Your Car's Baggage (The Loan) Vanishes. Sell It Fast, Vancouver.

Table of Contents

- Key Takeaways

- The Urgent Truth: Why Vancouver Drivers Need to Sell Financed Cars Fast

- Beyond the Basics: Unpacking the 'Why Now?' for Vancouverites

- The Weight of the Loan: When Payments Become a Burden

- Decoding Your Car's Financial DNA: Equity, Liens, and Loan Labyrinth in British Columbia

- Your Car's True Worth: Beyond the Dealership Sticker Price

- The Ghost in the Machine: Understanding Your Outstanding Loan Balance

- The Lender's Claim: What a Lien Means in British Columbia

- Positive Equity: Your Green Light to a Smoother Sale

- The Negative Equity Dilemma: When You Owe More Than It's Worth

- Vancouver's Fast Lanes: Your Selling Pathways for a Financed Car

- The Instant Gratification Route: Online Car Buyers (e.g., Clutch, Canada Drives)

- The Dealership Trade-In: Swapping Old Debt for New Dreams (or Less Debt)

- The Private Sale Paradox: Max Value, Max Effort (and Lien Complexity)

- The Great Escape: Discharging Your Car's Lien in British Columbia

- The Moment of Truth: Paying Off the Loan

- Direct Lender Communication: Your Key to a Clean Title

- Receiving the Lien Release: What to Expect and When

- Registering the Clean Title: British Columbia's ICBC Requirements

- Tackling Negative Equity: Strategies for a Debt-Free Exit

- Facing the Numbers: Calculating Your Shortfall Accurately

- The Out-of-Pocket Payment: The Simplest, If Not Easiest, Solution

- Personal Loans: A Bridge to a Clean Sale?

- Refinancing the Remaining Balance: Is It Worth It?

- The Paper Trail & Legalities: Selling Smart in British Columbia

- Essential Documents: Ownership, Loan Agreement, Payoff Letter

- The Bill of Sale: Protecting Yourself in Vancouver

- Transferring Ownership with ICBC: The Final Steps

- Sales Tax Implications in British Columbia: What Buyers and Sellers Need to Know

- Preparing Your Car for a Quick Vancouver Sale

- First Impressions Count: Detailing for Dollars

- Minor Repairs, Major Impact: Fixing the Low-Hanging Fruit

- Service Records: Your Car's Resume

- Pricing it Right for the Vancouver Market: Researching Local Listings

- Avoiding Pitfalls and Scams in the British Columbia Car Market

- The Red Flags: What to Watch Out For

- Secure Payments: Avoiding Bounced Cheques and Fraudulent Transfers

- Meeting Safely: Public Places in Vancouver

Life in Vancouver moves fast. One day you're cruising the scenic Sea-to-Sky Highway, the next you might be staring down a sudden job relocation to Calgary, a growing family, or an unexpected financial shift that makes your current car payment feel like a lead weight. Whatever the reason, if you're a Vancouver driver with an outstanding car loan and the urgent need to sell, you're not alone. The idea of selling a financed vehicle can seem like navigating a dense British Columbia rainforest without a map – complex, daunting, and full of hidden traps. But what if we told you it doesn't have to be?

At SkipCarDealer.com, we understand the unique pressures and opportunities of the Canadian automotive market, especially in dynamic cities like Vancouver. This comprehensive guide is designed to be your compass, demystifying the process of selling a financed car quickly and securely, ensuring your car's "baggage" vanishes, leaving you free to move forward. We'll walk you through understanding your equity, dealing with liens, exploring your selling options, and handling all the necessary paperwork with confidence.

Key Takeaways

- Understand Your Equity First: Always know your payoff balance versus market value before anything else. This crucial calculation dictates your entire selling strategy.

- Lien Discharge is Paramount: The loan must be cleared for a legal sale in British Columbia. Plan for this process, as it's the non-negotiable step to transfer ownership.

- Consider Online Buyers for Speed: Companies like Clutch or Canada Drives often offer the fastest, most convenient solution, frequently handling the lien payoff directly, which can be a huge time-saver in Vancouver's busy market.

- Negative Equity isn't a Deal Breaker: Strategies exist to manage it, from out-of-pocket payments to personal loans. Be prepared for potential costs, but don't assume your car is unsellable. For more insights on navigating complex financial situations, check out our guide on The Consumer Proposal Car Loan You Were Told Was Impossible.

- Paperwork Precision: Gather all loan documents, title information, and understand British Columbia's transfer requirements. Meticulous organization prevents delays.

- Price Competitively for Vancouver: Research local market prices thoroughly to ensure a fast sale without leaving money on the table. Vancouver's market has its own nuances.

The Urgent Truth: Why Vancouver Drivers Need to Sell Financed Cars Fast

There are countless reasons why a car that once perfectly suited your needs suddenly becomes a burden. For Vancouverites, the urgency to sell a financed vehicle can stem from a variety of personal and financial pressures, often demanding a swift resolution. Understanding these common scenarios can help you recognize the validity of your situation and motivate a proactive approach to selling.

Beyond the Basics: Unpacking the 'Why Now?' for Vancouverites

Life rarely follows a perfectly predictable path, and for many in British Columbia, unforeseen circumstances necessitate a rapid change of vehicles. What might seem like a minor inconvenience in a stable financial environment can become a pressing issue when a car loan is involved.

- Sudden Job Relocation (e.g., moving from Vancouver to Calgary or Toronto): A new job opportunity in another province or even overseas often means selling assets quickly. Shipping a car can be expensive and impractical, making a fast local sale the most sensible option. You might need a different vehicle type for a new environment, or simply want to simplify your move.

- Unexpected Financial Strain or Debt Consolidation: A job loss, medical emergency, or accumulating credit card debt can quickly turn a manageable car payment into a significant monthly drain. Selling the vehicle to eliminate the loan can be a crucial step towards financial recovery and debt consolidation.

- Need for a Different Vehicle Type (e.g., growing family, downsizing): A new baby might mean your sporty sedan no longer fits the car seats and strollers, necessitating an SUV or minivan. Conversely, an empty nest could prompt a desire to downsize from a large SUV to a more fuel-efficient compact car, especially with Vancouver's higher fuel prices.

- High Interest Rates Making Payments Unmanageable: If you secured your car loan when interest rates were higher, or if your credit situation has improved, you might be looking to shed a high-interest burden. Even a slight increase in other living costs can push a high car payment into the "unmanageable" category.

The Weight of the Loan: When Payments Become a Burden

Beyond the practicalities, there's a significant psychological component to carrying a car loan. The monthly payment, often one of the largest fixed expenses after rent or mortgage, can feel like a heavy weight, especially when financial circumstances change. Imagine the relief of seeing that payment disappear from your budget, freeing up hundreds of dollars each month for other necessities, savings, or even just peace of mind.

For many, selling a financed car quickly isn't just about financial prudence; it's about reclaiming financial freedom and reducing stress. The desire to "vanish" that loan payment is a powerful motivator, driving the need for efficient, secure, and rapid selling strategies tailored for the Vancouver market.

Decoding Your Car's Financial DNA: Equity, Liens, and Loan Labyrinth in British Columbia

Before you can effectively sell your financed car in Vancouver, you need to understand its financial standing. This means delving into concepts like equity, outstanding loan balances, and the ever-important lien. Grasping these mechanics is fundamental to navigating the sale process successfully in British Columbia.

Your Car's True Worth: Beyond the Dealership Sticker Price

The first step in any car sale is knowing your vehicle's current market value. This isn't what you paid for it or what you wish it was worth; it's what buyers in Vancouver are willing to pay for a car like yours, in its current condition, right now.

- Utilizing online valuation tools (e.g., Kelley Blue Book, Canadian Black Book): These reputable platforms provide estimates based on make, model, year, mileage, and condition. Remember, these are starting points.

- Considering condition, mileage, and trim level: A car with low kilometres and a full service history will command a higher price than one with significant wear and tear. Your specific trim package (e.g., a fully loaded touring model vs. a base model) also plays a big role.

- Pro Tip: Compare recent sales in Vancouver and surrounding areas like Surrey and Richmond for a realistic price. Check AutoTrader British Columbia, Craigslist Vancouver, and even local dealership used car inventories. This hyper-local research gives you the most accurate pulse of the market.

The Ghost in the Machine: Understanding Your Outstanding Loan Balance

Your outstanding loan balance is the total amount you still owe your lender. This isn't always the same as the "current balance" you see on your monthly statement, especially if you're close to the end of your billing cycle.

- Difference between current balance and payoff amount (due to interest accrual): Interest accrues daily. Your payoff amount is the exact amount required to clear your loan on a specific day, including any per-diem interest and potential fees.

- Contacting your specific lender (e.g., RBC, Scotiabank, BMO, manufacturer financing like Toyota Financial Services) for a payoff letter: This is critical. Request a precise payoff amount, valid for a specific period (e.g., 7-10 days). This letter will also include instructions on how a third party can pay off the loan.

The Lender's Claim: What a Lien Means in British Columbia

When you finance a car, the lender (bank, credit union, or manufacturer's finance arm) places a lien on the vehicle. This legal claim signifies their ownership interest until the loan is fully repaid.

- How a lien is registered with ICBC (Insurance Corporation of British Columbia): In British Columbia, liens are typically registered with ICBC, making it publicly discoverable. Any potential buyer or dealership can easily check if a lien exists.

- The lender's ownership until the loan is fully paid: Until that final payment clears, your lender is the legal owner of the vehicle, even if you possess it and make payments. You cannot legally transfer ownership to a new buyer until the lien is discharged.

- Why a clear title is non-negotiable for transfer of ownership: No legitimate buyer will purchase a car with an active lien, as it means they wouldn't truly own the vehicle. The lien must be removed from the vehicle's record for a clean title transfer to occur.

Positive Equity: Your Green Light to a Smoother Sale

You have positive equity when your car's current market value is GREATER than your outstanding loan payoff amount. This is the ideal scenario for selling a financed car.

Example: Your car is worth $20,000, and your loan payoff is $15,000. You have $5,000 in positive equity. This means after the loan is paid off, you'll walk away with $5,000 cash in hand, making the sale straightforward and potentially profitable.

The Negative Equity Dilemma: When You Owe More Than It's Worth

Negative equity, often called being "upside down" or "underwater," occurs when your car's market value is LESS than your outstanding loan payoff amount. This is a common situation, especially for newer cars that depreciate quickly or if you rolled negative equity from a previous vehicle into your current loan.

- Calculating your shortfall: If your car is worth $15,000 and your payoff is $20,000, you have $5,000 in negative equity. This shortfall must be covered to clear the lien.

- Initial shock vs. actionable strategies: Discovering you have negative equity can be disheartening, but it's not a dead end. Many Vancouver drivers face this, and there are clear strategies to manage it, which we'll explore shortly. For those facing credit challenges, understanding your options is key. Our article on Your Neighbour's Car. Your Poor Credit. Still a Match, Vancouver offers helpful perspectives on vehicle financing even with low credit.

Vancouver's Fast Lanes: Your Selling Pathways for a Financed Car

When time is of the essence, choosing the right selling avenue is crucial. Each option offers a different balance of speed, convenience, and potential return. Let's compare the most common pathways for selling a financed car in Vancouver.

The Instant Gratification Route: Online Car Buyers (e.g., Clutch, Canada Drives)

For sheer speed and convenience, online car buying services have become incredibly popular in Canada, including across British Columbia. These platforms often provide instant, no-obligation quotes and can complete a sale within days.

- Speed vs. Offer: The primary advantage here is speed. You can get an offer online, often within minutes, schedule an inspection, and have the car picked up quickly. The trade-off is that the offer might be slightly lower than what you could get through a private sale, as these companies need to factor in their own profit margins and reconditioning costs.

- How They Handle the Lien: This is where online buyers truly shine for financed vehicles. Most reputable online car buyers are experienced in directly dealing with lenders. They will verify your payoff amount, pay off your loan directly, and then provide you with the remaining equity (if positive) or collect the negative equity (if applicable). This significantly simplifies the process for the seller. Always verify their exact process and ensure you get clear documentation.

- Local Players and Reach: Companies like Clutch and Canada Drives operate across Canada, with strong presences in major metropolitan areas like Vancouver, Surrey, Victoria, and Richmond, offering convenient pick-up services.

- Pro Tip: Always get multiple online quotes to ensure you're getting a competitive offer. The market can fluctuate, and different companies might value your specific vehicle differently. Don't settle for the first offer you receive.

The Dealership Trade-In: Swapping Old Debt for New Dreams (or Less Debt)

Trading in your financed car at a dealership is another popular and relatively convenient option, especially if you're planning to purchase another vehicle.

- The Power of Negotiation: While convenient, trading in involves negotiating two transactions simultaneously: the price of your new car and the value of your trade-in. Be prepared to negotiate both. Dealerships often have more wiggle room on the new car price than on the trade-in value, so ensure you understand the true value of both components.

- Rolling Over Negative Equity: A common practice, but a dangerous game for your future finances. If you have negative equity, a dealership might offer to "roll" that amount into your new car loan. This means you'll be financing the negative equity from your old car on top of the price of your new car, increasing your total debt and monthly payments. This can quickly lead to being even more upside down on your new vehicle.

- Pro Tip: Understand the true value of your trade-in versus the new car's price. Don't let them blur the lines. Get an independent valuation of your current vehicle before stepping into the dealership, and try to negotiate the new car price separately from the trade-in value.

The Private Sale Paradox: Max Value, Max Effort (and Lien Complexity)

Selling your car privately typically yields the highest sale price, but it comes with the most effort and complexity, especially when a lien is involved.

- Navigating the Private Market in Vancouver: Platforms like Craigslist Vancouver, AutoTrader British Columbia, Facebook Marketplace, and local classifieds are popular. You'll need to create compelling listings, respond to inquiries, arrange test drives, and handle negotiations.

- The Buyer's Perspective: Reassuring them about the outstanding lien: This is the biggest hurdle. Most private buyers are wary of purchasing a car with a lien, fearing they won't get a clear title. You'll need to clearly explain the process of lien discharge and reassure them that the transaction will be secure and legal. Transparency is key.

- The Escrow Option: A safe bet for both parties to ensure secure payment and lien discharge: While less common for private car sales in British Columbia, an escrow service can act as a neutral third party, holding the buyer's payment until the lien is discharged and the title is clear. This adds a layer of security but also complexity and cost. More commonly, the buyer and seller go to the seller's bank together, where the buyer's bank draft is used to pay off the loan, and the remaining funds (if any) are given to the seller.

Here's a quick comparison of the selling pathways:

| Selling Pathway | Typical Speed | Effort Required | Potential Return | Lien Handling |

|---|---|---|---|---|

| Online Car Buyers | Very Fast (Days) | Low | Good (Slightly below private) | Handled directly by buyer (seamless) |

| Dealership Trade-In | Fast (Hours to Days) | Medium (Negotiation) | Variable (Often lower than private, can roll negative equity) | Handled by dealership (integrated into new purchase) |

| Private Sale | Slow to Medium (Weeks to Months) | High | Highest potential | Seller/Buyer coordination required (most complex) |

The Great Escape: Discharging Your Car's Lien in British Columbia

Regardless of how you sell your financed car, the lien must be discharged. This is the absolute critical step that transforms a "financed" car into a "clear title" car, ready for legal transfer of ownership. Understanding this process is paramount for any British Columbia car seller.

The Moment of Truth: Paying Off the Loan

The core of lien discharge is the payment of your outstanding loan balance. This can happen in a few ways, depending on your selling method.

- Methods of payment: Wire transfer, certified cheque, direct payment from buyer/dealer:

- If selling to an online buyer or dealership, they will typically send a wire transfer or certified cheque directly to your lender for the payoff amount.

- If selling privately, the buyer might provide a bank draft or certified cheque made out to your lender for the payoff amount, with any remaining equity going to you. Alternatively, you might pay off the loan yourself using your own funds, then proceed with the private sale once the title is clear.

- Ensuring the payment is processed correctly and swiftly: Always confirm with your lender that the payment has been received and applied to your account. Get a confirmation number or email.

Direct Lender Communication: Your Key to a Clean Title

Proactive communication with your lending institution is vital throughout this process.

- Requesting a 'lien release letter' or 'satisfaction of lien' document: Once the loan is fully paid off, immediately request an official document from your lender confirming the lien has been satisfied. This is your proof that you no longer owe money on the vehicle.

- Understanding your lender's specific process for lien discharge: Each lender (e.g., Scotiabank, BMO, TD Auto Finance) will have slightly different procedures and timelines for releasing a lien. Ask them upfront about their process, what documents to expect, and when to expect them.

Receiving the Lien Release: What to Expect and When

After your loan is paid off, the waiting game begins for the official lien release documentation.

- Typical processing times for lenders (can vary from days to weeks): While some lenders are quick, it can take anywhere from a few days to several weeks to receive the official lien release letter. This is why planning ahead is important for a speedy sale.

- What the official lien release document looks like: It will be an official letter on the lender's letterhead, clearly stating that the loan for your specific vehicle (identified by VIN) has been paid in full and the lien is released. Keep this document safe!

Registering the Clean Title: British Columbia's ICBC Requirements

Receiving the lien release from your lender is a major step, but it's not the final one for British Columbia residents. You must ensure ICBC's records are updated.

- Updating the vehicle's registration with ICBC to reflect the lien removal: Take your lien release letter to an ICBC Autoplan broker. They will update the vehicle's registration to remove the lienholder's name, effectively giving you a clear title in ICBC's system.

- Pro Tip: Don't forget to follow up with ICBC! Common pitfalls and how to avoid delays in receiving your clear title. Many sellers assume the lender notifies ICBC automatically, but it's always best practice to confirm the update yourself. A delay here can hold up your final sale.

Tackling Negative Equity: Strategies for a Debt-Free Exit

Facing negative equity can feel like a setback, but it doesn't mean you're stuck with your car or your loan. Many Vancouver drivers find themselves in this position, and there are practical strategies to overcome it and achieve a clean sale.

Facing the Numbers: Calculating Your Shortfall Accurately

Before exploring solutions, confirm the exact amount of your negative equity. This is your car's market value minus your precise loan payoff amount. A clear understanding of this number is your starting point for any strategy.

- Market value minus payoff amount equals your negative equity: Be realistic about your car's value and precise about your loan payoff. Don't guess.

The Out-of-Pocket Payment: The Simplest, If Not Easiest, Solution

If you have the financial means, covering the negative equity directly from your savings is often the most straightforward solution. You simply pay the difference to your lender, making your car's title clear, and then proceed with the sale as if it had positive equity. This avoids additional interest or new loans.

Personal Loans: A Bridge to a Clean Sale?

If you don't have the cash readily available, a personal loan can bridge the gap, allowing you to pay off the car loan and clear the lien.

- When a personal loan makes sense (e.g., lower interest than car loan, short-term need): A personal loan can be a good option if its interest rate is lower than your current car loan, saving you money in the long run. It's also suitable if you need a short-term solution and plan to repay the personal loan quickly once the car is sold and other financial matters are settled.

- Impact on your credit score and future borrowing capacity: Taking out a new loan will affect your credit score, potentially lowering it temporarily. Consider the impact on any future borrowing needs. For more information on how various financial situations impact your ability to get a car loan, particularly with low credit, you might find our article on That '69 Charger & Your Low Credit? We See a Future, British Columbia insightful.

Refinancing the Remaining Balance: Is It Worth It?

In some cases, if the negative equity is a manageable amount, you might consider refinancing the remaining balance into a new, smaller loan, perhaps with a credit union or a specialized lender.

- Looking at options with credit unions or smaller lenders: These institutions sometimes offer more flexible terms or better rates for smaller personal loans than larger banks.

- Pro Tip: Explore all options thoroughly before rolling negative equity into a new car loan, as this compounds debt. While tempting to simply push the problem into a new vehicle purchase, this strategy often leads to a cycle of perpetual negative equity, making future car sales even harder. Address the negative equity directly if possible.

The Paper Trail & Legalities: Selling Smart in British Columbia

Selling a car involves more than just finding a buyer; it's about meticulous documentation and adhering to British Columbia's legal requirements. This is especially true when a loan is involved, as precision protects both you and the buyer.

Essential Documents: Ownership, Loan Agreement, Payoff Letter

Having all your paperwork in order from the outset will prevent delays and instill confidence in potential buyers.

- Original loan agreement and current statement: These documents prove your legal relationship with the lender and show your payment history.

- Lien release letter (once obtained): This is your golden ticket. Without it, you cannot legally transfer ownership.

- Vehicle registration and proof of insurance (ICBC): These show you are the registered owner and that the vehicle is currently insured, which is necessary for test drives.

The Bill of Sale: Protecting Yourself in Vancouver

A properly drafted Bill of Sale is a legal contract that protects both the buyer and the seller. It's especially crucial for private sales in British Columbia.

- Key information: VIN, sale price, 'as-is' clause, date, signatures: The Bill of Sale must clearly state the Vehicle Identification Number (VIN), the agreed-upon sale price, the date of sale, and include signatures from both buyer and seller. An "as-is" clause is vital for private sales, stating that the buyer is purchasing the vehicle in its current condition with no warranties from the seller.

- Specific clauses for financed cars (e.g., conditional on lien discharge): If you're selling privately before the lien is fully discharged, the Bill of Sale should clearly state that the transfer of ownership is conditional upon the full payment of the outstanding loan and the discharge of the lien. This protects the buyer by making it clear that they won't get the title until the debt is cleared.

Transferring Ownership with ICBC: The Final Steps

The sale isn't complete until the ownership transfer is formally registered with ICBC.

- Required forms and procedures at an ICBC Autoplan broker: Both the buyer and seller must complete and sign the Transfer/Tax Form (APV9T) from ICBC. You'll typically do this at an Autoplan broker's office. The seller needs to submit their portion of the form within 10 days of the sale, and the buyer must register the vehicle in their name.

- Ensuring the transfer is completed promptly to avoid future liabilities: It's critical that the ownership transfer is registered quickly. As the seller, you want to ensure the vehicle is no longer legally your responsibility to avoid any future fines, tickets, or even accident liabilities associated with the car.

Sales Tax Implications in British Columbia: What Buyers and Sellers Need to Know

Understanding the tax situation is important for both parties involved in a private car sale in British Columbia.

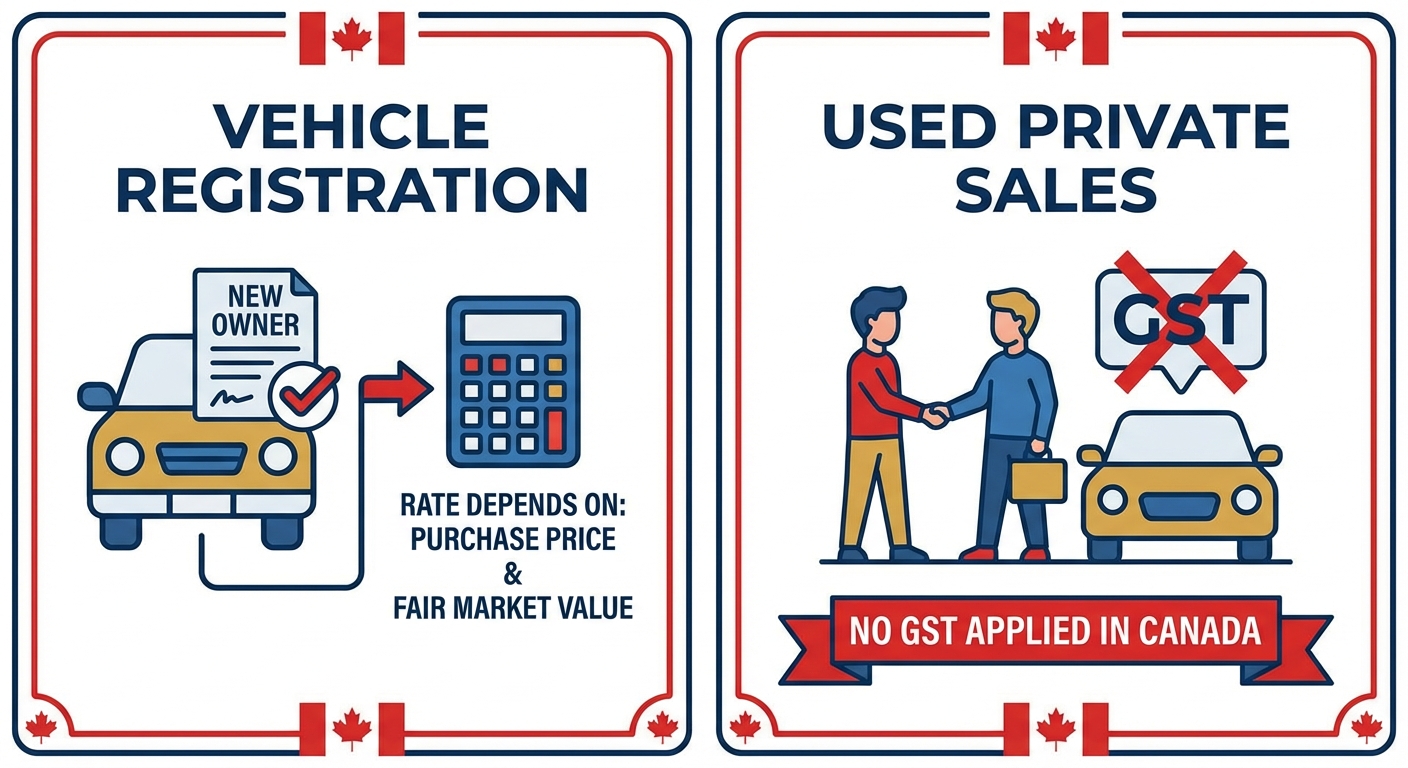

- Buyer's responsibility for PST (Provincial Sales Tax) on the purchase price: In British Columbia, the buyer is responsible for paying PST on the purchase price of a used vehicle. This is paid to ICBC when the vehicle is registered in the new owner's name. The rate depends on the purchase price and the vehicle's fair market value.

- No GST on used private sales: Importantly, there is no GST (Goods and Services Tax) applied to used vehicles sold privately in Canada.

Preparing Your Car for a Quick Vancouver Sale

In a competitive market like Vancouver, presentation matters. A well-prepared car can sell faster and for a better price, even with an outstanding loan. Think of it as putting your best foot forward.

First Impressions Count: Detailing for Dollars

You never get a second chance to make a first impression. A clean car signals to buyers that you've cared for the vehicle, which translates to perceived value.

- Interior and exterior detailing (DIY vs. professional services in Vancouver): A thorough wash, wax, interior vacuum, and wipe-down can make a huge difference. Consider professional detailing services in Vancouver, Burnaby, or Coquitlam if you want a showroom finish without the effort.

- Importance of curb appeal for attracting buyers: A sparkling clean car in a well-lit photograph will grab attention online and make a strong statement during in-person viewings.

Minor Repairs, Major Impact: Fixing the Low-Hanging Fruit

Small, inexpensive fixes can significantly boost a car's perceived value and prevent buyers from negotiating down the price for minor issues.

- Burnt-out light bulbs, minor scratches, tire pressure: Replace any burnt-out bulbs (headlights, tail lights, interior lights). Touch up minor paint scratches. Ensure tires are properly inflated. These small details suggest a well-maintained vehicle.

- When to invest in repairs vs. selling 'as-is': Generally, only invest in repairs that cost less than the value they add. For example, fixing a check engine light that indicates a serious mechanical issue might not be worth it if you're trying to sell quickly and cheaply, unless it's a very simple, inexpensive fix. For more complex repairs, it might be better to sell "as-is" and factor the repair cost into your asking price.

Service Records: Your Car's Resume

A comprehensive service history is a powerful selling tool that builds buyer confidence.

- Organizing maintenance records, oil changes, and major repairs: Gather all receipts and records of oil changes, tire rotations, brake replacements, and any major repairs. Present them in an organized folder.

- Proof of regular upkeep in British Columbia's driving conditions: Showing a consistent service history demonstrates that the car has been properly maintained, which is especially reassuring for buyers considering British Columbia's varied driving conditions, from urban Vancouver streets to mountain passes.

Pricing it Right for the Vancouver Market: Researching Local Listings

Setting the right price is paramount for a quick sale. Overprice it, and it will sit; underprice it, and you leave money on the table.

- Analyzing similar cars on Craigslist Vancouver, AutoTrader British Columbia, and local dealer sites: This is a crucial step. Look at cars with similar make, model, year, mileage, and condition within your local market. What are they actually selling for, not just listed for?

- Understanding seasonality in the Vancouver car market: Certain times of year can influence demand. Convertibles might sell better in spring/summer, while SUVs and AWD vehicles see a bump in fall/winter. Factor this into your pricing strategy if you have flexibility.

Avoiding Pitfalls and Scams in the British Columbia Car Market

While the goal is a fast sale, security should never be compromised. The British Columbia car market, like any other, has its share of unscrupulous individuals. Being aware of common scams and taking precautions will protect you and your finances.

The Red Flags: What to Watch Out For

Scammers often use similar tactics. Learning to recognize these red flags can save you a lot of grief.

- Overpayment scams, fake cheques, remote buyers with elaborate shipping schemes: Be highly suspicious of buyers who offer to pay more than the asking price, especially if they want you to send money back to them. Fake bank drafts or certified cheques can look real but bounce days later. Remote buyers claiming to be overseas or out of province who want to arrange shipping without seeing the car are almost always scams. They often involve third-party payment processors or shipping agents that are part of the fraud.

- Buyers unwilling to meet in person or inspect the vehicle: A legitimate buyer will want to see the car, test drive it, and potentially have it inspected by a mechanic. Anyone trying to buy without these steps is a major red flag.

Secure Payments: Avoiding Bounced Cheques and Fraudulent Transfers

For private sales, securing payment is paramount, especially when a large sum is involved to cover a loan payoff.

- Bank drafts, certified cheques (verified with the issuing bank), direct wire transfers: These are the most secure forms of payment. If accepting a bank draft or certified cheque, insist on meeting at the issuing bank to verify its authenticity with a teller before completing the transaction. Direct wire transfers are also secure but ensure they clear into your account before releasing the vehicle or title documents.

- Avoiding personal cheques or cash for large sums: Never accept personal cheques, as they can easily bounce. While cash might seem appealing, handling large amounts of cash can be risky, and counterfeits can be an issue.

Meeting Safely: Public Places in Vancouver

When arranging test drives or meetings with potential buyers, prioritize your personal safety.

- Meeting in well-lit, public locations (e.g., shopping mall parking lots in Burnaby or Coquitlam): Instead of your home, choose a busy, public place during daylight hours. A local shopping centre parking lot, coffee shop parking lot, or even a police station parking lot (some municipalities offer designated safe exchange zones) are good options.

- Bringing a friend or family member: Always have someone else with you during test drives or when meeting a buyer for the first time. This provides an extra layer of safety and a witness if anything goes awry.