Nova Scotia: Your Settlement's Coming. Your Car Just Arrived.

Table of Contents

- Key Takeaways

- The Nova Scotia Drive: Why a Car Can't Wait for Your Settlement Check

- From Halifax's Bustle to Cape Breton's Coasts: Public Transit Limitations

- Bridging the Geographical Gap: Essential for Life in the Maritimes

- The Emotional and Practical Toll

- Economic Imperatives

- Unlocking Your Wheels: The Power of Settlement Financing in Nova Scotia

- More Than Just a Loan: A Cash Advance Against Your Future

- The 'Non-Recourse' Advantage: Your Financial Safety Net

- Common Settlement Types That Qualify

- The Unvarnished Truth: Decoding Rates, Fees, and Hidden Costs of Settlement Loans

- Understanding Interest Rates: Why They Are Different

- Beyond the APR: Unpacking Administrative Fees and Other Charges

- Repayment Structures Explained

- Comparing Lenders: LitigationLoans.ca vs. MagicalCredit.ca and Beyond

- The True Cost of Convenience

- Your Approval Odds: Navigating the Application Process in Nova Scotia

- The Strength of Your Case: Paramount Over Personal Credit

- Essential Documentation

- Credit Score vs. Case Merit: Why 'Bad Credit' Isn't a Deal-Breaker

- The Timeline to Funds

- Car Shopping with a Settlement Loan: Nova Scotia-Specific Considerations

- New vs. Used Vehicles: Balancing Needs with Prudence

- Dealership Financing vs. Private Sale

- Insurance Implications in Nova Scotia

- Registration and Licensing

- Specific Car Brands and Models for Nova Scotia

- Beyond the Loan: Alternative Strategies for Immediate Transportation Needs

- Interim Disbursements from Your Lawyer

- Leveraging Personal Networks

- Short-Term Rentals or Ride-Sharing

- Public Transit Options (Where Available)

- Budgeting and Prioritization

- Safeguarding Your Future: Risks, Responsibilities, and What Ifs

- What if Your Settlement is Delayed or Less Than Expected?

- Impact on Your Final Settlement Amount

- Avoiding Over-Borrowing

- The Absolute Necessity of Legal Advice

- Your Next Steps to Approval: Driving Towards Financial Freedom

- Step 1: Consult Your Nova Scotia Lawyer Immediately

- Step 2: Research Specialized Lenders Thoroughly

- Step 3: Understand Every Term and Condition

- Step 4: Create a Realistic Car Budget

- Step 5: Apply with Confidence and Preparedness

- Frequently Asked Questions (FAQ)

Waiting for a legal settlement can feel like an eternity, especially when life's necessities, like reliable transportation, simply can't wait. In Nova Scotia, where the vastness of the province often makes a personal vehicle a non-negotiable part of daily life, this waiting game can be particularly frustrating. Whether you're recovering from a personal injury, an auto accident, or navigating a medical malpractice claim, the thought of being stuck without a car while your case slowly winds through the legal system can add immense stress to an already challenging situation.

But what if there was a way to bridge that gap? What if you could get the car you need *now*, leveraging your future settlement as collateral, without taking on traditional debt or worrying about your credit score? Welcome to the world of settlement financing, a specialized financial solution designed to provide immediate relief for those awaiting legal payouts. At SkipCarDealer.com, we understand the unique challenges faced by Canadians in these circumstances, and we're here to guide you through how a settlement loan can put you behind the wheel in Nova Scotia, often faster than you might imagine.

Key Takeaways

- Settlement loans offer a crucial bridge for immediate car needs, but their specific costs and structures differ significantly from traditional financing.

- Not all legal settlements qualify; common types include personal injury, auto accident claims, and medical malpractice, often relevant to Nova Scotia's legal landscape.

- Expect higher interest rates and various fees compared to conventional loans; diligent comparison between lenders like LitigationLoans.ca and MagicalCredit.ca is vital.

- Nova Scotia's unique blend of urban and rural settings often makes personal transportation a critical necessity that cannot wait for a protracted legal process.

- Always prioritize understanding the full loan terms, including the 'non-recourse' nature, and consult extensively with your legal counsel before committing.

The Nova Scotia Drive: Why a Car Can't Wait for Your Settlement Check

Nova Scotia, with its stunning coastline, vibrant communities, and diverse geography, presents a unique set of transportation challenges and necessities for its residents. While the idea of waiting for your settlement funds to arrive might seem financially prudent, the reality on the ground often dictates a more immediate solution for mobility.

From Halifax's Bustle to Cape Breton's Coasts: Public Transit Limitations

Halifax, the provincial capital, offers a relatively robust public transit system with its Halifax Transit buses and ferries. Sydney, in Cape Breton, also has a bus network. However, venture beyond these major urban centres, and public transportation options dwindle rapidly. Imagine living in a charming town like Truro, Antigonish, or Yarmouth, where bus routes are infrequent or non-existent, and the nearest grocery store, doctor's office, or workplace is several kilometres away. Relying on friends, taxis, or infrequent ride-sharing services becomes not just inconvenient, but often unsustainable and costly in the long run.

Bridging the Geographical Gap: Essential for Life in the Maritimes

For many Nova Scotians, a personal vehicle isn't a luxury; it's a lifeline. Consider:

- Work Commutes: Many employment opportunities, particularly in industries outside Halifax, require commuting across distances not served by public transit. Missing work due to lack of transport can jeopardize your financial stability, especially while awaiting a settlement.

- Accessing Healthcare: From specialist appointments in Halifax to regular check-ups in smaller communities, reliable transportation is paramount. This is particularly true if your legal claim stems from an injury requiring ongoing medical treatment.

- Family Responsibilities: Picking up children from school, caring for elderly relatives, or simply maintaining family connections across the province often necessitates a car.

- Daily Errands: Groceries, banking, and other essential services are not always within walking distance, especially during Nova Scotia's often harsh winters.

The Emotional and Practical Toll

Being without reliable transportation during an already stressful legal battle can exacerbate feelings of isolation, frustration, and helplessness. The constant worry about how you'll get from point A to point B adds another layer of anxiety. A car provides not just physical mobility but also a sense of independence and control, which can be invaluable during a difficult time.

Economic Imperatives

For some, a car is directly tied to their ability to maintain employment or seek new opportunities. If your injury or circumstances have forced a change in career or location, having a vehicle can be the critical factor in regaining financial footing while you wait for your settlement to materialize. Without it, you might find yourself in a deeper financial hole before your compensation even arrives.

Unlocking Your Wheels: The Power of Settlement Financing in Nova Scotia

If the scenarios above resonate with you, settlement financing might be the solution you've been looking for. This isn't just another loan; it's a specialized financial product designed specifically for individuals with pending legal claims.

More Than Just a Loan: A Cash Advance Against Your Future

Settlement financing, often referred to as a "litigation loan" or "legal funding," is essentially a cash advance provided against the expected proceeds of your future legal judgment or settlement. Unlike a traditional car loan, which you repay with monthly installments regardless of your financial situation, a settlement loan's repayment is tied directly to the successful resolution of your legal case.

The 'Non-Recourse' Advantage: Your Financial Safety Net

This is arguably the most critical feature of a settlement loan and a key differentiator from conventional debt. A 'non-recourse' loan means that if your legal case is unsuccessful, you are generally not obligated to repay the loan. The lender takes on the risk that your case might not settle or might not result in a payout. This provides a significant safety net, protecting you from accumulating debt for a car you purchased if your legal claim doesn't pan out as expected.

Think about it: if you took out a traditional car loan and then lost your legal case, you'd still be on the hook for those car payments, potentially creating an even greater financial burden. With a non-recourse settlement loan, that risk is largely mitigated.

Common Settlement Types That Qualify

While specific criteria vary by lender, settlement loans are typically available for claims where a substantial financial payout is anticipated. Common types of cases that often qualify in Canadian legal systems include:

- Personal Injury Claims: This is perhaps the most common category, covering injuries sustained due to another party's negligence, such as slip and falls, workplace incidents (outside Workers' Compensation), or assaults.

- Motor Vehicle Accident Claims: Highly relevant for car purchases, these claims arise from injuries sustained in vehicle collisions where another driver was at fault. The anticipated payout can cover medical expenses, lost wages, and pain and suffering, making it a strong basis for a settlement loan.

- Medical Malpractice Claims: Cases where a healthcare professional's negligence led to injury or harm.

- Estate Disputes: While less common for car purchases, these can also qualify if a significant inheritance or payout is expected.

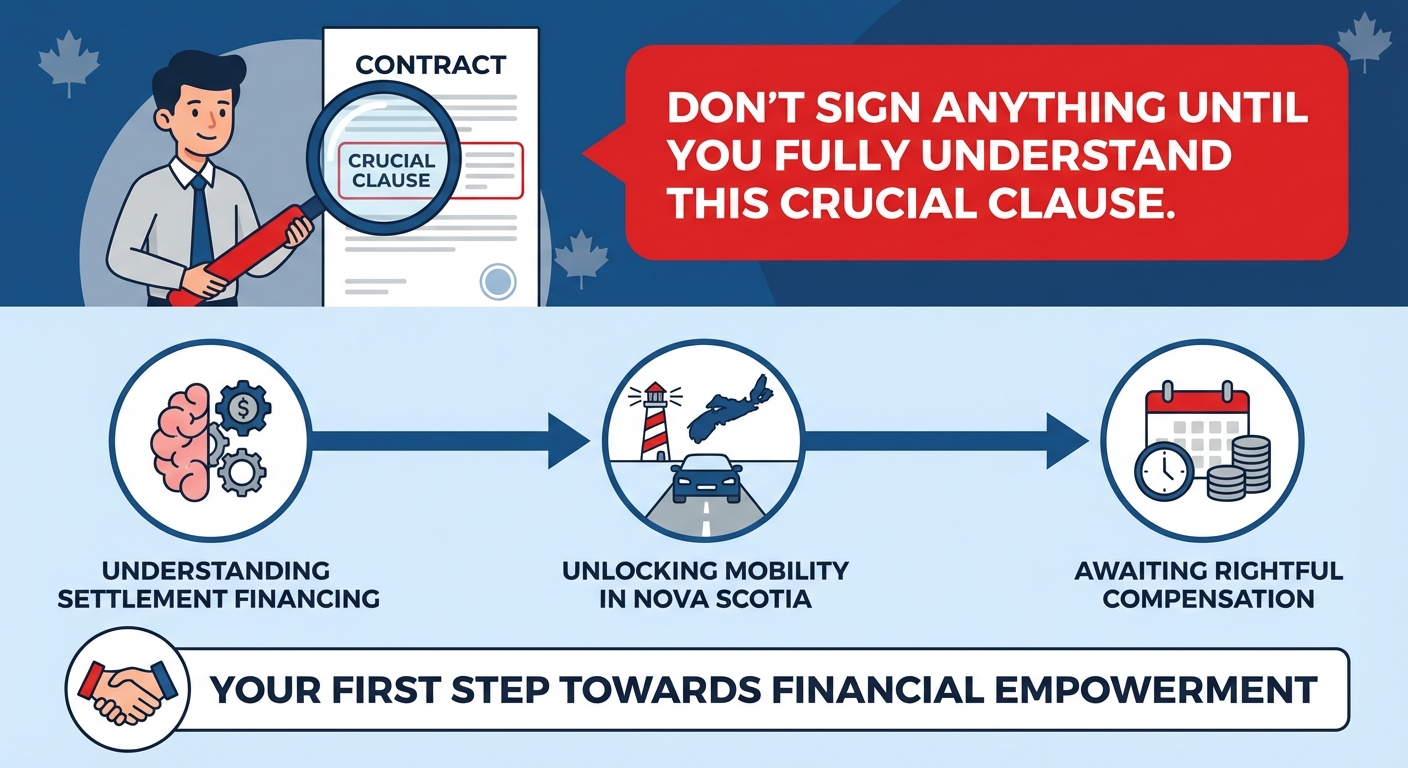

Pro Tip: Always ensure your settlement loan agreement explicitly states it is 'non-recourse.' This is your primary protection if your case doesn't settle or goes unfavorably. Your lawyer can confirm this wording and explain its full implications for your specific situation. Don't sign anything until you fully understand this crucial clause.

Understanding these fundamental aspects of settlement financing is the first step towards unlocking the mobility you need in Nova Scotia while awaiting your rightful compensation.

The Unvarnished Truth: Decoding Rates, Fees, and Hidden Costs of Settlement Loans

While settlement loans offer an invaluable lifeline, it's crucial to approach them with a clear understanding of their financial realities. They are not 'cheap' money, and their cost structure differs significantly from what you might expect from a conventional bank loan.

Understanding Interest Rates: Why They Are Different

Settlement loans carry higher interest rates than traditional car loans or personal loans. Why? Because lenders assume a higher risk. They are lending against an uncertain future event (your settlement) and often offer a non-recourse clause, meaning they might not be repaid if your case is lost. This elevated risk is reflected in the rates.

- Simple Interest vs. Compound Interest: Many settlement loan providers charge simple interest, which is calculated only on the principal amount. However, some might use a compounded rate, which can significantly increase the total cost over time. Always clarify which method is used.

- Flat Fees: Instead of a percentage interest rate, some lenders might charge a flat monthly or quarterly fee, which can accumulate quickly.

- Realistic Range: While exact rates vary widely based on the strength of your case, the lender, and the loan amount, expect rates that could range from 2% to 4% per month (effectively 24% to 48% APR or higher) or equivalent flat fees. Lenders like Magical Credit, which caters to individuals with less-than-perfect credit, might fall into the higher end of this spectrum due to the perceived additional risk.

Beyond the APR: Unpacking Administrative Fees and Other Charges

Interest rates are just one piece of the puzzle. Settlement loans often come with various fees that can significantly increase the total cost of borrowing. These might include:

- Origination Fees: A charge for processing the loan application, typically a percentage of the loan amount or a flat fee.

- Administrative Fees: Ongoing monthly or quarterly fees for managing the loan.

- Legal Review Fees: Some lenders might charge for the cost of reviewing your legal case with your lawyer.

- Documentation Fees: For preparing the loan agreements.

- Wire Transfer Fees: If funds are disbursed electronically.

It is imperative to get a detailed breakdown of all potential costs before signing any agreement.

Repayment Structures Explained

Unlike traditional loans with fixed monthly payments, settlement loans are typically repaid as a lump sum directly from your settlement proceeds when your case concludes. Your lawyer will receive the settlement funds, and the lender will be paid directly from those funds, with the remaining balance going to you. This model means you don't have to worry about making payments while your case is ongoing, but it also means the total amount repaid can grow substantially if your case takes a long time to settle.

Comparing Lenders: LitigationLoans.ca vs. MagicalCredit.ca and Beyond

The Canadian market for settlement loans has several players, each with slightly different offerings and target demographics. Understanding these differences is key to making an informed choice:

| Feature | LitigationLoans.ca (Example) | MagicalCredit.ca (Example) | Traditional Car Loan (for comparison) |

|---|---|---|---|

| Primary Focus | General litigation funding for various claims. | Personal loans for bad credit, including settlement loans. | Secured financing for vehicle purchase. |

| Credit Score Impact | Minimal; case merit is paramount. | Less critical; focuses on ability to repay from settlement. | Significant; often the primary determinant. |

| Interest Rates/Fees | Higher than traditional loans, often simple interest or flat fees. Specifics vary by case. | Higher than traditional, often caters to higher-risk borrowers, potentially higher rates. | Lower, competitive rates (e.g., 5-15% APR) for good credit. |

| Repayment Structure | Lump sum from settlement; non-recourse. | Lump sum from settlement; often non-recourse. | Fixed monthly payments regardless of other income/events. |

| Approval Speed | Can be relatively fast (days to weeks) once documentation is complete. | Often designed for quick approvals for immediate needs. | Varies; can be fast with good credit, slower with challenges. |

| Eligibility | Strong legal case, represented by counsel. | Strong legal case, often for those with poor credit or non-traditional income. | Stable income, good credit history. |

When comparing providers, always ask:

- What is the exact interest rate (simple or compound)?

- What are all the associated fees (origination, administrative, legal, etc.)?

- What is the total cost of the loan if my settlement takes 1 year, 2 years, or 3 years?

- Is the loan explicitly non-recourse?

The True Cost of Convenience

Calculating the overall financial impact means looking beyond just the principal amount. If you borrow $10,000 at a rate that equates to 3% per month, and your case takes two years (24 months) to settle, you could be looking at an additional $7,200 in interest alone (3% x 24 months x $10,000, assuming simple interest, not including other fees). This significantly reduces your net settlement amount. It's the cost you pay for immediate access to funds and the peace of mind that comes with the non-recourse feature. Weigh this cost against the benefits of having a car now – maintaining employment, accessing medical care, and reducing stress.

Your Approval Odds: Navigating the Application Process in Nova Scotia

Applying for a settlement loan is a different beast compared to a traditional car loan. While conventional lenders meticulously scrutinize your credit score and income, settlement loan providers prioritize the strength and potential value of your legal claim.

The Strength of Your Case: Paramount Over Personal Credit

This is the cornerstone of settlement loan approval. Lenders are primarily assessing the likelihood of your case succeeding and the estimated amount of your future payout. They work closely with your Nova Scotia legal counsel to understand:

- The merits of your claim (how strong is the evidence?).

- The defendant's ability to pay.

- The estimated timeline for settlement or judgment.

- The projected value of your settlement.

If your lawyer believes you have a strong case with a high probability of a substantial settlement, your chances of approval are significantly higher.

Essential Documentation

Be prepared to provide a comprehensive package of information to the lender, often facilitated by your lawyer. This typically includes:

- Legal Agreements: Your retainer agreement with your Nova Scotia lawyer.

- Legal Case Summary: A document prepared by your lawyer outlining the details of your claim, the parties involved, and the legal strategy.

- Medical Reports: For personal injury or medical malpractice cases, these are crucial to demonstrate the extent of your injuries and their impact.

- Police Reports: Essential for auto accident claims, providing an official record of the incident.

- Financial Documentation: Evidence of lost wages or other financial damages.

- Direct Contact Information for Your Legal Counsel: Lenders will need to communicate directly with your lawyer to verify details and assess the case.

Credit Score vs. Case Merit: Why 'Bad Credit' Isn't a Deal-Breaker

This is where settlement loans truly shine for many Canadians. If you have a poor credit history, a low credit score, or even a consumer proposal or bankruptcy on your record, traditional lenders might immediately decline your application for a car loan. However, for settlement loan providers like Magical Credit, your credit score is often a secondary, if not irrelevant, factor. They are lending against the value of your future legal settlement, not your past credit behaviour. So, if you've been told 'no' elsewhere because of your credit, this avenue remains wide open. For more insights into how your credit score might not be the deciding factor, check out our guide on Alberta Car Loan: What if Your Credit Score Doesn't Matter?

The Timeline to Funds

Once all necessary documentation is submitted and reviewed, the approval process can be surprisingly quick. While it varies, many lenders can approve and disburse funds within days or a couple of weeks, allowing you to access the money for your car purchase relatively swiftly after your lawyer has provided all the required information.

Pro Tip: Maintain open and honest communication with your legal team throughout the application process. Their cooperation and insight are crucial for a successful loan application. They will be the primary point of contact for the lender regarding the merits of your case, so ensure they are fully on board and prepared to assist.

Car Shopping with a Settlement Loan: Nova Scotia-Specific Considerations

Once your settlement loan is approved, the exciting part begins: car shopping! However, using a settlement loan for a vehicle purchase in Nova Scotia requires a strategic approach to ensure you make a financially sound decision.

New vs. Used Vehicles: Balancing Needs with Prudence

- New Vehicles: Offer reliability, manufacturer warranties, and the latest features. However, they depreciate significantly the moment they leave the lot. If your settlement is still years away, a new car might not be the most fiscally responsible choice, as the depreciation could eat into your eventual net settlement.

- Used Vehicles: Generally offer better value, especially if you can find a well-maintained model. They've already taken the initial depreciation hit. When using a settlement loan, a reliable used car can meet your immediate transportation needs without overspending, preserving more of your future settlement.

The key is to balance your immediate transportation needs with long-term financial prudence. Consider the duration you expect to be waiting for your settlement and how much value you want to retain from your vehicle.

Dealership Financing vs. Private Sale

When you have a settlement loan, you essentially have cash in hand (or rather, guaranteed funds). This changes the dynamic of your purchase:

- Dealerships: You can negotiate as a cash buyer, potentially securing a better price. Dealerships offer convenience, warranties (on new and certified used cars), and a wider selection. However, be wary of their own financing offers if you don't need them; stick to your settlement loan.

- Private Sale: Often allows for lower prices than dealerships, as sellers don't have overheads. This can be an excellent option for maximizing your settlement loan funds. However, private sales come with more risk (no warranties, 'as-is' condition). If you're considering a private sale, especially with challenging credit, remember that lenders like SkipCarDealer.com can still help. For more on this, check out our guide on Bad Credit? Private Sale? We're Already Writing the Cheque.

Insurance Implications in Nova Scotia

Mandatory auto insurance is a critical requirement in Nova Scotia. Factors influencing your rates include your driving history, the type of vehicle you choose, your age, and where you live (rates in Halifax might differ from rural areas). Obtain multiple competitive quotes from different insurance providers before finalizing your car purchase. Remember to factor in collision and comprehensive coverage, especially if your vehicle is relatively new or valuable, as it protects your investment.

Registration and Licensing

In Nova Scotia, vehicle registration and licensing are handled by Service Nova Scotia. You will need to:

- Provide proof of ownership (bill of sale).

- Show proof of valid insurance.

- Pay the provincial sales tax (HST) on the purchase price.

- Ensure the vehicle passes any required safety inspections.

Plan for these costs and administrative steps as part of your overall car acquisition budget.

Specific Car Brands and Models for Nova Scotia

Given Nova Scotia's climate and varied terrain, certain vehicle characteristics are highly desirable:

- Reliability: Brands like Toyota, Honda, and Subaru are often praised for their durability, reducing unexpected repair costs.

- All-Wheel Drive (AWD): Highly recommended for navigating winter conditions, especially on unplowed rural roads or hilly urban streets in Halifax. Subaru models, certain Mazda SUVs, and many Ford/GM options excel here.

- Fuel Efficiency: For longer commutes across the province, a fuel-efficient vehicle (e.g., Honda Civic, Toyota Corolla, Hyundai Elantra, or a hybrid) can save you significant money over time.

- Strong Resale Value: Choosing a popular model can help retain value, which is beneficial if you decide to upgrade after your settlement comes through.

Pro Tip: Before finalizing any car purchase, especially for used vehicles from a private seller or a non-certified dealership, obtain a pre-purchase inspection from an independent mechanic. This helps identify any hidden issues or impending repair costs that could drain your settlement loan funds and cause further financial strain.

Beyond the Loan: Alternative Strategies for Immediate Transportation Needs

While settlement loans are a powerful tool, they are not the only option. It's always wise to explore alternative strategies for acquiring transportation, especially if a settlement loan isn't your preferred route or if your case doesn't qualify.

Interim Disbursements from Your Lawyer

In very specific and often rare circumstances, your lawyer might be able to arrange an interim disbursement directly from your settlement. This is not a loan but an early release of a portion of your anticipated settlement. This usually only happens in cases where liability is absolutely clear, the damages are well-quantified, and the defendant's insurance company or legal team agrees to an early payment. This is entirely at the discretion of your lawyer and the opposing party, and it's not a common occurrence. Always discuss this possibility with your legal team.

Leveraging Personal Networks

Don't underestimate the power of your support system. Family or friends might be willing to offer:

- Temporary Loans: A short-term, interest-free loan from a loved one could bridge the gap until your settlement arrives. Be sure to formalize the agreement to avoid misunderstandings.

- Shared Vehicle Use: Perhaps a family member has an extra vehicle they're not using, or you could arrange a car-sharing agreement.

- Ride-Sharing: Setting up a carpool with colleagues or friends for commutes can significantly reduce the burden.

Short-Term Rentals or Ride-Sharing

As a temporary measure, short-term car rentals or ride-sharing services (like Uber or Lyft, where available in larger Nova Scotia cities like Halifax) can provide mobility. However, these options can become very expensive over an extended period. Carefully calculate the costs versus the duration of your expected wait to determine if this is a viable bridge solution.

Public Transit Options (Where Available)

While limited outside major centres, Halifax Transit in Halifax and the bus services in Sydney can be cost-effective options for daily commutes if your home and destination are on a route. Realistically assess if these services can genuinely meet your needs, considering schedules, transfer times, and the physical demands of your situation (especially if your legal claim involves an injury).

Budgeting and Prioritization

Sometimes, the solution lies within your existing finances. Review your current budget with a fine-tooth comb. Are there non-essential expenses you can cut back on? Could you temporarily reallocate funds from other savings goals to afford a very basic, inexpensive vehicle? This might involve making sacrifices, but it could free up cash for a down payment or even the full purchase of a cheap, reliable car, avoiding the interest costs of a loan.

Safeguarding Your Future: Risks, Responsibilities, and What Ifs

While settlement loans offer significant advantages, it's paramount to understand the potential downsides and your responsibilities. Informed decision-making means knowing the risks as well as the rewards.

What if Your Settlement is Delayed or Less Than Expected?

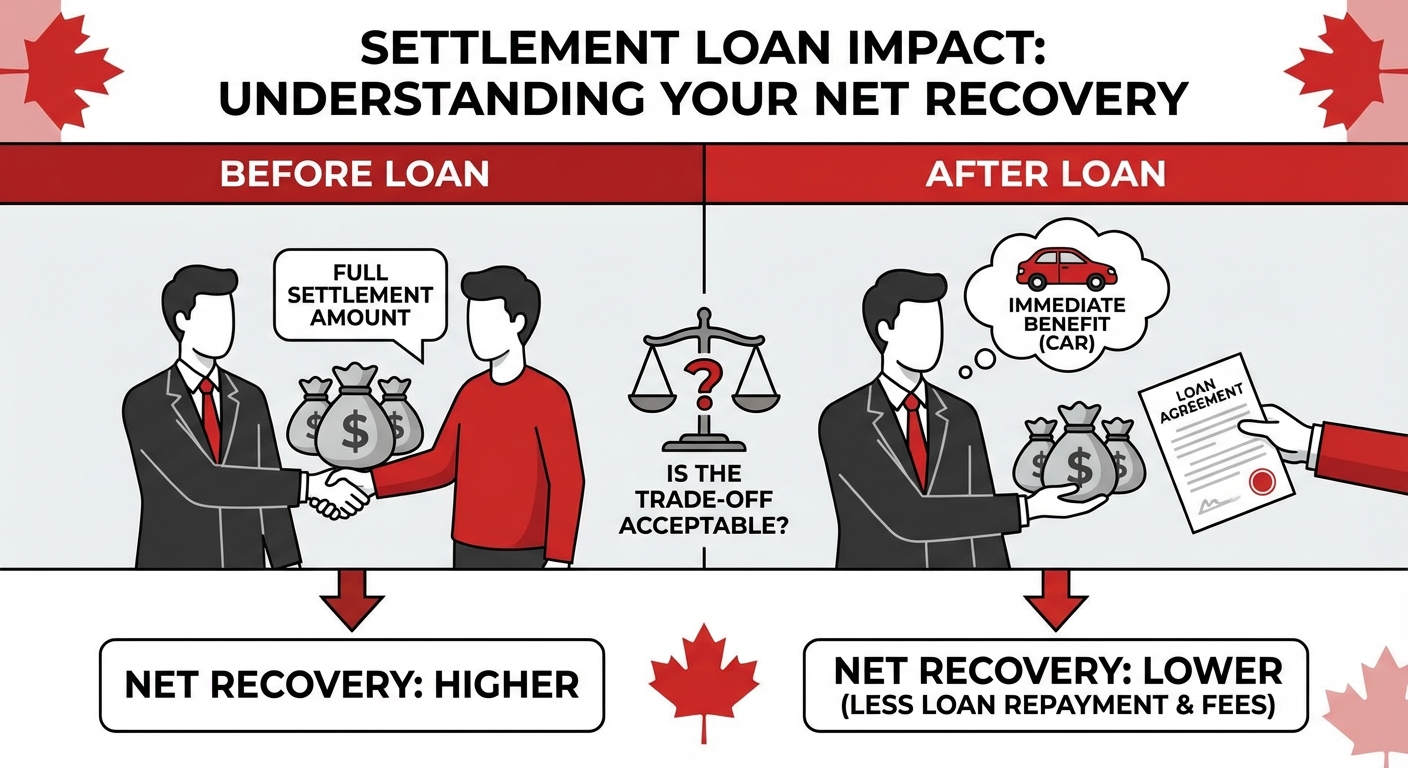

Legal cases can be unpredictable. Settlements can be delayed for months or even years beyond initial estimates, and the final amount might be less than anticipated. This is where the 'non-recourse' clause becomes your greatest protection. If your loan is truly non-recourse, and your case is lost or settles for an amount that doesn't cover the loan, you typically won't owe the lender anything further. However, if your settlement is merely *delayed*, the interest and fees will continue to accumulate, significantly increasing the total cost of the loan and reducing your net recovery.

Impact on Your Final Settlement Amount

This is a critical consideration. Every dollar paid in interest and fees for your settlement loan is a dollar less that you receive from your final settlement. If you borrow $15,000 for a car, and with interest and fees, you owe $20,000 at the time of settlement, that $20,000 comes directly off the top of your compensation. You need to weigh the immediate benefit of having a car against this reduction in your ultimate payout.

Avoiding Over-Borrowing

The temptation to borrow more than you strictly need can be strong, especially when facing financial strain. However, borrowing extra for non-essential items or simply 'just in case' can have severe long-term financial consequences. The interest and fees on settlement loans are high, and every additional dollar borrowed compounds that cost. Stick to what you genuinely need for essential transportation and related expenses. Over-borrowing reduces your final net settlement and can leave you with less compensation for your recovery and future.

The Absolute Necessity of Legal Advice

This cannot be stressed enough: your Nova Scotia lawyer's counsel is non-negotiable before signing any settlement loan agreement. Your lawyer understands the specifics of your case, its likely trajectory, and the potential pitfalls. They can:

- Review the loan agreement for fairness and ensure the 'non-recourse' clause is properly worded.

- Advise you on the realistic potential of your settlement and how a loan might impact it.

- Explain any provincial regulations or legal nuances in Nova Scotia that could affect the loan.

- Ensure the loan does not compromise your legal strategy or your relationship with your legal team.

Pro Tip: Always engage in a detailed discussion with your lawyer about the potential net financial impact of a settlement loan on your overall recovery. Understand precisely how much less you will receive after the loan is repaid and whether that trade-off is acceptable for the immediate benefits of a car.

Your Next Steps to Approval: Driving Towards Financial Freedom

Ready to explore how a settlement loan can put you in the driver's seat in Nova Scotia? Here’s a clear, actionable roadmap to guide you:

Step 1: Consult Your Nova Scotia Lawyer Immediately

This is your critical first move. Discuss your urgent transportation needs and the feasibility of a settlement loan in the context of your specific legal case. Your lawyer's assessment of your case's strength and value is the foundation of any settlement loan application. They will also be instrumental in providing the necessary documentation to the lender.

Step 2: Research Specialized Lenders Thoroughly

Investigate providers like LitigationLoans.ca and MagicalCredit.ca, along with others available in the Canadian market. Focus on their terms, eligibility criteria, and reputation. Read reviews, look for transparency, and see if their offerings align with your specific needs, especially if you have less-than-perfect credit. For those with alternative financial situations, services that focus on factors beyond traditional credit scores can be a great asset. For example, if you're exploring options where your credit history isn't the primary focus, our article on Your Down Payment Just Called In Sick. Get Your Car. might offer valuable perspectives on securing a vehicle without traditional upfront funds.

Step 3: Understand Every Term and Condition

Do not sign anything until you fully comprehend the interest rates (simple vs. compound), all associated fees (origination, administrative, legal review), and the repayment structure. Ask for a clear breakdown of the total estimated cost of the loan over various potential settlement timelines. If anything is unclear, ask your lawyer for clarification.

Step 4: Create a Realistic Car Budget

Account for more than just the vehicle's purchase price. Factor in:

- The settlement loan amount and its repayment costs.

- Mandatory Nova Scotia auto insurance.

- Registration and licensing fees (Service Nova Scotia).

- Potential pre-purchase inspection costs.

- Ongoing fuel, maintenance, and repair expenses.

Ensure this budget aligns with a conservative estimate of your expected net settlement after all legal fees and the loan repayment.

Step 5: Apply with Confidence and Preparedness

Gather all necessary documentation, including legal agreements, medical reports, and police reports (if applicable). Be ready to provide detailed information about your legal case and authorize your lawyer to communicate with the lender. A well-prepared application can significantly speed up the approval process.