Your Trade-In Is Your Credit Score. Seriously. Ontario.

Table of Contents

- Key Takeaways

- The Unspoken Truth: Why Your Trade-In is Your Credit Score in Ontario

- Ontario's Credit Conundrum: The Roadblocks for First-Timers in the Province

- The Mechanics of Momentum: How a Trade-In Builds Your Credit Foundation from Scratch

- Unpacking the Numbers: What to Expect with Rates, Terms, and Hidden Costs in Ontario

- Maximizing Your Asset: Getting the Best Value for Your Ontario Trade-In

- Navigating the Ontario Dealership Landscape: Your Path to Approval

- The Strategic Car Choice: Vehicles That Accelerate Your Credit Journey in Ontario

- Beyond the Purchase: Sustaining Your Credit Growth in Ontario

- Debunking Myths & Clarifying Misconceptions for Ontario Borrowers

- Your Next Steps to Approval: An Ontario Action Plan

- Common Questions Answered: Ontario Auto Loan & Credit Building FAQ

Navigating the world of car financing in Ontario can feel like a complex maze, especially when you're just starting to build your credit. The frustrating catch-22 of needing credit to get credit is a common barrier for many Ontarians, from recent graduates to new Canadians and those simply looking to establish a solid financial footing. How do you prove your creditworthiness when you haven't had the chance to build a history?

Here at SkipCarDealer.com, we understand this challenge intimately. We're here to reveal an often-overlooked secret weapon in your financial arsenal: your trade-in vehicle. Seriously, in the unique context of Ontario's auto financing landscape, your trade-in is far more than just a convenience; it can literally be your credit score, especially when you’re starting from scratch.

Key Takeaways

- A trade-in acts as a de-facto down payment, significantly reducing loan risk for lenders and improving your chances of approval.

- It can effectively bypass the 'no credit, no loan' barrier that plagues many first-time borrowers in Ontario, providing a tangible asset that lenders value.

- Successfully leveraging a trade-in establishes your first positive credit tradeline through consistent auto loan payments, crucial for building future financial health.

- Specific strategies are vital for maximizing this advantage, including proper vehicle preparation, accurate valuation, and choosing the right dealership within the unique market conditions of Ontario.

The Unspoken Truth: Why Your Trade-In is Your Credit Score in Ontario

For many Ontarians, the idea of buying a car without an established credit history can be daunting. Banks often look for a proven track record of responsible borrowing, and if you don't have credit cards, mortgages, or previous loans reported to credit bureaus, you might find yourself in a challenging position. This is where your existing vehicle, whether owned outright or nearly paid off, enters the scene as your most powerful financial asset for establishing initial credit.

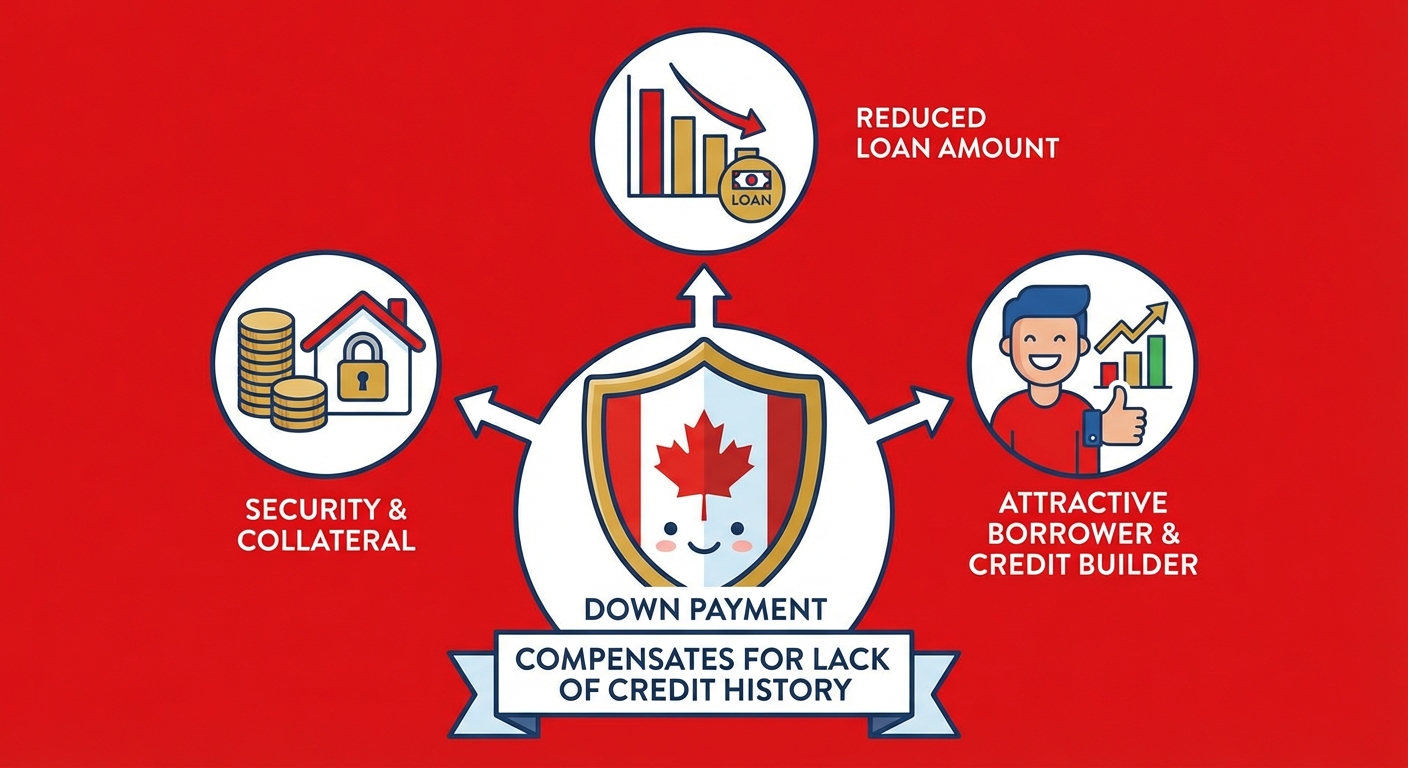

Think of it this way: when you trade in your car, you're essentially providing the lender with a substantial upfront payment. This reduces the total amount of money you need to borrow, which in turn reduces the lender's risk. A lower-risk loan is far more appealing to financial institutions, making them more willing to approve someone with a thin or non-existent credit file. It’s a paradigm shift in how you approach car financing, moving from a position of "I have no credit" to "I have an asset that makes me a safer bet." This initial approval then opens the door to building that crucial credit history, one on-time payment at a time. It’s not just about getting a car; it’s about building a financial future.

Ontario's Credit Conundrum: The Roadblocks for First-Timers in the Province

To truly appreciate the power of a trade-in, it's essential to understand the "beast" of credit in Ontario. Credit scores, primarily generated by Canadian bureaus like Equifax and TransUnion, are three-digit numbers that summarize your financial reliability. They are paramount for auto loans across Ontario because they give lenders a quick snapshot of your past borrowing and repayment behaviour. A high score signals low risk, while a low or non-existent score raises red flags.

The "thin file" problem is a common scenario for many Ontarians. This means you have little to no credit history – perhaps you've always paid cash, never had a credit card, or are new to the country. Without this history, lenders lack the data points to assess your risk, making them hesitant to approve a loan, even for stable individuals. They simply don't have enough information to go on. This is where the frustration sets in, as you're caught in a loop: you need credit to get credit, but you can't get credit without a history.

Beyond the numbers, Ontario lenders meticulously examine other factors. They'll look at your stable income and employment history to ensure you have the means to make payments. Residency is also key – how long have you lived at your current address? A longer, more stable residency often signals reliability. Your debt-to-income ratio (DTI) is another critical metric; it compares your monthly debt payments to your gross monthly income. Even with no credit history, a high DTI from other obligations could make lenders wary. Understanding these elements is your first step towards navigating the Ontario auto loan market effectively. For those facing these challenges, remember that solutions exist. For more insights on this, you might find our article Your 'Bad Credit' Isn't a Wall. It's a Speed Bump to Your New Car, Toronto particularly helpful.

– Visualizing the Trade-In Advantage: Before & After

To truly grasp the impact of a trade-in, let's visualize two identical car purchase scenarios in Ontario. One is without a trade-in, and the other leverages a significant trade-in value. This isn't just theory; it's the reality of how lenders assess your application.

Consider the following comparison for a $25,000 vehicle purchase in Ontario, assuming an applicant with a 'thin file' credit history:

| Scenario | Loan Amount Requested | Lender Risk Perception | Approval Odds | Potential Interest Rate (Thin File) | Monthly Payment (Approx. 60-month term) |

|---|---|---|---|---|---|

| Without Trade-In | $25,000 | High Risk (No credit history, full loan amount) | Low to Moderate (Potential denial or co-signer required) | 12% - 18%+ | $550 - $630+ |

| With $10,000 Trade-In | $15,000 | Moderate to Low Risk (Reduced principal, demonstrates asset ownership) | Moderate to High (More favourable, less reliance on co-signer) | 8% - 14% | $300 - $350 |

As you can see, the immediate impact of the trade-in is profound. It transforms a high-risk, potentially unapprovable loan into a more manageable and attractive proposition for lenders. The trade-in acts as a tangible demonstration of your financial commitment and reduces the lender's exposure, making them far more comfortable saying "yes." This visual reinforces the immediate, positive difference your trade-in makes, not just in terms of monthly payments, but in your fundamental ability to secure financing and begin building your credit journey in Ontario.

The Mechanics of Momentum: How a Trade-In Builds Your Credit Foundation from Scratch

The power of your trade-in is not merely psychological; it's a fundamental shift in the financial mechanics of your car loan. Your trade-in's value translates directly into a reduced loan principal. For instance, if you're buying a $30,000 vehicle and trade in a car worth $10,000, you're only financing $20,000 (plus taxes and fees). This substantial reduction makes the loan inherently less risky for the lender. They are exposed to a smaller amount of money, which makes them significantly more willing to approve your application, even if your credit history is non-existent. It’s a tangible asset that de-risks the deal, making you a much more attractive borrower in their eyes.

Once approved, the real credit-building begins. Regular, on-time car payments are meticulously reported to Canada's major credit bureaus, Equifax and TransUnion. Each month you make a payment, a positive entry is added to your credit file. This consistent pattern of responsible repayment is the cornerstone of building a strong credit score. Over time, these positive tradelines demonstrate your ability to manage debt, which is precisely what future lenders will look for. An auto loan is often one of the first significant credit accounts many Ontarians open, making it a critical stepping stone.

Pro Tip: Don't underestimate the power of even a modest trade-in. Its strategic value for credit building often outweighs its raw cash value in the initial stages of your financial journey. Even a vehicle worth a few thousand dollars can provide that crucial down payment to get your foot in the door and start reporting positive payment history to the credit bureaus.

Unpacking the Numbers: What to Expect with Rates, Terms, and Hidden Costs in Ontario

When you're building credit from scratch in Ontario, it's a reality that you might face potentially higher initial interest rates compared to someone with an excellent credit score. Lenders view a thin credit file as a higher risk, and interest rates are their way of mitigating that risk. However, there are actionable strategies to mitigate these rates. A larger trade-in, for example, directly reduces the loan amount, which can often lead to a better rate. Opting for a shorter loan term, while resulting in higher monthly payments, typically means you pay less interest over the life of the loan and build credit faster. For more on how your financial standing can impact your rates, you can explore Your Credit Score is NOT Your Rate. Get a Fair Loan, Toronto.

Loan terms also play a significant role. Longer terms (e.g., 72 or 84 months) offer lower monthly payments but accumulate more interest over time. Shorter terms (e.g., 36 or 48 months) mean higher payments but less total interest and a faster path to owning your vehicle free and clear, accelerating your credit-building journey. Balancing these factors is key to finding a payment you can comfortably afford while making progress on your credit.

Beyond the sticker price, several associated fees are specific to Ontario that you need to factor into your budget. These include documentation fees, licensing, provincial sales tax (PST) on the depreciated value of the trade-in (if applicable), registration costs, and potentially extended warranties. Always ask for a full breakdown of all costs to avoid surprises. Understanding these elements fully is essential for accurate budgeting.

It's also important to clarify the "negative equity" myth, especially for initial credit builders. This strategy *avoids* the common pitfalls of rolling over existing debt. When you have a trade-in that is owned outright or nearly paid off, you're starting with positive equity. This is a key differentiator from the complexities faced by those trading in an *already financed* vehicle with outstanding debt, a situation often discussed by competitors like Carlantic Auto, where negative equity can complicate a deal. Here, your trade-in is a net positive, actively working to build your credit, not hinder it.

Maximizing Your Asset: Getting the Best Value for Your Ontario Trade-In

To ensure your trade-in acts as the powerful credit-building tool it can be, you need to maximize its value. A little preparation goes a long way. Before appraisal, thoroughly clean your vehicle, both inside and out. Address any minor cosmetic repairs, like small dents or scratches, if they are cost-effective to fix. Ensure all maintenance records are available; a well-documented service history signals a cared-for vehicle. Check tire condition and ensure all fluids are topped up. These small details can significantly impact the perceived value and, consequently, the offer you receive.

For an accurate, market-based valuation specifically within Ontario's diverse markets, utilize independent valuation tools. Canadian Black Book is an industry standard in Canada, providing wholesale and retail values. Kelley Blue Book (Canada) is another excellent resource. These online tools will give you a strong baseline, helping you understand what your vehicle is truly worth in cities like Toronto, Mississauga, or Ottawa.

When considering your options, weigh the convenience and immediate credit-building benefits of a dealership trade-in against the potential for a higher selling price through a private sale. While a private sale might yield more cash, it comes with the hassle of advertising, showing the car, and dealing with potential buyers, and it doesn't immediately facilitate your new car purchase and credit building. A dealership trade-in, however, streamlines the process, applies the value directly to your new purchase, and instantly kickstarts your credit journey.

| Factor | Dealership Trade-In | Private Sale |

|---|---|---|

| Convenience | High (One-stop shop, immediate exchange) | Low (Time-consuming, requires effort) |

| Credit Building | Immediate (Value applied to new loan, starts reporting) | Delayed (Cash received, then applied as down payment elsewhere) |

| Selling Price | Often slightly lower (Wholesale value) | Potentially higher (Retail value, but no tax savings) |

| Tax Savings (Ontario) | Yes (PST only paid on net difference between new car price and trade-in value) | No (PST paid on full new car price) |

| Paperwork/Liability | Handled by dealership | Your responsibility (Potential liability after sale) |

Pro Tip: Always seek multiple appraisals from different dealerships across various Ontario cities like Toronto, Mississauga, or Ottawa. This ensures you receive a competitive offer and a strong baseline for negotiation. Don't settle for the first offer; leverage competition to maximize your trade-in's value and thus, your credit-building power.

Navigating the Ontario Dealership Landscape: Your Path to Approval

Choosing the right dealership is paramount, especially when you're looking to build credit. Some dealerships are better equipped and more experienced in handling 'no credit' or 'thin file' situations. They often have specialized finance departments with extensive relationships with various lenders who understand these unique circumstances. These finance managers are adept at structuring deals that work for both you and the potential lender, focusing on your trade-in and income stability rather than just a credit score.

The application process itself can be simplified with the right preparation. You'll generally need proof of income (e.g., recent pay stubs, employment letter), residency verification (e.g., utility bill, driver's license), and for your trade-in, current vehicle ownership/title. Having these documents organized and ready can significantly expedite the approval process.

Dealerships often work with a broad network of financial institutions, including major Canadian banks (like RBC, TD, Scotiabank), local credit unions, and specialized auto finance companies. This extensive lender network benefits you by increasing approval odds, as different lenders have varying criteria and risk appetites. What one bank might decline, another might approve, especially with a solid trade-in. Your finance manager acts as your advocate, submitting your application to the lenders most likely to approve you based on your unique profile.

Pro Tip: Be completely transparent about your credit situation from the outset. A skilled finance manager will be your advocate, helping to structure a deal that works for both you and the potential lender. Hiding information only slows down the process and can lead to frustration. Trust their expertise to navigate the lender landscape on your behalf.

The Strategic Car Choice: Vehicles That Accelerate Your Credit Journey in Ontario

When embarking on your credit-building journey, your choice of vehicle is a strategic decision. Reliability over luxury should be your guiding principle. Opting for a dependable, affordable vehicle is your best strategy for initial credit building. Why? Because minimizing unexpected repair costs ensures you can consistently make your car payments without financial strain. A breakdown or major repair bill could jeopardize your ability to pay, which is detrimental to building a positive credit history. Focus on brands known for their longevity and lower maintenance costs.

Consider resale value. Choosing a vehicle known for holding its value well in the Ontario market makes future upgrades or trade-ins much easier and more financially sound. Cars that depreciate slowly mean you maintain more equity, which can be reinvested in your next vehicle, further strengthening your financial position. Research models that consistently perform well in the used car market.

Popular Ontario picks for first-time buyers, or those building credit, often include compact sedans like the Honda Civic or Toyota Corolla, or smaller SUVs such as the Hyundai Kona or Kia Seltos. These vehicles are generally more accessible in terms of price, have a strong market presence, and benefit from an extensive service network in areas like Hamilton or London. Their widespread availability also often translates to lower insurance premiums and readily available parts, further supporting your ability to manage costs and maintain consistent payments. Selecting a practical, reliable vehicle is not just about transportation; it’s about making a smart financial move that supports your long-term credit goals.

Beyond the Purchase: Sustaining Your Credit Growth in Ontario

Securing your first auto loan with a trade-in is a monumental first step, but the journey of credit building doesn't end there. The golden rule, which cannot be overstated, is the absolute critical importance of never missing a car payment. This is the cornerstone of credit building. Every on-time payment is a positive mark on your credit report, steadily increasing your credit score and demonstrating your reliability to future lenders. A single missed payment, however, can set back your progress significantly, so consistency is key.

Equally important is monitoring your credit. In Ontario, you have the right to access your free annual credit report from both Equifax and TransUnion. Make it a habit to review these reports regularly. Look for any inaccuracies, unauthorized accounts, or signs of identity theft. Monitoring your score's progress will give you a clear picture of how your auto loan payments are impacting your creditworthiness and where you stand financially. Many financial institutions and services also offer free credit score tracking tools.

After your auto loan has successfully established a positive credit foundation (typically after 12-24 months of consistent payments), you can begin to think about diversifying your credit portfolio. This means introducing other responsible credit-building tools. Consider a secured credit card, where your credit limit is backed by a cash deposit, or a small line of credit. These accounts, managed responsibly, further demonstrate your ability to handle various types of credit, which is another factor lenders consider when assessing your financial health. Remember, the auto loan is your first major step; these additional tools help solidify your new, improved credit profile.

Pro Tip: Set up automatic payments from your bank account to avoid accidental missed deadlines. Life gets busy, and it's easy for a due date to slip your mind. Automating your car payments is a simple yet incredibly effective way to ensure consistency, protect your newly established credit score, and build a strong financial reputation.

Debunking Myths & Clarifying Misconceptions for Ontario Borrowers

The world of credit and auto loans is rife with misconceptions, especially for those in Ontario trying to build credit. Let's set the record straight:

Myth 1: 'You need a perfect credit score to get a car loan.'

False: While a perfect score certainly helps, it's not a prerequisite. A strong trade-in significantly alters this equation, providing lenders with collateral and reducing their risk, making approval possible even with no prior credit history. Your trade-in effectively acts as your initial credit score.

Myth 2: 'All dealerships are the same when it comes to credit applications.'

False: This couldn't be further from the truth. Some dealerships, like SkipCarDealer.com, specialize in helping credit-challenged buyers or those with thin files. They have dedicated finance departments and established relationships with a broader network of lenders who are more flexible and understanding of unique credit situations. Doing your research on the dealership's expertise is crucial.

Myth 3: 'Trading in a car is always a bad financial deal.'

False: While a private sale *might* yield a slightly higher cash amount, when used strategically for credit building, a trade-in is an invaluable tool. It offers convenience, immediate tax savings (in Ontario, you only pay PST on the net price after trade-in), and most importantly, it's your express pass to establishing a positive credit history, which has immense long-term financial benefits. Sometimes, the strategic value outweighs the raw cash difference.

Myth 4: 'My trade-in value is irrelevant if I have no credit history.'

Absolutely false: As we've extensively discussed, your trade-in is your most powerful asset in this specific scenario. It's the tangible collateral that provides security to lenders, reduces the loan amount, and makes you a much more attractive borrower, directly compensating for your lack of credit history. It’s your down payment, your collateral, and your credit builder all rolled into one.

– The Credit Score Growth Chart

Imagine a clear, easy-to-understand line graph illustrating typical credit score progression. This graph would start with a flat line representing a 'no credit' or 'thin file' baseline. Then, upon securing an auto loan with a trade-in and consistently making on-time payments, the line would steadily climb over a 12-24 month period. This visual representation would effectively reinforce the tangible, long-term benefit of the trade-in strategy, showing how a proactive approach can transform your financial standing and open doors to future opportunities.

Your Next Steps to Approval: An Ontario Action Plan

Ready to turn your trade-in into a credit-building powerhouse? Here's your actionable plan for securing an auto loan in Ontario:

- Step 1: Thoroughly Assess Your Current Vehicle. Gather all ownership documents, ensure its service history is available, and inspect its condition. Address any minor issues that could affect its value.

- Step 2: Conduct Diligent Market Research. Use Canadian Black Book and Kelley Blue Book (Canada) to get accurate market values for both your trade-in and your desired vehicle, specifically within Ontario's diverse markets.

- Step 3: Budget Realistically. Account for all upfront costs (down payment from trade-in, taxes, fees), monthly payments, insurance, and ongoing maintenance. Understand the full financial picture before committing. For insights into budgeting and down payments, consider reading Your Down Payment Went Missing. Your Interest Rate Didn't Get the Memo, Edmonton.

- Step 4: Proactively Engage with Reputable Ontario Dealerships. Seek out dealerships with experienced finance managers who specialize in helping credit-building customers. Clearly communicate your goals and your trade-in's potential.

- Step 5: Meticulously Understand All Loan Terms. Read the fine print, ask questions, and ensure you're comfortable with the interest rate, term length, and total cost. Most importantly, commit unequivocally to responsible, on-time repayment for the duration of the loan. This commitment is your pathway to a robust credit score.