Toronto: Your Rejection Letter? It's Your New Down Payment.

Table of Contents

- Toronto: Your Rejection Letter? It's Your New Down Payment.

- The Rejection Rollercoaster: Turning 'No' into 'Next Step' in the Heart of Ontario

- Key Takeaways: Your Fast Track to Understanding Multiple Car Loan Rejections

- Beyond the Obvious: Why Canada (and Toronto) Kept Saying 'No' – Unpacking Your Multiple Denials

- The Hard Inquiry Avalanche: Why Too Many Applications Hurt More Than You Think

- The Debt-to-Income Ratio Trap: Are You Overleveraged Before You Even Start?

- Employment Instability and Income Verification Hurdles: The Lender's Need for Predictability

- The 'Phantom' Problem: Unseen Errors and Identity Issues on Your Credit Report

- Unmasking Your Credit Score: It's Not Just a Number, It's Your Financial Narrative

- Equifax vs. TransUnion: Decoding Canada's Credit Bureau Giants

- The Anatomy of a Credit Report: What Lenders Actually See (and Care About)

- Dispute and Conquer: Rectifying Errors That Are Holding You Back

- The Strategic Retreat: Pausing Applications and Rebuilding Your Financial Foundation

- Credit Building 101: From Secured Cards to Credit Builder Loans in Canada

- Taming Your Debt-to-Income: Strategies for Reducing Existing Liabilities

- Saving for Success: Why a Down Payment is Your Golden Ticket (Even a Small One)

- Beyond the Big Banks: Navigating the Landscape of Alternative Lenders in Canada

- Subprime Lenders and Dealership Financing: Your Path to Approval

- Credit Unions and Community Lenders: The Local Advantage

- The Online Marketplace: Convenience vs. Due Diligence

- The Co-Signer Advantage: Sharing the Risk, Doubling Your Chances (And the Responsibilities)

- Who Qualifies as a Co-Signer? The Ideal Candidate Profile

- The Shared Burden: Understanding Co-Signer Responsibilities and Risks

- Making the Ask: Approaching a Potential Co-Signer with Transparency

- Vehicle Choice: Your Ride, Your Approval Odds – Thinking Smart in the Canadian Market

- The Sweet Spot: Used Cars that Lenders Love (for Bad Credit Applicants)

- Beyond the Sticker Price: Understanding Total Cost of Ownership and Loan Risk

- The 'Lemon' Trap: Avoiding High-Risk Vehicles with Multiple Rejections

- Decoding the Fine Print: Interest Rates, Loan Terms, and Hidden Fees

- APR vs. Interest Rate: The True Cost of Borrowing After Rejections

- The Longer the Term, the Higher the Cost: Navigating Amortization

- Spotting Predatory Practices: Fees, Clauses, and Red Flags to Avoid

- Your Approval Blueprint: A Step-by-Step Guide to Your Next (Successful) Application

- Step 1: The Credit 'Health Check' and Report Clean-Up

- Step 2: Financial Preparedness – Down Payment and Debt Reduction

- Step 3: Strategic Lender Selection – Target the Right Fit

- Step 4: Document Arsenal – Gather Everything Before You Apply

- Step 5: The Informed Application – Ask Questions, Understand Terms

- Your Next Steps to Approval: From Rejection to Road Trip in Canada

- FAQ: Your Most Pressing Questions Answered About Car Loan Rejections

Toronto: Your Rejection Letter? It's Your New Down Payment.

The Rejection Rollercoaster: Turning 'No' into 'Next Step' in the Heart of Ontario

You’ve hit 'submit' one too many times, and the only thing you're collecting is rejection letters. In a vibrant, competitive market like Toronto, securing a car loan can feel like an impossible feat, especially after multiple denials. It's frustrating, disheartening, and often leaves you wondering, "What am I doing wrong?" This isn't just about getting a car; it's about regaining control, understanding the rules of the game, and strategically planning your next move. Every "no" isn't a dead end; it's a piece of feedback, a prompt to adjust your approach. This deep dive isn't a pity party; it's your strategic playbook to transform those rejections into the building blocks of your next approval, focusing on real-world solutions for Canadians facing this frustrating challenge. We'll explore why lenders in Ontario and across the country might be hesitant, and more importantly, how you can change their minds. Get ready to turn those setbacks into a powerful down payment on your future car.

Key Takeaways: Your Fast Track to Understanding Multiple Car Loan Rejections

- Stop applying immediately after multiple rejections. Each application can hurt your credit score further.

- Your credit report is your primary diagnostic tool. It reveals the 'why' behind the denials.

- Small down payments significantly improve your odds. Even a modest contribution shows commitment and reduces lender risk.

- Alternative lenders and co-signers are powerful allies. Don't limit yourself to traditional banks.

- Vehicle choice directly impacts approval likelihood. Opt for affordability and reliability initially.

- Patience and strategic planning are your most valuable assets. A thoughtful approach beats desperate, repeated attempts.

Beyond the Obvious: Why Canada (and Toronto) Kept Saying 'No' – Unpacking Your Multiple Denials

It's easy to assume a bad credit score is the sole culprit behind car loan rejections, but after multiple denials, it's often a sign of a deeper, more complex issue or a pattern that makes lenders wary. In the bustling financial landscape of Canada, from the high-rises of Toronto to the sprawling suburbs of Calgary, lenders assess risk with a meticulous eye. Understanding these less obvious reasons is crucial for crafting a successful strategy. Let's move beyond generic explanations to pinpoint what's truly holding you back in the Canadian lending landscape, giving you the clarity needed to fix it.

The Hard Inquiry Avalanche: Why Too Many Applications Hurt More Than You Think

Every time you apply for credit – whether it’s a car loan, a credit card, or a mortgage – a 'hard inquiry' is recorded on your credit report. This inquiry signals to other potential lenders that you're seeking new credit. While a single inquiry has minimal impact, a flurry of them in a short period can be a significant red flag. Why? Because it can suggest financial desperation or that you're trying to take on more debt than you can realistically handle. Lenders view this 'hard inquiry avalanche' as an increased risk, making them hesitant to approve your application. A strategic pause is vital here. Give your credit profile time to recover and those inquiries to age, reducing their negative impact. This period isn't passive; it's an active step towards improving your overall credit health.

The Debt-to-Income Ratio Trap: Are You Overleveraged Before You Even Start?

Lenders aren't just looking at your ability to repay a new car loan; they're looking at your ability to repay all your debts. Your debt-to-income (DTI) ratio is a critical metric that often goes unnoticed until those rejection letters start piling up. It's calculated by dividing your total monthly debt payments by your gross monthly income. For instance, if you live in a high-cost-of-living city like Vancouver or Montreal, where rent and other expenses are substantial, your existing debt burden might already push your DTI into an unfavourable zone. A high DTI suggests that a significant portion of your income is already committed to existing obligations, leaving little room for a new car payment, especially with the added costs of insurance and fuel. Lenders typically prefer a DTI below 36%, though some subprime lenders may accept higher. Understanding and actively working to reduce this ratio is a powerful step towards approval.

Employment Instability and Income Verification Hurdles: The Lender's Need for Predictability

Lenders thrive on predictability. They want to see a stable, verifiable income source that assures them you can consistently make your loan payments. Frequent job changes, a history of short-term employment, or self-employment without clear, consistent documentation can all be red flags. While being self-employed in Canada is increasingly common, demonstrating a stable income stream requires extra effort. Lenders in Ontario and across Canada will typically ask for recent pay stubs, employment letters, or several years of tax returns for self-employed individuals to verify income. If your income is irregular or your employment history is patchy, it signals a higher risk. The key is to present your income effectively and transparently, providing all requested documentation promptly and clearly to alleviate any concerns about your ability to pay. For more on this, check out our guide on Self-Employed? Your Bank Statement is Our 'Income Proof'.

The 'Phantom' Problem: Unseen Errors and Identity Issues on Your Credit Report

Sometimes, the problem isn't you or your financial habits; it's an error on your credit report. Mistakes, fraudulent activity, or outdated information can silently sabotage your applications, leading to repeated denials even when you believe your finances are perfectly in order. A misreported late payment, an account that isn't yours, or an incorrect balance can drastically lower your credit score and paint an inaccurate picture of your financial responsibility. This 'phantom' problem is why reviewing your credit report meticulously is not just a good idea, but a critical first step after multiple rejections. You can't fix what you don't know is broken.

Unmasking Your Credit Score: It's Not Just a Number, It's Your Financial Narrative

After multiple rejections, your credit report transforms from a distant concept into your most important document. This isn't merely about checking a three-digit number; it's about understanding the intricate story it tells lenders about your financial reliability and how you can actively rewrite that narrative. In Canada, your credit score and report are pivotal, serving as a comprehensive snapshot of your borrowing history. We’ll break down the Canadian credit reporting system and empower you to become your own credit detective, uncovering the secrets to unlocking future approvals.

Equifax vs. TransUnion: Decoding Canada's Credit Bureau Giants

In Canada, two primary credit bureaus, Equifax and TransUnion, collect and maintain your credit information. While they gather similar data—like your payment history, types of credit used, and public records—the way they process and weigh this information can lead to slight differences in your credit score between the two. It's not uncommon to have a score that varies by a few points or even a dozen between Equifax and TransUnion. Both bureaus are equally important, as different lenders may pull from one or the other, or sometimes even both. Under Canadian law, you are entitled to a free copy of your full credit report from each bureau annually. In provinces like Alberta and Quebec, accessing these reports is a straightforward process, often available online or by mail. Obtaining both reports is crucial to ensure accuracy across the board and to get a complete picture of what lenders are seeing.

The Anatomy of a Credit Report: What Lenders Actually See (and Care About)

Beyond the single score, your credit report is a detailed chronicle of your financial behaviour. Lenders delve into several key areas:

- Payment History (35%): This is the most critical factor. Are your payments on time, every time? Late payments, collections, or bankruptcies significantly damage this section.

- Credit Utilization (30%): How much of your available credit are you using? Keeping your credit card balances low (ideally below 30% of your limit) signals responsible credit management.

- Length of Credit History (15%): A longer history of responsible credit use is generally better, showing a consistent pattern over time.

- Types of Credit Used (10%): A healthy mix of credit (e.g., credit cards, lines of credit, installment loans) can positively impact your score.

- New Credit (10%): This includes hard inquiries from recent applications. Too many in a short period can be a negative signal, as discussed earlier.

- Public Records: Bankruptcies, consumer proposals, or judgments will also appear and heavily influence a lender's decision.

Understanding these components helps you pinpoint areas for improvement and directly impacts your approval odds. For more on specific score requirements, explore our article on The Truth About the Minimum Credit Score for Ontario Car Loans.

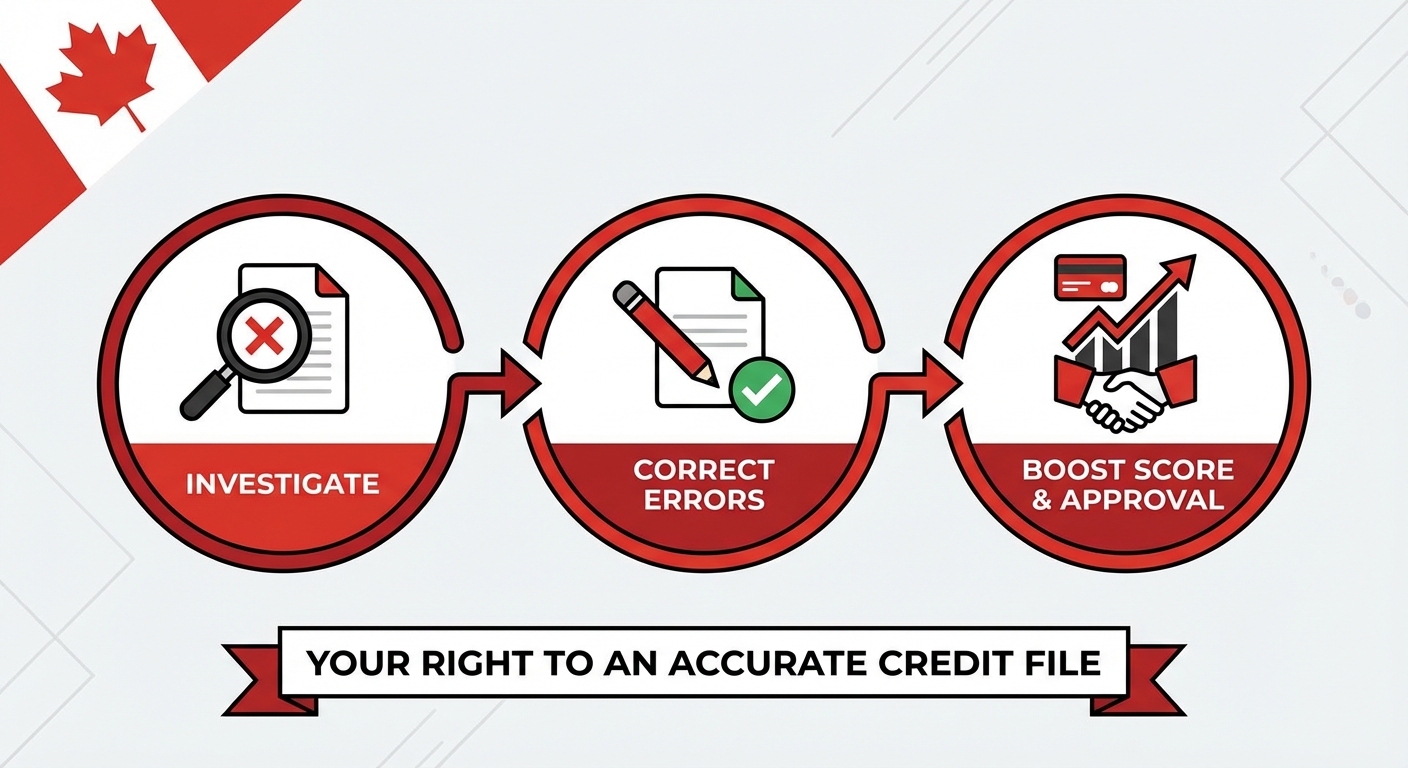

Dispute and Conquer: Rectifying Errors That Are Holding You Back

Finding an error on your credit report can feel like discovering hidden treasure. It's an opportunity to boost your score without waiting months for positive habits to take effect. A step-by-step guide to identifying and disputing inaccuracies is a critical proactive measure. First, meticulously review both your Equifax and TransUnion reports. Look for unfamiliar accounts, incorrect payment statuses, or outdated information. If you find an error, gather supporting documentation (e.g., proof of payment, identity documents) and contact the credit bureau directly, providing clear details of the inaccuracy and your supporting evidence. They are legally obligated to investigate and correct verifiable errors, which can significantly boost your score and your chances of approval, especially after repeated denials. Don't underestimate the power of this step – it’s your right to have an accurate credit file.

PRO TIP: The Strategic Credit Freeze (Use With Caution)

Consider a temporary credit freeze with Equifax and TransUnion after a flurry of rejections. This prevents further hard inquiries while you rebuild your credit, ensuring no new applications are made without your explicit permission. It's a powerful tool for regaining control. Remember to unfreeze your credit when you're genuinely ready to apply again, as lenders cannot access your report with a freeze in place.

The Strategic Retreat: Pausing Applications and Rebuilding Your Financial Foundation

After multiple rejections, the absolute worst thing you can do is keep applying. This desperate approach only compounds the damage to your credit score through additional hard inquiries and signals to lenders an inability to manage your financial situation. Instead, this is the time for a crucial 'pause' – a strategic retreat that allows you to regroup, analyze, and rebuild. This section outlines actionable strategies to strengthen your credit profile before your next attempt, transforming your frustration into focused, productive action. Think of this period as your financial boot camp, preparing you for a successful re-entry into the lending market.

Credit Building 101: From Secured Cards to Credit Builder Loans in Canada

Actively building positive credit history is paramount. If your credit is poor or non-existent, Canada offers several practical tools. A secured credit card is an excellent starting point: you deposit funds (e.g., $500) with the issuer, and that becomes your credit limit. Use it responsibly for small purchases and pay the balance in full each month, demonstrating your ability to manage credit. Many major banks and credit unions offer these. Another option is a credit builder loan, common at credit unions or specialized lenders. With this, the loan amount is held in a locked savings account while you make regular payments. Once paid off, you get access to the funds and, more importantly, a record of positive payments reported to the credit bureaus. Some financial institutions in cities like Calgary and Edmonton actively promote these. Finally, becoming an authorized user on a trusted individual's credit card account (with excellent payment history) can also help, as their positive activity may reflect on your report, but only if they manage it perfectly and you trust them implicitly.

Here's a comparison of common credit-building tools:

| Credit Building Tool | How It Works | Pros | Cons | Ideal For |

|---|---|---|---|---|

| Secured Credit Card | Deposit funds, get a credit limit equal to deposit. Use and pay monthly. | Guaranteed approval (with deposit), reports to bureaus, flexible use. | Requires upfront deposit, often higher annual fees. | Beginners, those with poor credit rebuilding. |

| Credit Builder Loan | Loan amount held in savings. Make payments, get funds at end. | Builds installment loan history, forced savings. | Funds locked until loan is paid, may have fees/interest. | Those needing installment history, disciplined savers. |

| Authorized User | Added to someone else's existing credit card. | Leverages good credit history of primary user, no deposit. | No legal responsibility for debt, depends on primary user's habits. | Individuals with no credit, trusted family/friends. |

Taming Your Debt-to-Income: Strategies for Reducing Existing Liabilities

Lenders want to see that you're not stretched too thin. Aggressively paying down high-interest debt, especially on credit cards, is a powerful strategy. Two popular methods are the debt snowball and debt avalanche. The snowball method involves paying off your smallest debts first, gaining psychological momentum. The avalanche method targets debts with the highest interest rates first, saving you money in the long run. Even small, consistent payments beyond the minimum can significantly improve your debt-to-income ratio and lower your credit utilization, making you a much more attractive borrower. Every dollar you free up from existing debt is a dollar that can be allocated towards a car payment, signaling financial responsibility to potential lenders.

Saving for Success: Why a Down Payment is Your Golden Ticket (Even a Small One)

After multiple rejections, a down payment becomes your most potent bargaining chip. Even a modest one, say $500 to $1,000, dramatically reduces the lender's risk. It shows commitment, reduces the loan amount, and signals that you have some financial discipline. For lenders, it means less money they have to risk, making them far more likely to approve an application. Strategies for saving, even on a tight budget in expensive cities like Toronto or Vancouver, include setting up automatic transfers to a dedicated savings account, cutting discretionary spending, or even taking on a temporary side hustle. Every dollar saved for that down payment isn't just money; it's a statement of your seriousness. For more insights on this, you might find our article No Down Payment? Your Gig Just Bought a Hybrid. Seriously. particularly useful.

Beyond the Big Banks: Navigating the Landscape of Alternative Lenders in Canada

When traditional banks, with their stringent criteria, say no, it's easy to feel defeated. But in Canada, your journey to car ownership is far from over. There's a robust and diverse ecosystem of alternative lenders specializing in helping individuals with challenging credit histories. These lenders often have more flexible criteria and a greater understanding of unique financial situations, making them a strong option when you've faced multiple rejections. This section explores these vital alternatives, their pros, cons, and how to approach them strategically.

Subprime Lenders and Dealership Financing: Your Path to Approval

Subprime lenders are financial institutions that specialize in offering loans to individuals with less-than-perfect credit. They understand that life happens and are willing to take on higher risk, albeit often with higher interest rates to compensate. Many dealerships, like those found in Burlington, Ontario, or across the Greater Toronto Area, have relationships with these subprime lenders or offer their own in-house financing. This can be a direct path to approval. Their criteria typically focus more on your current income stability, your ability to make a down payment, and your debt-to-income ratio, rather than solely on your past credit missteps. What to expect? Be prepared for a thorough review of your income and employment, and anticipate a higher Annual Percentage Rate (APR) than someone with prime credit. However, this is often a necessary stepping stone to rebuild your credit and secure transportation.

Credit Unions and Community Lenders: The Local Advantage

Often overlooked, credit unions and community lenders can be powerful allies. Unlike large banks, credit unions are member-owned and frequently operate with a more community-focused approach. This often translates to more flexible lending criteria, personalized service, and a willingness to look beyond just your credit score. They might consider your relationship with the credit union, your overall financial picture, and your unique circumstances. For individuals in smaller communities across Ontario, where local relationships matter, a credit union might offer a more compassionate ear and a tailored solution. Building a relationship with a local credit union, even by opening a small savings account, can pave the way for future lending opportunities when traditional avenues have closed.

The Online Marketplace: Convenience vs. Due Diligence

The digital age has brought a proliferation of online lending platforms that connect borrowers with a variety of lenders, including those specializing in bad credit car loans. The convenience is undeniable: you can often complete an application from your home in Montreal or any major urban centre, sometimes receiving multiple offers quickly. However, this convenience comes with a critical caveat: due diligence is paramount. While many online platforms are reputable, others can engage in predatory practices, offering sky-high interest rates or hidden fees. Always vet these platforms thoroughly. Look for transparent terms, positive customer reviews, and ensure they are licensed to operate in your province. Compare offers meticulously and never feel pressured to commit without fully understanding the terms. Use these platforms to gather information and compare, but proceed with caution.

PRO TIP: Pre-Approval from Alternative Lenders

Many alternative lenders and online platforms offer pre-approval with a soft credit check. This is invaluable! A soft credit check won't impact your credit score, allowing you to gauge your eligibility and potential rates without further damaging your credit with hard inquiries. Always seek pre-approval before visiting a dealership. This empowers you with negotiating leverage and a clear understanding of what you can afford, preventing unnecessary hard inquiries later.

The Co-Signer Advantage: Sharing the Risk, Doubling Your Chances (And the Responsibilities)

When your credit profile alone isn't strong enough to secure a car loan, a co-signer can be an absolute game-changer. Their good credit and stable financial history can significantly boost your approval odds, effectively sharing the risk with the lender. However, it's a profound commitment for both parties, one that requires open communication, trust, and a clear understanding of the responsibilities involved. This isn't a decision to be taken lightly, but when approached responsibly, it can be the key to getting you behind the wheel.

Who Qualifies as a Co-Signer? The Ideal Candidate Profile

An ideal co-signer is someone with a strong credit score, a stable employment history, and a low debt-to-income ratio. Essentially, they possess the financial qualifications that you currently lack. Often, this person is a close family member—a parent, sibling, or spouse—or a trusted friend who is willing to take on shared responsibility for your loan. Lenders will evaluate the co-signer's credit profile just as rigorously as they would a primary applicant. Their financial strength acts as a guarantee that if you, the primary borrower, are unable to make payments, they will step in. In a Canadian context, especially in close-knit communities, this trust and willingness to help are often rooted in personal relationships.

The Shared Burden: Understanding Co-Signer Responsibilities and Risks

This is the most crucial aspect: a co-signer is equally responsible for the loan. This isn't a passive endorsement; it's a legal commitment. If you miss a payment, it negatively impacts both your credit score and your co-signer's. If the loan defaults, the co-signer is legally obligated to make the payments, and their assets could be at risk. This shared burden also means that the loan appears on their credit report, potentially affecting their ability to secure future credit for themselves (e.g., a mortgage or their own car loan). The risks to their credit score, financial stability, and personal relationship are substantial. Emphasize open communication, a clear repayment plan, and perhaps even a written agreement between yourselves to safeguard the relationship and prevent misunderstandings down the road.

Making the Ask: Approaching a Potential Co-Signer with Transparency

Asking someone to co-sign for you is a sensitive conversation that requires complete honesty and transparency. Don't simply ask; explain your situation clearly, detailing why you need a co-signer (e.g., past rejections, credit rebuilding efforts). Present your concrete plan for repayment, showing them how you intend to make every payment on time. Discuss the potential risks to them openly and assure them of your commitment to uphold your end of the agreement. Be prepared to provide them with all necessary financial information. This transparent approach, showing you understand the gravity of their commitment, is essential to maintaining trust and securing their help. It’s about building confidence, not just making a request, especially in close-knit communities across Canada where personal reputation holds significant weight.

Vehicle Choice: Your Ride, Your Approval Odds – Thinking Smart in the Canadian Market

The car you choose dramatically impacts your approval chances, especially after multiple rejections. Lenders, particularly those dealing with higher-risk applicants, are looking for a sound investment that aligns with your ability to repay. This section guides you toward making smart vehicle choices that increase your likelihood of approval, focusing on practicality and financial sensibility over the allure of luxury. In the Canadian market, where winter conditions and resale value are key considerations, choosing wisely is paramount.

The Sweet Spot: Used Cars that Lenders Love (for Bad Credit Applicants)

For individuals with multiple rejections, affordable, reliable used cars are often the easiest to get approved for. Lenders prefer vehicles that retain their value well and are less prone to immediate, costly repairs. Typically, cars that are 3 to 7 years old with reasonable mileage fall into this 'sweet spot.' These vehicles have already experienced their steepest depreciation, meaning the loan amount is lower, and the vehicle's value is more stable. This reduces the lender's risk significantly. Think established, high-volume brands known for their longevity. Specific examples relevant to the Canadian used car market in cities like Calgary or Ottawa might include a Honda Civic, Toyota Corolla, or Mazda3. These models are not only reliable but also hold their resale value, which is a big plus for lenders. Furthermore, choosing a used vehicle allows you to keep the overall loan amount lower, making the monthly payments more manageable and further improving your debt-to-income ratio. For more on this, you might find our guide Approval Secrets: Navigating the Best Used Car Finance Options for Ontario’s Self-Employed helpful.

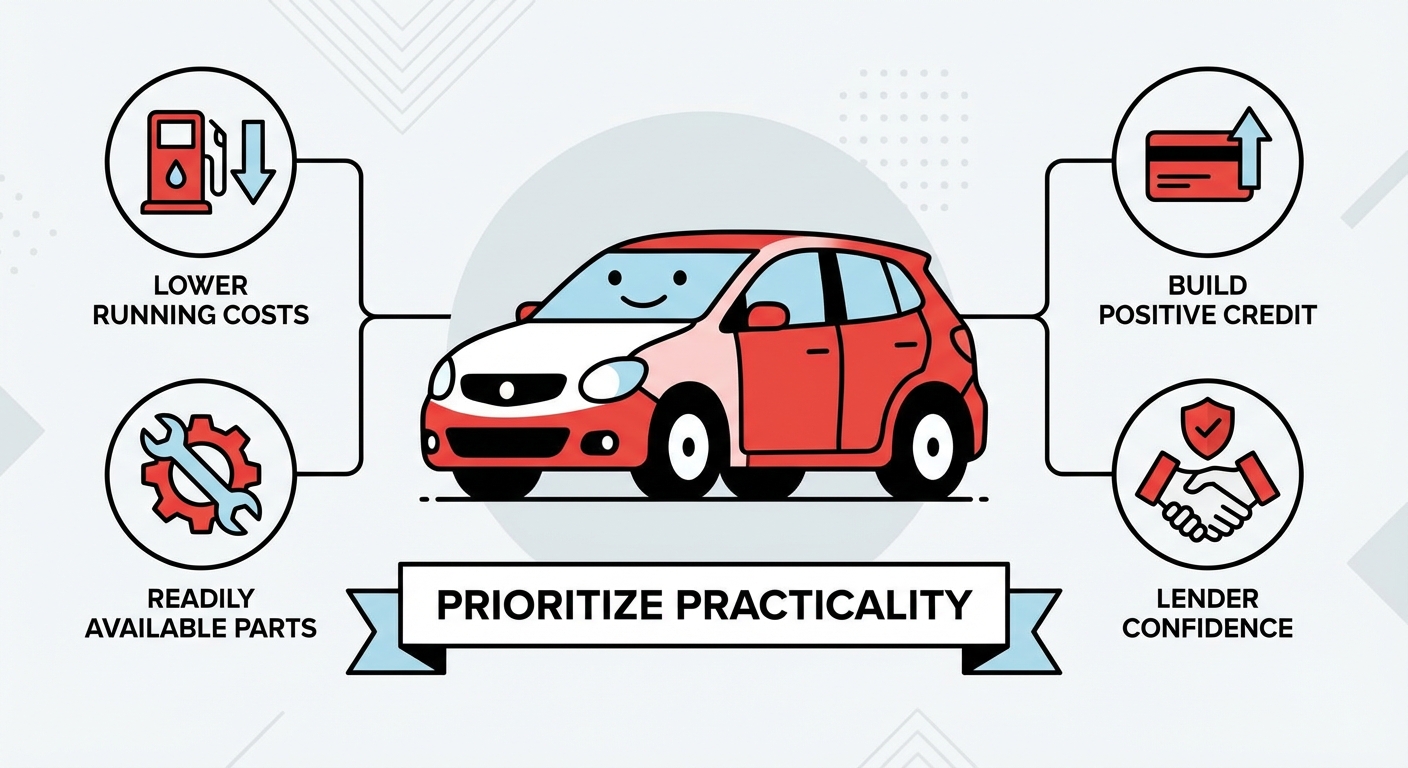

Beyond the Sticker Price: Understanding Total Cost of Ownership and Loan Risk

It's not just the purchase price that matters; it's the total cost of ownership. Lenders implicitly consider factors like maintenance costs, insurance premiums, and fuel efficiency because these directly affect your ability to repay the loan. A car with notoriously high insurance rates (especially in provinces like Ontario, where premiums can be significant) or one known for expensive parts and frequent breakdowns will be viewed as a higher risk. Why? Because these additional costs can quickly strain your budget, making it harder to consistently meet your car loan payments. When choosing a vehicle, think about the long-term financial implications. Research average insurance costs for specific models, look up reliability ratings, and consider fuel efficiency. Choosing a vehicle that fits your overall budget, not just the monthly payment, demonstrates financial prudence to lenders.

The 'Lemon' Trap: Avoiding High-Risk Vehicles with Multiple Rejections

Certain vehicle types or brands might be harder to finance, especially for applicants with challenging credit. Extremely old vehicles (e.g., 10+ years), vehicles with very high mileage, or those from brands known for poor reliability or high repair costs can be considered 'lemons' in a lender's eyes. Exotic or luxury vehicles, even if used, also pose a higher risk due to their often-volatile depreciation, higher insurance costs, and specialized maintenance. Steer clear of these, at least for your initial approval. Focus on vehicles with established reputations for longevity, lower running costs, and readily available parts. Your goal is to secure a reliable form of transportation and build positive credit history, not to impress with a high-maintenance ride. Prioritize practicality and lender confidence above all else.

Decoding the Fine Print: Interest Rates, Loan Terms, and Hidden Fees

Getting approved for a car loan, particularly after multiple rejections, is a triumph. But the battle isn't over. Understanding the true cost of your loan is just as critical as securing the approval itself. This section empowers you to read beyond the enticing monthly payment, scrutinizing interest rates, loan terms, and potential hidden fees common in bad credit car loans across Canada. Knowledge here is your best defence against overpaying and ensuring your new car doesn't become a financial burden.

APR vs. Interest Rate: The True Cost of Borrowing After Rejections

When reviewing a loan offer, you'll encounter both an 'interest rate' and an 'Annual Percentage Rate' (APR). It's crucial to understand the distinction, especially with higher-risk loans. The interest rate is simply the cost of borrowing money, expressed as a percentage of the principal. The APR, however, represents the total cost of your loan over a year, encompassing not just the interest rate but also any additional fees (e.g., origination fees, administrative fees). For example, a loan might have a 10% interest rate, but if it includes various fees, its APR could be 12% or higher. For individuals with multiple rejections and less-than-perfect credit, APRs tend to be significantly higher. Always compare offers based on their APR, as this provides the most accurate picture of the overall cost of borrowing. It allows for a true apples-to-apples comparison between different lenders.

The Longer the Term, the Higher the Cost: Navigating Amortization

Loan terms—the length of time you have to repay the loan—can range from a few years to seven or even eight years. While a longer term means lower monthly payments, which might seem appealing when you're focusing on affordability, it dramatically increases the total amount of interest you'll pay over the life of the loan. For example, a $20,000 loan at 12% APR over 5 years might cost you $6,000 in interest, while the same loan over 7 years could cost you $8,500 or more in interest. The longer the amortization period, the more time interest has to accrue. Strategies for balancing affordability with total expense include aiming for the shortest term you can comfortably afford. If you must take a longer term to secure approval, prioritize making extra payments whenever possible to reduce the principal faster and save on interest. Be mindful of the total cost, not just the monthly commitment.

Spotting Predatory Practices: Fees, Clauses, and Red Flags to Avoid

In competitive markets like Toronto, where desperation can lead to hasty decisions, it's vital to protect yourself from unscrupulous lenders. Learn to identify unfair fees, confusing clauses, and outright red flags. Watch out for:

- Excessive Origination or Administrative Fees: While some fees are standard, unreasonably high upfront costs should raise an eyebrow.

- Prepayment Penalties: A clause that charges you a fee for paying off your loan early. This can undermine your efforts to save on interest.

- Balloon Payments: A large, lump-sum payment due at the end of the loan term, which can be a nasty surprise if not anticipated.

- Vague or Unexplained Clauses: If you don't understand a term, ask for clarification. If the explanation is evasive, consider it a red flag.

- Pressure to Buy Add-ons: Extended warranties, rustproofing, or credit insurance can significantly inflate your loan amount and are often high-profit items for dealerships. Evaluate their necessity carefully.

Equip yourself with the knowledge to negotiate and never sign anything you don't fully comprehend. If an offer seems too good to be true, it likely is. If you feel pressured, walk away.

PRO TIP: 'Cooling-Off' Period & Review

Even if you're desperate for approval, never feel pressured to sign on the spot. Take the loan agreement home, review it carefully, and even have a trusted advisor (like a financial counsellor or lawyer) look it over. In some provinces, there might be a 'cooling-off' period for certain contracts, though this is less common for car loans. Always understand what you're signing, including the APR, total cost, and all terms and conditions, before making a final commitment.

Your Approval Blueprint: A Step-by-Step Guide to Your Next (Successful) Application

You've absorbed the knowledge, understood the pitfalls, and committed to rebuilding. Now, it's time to consolidate all these strategies into a clear, actionable roadmap for your next car loan application. This isn't just about trying again; it's about approaching the process with confidence, preparation, and a significantly higher chance of success. This blueprint ensures you tackle each stage methodically, turning past rejections into a robust foundation for approval.

Step 1: The Credit 'Health Check' and Report Clean-Up

Before you even think about applying, your absolute first move must be to review your credit reports from both Equifax and TransUnion. Obtain your free copies, scrutinize every detail for errors, and actively dispute any inaccuracies you find. This foundational step ensures that lenders are looking at the most accurate and positive representation of your financial history. A clean, accurate report is your best starting point. This is where you identify the 'why' behind previous rejections and address it head-on.

Step 2: Financial Preparedness – Down Payment and Debt Reduction

Show lenders you're serious about your financial commitment. Actively work on saving for a down payment, even if it's a modest one. Simultaneously, implement a strategy to reduce your existing high-interest debt, particularly on credit cards. Lowering your debt-to-income ratio and improving your credit utilization will make you a much more attractive borrower. These actions demonstrate discipline and an enhanced ability to manage new debt, signaling responsibility to potential lenders.

Step 3: Strategic Lender Selection – Target the Right Fit

Don't cast a wide net again. Based on your improved credit profile and understanding of the lending landscape, identify the lenders most likely to approve your specific situation. This might mean starting with credit unions, exploring alternative lenders, or working directly with dealerships that specialize in subprime financing. Utilize pre-approval processes (with soft credit checks) to gauge your eligibility without harming your score. This focused approach saves you from unnecessary hard inquiries and frustration.

Step 4: Document Arsenal – Gather Everything Before You Apply

Preparation is key to a smooth application. Before you even submit, gather all necessary documents:

- Proof of income (recent pay stubs, employment letters, tax returns for self-employed individuals, bank statements). For self-employed individuals, our article Self-Employed? Your Bank Statement is Our 'Income Proof'. offers more detailed guidance.

- Proof of residency (utility bills, lease agreement).

- Government-issued identification (driver's license, passport).

- Banking information.

- Any co-signer documents, if applicable (their income, ID, credit details).

Having a complete, organized package ready demonstrates professionalism and expedites the approval process, leaving no room for doubt or delays.

Step 5: The Informed Application – Ask Questions, Understand Terms

When you apply, do so with confidence, knowing your credit standing and the terms you are looking for. Don't be afraid to ask questions about the APR, loan term, total cost, and any fees. Understand every clause in the agreement. Negotiate if necessary, especially if you have multiple offers. An informed applicant is a powerful applicant. By following these steps, you're not just applying for a car loan; you're demonstrating financial maturity and setting yourself up for success.

Your Next Steps to Approval: From Rejection to Road Trip in Canada

Multiple rejections are not the end of your journey to car ownership, especially not in a resilient and bustling city like Toronto. They are, in fact, a powerful, albeit frustrating, lesson. Each "no" has provided invaluable feedback, shining a light on areas of your financial profile that needed attention. By understanding the 'why' behind those denials, taking a strategic pause to prevent further damage, diligently rebuilding your credit, exploring all available lending options, and making smart vehicle choices, you're not just aiming for a car loan; you're building a stronger, more resilient financial future for yourself. Your rejection letter wasn't a stop sign; it was a detour sign pointing you towards a smarter, more informed, and ultimately, more successful path to approval. The road ahead may have a few bumps, but with this blueprint, you are now equipped to navigate them confidently. Take control, make wise decisions, and drive forward with the assurance that your next application will be a success. Your car is waiting.