Car Loan After Bankruptcy Discharge? The 2026 Approval Guide

Table of Contents

- Your Fresh Start is Here: Decoding Car Loan Approval Post-Bankruptcy

- Key Takeaways

- The First 90 Days: What 'Immediately After Discharge' Really Means for Lenders

- Assembling Your Approval Toolkit: The Non-Negotiable Documents Lenders Need to See

- Bank vs. Credit Union vs. In-House Financing: Where to Apply in Ontario, Alberta, and Beyond

- Decoding the Fine Print: Interest Rates, Hidden Fees, and Your Total Cost of Borrowing

- The Road Ahead: How Economic Shifts and New Tech Will Impact Your 2026 Car Loan

- Your 30-Day Action Plan: From Discharge Certificate to Driving Away

- Frequently Asked Questions About Post-Bankruptcy Car Loans in Canada

Your Fresh Start is Here: Decoding Car Loan Approval Post-Bankruptcy

Completing a bankruptcy is a monumental step toward financial recovery. It’s a clean slate, a chance to rebuild. Now, with your discharge certificate in hand, a pressing and practical question arises: can you get a car loan? You need reliable transportation for work, for family, for life. So let's get straight to it.

Yes, getting a car loan immediately after your bankruptcy discharge in Canada is absolutely possible. However, the word 'immediately' needs a strategic definition. It’s not about walking into a bank the day after you're discharged, but about a well-planned approach in the first 30 to 90 days.

This isn't just another guide; it's your strategic roadmap for 2026. We will walk you through the entire process, from understanding what your discharge certificate means to lenders, to assembling the perfect application, to finally holding the keys. Our goal is to get you from the discharge certificate to the driver's seat with your dignity and finances firmly intact.

Key Takeaways

- 'Immediate' Approval is Realistic: You can often get approved within 30-90 days of receiving your discharge certificate, provided you have proof of stable income and a reasonable down payment.

- Expect Higher Rates (Initially): Your first post-bankruptcy loan will likely have an interest rate between 15% and 29.9%. The primary goal is to use this loan as a tool to rebuild your credit, aiming for a much better rate in 12-18 months.

- Lender Choice is Crucial: Where you apply matters more than ever. Specialized non-prime lenders and experienced dealership finance departments are your best bet. Major banks like RBC or TD are unlikely to approve your very first loan after a discharge.

- The 2026 Outlook: With fluctuating interest rates and evolving lender technology, preparation is paramount. Digital lenders may offer faster approvals, but established dealership relationships can often provide more flexible and understanding terms.

- Documentation is Your Superpower: Your discharge papers, recent proof of income (pay stubs), and proof of residence are non-negotiable. Having these documents organized and ready will dramatically speed up the process.

The First 90 Days: What 'Immediately After Discharge' Really Means for Lenders

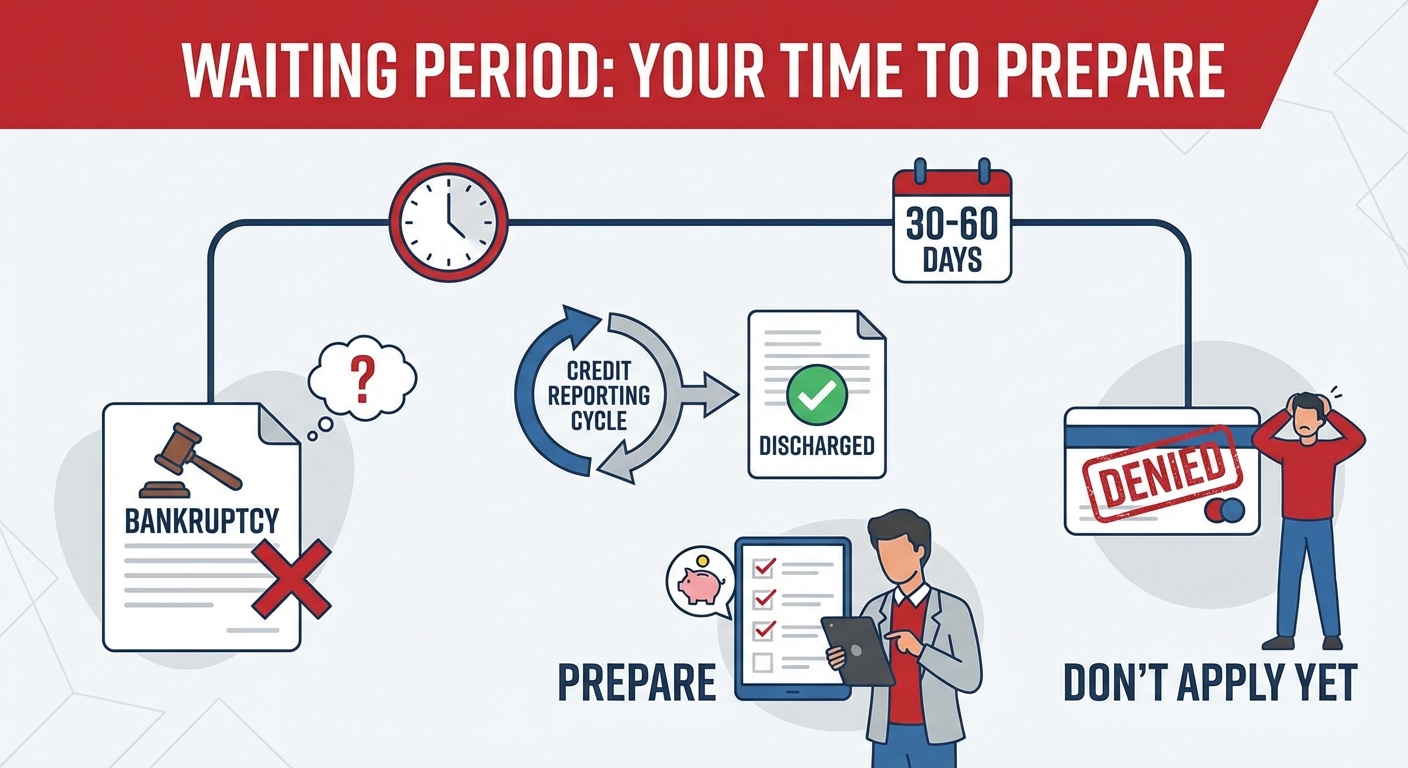

You can get a car loan immediately after a bankruptcy discharge in Canada, typically within 30 to 90 days. This timeline allows for your credit report to be updated with the discharge information. Lenders require your discharge certificate, proof of income, and often a down payment to consider your application.

From a lender's perspective, a recently discharged individual is a unique case. On one hand, you carry the history of a bankruptcy. On the other, you are legally debt-free—a "clean slate." Specialized lenders see this as an opportunity. You have no other major debt obligations, meaning your entire income is available to service a new car loan. They are cautious, but they are definitely interested.

Understanding the timeline is critical to managing your expectations and planning your approach:

- Day 1: Discharge Day. You receive your Absolute Discharge Certificate. This is the official document proving your bankruptcy is complete.

- Day 7-14: Bureaus Notified. Your Licensed Insolvency Trustee notifies Equifax and TransUnion of your discharge.

- Day 30-60: Your Credit Report Updates. This is the crucial waiting period. It can take a full credit reporting cycle for the bankruptcy to show as "discharged" on your report. Applying before this update is often a waste of time and a needless credit inquiry. This 30-60 day window is your time to prepare.

Scenario Analysis: The Reality on the Ground

Let's make this real. Imagine you're a nurse in Calgary, discharged just two weeks ago. You have a stable income and you've saved up a $5,000 down payment for a reliable used SUV. What are your real approval odds?

- At a Big 5 Bank: Your odds are extremely low. Their automated systems will likely flag the recent bankruptcy (R9 rating) and issue an instant decline, regardless of your income or down payment.

- At a Specialized Dealership on Macleod Trail: Your odds are very high. The finance manager here works daily with lenders who specialize in post-bankruptcy files. They will see your stable nursing income, your significant down payment, and your debt-free status as major positives. They understand the 90-day window and know how to present your file for maximum success.

Pro Tip: Avoid the 'Application Shotgun'

The single biggest mistake we see is people panicking and applying everywhere at once. Do not do this. Every application for credit results in a "hard inquiry" on your credit report. Multiple hard inquiries in a short period signal desperation to lenders and will lower your newly recovering credit score. Be surgical. Choose one or two specialized lenders or dealerships to start your journey.

Assembling Your Approval Toolkit: The Non-Negotiable Documents Lenders Need to See

Walking into a dealership prepared is the fastest way to earn respect and get a 'yes'. A finance manager sees an organized client as a reliable future borrower. Here's what you need and, more importantly, *why* you need it.

- The Absolute Discharge Certificate: This is your golden ticket. It's the legal document that proves your past debts have been cleared. Without it, no lender will even consider your file. It's usually a one or two-page document issued by the court. If you can't find yours, contact your Licensed Insolvency Trustee immediately to get a copy.

- Verifiable Proof of Income: This is how you prove you can afford the payments. Lenders want to see your most recent 3 months of pay stubs. Why? Because a job letter shows your salary, but pay stubs show your actual, consistent net (take-home) pay. For gig economy workers or the self-employed in places like Vancouver, this can be tricky. In these cases, your last two years' Notice of Assessments (NOA) from the CRA and 3-6 months of business bank statements are essential. For more details, our guide on Self-Employed? Your Bank Statement is Our 'Income Proof' provides an in-depth look.

- The Down Payment: Cash is king. A down payment of 10-20% of the vehicle's price does two powerful things: it lowers the amount you need to borrow, and it shows the lender you have "skin in the game." You are sharing the risk. We call this 'buying down your risk.' A larger down payment can often be the deciding factor in getting approved and may even help you secure a slightly lower interest rate.

- Proof of Residence: A recent utility bill (hydro, gas) or a cell phone bill in your name at your current address is crucial. This simple document helps the lender build a picture of stability. It confirms you are who you say you are and that you have roots in the community.

Pro Tip: Go Digital and Be Ready

Before you even step on a car lot, use your phone to scan or take clear pictures of all these documents. Save them as PDFs in a dedicated folder on your phone or a cloud service like Google Drive. When the finance manager asks for them, you can email the entire package in seconds. This level of organization and speed makes a powerful first impression.

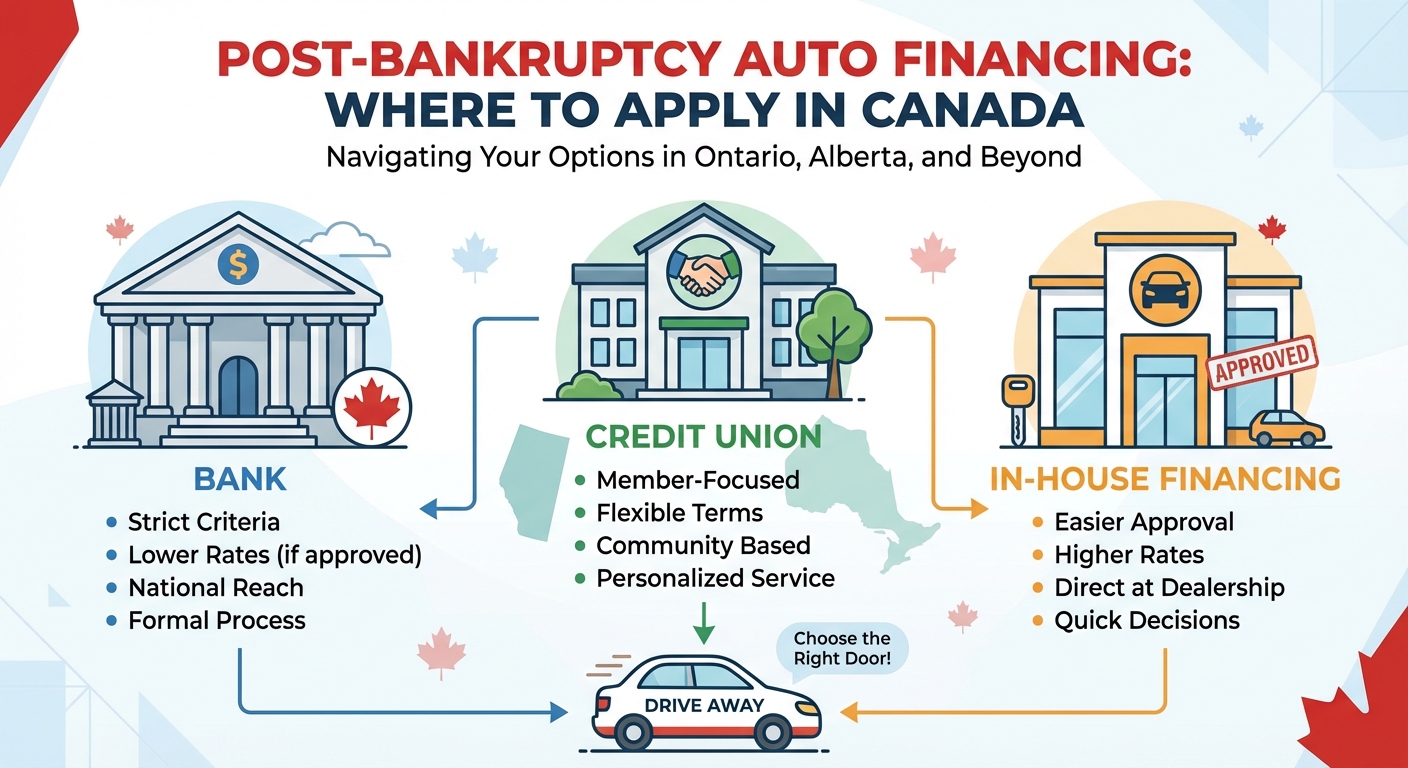

Bank vs. Credit Union vs. In-House Financing: Where to Apply in Ontario, Alberta, and Beyond

Not all lenders are created equal, especially when it comes to post-bankruptcy auto financing. Choosing the right door to knock on is half the battle.

| Lender Type | Approval Odds (First 90 Days) | Typical Interest Rate Range | Vehicle Selection | Speed of Funding |

|---|---|---|---|---|

| Major Banks (RBC, TD, Scotiabank) | Very Low | N/A (Typically Decline) | Any vehicle | Slow (if approved) |

| Credit Unions (Meridian, Servus) | Low to Medium | 12% - 20% | Any vehicle | Medium |

| Specialist Lenders & Dealerships | High | 15% - 29.9% | Dealer Inventory | Fast (Same Day) |

Major Banks (e.g., Scotiabank, BMO)

These institutions are the most risk-averse. Their automated lending systems are typically programmed to decline applications with a recent bankruptcy. In our experience, it's best to wait at least two years after discharge and have a solid history of rebuilt credit (like a secured credit card) before approaching a major bank for a car loan.

Credit Unions (e.g., Meridian in Ontario, Servus in Alberta)

Credit unions are more community-focused and can sometimes be more flexible than big banks. If you maintained a positive relationship with a local credit union before your bankruptcy, they might be willing to look at your file more holistically. However, they are still cautious. They represent a good option to explore about 6-12 months after your discharge, once you've started rebuilding your credit.

Specialized Lenders & Dealership Finance Departments

This is your most likely path to an 'immediate' approval. Dealerships like SkipCarDealer.com work with a portfolio of specialized, non-prime lenders whose entire business model is built around helping people in your exact situation. They understand the nuances of a bankruptcy discharge and focus more on your current income and stability than your past credit history. The dealership's finance department acts as your advocate, packaging your application and sending it to the lenders most likely to say 'yes'.

The Geography Factor

Your location in Canada also plays a role. In major urban centres like Toronto, you have dozens of specialized dealerships competing for your business. In smaller towns in Saskatchewan or the Maritimes, your local Ford, GM, or Toyota dealer's finance manager becomes your most critical relationship. Building a rapport with them can make all the difference.

Decoding the Fine Print: Interest Rates, Hidden Fees, and Your Total Cost of Borrowing

Getting approved is the first step. Understanding the true cost of the loan is the second. This is where you demonstrate financial responsibility and protect your fresh start.

Interest Rate Reality Check

Your first car loan after bankruptcy will have a higher interest rate. This is unavoidable. The lender is taking on a higher perceived risk. However, this loan is a tool. By making every payment on time for 12-18 months, you will rebuild your credit score and qualify for much better rates on future loans. Let's look at the real-world numbers.

| Credit Profile | Sample Interest Rate | Estimated Monthly Payment | Total Interest Paid |

|---|---|---|---|

| Good Credit (Prime) | 8.0% | $304 | $3,249 |

| Post-Bankruptcy (Subprime) | 22.0% | $415 | $9,900 |

As the table shows, the difference is significant—over $100 more per month and an extra $6,651 in interest over the life of the loan. This is why the goal isn't to keep this loan for the full five years. The goal is to perform perfectly and refinance when your credit improves. If you find yourself with a high-interest loan and negative equity, it's worth exploring your options. For a deeper look, see our guide on Upside-Down Car Loan? How to Refinance Without a Trade 2026.

Beyond the Interest Rate - The Fees to Watch For

Always scrutinize the bill of sale for fees beyond the vehicle price and taxes. Here are common ones:

- Admin/Documentation Fees: Most dealerships charge an administrative fee, which can range from $500 to $1,000. While often non-negotiable, it's always worth asking if it can be reduced.

- PPSA Fees: This is the fee for registering the lender's lien on your vehicle under the Personal Property Security Act. It's a legitimate government fee that varies by province. For example, it's generally higher in Ontario than in British Columbia.

- Mandatory Warranties/Insurance: Some subprime lenders may require you to purchase an extended warranty to protect their asset (the car). While this can be a condition of the loan, be sure you understand the coverage and the cost. Question any products that seem excessive.

Pro Tip: Demand the 'Out-the-Door' Number

Don't negotiate based on the monthly payment. Always negotiate the vehicle price first. Once you agree on a price, ask for the "all-in" or "out-the-door" number on the final bill of sale. This forces the dealership to disclose every single fee, tax, and charge upfront, leaving no room for surprises when you sit down to sign.

The Road Ahead: How Economic Shifts and New Tech Will Impact Your 2026 Car Loan

The world of auto finance is constantly evolving. Staying aware of these trends gives you an advantage.

The Interest Rate Environment

The Bank of Canada's overnight rate influences all borrowing costs. As we move into 2026, economists are watching for rate stability. For post-bankruptcy borrowers, a stable or slightly declining rate environment is good news. It means subprime lenders may have more room to offer competitive rates to attract business. However, continued volatility means lenders will remain cautious, placing an even higher value on strong income and down payments.

The Rise of Fintech Lenders

Online-only lenders are changing the game. They use artificial intelligence (AI) and alternative data—like your real-time cash flow from your bank account—to assess risk. This can be a huge benefit for someone with a bankruptcy. Instead of focusing solely on a damaged credit score, their algorithms can see your consistent paycheques and responsible spending habits post-discharge, potentially leading to faster and fairer approvals.

Vehicle Market Dynamics

The used car market remains dynamic. The shift toward Electric Vehicles (EVs) and the fluctuating supply of quality used cars impact what lenders are willing to finance. A reliable, fuel-efficient used 2022 Hyundai Elantra might be seen as a safer bet for a lender than an older, gas-guzzling 2021 Ford Escape with higher potential maintenance costs. Lenders consider the total cost of ownership and the vehicle's resale value when approving a loan.

New Provincial Regulations

Consumer protection is an ongoing priority for provincial governments. Keep an eye out for potential updates in provinces like Quebec or British Columbia that could introduce new caps on interest rates or fees for high-risk loans. These changes could provide additional protections and make borrowing more transparent for consumers rebuilding their credit.

Your 30-Day Action Plan: From Discharge Certificate to Driving Away

Feeling overwhelmed? Don't be. Follow this simple, week-by-week plan to navigate the process with confidence.

- Week 1: Gather Intelligence. Your first task is to get your house in order. Locate and scan your Absolute Discharge Certificate. Gather your last three months of pay stubs and a proof of residence. Pull your own credit reports for free from Equifax and TransUnion to see exactly what lenders will see. Start putting aside every extra dollar into a "car fund" for your down payment.

- Week 2: Build Your Foundation. This is the single most important step for your future. Apply for a secured credit card from a provider like Capital One or your local credit union. Get a small limit ($300-$500), use it for a small, recurring purchase like your gas or Netflix subscription, and—this is crucial—pay the balance in full every single month before the due date. This begins generating positive credit history immediately.

- Week 3: Strategic Application. With your documents ready, it's time to act. Choose ONE trusted source to get a pre-approval. This could be an online service like SkipCarDealer.com or a local dealership with a strong reputation for helping people with bad credit. A pre-approval gives you a realistic budget to work with and minimizes the number of hard inquiries on your credit report.

- Week 4: The Test Drive & Negotiation. Now for the fun part. With your pre-approval amount in hand, you are effectively a 'cash buyer' at the dealership. This gives you leverage. Focus on finding a reliable vehicle that fits your budget and needs. Negotiate the price of the car, not the monthly payment. Before you sign anything, review the final bill of sale line by line to ensure there are no hidden fees.