Bad Credit? Private Sale? We're Already Writing the Cheque.

Table of Contents

- Key Takeaways

- The Unconventional Path: Unlocking Your Private Sale Car Loan Despite Bad Credit

- Debunking the Myths: Why Bad Credit & Private Sales Aren't a Dead End

- The 'Dealership Advantage' Fallacy: Why Private Sales Can Still Be Your Smartest Move

- Understanding Lender Perspectives: Why Some Lenders *Do* Cater to This Niche

- The Credit Conundrum: What 'Bad Credit' Really Means for Car Loans

- Beyond the Score: Delving into Your Credit Report's Story

- The Risk Assessment Matrix: How Lenders View Different Credit Challenges

- Your True Allies: Navigating the Landscape of Bad Credit, Private Sale Lenders

- Beyond the Big Banks: Why Traditional Institutions Aren't Always Your First Stop

- Specialized Subprime Auto Lenders: Who They Are and Why They're Built for You

- Credit Unions: The Often-Overlooked Community Advantage

- Peer-to-Peer Lending: Is It a Viable, Albeit Niche, Option for Private Sales?

- The Pre-Approval Blueprint: Your Step-by-Step Guide to Securing Funds

- Phase 1: Getting Your Financial House in Order

- Phase 2: Crafting Your Loan Application for Success

- Decoding the Dollars: Interest Rates, Fees, and the True Cost of Your Loan

- The 'Bad Credit' Premium: Why Rates Are Higher and How to Understand Them

- Fixed vs. Variable: Which Is Right for Your Financial Situation?

- Hidden Fees and Charges: The Fine Print You *Must* Read

- Amortization Explained: How Your Payments Really Break Down Over Time

- Finding Your Ride: Navigating the Private Sale Market with Pre-Approved Funds

- Setting Realistic Expectations: What Kind of Car Can You Afford?

- The Pre-Purchase Inspection: Non-Negotiable for Private Sales

- Title Transfer and Registration: Protecting Your Investment Legally

- Beyond the Purchase: Building a Stronger Financial Future

- Making Payments On Time: The Most Critical Step to Credit Repair

- Understanding Refinancing Opportunities: When and How to Lower Your Rate Later

- Protecting Your Asset: Insurance, Maintenance, and Avoiding Costly Breakdowns

You've got a specific car in mind, a seller ready to shake hands, and one major hurdle: bad credit. Traditional lenders might have already slammed the door on your private sale car loan dreams, but here at SkipCarDealer.com, we see things differently. We understand that life happens, and a less-than-perfect credit score shouldn't be a permanent roadblock to getting the vehicle you need.

You’re not looking for a handout; you're looking for a solution, a way to bridge the gap between your current financial standing and the car that will get you to work, school, or simply give you the freedom you deserve. This isn't just another article; it's your comprehensive roadmap. We're going to dive deep into the world of private sale car loans for those with bad credit, dismantling myths, revealing your true allies, and equipping you with the strategies to secure the financing you thought was impossible. Forget the skepticism – we're already writing the cheque, metaphorically speaking, to get you behind the wheel.

Key Takeaways

- Getting a private sale car loan with bad credit is challenging but absolutely achievable with the right strategy and understanding.

- Traditional banks often aren't your primary solution; specialized lenders and credit unions are your true allies.

- Preparation is paramount: understanding your credit, proving income, and having a down payment significantly boost your approval odds.

- Focus on the total cost, not just the interest rate, and be diligent about reading the fine print for hidden fees.

- This loan isn't just about a car; it's a powerful opportunity to rebuild your credit for a stronger financial future.

The Unconventional Path: Unlocking Your Private Sale Car Loan Despite Bad Credit

The journey to securing a private sale car loan when your credit history has a few bumps can feel like navigating a maze blindfolded. Many assume it's an impossible feat, a financial pipe dream. But what if we told you that not only is it possible, but with the right knowledge and approach, it's a path many Canadians successfully take? This deep-dive is designed to be your essential guide, cutting through the confusion and directly addressing your skepticism. We'll show you how to unlock the financing you need, even when traditional avenues seem closed. It's about understanding the landscape, knowing where to look, and presenting yourself in the best possible light to lenders who are willing to say "yes."

Debunking the Myths: Why Bad Credit & Private Sales Aren't a Dead End

The moment you utter "bad credit" and "private sale car loan" in the same sentence, you're often met with raised eyebrows or outright dismissal. There's a pervasive myth that these two factors combine to create an insurmountable barrier. We're here to tell you that this simply isn't true. While it presents a unique set of challenges, it's far from a dead end. The anxiety surrounding this combination is understandable, but by understanding the realities, you'll see why this isn't as prohibitive as it seems.

The 'Dealership Advantage' Fallacy: Why Private Sales Can Still Be Your Smartest Move

For years, the narrative has been that if you have bad credit, a dealership is your only hope for a car loan. They often market "guaranteed approval" or "all credit accepted" schemes. While dealerships do streamline the financing process, often working with a network of lenders, this convenience comes at a cost. Dealerships frequently mark up vehicle prices significantly, sometimes to offset the perceived risk of subprime financing or simply to maximize profit. This 'dealership advantage' can be a fallacy for the savvy buyer.

A private sale, on the other hand, allows you to negotiate directly with a seller, often securing a much better price for the exact same vehicle. You cut out the middleman's overhead and profit margins. While arranging independent financing might seem more complex, the potential savings on the vehicle itself can be substantial, often outweighing the slightly higher interest rates you might face with bad credit. It truly can be your smartest move if you're prepared to do a little extra legwork to secure your own financing.

Understanding Lender Perspectives: Why Some Lenders *Do* Cater to This Niche

It's natural to wonder why any lender would take on the "risk" of someone with bad credit wanting a private sale loan. The truth is, it's not charity; it's a calculated business model. A specific segment of the lending industry specializes in what's known as subprime auto loans, and many of these lenders are perfectly willing to finance private sales. They understand that credit scores don't always tell the whole story and that people with past financial challenges still need reliable transportation.

These specialized lenders have developed unique underwriting processes. They assess risk differently, often looking beyond just your credit score to factors like your current income stability, employment history, and your ability to make a down payment. They mitigate their increased risk by charging higher interest rates and sometimes requiring more stringent loan terms. It's a profitable niche, and they're actively looking for borrowers who fit their specific parameters – borrowers just like you, who are ready to demonstrate their current financial responsibility.

The Credit Conundrum: What 'Bad Credit' Really Means for Car Loans

Before you even think about approaching a lender, you need to understand your own credit situation. "Bad credit" isn't a single, monolithic entity; it's a spectrum. Lenders don't just see a low number; they delve into the story behind that number. Understanding this narrative and how to mitigate negative factors is your first powerful step towards approval.

Beyond the Score: Delving into Your Credit Report's Story

Your credit score, typically a three-digit number, is merely a summary. What truly matters to lenders is your full credit report from agencies like Equifax and TransUnion. This report details your financial behaviour and history across several key components:

- Payment History (35%): This is the most crucial factor. Lenders want to see consistent, on-time payments. Late payments, collections, or defaults on previous loans or credit cards will significantly impact their decision.

- Amounts Owed (30%): How much debt do you currently carry? High credit utilization (using a large percentage of your available credit) signals higher risk.

- Length of Credit History (15%): A longer history with positive accounts demonstrates consistent financial management.

- New Credit (10%): Multiple recent credit applications can make you appear desperate for credit, which is a red flag.

- Credit Mix (10%): A healthy mix of different credit types (credit cards, lines of credit, previous loans) can be beneficial, showing you can manage various forms of credit responsibly.

Lenders will meticulously interpret specific negative marks. A recent bankruptcy or consumer proposal, for example, is a significant event, but it's not a permanent disqualifier. For more on navigating such situations, you might find our article, Your Consumer Proposal? We Don't Judge Your Drive, particularly helpful. They'll assess the recency and severity of these marks. A few isolated late payments from years ago are viewed differently than ongoing missed payments or recent collections.

The Risk Assessment Matrix: How Lenders View Different Credit Challenges

Lenders categorize "bad credit" into various tiers of risk. This isn't just about the numerical score; it's about the underlying reasons and patterns:

| Credit Challenge Level | Description & Lender Perception | Likely Impact on Loan |

|---|---|---|

| Minor Blemishes | A few isolated late payments (30-60 days past due) from years ago, or high credit card utilization that has since been reduced. | Higher interest rates than prime, but generally good approval odds if other factors are strong. |

| Moderate Issues | More frequent late payments, a collection account, or a settled consumer proposal that is a few years old. | Significantly higher interest rates, potentially requiring a larger down payment or a co-signer. Approval is still very possible. |

| Severe Challenges | Recent bankruptcy, multiple active collection accounts, or ongoing defaults. | Highest interest rates, stricter terms, potentially smaller loan amounts. Requires strong compensating factors (stable income, large down payment). |

Understanding where you fall on this matrix helps you anticipate lender expectations and prepare your application accordingly. For instance, a recent bankruptcy will necessitate a different approach than a few missed credit card payments from two years ago. For a deeper dive into credit scores in the Canadian context, especially in Ontario, consider reading The Truth About the Minimum Credit Score for Ontario Car Loans.

Pro Tip 1: Pull Your Own Report – The First Step to Empowerment

Before you apply for any loan, get free copies of your credit report from Equifax and TransUnion. This isn't just a suggestion; it's critical. Review it meticulously for errors – even small discrepancies can negatively impact your score. Understanding exactly what lenders will see *before* you apply empowers you to address any issues, explain past challenges proactively, and avoid surprises that could lead to denial. You can't fix what you don't know is broken, and you can't explain what you don't understand.

Your True Allies: Navigating the Landscape of Bad Credit, Private Sale Lenders

When you have bad credit and are seeking a private sale car loan, your typical high-street bank might not be your best bet. It's crucial to know where to focus your efforts. Your true allies are often found beyond the traditional institutions.

Beyond the Big Banks: Why Traditional Institutions Aren't Always Your First Stop

Large, traditional banks in Canada, while offering a wide range of financial products, often have stricter lending criteria, especially for bad credit borrowers and private sales. Why? Because private sales lack the built-in vetting process that comes with purchasing from a dealership. The bank has less assurance about the vehicle's condition or market value, and the borrower's credit history adds another layer of perceived risk. While some major banks do offer private sale loan products, their typical target demographic is usually prime borrowers with excellent credit. This doesn't mean you can't apply, but it's often not the most efficient use of your time if your credit is significantly challenged.

Specialized Subprime Auto Lenders: Who They Are and Why They're Built for You

This is where your search should primarily focus. Non-prime or subprime auto lenders are financial institutions whose entire business model is built around lending to individuals with less-than-perfect credit. They understand the nuances of bad credit and have developed sophisticated, often automated, underwriting processes to assess risk beyond a simple credit score. They look at your current ability to pay, your employment stability, and your debt-to-income ratio more heavily.

These lenders are willing to take on higher risk, but they compensate for it with higher interest rates. They might include online loan aggregators (like SkipCarDealer.com!) that connect you with multiple specialized lenders, or direct subprime lenders who focus solely on this market. Their willingness to finance private sales is also often greater, as they are accustomed to working with various collateral types and individual sellers. They are truly built for your situation.

Credit Unions: The Often-Overlooked Community Advantage

Don't underestimate credit unions. These member-owned financial cooperatives often have a more community-focused approach to lending. If you're a long-standing member with an established relationship, even with less-than-perfect credit, they might be more flexible than a large bank. They often evaluate applications on a case-by-case basis, considering your overall financial picture and your relationship with them, rather than relying solely on automated credit scoring models. It's always worth exploring your local credit union options.

Peer-to-Peer Lending: Is It a Viable, Albeit Niche, Option for Private Sales?

Peer-to-peer (P2P) lending platforms connect individual borrowers with individual investors. While they can sometimes offer more flexible terms than traditional lenders, they are less common for secured auto loans, particularly for private sales where the vehicle itself acts as collateral. P2P platforms often focus on unsecured personal loans. The interest rates can vary wildly depending on the perceived risk, and the process might be less streamlined than with dedicated auto lenders. It's a niche option, and while worth exploring if other avenues are exhausted, it's generally not the first or most reliable choice for a private sale car loan with bad credit.

Pro Tip 2: Comparing Apples to Oranges – Don't Just Look at the Rate

When evaluating different lenders, it's easy to get fixated on the interest rate. However, you need to compare apples to oranges, not just the single number. Look at the total cost of the loan. This includes the interest rate, but also consider:

- Loan Terms: How long is the repayment period? A longer term might mean lower monthly payments but significantly more interest paid over time.

- Fees: Are there origination fees, administrative fees, or other hidden charges?

- Prepayment Penalties: Can you pay off the loan early without penalty? This is crucial if you plan to improve your credit and refinance later.

- Customer Service: How responsive and helpful is the lender?

A slightly higher interest rate from a transparent lender with fair terms might be better than a seemingly lower rate riddled with hidden fees and restrictive clauses.

The Pre-Approval Blueprint: Your Step-by-Step Guide to Securing Funds

Securing a private sale car loan with bad credit isn't about luck; it's about preparation. A meticulous approach to your finances and application can dramatically increase your chances of approval. This blueprint will guide you through each phase.

Phase 1: Getting Your Financial House in Order

Budgeting for Reality

Before you even look at cars, you need a realistic budget. This goes far beyond just the car payment. Factor in:

- Insurance: Often higher for newer cars or those financed, and potentially higher with bad credit. Get quotes!

- Maintenance: All cars need it. Factor in routine oil changes, tire rotations, and an emergency fund for unexpected repairs.

- Fuel: Estimate your weekly or monthly fuel costs based on your commute.

- Registration & Licensing: Annual provincial fees.

- Other Expenses: Parking, car washes, etc.

Lenders want to see that you've thought this through and can comfortably afford the total cost of car ownership, not just the loan payment.

Proving Income Stability

This is paramount for bad credit loans. Lenders need assurance that you have a consistent, verifiable source of income to make payments. Gather:

- Recent pay stubs (typically 2-3 months).

- Bank statements showing regular deposits (3-6 months).

- Employment verification letters.

If you're self-employed, proving income can be a bit different, but it's certainly not impossible. For those navigating this, our guide on Self-Employed? Your Bank Statement is Our 'Income Proof' offers valuable insights.

The Down Payment Power-Up

Even a small down payment can significantly de-risk the loan for the lender and improve your chances of approval. It shows commitment, reduces the loan amount, and can even help you secure a lower interest rate. A down payment tells the lender you have "skin in the game." If cash is tight, don't despair. There are options, and our article Your Down Payment Just Called In Sick. Get Your Car explores ways to navigate this challenge. Even 5-10% of the vehicle's value can make a noticeable difference.

Phase 2: Crafting Your Loan Application for Success

What Lenders *Really* Look For

Beyond your credit score, lenders assess several key factors:

- Employment History: A stable job history (e.g., 6+ months with the same employer) signals reliability.

- Residency Stability: A consistent address shows stability.

- Debt-to-Income Ratio (DTI): This compares your total monthly debt payments to your gross monthly income. Lenders prefer a DTI below 40-50%.

- References: Sometimes requested, especially by smaller lenders.

The Art of the Explanation

Don't hide from your past credit issues. Proactively address them in your application or when speaking with a loan officer. Explain *what* happened (e.g., job loss, medical emergency), *how* you've addressed it, and *what* you've learned. Demonstrate that you're in a better financial position now. This transparency can build trust.

Avoid Common Application Mistakes

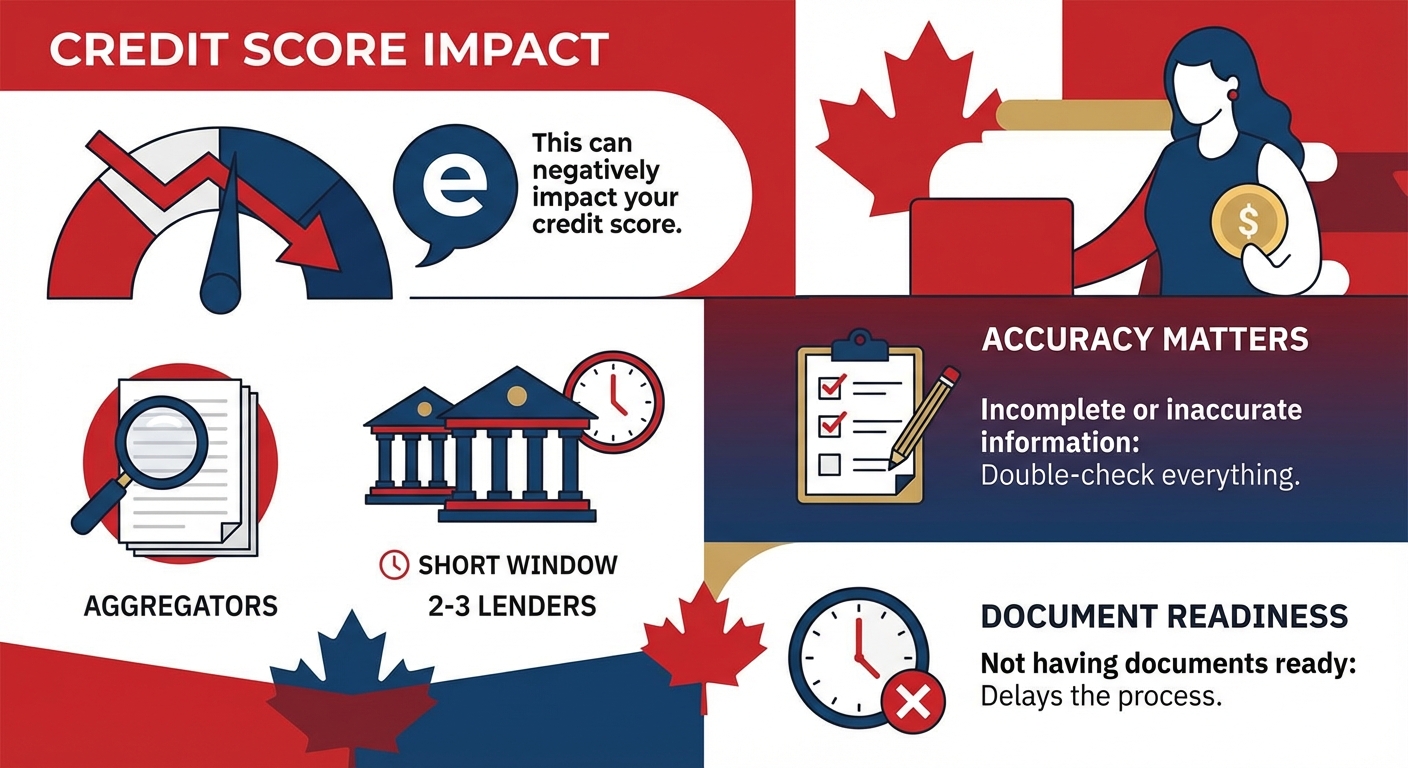

- Applying to too many lenders at once: This can negatively impact your credit score. Use aggregators or apply to 2-3 carefully chosen lenders within a short window.

- Incomplete or inaccurate information: Double-check everything.

- Not having documents ready: Delays the process.

Pro Tip 3: The Co-Signer Advantage – When a Helping Hand Isn't a Crutch

If your credit is severely challenged, a co-signer can be a game-changer. A co-signer, typically someone with good credit, agrees to be equally responsible for the loan if you default. This significantly lowers the risk for the lender, potentially leading to:

- Higher approval odds.

- Lower interest rates.

- Access to a larger loan amount.

However, understand the responsibilities involved. Your co-signer's credit will also be impacted by the loan, and they are legally obligated to pay if you cannot. Choose someone reliable, and ensure both parties fully understand the commitment. It's a helping hand, not a crutch, if used wisely and responsibly.

Decoding the Dollars: Interest Rates, Fees, and the True Cost of Your Loan

Understanding the financial intricacies of a bad credit auto loan is crucial. It's not just about the monthly payment; it's about the total financial commitment and ensuring transparency every step of the way.

The 'Bad Credit' Premium: Why Rates Are Higher and How to Understand Them

Let's be upfront: with bad credit, your interest rate will be higher than someone with excellent credit. This isn't punitive; it's the 'bad credit' premium, reflecting the increased risk the lender is taking. Lenders use interest rates to offset the higher probability of default associated with subprime borrowers. A realistic rate could range anywhere from 9% to 29% or even higher, depending on the severity of your credit issues, your income, the loan term, and the vehicle's age and value. Factors influencing your individual rate include:

- Your specific credit score and report details.

- Your debt-to-income ratio.

- The amount of your down payment.

- The vehicle's year, make, and model (as it affects collateral value).

- The loan term (shorter terms often have slightly lower rates).

Fixed vs. Variable: Which Is Right for Your Financial Situation?

When securing your loan, you'll typically be offered either a fixed or variable interest rate. Understanding the difference is key:

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Definition | The interest rate remains constant for the entire loan term. | The interest rate can fluctuate over the loan term, usually tied to a benchmark rate (e.g., Prime Rate). |

| Monthly Payments | Predictable and consistent. | Can change, potentially increasing or decreasing. |

| Risk for Borrower | Low risk of unexpected payment increases. | Higher risk; payments could increase if benchmark rates rise. |

| Suitability for Bad Credit | Generally recommended. Provides budget stability, which is crucial when rebuilding credit. | Generally not recommended. Adds unpredictability to an already challenging financial situation. |

For most individuals with bad credit, a fixed interest rate is the safer and more manageable option. It provides predictability, allowing you to budget effectively and focus on consistent, on-time payments, which is paramount for credit repair.

Hidden Fees and Charges: The Fine Print You *Must* Read

Never sign a loan agreement without thoroughly reading the fine print. Some lenders, particularly those in the subprime market, might include various fees that can significantly increase the total cost of your loan. Be vigilant and ask direct questions about:

- Origination Fees: A fee for processing the loan.

- Administrative Fees: Charges for setting up or managing the loan.

- Late Payment Penalties: What are the charges if a payment is missed or late?

- Prepayment Penalties: Are you penalized for paying off your loan early? This is critical if you plan to refinance in the future.

- NSF Fees: Charges for non-sufficient funds if a payment bounces.

Create a checklist of these questions and get clear answers in writing before committing to anything.

Amortization Explained: How Your Payments Really Break Down Over Time

Amortization is the process of paying off a debt over time in regular installments. For car loans, especially early in the term, a larger portion of your monthly payment goes towards interest, and a smaller portion reduces the principal balance. As the loan matures, this ratio shifts, with more of your payment going towards the principal. Understanding this is important because it means that if you can make extra payments, even small ones, early in the loan term, you can significantly reduce the total interest paid and shorten the life of the loan. This is a powerful strategy to save money, especially with higher interest rates common for bad credit loans.

Pro Tip 4: Negotiating Your Rate – Yes, Even with Bad Credit, It's Possible

Many borrowers with bad credit assume they have no power to negotiate. This isn't entirely true. While you might not achieve prime rates, you can still improve your offer. Here’s how:

- Compare Multiple Offers: This is your strongest leverage. If you have two pre-approvals, use one to try and get a better deal from the other.

- Highlight Your Strengths: Emphasize your stable employment, significant down payment, low debt-to-income ratio, or any positive credit activity since your last negative mark.

- Be Prepared to Walk Away: If a lender isn't willing to budge on egregious terms or rates, be prepared to explore other options.

Every percentage point you can shave off your interest rate will save you hundreds, if not thousands, of dollars over the life of the loan.

Finding Your Ride: Navigating the Private Sale Market with Pre-Approved Funds

Once you have your pre-approval in hand, the real fun begins: finding the right vehicle. But even with funds secured, a strategic approach is necessary to make the most of your private sale opportunity.

Setting Realistic Expectations: What Kind of Car Can You Afford?

With bad credit, your focus should be on reliability and affordability, not luxury. While a pre-approval gives you a budget, always aim for a vehicle that leaves some wiggle room in your monthly finances. Look for:

- Reliable Brands: Toyota, Honda, Mazda, Hyundai, Kia are often good choices for long-term dependability and lower maintenance costs.

- Age & Mileage: Lenders for bad credit loans often have limits on vehicle age (e.g., no older than 10-12 years) and mileage (e.g., under 180,000-200,000 kilometres) due to collateral value.

- Value Over Luxury: A well-maintained used sedan or hatchback will serve your needs far better than an older, high-end luxury car that could become a money pit.

Remember, this car is a tool to rebuild your credit and provide transportation, not necessarily a status symbol at this stage.

The Pre-Purchase Inspection: Non-Negotiable for Private Sales

This cannot be stressed enough: NEVER buy a private sale vehicle without a professional, independent pre-purchase inspection (PPI) by a trusted mechanic. Unlike dealerships, private sellers offer no warranties or guarantees. A PPI can uncover hidden mechanical issues, accident damage, or potential problems that could cost you thousands down the road. Arrange for the seller to take the car to a mechanic of your choosing, or meet at a shop. What to look for in a reputable mechanic:

- ASE certification (or equivalent Canadian provincial certification).

- Good online reviews and reputation.

- Experience with the specific make and model you're considering.

The small cost of a PPI is a tiny investment that can save you from buying a "lemon."

Title Transfer and Registration: Protecting Your Investment Legally

Once you've found the perfect car and the loan is finalized, you need to complete the legal transfer of ownership. This typically involves:

- Bill of Sale: A legal document detailing the transaction, signed by both buyer and seller. Include VIN, odometer reading, purchase price, and date.

- Vehicle History Report: Always get a CARFAX Canada or equivalent report. This reveals accident history, lien status, and odometer discrepancies. Your lender will likely require this.

- Lien Registration: Your lender will place a lien on the vehicle's title. This means they are the legal owner until the loan is fully repaid, protecting their collateral.

- Provincial Registration: You'll need to register the vehicle in your name with your provincial motor vehicle authority (e.g., Service Ontario, Service Alberta). This involves providing proof of ownership, insurance, and paying applicable taxes and fees.

Ensure all paperwork is accurately completed and submitted to protect your investment and comply with the law.

Pro Tip 5: Never Pay Cash Upfront – Protect Yourself from Scams

In private sales, be wary of sellers asking for large cash deposits upfront, especially before you've seen the car or completed a PPI. Always use secure payment methods coordinated with your lender. When you have a pre-approved loan, the lender typically handles the payment directly to the seller upon satisfactory completion of all paperwork and inspection. This protects you from scams and ensures the transaction is legitimate. Your lender acts as a crucial safeguard in the private sale process.

Beyond the Purchase: Building a Stronger Financial Future

Getting your private sale car loan with bad credit is a significant achievement, but the journey doesn't end there. This loan is a powerful tool, not just for transportation, but for rehabilitating your financial health and building a stronger future.

Making Payments On Time: The Most Critical Step to Credit Repair

This is the golden rule. Consistent, on-time payments are the single most effective way to improve your credit score. Every single payment reported positively to the credit bureaus demonstrates your reliability and ability to manage debt. Set up automated payments to ensure you never miss a due date. This consistent positive activity will gradually, but significantly, outweigh past negative marks, paving the way for better financial opportunities in the future.

Understanding Refinancing Opportunities: When and How to Lower Your Rate Later

Once you've made 6-12 months of consistent, on-time payments, and your credit score has started to improve, you might qualify for refinancing at a lower interest rate. Refinancing involves taking out a new loan to pay off your existing one, ideally with better terms. This can save you a substantial amount of money over the life of the loan. The process typically involves:

- Checking your updated credit score.

- Shopping around for new lenders (including traditional banks or credit unions, which might now be more accessible).

- Submitting a new application, highlighting your excellent payment history on your current auto loan.

This is a strategic move to leverage your improved credit for even greater savings.

Protecting Your Asset: Insurance, Maintenance, and Avoiding Costly Breakdowns

Your vehicle is a significant investment and, with a lienholder, it's also collateral for your loan. Protecting it is paramount:

- Adequate Car Insurance: Your lender will require comprehensive and collision coverage to protect their investment. Always maintain sufficient insurance.

- Regular Maintenance: Stick to the manufacturer's recommended maintenance schedule. Regular oil changes, tire rotations, and fluid checks prevent minor issues from becoming costly major breakdowns.

- Emergency Fund: Set aside a small emergency fund specifically for unexpected car repairs. This prevents you from falling behind on payments or incurring new debt if a repair is needed.

Proactive care of your vehicle protects both your transportation and your financial stability