EI Benefits? Your Car Loan Just Got Its Paycheck.

Table of Contents

- EI Benefits? Your Car Loan Just Got Its Paycheck.

- Unlocking the Road Ahead: Yes, a Car Loan on EI is Possible!

- Key Takeaways

- Decoding the Lender's Playbook: How Financial Institutions View Your EI Income

- Your Strategic Arsenal: Building an Irresistible Application While on EI

- Navigating the Lender Labyrinth: Where to Find Your EI-Friendly Car Loan

- The EI-Conscious Car: Choosing a Vehicle That Won't Break the Bank (or Your Loan)

- From Application to Ignition: Your Step-by-Step Car Loan Journey on EI

- Beyond the Benefits: Managing Your Loan as Your Income Evolves

EI Benefits? Your Car Loan Just Got Its Paycheck.

Unlocking the Road Ahead: Yes, a Car Loan on EI is Possible!

Are you currently receiving Employment Insurance (EI) benefits and dreaming of hitting the open road in a new-to-you vehicle? Perhaps you've been told it's impossible, or that lenders won't even consider your application. We're here to tell you to put those misconceptions in the rearview mirror. Getting a car loan while on EI is not only possible, but it's a reality for many Canadians navigating temporary income situations.

At SkipCarDealer.com, we understand that life happens. Job transitions, parental leave, or periods of illness are common, and they shouldn't automatically derail your need for reliable transportation. A car isn't just a luxury for many; it's a necessity for getting to job interviews, childcare, appointments, or even a new job once your benefits conclude. This deep-dive article is designed to equip you with the knowledge and strategies needed to turn your EI benefits into a car loan approval. We'll show you how to present your financial situation in the best possible light, connect with the right lenders, and drive away with confidence.

Key Takeaways

- EI Doesn't Disqualify You: While considered temporary, EI can be a valid income source for a car loan, especially when presented strategically.

- Credit Score & Debt-to-Income Are Crucial: Lenders will heavily scrutinize your credit history and how much of your EI income is already committed to other debts.

- Boost Your Odds: A substantial down payment, a reliable co-signer, and showcasing any supplementary income can significantly improve your chances.

- Choose Your Lender Wisely: Not all financial institutions view EI income the same way. Dealerships, online lenders, and subprime specialists are often more flexible than traditional banks.

- Budget Beyond the Payment: Factor in insurance, fuel, maintenance, and registration to ensure your car loan is truly affordable on an EI budget.

Decoding the Lender's Playbook: How Financial Institutions View Your EI Income

When you apply for a car loan, lenders aren't just looking at your current income; they're assessing your ability to consistently make payments for the entire loan term, which can stretch for several years. This is where EI income often presents a unique challenge, primarily because it's classified as "temporary."

The 'Temporary' Income Hurdle: Why EI isn't seen like a salary.

Unlike a stable, long-term employment salary, EI benefits have an expiry date. Lenders perceive this as a higher risk because there's an inherent uncertainty about your income stream once the benefits cease. They want assurance that you'll have sufficient funds to cover your monthly car payments, even after your EI period ends. This doesn't mean EI is a non-starter, but it does mean you need to address this concern head-on.

Stability vs. Sufficiency: What lenders are truly assessing.

Lenders are weighing two main factors:

- Stability: How predictable and reliable is your income? EI has a defined end, which impacts perceived stability.

- Sufficiency: Is your current EI income, combined with any other income, enough to comfortably cover the proposed car payment and all your other monthly expenses?

They want to see a clear path to continued income after EI, or enough financial buffer to bridge the gap.

The Big Three: Credit Score, Debt-to-Income (DTI), and Income Verification.

Regardless of your income source, these three pillars form the foundation of any loan application:

- Credit Score: This numerical representation of your creditworthiness tells lenders how reliably you've managed debt in the past. A higher score (generally 650+) indicates lower risk. If your credit score needs some work, don't despair; many lenders specialize in helping Canadians with less-than-perfect credit. For more insights into what lenders look for, check out our guide on The Truth About the Minimum Credit Score for Ontario Car Loans.

- Debt-to-Income (DTI) Ratio: This is a percentage that compares your total monthly debt payments to your gross monthly income. Lenders typically prefer a DTI below 40%, meaning less than 40% of your income is already committed to other debts. A lower DTI indicates you have more disposable income to handle a new car payment.

- Income Verification: Lenders will require official documentation to verify your EI income. This usually includes your Service Canada benefit statements, bank statements showing direct deposits, and potentially your Record of Employment (ROE).

Different Flavours of EI: Does regular EI differ from sickness or maternity benefits in a lender's eyes?

While all EI benefits are temporary, some types might be viewed slightly differently:

- Regular EI: Often seen as income during a job search. Lenders will be keen to know your re-employment prospects.

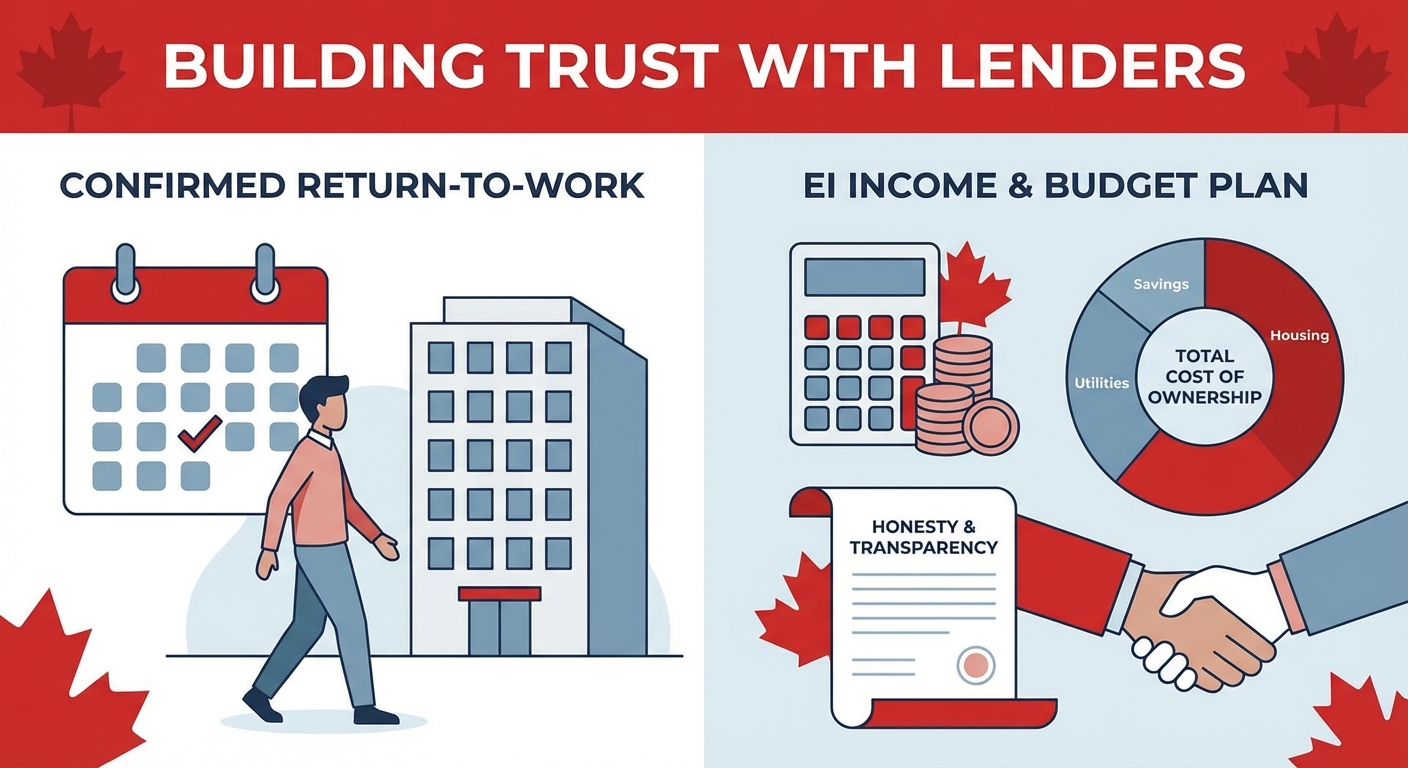

- Maternity/Parental Benefits: These often come with a clear return-to-work date, which can be a significant advantage. If you have a letter from your employer confirming your return, it greatly strengthens your application.

- Sickness Benefits: Similar to regular EI, but with the added factor of recovery. Lenders might inquire about your health status and expected return to work.

The key is to always provide as much context and future planning as possible.

Pro Tip: Always present your EI as a 'bridge' to stable employment, showcasing your job search efforts or future plans.

When speaking with lenders, emphasize that your EI is a temporary phase. Highlight your active job search, any upcoming job interviews, or a confirmed return-to-work date if applicable. If you're using EI for parental leave, provide documentation of your return to your previous employer. This proactive approach demonstrates responsibility and a clear path to stable income, significantly easing lender concerns.

Your Strategic Arsenal: Building an Irresistible Application While on EI

Securing a car loan on EI isn't about hiding your situation; it's about strategizing and presenting a compelling case. Here are concrete, actionable steps you can take to bolster your application and mitigate the perceived risks for lenders.

The Power of the Down Payment: How a significant upfront investment mitigates lender risk and lowers your loan amount.

A down payment is arguably one of the most powerful tools in your arsenal when applying for a car loan on EI. By putting money down upfront, you achieve several critical things:

- Reduces Loan Amount: A smaller loan means smaller monthly payments, making the loan more manageable on a temporary income.

- Lowers Lender Risk: Lenders see less risk when you have a financial stake in the vehicle. It shows commitment and reduces the amount they're lending.

- Potentially Better Terms: A lower loan-to-value (LTV) ratio can sometimes qualify you for more favourable interest rates.

- Builds Equity Faster: You'll owe less than the car's value sooner, which is a smart financial move.

Even a modest down payment can make a big difference, but the more you can put down, the stronger your application becomes.

Enlisting a Trusted Co-Signer: When and how to leverage a strong financial partner, and what it means for both parties.

A co-signer with strong credit and stable income can be a game-changer for your EI car loan application. A co-signer essentially guarantees the loan, promising to make payments if you default. This significantly reduces the lender's risk.

- Who to Ask: A trusted family member (parent, spouse, sibling) is typically the best choice.

- What it Means for Them: They are equally responsible for the debt. If you miss payments, their credit score will be negatively affected, and they could be pursued for the full loan amount. Ensure they understand this serious commitment.

- Benefits for You: Increased approval odds, potentially lower interest rates, and access to a wider range of vehicles.

It's a serious decision, so ensure open and honest communication with your potential co-signer.

Showcasing Supplementary Income: Beyond EI – side gigs, part-time work, government benefits (CCB, disability), and investment income.

EI might be your primary income, but it's rarely your only potential income stream. Lenders are interested in your total financial picture. Think broadly about any additional income you receive:

- Part-Time Work/Side Gigs: Even a few hours a week can add up. Provide pay stubs or bank statements.

- Canada Child Benefit (CCB): If you have children, CCB payments are a consistent, verifiable income.

- Disability Benefits: Provincial or federal disability benefits are often considered stable.

- Investment Income: Dividends, interest, or rental income from properties can also count.

- Alimony/Child Support: If legally mandated and consistently received.

Gather documentation for all these sources to present a more robust income profile. Every dollar helps demonstrate your capacity to pay.

Credit Score Reinvention: Practical steps to improve your score quickly and demonstrate financial responsibility.

While improving your credit score significantly overnight is challenging, you can take immediate steps to show responsibility:

- Check Your Credit Report: Obtain free copies from Equifax and TransUnion. Dispute any errors immediately.

- Pay Bills on Time: Even small bills like phone or utility payments can impact your score.

- Reduce Existing Debt: Paying down credit card balances (especially keeping utilization below 30%) can give your score a quick boost.

- Avoid New Credit: Don't open new credit accounts or make multiple credit inquiries just before applying for a car loan.

A lender will look at your recent credit behaviour as much as your long-term history.

Crafting Your Financial Narrative: How to explain your situation, your need for a car, and your future income projections confidently.

Don't just hand over documents; tell your story. Be prepared to explain your situation clearly and confidently:

- Why you're on EI: Be concise and factual.

- Why you need a car: Is it for job searching, childcare, medical appointments, or a confirmed commute for a future job?

- Your plan for re-employment: Detail your job search efforts, skills upgrading, or confirmed return-to-work date.

- Your budget: Show you've thought about the total cost of ownership and how it fits into your EI income.

Honesty and a well-thought-out plan build trust with lenders. They appreciate transparency.

Pro Tip: Get a pre-approval from multiple lenders to understand your standing before committing to a specific car or dealership.

Pre-approval is like a test run for your loan application. It tells you how much you're likely to qualify for and at what interest rate, without committing you to a specific vehicle. This empowers you to shop for a car with a clear budget in mind and gives you leverage when negotiating at the dealership. It also helps you identify lenders who are more receptive to EI income.

Navigating the Lender Labyrinth: Where to Find Your EI-Friendly Car Loan

The landscape of car financing is diverse, and not all lenders are created equal when it comes to accepting EI income. Knowing where to focus your search can save you time and frustration.

Dealership Financing (The Path of Least Resistance?): Understanding their networks, captive financing, and how they work with various credit tiers.

Dealerships are often a good starting point because they work with a broad network of lenders, including major banks, credit unions, and subprime specialists. Their finance managers are skilled at packaging applications to fit different lender criteria.

- Wide Network: They can submit your application to multiple lenders simultaneously, increasing your chances of finding one willing to approve EI income.

- Captive Financing: Some dealerships offer financing directly through the manufacturer (e.g., Ford Credit, Honda Financial Services). These can sometimes be more flexible, especially for new car purchases, but may have stricter income requirements.

- Subprime Connections: Dealerships often have relationships with lenders who specialize in helping customers with unique financial situations, including those on EI or with lower credit scores.

The convenience of a one-stop shop can be a major advantage, but always compare their offers with others.

Online Lenders & Subprime Specialists: The speed and accessibility, but also the potential pitfalls of higher interest rates.

Online lenders and subprime specialists have carved a niche by catering to borrowers who might not fit traditional bank criteria. They are often more understanding of non-traditional income sources like EI.

- Accessibility: Applications are quick and can be done from anywhere.

- Flexibility: They are generally more open to considering EI income, especially if you have other mitigating factors like a good down payment or a co-signer.

- Speed: You can often get a decision within hours or even minutes.

- Potential Pitfalls: Because they take on higher risk, interest rates can be significantly higher than those offered by prime lenders. Always read the fine print and understand all fees.

These lenders can be a lifeline, but ensure you're comfortable with the terms. For more specific guidance on finding approval despite challenges, you might find our article Denied a Car Loan on EI? They Lied. Get Approved Here particularly helpful.

Credit Unions & Local Banks: Often more community-focused and potentially flexible, but may have stricter initial requirements.

Your local credit union or bank might be a good option, especially if you have an existing relationship with them. They sometimes offer more personalized service and may be willing to look beyond strict formulas.

- Relationship-Based Lending: If you've been a long-standing, responsible customer, they might be more flexible.

- Potentially Lower Rates: If you qualify, their rates can be very competitive.

- Stricter Initial Requirements: They often prefer borrowers with stable, traditional employment and strong credit scores. You might need a very strong application (e.g., large down payment, excellent credit) to get approved on EI alone.

Beware of the Wolves: Identifying predatory lenders, sky-high interest rates, and hidden fees.

Unfortunately, where there's a need, there can be unscrupulous actors. Be vigilant for lenders who:

- Guarantee Approval: No legitimate lender can guarantee approval without reviewing your application.

- Demand Upfront Fees: Legitimate lenders will deduct fees from the loan amount, not ask for cash upfront.

- Use High-Pressure Tactics: Don't let anyone rush you into signing.

- Offer Exorbitant Interest Rates: While rates might be higher for EI loans, anything excessively high (e.g., 30%+) should raise a red flag.

- Have Hidden Fees: Read the entire loan agreement carefully for penalties or charges you weren't expecting.

Always compare offers and if something feels too good to be true, it probably is.

Pro Tip: Focus on lenders who understand 'non-traditional' income streams, rather than just prime banks.

While your local bank might be your first thought, their strict criteria often make them less ideal for EI recipients. Instead, seek out lenders, often found through dealerships or online, who specifically advertise their flexibility with various income types. They are better equipped to assess your unique financial situation and offer viable solutions.

The EI-Conscious Car: Choosing a Vehicle That Won't Break the Bank (or Your Loan)

Getting approved for a loan is one thing; choosing a car that fits your budget while on EI is another. This is where smart, practical decisions become paramount. Remember, the goal is reliable transportation without financial strain.

New vs. Used: The Realistic Choice: Why a reliable used car is often the smarter move.

While the allure of a brand-new car is strong, a reliable used vehicle is almost always the more financially prudent choice when on EI.

| Feature | New Car | Reliable Used Car |

|---|---|---|

| Initial Cost | Significantly higher | Much lower |

| Depreciation | Rapid in the first few years | Slower, much of the initial depreciation absorbed by previous owner |

| Insurance Costs | Generally higher | Generally lower |

| Loan Amount | Larger, leading to higher payments | Smaller, leading to more manageable payments |

| Features/Technology | Latest and greatest | Still modern, but not cutting-edge; often good value |

| Warranty | Full factory warranty | Often has remaining factory warranty or certified pre-owned warranty |

A used car allows you to secure a smaller loan, which is easier to get approved for and more affordable on a temporary income. Focus on certified pre-owned vehicles or those with a strong maintenance history for peace of mind.

Focus on Functionality, Not Flash: Prioritizing fuel efficiency, low maintenance, and insurance costs.

When every dollar counts, your car choice should reflect practicality:

- Fuel Efficiency: A vehicle with good gas mileage will save you hundreds, if not thousands, of dollars over the year. Look for compacts, subcompacts, or hybrids.

- Low Maintenance Costs: Research common issues and average repair costs for different makes and models. Japanese and Korean brands often have a reputation for reliability and affordable parts.

- Affordable Insurance: Certain vehicle types (e.g., sports cars, luxury vehicles) come with much higher insurance premiums. Opt for models known for lower insurance rates.

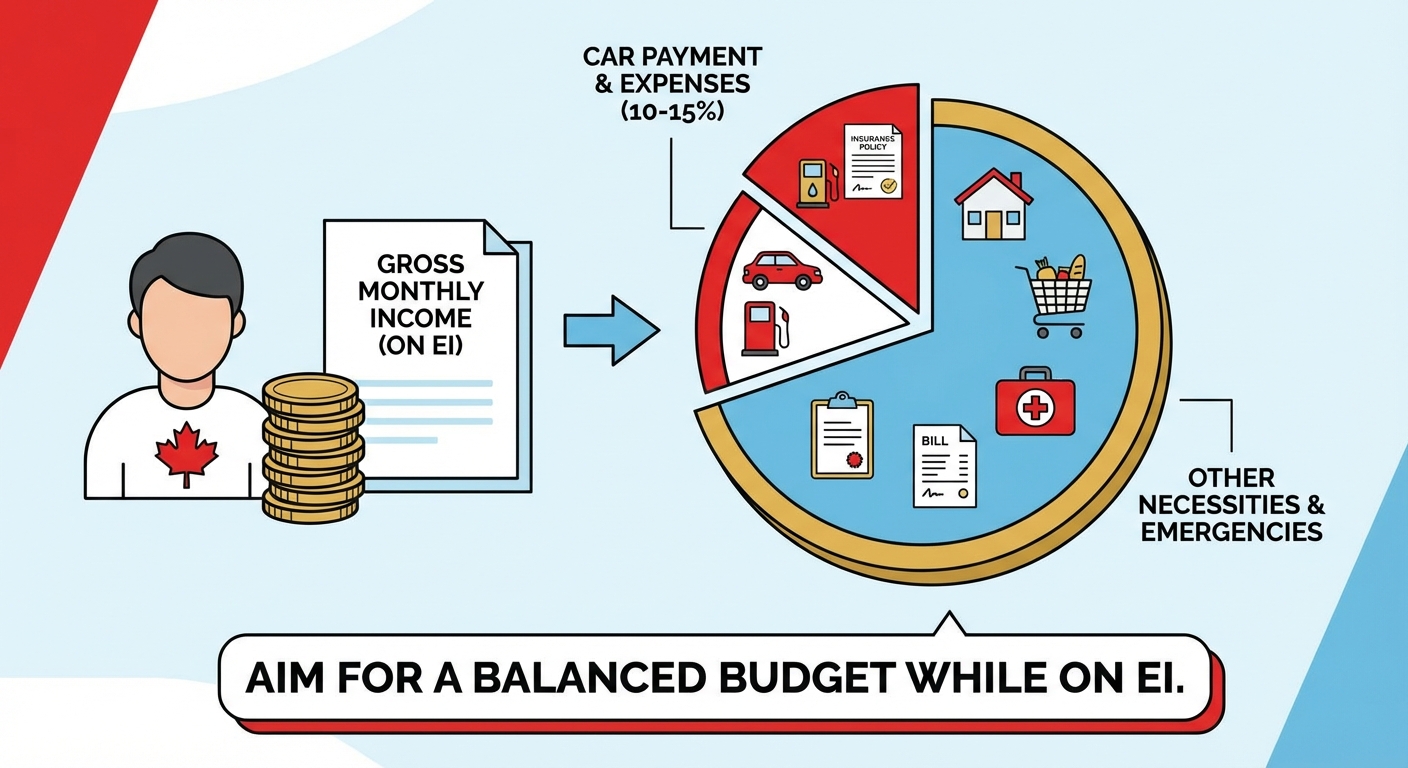

The True Cost of Ownership: Beyond the monthly payment – insurance, fuel, maintenance, registration, and unexpected repairs.

The sticker price and monthly payment are just the beginning. Factor in ALL costs:

- Car Insurance: This can be a significant monthly expense, varying widely based on your vehicle, driving record, location, and coverage.

- Fuel: Estimate your weekly or monthly fuel consumption based on your driving habits.

- Maintenance: Budget for oil changes, tire rotations, brake pads, and other routine servicing.

- Registration & Licensing: Annual fees to keep your vehicle legal on the road.

- Unexpected Repairs: Even reliable cars need repairs. Set aside an emergency fund.

Calculating Your Sustainable Payment: Tools and strategies to ensure the car loan doesn't become a burden.

Before you even look at cars, sit down and calculate what you can truly afford. Use an online car loan calculator and input your EI income, any supplementary income, and all your fixed monthly expenses. Aim for a car payment that, combined with all other car-related expenses, doesn't exceed 10-15% of your gross monthly income while on EI. This leaves room for other necessities and emergencies.

Pro Tip: Get an insurance quote *before* finalizing your car purchase; it can significantly impact your monthly budget.

Insurance costs can vary wildly between vehicle models, even for similar cars. Before you commit to a purchase, get a firm quote for the exact make, model, and year of the car you're considering. This prevents sticker shock and ensures the total cost of ownership remains within your budget.

From Application to Ignition: Your Step-by-Step Car Loan Journey on EI

Navigating the application process can feel daunting, but with the right preparation, you can approach it with confidence. Here's a detailed walkthrough, tailored for EI recipients.

The Document Checklist: EI stubs, bank statements, proof of residency, employment history, utility bills, etc.

Organization is key. Have all your documents ready before you apply. This shows preparedness and speeds up the process.

- Proof of Income: Service Canada EI benefit statements (most recent), bank statements showing EI direct deposits, pay stubs from any supplementary employment.

- Proof of Identity: Valid Canadian driver's licence, passport, or other government-issued ID.

- Proof of Residency: Utility bills (electricity, gas, internet), rental agreement, or mortgage statement.

- Employment History: Your Record of Employment (ROE), letters from previous employers, or a resume. If you have a confirmed return-to-work date, a letter from your employer stating this is invaluable.

- Bank Statements: Recent statements (3-6 months) to show your financial habits and cash flow.

- References: Some lenders may ask for personal references (not always required for car loans, but good to have).

Having these readily available demonstrates your seriousness and transparency. For more on what paperwork is generally needed, consider our guide on Approval Secrets: Exactly What Paperwork You Need for Alberta Car Financing, which offers a good general checklist.

Completing the Application with Confidence: Common questions and how to answer them truthfully and strategically.

Fill out the application completely and honestly. Don't leave blanks or try to conceal your EI status; transparency builds trust.

- Income Section: Clearly state your EI income and specify the type of benefit (e.g., regular, parental). Add any supplementary income separately.

- Employment Status: State "Currently receiving EI benefits" and be prepared to elaborate on your re-employment strategy or return-to-work date.

- Reason for Loan: Be prepared to articulate why a car is essential for your current situation and future plans.

The 'Interview' Phase: What to expect when speaking with a loan officer and how to present your case effectively.

The loan officer may ask follow-up questions to better understand your situation. This is your chance to shine:

- Be Prepared: Have your documents organized and be ready to discuss your financial plan.

- Be Honest: Don't exaggerate or make false claims.

- Be Confident: Present your EI as a temporary bridge, not a permanent state. Discuss your job search, skills upgrading, or confirmed return to work.

- Highlight Strengths: Emphasize your good credit history (if applicable), significant down payment, or strong co-signer.

Understanding Your Loan Offer: Dissecting interest rates, loan terms, fees, and penalties. Don't rush!

Once you receive an offer, review it meticulously. Don't feel pressured to sign on the spot.

- Interest Rate (APR): This is the annual cost of borrowing. Compare offers carefully.

- Loan Term: The length of time you have to repay the loan (e.g., 48, 60, 72 months). Longer terms mean lower monthly payments but more interest paid overall.

- Total Cost of Loan: Calculate the total amount you'll pay over the loan term (principal + interest).

- Fees: Look for administration fees, documentation fees, or early payment penalties.

- Prepayment Options: Can you pay off the loan early without penalty? This is crucial if you expect your income to stabilize soon.

Signing on the Dotted Line: Final checks and what to look out for.

Before you sign, do a final review:

- Ensure all terms match what was discussed and offered.

- Confirm the vehicle details (VIN, make, model, year) are correct.

- Understand any clauses regarding late payments or defaults.

- Get copies of all signed documents for your records.

Pro Tip: Never feel pressured to sign immediately. Take the offer home, review it, and compare it with other options.

A reputable lender will give you time to consider their offer. Rushing into a loan can lead to regret. Compare at least two or three offers to ensure you're getting the best possible terms for your situation.

Beyond the Benefits: Managing Your Loan as Your Income Evolves

Securing your car loan is a significant achievement, but responsible management continues well after you drive off the lot. Your financial situation will likely evolve, especially as you transition off EI.

The Transition Off EI: What to do when you secure a new job.

Congratulations! When you land a new job, it's a positive change for your financial health. While you aren't strictly required to inform your car loan lender immediately, it's a good practice for a few reasons:

- Peace of Mind: Knowing your loan is secured by a stable income reduces stress.

- Future Opportunities: A history of stable income makes you a stronger candidate for future credit.

- Refinancing Potential: A stable job could open doors for refinancing, potentially lowering your interest rate and saving you money.

Refinancing Opportunities: When and why to consider refinancing for better terms once your income stabilizes.

Once you're back in stable employment and your credit score has potentially improved, refinancing your car loan can be a smart move.

- Lower Interest Rate: If your initial EI loan had a higher interest rate due to perceived risk, a stable income can help you qualify for a much lower rate, reducing your monthly payments and the total cost of the loan.

- Shorter Loan Term: You might be able to afford higher payments with your new income, allowing you to pay off the car faster and save on interest.

- Improved Credit Score: Making consistent payments while on EI will already be boosting your credit. A stable job further enhances your credit profile, making you more attractive to prime lenders.

Keep an eye on interest rates and your credit score, and explore refinancing options a few months into your new job. For more on this, check out our article on