Ontario Divorcees: Your Car Loan Just Signed Its Own Papers.

Table of Contents

- Key Takeaways

- From 'We' to 'Me': Understanding Your New Financial Landscape in Ontario

- The 'Without Spousal Support' Reality Check: Why This Factor Shapes Your Ontario Car Loan Eligibility

- Verifying Your Solo Income

- The Debt-to-Income (DTI) Ratio Dilemma

- Re-establishing Financial Independence

- Navigating the Post-Divorce Credit Maze: Rebuilding Your Score in Ontario, One Payment at a Time

- Untangling Joint Accounts

- Credit Repair Strategies for Ontario Residents

- The Power of a Clean Slate

- Unmasking Your Options: Where to Find the Best Car Loan for Your New Chapter in Ontario

- Traditional Banks & Credit Unions

- Dealership Financing (Captive Lenders)

- Online Lenders & Fintech Solutions

- Subprime Lenders in Ontario

- Beyond the Sticker Price: Crafting Your Ontario Car Budget for True Affordability

- Total Cost of Ownership (TCO)

- Ontario Car Insurance Rates

- Registration & Licensing Fees

- Unexpected Expenses: The Crucial Need for an Emergency Fund

- The Vehicle That Fits Your New Life (and Budget): New, Used, or Electric in Ontario?

- New Cars

- Used Cars

- Certified Pre-Owned (CPO)

- Electric Vehicles (EVs) in Ontario

- Reliable Makes & Models

- Deconstructing the Loan Agreement: What Ontario Divorcees Must Scrutinize

- Interest Rates (APR)

- Loan Terms

- Hidden Fees & Add-ons

- Prepayment Penalties

- Ontario Specifics: Legalities, Resources, and Regional Nuances for Car Buyers

- Divorce Decree & Car Loans

- Consumer Protections in Ontario

- Regional Market Differences

- Community Resources

- Your Roadmap to Financial Rebuilding (Beyond the Car Loan)

- Budgeting Tools & Apps

- Emergency Savings

- Future Financial Goals

- Seeking Professional Advice

- Your Next Steps to Approval: An Actionable Plan for Ontario Divorcees

- Frequently Asked Questions (FAQ) for Ontario Car Loans After Divorce

The ink on your divorce papers might be dry, but for many in Ontario, the journey to financial independence is just beginning. And nothing quite symbolizes that new chapter like a new set of wheels. But what happens when that crucial financial support from your former spouse is no longer part of the equation? Securing a car loan in Ontario as a newly single individual, especially without spousal support, can feel like navigating a complex, winding road.

At SkipCarDealer.com, we understand these unique challenges. We're here to guide you through every turn, helping you understand how your new financial landscape impacts your eligibility, what lenders look for, and how to position yourself for success. It's about empowering you to drive forward with confidence, making smart, sustainable choices for your independent future.

Key Takeaways

- Prioritize Individual Credit Health: Your personal credit score and history are now paramount. Access your free credit reports from Equifax Canada and TransUnion Canada immediately to understand your standing.

- Budget Holistically: A car's true cost extends far beyond the monthly payment. Factor in Ontario insurance rates, fuel, maintenance, and unexpected repairs to create a realistic, sustainable budget.

- Understand Your Income & DTI: Lenders will scrutinize your sole income and debt-to-income ratio. Be prepared to provide consistent proof of income and actively work to reduce existing debt.

- Explore Diverse Lender Options: Don't limit yourself to traditional banks. Research credit unions, dealership financing, and online lenders in Ontario to find the best fit for your unique financial situation.

- Scrutinize Every Detail: Before signing, thoroughly understand the interest rate (APR), loan term, and all fees. Knowledge is your strongest negotiation tool.

- Rebuild & Plan: View this car loan as a stepping stone to broader financial rebuilding. Consistent, on-time payments will significantly improve your credit and open doors to future financial goals.

From 'We' to 'Me': Understanding Your New Financial Landscape in Ontario

The emotional toll of divorce is undeniable, but the practical implications for your finances are equally significant, particularly when it comes to major purchases like a vehicle. Moving from a shared household income and often shared financial responsibilities to a solely individual financial landscape requires a complete mental and practical reset. This shift is even more pronounced for individuals in Ontario who are navigating this transition without the supplementary income of spousal support.

You're not just buying a car; you're establishing a new foundation of financial independence. Lenders, while sympathetic to life changes, operate on risk assessment. They need to see evidence of stable, individual income and responsible money management. Your past joint financial history will be dissected, and your ability to manage debt on your own will be critically evaluated.

Embracing this new financial reality means taking a proactive approach. It involves understanding where you stand financially, identifying potential hurdles, and strategizing to overcome them. This isn't just about getting a car loan; it's about building a robust financial future for yourself in Ontario.

The 'Without Spousal Support' Reality Check: Why This Factor Shapes Your Ontario Car Loan Eligibility

For lenders in Ontario, spousal support, when awarded, is often considered a stable form of income, contributing positively to an applicant's financial profile. Its absence means your application will be solely assessed on your individual income and financial strength. This significantly impacts your debt-to-income (DTI) ratio and how lenders perceive your ability to manage new debt.

Lenders prioritize consistent, verifiable income. They want assurance that you can comfortably make your monthly car loan payments alongside all your other financial obligations. Without spousal support, your personal employment income becomes the sole metric for assessing your repayment capacity.

Verifying Your Solo Income

When applying for a car loan in Ontario, lenders require specific documentation to verify your income. This isn't just a formality; it's how they assess your ability to repay the loan. Expect to provide:

- Consistent Pay Stubs: Typically, your last two to three months of pay stubs demonstrating regular employment and income.

- Employment Letters: A formal letter from your employer confirming your position, start date, and annual salary.

- Tax Assessments (Notice of Assessment - NOA): For self-employed individuals or those with varied income, your most recent T1 General and Notice of Assessment (NOA) from the Canada Revenue Agency (CRA) will be crucial. This provides a comprehensive overview of your declared income over the past year or two. For self-employed individuals, proving income can be a unique challenge, but it's far from impossible.

- Bank Statements: Lenders may request bank statements to show consistent deposits and demonstrate responsible cash flow management.

The Debt-to-Income (DTI) Ratio Dilemma

Your DTI ratio is a critical metric for lenders. It compares your total monthly debt payments to your gross monthly income. Without spousal support boosting your income, your DTI can appear higher, potentially reducing your borrowing power. Strategies for optimizing your DTI include:

- Reducing Existing Debt: Actively pay down high-interest credit card debt or personal loans before applying for a car loan. Even small reductions can improve your DTI.

- Accurate Disposable Income Calculation: Create a meticulous budget. Understand exactly how much money you have left after all essential expenses. This demonstrates to yourself and potentially to a lender that you've thought through your finances.

- Consider a More Affordable Vehicle: A lower car loan amount directly translates to a lower monthly payment, improving your DTI.

Re-establishing Financial Independence

Demonstrating a track record of responsible financial management post-divorce is vital. This means:

- Paying Bills on Time: Consistency is key. Every on-time payment for utilities, rent, and any remaining individual debts builds a positive credit history.

- Building Individual Credit: If most of your credit history was tied to joint accounts, now is the time to establish your own. We'll delve into this in the next section.

- Saving an Emergency Fund: Having a financial cushion indicates stability and reduces perceived risk for lenders.

Navigating the Post-Divorce Credit Maze: Rebuilding Your Score in Ontario, One Payment at a Time

Divorce can leave a significant imprint on your credit score. Shared accounts, missed payments during tumultuous times, or new financial arrangements can all cause your score to dip. For Ontario divorcees, understanding and actively improving your credit score is a crucial step *before* applying for a car loan. Your credit score is a numerical representation of your creditworthiness, and a higher score unlocks better interest rates and loan terms.

Untangling Joint Accounts

One of the most complex aspects of post-divorce finances is untangling joint accounts. Shared credit cards, lines of credit, and mortgages can linger on both your credit reports, even after separation. If your former spouse is late on payments for a joint account, it can negatively impact your score, regardless of your personal financial habits.

- Close Joint Accounts: If possible, close joint credit cards or lines of credit, or remove yourself as an authorized user.

- Monitor Joint Debt: If you're still legally responsible for joint debts (like a mortgage), ensure payments are being made on time. Your divorce decree should outline who is responsible, but the lender still holds both parties liable.

- Check for Inaccuracies: Review your credit reports carefully for any accounts that should have been removed or changed to individual status. Dispute any errors promptly.

Credit Repair Strategies for Ontario Residents

Rebuilding your credit takes time and consistency, but there are actionable steps you can take:

- Secured Credit Cards: These cards require a deposit, which becomes your credit limit. They are an excellent way to demonstrate responsible usage and build positive credit history in Ontario.

- Credit-Builder Loans: Offered by some credit unions and financial institutions, these loans are designed specifically to help you build credit. The loan amount is held in an account until you've made all payments, then released to you.

- Timely Bill Payments: This cannot be stressed enough. Every single bill paid on time – credit cards, utility bills, rent, phone bills – contributes positively to your credit history. Payment history is the most significant factor in your credit score.

- Keep Old Accounts Open (If Positive): If you have an old individual credit card with a good payment history, keep it open. The length of your credit history positively impacts your score.

The Power of a Clean Slate

Your divorce, while challenging, also presents an opportunity for a financial clean slate. By meticulously managing your individual finances, you can strategically build a robust credit history that truly reflects your personal responsibility. This isn't just about getting a car loan; it's about establishing a strong foundation for all future financial endeavours in Ontario, from renting an apartment to securing a mortgage.

Unmasking Your Options: Where to Find the Best Car Loan for Your New Chapter in Ontario

The landscape of car financing in Ontario is diverse, and knowing your options is crucial, especially when navigating a post-divorce financial situation without spousal support. Each type of lender has its own advantages, disadvantages, and typical requirements. Understanding these can help you target the right institutions and increase your chances of approval.

Traditional Banks & Credit Unions

Major banks like RBC, TD Canada Trust, Scotiabank, BMO, and CIBC, as well as local credit unions such as Meridian Credit Union or Alterna Savings, often offer competitive interest rates for car loans. However, they typically have more stringent requirements for solo applicants, prioritizing strong credit scores and stable, verifiable income.

- Advantages: Often lower interest rates, established reputation, diverse financial products.

- Disadvantages: Stricter credit score requirements, potentially longer approval processes, less flexibility for unique financial situations.

- Tip: Securing a pre-approved loan from your bank or credit union before stepping into a dealership gives you significant bargaining power and a clear budget.

Dealership Financing (Captive Lenders)

Many dealerships in Ontario offer financing directly through partnerships with manufacturers' captive lenders (e.g., Toyota Financial Services, Ford Credit, GM Financial) or a network of third-party lenders. This can be convenient, often offering promotional rates or incentives on specific models.

- Advantages: Convenience (one-stop shop), potential for manufacturer incentives (low interest rates, cash rebates), faster approval.

- Disadvantages: Rates might be less competitive if your credit isn't stellar, may push for higher-profit add-ons, terms can be less flexible.

- Tip: Always scrutinize the terms and compare them to any pre-approved offers you might have.

Online Lenders & Fintech Solutions

The digital age has brought a rise in online lenders and fintech companies that specialize in car loans. Companies like LoanConnect or Car Loans Canada can offer speed, accessibility, and often more tailored options for various credit profiles, including those with less-than-perfect credit. They leverage technology to streamline the application and approval process.

- Advantages: Quick pre-approval, convenient online application, potentially more flexible criteria for diverse credit situations.

- Disadvantages: May have slightly higher interest rates than traditional banks for prime borrowers, requires careful research to ensure legitimacy.

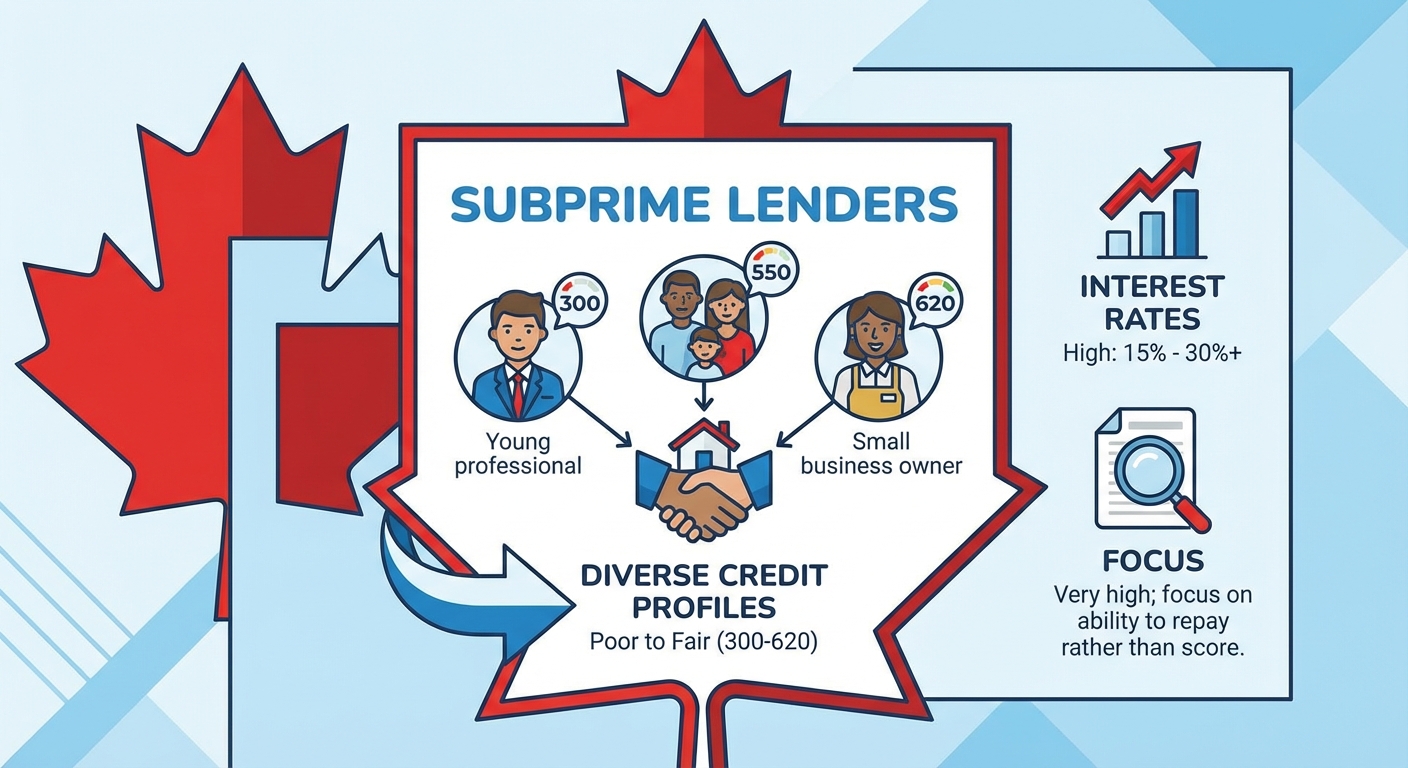

Subprime Lenders in Ontario

For individuals with lower credit scores, a limited credit history, or unique financial circumstances post-divorce, subprime lenders can be a viable option for securing a car loan and rebuilding credit. However, it's crucial to approach these lenders with caution.

- When to Consider: If you've been declined by traditional lenders and need a vehicle.

- What to Watch Out For: Higher interest rates, potentially longer loan terms, and additional fees.

- Avoiding Predatory Lending: Always ensure the lender is licensed in Ontario, thoroughly read the loan agreement, and never feel pressured to sign. Research their reputation and reviews. If you're dealing with negative equity on an existing car, there are solutions available in Ontario.

Here's a comparison to help you weigh your options:

| Lender Type | Typical Approval Odds (Post-Divorce, No Spousal Support) | Average Interest Rate Ranges (APR) | Required Credit Score Range | Application Flexibility |

|---|---|---|---|---|

| Traditional Banks & Credit Unions | Moderate to Low | 5% - 10% | Good to Excellent (680+) | Less flexible; strong documentation needed. |

| Dealership Financing (Captive Lenders) | Moderate to High (especially with incentives) | 0% - 12% (highly variable) | Fair to Excellent (620+) | Moderate; dependent on manufacturer programs. |

| Online Lenders & Fintech | Moderate to High | 6% - 25%+ | Varied (500+) | High; often cater to diverse credit profiles. |

| Subprime Lenders | High | 15% - 30%+ | Poor to Fair (300-620) | Very high; focus on ability to repay rather than score. |

Beyond the Sticker Price: Crafting Your Ontario Car Budget for True Affordability

When you're navigating a new financial chapter in Ontario, focusing solely on the monthly car loan payment is a common pitfall. The true cost of car ownership, known as the Total Cost of Ownership (TCO), encompasses a wide array of recurring and unexpected expenses. A holistic budget that accounts for all these factors is crucial for true affordability and long-term financial stability.

Total Cost of Ownership (TCO)

Beyond the principal and interest of your loan, consider these recurring expenses:

- Fuel: Gas prices in Ontario can fluctuate. Estimate your weekly or monthly fuel costs based on your commute and typical driving habits.

- Routine Maintenance: Oil changes, tire rotations, brake inspections, and fluid checks are essential for vehicle longevity. Budget for these preventative measures.

- Unexpected Repairs: Even reliable vehicles can surprise you. A flat tire, a dead battery, or a larger mechanical issue can arise at any time.

- Depreciation: While not a direct monthly cost, depreciation is the loss in value of your vehicle over time. It's a significant factor in the true cost of ownership.

Ontario Car Insurance Rates

Ontario has some of the highest car insurance rates in Canada, and they vary dramatically by region, driver profile, and vehicle type. Factors influencing your premiums include:

- Postal Code: Living in high-traffic, high-theft areas like parts of Toronto, Brampton, or Vaughan can lead to significantly higher rates compared to more rural areas or cities like Ottawa or London.

- Driver History: Your driving record, including accidents and tickets, directly impacts your premium.

- Vehicle Type: Certain makes and models are more expensive to insure due to repair costs, theft rates, or performance.

- Coverage Levels: The amount of liability, collision, comprehensive, and other optional coverages you choose.

- Actionable Tips: Inquire about discounts for bundling home and auto insurance, increasing your deductible, installing telematics devices (usage-based insurance), or taking defensive driving courses.

Registration & Licensing Fees

In Ontario, you'll incur annual costs for vehicle plates and ownership. These fees are set provincially and are non-negotiable. Ensure you factor these into your yearly budget.

Unexpected Expenses: The Crucial Need for an Emergency Fund

Life after divorce often comes with increased financial vulnerability. A dedicated emergency fund for vehicle repairs is not a luxury; it's a necessity. Aim to save at least $500-$1000 specifically for car-related emergencies. This prevents you from going into debt or defaulting on your loan when unexpected issues arise.

The Vehicle That Fits Your New Life (and Budget): New, Used, or Electric in Ontario?

Choosing the right vehicle is a balance between your needs, desires, and your newly independent budget. Each option—new, used, or electric—comes with its own set of financial implications and benefits in the Ontario context.

New Cars

- Pros: Full warranty, latest safety and technology features, often attractive manufacturer financing incentives (low interest rates or cash rebates).

- Cons: Rapid depreciation (a new car loses a significant portion of its value in the first few years), higher initial cost, more expensive insurance.

- Leveraging Incentives: If your credit is strong, manufacturer-backed financing can offer very competitive rates, sometimes even 0% APR, making a new car more appealing.

Used Cars

For many divorcees in Ontario, a used car is often the smartest financial choice, offering excellent value and lower depreciation.

- Tips for Inspecting: Always get a pre-purchase inspection by an independent mechanic.

- Vehicle History Reports: Obtain a Carfax Canada report to check for accident history, liens, and service records.

- Reputable Dealerships: Seek out well-reviewed used car dealerships across Ontario, whether in bustling Mississauga, the growing communities of Hamilton, or the vibrant city of Vaughan, to ensure a trustworthy purchase experience.

Certified Pre-Owned (CPO)

CPO vehicles offer a compelling middle ground. These are used cars that have undergone rigorous manufacturer-specified inspections and often come with an extended factory-backed warranty, providing added peace of mind and reducing the risk associated with used car purchases.

Electric Vehicles (EVs) in Ontario

The EV market is growing in Ontario. While the upfront cost can be higher, long-term savings are attractive.

- Incentives: While provincial incentives for EVs in Ontario have fluctuated, federal incentives may still be available. Research current programs before you buy.

- Charging Infrastructure: The charging network is continuously expanding in major Ontario cities like Toronto, Ottawa, and London, but planning your charging habits is essential.

- Long-term Savings: Significantly lower fuel costs (electricity is cheaper than gas) and reduced maintenance (fewer moving parts) can make EVs a cost-effective choice over the lifespan of the vehicle.

Reliable Makes & Models

When budget is a concern, focus on vehicles known for durability, lower maintenance costs, and good fuel economy. Brands like Honda, Toyota, Mazda, and Hyundai often appear on reliability lists and offer excellent long-term value for budget-conscious owners.

Deconstructing the Loan Agreement: What Ontario Divorcees Must Scrutinize

The car loan agreement is a legally binding document, and understanding every clause is paramount, especially when you're the sole borrower. Don't be rushed into signing. Take your time to read and ask questions about every detail. This section highlights common pitfalls and essential clauses unique to borrowing in Ontario.

Interest Rates (APR)

The interest rate determines how much extra you'll pay over the life of the loan. The Annual Percentage Rate (APR) is the true cost of borrowing, as it includes the interest rate plus certain fees. Compare:

- Fixed vs. Variable Rates: Fixed rates remain constant, offering predictable payments. Variable rates can fluctuate with market conditions, potentially leading to higher or lower payments. For stability, fixed rates are often preferred post-divorce.

- Impact of APR: Even a small difference in APR can translate to thousands of dollars over a multi-year loan term.

Loan Terms

The loan term is the duration over which you'll repay the loan, typically measured in months (e.g., 60, 72, 84 months). While longer terms mean lower monthly payments, they also mean you'll pay significantly more in total interest over the life of the loan. Strive for the shortest term you can comfortably afford to minimize overall costs.

Hidden Fees & Add-ons

Be vigilant about extra costs that can inflate your loan. Some are legitimate, others are negotiable:

- PPSA (Personal Property Security Act) Registration: This is a mandatory provincial fee in Ontario to register the lender's lien on your vehicle. It's legitimate but often small.

- Administration Fees: Some dealerships charge these for processing paperwork. They can sometimes be negotiated down or waived.

- Mandatory Extended Warranties: While extended warranties can offer peace of mind, ensure they are truly optional and that you understand what they cover and for how long. They add significantly to your loan amount and interest.

- GAP Insurance (Guaranteed Asset Protection): This covers the difference between what you owe on your loan and what your insurance company will pay if your car is stolen or totaled. It can be valuable, especially for new cars or if you have a low down payment, but compare costs and consider if it's necessary for your situation.

Prepayment Penalties

Check if your loan agreement includes penalties for paying off your loan early. As your financial situation improves post-divorce, you might want the flexibility to pay down or pay off your loan sooner without incurring extra charges. Most open loans in Canada allow for lump-sum payments without penalty, but it's always wise to confirm.

Ontario Specifics: Legalities, Resources, and Regional Nuances for Car Buyers

Purchasing a car and securing a loan in Ontario involves navigating not just national financial regulations but also provincial laws and local market dynamics. Being aware of these Ontario-specific details can protect you and inform your decisions.

Divorce Decree & Car Loans

Your divorce decree or separation agreement, while not directly a car loan document, can indirectly impact your financial capacity. Clauses related to:

- Responsibility for Old Joint Debts: If your decree assigns you responsibility for a joint car loan or other debts, this will be factored into your DTI for a new loan.

- Equalization Payments: Receiving or paying equalization payments can affect your available cash flow for a down payment or monthly loan payments.

Ensure you understand how these legal obligations interact with your new financial plans. For more on navigating car loans when your ex is still tied to old debts, check out our guide.

Consumer Protections in Ontario

As a car buyer and borrower in Ontario, you are protected by several provincial laws:

- Motor Vehicle Dealers Act (MVDA): Administered by the Ontario Motor Vehicle Industry Council (OMVIC), this act regulates car sales by registered dealers. It requires dealers to be licensed, disclose vehicle history (e.g., accident repairs over a certain value), and provides a framework for consumer complaints. Always buy from an OMVIC-registered dealer for protection.

- Consumer Protection Act, 2002: This broader act covers various consumer transactions, including aspects of financing. It ensures fair dealing, prohibits unfair practices, and provides recourse for consumers.

Knowing your rights empowers you to negotiate confidently and resolve disputes effectively.

Regional Market Differences

The car market in Ontario isn't uniform. Prices, availability, and even insurance rates can vary significantly:

- High-Cost, High-Demand Areas (GTA): Cities like Toronto, Mississauga, Brampton, and Vaughan often see higher prices for both new and used vehicles due to demand and higher operational costs for dealerships. Insurance rates are also typically elevated here.

- More Affordable Markets: You might find slightly more competitive pricing or greater selection in mid-sized cities like Kingston, Windsor, Sudbury, or London, especially for used vehicles. Expanding your search radius can sometimes yield better deals.

Community Resources

If you're struggling with your finances or need guidance, Ontario offers various resources:

- Financial Literacy Support: Non-profit organizations and some credit unions offer free workshops and resources on budgeting, credit management, and financial planning.

- Credit Counselling Services: Accredited credit counsellors can help you assess your debt, create a budget, and negotiate with creditors. Services are often free or low-cost.

- Legal Aid Clinics: For issues related to your divorce decree or consumer rights, legal aid clinics in major cities like Hamilton, Vaughan, or Brampton can provide advice or representation.

Your Roadmap to Financial Rebuilding (Beyond the Car Loan)

Securing a car loan after divorce is a significant achievement, but it's just one component of your broader financial rebuilding journey. This is an opportunity to establish lasting financial health, positioning yourself for future prosperity and true independence.

Budgeting Tools & Apps

Effective money management is the cornerstone of financial stability. Leverage modern tools to help you stay on track:

- Mint: A popular free app that connects to your bank accounts, tracks spending, and helps you create budgets.

- YNAB (You Need A Budget): A paid app based on a zero-based budgeting philosophy, helping you give every dollar a job.

- Credit Karma: While primarily for credit monitoring, it also offers insights into your spending habits and debt.

- Spreadsheets: Sometimes, the simplest tools are the most effective. A well-maintained spreadsheet can provide granular control over your finances.

Emergency Savings

Beyond the car repair fund, building a robust general emergency savings account is paramount. Aim for at least 3-6 months' worth of essential living expenses. This safety net provides peace of mind and prevents minor setbacks from spiralling into major financial crises, protecting your newly established financial independence.

Future Financial Goals

A well-managed car loan contributes positively to your credit history, which in turn supports larger financial aspirations:

- Retirement Planning: Establishing consistent savings habits now will pay dividends for your retirement.

- Children's Education: If applicable, a stable financial foundation allows you to plan and save for your children's future education without added stress.

- Future Homeownership: A strong credit score and low DTI, bolstered by responsible car loan payments, will significantly improve your eligibility and rates for a future mortgage in Ontario.

Seeking Professional Advice

You don't have to navigate this journey alone. Consulting professionals can provide personalized guidance:

- Certified Financial Advisor: Can help you create a comprehensive financial plan, set goals, and advise on investments and retirement.

- Credit Counsellor: If debt feels overwhelming, a credit counsellor can offer strategies for debt repayment and improve your credit health.

These experts, particularly those familiar with the Ontario financial landscape, can be invaluable partners in your journey to financial rebuilding.

Your Next Steps to Approval: An Actionable Plan for Ontario Divorcees

Navigating a car loan after divorce, especially without spousal support, requires a systematic approach. By following these steps, you'll be well-prepared to secure the best possible financing for your new vehicle and drive forward with confidence.

- Assess & Plan:

- Obtain your free credit reports from Equifax Canada and TransUnion Canada. Review them meticulously for accuracy and identify any areas for improvement.

- Create a detailed, realistic budget that accounts for all income and expenses, including the total cost of car ownership (loan payment, insurance, fuel, maintenance, emergency fund).

- Identify your comfortable monthly payment range.

- Research & Compare:

- Investigate various lenders (traditional banks, credit unions, online lenders, dealership finance) to understand their requirements and typical offerings for someone in your situation.

- Research potential vehicles that align with your budget, lifestyle, and reliability needs (new, used, CPO, EV).

- Obtain car insurance quotes for your preferred vehicle models *before* finalizing your choice.

- Gather Documents:

- Prepare all necessary income proof (pay stubs, employment letters, CRA NOAs for self-employed).

- Collect identification (driver's license, proof of residency).

- Have bank statements and any other relevant financial documents readily accessible.

- Apply Strategically:

- Start with pre-approval applications, which often involve soft credit checks that don't harm your score.

- Apply to a few different lenders within a short timeframe (e.g., 14-30 days) to minimize the impact of multiple hard inquiries on your credit score.

- Review & Negotiate:

- Scrutinize *every detail* of the loan offer: interest rate (APR), loan term, all fees, and any add-ons.

- Don't be afraid to negotiate the vehicle price, trade-in value (if applicable), interest rate, and specific terms.

- Ensure you understand any prepayment penalties.

- Drive Forward:

- Make an informed decision that supports your long-term financial health.

- Once approved, maintain consistent, on-time payments to continue building your credit and financial independence.

- Enjoy your new independence on the diverse and scenic roads of Ontario!