Refinance Car Loan After Parental Leave Ontario 2026

Table of Contents

- Key Takeaways

- The Financial Crossroads: Why Strategic Vehicle Loan Refinancing Matters for New Parents

- A. The Shifting Financial Landscape of New Parenthood

- B. Beyond Just Lower Payments: The Multifaceted Benefits of Refinancing

- Deconstructing the Lender's Lens: Income Qualification While on Leave

- A. Beyond the Standard Pay Stub: Understanding Diverse Income Streams During Parental Leave

- B. The 'Pre-Leave Income' Advantage: Leveraging Your Earning History for Approval

- C. The Return-to-Work Blueprint: Demonstrating Future Earning Capacity

- D. Navigating the Income Gap: Strategic Approaches for Stronger Applications

- The Mechanics of Refinancing: What You Need to Know Beyond the Application

- A. Decoding the Numbers: Interest Rates, Term Lengths, and Payment Structures

- B. Unmasking the True Cost: Fees, Penalties, and Potential Hidden Charges

- C. The Credit Score Compass: How Your History Guides Your Refinancing Options

- D. Your Vehicle's Role: Age, Value, and Loan-to-Value (LTV) Considerations

- Choosing Your Champion: Lender Types and Application Pathways

- A. Traditional Banks vs. Credit Unions: A Head-to-Head Comparison for New Parents

- B. Online Lenders and Specialized Brokers: Expanding Your Horizons

- C. Dealership Financing: When to Consider (and When to Exercise Caution)

- D. The Application Toolkit: Essential Documents for a Seamless Process

- Beyond the Refinance: Long-Term Financial Planning for Growing Families

- A. Strategic Debt Consolidation: Integrating Your Vehicle Loan into a Larger Financial Plan

- B. Future-Proofing Your Finances: Preparing for Economic Shifts and Life Changes (e.g., by 2026)

- C. When Refinancing Isn't the Answer: Exploring Alternatives and Contingency Plans

- Your Next Steps to Approval: A Strategic Action Plan

- Frequently Asked Questions About Refinancing a Car Loan After Parental Leave

Navigating the exciting, yet often financially demanding, journey of new parenthood requires shrewd planning and adaptability. For many families in Ontario, the family car is not just a convenience; it's an essential tool for childcare, errands, and maintaining a semblance of pre-baby life. If you're returning from parental leave in 2026 and find your budget feeling the pinch, refinancing your car loan might be a powerful strategy to reclaim financial control.

At SkipCarDealer.com, we understand the unique challenges and opportunities new parents face. This comprehensive guide will walk you through everything you need to know about refinancing your car loan after parental leave in Ontario in 2026, from understanding how lenders view your income to securing the best possible rates and terms.

Key Takeaways

- Lenders can consider pre-leave income and confirmed return-to-work letters for qualification, recognizing parental leave as a temporary income adjustment.

- Shopping around various lender types (traditional banks, credit unions, online lenders, and brokers) is crucial for securing competitive rates and terms tailored to your unique situation.

- Understanding all associated fees, not just the interest rate, is essential for accurately calculating true savings and ensuring the refinance benefits your financial health.

- Proactively improving your credit score before applying significantly boosts your approval odds and helps you secure more favourable interest rates.

- Refinancing a car loan can be a powerful tool for enhancing cash flow management and supporting broader financial planning during the significant life transition of welcoming a new child.

The Financial Crossroads: Why Strategic Vehicle Loan Refinancing Matters for New Parents

Refinancing a car loan after parental leave in Ontario in 2026 involves replacing your existing car loan with a new one, typically with a lower interest rate, different payment terms, or both. This process can significantly reduce your monthly payments, decrease the total interest paid over the life of the loan, or help you manage your cash flow more effectively during a period of significant financial change.

A. The Shifting Financial Landscape of New Parenthood

The arrival of a new baby is a joyous occasion, but it often brings a significant shift in household finances. For many parents in Ontario, parental leave means a temporary reduction in income, as government benefits (like Employment Insurance) typically replace only a portion of your regular salary. This reduced income often coincides with a surge in new expenses, from diapers and formula to baby gear, clothing, and potentially, increased utility bills at home.

The financial strain can be profound, especially when considering the high cost of living and childcare in many parts of Ontario. Suddenly, a car payment that felt manageable before leave can become a considerable burden. Beyond the immediate costs, many families also face the prospect of significant childcare expenses once parental leave concludes, further squeezing the budget. This combination of reduced income and increased outflow creates a compelling need to reassess and optimize every aspect of your financial plan, including your vehicle loan.

B. Beyond Just Lower Payments: The Multifaceted Benefits of Refinancing

While a lower monthly payment is often the primary driver for considering a refinance, the benefits extend much further, offering a strategic advantage for new parents in 2026:

- Freeing up Crucial Monthly Cash Flow: Perhaps the most immediate and impactful benefit, a lower car payment can free up hundreds of dollars each month. This extra cash can be redirected to cover essential baby items, contribute to an emergency fund, or alleviate stress from other household bills. For families on a tighter budget, this additional liquidity can be a game-changer.

- Reducing Overall Interest Paid: By securing a lower interest rate, you'll pay less interest over the lifetime of the loan, even if your monthly payment doesn't drastically change. This means more of your payment goes towards the principal, accelerating your path to ownership and saving you a significant amount of money in the long run.

- Consolidating Higher-Interest Debt: A successful car loan refinance, especially one that frees up cash, can enable you to tackle other, higher-interest debts like credit card balances. This strategic approach can simplify your financial management and reduce your overall debt burden more efficiently.

- Adapting to Changing Financial Circumstances: Your financial profile might have improved since you first bought your car. Perhaps your credit score has increased, or market interest rates have dropped. Refinancing allows you to take advantage of these improvements, ensuring your loan terms align with your current financial standing.

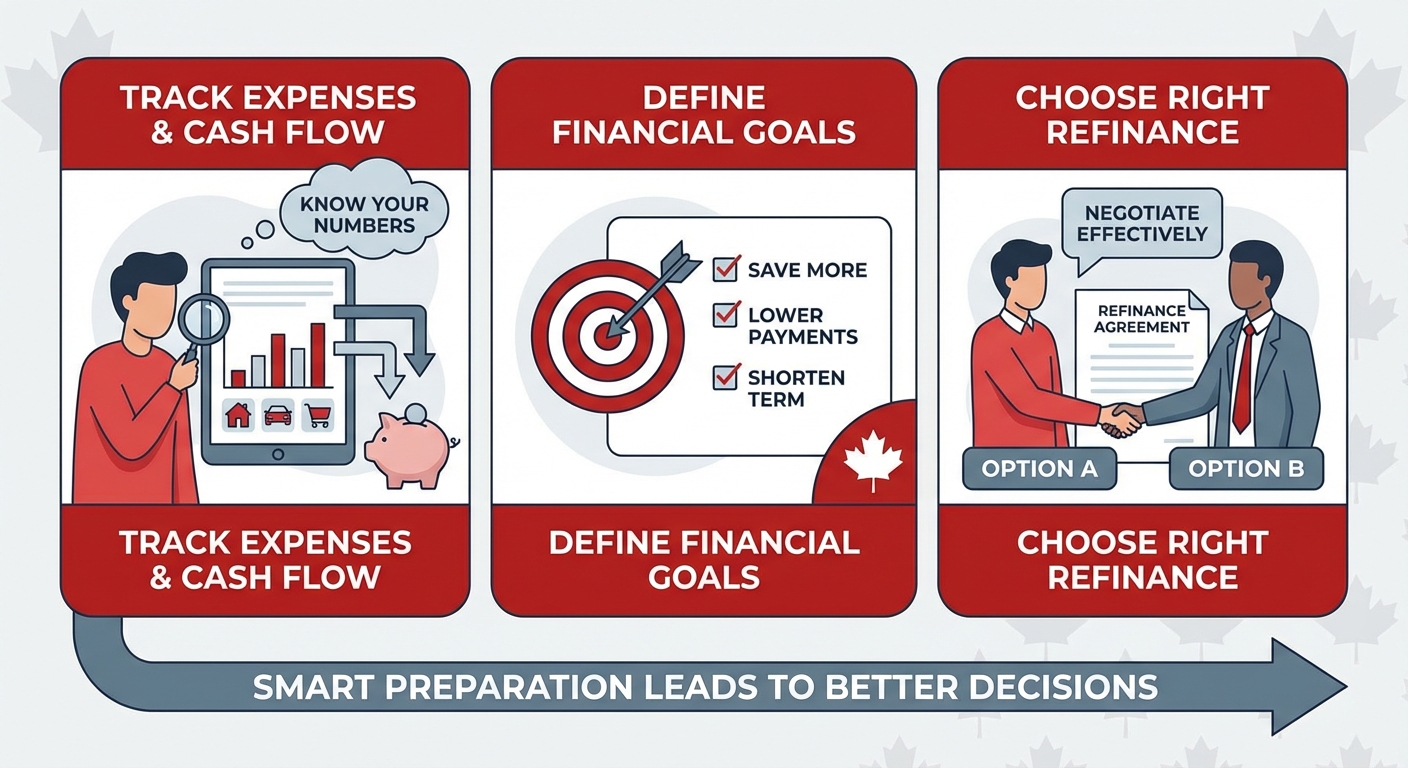

Pro Tip: Begin tracking your new expenses and cash flow before considering a refinance to clearly define your financial goals. Understanding exactly how much you need to save or free up will help you negotiate more effectively and choose the right refinance option.

Deconstructing the Lender's Lens: Income Qualification While on Leave

One of the biggest hurdles for parents on leave considering a car loan refinance in 2026 is income qualification. Lenders need assurance that you can consistently meet your payment obligations. However, they are also increasingly aware of the temporary nature of parental leave and have developed mechanisms to assess your financial capacity during this period.

A. Beyond the Standard Pay Stub: Understanding Diverse Income Streams During Parental Leave

When you're on parental leave, your income sources diversify. Lenders will look beyond just your regular bi-weekly pay stub to understand your complete financial picture:

- Government-provided Parental Benefits: In Canada, the primary source of income during parental leave for most is Employment Insurance (EI) parental benefits. These benefits, while federal, are a critical component of income for Ontario residents. Lenders recognize these benefits as legitimate, albeit temporary, income. They will want to see proof of these payments and understand the duration for which you will receive them.

- Employer Top-ups and Supplemental Benefits: Many employers in Ontario offer supplemental benefits or "top-ups" to their employees on parental leave, bridging the gap between EI benefits and their regular salary. These top-ups are highly valued by lenders as they demonstrate a higher, more stable income during leave. Documentation from your employer confirming these benefits is essential.

- Other Household Income Considerations: Lenders will also consider other stable income sources within your household. This includes a spouse's income, any part-time work you might be undertaking that is confirmed to continue post-leave, or regular investment income. Presenting a complete picture of household income can significantly strengthen your application.

B. The 'Pre-Leave Income' Advantage: Leveraging Your Earning History for Approval

For many lenders in 2026, your income *before* parental leave is a crucial indicator of your long-term earning potential. They understand that parental leave is a temporary interruption, not a permanent change in your professional capacity. This "pre-leave income" advantage can be leveraged:

- How Lenders Consider Pre-Leave Income: Many financial institutions are willing to use your pre-leave salary as a basis for assessing affordability, provided there's a clear plan for your return to work. They look at your historical earning power to project your ability to repay once you're back at your full income.

- Importance of a Confirmed Return-to-Work Date: This is paramount. A firm, documented return-to-work date, ideally within a reasonable timeframe (e.g., 6-12 months), signals stability to lenders. They want to know when your full income will resume.

- Documentation of Pre-Leave Salary: Lenders will require documentation such as your previous pay stubs, employment contracts, and T4 slips to verify your pre-leave income. This helps them confirm your historical earning capacity.

- What Constitutes 'Stable' Income: Even during parental leave, lenders look for income that is predictable and consistent, whether it's EI, employer top-ups, or a spouse's salary. Sporadic or unverified income sources are generally not considered stable for loan qualification.

Pro Tip: Obtain an official letter from your employer confirming your pre-leave salary, your return-to-work date, and your position. This document, on company letterhead, is invaluable and often a non-negotiable requirement for lenders. It provides concrete proof of your future earning capacity.

C. The Return-to-Work Blueprint: Demonstrating Future Earning Capacity

Beyond current and past income, lenders are keenly interested in your future earning capacity, particularly your plan to return to work.

- Why a Clear Return-to-Work Plan is Paramount: A confirmed, written plan outlining your exact return date, whether full-time or part-time, assures lenders that your income will stabilize and increase. Without this, your application may be viewed as higher risk.

- Impact of Job Security and Employment History: A long, stable employment history with the same employer (or within the same industry) significantly boosts your credibility. It suggests a higher degree of job security and a lower likelihood of unexpected unemployment post-leave.

- How Lenders Calculate Debt-to-Income Ratios: Lenders use your projected post-leave income to calculate your debt-to-income (DTI) ratio. This ratio, which compares your total monthly debt payments to your gross monthly income, is a key metric. A lower DTI indicates less risk and a greater ability to manage additional debt. For instance, if your projected monthly income is $5,000 and your total debts (including the new car payment) are $1,500, your DTI is 30% ($1,500 / $5,000), which is generally considered healthy.

D. Navigating the Income Gap: Strategic Approaches for Stronger Applications

Even with pre-leave income and a return-to-work plan, the temporary income dip can be a concern. Here are strategic approaches to strengthen your application:

- The Role of a Co-signer: A co-signer with strong credit and stable income can significantly bolster your application. They share legal responsibility for the loan, making it less risky for the lender. This can be beneficial if your credit score has suffered or your income during leave is particularly low. However, remember that the co-signer is equally responsible, which has implications for their credit and finances. For more on navigating challenging credit situations, you might find our article on Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit helpful.

- Demonstrating Strong Savings, Investments, or Other Assets: Lenders look favourably upon applicants with a healthy financial cushion. High savings, GICs, RSPs, or other liquid assets demonstrate financial responsibility and provide a buffer in case of unexpected financial challenges.

- Strategies for Minimizing Other Debts: Reducing your overall debt load before applying for a refinance can dramatically improve your debt-to-income ratio. Paying down credit card balances or other personal loans signals to lenders that you are a responsible borrower and have more capacity for a new car loan payment.

The Mechanics of Refinancing: What You Need to Know Beyond the Application

Understanding the application process is just one piece of the puzzle. To make an informed decision about refinancing your car loan in Ontario in 2026, you need to grasp the underlying mechanics, from interest rates to fees and the role your credit score plays.

A. Decoding the Numbers: Interest Rates, Term Lengths, and Payment Structures

The core of any loan is its numerical structure. Here’s what you need to understand:

- Factors Influencing Refinance Rates:

- Credit Score: This is arguably the most critical factor. A higher credit score (typically 680+ for prime rates) indicates lower risk to lenders, resulting in lower interest rates.

- Vehicle Age and Mileage: Lenders prefer newer vehicles with lower mileage. An older car (e.g., 8+ years old) or one with very high mileage (e.g., over 150,000 km) may qualify for higher rates or be ineligible for refinancing entirely.

- Loan-to-Value (LTV) Ratio: This compares the outstanding loan amount to the vehicle's current market value. An LTV of 100% or less (meaning you owe less than or equal to the car's value) is ideal. If you have negative equity (LTV > 100%), refinancing can be more challenging and rates higher.

- Comparing Shorter vs. Longer Terms: The loan term significantly impacts both your monthly payments and the total interest paid.

- Shorter Terms (e.g., 36-48 months): Result in higher monthly payments but mean you pay off the loan faster and incur less total interest. This is often the most financially prudent option if your budget allows.

- Longer Terms (e.g., 60-84 months): Offer lower monthly payments, which can be attractive during parental leave when cash flow is tight. However, you'll pay more interest over the loan's lifetime.

- Understanding Fixed vs. Variable Interest Rates:

- Fixed-Rate Loans: The interest rate remains the same for the entire loan term. This offers predictable monthly payments, which is highly desirable for new parents seeking budget stability.

- Variable-Rate Loans: The interest rate can fluctuate based on market conditions (e.g., changes to the Bank of Canada's prime rate). While potentially starting lower, these loans carry the risk of rising payments, which can be a concern for families on a tight budget. For most new parents in 2026, a fixed rate often provides greater peace of mind.

Let's look at an example of how different terms and rates can impact your payments on a remaining balance of $18,000:

| Loan Characteristic | Current Loan (Example) | Refinanced Loan (Shorter Term) | Refinanced Loan (Longer Term) |

|---|---|---|---|

| Remaining Balance | $18,000 | $18,000 | $18,000 |

| Interest Rate (2026 Estimate) | 10.99% (Original) | 7.49% (Refinanced - Good Credit) | 7.99% (Refinanced - Good Credit) |

| Term Length | 60 months remaining | 48 months | 72 months |

| Estimated Monthly Payment | $389.00 | $434.00 | $304.00 |

| Total Interest Paid (over remaining term) | $5,340.00 | $2,832.00 | $3,900.00 |

As you can see, the shorter term (48 months) saves you the most interest, but the longer term (72 months) significantly reduces your monthly payment, offering valuable cash flow relief during parental leave.

B. Unmasking the True Cost: Fees, Penalties, and Potential Hidden Charges

Interest rates are important, but they don't tell the whole story. Hidden costs can erode your savings if you're not careful:

- Common Fees Associated with Refinancing:

- Application Fees: Some lenders charge a small fee to process your application, typically ranging from $50-$200.

- Administrative Costs: These cover the lender's internal processing, often $100-$300.

- Lien Transfer Fees: In Ontario, there's a fee to register and transfer the lien on your vehicle from your old lender to the new one, usually a nominal amount (e.g., $10-$20).

- Early Repayment Penalties on Your Existing Loan: Crucially, your *current* loan agreement might include penalties for paying it off early. These can be a fixed amount, a certain number of months' interest, or a percentage of the outstanding balance. Always review your original loan contract carefully or contact your current lender to understand any such clauses.

- Potential Provincial Registration or Lien Transfer Fees: As mentioned, transferring the lien and updating registration records with the Ministry of Transportation in Ontario will incur minor fees. While small, these contribute to the overall cost.

Pro Tip: Always request a detailed, itemized breakdown of all costs and fees from any prospective lender before signing. Compare the total cost of the new loan, including all fees and any early repayment penalties from your old loan, not just the interest rate. This comprehensive view ensures you calculate your true savings accurately.

C. The Credit Score Compass: How Your History Guides Your Refinancing Options

Your credit score is a numerical representation of your creditworthiness, and it's a critical factor in refinancing:

- Direct Correlation Between Credit Score and Eligibility/Rates: A higher credit score (e.g., 700+) qualifies you for the best interest rates and terms. A lower score (e.g., below 600) makes refinancing more challenging and will result in significantly higher interest rates, if approved at all. Lenders use your score to gauge the risk of lending to you.

- Strategies for Proactively Improving Your Credit Score:

- Pay Bills on Time: Payment history is the most impactful factor in your score. Consistent, on-time payments are essential.

- Reduce Credit Card Balances: High credit utilization (using a large portion of your available credit) can lower your score. Aim to keep balances below 30% of your limit.

- Avoid New Credit Applications: Multiple hard inquiries in a short period can temporarily ding your score.

- Check Your Credit Report: Review your credit report regularly for errors and dispute any inaccuracies.

- Navigating Refinancing Options with a Less-Than-Perfect Credit History: If your credit score took a hit, perhaps due to missed payments or increased debt during early parenthood, you still have options. Some lenders specialize in what's known as "subprime" lending, catering to individuals with lower credit scores. While their interest rates will be higher, they can provide access to financing. Secured loans, where your vehicle acts as collateral, can also be an option for those with challenged credit. For an in-depth look at this, read our guide on Your Low Credit Score *Earned* You a Hybrid Loan. Yes, in Ontario.

D. Your Vehicle's Role: Age, Value, and Loan-to-Value (LTV) Considerations

The car itself is a major factor in the refinance equation:

- How the Age, Mileage, and Market Value of Your Car Impact Refinance: Lenders are primarily concerned with the collateral value of the vehicle. Newer cars with lower mileage hold their value better, making them less risky to finance. Most lenders have age limits (e.g., no older than 7-10 years) and mileage limits (e.g., under 150,000-200,000 km) for refinancing. A car nearing the end of its typical lifespan may be difficult or impossible to refinance.

- Understanding Negative Equity (Being 'Upside Down' on Your Loan): If you owe more on your car than it's currently worth, you have negative equity. This can make refinancing challenging, as the new lender would be taking on a loan for an asset worth less than the debt. Some lenders may allow you to roll the negative equity into the new loan, but this increases your principal and total interest paid.

- The Importance of Getting an Accurate Vehicle Appraisal: Before applying, get an accurate estimate of your vehicle's market value. Websites like Canadian Black Book (CBB) or Kelley Blue Book (KBB) Canada can provide estimates. Dealerships can also offer appraisals. Knowing your car's true value helps you understand your LTV and what kind of refinance terms you might qualify for.

Choosing Your Champion: Lender Types and Application Pathways

With a clearer understanding of the mechanics, the next step in refinancing your car loan after parental leave in Ontario in 2026 is choosing the right lender. The landscape of financial institutions is diverse, each with its own advantages.

A. Traditional Banks vs. Credit Unions: A Head-to-Head Comparison for New Parents

These two pillars of the financial industry offer distinct experiences:

- Pros and Cons of Large Banks:

- Pros: Established, reputable, often offer competitive rates for applicants with excellent credit, and have robust online platforms.

- Cons: Can be less flexible with unique income situations (like parental leave), may have stricter lending criteria, and might have a more impersonal application process. Their rates for those with average credit might not be the most competitive.

- Pros and Cons of Credit Unions:

- Pros: Member-focused, often provide more personalized service, may be more flexible in assessing unique income situations (understanding the nuances of EI and employer top-ups), and can sometimes offer slightly better rates due to their non-profit structure. They might be more willing to consider your overall relationship with them.

- Cons: May have fewer branch locations or less advanced online tools than large banks. Membership requirements (e.g., living in a specific region or working for certain employers) apply.

- Leveraging Existing Banking Relationships: If you have a long-standing relationship with a bank or credit union, they may be more inclined to work with you during parental leave, given your established financial history with them.

Here’s a comparison of common lender types:

| Feature | Traditional Bank | Credit Union | Online Lender/Broker |

|---|---|---|---|

| Interest Rates (Prime, 2026) | Typically 6.5% - 9.0% | Often 6.0% - 8.5% | Highly competitive, 5.9% - 9.5% |

| Flexibility with Parental Leave Income | Generally stricter, prefers confirmed return-to-work letters. | More accommodating, may consider overall financial relationship. | Varies greatly; some specialize in unique income profiles. |

| Speed of Approval | Moderate (2-5 business days) | Moderate (2-5 business days) | Often fastest (24-48 hours) |

| Customer Service | Standard, sometimes impersonal. | Personalized, relationship-focused. | Can range from excellent to fully automated. |

| Fees | Standard application/admin fees possible. | Often lower or waived. | Can be variable, some very transparent, others less so. |

B. Online Lenders and Specialized Brokers: Expanding Your Horizons

Beyond traditional institutions, the digital age offers efficient alternatives:

- The Convenience and Speed of Online-Only Lenders: Online lenders have streamlined the application process, often allowing you to apply, get approved, and finalize your loan entirely online, sometimes within 24-48 hours. They can be particularly competitive with rates and might have more flexible qualification criteria for those with unique income situations like parental leave.

- The Invaluable Role of Mortgage and Loan Brokers: Auto loan brokers act as intermediaries, connecting you with a wide network of lenders, including those that might not be easily accessible to the public. They can be incredibly valuable for new parents on leave, as they have expertise in navigating complex income scenarios and can find lenders specializing in such situations. A good broker understands how to present your application in the best light.

Pro Tip: Don't limit your search to your primary bank. Explore at least 3-5 different lender types (e.g., your bank, a credit union, and 1-2 online lenders or a broker) to ensure you're getting the best possible terms for your car loan refinance in 2026.

C. Dealership Financing: When to Consider (and When to Exercise Caution)

While dealerships are primary sources for new car financing, they can also facilitate refinancing:

- Refinancing Through the Original Dealership vs. a New One: Some dealerships have partnerships with various lenders and can help you refinance. If you have a good relationship with your original dealership, they might be able to assist. However, it's often more beneficial to seek financing independently.

- Understanding Dealership Mark-ups on Interest Rates: Dealerships often act as intermediaries for lenders and may add a "mark-up" to the interest rate they offer you. This means you might get a higher rate than if you went directly to the lender. Always compare dealership offers with pre-approvals from banks, credit unions, or online lenders.

D. The Application Toolkit: Essential Documents for a Seamless Process

Being prepared with all the necessary documentation will significantly speed up your refinance application:

- Proof of Identity: Government-issued photo ID (e.g., driver's licence, passport).

- Proof of Residency: Utility bill, lease agreement, or property tax statement.

- Income Verification:

- Recent pay stubs (pre-leave).

- Employment Insurance (EI) statements for parental benefits.

- Employer letter confirming pre-leave salary, return-to-work date, and position (crucial for parental leave applicants).

- T4 slips and Notices of Assessment (NOA) for the past 1-2 years.

- Proof of any employer top-ups.

- Spousal income documentation (if applicable, for household income).

- Existing Loan Details:

- Current loan statement showing outstanding balance.

- Original loan agreement (to check for early repayment penalties).

- Current lender's contact information.

- Vehicle Information:

- Vehicle Identification Number (VIN).

- Current vehicle registration.

- Proof of comprehensive insurance.

- Odometer reading.

- Make, model, and year of the vehicle.

Beyond the Refinance: Long-Term Financial Planning for Growing Families

Refinancing your car loan is a tactical move, but it should also fit into a broader, long-term financial strategy for your growing family in 2026. Looking beyond the immediate savings can help you build lasting financial security.

A. Strategic Debt Consolidation: Integrating Your Vehicle Loan into a Larger Financial Plan

A successful refinance can create a ripple effect, improving your overall financial health:

- How a Successful Refinance Can Free Up Funds to Tackle Higher-Interest Debts: The extra cash flow generated by a lower car payment can be strategically redirected. Instead of simply spending it, consider using it to aggressively pay down high-interest debts like credit cards or personal lines of credit. This approach significantly reduces your overall interest burden and accelerates your path to debt freedom.

- Creating a Holistic Budget that Incorporates New Lower Car Payments and Other Family Expenses: With your new car payment, it's the perfect time to revise your entire household budget. Factor in all new baby-related expenses, childcare costs, and allocate the savings from your refinance purposefully. A comprehensive budget provides clarity and control over your money.

- Building an Emergency Fund: For new parents, an emergency fund is not just advisable; it's critical. Unexpected expenses—medical emergencies, car repairs, or even a temporary job loss—can derail a family budget. Aim for 3-6 months of essential living expenses saved in an easily accessible account. The cash flow freed up by refinancing can be a direct contributor to building this vital buffer. If you're struggling with past financial issues and need to build a new financial foundation, our article on Your Missed Payments? We See a Down Payment offers perspectives on how to move forward.

B. Future-Proofing Your Finances: Preparing for Economic Shifts and Life Changes (e.g., by 2026)

The financial world is dynamic. Proactive planning ensures resilience:

- Considering Potential Interest Rate Fluctuations and Their Impact on Future Financial Decisions: While you might secure a fixed rate now, understanding the broader economic landscape in 2026 is important. If interest rates continue to rise, future borrowing (e.g., for a mortgage or another vehicle) could be more expensive. Factor this into your long-term debt strategy.

- The Importance of Regular Financial Reviews as Your Family Grows and Income Stabilizes: Your budget and financial priorities will evolve as your child grows and your income stabilizes post-leave. Make it a habit to review your finances quarterly or semi-annually. Adjust your budget, debt repayment strategies, and savings goals as needed.

- Planning for Future Major Expenses: Look ahead to significant future costs. This might include saving for your child's education (e.g., through an RESP), planning for a down payment on a larger home, or saving for another vehicle purchase down the line. A successful refinance now can lay the groundwork for these future goals.

C. When Refinancing Isn't the Answer: Exploring Alternatives and Contingency Plans

Refinancing is a powerful tool, but it's not always the best solution for every situation. It's crucial to consider alternatives:

- Temporary Payment Deferrals or Modifications with Your Current Lender: If your financial hardship is temporary (e.g., only during the initial months of parental leave), contacting your current lender might be a better first step. They may offer options like payment deferrals, reduced payments for a short period, or minor loan modifications. This can provide immediate relief without the costs and credit inquiry associated with refinancing.

- The Option of Selling the Vehicle if the Financial Burden is Too Great: In some cases, the car loan, even after refinancing, might still be an unsustainable burden. If the vehicle is a significant source of financial stress, selling it might be the most responsible option. This could mean downgrading to a more affordable used car or, if feasible, relying on public transit or ride-sharing services to eliminate the car payment entirely.

- Aggressive Budget Adjustments and Expense Reduction Strategies: Before committing to a refinance, thoroughly explore every avenue for cutting expenses. This could involve reducing discretionary spending, finding cheaper insurance, or re-evaluating subscriptions. Sometimes, aggressive budgeting can free up enough cash flow to make your current car payment manageable without needing a new loan. For those facing extreme financial difficulties, such as collections, it's crucial to remember that options still exist for vehicle financing. Consider our article on Toronto Essential: Collections? Drive *Anyway* for insights on navigating such challenges.

Your Next Steps to Approval: A Strategic Action Plan

Armed with this information, you're ready to take concrete steps towards refinancing your car loan after parental leave in Ontario in 2026. Follow this strategic action plan for the best chance of success:

- Step 1: Assess Your Current Financial Standing: Review your current income (including parental benefits and top-ups), all household expenses, and get a copy of your credit report and score. Understand where you stand before approaching lenders.

- Step 2: Gather All Essential Documentation: Proactively collect all necessary papers, especially that crucial employer letter confirming your pre-leave salary and return-to-work date. Having everything organized will streamline the application process.

- Step 3: Research and Compare Lenders: Don't settle for the first offer. Reach out to multiple institutions—your current bank, a local credit union, and at least one online lender or broker. Compare their rates, fees, and their approach to parental leave income.

- Step 4: Understand the Fine Print: Before signing anything, meticulously scrutinize all loan terms, fees, potential early repayment penalties on your existing loan, and any provincial charges. Ensure you understand the total cost and true savings.

- Step 5: Make an Informed Decision: Choose the refinance option that best aligns with your immediate cash flow needs during parental leave and your long-term financial goals for your growing family.

Refinancing your car loan after parental leave is a smart financial move that can provide significant relief and stability during a transformative period. By understanding the process, preparing thoroughly, and comparing your options, you can secure a loan that supports your family's future.