Ditch Negative Equity Car Loan | 2026 Canada Guide

Table of Contents

- Key Takeaways

- The 'Upside Down' Reality Check: Decoding Negative Equity on Your Canadian Car Loan

- Beyond the Definition: What it truly means to be 'underwater' or 'upside down' on your car loan in the Canadian context.

- Why Canadian Drivers Get Stuck: Common culprits behind negative equity:

- Pro Tip: Early Warning Signs

- Pinpointing the Problem: How to Calculate Your True Negative Equity (and Why it Matters for a Sale)

- Step-by-Step Guide to Finding Your Car's Market Value:

- Accessing Your Outstanding Loan Balance: Contacting your lender for an exact payoff quote (not just your current balance).

- Calculating the 'Equity Gap': Subtracting your car's market value from your outstanding loan balance to reveal the negative equity.

- The Significance of the Gap: Why a smaller gap offers more solutions, while a larger one requires more strategic planning.

- Strategy 1: Bridging the Gap While Keeping Your Ride – The 'Stay & Fix' Approach

- Refinancing Your Way Out: A Canadian Borrower's Guide to Lowering Payments & Building Equity:

- Pro Tip: The Power of a Shorter Loan Term

- Accelerated Payments: Your Personal Equity Acceleration Plan

- The Hidden Value Play: Enhancing Your Car's Worth (Strategically)

- Pro Tip: Focus on Curb Appeal and Mechanical Soundness

- Strategy 2: The Exit Strategy – How to Get Rid of Your Car with Negative Equity (The Real Dilemma)

- The Trade-In Tango: Navigating Dealerships in a Negative Equity Scenario:

- Pro Tip: Never Tell a Salesperson You Have Negative Equity (Initially)

- Selling Privately with an Upside-Down Loan: Is It Even Possible in Canada?

- Voluntary Repossession: The Absolute Last Resort (and Why You Should Avoid It)

- The Lender's Perspective: What Banks and Financial Institutions Look For

- Pro Tip: Building a Strong Case

- Hidden Costs and Unexpected Hurdles: Beyond the Loan Balance

- Your Next Steps to Approval & Freedom: Crafting Your Personalized Exit Plan

- Pro Tip: Don't Let Desperation Drive Decisions

- Preventing the Plunge: Smart Car Buying Strategies for Canadian Drivers

- FAQ: Burning Questions About Negative Equity Car Loans in Canada

Key Takeaways

- Negative equity is a common but manageable challenge for Canadian car owners.

- Ignoring negative equity can lead to a cycle of debt and credit score damage.

- Multiple strategies exist, from 'staying and fixing' to 'exiting strategically,' each with its own pros and cons.

- Understanding your car's true market value and outstanding loan balance is the critical first step.

- Rolling negative equity into a new loan often exacerbates the problem, creating a larger financial burden.

For many Canadian drivers in 2026, the dream of a new car can quickly turn into the nightmare of negative equity. Also known as being "upside down" or "underwater" on your car loan, this financial predicament means you owe more on your vehicle than it's actually worth. It's a surprisingly common issue, especially with rapid depreciation and increasingly longer loan terms, but it's far from an insurmountable problem. Navigating negative equity requires a clear understanding of your financial situation, the market, and the strategic options available to you.

This comprehensive 2026 Canada Guide is designed to equip you with the knowledge and tools needed to ditch that negative equity car loan. We'll dive deep into calculating your exact position, explore viable strategies to either fix the problem while keeping your car or exit the situation strategically, and arm you with the insights to prevent future financial traps. Whether you're in Vancouver, Toronto, Montreal, or any corner of Canada, understanding these mechanics is your first step towards financial freedom on the road.

The 'Upside Down' Reality Check: Decoding Negative Equity on Your Canadian Car Loan

Negative equity on a car loan means your outstanding loan balance is greater than the current market value of your vehicle. This puts you in a financially precarious position, as selling or trading in your car would not generate enough money to cover the remaining debt, leaving you to pay the difference out of pocket.

Beyond the Definition: What it truly means to be 'underwater' or 'upside down' on your car loan in the Canadian context.

Being 'underwater' on your car loan is more than just a financial term; it’s a reality check that can impact your ability to upgrade, refinance, or even simply move on from a vehicle that no longer suits your needs. In Canada, where vehicle prices and interest rates have seen significant fluctuations, understanding this concept is more crucial than ever. It means that if you had to sell your car today, you'd not only lose your vehicle but also still owe money to the bank. This can feel like a financial trap, tying you to a car you can't afford to get rid of.

Why Canadian Drivers Get Stuck: Common culprits behind negative equity:

- Rapid depreciation of new vehicles (especially in the first 1-3 years). A brand-new car begins losing value the moment it leaves the dealership lot. Generally, a new vehicle can lose 20-30% of its value in the first year alone, and another 15-20% over the next two to three years. This steep decline often outpaces the rate at which you pay down your loan principal, particularly in the initial years of the loan.

- Long loan terms (e.g., 72, 84, or even 96 months), common in provinces like Quebec and Ontario, extending the period before equity is built. To make monthly payments more affordable, Canadian lenders and dealerships frequently offer extended loan terms. While this reduces the immediate financial burden, it drastically slows down your equity accumulation. For instance, a 96-month loan on a $40,000 vehicle at 7% interest will see you paying primarily interest for many years before making a significant dent in the principal. This means you stay upside down for a much longer period.

- Zero-down or minimal down payment deals, immediately starting you behind. While appealing, a zero-down payment means you finance the entire purchase price of the car, plus taxes and fees. Since the car immediately depreciates, you're instantly in a negative equity position from day one. A substantial down payment, typically 10-20% of the vehicle's value, is crucial for offsetting initial depreciation.

- High interest rates on previous loans, slowing principal reduction. If you financed your car with a high interest rate, a larger portion of your early payments goes towards interest, not the principal. This further delays the point at which your loan balance falls below your car's market value. For Canadians with less-than-perfect credit, securing a loan at 12-18% isn't uncommon, making negative equity a faster reality.

- Market fluctuations impacting resale values. The used car market can be volatile. Economic downturns, shifts in consumer preferences (e.g., towards electric vehicles), or an oversupply of certain models can cause resale values to drop unexpectedly, pushing you into negative equity even if you started with a good financial position.

Pro Tip: Early Warning Signs

Look for early warning signs your loan might be 'underwater' – a significant gap between your payment and principal reduction, or a sudden drop in market value. If you're 2-3 years into a 7-year loan and feel like your principal hasn't moved much, it's time to investigate.

Pinpointing the Problem: How to Calculate Your True Negative Equity (and Why it Matters for a Sale)

Before you can tackle negative equity, you need to know exactly how much you're dealing with. This isn't just a ballpark figure; precision is key. A small negative equity gap might be covered with a few extra payments, while a large one requires a more substantial plan. Knowing your exact numbers is also vital for any potential sale or trade-in, as it dictates how much cash you might need to bring to the table.

Step-by-Step Guide to Finding Your Car's Market Value:

Determining your car's true market value requires a bit of research, as it fluctuates based on condition, mileage, and local demand.

- Utilizing Canadian resources: AutoTrader, Kijiji, Canadian Black Book, local dealership appraisals (e.g., getting quotes in Vancouver or Toronto).

- AutoTrader.ca and Kijiji.ca: These platforms are excellent for seeing what similar cars are currently listed for in your area. Search for your exact make, model, year, trim level, and approximate kilometres. This gives you a good sense of the private sale market.

- Canadian Black Book (CBB): CBB offers free online valuation tools that provide trade-in and retail values for vehicles based on your specific details (kilometres, condition, location). This is a widely respected industry standard.

- Local Dealership Appraisals: Visit a few dealerships in cities like Vancouver or Toronto. Ask for a trade-in appraisal, even if you're not immediately buying. This gives you a professional estimate of what they would pay for your vehicle. Be transparent that you're just looking for a valuation.

- Considering condition, mileage, and trim level for an accurate assessment. Be honest about your car's condition. A "fair" condition car will fetch less than an "excellent" one. High kilometres significantly impact value, as does the specific trim level (e.g., a base model vs. a fully loaded luxury trim).

Accessing Your Outstanding Loan Balance: Contacting your lender for an exact payoff quote (not just your current balance).

Your monthly statement shows your current balance, but this isn't the same as a payoff quote. A payoff quote is the exact amount required to close your loan on a specific date, including any accrued interest or fees. Always call your lender directly and request a "payoff quote" with a specific valid-until date. This is the only definitive number you should use.

Calculating the 'Equity Gap': Subtracting your car's market value from your outstanding loan balance to reveal the negative equity.

Once you have both numbers, the calculation is straightforward:

Outstanding Loan Balance - Car's Market Value = Negative Equity (or Positive Equity)

Let's look at an example:

| Item | Amount (CAD) |

|---|---|

| Outstanding Loan Balance | $25,000 |

| Car's Market Value | $18,000 |

| Negative Equity | $7,000 |

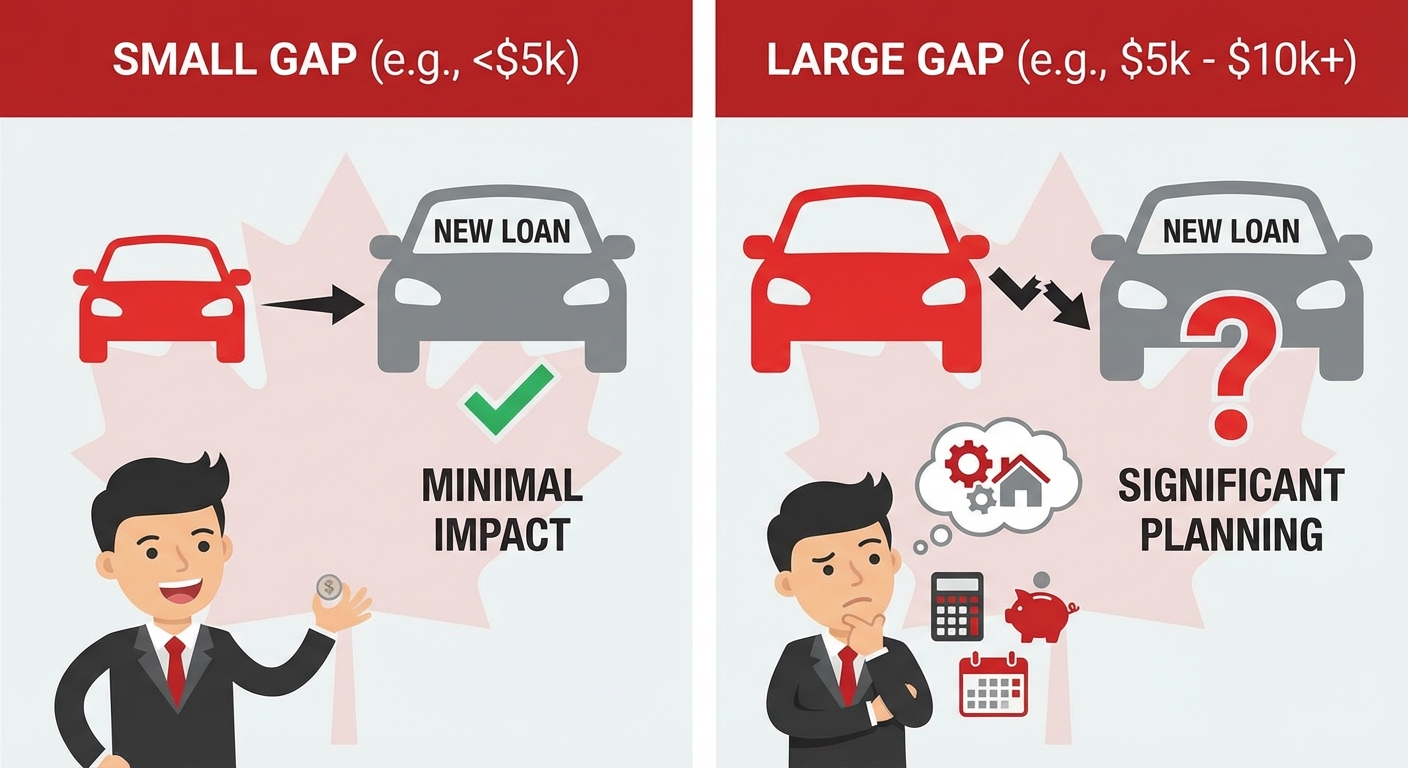

The Significance of the Gap: Why a smaller gap offers more solutions, while a larger one requires more strategic planning.

A smaller negative equity gap (e.g., $1,000 - $3,000) is often easier to manage. You might be able to pay it off directly, cover it with a small personal loan, or negotiate its absorption into a new car loan with minimal impact. A larger gap (e.g., $5,000 - $10,000+) requires more significant financial planning, potentially involving a combination of strategies, extra savings, or a longer-term approach to resolve.

Strategy 1: Bridging the Gap While Keeping Your Ride – The 'Stay & Fix' Approach

Sometimes, getting rid of your car isn't the best option, or simply isn't feasible. In such cases, a "stay and fix" approach focuses on accelerating your equity build-up and improving your financial standing while retaining your current vehicle. This strategy typically involves refinancing, making accelerated payments, and strategically enhancing your car's value.

Refinancing Your Way Out: A Canadian Borrower's Guide to Lowering Payments & Building Equity:

Refinancing your car loan means taking out a new loan to pay off your existing one, ideally with better terms. This can be a powerful tool for tackling negative equity, especially if your financial situation has improved since you first financed the car.

- When Refinancing is Viable:

- Better credit score: If your credit score has improved significantly (e.g., from 620 to 700+), you're likely eligible for lower interest rates.

- Lower interest rates available: The market may have shifted, or your original loan might have been at a higher rate due to your credit at the time.

- Shorter loan terms: While this might increase your monthly payment, a shorter term dramatically accelerates equity build-up and reduces total interest paid.

- Original loan had high interest or unfavorable terms: If you initially got a loan with a high rate or hidden fees, refinancing can correct this.

- Exploring Canadian Lenders: Comparing offers from major banks (e.g., RBC, TD), credit unions, and specialized auto finance companies. Don't just stick with your current lender. Shop around! Major banks like RBC and TD, local credit unions (which often offer competitive rates to their members), and specialized auto finance companies all offer refinancing options. Compare their advertised rates, terms, and any associated fees. For more insights on finding fair loan terms, even with a less-than-perfect credit history, you might find our guide on Your Credit Score is NOT Your Rate. Get a Fair Loan, Toronto. helpful.

- The Refinancing Process: Application, credit check, loan approval, and transfer of lien.

- Application: You'll submit an application with your personal, employment, and vehicle details.

- Credit Check: Lenders will pull your credit report to assess your creditworthiness.

- Loan Approval: If approved, you'll receive a new loan offer with specific interest rates and terms.

- Transfer of Lien: The new lender pays off your old loan, and the lien (the legal right to your vehicle as collateral) is transferred from the old lender to the new one.

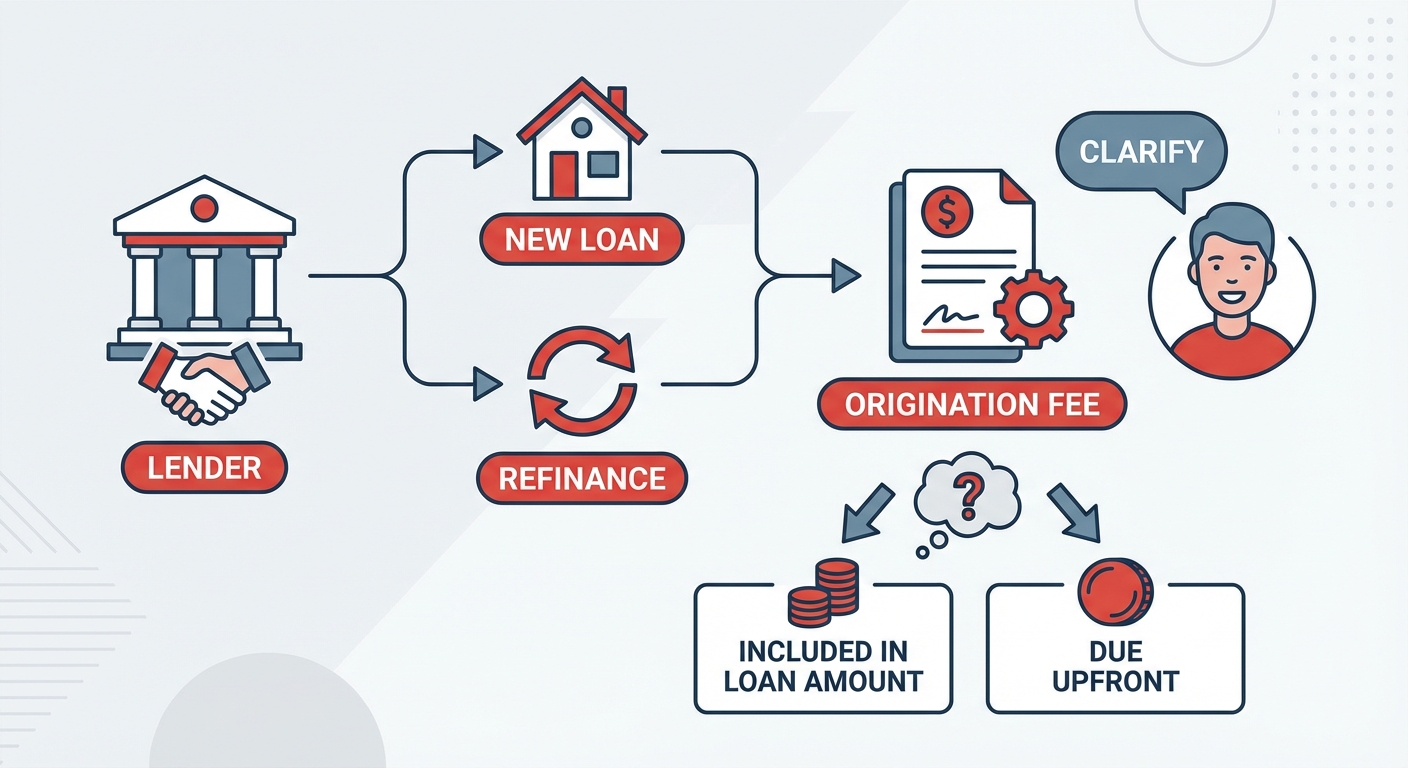

- Hidden Costs of Refinancing: Potential administrative fees, new registration costs. While refinancing can save money, be aware of potential fees. Some lenders charge application or origination fees. You might also incur provincial fees for updating your vehicle registration to reflect the new lienholder. Always ask for a full breakdown of all costs.

Pro Tip: The Power of a Shorter Loan Term

The often-overlooked power of a slightly shorter loan term (e.g., moving from 72 to 60 months) is immense. Even if your monthly payment increases by a small amount, you'll accelerate equity build-up dramatically and save thousands in total interest paid over the life of the loan. For example, refinancing a $20,000 balance at 8% from 72 to 60 months could save you over $1,000 in interest.

Here’s a comparison of a typical loan vs. a refinanced loan scenario (assuming a $25,000 balance remaining, 10% interest, 48 months remaining on original loan):

| Loan Detail | Original Loan (10% APR) | Refinanced Loan (7% APR) |

|---|---|---|

| Remaining Balance | $25,000 | $25,000 |

| Remaining Term | 48 months | 48 months |

| Monthly Payment | $633.37 | $599.93 |

| Total Interest Paid (Remaining) | $5,401.76 | $3,996.60 |

| Total Savings from Refinancing | N/A | $1,405.16 |

This table demonstrates how even a 3% reduction in interest rate on the same term can lead to significant savings, freeing up cash that can then be used to pay down principal faster.

Accelerated Payments: Your Personal Equity Acceleration Plan

Even without refinancing, you can chip away at negative equity by making extra payments. Every extra dollar you put towards your principal reduces the amount of interest you’ll pay over the life of the loan and gets you out of negative equity faster.

- The Power of Small Increases: Rounding up payments, making extra principal-only contributions.

- Rounding Up: If your payment is $458, round it up to $500. That extra $42 per month goes directly to principal, making a surprisingly big difference over time.

- Extra Principal-Only Contributions: If you get a small bonus or find some extra cash, designate it as a principal-only payment. Contact your lender to ensure it’s applied correctly and not just advanced to cover future payments.

- Bi-weekly vs. Monthly Payments: How bi-weekly payments can effectively add one extra payment per year, reducing your loan term and interest. Many Canadian lenders offer bi-weekly payment options. Instead of 12 monthly payments, you make 26 bi-weekly payments (half your monthly payment amount every two weeks). This means you effectively make 13 "monthly" payments per year, significantly shortening your loan term and reducing total interest.

- Lump-Sum Contributions: Applying tax refunds, bonuses, or unexpected windfalls directly to your principal. Any larger, unexpected sums of money – a tax refund, an annual bonus, a modest inheritance, or even proceeds from selling unused items – should be seriously considered for a direct lump-sum payment to your car loan principal. This is one of the fastest ways to build equity.

- Impact on Total Interest Paid: Illustrating how even small, consistent extra payments can save thousands over the life of the loan.

Consider a $30,000 loan at 7% over 72 months ($508.47/month payment).

| Payment Strategy | Monthly Payment | Total Interest Paid | Loan Term Reduction |

|---|---|---|---|

| Standard Monthly | $508.47 | $6,610.16 | 72 months |

| + $50/month (Principal) | $558.47 | $5,221.78 | 62 months |

| Bi-Weekly (Standard) | $254.24 (x26) | $6,274.60 | 69 months |

| Bi-Weekly (+ $25/payment) | $279.24 (x26) | $4,879.36 | 59 months |

As you can see, even a modest extra $50 per month can save you over $1,300 in interest and shave 10 months off your loan term, helping you escape negative equity faster.

The Hidden Value Play: Enhancing Your Car's Worth (Strategically)

While you can't magically reverse depreciation, you can strategically improve your car's perceived and actual value, which can help reduce your negative equity gap when the time comes to sell or trade-in.

- What Genuinely Adds Value: Minor cosmetic repairs, professional detailing, up-to-date maintenance records, new tires (if needed).

- Minor Cosmetic Repairs: Fixing small dents, scratches, or replacing a cracked windshield can significantly improve curb appeal and add more value than the repair cost.

- Professional Detailing: A thorough interior and exterior cleaning can make a car look years newer. It suggests the car has been well-cared for.

- Up-to-Date Maintenance Records: A complete service history shows prospective buyers or dealerships that you've been diligent with maintenance, instilling confidence in the car's reliability.

- New Tires (if needed): Bald tires are a major red flag. If your tires are nearing the end of their life, replacing them can be a worthwhile investment if you're planning to sell soon.

- Wasted Effort & Overspending: Knowing when repairs are too costly or won't yield a return on investment. Don't sink thousands into major engine overhauls or transmission replacements unless you plan to keep the car for many more years. These expensive repairs rarely yield a dollar-for-dollar return on investment when selling, especially if you're already in negative equity. Similarly, highly personalized modifications might not appeal to a broad market.

Pro Tip: Focus on Curb Appeal and Mechanical Soundness

Focus on curb appeal and mechanical soundness for the best potential return, especially if considering a future sale or trade-in. A clean car with no obvious warning lights on the dash and a well-documented service history will always command a better price than a mechanically questionable or visually neglected one.

Strategy 2: The Exit Strategy – How to Get Rid of Your Car with Negative Equity (The Real Dilemma)

Sometimes, keeping the car isn't an option. You might need a different vehicle, or the existing car is becoming a financial burden. This is where the 'exit strategy' comes into play – a set of approaches focused on getting rid of the car, even with negative equity. This path often requires careful planning and a clear understanding of the financial implications.

The Trade-In Tango: Navigating Dealerships in a Negative Equity Scenario:

Trading in your vehicle at a dealership is the most common way Canadians transition from one car to another. However, when you have negative equity, this process becomes a delicate dance.

- The 'Rolling Over' Trap: How dealers in Alberta or Ontario might absorb your negative equity into a new car loan, creating a larger, more expensive new loan. This is the most prevalent pitfall. A dealer might offer to take your old car as a trade-in and simply add the negative equity onto your new car loan. For example, if you have $5,000 in negative equity and want a new $30,000 car, the dealer might finance you for $35,000. While this sounds convenient, it means you're now paying interest on a debt that has nothing to do with your new vehicle. This increases your monthly payments, total interest paid, and puts you in an even deeper negative equity hole on your new car from day one. This practice is widespread in provinces like Alberta and Ontario, where dealerships aim to facilitate sales.

- Negotiating Tactics: Always get a separate valuation for your trade-in before discussing the price of a new vehicle. Treat your trade-in as a separate transaction. Ask the dealership for their best cash offer for your existing car first, without any commitment to buying a new one. Once you have that firm number, then you can discuss the price of the new vehicle. This prevents the dealer from inflating your trade-in value while simultaneously inflating the price of the new car. For strategies on maximizing your trade-in value, our article on Your Trade-In Is Your Credit Score. Seriously. Ontario. offers valuable insights.

- The 'Cash Down' Advantage: Using your own funds to cover the negative equity at the time of trade-in. The ideal scenario is to pay off the negative equity with cash at the time of trade-in. If you have $5,000 negative equity, bring $5,000 to the dealership. This clears the old loan entirely, allowing you to start fresh with your new car loan without any carry-over debt. This is financially the cleanest way to handle the situation.

Pro Tip: Never Tell a Salesperson You Have Negative Equity (Initially)

Never tell a salesperson you have negative equity until you have a firm offer on your new vehicle and a separate, clear offer for your trade-in. Let them appraise your car and make their best offer first. This prevents them from factoring your negative equity into their initial pricing strategy, which can be detrimental to your negotiation power.

Here’s an example of the 'rolling over' trap:

| Scenario | Old Car Loan Balance | Old Car Trade-in Value | Negative Equity | New Car Price | New Loan Amount | Estimated Monthly Payment (7% APR, 72 months) |

|---|---|---|---|---|---|---|

| Option 1: Roll Over Negative Equity | $20,000 | $15,000 | $5,000 | $30,000 | $35,000 | $594.12 |

| Option 2: Pay Off Negative Equity with Cash | $20,000 | $15,000 | $5,000 | $30,000 | $30,000 | $509.30 |

| Monthly Savings (Option 2 vs. Option 1) | N/A | N/A | N/A | N/A | N/A | $84.82 |

Over 72 months, that $84.82/month difference from rolling over negative equity adds up to over $6,100 in extra payments, plus more interest paid on the new loan.

Selling Privately with an Upside-Down Loan: Is It Even Possible in Canada?

Selling your car privately often yields a higher price than trading it into a dealership. However, when you have negative equity, a private sale becomes more complex due to the lien on your vehicle.

- The Legalities of Selling a Financed Car in Canada: Understanding the lien on your vehicle's title and your lender's requirements. In Canada, if you have a car loan, your lender holds a lien on the vehicle. This means they are the legal owner until the loan is fully paid off. You cannot legally transfer ownership to a new buyer until this lien is cleared. The lender will be listed on your vehicle's registration (e.g., on the UVIP in Ontario or similar documents in other provinces).

- Working with Your Lender: Facilitating the sale process with your bank to ensure the lien is properly discharged. You must involve your lender in a private sale. Inform them of your intention to sell and request a payoff quote. The ideal scenario is that the buyer pays the full sale price directly to your lender, and if there's a surplus, it goes to you. If there's negative equity, you'll need to pay the difference to the lender to clear the lien. Your lender will then provide a letter confirming the lien release, which is necessary for transferring ownership to the buyer.

- Finding the Buyer: Challenges and best platforms (Kijiji, Facebook Marketplace, AutoTrader Private Listings in cities like Montreal or Calgary). Finding a private buyer for a car with negative equity can be challenging because most buyers expect a clean title immediately. Be transparent about the lien. Platforms like Kijiji, Facebook Marketplace, and AutoTrader's private listings are popular in Canadian cities like Montreal or Calgary for connecting private sellers with buyers.

- The 'Cash to Close' Problem: Where to get the extra funds if the sale price doesn't cover the full loan balance. This is the biggest hurdle. If your car sells for $15,000 but you owe $20,000, you have a $5,000 negative equity gap. You must come up with that $5,000 out of pocket to pay your lender and clear the lien. Options include personal savings, a personal line of credit, or a small personal loan. Failing to do so means you cannot legally sell the car. For buyers with poor credit looking for private sales, our guide on Cash-Only Private Sale? Your Poor Credit *Just Bought The Car*, Edmonton. might offer some perspective, though it's focused on the buyer's side.

- Mitigating Risk: Using certified checks, bank drafts, and conducting transactions at your bank for security. Always conduct the financial transaction safely. For the buyer's payment, insist on a certified check or bank draft. Ideally, meet at your bank. The buyer can hand the bank draft to your teller, who can then verify it and apply it directly to your loan. This ensures the funds are legitimate and the loan is paid off, allowing the lien to be released safely.

Voluntary Repossession: The Absolute Last Resort (and Why You Should Avoid It)

Voluntary repossession, also known as a voluntary surrender, is when you proactively return your vehicle to the lender because you can no longer afford the payments. While it might seem like an easy way out, it is almost always the worst possible option.

- Severe Credit Implications: The long-term damage to your credit score across Canada (typically remains for 6-7 years). A voluntary repossession will severely damage your credit score. It will be listed on your credit report (Equifax and TransUnion) for 6 to 7 years, making it extremely difficult to obtain any new credit (car loans, mortgages, credit cards) at reasonable rates during that time.

- Deficiency Judgments: Understanding that you will likely still owe the difference between the car's auction price and your loan balance, plus fees. When you surrender a car, the lender sells it at auction, usually for a price significantly below market value. You will still be responsible for paying the "deficiency" – the difference between the auction sale price and your outstanding loan balance, plus all repossession, auction, and administrative fees. This means you lose your car and still have a significant debt.

- Legal Recourse for Lenders: How banks pursue outstanding debts, even after repossession. Lenders are not shy about pursuing deficiency judgments. They can take legal action against you to collect the remaining debt, potentially leading to wage garnishments, bank account levies, or liens on other assets.

- Exploring Alternatives First: Why almost any other option is preferable to voluntary repossession. Before considering voluntary repossession, explore every other strategy discussed in this guide. Refinancing, accelerating payments, selling privately (even with a small personal loan to cover the gap), or even talking to a non-profit credit counsellor are all far better options with less severe long-term consequences.

The Lender's Perspective: What Banks and Financial Institutions Look For

When you're trying to refinance a loan or secure a new one, understanding what your lender is looking for can significantly improve your chances of approval and getting favourable terms. Lenders assess risk, and your financial profile dictates how they perceive that risk.

- Credit Score is King: Understanding how your Equifax and TransUnion reports influence decisions. Your credit score, compiled by agencies like Equifax and TransUnion, is a primary indicator of your creditworthiness. A higher score (generally 680+) indicates a lower risk and qualifies you for better interest rates. Scores below 600 often mean higher rates or outright denial. Lenders want to see a history of responsible borrowing and timely payments.

- Debt-to-Income Ratio: Your capacity to repay new or refinanced loans. Your Debt-to-Income (DTI) ratio is a percentage that compares your total monthly debt payments to your gross monthly income. Lenders typically prefer a DTI of 36% or lower. If you're carrying a lot of debt (including your existing car loan, credit cards, mortgage, etc.), adding more debt through a new or refinanced car loan might make your DTI too high, signaling that you might struggle to make payments.

- Collateral Value: The car's actual worth versus the loan amount. For a car loan, the vehicle itself acts as collateral. Lenders are more comfortable when the car's market value is close to or exceeds the loan amount. If your car has significant negative equity, the collateral value is less than the loan, increasing the lender's risk.

- Loan-to-Value (LTV) Ratio: Why a high LTV makes approval harder. The Loan-to-Value (LTV) ratio compares the loan amount to the collateral's value. An LTV of 100% means the loan equals the car's value. If you have negative equity, your LTV is over 100% (e.g., you owe $25,000 on a car worth $20,000, so LTV is 125%). Lenders are hesitant to approve loans with very high LTVs because if you default, they are unlikely to recoup their losses by selling the car.

Pro Tip: Building a Strong Case

Building a strong case for refinancing or a new loan means gathering all relevant financial documents, explaining your situation clearly, and demonstrating a commitment to repayment. Highlight any improvements in your credit score, income, or debt reduction efforts since your last loan. Be prepared to show pay stubs, bank statements, and your current loan details.

Here's a simplified look at how lender criteria can vary:

| Criteria | Good Credit (700+) | Fair Credit (600-699) | Poor Credit (Below 600) |

|---|---|---|---|

| Interest Rate Range (2026 Estimate) | 4.99% - 8.99% | 8.99% - 15.99% | 15.99% - 29.99% |

| Preferred LTV Ratio | Up to 100-110% | Up to 90-100% (less flexible) | Often requires lower LTV, or significant down payment |

| Debt-to-Income (DTI) | Below 40% | Below 45% (more scrutiny) | Below 50% (very high scrutiny, often requires co-signer) |

| Down Payment Expectation | Optional, but always helps | Often recommended (5-10%) | Often required (10-20% or more) |

This table highlights why improving your credit and managing your debt are crucial steps before approaching lenders, especially when dealing with existing negative equity.

Hidden Costs and Unexpected Hurdles: Beyond the Loan Balance

When dealing with negative equity, it's easy to focus solely on the principal balance. However, several other costs and hurdles can arise, potentially adding to your financial burden. Being aware of these can help you budget accurately and avoid unpleasant surprises.

- Early Termination Fees: (If applicable) penalties for paying off a loan sooner than scheduled. Some car loans, especially those with fixed interest rates or from certain subprime lenders, might include clauses for early termination fees or prepayment penalties. Always check your loan agreement carefully. While less common with prime auto loans in Canada, they can exist and add hundreds of dollars to your payoff amount.

- Lien Release Fees & Administrative Costs: Small but often overlooked charges from your lender or provincial registries. When you pay off a loan, your lender might charge a small administrative fee to process the lien release. Additionally, provincial registries (e.g., Service Ontario, ICBC in BC, SAAQ in Quebec) may charge a fee to update the vehicle's ownership records and remove the lien from the title or registration. These are usually modest fees but can add up.

- Sales Tax Implications: Understanding how provincial sales tax (PST/HST) applies to trade-ins versus private sales (e.g., differences between Manitoba's PST and Nova Scotia's HST). Sales tax rules vary significantly by province and can impact your decision.

- Trade-in: In many provinces (e.g., Ontario, British Columbia, Alberta), sales tax (PST/HST) is generally applied only to the *difference* between the price of the new car and the trade-in value. If you trade in a car worth $15,000 for a new car priced at $30,000, you only pay tax on $15,000. This is a significant tax saving.

- Private Sale: If you sell privately, and then buy a new car, you'll pay full sales tax on the new purchase, missing out on the trade-in tax credit. For example, in Manitoba, you'd pay 7% PST on the full new car price. In Nova Scotia, it would be 15% HST. This difference can amount to thousands of dollars.

- Insurance Considerations: If you're keeping a car with negative equity, ensuring you have adequate coverage, including gap insurance. If you're staying with a car that has negative equity, ensure you have comprehensive and collision insurance. More importantly, consider gap insurance. Gap insurance covers the "gap" between what your standard auto insurance pays out (the Actual Cash Value) if your car is totaled or stolen, and what you still owe on your loan. Without it, if your car is worth $18,000 but you owe $25,000, you'd still be on the hook for $7,000 after your insurer pays out.

- New Loan Origination Fees: Costs associated with setting up a new loan or refinancing. Similar to early termination fees, some lenders (especially those dealing with higher-risk borrowers) may charge an origination fee to set up a new loan or refinance. Always clarify if these fees are included in the loan amount or due upfront.

Your Next Steps to Approval & Freedom: Crafting Your Personalized Exit Plan

Ditching negative equity isn't a one-size-fits-all solution. It requires a personalized approach, careful planning, and often, a dose of patience. The key is to be proactive and make informed decisions rather than reactive ones driven by desperation.

- Step 1: Get All Your Numbers in Order: Accurate market value, precise loan payoff, and understanding your financial capacity. You cannot make a sound decision without solid data. Know exactly what your car is worth, what you owe (get that payoff quote!), and realistically assess how much extra cash you can put towards the problem, either through savings or increased monthly payments.

- Step 2: Explore All Options Before Committing: Don't rush into a decision; weigh the long-term impact of each strategy. List out the pros and cons of refinancing, accelerating payments, selling privately, or trading in for your specific situation. Consider the financial implications over the next 1-3 years. A hasty decision, like rolling over significant negative equity, can haunt you for years.

- Step 3: Consult Financial Advisors: Especially if your debt feels overwhelming, a professional can offer unbiased guidance. If you feel overwhelmed or unsure of the best path forward, a certified financial advisor or a reputable non-profit credit counsellor can provide unbiased advice tailored to your complete financial picture. They can help you create a realistic budget and debt reduction plan.

- Step 4: The Power of Patience and Responsible Financial Planning: Building an emergency fund, improving credit, and saving for a down payment are long-term solutions. Getting out of negative equity, especially a large amount, takes time. Use this period to build healthier financial habits. Start an emergency fund, actively work on improving your credit score, and begin saving for a substantial down payment on your next vehicle. These long-term strategies will not only get you out of your current bind but prevent future ones.

Pro Tip: Don't Let Desperation Drive Decisions

Don't let desperation drive your decisions. A hasty move (like rolling over negative equity without understanding the consequences or opting for voluntary repossession) can worsen your financial situation significantly. Take a breath, get educated, and choose the strategy that offers the best long-term financial health.

Taking control of your negative equity situation is a crucial step towards regaining financial freedom and making smarter choices for your future car purchases. Start your journey today!

Preventing the Plunge: Smart Car Buying Strategies for Canadian Drivers

The best way to deal with negative equity is to avoid it entirely. By adopting smart car buying habits, Canadian drivers in 2026 can significantly reduce their risk of going "upside down" on their next vehicle purchase. These strategies focus on maintaining positive equity from day one.

- The Power of a Significant Down Payment: Starting with equity from day one. A substantial down payment (ideally 10-20% of the purchase price) is your strongest defense against negative equity. It immediately reduces the amount you need to finance and creates a buffer against initial depreciation, ensuring you start your loan with positive equity. For those starting with no credit, making a down payment can be even more crucial; consider our guide on Zero Credit? Perfect. Your Canadian Car Loan Starts Here.

- Shorter Loan Terms: Why 48 or 60 months typically beats 72 or 84 months for building equity and saving interest. While longer terms offer lower monthly payments, they keep you in debt longer and slow down equity accumulation. Shorter terms, like 48 or 60 months, ensure you pay off the principal faster than the car depreciates, leading to positive equity much sooner and significantly reducing the total interest paid.

- Understanding Depreciation: Choosing vehicles known for better resale value (e.g., researching specific brands known for holding value well in British Columbia or Saskatchewan). Not all cars depreciate at the same rate. Research vehicles with strong resale values. Brands like Honda, Toyota, and Subaru often hold their value well in Canadian markets, including regions like British Columbia or Saskatchewan. Websites like Canadian Black Book provide data on vehicle depreciation. Choosing a car that retains its value helps protect your equity.

- Gap Insurance: When this supplemental insurance is a wise investment (especially for new cars with low down payments). If you do opt for a minimal down payment or a longer loan term on a new vehicle, gap insurance is a wise investment. It covers the difference between your car's actual cash value (what your regular insurance would pay out if it's totaled or stolen) and your outstanding loan balance. It provides peace of mind against unforeseen events that could otherwise leave you with a significant debt and no car.

- Regular Market Value Checks: Periodically compare your car's value to your loan balance to stay informed. Make it a habit to check your car's market value against your loan balance every 6-12 months. This allows you to monitor your equity position and identify if you're approaching negative equity before it becomes a major problem. Early detection gives you more time to implement preventive measures.