Your Missed Payments? We See a Down Payment.

Table of Contents

- Key Takeaways

- I. The Elephant in the Room: Navigating Missed Payments and Your Car Trade-In Realities

- A. Beyond the Anxiety: Acknowledging Your Situation and the Path Forward

- II. Unpacking the 'Missed Payments' Dilemma: Why Your Situation is Different (and How to Address It)

- A. The Credit Score Catastrophe: How Missed Payments Devastate Your FICO and What It Means for New Loans

- B. The Spectre of Negative Equity: Calculating Your True Financial Position and Its Inevitability

- C. The Lender's Lens: Understanding Why Banks and Dealerships View You Differently

- III. Your Pre-Game Strategy: Essential Steps Before Even Thinking 'Dealership'

- A. Know Your Numbers, Inside and Out: The Foundation of Your Negotiation

- B. Budgeting for Reality: What Can You Genuinely Afford for a New Monthly Payment?

- C. Exploring Current Lender Options: A Long Shot, But Worth the Inquiry

- D. The 'What If' Scenario: Urgent Steps If Repossession is Imminent

- IV. The Financial Crossroads: Visualizing the Burden and the Path Forward

- V. Navigating the Dealership Landscape: Your Battle Plan for Success

- A. Choosing the Right Dealership: Not All Sales Floors Are Created Equal

- B. The Art of Disclosure: When and How to Reveal Your Missed Payments and Negative Equity

- C. The Negotiation Playbook: Maximizing Your Position Despite Challenges

- D. Dealer vs. Bank Financing (for a New Loan): Which is Better When You Have Missed Payments?

- VI. Securing Your Next Ride: Financing Options When Credit is Bruised

- A. Subprime Lenders: Your Best Bet for Approval (and What to Expect)

- B. The Power of a Co-Signer: When a Strong Financial Partner Can Be a Game-Changer

- C. Cash Down Payments (Yes, Even With Negative Equity): Why It's More Crucial Than Ever

- D. Understanding the Loan-to-Value (LTV) Ratio: Why Lenders Obsess Over It

- E. Exploring Lease Options: Is Leasing a Viable Alternative to Buying When Credit is Poor?

- VII. Beyond the Trade-In: Alternative Paths When the Numbers Don't Add Up

- A. Selling Privately (If Possible): Minimizing Your Negative Equity Out-of-Pocket

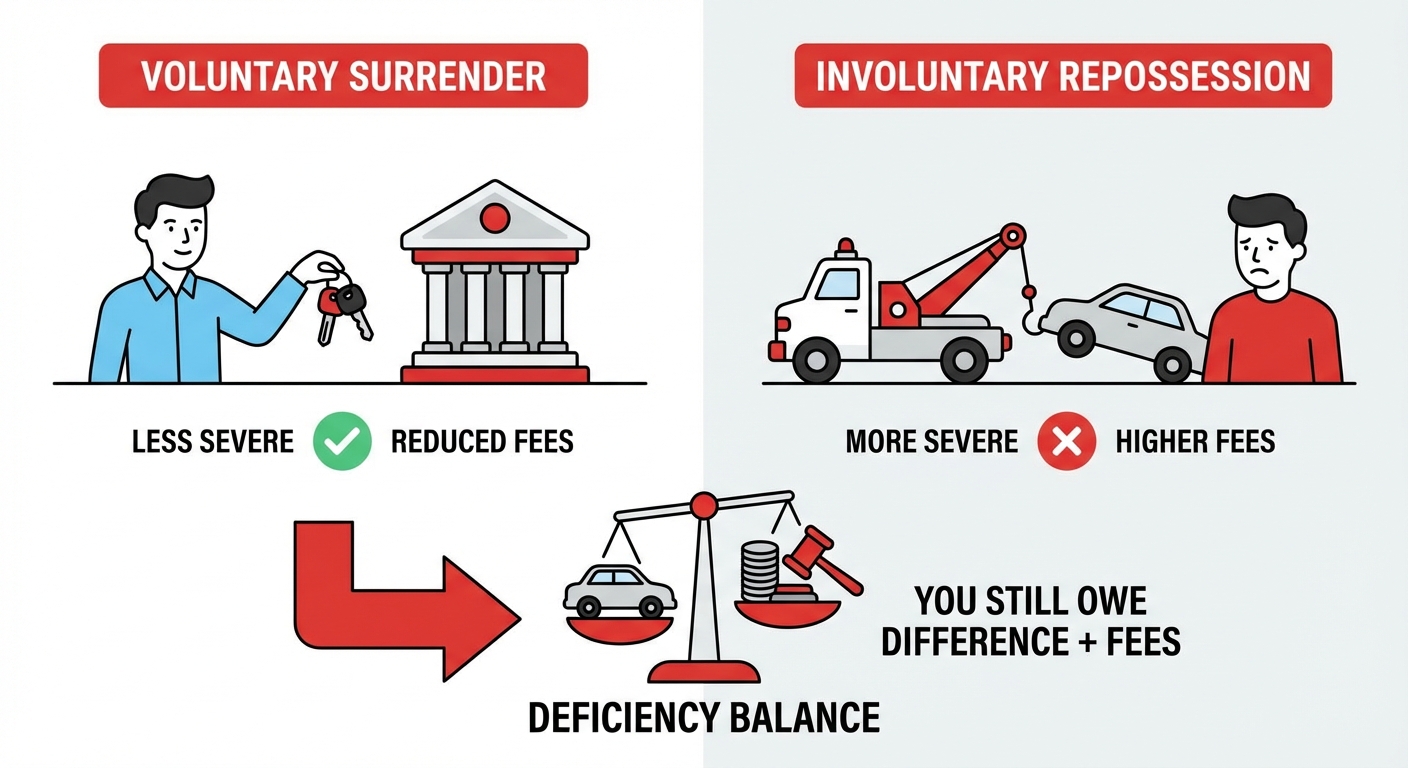

- B. Voluntary Repossession

Life happens. Bills pile up, unexpected emergencies strike, and suddenly, those car payments you once managed effortlessly become a source of crushing stress. You’ve missed a few, maybe more, and now the thought of trading in your vehicle feels like navigating a minefield.

At SkipCarDealer.com, we understand this reality. We know the anxiety that comes with a bruised credit score and the fear that your car, which once represented freedom, now feels like a financial anchor. But what if we told you that even with missed payments, your current vehicle could still represent a crucial component of your next down payment?

This isn't about ignoring the challenges; it's about acknowledging them head-on and empowering you with a clear, strategic path forward. Instead of seeing insurmountable debt, we'll show you how to identify and leverage opportunities, transforming what feels like a liability into a stepping stone towards your next reliable ride.

Key Takeaways

- Missed payments significantly impact your credit profile, making trade-ins a distinct challenge compared to simply 'owing money' on a loan. Lenders see these as red flags, not just an outstanding balance.

- Negative equity is a near certainty in this scenario, but it's a hurdle, not a roadblock. Understanding your precise negative equity is the first step to overcoming it.

- Preparation is paramount: understanding your credit, your car's value, and your loan payoff before engaging with dealerships is non-negotiable. This knowledge is your negotiation power.

- Specialized financing departments and subprime lenders are your likely allies; knowing how to identify and leverage them is crucial for securing approval.

- Your existing vehicle, even with negative equity, can still serve as a component of your new down payment, often by rolling the deficit into a new loan. However, this strategy requires careful consideration of the long-term costs.

I. The Elephant in the Room: Navigating Missed Payments and Your Car Trade-In Realities

A. Beyond the Anxiety: Acknowledging Your Situation and the Path Forward

The knot in your stomach when you think about your car loan and those missed payments is a familiar feeling for many Canadians. It’s easy to feel overwhelmed, to assume that your chances of getting into a new vehicle are completely dashed. Common misconceptions often fuel this anxiety: "No one will approve me," "My car is worth nothing now," or "I'm stuck with this vehicle forever." While the situation presents genuine hurdles, it is far from hopeless. The key is to shift your perspective from one of defeat to one of strategic planning.

We're here to reassure you that trading in a vehicle with a history of missed payments is often possible, provided you approach it with the right information and a clear strategy. This article aims to empower you to see a potential down payment where others might see only debt. By understanding the underlying financial mechanics and preparing diligently, you can transform a challenging situation into an opportunity for a fresh start with a new vehicle.

II. Unpacking the 'Missed Payments' Dilemma: Why Your Situation is Different (and How to Address It)

A. The Credit Score Catastrophe: How Missed Payments Devastate Your FICO and What It Means for New Loans

Your credit score, often referred to as your FICO score in North America (though Canadian credit bureaus have their own proprietary scoring models like Equifax’s Risk Score or TransUnion’s CreditVision), is a numerical representation of your creditworthiness. Missed payments are perhaps the most damaging events that can appear on your credit report. Even a single payment reported 30 days late can cause a significant drop in your score, and the impact compounds with each subsequent missed payment.

Lenders use your credit score and report to assess risk. When they see a history of missed payments, it signals a higher probability that you might default on a new loan. This isn't just about owing money; it's about your payment behaviour. A late payment (e.g., 30-59 days past due) is a serious mark, but a 'missed payment' (often 60+ days past due, leading to default notices or even repossession warnings) is a red flag that can make many traditional lenders hesitant to approve you for new credit. These derogatory marks can remain on your report for up to six or seven years, impacting your ability to secure favourable loan terms for cars, homes, and even some jobs or rental agreements.

Pro Tip: Obtain your full credit report from all three major bureaus (Equifax, Experian, TransUnion) well in advance. Scrutinize every detail for errors and dispute them immediately. This foundational step is non-negotiable. Knowing precisely what lenders see is your first line of defence and empowers you to address any inaccuracies before they hinder your application.

B. The Spectre of Negative Equity: Calculating Your True Financial Position and Its Inevitability

Negative equity, also known as being 'upside down' or 'underwater' on your car loan, occurs when you owe more on your vehicle than it's currently worth. In situations involving missed payments, negative equity is almost guaranteed. Why? Cars depreciate rapidly, especially in their first few years. When you miss payments, you're not paying down the principal as quickly, and accrued interest and late fees can inflate your outstanding balance. This combination often leads to a widening gap between what you owe and what the car is actually worth.

Calculating your precise negative equity is crucial for your pre-game strategy. It allows you to understand the financial hole you're starting from. Here's how to do it:

Formula Breakdown:

(Exact Loan Payout Amount) - (Current Market Value of Your Car) = Negative Equity

- Exact Loan Payout Amount: This is not simply your remaining balance. It's the exact amount your lender requires to close your loan today, including any daily interest accruals or payoff fees. You must obtain an official '10-day payoff' letter from your lender.

- Current Market Value of Your Car: This is what your car is truly worth in the current market. Importantly, 'market value' is not necessarily 'trade-in value,' which is often lower because the dealership needs to make a profit. You'll need to research your car's value using reputable sources (more on this in the next section).

For more detailed information on navigating this challenge, you might find our article Negative Equity in Ontario? Your 'No' Just Became 'Yes.' particularly helpful.

C. The Lender's Lens: Understanding Why Banks and Dealerships View You Differently

When you apply for a new car loan, lenders perform a rigorous risk assessment. For borrowers with a history of missed payments, this assessment becomes even more critical. They are looking for patterns of behaviour, your current ability to pay, and the likelihood of future defaults.

- Traditional Banks (Prime Lenders): Major banks and credit unions typically cater to 'prime' borrowers with excellent credit scores and stable financial histories. A history of missed payments usually places you outside their lending criteria, making approval highly unlikely or only possible with an exceptionally strong co-signer and a substantial down payment.

- Dealership Financing Departments (Subprime Lenders): This is where your potential lies. Dealerships often work with a network of lenders, including 'subprime' lenders who specialize in financing individuals with less-than-perfect credit. These lenders are willing to take on higher risk, but they compensate for it through 'risk-based pricing.' This means you should anticipate higher interest rates (APR - Annual Percentage Rate) to offset the increased risk they are taking. They will scrutinize your income stability, debt-to-income ratio, and your ability to make a down payment more closely.

Understanding this distinction is vital. Approaching the right type of lender from the start saves you time, frustration, and unnecessary credit inquiries that could further impact your score.

III. Your Pre-Game Strategy: Essential Steps Before Even Thinking 'Dealership'

Before you even set foot on a dealership lot, your most powerful asset will be knowledge. Being fully informed about your financial situation, your current vehicle, and your credit profile puts you in the driver's seat, even with past payment issues.

A. Know Your Numbers, Inside and Out: The Foundation of Your Negotiation

Empower yourself by having all the critical financial data at your fingertips. This isn't just about being prepared; it's about projecting confidence and seriousness to potential lenders and dealerships.

1. Your Exact Loan Payout:

This is non-negotiable. You need an official, written '10-day payoff' letter from your current lender. This document specifies the exact amount required to fully satisfy your loan on a particular date, accounting for daily interest accruals and any fees. Do not rely on your online account balance or a verbal estimate; these can be inaccurate. Call your lender and request this letter. It's the only way to know precisely how much you truly owe.

2. Your Car's True Market Value:

Research your vehicle's value using multiple reputable sources. While sites like Kelley Blue Book (KBB) and Edmunds are popular in the US, for Canadian context, you can also look at AutoTrader.ca, Canadian Black Book (CBB), or even local dealership websites for similar models. Look for both 'trade-in value' and 'private party sale value.' Be honest about your car's condition, mileage (in kilometres!), and any optional features or damage. The trade-in value will almost always be lower than a private sale price because the dealership needs to factor in reconditioning costs, marketing, and profit margins.

3. Your Credit Score & Report Deep Dive:

Revisit your credit reports from Equifax and TransUnion (the two main bureaus in Canada). Understand every derogatory mark, especially those related to your missed payments. Note the dates, amounts, and how many payments were missed. Lenders will scrutinize your payment history, your debt-to-income ratio, and any recent credit applications. Knowing this information allows you to anticipate lender concerns and proactively address them.

B. Budgeting for Reality: What Can You Genuinely Afford for a New Monthly Payment?

This step is critical to avoid repeating past mistakes. Don't just focus on the car payment itself. Create a comprehensive budget that factors in:

- Potentially Higher Interest Rates: With missed payments, your APR will likely be higher.

- Impact of Rolling Over Negative Equity: If you roll negative equity into your new loan, your total loan amount will increase, leading to higher payments or a longer loan term.

- Increased Insurance Premiums: A new or different vehicle might have higher insurance costs.

- Maintenance and Fuel Costs: Don't forget the ongoing operational expenses.

- Emergency Fund: Factor in saving for unexpected expenses to prevent future payment issues.

Your goal is a sustainable monthly payment that comfortably fits into your budget, leaving room for other expenses and savings. Be realistic; stretching your budget too thin is a recipe for future financial stress.

C. Exploring Current Lender Options: A Long Shot, But Worth the Inquiry

If you've only missed one or two payments recently and are now in a more stable financial position, it might be worth contacting your current lender. Explore options like a loan modification, deferment, or a temporary payment plan. While unlikely to directly resolve the trade-in issue or eliminate negative equity, it might stabilize your current loan, prevent further damage to your credit, and demonstrate to a new lender that you are actively trying to manage your finances responsibly.

D. The 'What If' Scenario: Urgent Steps If Repossession is Imminent

This is the most critical scenario, and time is of the essence. If your car is on the verge of repossession, immediate action is paramount.

- Contact Your Lender IMMEDIATELY: Try to negotiate. They might be willing to work with you on a payment plan to avoid the costs and hassle of repossession.

- Understand Your Provincial Repossession Laws: Laws vary across Canada regarding notice periods, your rights, and the process. Know what to expect.

- Explore Voluntary Surrender: As a last resort before involuntary repossession, you might consider voluntarily surrendering the vehicle. While still damaging to your credit, it can sometimes be less severe than an involuntary repossession and may reduce some fees. However, you will still be liable for any deficiency balance (the difference between what you owe and what the lender sells the car for at auction, plus fees).

IV.  The Financial Crossroads: Visualizing the Burden and the Path Forward

The Financial Crossroads: Visualizing the Burden and the Path Forward

Imagine a heavy scale, tipped precariously. On one side, a massive, leaden weight representing your outstanding loan amount, inflated by missed payments and interest. On the other, a much lighter feather, symbolizing your car's actual market value. This imbalance is the visual metaphor for negative equity – a burden that can feel overwhelming. But now, visualize a clear, albeit uphill, path emerging from beneath that scale, leading towards a brighter horizon. This path is paved with knowledge, strategic planning, and the right resources, showing that the weight can be managed and eventually lifted with deliberate action. It's about seeing the problem clearly, understanding its components, and then charting a course to overcome it, one strategic step at a time.

V. Navigating the Dealership Landscape: Your Battle Plan for Success

Armed with your financial data, you're ready to engage with dealerships. But not all dealerships are created equal, especially when you have a history of missed payments and negative equity.

A. Choosing the Right Dealership: Not All Sales Floors Are Created Equal

Your first step should be to identify dealerships that specialize in 'special financing,' 'bad credit car loans,' or have dedicated subprime lending departments. A standard new car dealership focused on prime borrowers might not have the lender relationships or the expertise to handle complex credit situations effectively. They might simply reject your application, leading to unnecessary credit inquiries that further hurt your score.

Look for dealerships that actively advertise that they 'work with all credit types,' 'credit challenged welcome,' or 'guaranteed approval' (though be wary of any promises that sound too good to be true). These dealerships have established relationships with subprime lenders who are more accustomed to approving loans for individuals with past credit issues. Research online reviews, specifically looking for feedback on their finance department's ability to assist customers with challenging credit histories.

Pro Tip: Start your search online. Many dealerships now have dedicated sections on their websites for 'special financing' or 'credit approval,' often with pre-qualification forms. Filling these out can give you an initial idea of your options without committing to a full credit check just yet.

B. The Art of Disclosure: When and How to Reveal Your Missed Payments and Negative Equity

Strategic transparency is your best approach. Don't try to hide your situation; the dealership will discover your credit issues and negative equity once they pull your credit report and appraise your vehicle. Being upfront, but not overly apologetic, about your situation builds trust and positions you as a serious, informed buyer.

When you first engage with the finance manager, state your situation clearly and concisely, armed with your pre-calculated numbers. For example: "I have X amount of negative equity on my current vehicle, and my credit report shows some missed payments from a challenging period. I am looking for a reliable vehicle with a manageable monthly payment of Y, and I have Z cash for a down payment." This approach shows you've done your homework, understand the challenges, and are actively seeking a solution.

Pro Tip: Present solutions, not just problems. Frame your discussion around your goal: "I understand I have negative equity, and I'm looking for a vehicle that allows me to rebuild my credit with a payment I can confidently afford." This proactive stance is more effective than simply lamenting your situation.

C. The Negotiation Playbook: Maximizing Your Position Despite Challenges

Negotiating when you have missed payments and negative equity requires a disciplined approach.

1. Separating the Deals: Always negotiate the price of the new car first, independent of your trade-in. Once you've agreed on a fair price for the vehicle you want to purchase, then introduce your trade-in. This prevents the dealership from manipulating the numbers by giving you a seemingly good trade-in value but inflating the new car's price.

2. Understanding the 'Roll Over': Demystify how negative equity is absorbed into the new loan. The dealership will add your negative equity to the purchase price of the new vehicle. For example, if you buy a $20,000 car and have $5,000 in negative equity, your new loan amount (before taxes and fees) becomes $25,000. Understand the implications this has for your loan term, monthly payments, and the total interest paid over the life of the loan. A longer term means lower monthly payments but significantly more interest paid.

3. Watch Out for 'Payment Packing': Educate yourself on common dealership tactics to inflate monthly payments with unnecessary add-ons. These can include extended warranties, GAP insurance (which is often recommended with negative equity, but ensure it's priced fairly), etching, fabric protection, and other extras. Scrutinize every line item on the contract and question anything you don't understand or didn't explicitly ask for. Be prepared to say "no" to anything you don't need or can't afford.

Common Payment Packing Red Flags:

| Red Flag Tactic | Description | Your Action |

|---|---|---|

| "Four-Square" Method | A negotiation sheet that distracts you by juggling trade-in value, new car price, monthly payment, and down payment. | Focus on one variable at a time: new car price first, then trade-in, then financing. |

| Unnecessary Add-ons | Pressure to buy extended warranties, rustproofing, paint protection, or VIN etching. | Decline anything not explicitly requested or thoroughly researched. Read the fine print. |

| Inflated APR | Offering an interest rate higher than what you qualify for, pocketing the difference. | Get pre-approved if possible, or at least research typical rates for your credit tier. Don't be afraid to walk away. |

| "Yo-Yo" Financing | You drive off with the car, only to be told later that the financing fell through, requiring new (and often worse) terms. | Ensure your financing is 100% approved before leaving the lot. Get it in writing. |

| Misleading Payment Focus | Salesperson focuses solely on the monthly payment, not the total price or loan term. | Always look at the total cost of the car, including interest, and the full loan term. |

D. Dealer vs. Bank Financing (for a New Loan): Which is Better When You Have Missed Payments?

When your credit is bruised, dealership financing often becomes your more accessible option. Here's why:

- Dealership Financing: Dealerships have established relationships with a wide network of lenders, including subprime lenders who specialize in high-risk loans. They can often shop your application to multiple lenders simultaneously, increasing your chances of approval. While the interest rates might be higher, the convenience and the broader access to lenders make them a more likely source of approval when you have a history of missed payments.

- Direct Bank Financing: Applying directly to a major bank or credit union for a new loan when you have missed payments on your credit report is often an uphill battle. These institutions typically have stricter lending criteria and are less likely to approve high-risk borrowers. If you do get approved, it might be at a less competitive rate than what a specialized subprime lender could offer through a dealership.

For most individuals with missed payments, starting with a reputable dealership that specializes in 'special finance' is usually the most effective strategy. They are equipped to navigate these complex situations.

VI. Securing Your Next Ride: Financing Options When Credit is Bruised

Even with missed payments, there are avenues to secure financing. It requires understanding which options are most viable and what to expect from them.

A. Subprime Lenders: Your Best Bet for Approval (and What to Expect)

Subprime lenders are financial institutions that specialize in providing loans to individuals with lower credit scores, thin credit files, or a history of credit challenges like missed payments, collections, or even bankruptcy. They are your most likely source of approval in this situation.

- Typical Criteria: While their criteria are more lenient than prime lenders, they will still look for stability in income, employment history, and residence. They want to see that you have the capacity to repay the loan, despite past issues.

- Higher Interest Rates: This is the reality of subprime lending. To compensate for the increased risk, subprime lenders charge significantly higher interest rates than prime lenders. This means your total cost of borrowing will be higher.

- Potentially Shorter Loan Terms: Some subprime loans might have shorter terms to reduce the overall risk, leading to higher monthly payments.

Pro Tip: When comparing subprime loan offers, focus on the overall cost of the loan (total interest paid over the term) not just the monthly payment. A slightly higher monthly payment over a shorter term can save you thousands in interest compared to a stretched-out loan with a seemingly lower payment.

B. The Power of a Co-Signer: When a Strong Financial Partner Can Be a Game-Changer

A co-signer with excellent credit can dramatically improve your chances of approval and potentially secure a lower interest rate. A co-signer essentially guarantees the loan, promising to make payments if you default. This significantly reduces the risk for the lender.

- Benefits: Increased approval odds, potentially lower interest rates, and an opportunity to rebuild your own credit with timely payments.

- Responsibilities and Risks: A co-signer is equally responsible for the loan. If you miss payments, their credit score will be negatively impacted, and they will be legally obligated to make the payments. This can strain relationships, so both parties must fully understand the commitment.

Approach a potential co-signer with a clear plan, honest disclosure of your situation, and a commitment to meticulous repayment.

C. Cash Down Payments (Yes, Even With Negative Equity): Why It's More Crucial Than Ever

Even if you have negative equity, making a cash down payment on your new vehicle is more crucial than ever. A down payment, even a modest one, can significantly reduce the amount of negative equity rolled over into the new loan. This has several benefits:

- Improves Approval Odds: Lenders see a down payment as a sign of commitment and reduces their risk.

- Lowers Loan-to-Value (LTV) Ratio: This is a key metric for lenders (see next section). A lower LTV makes your loan more attractive.

- Potentially Lower Interest Rates: A stronger application can sometimes lead to a slightly better rate.

- Reduces Total Interest Paid: Less money borrowed means less interest paid over the life of the loan.

Quantify the impact: even $500 or $1,000 cash down can make a noticeable difference in your monthly payment and overall loan structure, especially when you're already carrying negative equity.

D. Understanding the Loan-to-Value (LTV) Ratio: Why Lenders Obsess Over It

The Loan-to-Value (LTV) ratio is a critical metric for lenders, especially in high-risk scenarios. It's calculated by dividing the loan amount by the vehicle's market value. For example, if you borrow $20,000 for a car worth $18,000, your LTV is over 100% ($20,000 / $18,000 = 1.11 or 111%).

Lenders prefer lower LTVs because it means they have less risk. If you default, they can repossess and sell the car, and the higher the LTV, the more likely they are to lose money. When you roll negative equity into a new loan, your LTV can easily exceed 100%, making lenders nervous. A cash down payment directly addresses this by reducing the loan amount, thereby lowering the LTV and making your application more appealing.

E. Exploring Lease Options: Is Leasing a Viable Alternative to Buying When Credit is Poor?

For most individuals with bad credit or significant negative equity, leasing is generally not a viable option. Here's why:

- Stricter Credit Requirements: Leasing companies often have even stricter credit requirements than lenders for traditional car loans because they are essentially financing the depreciation of a new vehicle.

- Negative Equity Complications: Rolling negative equity into a lease is complex and expensive, significantly inflating your monthly payments and making the lease far less attractive.

- Limited Flexibility: Leases come with mileage restrictions, wear-and-tear clauses, and early termination penalties that can be very costly if your financial situation doesn't improve.

In most cases, buying a used vehicle, even with a higher interest rate from a subprime lender, is a more accessible and often more financially responsible path when you have challenging credit. It allows you to build equity over time and eventually refinance once your credit improves.

VII. Beyond the Trade-In: Alternative Paths When the Numbers Don't Add Up

Sometimes, despite your best efforts, trading in your car with negative equity and missed payments simply isn't the most financially sound option. In such cases, exploring alternative strategies can help minimize your losses and set you up for future success.

A. Selling Privately (If Possible): Minimizing Your Negative Equity Out-of-Pocket

Selling your car privately can often yield a higher price than a dealership trade-in value, potentially reducing the amount of negative equity you have to cover. However, selling a car with an outstanding loan requires careful coordination with your lender.

- Pros: Higher sale price, potentially less negative equity to pay.

- Cons: More effort (marketing, showing the car, dealing with buyers), complexity of managing the loan payoff and title transfer.

- How to Manage: You'll need to secure the exact payoff amount from your lender. When you find a buyer, they will typically pay you, and you will then immediately pay off the loan. The lender will then release the title to you, which you can then transfer to the buyer. If the sale price is less than what you owe, you'll need to pay the difference out-of-pocket to clear the loan. For more on this, check out Bad Credit? Private Sale? We're Already Writing the Cheque.