Your Ex's Score? Calgary Says 'New Car, Who Dis?

Table of Contents

- Key Takeaways: Navigating Calgary's Auto Loan Landscape After an Ex's Financial Impact

- The Aftermath: When 'We' Becomes 'Me' and My Credit Takes a Hit in Calgary

- Disentangling Your Financial Past: How an Ex's Actions Impact Your Credit Score in Alberta

- Joint Accounts & Co-signing

- Authorized Users

- Missed Payments & Collections

- Voluntary Debt Forgiveness & Bankruptcy

- The Credit Bureaus' Perspective

- Calgary's Credit Conundrum: Understanding Your Score and Why It Matters for a Car Loan

- What is a Credit Score (and Report) in Canada?

- The 'Damaged' Credit Spectrum

- Why Lenders Care

- Your Right to Know

- The Road Ahead: Can Calgary Lenders See Past Your Ex's Shadow?

- The Collateral Advantage

- Your Current Financial Stability

- Navigating Calgary's Auto Financing Landscape with Damaged Credit

- Subprime Lenders: Your First Port of Call?

- Dealership Financing: Your Calgary Car Lot as a Partner

- Credit Unions in Alberta: A Community-Focused Approach

- Online Lenders & Brokers

- Crafting Your Comeback Case: What Calgary Lenders Really Want to See

- Proof of Income Stability

- The Power of a Down Payment

- Understanding Your Debt-to-Income (DTI) Ratio

- The 'Story' Behind the Credit Damage

- The Numbers Game: Demystifying Interest Rates and Hidden Costs in Alberta

- Understanding Annual Percentage Rate (APR)

- What to Expect with Challenged Credit

- Fees to Watch Out For

- The True Cost of the Loan

- Choosing Your Ride: What Kind of Car Loan Makes Sense for Credit Rebuilding in Calgary?

- New vs. Used Vehicles for Rebuilding Credit

- Affordability vs. Desire

- The Vehicle as Collateral Revisited

- Beyond the Loan: Smart Strategies for Rebuilding Your Credit Post-Ex in Calgary

- Making Payments On Time, Every Time

- Automated Payments

- Keeping Credit Utilization Low

- Diversifying Your Credit Mix (Carefully)

- Regularly Checking Your Credit Report

- Local Legends: Calgary Resources and Consumer Protections

- Consumer Credit Counselling Services in Calgary

- Alberta's Consumer Protection Laws

- Reporting Unfair Practices

- Legal Aid if Fraud is Suspected

- Your Next Steps to Approval: A Calgary-Specific Action Plan

- Frequently Asked Questions (FAQ): Your Calgary Car Loan Queries Answered

Key Takeaways: Navigating Calgary's Auto Loan Landscape After an Ex's Financial Impact

- Hope is Real: Despite an ex's credit damage, securing a car loan in Calgary is entirely possible with the right strategy.

- Documentation is King: Gather all relevant financial records and be prepared to explain your situation clearly, focusing on your current stability.

- Calgary's Options: Explore a range of lenders, from specialized subprime auto financiers to local credit unions, all familiar with diverse credit situations.

- Beyond Approval: A car loan isn't just transport; it's a powerful tool for actively rebuilding your credit score in Alberta.

- Local Resources: Calgary offers specific consumer protection and credit counseling services to guide you through the process.

The Aftermath: When 'We' Becomes 'Me' and My Credit Takes a Hit in Calgary

Breakups are rarely easy, and the emotional toll can be profound. Yet, for countless individuals across Calgary and indeed, all of Alberta, the sting of a dissolved relationship is often compounded by a deeply unwelcome financial fallout. Imagine waking up one morning, ready to move forward, only to discover that your ex's financial missteps have left your credit score in tatters. It's a frustrating, disheartening reality that many Canadians face.

Suddenly, the dreams of independence, of a fresh start, feel overshadowed by the practical weight of a damaged financial history. You need a car for work, for errands, for reclaiming your freedom on Calgary's sprawling roads, but the thought of applying for a loan feels like an insurmountable hurdle. Will lenders even look at you? Can you truly disentangle your financial future from someone else's past actions?

At SkipCarDealer.com, we understand the emotional and practical gravity of this situation. We know that a car loan isn't just about getting from point A to point B; it's about regaining your independence, rebuilding your financial control, and driving confidently into a new chapter. This article is your comprehensive guide to navigating Calgary's auto loan landscape, proving that an ex's shadow doesn't have to define your financial destiny.

Disentangling Your Financial Past: How an Ex's Actions Impact Your Credit Score in Alberta

Understanding how your ex's financial behaviour can directly affect your credit score is the first crucial step towards repairing it. Many Canadians are surprised to learn the extent to which their financial lives can intertwine, even after a relationship ends. It's not always about direct fraud; often, it's the lingering effects of shared financial products that cause the most damage.

Joint Accounts & Co-signing

Perhaps the most straightforward way an ex can impact your credit is through joint accounts or co-signed debts. If you shared a credit card, a line of credit, a previous car loan, or even a mortgage with your ex, any missed payments, late fees, or defaults on those accounts will appear on both your credit reports. Even if your ex was solely responsible for making payments, your name on the account means you're equally liable in the eyes of the credit bureaus. This shared liability doesn't magically disappear with a breakup; it requires active disentanglement.

Authorized Users

An often-overlooked pitfall is being an authorized user on an ex's credit card. While this typically means you're not legally responsible for the debt, the payment history of that card *can* still appear on your credit report. If your ex was consistently late with payments or maxed out the card, those negative marks could be silently dragging down your score. The good news is that as an authorized user, you can usually request to be removed from the account, and in many cases, the associated history will eventually fall off your report, though it might take some time.

Missed Payments & Collections

Beyond joint accounts, an ex's financial negligence can have ripple effects. If they were supposed to pay a bill that was in your name (utility bills, phone contracts, internet services) and they failed to do so, those missed payments can lead to collections agencies contacting you and negative marks appearing on your credit report. These are particularly damaging as they indicate a failure to meet financial obligations.

Voluntary Debt Forgiveness & Bankruptcy

More severe financial events, such as a consumer proposal or bankruptcy filed by your ex, can have an even more profound impact if you had any shared obligations. For instance, if you co-signed a loan and your ex included it in their bankruptcy, that loan could still be legally collectible from you, and its negative status would certainly be reflected on your credit report. Even if the debt is entirely theirs, the associated fallout can make lenders wary of individuals linked to such events, especially if there's any ambiguity in your credit file.

The Credit Bureaus' Perspective

In Canada, credit bureaus like Equifax and TransUnion are the gatekeepers of your financial reputation. They meticulously record all your credit-related activities, including joint accounts, co-signed loans, and authorized user statuses. Their systems are designed to report factual financial history. While they don't assign blame for a breakup, they simply report the facts of what was on your credit file. Understanding this mechanical process is key to realizing that while the past can't be erased, it can certainly be outmanoeuvred.

Calgary's Credit Conundrum: Understanding Your Score and Why It Matters for a Car Loan

Before you even think about stepping onto a car lot in Calgary, it's essential to grasp the fundamentals of your credit score and report. This knowledge isn't just power; it's your roadmap to securing the best possible car loan, even with past financial turbulence.

What is a Credit Score (and Report) in Canada?

Your credit score is a three-digit number, typically ranging from 300 to 900, that represents your creditworthiness. It's a snapshot of your financial reliability. The two main models used in Canada are FICO and VantageScore. A higher score indicates less risk to lenders. Your credit report, on the other hand, is a detailed historical record of your borrowing and repayment behaviour over the past several years. It lists all your credit accounts, payment history, inquiries, and any public records like bankruptcies or consumer proposals. This report is what lenders truly dive into, with the score acting as a quick summary.

The 'Damaged' Credit Spectrum

When we talk about 'bad credit' or 'subprime' in the context of auto financing in Alberta, we're generally referring to credit scores below the prime lending threshold, which is typically around 660-680. Scores ranging from, say, 500-650 would be considered subprime, while anything below 500 might be classified as deep subprime or very poor credit. It's a spectrum, not a binary, and lenders have different appetites for risk within these ranges.

Why Lenders Care

From the perspective of Calgary-based financial institutions, your credit score and report are their primary tools for assessing risk. They want to know the likelihood of you repaying your loan on time. A low credit score, especially one marred by missed payments or defaults, signals a higher risk. This doesn't mean you're unlendable; it simply means lenders will likely offer different terms, such as higher interest rates or require a larger down payment, to offset that perceived risk. They're looking for evidence of stability and a willingness to honour financial commitments.

Your Right to Know

Your crucial first step in this journey is to access and review your free credit report from both Equifax Canada and TransUnion Canada. By law, you are entitled to a free copy of your credit report each year. You can request it by mail, online, or by phone. Scrutinize every detail. Look for accounts you don't recognize, incorrect payment histories, or any lingering debts that should have been resolved. Disputing errors promptly is vital, as even small inaccuracies can negatively affect your score and your chances of approval. This proactive approach shows lenders you are engaged and responsible.

The Road Ahead: Can Calgary Lenders See Past Your Ex's Shadow?

Let's cut right to the chase, because this is likely the question weighing most heavily on your mind: Yes, absolutely. You can get a car loan if your ex ruined your credit in Calgary. While your past credit history is a significant factor, it is by no means the only one, nor is it an insurmountable barrier.

The Collateral Advantage

One of the primary reasons car loans are often more accessible for individuals with challenged credit than other loan types (like unsecured personal loans) is the nature of the loan itself: it's secured by the vehicle. The car acts as collateral. This means that if you default on the loan, the lender has the legal right to repossess the vehicle to recoup their losses. This significantly reduces the lender's risk, making them more willing to approve loans for borrowers who might not qualify for other forms of credit.

Your Current Financial Stability

While your credit report tells a story of your past, lenders in Calgary and across Alberta are also keenly interested in your present. They want to see evidence of your current financial stability. This includes your income, your employment history, and your residency. Are you employed full-time? Have you been in your job for a while? Do you have a stable address in Calgary? These factors demonstrate your current ability to make consistent payments, shifting the focus from past shared issues to your individual capacity today.

Navigating Calgary's Auto Financing Landscape with Damaged Credit

Calgary's auto financing market is diverse, offering various avenues for individuals with damaged credit. Knowing where to look and what to expect from each type of lender can significantly streamline your car-buying process.

Subprime Lenders: Your First Port of Call?

These are specialized financial institutions that cater specifically to non-prime borrowers, meaning those with lower credit scores. Many reputable subprime lenders operate throughout Alberta, including those partnered with SkipCarDealer.com.

- Who they are: Think of lenders that have built their business around understanding and mitigating the risks associated with challenged credit. They look beyond just the score.

- Pros: Higher approval rates are their hallmark. They focus heavily on your current ability to pay, your employment stability, and your residency in Calgary, often placing less emphasis on past credit blemishes. They are also instrumental in understanding credit rebuilding.

- Cons: Be prepared for potentially higher interest rates and stricter loan terms compared to prime loans. This is how they offset the increased risk they're taking. However, these rates are often a necessary stepping stone to rebuilding your credit.

Dealership Financing: Your Calgary Car Lot as a Partner

Many Calgary dealerships are not just about selling cars; they're also financial hubs that can connect you with a wide array of lending options.

- The 'Special Finance' Department: A growing number of dealerships, including those we partner with, have dedicated 'Special Finance' or 'Credit Rebuilding' teams. These specialists are trained to help customers with challenged credit navigate the application process.

- Their network: Dealerships often work with multiple lenders – both prime banks and specialized subprime financiers. This means they can shop your application around to various institutions, increasing your chances of finding a suitable option without you having to apply everywhere individually.

- Convenience: The process is streamlined. You can select your vehicle and apply for financing all in one place, making the car-buying experience much smoother.

Credit Unions in Alberta: A Community-Focused Approach

Local credit unions in Calgary and other Alberta communities can sometimes offer a more personalized approach to lending.

- Member-owned advantage: As member-owned institutions, credit unions often have more flexibility and are willing to look beyond just a credit score. They'll consider your entire financial picture, your history with them, and your relationship as a member.

- Building relationships: Establishing a banking relationship with a local credit union can provide long-term benefits, potentially leading to better loan terms down the line as you demonstrate responsible financial behaviour.

Online Lenders & Brokers

The digital age has brought a new wave of convenience to auto financing. Online lenders and brokers can connect you with various loan options across Alberta, often with quick pre-approval processes.

- Accessibility: You can apply from the comfort of your Calgary home, comparing different offers.

- Variety: Many online platforms work with a network of lenders, similar to dealerships, to find you the best possible rates for your situation.

Here's a quick comparison of lender types for challenged credit:

| Lender Type | Pros for Challenged Credit | Cons for Challenged Credit | Key Focus |

|---|---|---|---|

| Subprime Lenders | High approval rates, understanding of credit rebuilding, focus on current income. | Higher interest rates, potentially stricter terms. | Current income & stability. |

| Dealership Financing | Access to multiple lenders (prime & subprime), streamlined process, specialized finance teams. | Rates can vary, may push specific vehicles. | Vehicle sale & financing options. |

| Credit Unions | Personalized approach, may consider full financial picture, member benefits. | May require membership, potentially less experience with deep subprime. | Member relationship & overall financial health. |

| Online Lenders/Brokers | Convenience, quick pre-approvals, access to wide network. | Less personal interaction, need to verify legitimacy. | Speed & broad lender matching. |

Crafting Your Comeback Case: What Calgary Lenders Really Want to See

Securing a car loan when your credit has been impacted by an ex isn't just about finding the right lender; it's about presenting your financial story in the most compelling light. Think of it as building a strong case for your current reliability and future commitment.

Proof of Income Stability

This is paramount. Lenders want reassurance that you have the consistent financial capacity to make your monthly car payments.

- Recent pay stubs: Typically, the last 2-3 months of pay stubs demonstrating consistent employment and income from your job in Calgary are essential.

- Employment letters: A formal letter from your employer confirming your position, start date, and salary can be very helpful, especially if you're new to your current role.

- Tax returns (T4s): For a broader historical view, your most recent T4s can confirm your annual income.

- Understanding different income sources: Don't despair if your income isn't from a traditional salaried job. Lenders are increasingly flexible. If you're self-employed, for example, your bank statements can often serve as proof of income, demonstrating consistent deposits over several months. For more on this, check out our guide on Self-Employed? Your Bank Account *Is* Your Proof. Get Approved. Similarly, if you receive government benefits like AISH or EI, many lenders specialize in financing for these income types.

The Power of a Down Payment

While not always mandatory, a significant down payment is one of the most effective tools you have for improving your loan terms and increasing your approval chances.

- Why it reduces risk: A down payment demonstrates your commitment to the loan and immediately reduces the amount the lender is risking. It also means you'll be borrowing less, which translates to lower monthly payments and less interest paid over the life of the loan.

- Strategies for saving: Even a modest down payment can make a difference. Consider setting aside a portion of each paycheque, selling unneeded items, or temporarily cutting back on non-essentials to save up.

Understanding Your Debt-to-Income (DTI) Ratio

Your DTI ratio is a critical metric for lenders. It's the percentage of your gross monthly income that goes towards paying your monthly debt obligations.

- Explaining DTI: If your monthly income is $4,000 and your total monthly debt payments (credit cards, existing loans, rent/mortgage) are $1,600, your DTI is 40% ($1,600 / $4,000). Lenders typically prefer DTI ratios below 40-45%, though subprime lenders can be more flexible.

- Tips for improving DTI: Before applying, consider paying down any small, manageable debts. Even clearing a small credit card balance can marginally improve your DTI and show lenders you're actively managing your finances.

The 'Story' Behind the Credit Damage

Lenders are human, and they understand that life happens. They want to hear your story, but they want it presented clearly, concisely, and with a focus on your current situation.

- Honesty and clarity: Be prepared to articulate how the credit damage occurred, taking responsibility where appropriate, but also clearly outlining your ex's role and the steps you've taken to separate your finances.

- Focus on proactive steps: Emphasize what you've done since the breakup to improve your financial standing. Have you closed joint accounts? Disputed errors? Started a savings plan? This demonstrates initiative and commitment.

The Numbers Game: Demystifying Interest Rates and Hidden Costs in Alberta

When you're securing a car loan in Calgary, especially with challenged credit, understanding the true cost of borrowing is paramount. It's not just about the monthly payment; it's about the total interest paid and any additional fees that can inflate the overall price.

Understanding Annual Percentage Rate (APR)

Beyond the simple interest rate, the Annual Percentage Rate (APR) is what truly represents the total cost of borrowing. APR includes not only the interest rate but also any additional fees or charges associated with the loan, expressed as a yearly percentage. It's the most accurate figure to use when comparing loan offers, as it gives you a holistic view of what you'll actually pay over the life of the loan. Always ask for the APR, not just the interest rate.

What to Expect with Challenged Credit

It's important to set realistic expectations for interest rates when rebuilding credit. Prime borrowers might see rates as low as 0-5%, but with damaged credit, you should expect higher rates. These could range from 9% to 29.99% or even higher, depending on the severity of your credit damage, your income stability, the loan term, and the down payment you provide. While these rates are higher, remember that successfully managing this loan will actively contribute to improving your credit score, potentially allowing you to refinance at a lower rate in the future. For more on this, check out our guide on Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit.

Fees to Watch Out For

Loan agreements can sometimes come with various fees that add to the total cost. Be diligent in identifying and questioning them:

- Administration fees: Charged for processing the loan.

- Documentation fees: For preparing the paperwork.

- Lien registration fees: The cost to register the lender's interest in the vehicle with the provincial government (Service Alberta).

- Loan origination fees: A fee for setting up the loan.

Always insist on a clear breakdown of all costs and understand what each fee represents. Don't be afraid to negotiate or question charges that seem excessive. Reading the fine print of any loan agreement in Alberta is not just recommended; it's crucial for your financial protection.

The True Cost of the Loan

To truly understand the impact on your budget, calculate the total interest paid over the life of the loan. A higher interest rate over a longer term can add thousands of dollars to the purchase price of the vehicle. Use online loan calculators to input different interest rates and terms to see how they affect your total cost and monthly payments. This exercise will help you make an informed decision that aligns with your financial goals.

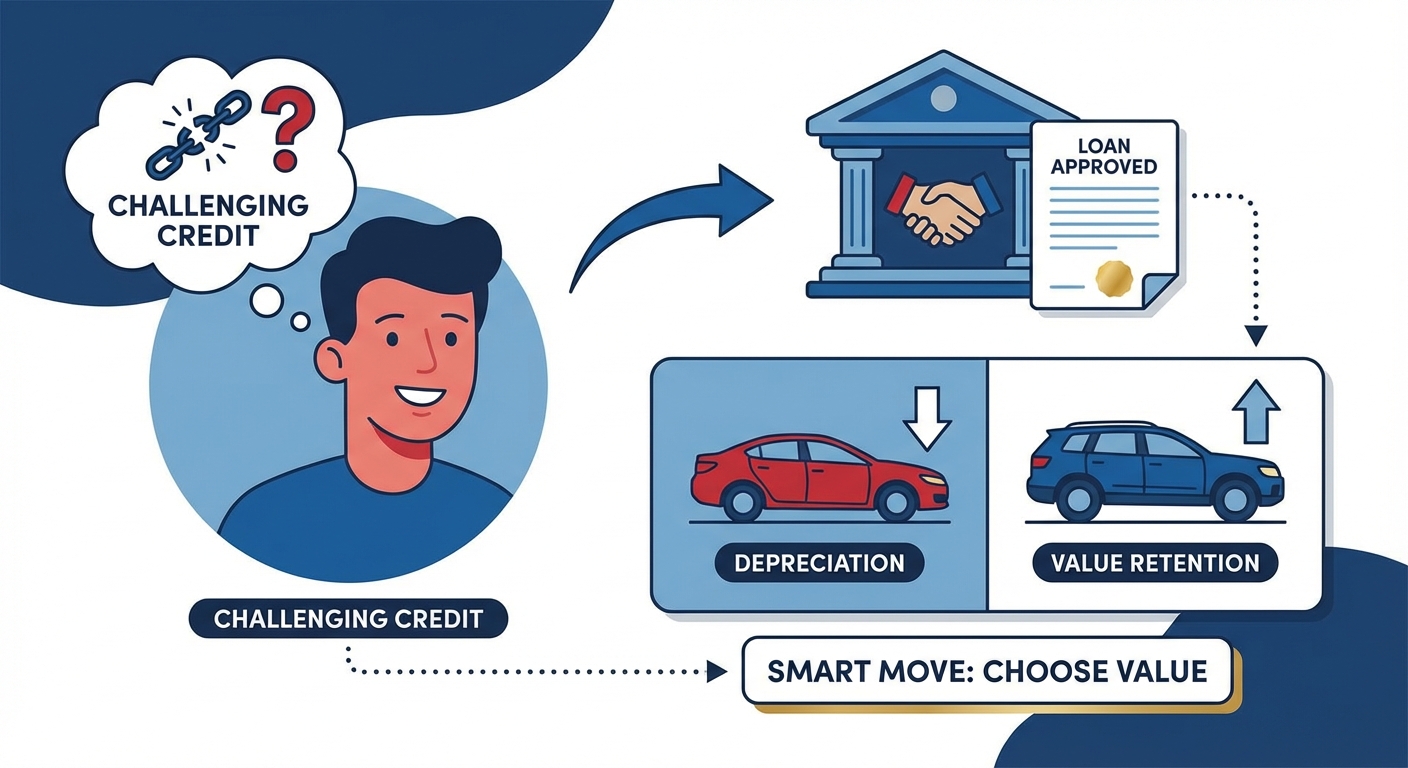

Choosing Your Ride: What Kind of Car Loan Makes Sense for Credit Rebuilding in Calgary?

Once you've navigated the complexities of credit and financing, the exciting part begins: choosing your vehicle. However, when your primary goal is credit rebuilding, this decision needs to be strategic, balancing desire with practicality.

New vs. Used Vehicles for Rebuilding Credit

For individuals with damaged credit, a reliable used vehicle is almost always the smarter choice.

- Lower purchase price: Used cars are significantly less expensive than new ones, directly translating to a lower loan amount.

- Lower loan amount: A smaller loan means more manageable monthly payments, which is crucial for ensuring you can make payments on time and consistently. This consistency is the backbone of credit rebuilding.

- Reduced depreciation: New cars lose a substantial portion of their value the moment they're driven off the lot. Used cars have already experienced this initial depreciation, meaning your investment holds its value better.

While the allure of a brand-new car can be strong, prioritizing a reliable, affordable used vehicle is a responsible step towards long-term financial health and credit score improvement.

Affordability vs. Desire

It's easy to get carried away by shiny vehicles, but it's essential to balance your desire for a particular car with what you can genuinely afford. Consider not just the monthly loan payment, but also insurance costs (which can be higher with challenged credit), fuel, maintenance, and registration fees in Alberta. Your chosen vehicle should comfortably fit within your budget, leaving room for other expenses and savings. Remember, this car isn't just transportation; it's a tool for financial recovery.

The Vehicle as Collateral Revisited

Remember that the car itself serves as collateral for your loan. Lenders will assess the vehicle's value to ensure it's sufficient to secure the loan amount. This protection for the lender is precisely what makes the loan possible for you, even with a challenging credit history. Choosing a car that holds its value reasonably well can also be a smart move, ensuring that you don't end up owing more than the car is worth (negative equity) too quickly.

Context: A clear, well-lit image of a person (diverse representation) thoughtfully reviewing loan documents or a credit report, perhaps with a backdrop hinting at Calgary. This represents the careful consideration and planning involved.

Context: A clear, well-lit image of a person (diverse representation) thoughtfully reviewing loan documents or a credit report, perhaps with a backdrop hinting at Calgary. This represents the careful consideration and planning involved.

Beyond the Loan: Smart Strategies for Rebuilding Your Credit Post-Ex in Calgary

Getting approved for a car loan is a huge victory, but it's also just the beginning of your credit rebuilding journey. Your new car loan is a powerful tool; wield it wisely to actively repair and strengthen your financial reputation in Calgary.

Making Payments On Time, Every Time

This is, without a doubt, the single most important action you can take to improve your credit score. Payment history accounts for approximately 35% of your FICO score. Every on-time payment you make on your car loan will be reported to Equifax and TransUnion, slowly but surely replacing the negative marks associated with your ex's past actions with positive ones. Consistency is key here; even one late payment can set back your progress.

Automated Payments

To ensure you never miss a payment, set up automatic withdrawals from your bank account. This takes the human error factor out of the equation and guarantees your payments are made punctually each month. It’s a simple, effective strategy to build a flawless payment history.

Keeping Credit Utilization Low

While your car loan is an installment loan, it's still crucial to manage any revolving credit you might have (like credit cards). Credit utilization – the amount of credit you're using compared to your total available credit – accounts for about 30% of your credit score. Aim to keep your credit card balances below 30% of your limit, ideally even lower. If you have a credit card that was affected by your ex, focus on paying it down to demonstrate responsible usage.

Diversifying Your Credit Mix (Carefully)

Once your car loan is established and you've made several months of on-time payments, consider carefully diversifying your credit mix. Having a healthy mix of different credit types (e.g., installment loan like a car loan, and revolving credit like a credit card) can positively impact your score. You might explore a secured credit card or a small personal loan, but only if you can comfortably afford the payments and avoid accumulating more debt.

Regularly Checking Your Credit Report

Continue to monitor your credit report from Equifax and TransUnion regularly (at least once a year, but more frequently if you're actively rebuilding). This allows you to track your progress, identify any new errors, and ensure that your ex's past actions don't resurface or that new issues haven't appeared. Catching and disputing inaccuracies promptly is critical to protecting your improving score.

Local Legends: Calgary Resources and Consumer Protections

Navigating financial challenges can feel isolating, but in Calgary and Alberta, you're not alone. There are numerous resources and consumer protections designed to guide and safeguard you through your credit rebuilding journey.

Consumer Credit Counselling Services in Calgary

Organizations such as the Credit Counselling Society and Money Mentors offer invaluable services. They provide free or low-cost advice on debt management, budgeting, and financial planning. Their certified credit counsellors can help you understand your credit report, create a realistic budget, and develop a strategy to pay down debt and rebuild your credit. They are impartial experts who can offer tailored guidance for your specific situation.

Alberta's Consumer Protection Laws

As a borrower in Alberta, you have rights. Service Alberta oversees consumer protection and ensures fair practices in the marketplace. Familiarize yourself with the provincial laws that govern auto sales and lending, such as the Fair Trading Act. These laws protect you from deceptive practices, ensure transparency in contracts, and outline your rights regarding warranties and complaints.

Reporting Unfair Practices

If you encounter deceptive or predatory lending practices from a dealership or lender in Calgary or anywhere in Alberta, do not hesitate to report it. You can contact Service Alberta's Consumer Contact Centre. They investigate complaints and can take action against businesses that violate consumer protection laws. Your vigilance helps protect not only yourself but also other consumers in the province.

Legal Aid if Fraud is Suspected

In more severe cases, if you believe your ex committed financial fraud that directly impacted your credit, legal aid resources might be available. While beyond the scope of a typical car loan application, it's important to know that pathways exist for individuals in Calgary who need legal assistance to rectify such serious financial grievances.

Your Next Steps to Approval: A Calgary-Specific Action Plan

You're equipped with knowledge, understanding, and a renewed sense of purpose. Here’s a clear, actionable plan to get you driving in Calgary, with your credit rebuilding firmly on track:

- Step 1: Get Your Credit Report (and Dispute Errors): This is non-negotiable. Request your free credit reports from Equifax Canada and TransUnion Canada. Scrutinize every detail. If you find errors, dispute them immediately. This foundational step ensures you're working with accurate information.

- Step 2: Assess Your Budget & Affordability: Be realistic. What can you *truly* afford for a car payment, including insurance, fuel, and maintenance, within your current Calgary budget? Don't overextend yourself. A sustainable payment is a credit-building payment.

- Step 3: Gather Your Documentation: Prepare a folder with all necessary paperwork: recent pay stubs, employment letters, tax returns (T4s), proof of residency (utility bills), and any legal documents (separation agreements, divorce papers) that clarify your financial separation from your ex. The more prepared you are, the smoother the process.

- Step 4: Explore Calgary Lenders: Start your search. Consider visiting dealerships with specialized finance departments. Explore local credit unions, especially if you're already a member or plan to become one. Finally, look into reputable specialized subprime lenders. Remember, SkipCarDealer.com specializes in connecting you with lenders who understand your situation.

- Step 5: Compare Offers Carefully: Don't jump at the first approval. Apply with a few lenders within a short timeframe and compare the Annual Percentage Rate (APR), total cost of the loan, and all terms and conditions, not just the monthly payment. Understand every fee.

- Step 6: Drive Away with Confidence: Once approved, sign your loan agreement, and drive away not just with a new set of wheels, but with a renewed sense of financial self-reliance and a concrete plan for rebuilding your credit. Make every payment on time.

Context: A vibrant, aspirational image of someone (diverse representation) confidently driving a car through a scenic part of Calgary (e.g., with mountains in the background), symbolizing freedom, independence, and a fresh start.

Context: A vibrant, aspirational image of someone (diverse representation) confidently driving a car through a scenic part of Calgary (e.g., with mountains in the background), symbolizing freedom, independence, and a fresh start.