All Necessary Documents: Have your ID, pay stubs, bank statements, and bankruptcy discharge papers ready.

- Research Specialized Lenders: Identify subprime lenders or dealerships in your area that work with challenging credit.

Embrace the Journey: Patience and Persistence Pay Off

Rebuilding your credit and securing a car loan after bankruptcy is a marathon, not a sprint. There will be challenges, but with persistence, a positive attitude, and the right strategy, you can achieve your goal. Each on-time payment is a step towards a healthier financial future and more opportunities down the road. You've navigated bankruptcy; you have the resilience to secure your next ride.