Bankruptcy Discharge: Your Car Loan's Starting Line.

Table of Contents

- II. Key Takeaways: Your Fast Track to a Car Loan After Discharge

- III. Debunking the Myths: Why a Car Loan After Discharge IS Possible

- The 'Forever Ruined' Fallacy

- The 'No Loan for Years' Myth

- Bankruptcy vs. Consumer Proposal

- Comparing Insolvency Options and Lender Perception

- IV. Before You Even Look at Cars: Setting Your Financial Foundation

- 4.1 The Credit Score Reboot: Post-Bankruptcy Edition

- 4.2 Budgeting for Reality: What You Can Truly Afford

- 4.3 The Down Payment Power-Up

- V. Navigating the Lender Landscape: Who Will Say Yes?

- 5.1 Specialized Lenders: Your First Stop on the Road to Recovery

- 5.2 Dealership Finance Departments: Convenience vs. Cost

- 5.3 Traditional Banks & Credit Unions: A Later Stage Option

- 5.4 The Co-Signer Conundrum: When it Helps, When it Hurts

- VI. Crafting Your Winning Application: More Than Just Numbers

- 6.1 Gathering Your Arsenal: Documents & Details for Approval

- 6.2 The Art of Honesty & Transparency: Building Trust with Lenders

- 6.3 Pre-Approval Power: What it Means and How to Get It

- VII. Decoding the Deal: Interest Rates, Terms & Hidden Traps

- 7.1 Understanding Interest Rates: Expecting Higher, Aiming Lower

- 7.2 Loan Terms: Short vs. Long – The True Cost of Flexibility

- 7.3 Beyond the Sticker Price: Fees & Add-ons to Scrutinize

- VIII. Driving Forward: Managing Your New Loan & Rebuilding for Good

- 8.1 The Power of Punctual Payments: Your Credit Rebuilding Engine

- 8.2 The Refinancing Advantage: Lowering Your Rate Later

- 8.3 Avoiding the Debt Cycle Repeat: Sustaining Financial Health

Facing bankruptcy can feel like reaching a dead end on your financial journey. The weight of debt is lifted, but often, a new anxiety settles in: "Will I ever be able to get a car loan again?" It's a common, completely understandable concern, born from widespread misconceptions about life after insolvency. Many believe that a bankruptcy discharge means years, if not a lifetime, of being shut out from significant credit, especially for something as crucial as a vehicle.

But what if we told you that bankruptcy isn't a financial endpoint, but rather a powerful financial reset? It's a challenging chapter, yes, but its discharge marks a new beginning – a starting line, not a finish line, for rebuilding your credit and securing the assets you need, like a reliable car. This isn't about ignoring the past; it's about learning from it and strategically moving forward with renewed financial literacy.

This guide isn't just another generic article offering vague advice. We're here to provide you with practical, actionable strategies tailored for Canadians navigating the post-bankruptcy landscape. We'll dive deep into understanding your new credit profile, identifying the right lenders, crafting a winning application, and ultimately, using a car loan as a powerful engine to rebuild your credit score. If you're ready to leave the past in the rearview mirror and drive towards a stronger financial future, you're in the right place.

II. Key Takeaways: Your Fast Track to a Car Loan After Discharge

Navigating the world of car loans after a bankruptcy discharge can seem daunting, but it's far from impossible. Here are the essential points to keep in mind as you embark on this journey:

- Immediate Hope: Getting a car loan post-discharge is not just possible, but a common and achievable goal. Many Canadians successfully secure financing soon after their bankruptcy is discharged.

- Preparation is Power: Your success hinges on understanding your credit situation, setting a realistic budget that accounts for all vehicle costs, and meticulously building a strong, transparent application.

- Lender Diversity: Don't limit your search to traditional banks. Specialized lenders and dealership finance programs are specifically designed to work with individuals rebuilding their credit and are often far more accessible initially.

- Down Payment Advantage: A significant down payment is your single most effective tool. It dramatically improves approval odds, signals commitment to lenders, and helps secure more favourable terms.

- Credit Rebuilding Engine: An auto loan, when managed responsibly with consistent, on-time payments, is a powerful and efficient tool for actively rebuilding your credit score and demonstrating new financial stability.

III. Debunking the Myths: Why a Car Loan After Discharge IS Possible

The aftermath of bankruptcy is often shrouded in myths that can leave individuals feeling hopeless about their financial future, especially concerning major purchases like a car. Let's shine a light on the truth and dispel these common misconceptions.

The 'Forever Ruined' Fallacy

One of the most pervasive myths is that bankruptcy "forever ruins" your credit. While it's true that a bankruptcy filing significantly impacts your credit score and remains on your credit report for several years (6-7 years in Canada, depending on the province and whether it's a first or second bankruptcy), its discharge is a crucial turning point. To lenders, discharge signals a fresh start. It means your old, unmanageable debts have been legally wiped out, and you are no longer burdened by them. This clean slate, combined with a stable income, can actually make you a more attractive borrower to certain lenders than someone struggling with a mountain of unsecured debt. You're no longer seen as a high risk due to overwhelming debt; instead, you're a new risk, with a clear path to demonstrating renewed financial responsibility.

The 'No Loan for Years' Myth

Many believe they must wait several years after discharge before even thinking about a car loan. This simply isn't true. While some traditional lenders might prefer a longer waiting period, many specialized lenders and dealership finance departments are prepared to work with you almost immediately after your bankruptcy is discharged. The key is to demonstrate current stability – a steady job, a reasonable income, and a clear budget. In fact, getting a car loan relatively soon after discharge can be a strategic move, as it allows you to start rebuilding your credit history much sooner. For an in-depth look at how quickly you can get back on track, check out our guide on Discharged? Your Car Loan Starts Sooner Than You're Told.

Bankruptcy vs. Consumer Proposal

It's important to understand that not all insolvency options are viewed identically by lenders. A Consumer Proposal, for instance, is an offer made to your creditors to pay a portion of what you owe, over a period of time, often to avoid bankruptcy. While both impact your credit, a Consumer Proposal typically has a slightly less severe impact and is removed from your credit report sooner (three years after completion, compared to 6-7 years for bankruptcy). Lenders often perceive a Consumer Proposal as a slightly more responsible approach to debt resolution, as it involves a commitment to repay a portion of what's owed. However, regardless of the path taken, the principles for securing a car loan remain similar: demonstrate new financial stability and a commitment to on-time payments.

Pro Tip: Understanding Your Credit Report Post-Discharge

After your bankruptcy discharge, it's absolutely critical to obtain and meticulously review your credit report from both Equifax and TransUnion. Ensure all old debts included in the bankruptcy are correctly marked as "discharged" or "included in bankruptcy" with a zero balance. Dispute any inaccuracies immediately. This clean-up process is vital because lenders rely on this report to assess your current standing. Knowing exactly what's on your report empowers you to explain your situation clearly and confidently to potential lenders.

Comparing Insolvency Options and Lender Perception

To further clarify the differences, here's a brief comparison:

| Feature | Bankruptcy | Consumer Proposal |

|---|---|---|

| Definition | Legal process to eliminate most unsecured debts, administered by a Licensed Insolvency Trustee. | A legally binding offer to creditors to pay a percentage of what you owe, or extend the time to pay. |

| Credit Report Impact | Remains for 6-7 years (first bankruptcy) after discharge. More significant initial score drop. | Remains for 3 years after completion of the proposal. Less severe initial score drop. |

| Debt Elimination | Most unsecured debts are discharged. | Reduces total debt owed, but you still pay a portion. |

| Lender Perception | Clean slate after discharge; focus on current income/stability. | Often viewed slightly more favourably due to commitment to repaying a portion of debt. |

| Rebuilding Timeframe | Can start rebuilding immediately post-discharge. | Can start rebuilding during or immediately after completion. |

IV. Before You Even Look at Cars: Setting Your Financial Foundation

Securing a car loan after bankruptcy isn't just about finding a lender; it's about setting yourself up for long-term financial success. This means laying a robust financial foundation long before you step onto a dealership lot.

4.1 The Credit Score Reboot: Post-Bankruptcy Edition

After a bankruptcy discharge, your credit profile essentially gets a hard reset. Old debts are gone, but so is much of your positive payment history. Your "new" credit profile will likely show a low score, but crucially, it's a blank slate for new, positive entries. This is your opportunity to build a new, strong credit history from the ground up.

Strategies for rapid credit rebuilding are crucial. Start with a secured credit card; you deposit money as collateral, and that becomes your credit limit. Use it for small, regular purchases and pay the balance in full every month. This demonstrates responsible credit usage. Another option is a small installment loan, sometimes called a credit builder loan, specifically designed to help you make regular payments and establish history. Becoming an authorized user on a trusted family member's credit card can also help, provided they have good credit and you both understand the implications. The critical importance of establishing new, positive credit history with on-time payments cannot be overstated. Every single payment, even for small bills like utilities or cell phone contracts, made consistently and on time, contributes to repairing and rebuilding your credit score.

4.2 Budgeting for Reality: What You Can Truly Afford

Many people make the mistake of only considering the monthly car payment. However, owning a car involves a multitude of expenses that can quickly derail a carefully planned budget. Moving beyond the monthly payment means a comprehensive cost analysis. This includes:

- Insurance: Often higher for drivers with a history of bankruptcy. Get quotes *before* you buy.

- Fuel: A significant ongoing expense, especially with fluctuating gas prices and daily commutes.

- Maintenance: Regular oil changes, tire rotations, and unexpected repairs are inevitable. Budget for these.

- Registration & Licensing: Annual fees that add up.

- Parking: If applicable in your area.

Calculating your true Debt-to-Income (DTI) ratio post-discharge is paramount. Lenders use DTI to assess your ability to manage monthly payments. It's the percentage of your gross monthly income that goes towards debt payments. After bankruptcy, your DTI should ideally be low, as most debts are gone. Keep it that way by only taking on manageable new debt. Setting realistic vehicle expectations is also key. Prioritize reliability and affordability over luxury. A reliable used car, perhaps 3-5 years old, is often a much wiser choice than a brand-new vehicle, which depreciates rapidly and comes with higher insurance and financing costs. Focus on practical makes and models that fit your needs, not your past desires.

4.3 The Down Payment Power-Up

Why is a substantial down payment your single most effective tool for approval and better terms post-bankruptcy? Because it directly addresses the lender's primary concern: risk. A larger down payment reduces the amount you need to borrow, which in turn lowers the lender's exposure. It signals to them that you have skin in the game, that you're committed, and that you have disposable income and good saving habits. This translates into better approval odds, and often, more favourable interest rates and loan terms.

Practical strategies for saving aggressively after discharge include identifying disposable income you might not have noticed before. Temporary lifestyle adjustments – cutting back on non-essential spending, dining out less, finding cheaper entertainment – can free up significant funds. Even a few hundred extra dollars a month can accumulate quickly. The direct impact of down payment size on reducing perceived risk, lowering interest rates, and improving loan-to-value (LTV) ratios cannot be overstated. LTV is the loan amount divided by the vehicle's value. A lower LTV (meaning a higher down payment) makes the loan less risky for the lender, as they have more equity in the vehicle from the start.

Pro Tip: Get a Copy of Your Credit Report & Score Regularly

Monitoring your credit report and score isn't a one-time task. After bankruptcy, make it a regular habit. Obtain free annual reports from Equifax and TransUnion and consider a paid monitoring service for more frequent updates. This allows you to track your progress, identify any potential fraud, and ensure all information is accurate. Knowing your score and what's on your report empowers you when discussing financing options with lenders.

V. Navigating the Lender Landscape: Who Will Say Yes?

Understanding where to apply for a car loan after bankruptcy is just as important as preparing your finances. Not all lenders are created equal, especially when it comes to individuals rebuilding their credit.

5.1 Specialized Lenders: Your First Stop on the Road to Recovery

When traditional banks might seem hesitant, specialized lenders, often referred to as subprime lenders, become your most viable option. These lenders have a business model specifically designed for higher-risk profiles, including individuals with recent bankruptcies or low credit scores. They understand that life happens, and they focus less on your past credit missteps and more on your current ability to pay.

How do these lenders assess risk differently? Instead of relying solely on a high credit score, they place a greater emphasis on your current income stability, employment history, debt-to-income ratio (post-discharge, this should be favourable), and your willingness to make a down payment. They look at your future payment capacity, not just your past credit history. Many finance companies, including those partnered with SkipCarDealer.com, have dedicated bankruptcy programs with specific criteria designed to help you get back on your feet. For more insights on how these types of lenders operate, you might find our article No Credit? Great. We're Not Your Bank. particularly enlightening.

5.2 Dealership Finance Departments: Convenience vs. Cost

Dealership finance managers play a crucial role as intermediaries. They have established relationships with a network of lenders, including traditional banks, credit unions, and, importantly for you, a wide array of subprime lenders. This can offer a convenient one-stop shop for finding financing. They can often quickly match your profile with a lender willing to approve your loan.

However, it's essential to be aware of potential markups on interest rates and fees. Dealerships often add a margin to the interest rate offered by the lender, which is how they make additional profit on the financing. Strategies for negotiation include doing your homework on interest rates beforehand, being pre-approved (more on this later), and being prepared to walk away if the terms aren't reasonable. The "buy here, pay here" model, where the dealership itself is the lender, offers easy approval, but often comes with very high interest rates and sometimes limited reporting to credit bureaus, which can hinder your credit rebuilding efforts. Use this option only as a last resort and be extremely cautious.

5.3 Traditional Banks & Credit Unions: A Later Stage Option

Immediately after discharge, securing a car loan from a major bank or credit union can be challenging. Their underwriting criteria are typically much stricter, often requiring a longer period of positive credit history and a higher credit score than you'll likely have right after bankruptcy. They are generally less forgiving of recent insolvency.

However, building a relationship with your bank post-bankruptcy is still valuable. Start with a chequing and savings account, and consider a secured credit card through them. After a period of 12-24 months of consistent, positive payment history on your new credit accounts (including your first car loan, if you get one through a specialized lender), you can re-approach traditional lenders for refinancing or future loans. They value loyalty and demonstrated financial stability over time.

5.4 The Co-Signer Conundrum: When it Helps, When it Hurts

Having a co-signer with good credit can significantly boost your chances of approval and potentially secure better interest rates and terms. The co-signer's strong credit profile offsets your weaker one, reducing the perceived risk for the lender. This can be a game-changer if you're struggling to get approved on your own.

However, it's vital to understand the significant risks and responsibilities for both parties. A co-signer is equally responsible for the loan. If you miss payments, it negatively impacts their credit score, and they are legally obligated to make the payments. This can strain relationships. Legal implications are serious, so ensure there are clear agreements and open communication to protect both your financial health and your personal relationships.

Pro Tip: Don't Apply Everywhere at Once

Each time you apply for credit, a 'hard inquiry' is recorded on your credit report. Too many hard inquiries in a short period can temporarily ding your credit score and make you appear desperate to lenders. Strategize your applications. Research lenders known for working with post-bankruptcy clients, get pre-qualified (which often involves a 'soft inquiry' that doesn't affect your score), and then apply to a select few with the highest likelihood of approval.

VI. Crafting Your Winning Application: More Than Just Numbers

Your application isn't just a collection of forms; it's your opportunity to tell your financial story and demonstrate your commitment to a fresh start. A well-prepared, honest application significantly increases your chances of approval.

6.1 Gathering Your Arsenal: Documents & Details for Approval

Preparation is key. Lenders will want to see a clear picture of your current financial situation. A comprehensive checklist of essential documents includes:

- Proof of Income: Recent pay stubs (usually 2-3 months), employment letters confirming your position and salary, or if self-employed, bank statements and tax assessments. For more on what income verification might be needed, especially if you're self-employed, consider resources like Approval Secrets: Exactly What Paperwork You Need for Alberta Car Financing.

- Proof of Residency: Utility bills, lease agreements, or mortgage statements showing your current address.

- Identification: Valid government-issued photo ID (e.g., driver's licence, passport).

- Bankruptcy Discharge Papers: This is crucial. It proves your bankruptcy is complete and you are free of past debts.

- Bank Statements: Recent statements to show financial stability and a healthy cash flow.

Beyond the paperwork, be ready to provide a concise, honest explanation of your bankruptcy. This isn't about making excuses, but about demonstrating that you understand what happened, what you've learned, and your commitment to financial recovery. Lenders want to see stable employment history and consistent income as key indicators of your ability to make future payments. If you've recently changed jobs, explain the stability of your new role.

6.2 The Art of Honesty & Transparency: Building Trust with Lenders

Attempting to hide or downplay past financial issues is a critical mistake and can lead to immediate denial. Lenders will see your bankruptcy on your credit report, so trying to conceal it only erodes trust. Instead, be upfront and transparent. This is the "art of honesty."

Showcasing your proactive steps towards financial responsibility and stability since discharge is paramount. Talk about your new budget, your efforts to save for a down payment, and any new credit accounts you've opened and managed well. Communicate your understanding of the loan terms – the interest rate, the payment schedule, the total cost – and clearly articulate your capability to repay. This level of transparency builds trust and demonstrates maturity, which can be very persuasive to lenders.

6.3 Pre-Approval Power: What it Means and How to Get It

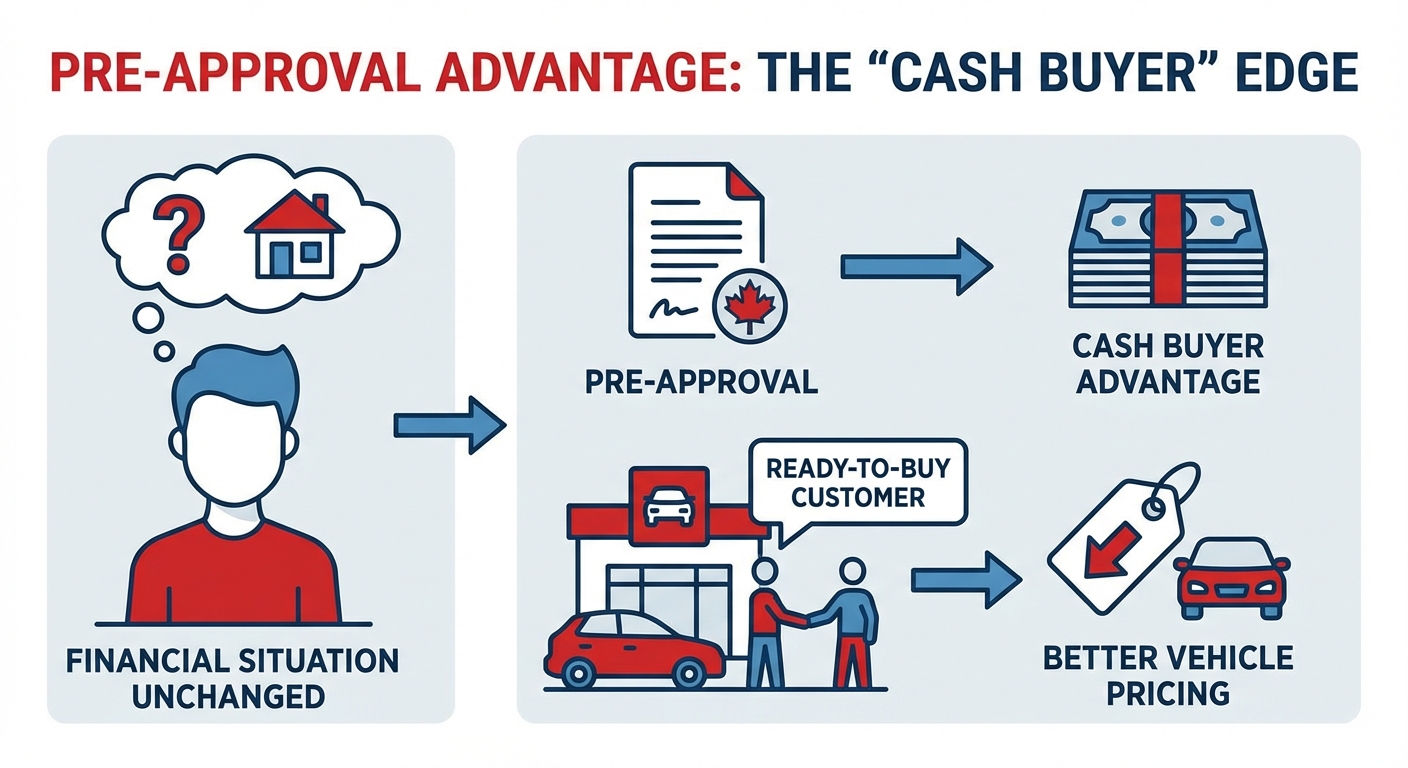

Securing pre-approval before you even step onto a dealership lot offers significant strategic benefits. It's like having a confirmed budget in your pocket. You'll know exactly how much you can borrow, at what interest rate, and for what term. This knowledge gives you immense negotiating power, allowing you to focus on the vehicle price rather than being swayed by monthly payment figures. It also helps you avoid pressure tactics from salespeople, as you already have financing secured.

It's important to understand the difference between pre-qualification and pre-approval. Pre-qualification is often a soft credit check, giving you an estimate. Pre-approval usually involves a hard credit inquiry and results in a conditional offer, meaning the lender is ready to fund your loan, provided the vehicle meets their criteria (e.g., age, mileage) and your financial situation hasn't changed. How can pre-approval give you a 'cash buyer' advantage? Because you're walking in with financing already arranged, the dealership sees you as a ready-to-buy customer, which can sometimes lead to better vehicle pricing.

VII. Decoding the Deal: Interest Rates, Terms & Hidden Traps

Once you've secured an offer, it's vital to scrutinize every detail of the deal. Understanding the nuances of interest rates, loan terms, and potential hidden fees can save you thousands of dollars and prevent future financial headaches.

7.1 Understanding Interest Rates: Expecting Higher, Aiming Lower

Let's be realistic: post-bankruptcy interest rates are inherently higher than prime rates. This is because, despite your discharge, you are still considered a higher risk by lenders. They are compensating for that perceived risk. Key factors influencing your specific rate include your credit history since discharge (how much positive history you've built), the size of your down payment, your Debt-to-Income (DTI) ratio, the loan term, and even the age and type of vehicle (older vehicles can sometimes carry higher rates due to lower resale value).

While you should expect higher rates initially, don't despair. The good news is that this first car loan, managed responsibly, is your ticket to better rates down the line. Strategies for eventual rate reduction revolve around the power of refinancing. After 12-18 months of perfect, on-time payments, your credit score will have improved significantly. This makes you a more attractive borrower to a wider range of lenders, including traditional banks and credit unions, who can offer you a much lower interest rate. This is a common and highly effective strategy for post-bankruptcy borrowers.

7.2 Loan Terms: Short vs. Long – The True Cost of Flexibility

When discussing loan terms, you'll encounter a trade-off: shorter terms mean higher monthly payments but significantly less total interest paid over the life of the loan. Longer terms offer lower monthly payments, which can seem appealing, but they come with a hefty price tag in the form of substantially more total interest paid. For example, a $20,000 loan at 15% interest over 4 years could cost you around $6,500 in interest, while the same loan over 7 years could cost over $12,000 in interest.

The danger of extending terms too much also includes the risk of negative equity (owing more on the car than it's worth), especially with rapid depreciation, and an increased risk of mechanical issues outlasting the loan. Imagine paying for a car that's constantly in the shop or has broken down completely. Finding the optimal balance for your budget and long-term financial goals is crucial. Aim for the shortest term you can comfortably afford without straining your monthly finances.

7.3 Beyond the Sticker Price: Fees & Add-ons to Scrutinize

The price of the car itself is only one piece of the puzzle. You must meticulously scrutinize all fees and add-ons. Common fees include administrative fees, documentation fees, and lien registration fees. While some are legitimate, others can be inflated. Ask for a breakdown of every fee.

Then there are the dealership upsells: extended warranties, rustproofing, paint protection, fabric protection, VIN etching, and more. When are they worth it? Rarely, for most post-bankruptcy buyers. Your priority should be getting a reliable vehicle at the best possible loan terms, not adding hundreds or thousands of dollars in extras that may offer minimal value. Understand what each add-on truly offers, its cost, and whether you can get a better deal elsewhere (e.g., third-party warranties). Finally, consider gap insurance, especially for high-risk loans where you might owe more than the car is worth for a significant period. If your car is totalled, gap insurance covers the difference between what you owe and what your regular insurance pays out. While it offers peace of mind, ensure it's truly necessary and that the cost is reasonable.

Pro Tip: Always Read the Fine Print and Ask Questions

Never, ever sign a document you don't fully understand. Take your time. Ask questions about anything unclear, no matter how small. If possible, bring a trusted advisor, friend, or family member with you to review the contract. They can offer a second pair of eyes and help identify any red flags. Remember, once you sign, it's legally binding.

VIII. Driving Forward: Managing Your New Loan & Rebuilding for Good

Securing your car loan is a massive achievement, but it's just the beginning. The real victory comes from managing it responsibly and leveraging it to solidify your financial recovery.

8.1 The Power of Punctual Payments: Your Credit Rebuilding Engine

This is where the rubber meets the road. Every single on-time payment on your car loan actively contributes to repairing and rebuilding your credit score. Lenders report your payment history to credit bureaus, and consistent, positive entries are gold for your credit profile. This loan becomes a powerful credit-rebuilding engine, demonstrating to future creditors that you are a reliable borrower.

To ensure no missed due dates, set up automatic payments directly from your bank account. Many lenders offer this, and it removes the risk of forgetting. Also, set up personal reminders a few days before each payment is due, just in case. The long-term impact of consistent, positive payment history extends beyond just getting another loan; it affects your ability to rent an apartment, get better insurance rates, and even secure certain jobs. It's the cornerstone of your overall financial health.

8.2 The Refinancing Advantage: Lowering Your Rate Later

As mentioned earlier, your first post-bankruptcy car loan will likely come with a higher interest rate. But this isn't forever. When and how should you consider refinancing your car loan for a lower interest rate? Typically, after 12-24 months of perfect, on-time payments, your credit score will have improved significantly. This demonstrated payment history is exactly what more traditional lenders (banks and credit unions) look for.

What credit improvements and financial stability benchmarks are necessary to qualify for more favorable refinancing terms? You'll want to see a noticeable increase in your credit score, a consistent income, and a low debt-to-income ratio. The process of shopping for refinancing involves contacting various lenders, comparing their offers, and providing updated financial information. The potential savings from refinancing can be substantial, reducing your monthly payments and the total amount of interest you pay over the loan's life. This is a smart financial move that rewards your diligence.

For more detailed strategies on how to achieve this, our guide on Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit offers excellent advice.

8.3 Avoiding the Debt Cycle Repeat: Sustaining Financial Health

The ultimate goal isn't just to get a car loan; it's to break free from the cycle that led to bankruptcy in the first place. Maintaining a responsible budget and living within your means are critical to preventing future financial distress. Continuously track your income and expenses, ensuring you're not spending more than you earn.

The importance of building an emergency fund cannot be overstated. Life is unpredictable, and unexpected expenses (car repairs, medical bills, job loss) can quickly derail a fragile budget. Aim to save at least 3-6 months of essential living expenses in an easily accessible savings account. This fund provides a financial buffer, allowing you to cover surprises without relying on credit cards or high-interest