Your Ex Can't Block Your New Ride. Trade Joint Car During Separation, Toronto.

Table of Contents

- Key Takeaways

- The Legal Labyrinth of Joint Assets During Separation in Ontario: What 'Jointly Owned' Really Means

- Married vs. Common-Law: Different Rules for Different Rings (or Lack Thereof)

- Beyond the Title: What Constitutes 'Joint Ownership' in the Eyes of the Law?

- The Weight of Shared Debt: Joint Car Loans and Your Separation Agreement

- Unpacking the Jointly Owned Car: More Than Just Wheels, It's an Asset (and a Liability)

- Fair Market Value: Getting an Unbiased Price Tag for Your Ride

- The Elephant in the Garage: Navigating Outstanding Car Loans and Lines of Credit

- Your Car's Role in Net Family Property: The Ontario Equalization Payment Context

- The 'Can I Trade It In?' Conundrum: Legal & Practical Hurdles in Toronto

- When 'Yes' is the Answer: Consent, Court Orders, and Separation Agreements

- When 'No' is the Reality: The Risks of Trading Without Consent (and Potential Repercussions)

- The Dealership's Perspective: What Car Sales Teams in the Greater Toronto Area Need from You

- Navigating the Trade-In Process: Dealer vs. Private Sale vs. Buyout in Ontario

- The Dealer Trade-In: Convenience at a Price (and How to Maximize Your Value)

- The Private Sale Route: Maximizing Value, Minimizing Hassle (with Your Ex's Cooperation)

- The Buyout Option: When One Partner Keeps the Car (and How to Finance It)

- Hidden Costs and Unexpected Fees: What to Budget For When Moving On

- Financial Fallout: Credit Scores, Debt, and Your Future Wheels Post-Separation

- The Ripple Effect: How Joint Debt Resolution Impacts Your Credit Score

- Strategies to Protect Your Credit: Proactive Steps for Financial Health

- Securing a New Car Loan: Approval Odds and Interest Rates in a Post-Separation World

- When Agreement Fails: Legal Pathways and Court Intervention for Car Disputes

- Mediation and Arbitration: Collaborative Solutions for Difficult Conversations

- Court Orders: When All Else Fails, What a Judge Might Decide

- Injunctions and Restraining Orders: Preventing Unauthorized Sale or Damage

- Beyond Ontario: A Glimpse at Joint Asset Division Across Canada

- British Columbia's Family Law Act: Key Differences and Similarities

- Alberta's Matrimonial Property Act: Understanding Property Division in the Prairies

- Your Next Steps to Driving Forward: A Practical Checklist for Action

- Frequently Asked Questions (FAQ) About Trading a Jointly Owned Car During Separation

Separation is a challenging journey, fraught with emotional and financial complexities. Among the many assets that need untangling, the family car often drives right into the centre of the storm. For many in Toronto and across Ontario, that jointly owned vehicle isn't just a mode of transport; it's a significant asset, a shared liability, and sometimes, a symbol of lingering attachment or contention. The burning question on many minds: "Can I actually trade in a jointly owned car during separation, or will my ex block my path to a new ride?"

The good news is that while challenging, solutions exist. Navigating joint car ownership during a separation requires a clear understanding of your legal rights, financial obligations, and practical options specific to the unique legal landscape of Toronto and Ontario. This article aims to empower you with the knowledge to understand your options, take control, and ultimately, drive forward into your new chapter with confidence.

Key Takeaways

- Consent is Paramount: Generally, you cannot legally trade in or sell a jointly owned car without the explicit written consent of your ex-partner, unless a court order dictates otherwise.

- Understand Ontario Law: The rules for dividing assets, including cars, differ significantly between married and common-law partners under Ontario's Family Law Act.

- Prioritize Joint Debt Resolution: Any outstanding car loans are a shared responsibility and must be addressed to protect both parties' credit scores and financial futures.

- Valuation is Key: Obtain accurate, independent valuations for the vehicle to ensure a fair division of its value or a reasonable buyout price.

- Legal Advice is Crucial: Consult with a family law professional in Ontario early in the process to understand your specific rights and obligations and to draft formal agreements.

- Explore All Options: Consider trade-ins, private sales, or buyouts, weighing the pros and cons of each in your unique situation.

The Legal Labyrinth of Joint Assets During Separation in Ontario: What 'Jointly Owned' Really Means

When you embark on a separation in Ontario, one of the primary tasks is to disentangle your financial lives. This includes determining what constitutes 'jointly owned' property and how it will be divided. A car, often a substantial asset, is rarely an exception. Understanding the legal definitions and implications specific to Ontario is your first critical step.

In Ontario, the law views property differently depending on whether you are married or in a common-law relationship. This distinction is foundational to how a jointly owned car fits into your overall asset division.

Married vs. Common-Law: Different Rules for Different Rings (or Lack Thereof)

For married couples in Ontario, the division of property is primarily governed by the Family Law Act. This legislation operates on the principle of "equalization of net family property." Essentially, the law aims to ensure that both spouses leave the marriage with an equal share of the wealth accumulated during the marriage. Each spouse calculates their "net family property" (assets minus debts as of the date of separation, excluding certain items like gifts or inheritances). If one spouse's net family property is greater than the other's, they pay an "equalization payment" to balance the scales.

A jointly owned car, along with any associated debt, is included in this calculation. Its value (minus any outstanding loan) contributes to each spouse's net family property. The equalization process means that even if one person keeps the car, its value will be factored into the overall financial settlement.

For common-law partners in Ontario, the situation is markedly different. The Family Law Act does not provide for automatic equalization of property. Instead, common-law partners generally retain ownership of the assets registered in their names. If a car is jointly registered, both partners are considered co-owners. Disputes over jointly owned property in common-law relationships often rely on principles of "unjust enrichment" or "constructive trust." This means one partner might argue they contributed to the asset (financially or through labour) and would be unfairly deprived if they don't receive a share. This can be a more complex and contentious path, often requiring detailed evidence of contributions.

Beyond the Title: What Constitutes 'Joint Ownership' in the Eyes of the Law?

While having both names on the vehicle registration (ownership permit) is the clearest indication of joint ownership, the legal reality can sometimes extend beyond mere paperwork. A car might be considered jointly owned, or at least have a claim from the other party, even if only one name is on the registration, especially in married relationships or long-term common-law unions where significant contributions were made.

Factors a court might consider include:

- Financial Contributions: Who paid for the down payment? Who made the monthly loan payments? Who covered insurance, maintenance, and fuel?

- Intent: Was there an understanding or agreement (even informal) that the car was for joint use and benefit, regardless of whose name was on the title?

- Use and Access: Was the car regularly used by both parties as a family vehicle?

- Source of Funds: Were the funds used to purchase the car derived from joint accounts or shared income?

These scenarios highlight why 'joint ownership' isn't always black and white and can become a point of contention during separation.

The Weight of Shared Debt: Joint Car Loans and Your Separation Agreement

Perhaps even more critical than asset division is the handling of shared debt. If you have a joint car loan, both your names are on the loan agreement, meaning both of you are legally responsible for the full amount of the debt, regardless of who primarily drives the car or whose name is on the registration. This is a crucial distinction: car ownership and car loan liability are separate legal concepts.

If one party stops paying, the lender can pursue the other party for the full outstanding balance. This can severely damage the credit rating of the responsible party and lead to collection actions. A comprehensive separation agreement is essential to formalize how this joint debt will be managed, who will be responsible for payments, and how the loan will eventually be resolved (e.g., through a sale, trade-in, or one party assuming the full debt).

Pro Tip: Seek legal advice from a family law professional in Ontario before making any significant decisions regarding jointly owned assets, especially cars. Early intervention can save considerable stress, prevent costly mistakes, and ensure your rights are protected throughout the separation process. A lawyer can help you understand the nuances of the Family Law Act and negotiate a fair outcome.

Unpacking the Jointly Owned Car: More Than Just Wheels, It's an Asset (and a Liability)

Beyond the general legal principles, it’s vital to focus specifically on the vehicle itself. A car isn't just a means of transport; it's a financial asset with a fluctuating value and, if financed, a significant liability. Accurately valuing the vehicle and understanding the impact of any outstanding loans are crucial steps in your separation proceedings.

Fair Market Value: Getting an Unbiased Price Tag for Your Ride

To divide the asset fairly, you first need to know what it's truly worth. Relying on an emotional attachment or a quick online search might not provide the unbiased figure needed for a legal separation agreement. Fair market value (FMV) is the price a willing buyer would pay and a willing seller would accept, neither being under compulsion to buy or sell, and both having reasonable knowledge of the relevant facts.

Practical steps for determining the true value of your vehicle in Toronto and Ontario include:

- Dealership Appraisals: Many car dealerships in the Greater Toronto Area (GTA) and beyond, including those along major automotive hubs like the 'Auto Park' in Brampton or dealerships in Scarborough, offer free trade-in appraisals. While these might be slightly lower than a private sale value, they provide a quick and tangible benchmark.

- Independent Assessments: For a more formal and unbiased valuation, consider hiring an independent, certified automotive appraiser. This carries a cost but provides a defensible value that can be critical in court or mediation.

- Online Valuation Tools: Websites like Canadian Black Book (CBB) and AutoTrader offer online valuation tools that provide estimated trade-in and private sale values based on make, model, year, mileage (kilometres), and condition. These can serve as a good starting point.

- Comparative Research: Look at similar vehicles listed for sale privately (on platforms like Kijiji or AutoTrader in Ontario) and at dealerships. This helps you gauge the current market demand and pricing for your specific car.

The importance of an agreed-upon valuation cannot be overstated. If both parties agree on the car's value, it significantly streamlines the division process, whether it's for a buyout, sale, or equalization payment.

The Elephant in the Garage: Navigating Outstanding Car Loans and Lines of Credit

Most vehicles today are financed, meaning an outstanding loan complicates their division. A joint car loan means both parties are equally responsible for the debt. This debt isn't simply "assigned" to one person in a separation agreement; the bank still holds both individuals liable until the loan is paid off or formally transferred.

Here’s a comprehensive look at how joint loans are treated and strategies for managing or transferring debt:

- Joint and Several Liability: This means the lender (e.g., Royal Bank of Canada, TD Bank, Scotiabank) can pursue either party for the full amount if payments are missed. Even if your separation agreement states your ex is solely responsible, if they default, your credit will suffer, and the bank can come after you.

- Risks of Default: A default on a joint loan can severely damage both parties' credit scores, making it difficult to secure new loans (car loans, mortgages) or even rent property in the future.

- Strategies for Management:

- Refinancing: One party might refinance the loan solely in their name. This requires the individual to qualify for the loan on their own, often necessitating a good credit score and sufficient income. If successful, the original joint loan is paid off, and a new loan is created.

- Selling the Car: If the car is sold (either privately or to a dealership), the proceeds are used to pay off the outstanding loan. Any remaining equity is then divided, or any shortfall is jointly covered.

- Buyout: If one party buys out the other's share, they might assume the existing loan (if the lender agrees to remove the other party, which is rare) or obtain a new loan to pay off the joint one and compensate the other party for their equity.

Clear communication with your lender is paramount. They are not bound by your separation agreement; they are bound by the original loan contract. Always aim to get the other party formally removed from the loan or have the loan fully discharged.

Your Car's Role in Net Family Property: The Ontario Equalization Payment Context

For married couples in Ontario, the car's value (and associated debt) directly contributes to the calculation of Net Family Property (NFP). This is a snapshot of each spouse's wealth on the date of separation, compared to their wealth on the date of marriage.

Let's say a car was purchased during the marriage with an initial value of $30,000 and an outstanding loan of $15,000 on the date of separation. The net value of the car ($15,000) would be included in the NFP calculation for the spouse who "owns" it or who is deemed to have it as part of their assets. If the car is jointly owned with a joint loan, its net value (market value minus loan) would be split, or its full net value might be attributed to the party who keeps it, with adjustments made in the overall equalization payment.

Pro Tip: Obtain at least three independent valuations for the vehicle from reputable sources (dealerships, certified appraisers) to ensure a fair and defensible market value. This prevents disputes and provides a solid basis for negotiation, whether you're selling, trading, or conducting a buyout.

The 'Can I Trade It In?' Conundrum: Legal & Practical Hurdles in Toronto

This is the core question that brings many to this article. The simple answer is: it depends heavily on consent and legal documentation. Attempting to trade in a jointly owned car without proper authorization can lead to severe legal and financial repercussions.

When 'Yes' is the Answer: Consent, Court Orders, and Separation Agreements

You can legally trade in a jointly owned car under specific circumstances:

- Written Consent from Your Ex-Partner: This is the cleanest and most common path. If both parties agree to the trade-in, they both sign off on the necessary paperwork at the dealership. This consent should ideally be in writing, clearly stating that both parties agree to the trade-in, the disposition of any trade-in value (e.g., used towards a new vehicle for one party, split between both), and how any outstanding loan will be managed.

- Formal Separation Agreement: A comprehensive separation agreement, drafted with legal counsel, can explicitly outline the disposition of the jointly owned vehicle. It can mandate that one party is entitled to trade in the car, specify how the proceeds are handled, and detail the transfer of loan responsibility. Once signed, this is a legally binding document.

- Court Order: If agreement cannot be reached, a family court judge in Toronto or elsewhere in Ontario can issue an order for the sale or trade-in of the vehicle. This order removes the need for your ex-partner's consent, as it is legally compelled. This is typically a last resort due to the time and cost involved in court proceedings.

When 'No' is the Reality: The Risks of Trading Without Consent (and Potential Repercussions)

Attempting to trade in a jointly owned vehicle without the explicit, written consent of your ex-partner or a valid court order is highly risky and can lead to significant legal and financial trouble:

- Dealership Refusal: Most reputable dealerships in the Greater Toronto Area (GTA) will refuse to process a trade-in if both registered owners are not present to sign or if there isn't clear legal documentation (like a court order) authorizing one party to act alone. They understand the legal risks involved.

- Legal Action: Your ex-partner could sue you for their share of the vehicle's value, or for damages if the trade-in occurred without their consent and prejudiced their financial interests.

- Fraud Allegations: In extreme cases, if you misrepresent ownership or forge signatures, you could face allegations of fraud, which carry criminal implications.

- Loan Liability: Even if you manage to trade in the car, if there's an outstanding joint loan, you and your ex remain jointly liable for that debt. The trade-in value might not cover the full loan, leaving both of you on the hook for the remainder.

The Dealership's Perspective: What Car Sales Teams in the Greater Toronto Area Need from You

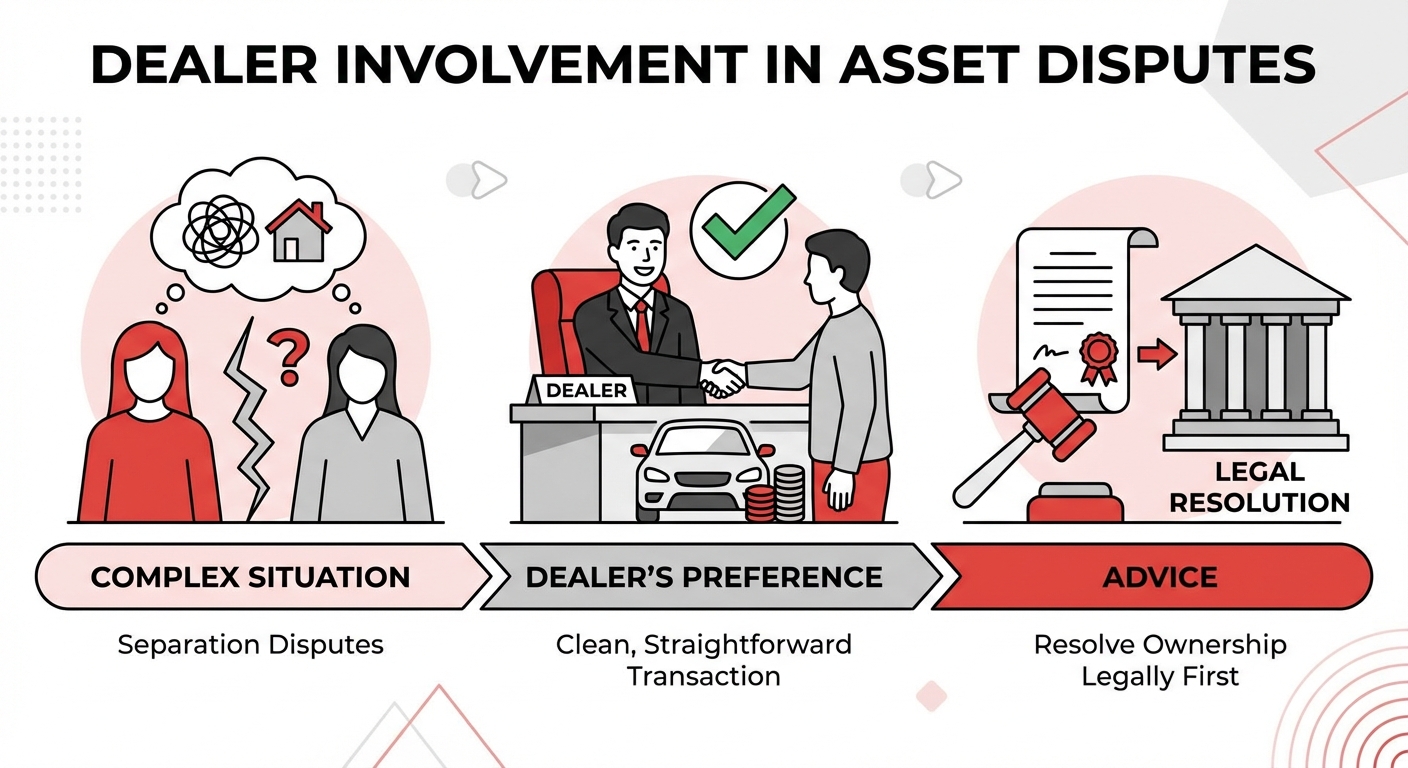

Car dealerships are businesses, and they want to avoid legal entanglements. When dealing with a jointly owned vehicle, their primary concern is clear title and ensuring they are not facilitating a transaction that could later be challenged. Here's what car sales teams in areas like Weston Road in Toronto, or dealerships in Markham, Mississauga, or Vaughan, will typically require:

- Both Registered Owners Present: Ideally, both individuals whose names appear on the vehicle's ownership permit (registration) should be present to sign all trade-in and sale documents.

- Valid Identification: Both owners will need to provide valid government-issued photo identification.

- Original Vehicle Ownership Permit: The dealer will need the original ownership permit.

- Lien Release (if applicable): If there's an outstanding loan, the dealership will need to confirm with the lender that they can obtain a lien release once the loan is paid off. Both parties may need to authorize this.

- Formal Documentation: If one party is absent, the dealership will require a legal document (e.g., a court order, a notarized power of attorney, or a comprehensive separation agreement) explicitly authorizing the present party to act on behalf of both owners for the trade-in.

Dealers are generally reluctant to get involved in separation disputes. Their preference is for a clean, straightforward transaction. If your situation is complex, they may advise you to resolve the ownership issue legally before they proceed.

Navigating the Trade-In Process: Dealer vs. Private Sale vs. Buyout in Ontario

Once you've navigated the legal hurdles and decided to move forward, you have several options for disposing of the jointly owned car. Each method has its own advantages and disadvantages, particularly when an ex-partner is involved. Understanding these can help you choose the best path for your situation in Ontario.

| Method | Pros | Cons | Key Considerations for Separation |

|---|---|---|---|

| Dealer Trade-In | Convenient, quick, tax savings (HST only on difference for new car), dealer handles paperwork. | Generally lower offer than private sale, less control over price. | Requires both parties' consent. Trade-in value can be put towards one party's new car or split. Simplest if agreement is reached. |

| Private Sale | Potentially highest sale price, more control over selling terms. | Time-consuming, requires effort (listing, showing, negotiating), safety concerns with strangers, no tax savings on a new car purchase. | Requires significant cooperation for viewings, paperwork, and division of proceeds. Can be contentious if parties disagree on price or process. |

| Buyout Option | One party keeps the car, maintaining familiarity and avoiding sale costs. | Requires financing for the buying party, potentially complex valuation, seller may feel shortchanged. | Needs clear valuation agreement, formal transfer of ownership, and assumption/refinancing of any joint loan. Critical to be in a separation agreement. |

The Dealer Trade-In: Convenience at a Price (and How to Maximize Your Value)

Trading in your jointly owned vehicle at a dealership, such as those found on the Queensway in Toronto or in London, Ontario, is often the most convenient option. The dealership handles the sale, the paperwork, and often, the payoff of any existing loan. You also receive a tax credit for the trade-in value against the purchase of a new vehicle (you only pay HST on the difference), which can be a significant saving in Ontario.

However, dealerships are in the business of profit, so their trade-in offer will typically be lower than what you might get through a private sale. To maximize your value:

- Do Your Homework: Get independent valuations (as discussed earlier) before approaching dealers.

- Negotiate: Don't accept the first offer. Be prepared to negotiate, especially if you're also buying a new car from them.

- Detailing & Maintenance: A clean, well-maintained car always fetches a better price. Address minor repairs and get a professional detailing.

- Be Transparent: Clearly explain the joint ownership situation upfront.

The Private Sale Route: Maximizing Value, Minimizing Hassle (with Your Ex's Cooperation)

Selling your car privately, through platforms like Kijiji, AutoTrader, or Facebook Marketplace (popular options in Ontario), generally yields a higher selling price than a trade-in. This means more equity to divide between you and your ex-partner, or more funds to put towards your next vehicle.

The challenge, however, is the logistical hassle and the absolute necessity of your ex-partner's cooperation. You'll need to coordinate:

- Listing and Marketing: Agree on the listing price, photos, and description.

- Viewings and Test Drives: Both parties might need to be present, or one needs explicit authorization.

- Negotiation: Agree on the final sale price.

- Paperwork: Both parties must sign the bill of sale and transfer of ownership documents.

- Loan Payoff: If there's an outstanding loan, the lender will need to be involved to release the lien. The proceeds will go directly to the lender first.

If your relationship with your ex-partner is particularly contentious, a private sale can become a prolonged and frustrating process, making a trade-in or buyout a more appealing, albeit potentially less profitable, alternative.

The Buyout Option: When One Partner Keeps the Car (and How to Finance It)

If one partner wishes to keep the car, they can 'buy out' the other's share. This involves determining the car's fair market value and then calculating the equity (value minus outstanding loan). The buying partner then pays the other partner half of that equity (or whatever share is agreed upon).

Financing a buyout can take several forms:

- Refinancing the Loan: The most common method. The buying partner applies for a new car loan solely in their name for the outstanding balance of the original joint loan, plus the amount needed to pay out the ex-partner's equity. This new loan pays off the old joint loan, and the ex-partner is formally removed from all liability. Lenders like Meridian Credit Union in Ontario, or major banks, offer various refinancing options.

- Personal Loan: If the equity amount is manageable, the buying partner might take out a personal loan from a bank or credit union to pay the ex-partner their share.

- Offsetting Other Assets: In the context of an overall separation agreement, the car's value might be offset against other assets. For example, if one partner keeps the car, the other might receive a larger share of a joint investment account or a lower equalization payment. This is often handled within the broader asset division strategy.

Crucially, ensure the ex-partner is formally removed from the original car loan if the buying partner assumes it. Otherwise, the "selling" partner remains liable, even if they no longer drive the car.

Hidden Costs and Unexpected Fees: What to Budget For When Moving On

Don't forget to factor in potential costs when disposing of or acquiring a vehicle post-separation:

- Appraisal Fees: If you use independent appraisers, there will be a cost.

- Lien Discharge Fees: Your lender might charge a small fee to process the release of the lien once the loan is paid off.

- Sales Tax (HST in Ontario): If you sell privately, the buyer pays the HST to the provincial government when they register the vehicle. If you trade in, you save HST on the trade-in value against your new car. If you do a buyout, the partner acquiring the car may have to pay HST on the value of the portion they are "buying" from their ex.

- Vehicle Transfer Fees: There are fees associated with transferring vehicle ownership at ServiceOntario.

- New Car Loan Fees: Application fees, interest, and potentially loan origination fees if you're financing a new vehicle.

- Insurance Adjustments: Your insurance premiums will likely change as a single driver, potentially increasing.

Pro Tip: If considering a buyout, ensure the terms are clearly outlined in a legally binding separation agreement. This document should detail the agreed-upon valuation, the buyout amount, timelines for payment, and the formal transfer of ownership and loan liability. This protects both parties.

Financial Fallout: Credit Scores, Debt, and Your Future Wheels Post-Separation

Divorce or separation is one of the most significant life events that can impact your financial health, and how you manage jointly owned assets like a car can have long-lasting effects on your credit score and future financing opportunities. Taking proactive steps to protect your financial standing is paramount.

The Ripple Effect: How Joint Debt Resolution Impacts Your Credit Score

A joint car loan means that both parties' credit reports reflect that debt. Every payment made (or missed) impacts both individuals' credit histories. If your ex-partner is assigned responsibility for the loan in your separation agreement but fails to make payments, it will negatively affect your credit score just as much as theirs. This is because the lender's contract is with both of you, regardless of your internal agreement.

A damaged credit score can make it harder to:

- Secure a new car loan with favourable interest rates.

- Qualify for a mortgage or rental property.

- Obtain credit cards or lines of credit.

- Even impact utility hook-ups or employment background checks.

Resolving joint debt is not just about fairness; it's about protecting your financial future. For more on this, check out our guide on Ontario Divorcees: Your Car Loan Just Signed Its Own Papers.

Strategies to Protect Your Credit: Proactive Steps for Financial Health

Taking control of your credit during separation is critical:

- Monitor Your Credit Reports: Obtain copies of your credit report from both Equifax and TransUnion, Canada's two main credit bureaus. Review them carefully for any inaccuracies or missed payments related to joint accounts. You are entitled to a free copy of your credit report annually.

- Communicate with Lenders: If a joint loan cannot be immediately paid off or refinanced, communicate with the lender. While they won't release you from liability without a new agreement, being aware of the situation might help.

- Formalize Debt Obligations: Ensure that your separation agreement clearly outlines who is responsible for which debts and includes indemnification clauses. An indemnification clause means if your ex defaults on a debt they agreed to pay, they are legally obligated to compensate you for any financial harm you suffer.

- Close Joint Accounts: Wherever possible, close joint credit cards, lines of credit, and other accounts. If they cannot be closed, ensure they are frozen or converted to individual accounts.

Securing a New Car Loan: Approval Odds and Interest Rates in a Post-Separation World

Once you've disentangled your finances, you might be looking for a new vehicle. Lenders in cities like Ottawa, London, or Toronto, Ontario, will assess your creditworthiness based on your individual financial standing. A recent separation or divorce, especially if it involved financial distress or credit damage, can make securing a new loan more challenging.

What to expect and tips for improving approval chances:

- Lender Scrutiny: Lenders will look closely at your credit history, income, current debt-to-income ratio, and stability of employment. They understand that life events like separation can impact finances.

- Interest Rates: If your credit score has taken a hit, you might be offered higher interest rates on a new car loan. This is because lenders perceive a higher risk. However, it's important to remember that your credit score is NOT your rate—there are always options available for fair loans.

- Tips for Improving Approval Chances:

- Improve Your Credit Score: Pay all your bills on time, reduce other debts, and avoid opening too many new credit accounts.

- Stable Income: Demonstrate a consistent and reliable source of income.

- Smaller Loan Amount: Consider a more affordable vehicle to reduce the loan amount and monthly payments.

- Down Payment: A down payment can significantly improve your chances and potentially lower your interest rate.

- Co-signer: If necessary, a co-signer with good credit can help you qualify for a better loan.

- Specialized Lenders: Companies like SkipCarDealer.com specialize in helping individuals with unique financial situations, including those post-separation or with zero credit score, get approved for car loans.

Pro Tip: Obtain a copy of your credit report from Equifax and TransUnion to understand your current financial standing before applying for any new credit. Knowing where you stand allows you to address any issues and present the strongest possible application.

When Agreement Fails: Legal Pathways and Court Intervention for Car Disputes

Ideally, you and your ex-partner can reach an amicable agreement regarding your jointly owned car. However, separation is often fraught with emotion, and agreement isn't always possible. When negotiations stall, legal pathways and court intervention become necessary to resolve disputes over the vehicle.

Mediation and Arbitration: Collaborative Solutions for Difficult Conversations

Before resorting to court, many separating couples in Ontario explore Alternative Dispute Resolution (ADR) methods:

- Mediation: A neutral third-party mediator helps facilitate communication and negotiation between you and your ex-partner. The mediator doesn't make decisions but guides you towards a mutually acceptable solution. Mediation is confidential, less adversarial, and often more cost-effective than court, and allows you to retain control over the outcome. It's an excellent option for discussing the car's value, who keeps it, or how proceeds from a sale will be divided.

- Arbitration: Similar to mediation, arbitration involves a neutral third party, an arbitrator, who acts like a private judge. After hearing arguments and reviewing evidence from both sides, the arbitrator makes a binding decision. This is faster and more private than court but can be more formal and less flexible than mediation.

Both mediation and arbitration are highly recommended for car disputes as they can provide a structured environment to resolve disagreements without the full intensity and cost of litigation.

Court Orders: When All Else Fails, What a Judge Might Decide

If mediation and arbitration prove unsuccessful, or if one party is simply uncooperative, seeking a court order may be the only remaining option. A family court judge in Ontario has the authority to make decisions regarding jointly owned property, including vehicles. This can include:

- Order for Sale: The court can order that the vehicle be sold, either privately or through a dealership, and dictate how the proceeds (after paying off any outstanding loans) are to be divided between the parties.

- Order for Transfer of Ownership: The court can order one party to transfer their ownership interest to the other, often in conjunction with an equalization payment or a buyout.

- Interim Orders for Temporary Use: In some cases, if there's a dispute over who gets to use the car during the separation process, the court can issue an interim order granting temporary exclusive use of the vehicle to one party, especially if it's essential for childcare or work.

Going to court is typically the most expensive and time-consuming option. It should be considered when all other avenues for agreement have been exhausted.

Injunctions and Restraining Orders: Preventing Unauthorized Sale or Damage

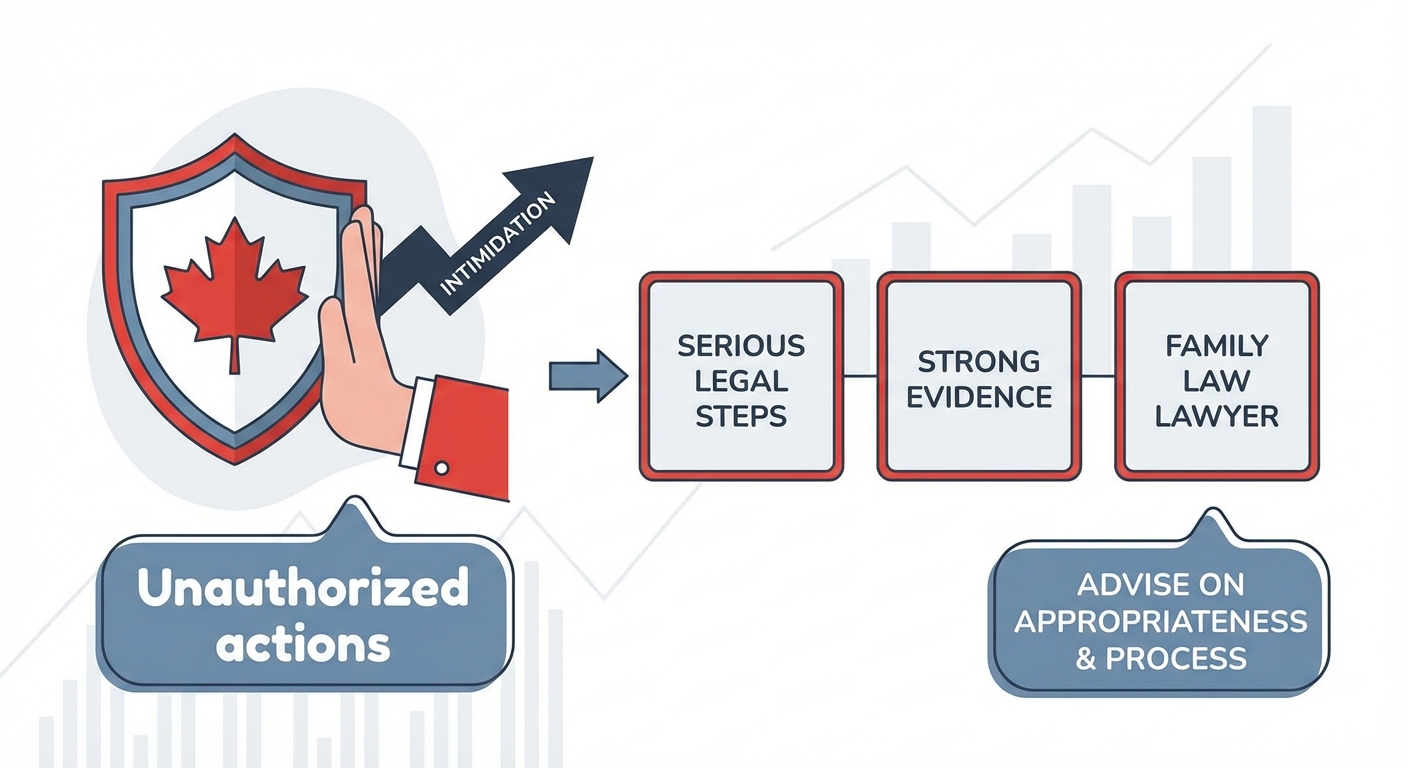

In situations where there is a genuine concern that an ex-partner might unilaterally sell, damage, or hide the jointly owned vehicle without consent, legal measures are available to protect your interest:

- Injunction: A court can issue an injunction preventing one party from selling, transferring, disposing of, or damaging the vehicle until a final resolution is reached. This is a powerful tool to preserve the asset.

- Restraining Order: While less common specifically for property, a restraining order might be sought if the dispute over the car is part of a broader pattern of harassment or intimidation.

These are serious legal steps and require strong evidence to support the claim that such unauthorized actions are likely to occur. Your family law lawyer can advise you on the appropriateness and process for obtaining such orders.

Beyond Ontario: A Glimpse at Joint Asset Division Across Canada

While this article focuses on the specific legal landscape of Ontario, it's important to recognize that family law, particularly concerning property division, varies significantly across Canadian provinces and territories. If you or your ex-partner reside outside of Ontario, or if your property is located elsewhere, you'll need to consult with legal professionals in those specific jurisdictions.

British Columbia's Family Law Act: Key Differences and Similarities

British Columbia's Family Law Act (FLA) also provides for the division of family property upon separation. Similar to Ontario, it aims for a fair division, but its approach has some key differences. In British Columbia, the general rule is a 50/50 division of "family property" and "family debt" that was acquired during the relationship. This includes assets like a jointly owned car and associated loans.

One notable difference is that BC's FLA applies to both married and common-law couples who have been in a marriage-like relationship for at least two years. This is a significant distinction from Ontario, where common-law partners do not have automatic property equalization rights under the Family Law Act. So, if you're separating in Vancouver with a jointly owned car, the process might feel more akin to a married separation in Ontario, with a presumption of equal division.

Alberta's Matrimonial Property Act: Understanding Property Division in the Prairies

Alberta's approach to matrimonial property is outlined in the Matrimonial Property Act. For married couples, the Act generally requires an "equitable" (fair) distribution of matrimonial property, which often means an equal division, but a court can deviate from 50/50 if it deems it inequitable based on various factors. Jointly owned vehicles would fall under matrimonial property.

For common-law couples in Alberta, similar to Ontario, the Matrimonial Property Act generally does not apply. Property division for common-law partners in Calgary, Edmonton, or elsewhere in Alberta typically relies on common law principles of unjust enrichment or constructive trust, requiring proof of contributions to claim an interest in property held solely in the other partner's name. This underscores the fragmented nature of family law across Canada.

Pro Tip: Always consult a family law expert in your specific province or territory. Family law varies significantly across Canada, and advice pertinent to Toronto may not fully apply to an individual separating in Montreal, Vancouver, or Halifax. Localized legal guidance is essential.

Your Next Steps to Driving Forward: A Practical Checklist for Action

Navigating the complexities of a jointly owned car during separation requires a strategic, step-by-step approach. Use this checklist to guide your actions and ensure you're making informed decisions that protect your interests and help you move forward.

- Seek Legal Counsel Immediately: Consult with a family law lawyer in Ontario to understand your specific rights and obligations regarding the jointly owned vehicle and all other assets/debts.

- Gather All Relevant Documents: Collect the vehicle's ownership permit, loan agreements, insurance policies, maintenance records, and any previous appraisals or purchase documents.

- Obtain Independent Valuations: Get at least three fair market value estimates for the vehicle from reputable sources (dealerships, independent appraisers, online tools like Canadian Black Book).

- Assess Outstanding Debt: Determine the exact payoff amount for any joint car loan and understand the terms of the loan agreement.

- Communicate with Your Ex (Through Counsel if Necessary): Initiate discussions about the car's disposition – trade-in, private sale, or buyout – and aim for a mutually agreeable solution.

- Consider Alternative Dispute Resolution: Explore mediation or arbitration to facilitate an agreement without resorting to court.

- Formalize Agreements: Ensure any decisions regarding the car (valuation, sale, trade-in, buyout, or transfer of loan liability) are clearly documented in a legally binding separation agreement.

- Address Joint Loan Liability: If one party is keeping the car, ensure the joint loan is either paid off, refinanced solely in the name of the party keeping the car, or that the other party is formally removed from the loan by the lender.

- Monitor Your Credit: Regularly check your credit reports from Equifax and TransUnion to ensure all joint debts are being managed as agreed and to address any discrepancies promptly.

- Plan for Your Next Vehicle: If you need a new car, begin assessing your financial situation, saving for a down payment, and exploring car loan options from specialized lenders like SkipCarDealer.com who understand unique credit situations.

- Update Insurance: Once ownership is transferred or a new vehicle is acquired, update your car insurance policy to reflect the changes in ownership and driver status.

Pro Tip: Create a detailed budget for your post-separation life. Factor in new car payments, insurance, maintenance, and other living expenses to ensure financial stability as you embark on your new chapter. This proactive budgeting will help you avoid financial strain and make informed decisions about your next vehicle.