Vancouver: Your SkipTheDishes Hustle *Is* Your Car Loan. Negative Equity? Approved.

Table of Contents

- Key Takeaways

- The Vancouver Grind: Why Your Delivery Hustle Demands a Reliable Ride (Even with Negative Equity)

- The Daily Reality: Life as a SkipTheDishes Driver in Vancouver, British Columbia

- The Stakes: Why a Reliable Vehicle Isn't a Luxury, It's Your Livelihood

- Key Takeaways: Your Roadmap to Urgent Car Financing in Vancouver

- Negative Equity: Unpacking the Financial Weight on Your Wheels

- What Exactly *Is* Negative Equity? A Straightforward Explanation for Real People

- How Did I Get Here? Common Pitfalls for Delivery Drivers

- The 'Catch-22': Why Trading In Feels Impossible with Negative Equity

- Pro Tip: Calculating Your True Negative Equity

- Your SkipTheDishes Earnings: Proving Your Worth to Vancouver Lenders

- Beyond the Pay Stub: How Gig Economy Income is Assessed by Lenders

- Essential Documentation: What Lenders *Really* Want to See

- Building a Consistent Picture: Strategies for Tracking and Presenting Irregular Income

- Pro Tip: Crafting a 'Gig Economy Income Statement'

- Cracking the Code: How Lenders Say 'Yes' to Negative Equity in Vancouver

- The Consolidation Strategy: Rolling Negative Equity into a New Loan

- Understanding the Risk: Why Lenders are Cautious and How to Mitigate It

- The Power of the Down Payment (Even a Small One): Why It Matters

- Exploring Co-Signers: When a Helping Hand Makes All the Difference

- Navigating the Loan Landscape: Banks, Dealers, and Specialty Lenders in British Columbia

- Traditional Banks vs. Credit Unions: The Pros and Cons for Challenging Credit

- Dealership Financing: The 'One-Stop Shop' Advantage for Negative Equity

- Subprime Lenders: Understanding the Role of Specialty Finance Companies Across Canada

- The Broker Advantage: Why Working with an Auto Finance Broker Can Save Time and Money

- Pro Tip: Questions to Ask Every Lender Before Signing

- The Smart Wheels for the Smart Hustler: Choosing Your Next Delivery Vehicle

- Fuel Efficiency is King: Prioritizing Low Consumption for Vancouver Traffic and Long Shifts

- Reliability Over Luxury: Best Car Brands and Models for High-Mileage Work

- Maintenance Matters: Looking for Vehicles with Affordable Parts and Service Costs

- Depreciation Watch: Selecting Cars That Hold Their Value Better

- Used vs. New: Making the Financially Savvy Choice for a Delivery Driver

- Beyond the Monthly Payment: Unmasking Hidden Costs and Sneaky Fees

- The True Cost of Interest: Understanding APR and How It Impacts Your Total Loan

- Administration Fees and Documentation Charges: What's Legitimate and What's Negotiable in British Columbia

- The Insurance Nightmare: Why Vancouver Car Insurance Can Be Shockingly High for Delivery Drivers

- Extended Warranties: Are They Worth It for a High-Mileage Vehicle?

- Pro Tip: Demanding a Full Cost Breakdown

- Boosting Your Approval Odds: Strategic Moves for Vancouver Drivers

- Credit Score CPR: Quick Ways to Improve Your Credit Before Applying

- Debt-to-Income Ratio: Why It Matters and How to Present Your Best Financial Self

- Proof of Residence and Stability: Showing You're a Reliable Resident of Vancouver, British Columbia

- The Art of Negotiation: Don't Be Afraid to Haggle on Price, Trade-In, and Interest Rates

- The Fast Track: Expediting Your Urgent Car Financing in Vancouver

- Pre-Approval Power: Getting a Head Start Before Hitting the Dealerships

- Gathering Documents *Now*: A Checklist for Swift Application

- Communicating Urgency: How to Convey Your Need to Lenders and Dealers Without Sounding Desperate

- What to Expect: The Typical Timeline from Application to Driving Away in Vancouver

- Beyond the Loan: Building a Stronger Financial Future in British Columbia

- Escaping the Negative Equity Cycle: Strategies for Future Vehicle Purchases

- Credit Score Ascension: Long-Term Habits for Improving Your Financial Health

- Budgeting for the Hustle: Managing Income Variability and Unexpected Car Expenses

- The Power of Savings: Creating an Emergency Fund for Your Delivery Vehicle

- Resources for Financial Literacy in British Columbia

- Your Next Steps to Approval: Driving Forward in Vancouver

- Recap of Crucial Actions: Your Immediate To-Do List

- Empowerment Message: Taking Control of Your Financial Journey

- Call to Action: Start Your Engine, Vancouver!

- Frequently Asked Questions (FAQ)

The streets of Vancouver, British Columbia, are your office. From the bustling lanes of Kitsilano to the winding roads of Burnaby and the sprawling suburbs of Surrey, you're constantly on the move, connecting hungry customers with their favourite meals. If you're a SkipTheDishes driver, or part of any gig economy delivery service in this vibrant, demanding city, you know your car isn't just a convenience; it's the engine of your livelihood.

But what happens when that engine starts sputtering? When unexpected repairs drain your hard-earned cash, or worse, when your current vehicle is on its last legs, and you realize you owe more on it than it's worth? This dreaded situation, known as negative equity, can feel like a financial trap, especially when every shift counts. The good news? For Vancouver's dedicated gig economy hustlers, negative equity doesn't have to be a dead end. SkipCarDealer.com understands your unique grind and is here to show you how your SkipTheDishes hustle *is* your car loan.

Key Takeaways

- Negative equity is a common challenge, but it is absolutely surmountable for gig economy drivers in British Columbia.

- Your SkipTheDishes income, when presented correctly, can secure you the financing you need, even without traditional pay stubs.

- Urgent car financing for negative equity is a reality in Vancouver, British Columbia, with the right strategy and the right partners.

- Making informed choices about lenders, vehicles, and loan terms is critical for long-term financial health and avoiding future negative equity traps.

The Vancouver Grind: Why Your Delivery Hustle Demands a Reliable Ride (Even with Negative Equity)

The Daily Reality: Life as a SkipTheDishes Driver in Vancouver, British Columbia

Picture this: it's a rainy Tuesday evening in Vancouver, and the dinner rush is in full swing. Your phone pings with back-to-back orders, each one a potential boost to your daily earnings. You navigate dense city traffic, dodge cyclists in Gastown, and climb the hilly streets of North Vancouver, all while racing against the clock to deliver hot food. This isn't just a part-time gig; for many, it's a full-time commitment, demanding resilience, exceptional time management, and, most critically, a vehicle that won't let you down.

The wear and tear on a delivery vehicle in a city like Vancouver is immense. Stop-and-go traffic, frequent parking, constant starting and stopping – these all accelerate depreciation and increase maintenance needs. From rising fuel costs to unexpected flat tires, the constant pressure to keep your wheels turning is a daily reality for thousands of British Columbians relying on the gig economy.

The Stakes: Why a Reliable Vehicle Isn't a Luxury, It's Your Livelihood

For a SkipTheDishes driver, a broken-down car isn't just an inconvenience; it's an immediate threat to your income. Every hour your car is off the road, you're losing money. A single missed shift due to a mechanical failure can impact your weekly earnings significantly. Beyond the immediate income loss, there's the ripple effect: declining customer ratings due to late deliveries, potential account deactivation, and the sheer stress of an unreliable vehicle hanging over your head.

In the gig economy, your car is your primary tool. It's your mobile office, your revenue generator, and your link to financial stability. Without a reliable vehicle, the ability to earn, pay bills, and maintain your independence in one of Canada's most expensive cities becomes incredibly challenging.

Key Takeaways: Your Roadmap to Urgent Car Financing in Vancouver

- Negative equity is a common challenge, but it is absolutely surmountable for gig economy drivers.

- Your SkipTheDishes income, when presented correctly, can secure you the financing you need.

- Urgent car financing for negative equity is a reality in Vancouver, British Columbia, with the right strategy.

- Making informed choices about lenders, vehicles, and loan terms is critical for long-term financial health and avoiding future negative equity.

Negative Equity: Unpacking the Financial Weight on Your Wheels

What Exactly *Is* Negative Equity? A Straightforward Explanation for Real People

Let's cut through the jargon. Negative equity, often called being "upside down" on your car loan, simply means you owe more money on your vehicle than it's currently worth. Imagine you bought a car for $25,000, and after a couple of years and many kilometres delivering meals across Vancouver, its market value has dropped to $15,000. If you still have $18,000 left on your loan, you have $3,000 in negative equity ($18,000 - $15,000 = $3,000). It's a common scenario, especially for vehicles that see heavy use.

How Did I Get Here? Common Pitfalls for Delivery Drivers

Several factors contribute to negative equity, particularly for gig economy drivers in British Columbia:

- Rapid Depreciation Due to High Mileage: Your SkipTheDishes hustle means putting on thousands of kilometres quickly. High mileage significantly reduces a vehicle's resale value faster than average.

- Previous High-Interest Loans: If your initial car loan came with a high interest rate, you might have paid more towards interest and less towards the principal, leaving you with a larger outstanding balance.

- Minimal or No Down Payment: Starting a loan without a substantial down payment means you're immediately financing a larger portion of the car's value, making it easier to fall into negative equity as the car depreciates.

- Market Value Fluctuations: While less common, certain market shifts can also impact vehicle values, although depreciation from heavy use is usually the dominant factor for delivery drivers.

The 'Catch-22': Why Trading In Feels Impossible with Negative Equity

This is where the frustration truly sets in. Your current car is failing, you need a new, reliable one for work, but you can't simply trade it in. If you have $3,000 in negative equity, a dealership would need to add that amount to the price of your new car. So, a $20,000 new car effectively becomes a $23,000 loan. This increases your monthly payments, making the new car less affordable and potentially extending your loan term significantly. It feels like you're stuck, needing a solution but penalized for seeking one.

Pro Tip: Calculating Your True Negative Equity

Pro Tip: Calculate Your True Negative Equity

Before you approach any lender or dealership, know your numbers. Here's how:

- Find Your Loan Payoff Amount: Contact your current lender and ask for your exact loan payoff amount. This is often different from your remaining balance as it includes per diem interest.

- Determine Your Vehicle's Market Value: Use reputable online tools like Canadian Black Book (CBB) or Kelley Blue Book (KBB.ca) for a trade-in estimate. You can also get a professional appraisal from a dealership. Be honest about mileage and condition, especially the wear and tear from delivery work.

- Subtract: Loan Payoff Amount - Market Value = Your Negative Equity (or positive equity, if you're lucky!).

Having this figure empowers you in negotiations and helps you understand the scope of the challenge.

Your SkipTheDishes Earnings: Proving Your Worth to Vancouver Lenders

Beyond the Pay Stub: How Gig Economy Income is Assessed by Lenders

Traditional lenders, like major banks, are often structured to understand consistent, bi-weekly pay stubs from a single employer. For gig economy workers, this model doesn't fit. Your income is often variable, comes from multiple sources (SkipTheDishes, Uber Eats, DoorDash, etc.), and you're essentially self-employed. This doesn't mean you're unlendable; it just means lenders need to assess your income differently.

Specialty lenders and dealerships that work with non-traditional income sources understand that consistency, even if variable, is key. They look for patterns, average monthly earnings, and a track record of active hustle. They're less concerned with a single pay stub and more interested in the overall picture of your financial activity. For more on how lenders view non-traditional income, check out our guide on Banks Need Pay Stubs. We Need Your Drive. Gig Worker Car Loans.

Essential Documentation: What Lenders *Really* Want to See

To prove your income as a gig worker, you'll need to provide comprehensive documentation. This paints a clear picture for lenders:

- Bank Statements: 3-6 months of personal bank statements showing consistent deposits from SkipTheDishes and other gig platforms. These are crucial as they offer a direct view of your cash flow.

- Tax Returns: Your most recent (1-2 years) tax returns, specifically your T4As (if applicable) and T2125 (Statement of Business or Professional Activities) for self-employed income. These forms provide an official summary of your earnings and expenses.

- SkipTheDishes Payment Summaries/Earnings Reports: Many platforms provide detailed weekly or monthly summaries of your earnings. Gather these to show your gross income.

- Proof of Consistent Deposits: Highlight these deposits on your bank statements to make it easy for the lender to identify your income.

Building a Consistent Picture: Strategies for Tracking and Presenting Irregular Income

Even if your income fluctuates, you can present a strong case:

- Meticulous Record-Keeping: Keep every payment summary, invoice, and expense receipt. This demonstrates financial responsibility and provides verifiable data.

- Budgeting Apps: Utilize apps that categorize your income and expenses. This can help you track your net earnings and show a clear financial pattern.

- Highlight Average Monthly Earnings: Calculate your average income over the past 3-6 months. This number is often what lenders focus on to determine affordability.

- Explain Variability: Be prepared to explain any significant dips or peaks in income, perhaps due to seasonal work, personal time off, or changes in demand.

Pro Tip: Crafting a 'Gig Economy Income Statement'

Pro Tip: Crafting a 'Gig Economy Income Statement'

Take control of your narrative. Compile your own summary document that clearly outlines:

- Your gross income from each gig platform (SkipTheDishes, Uber Eats, etc.) for the last 3-6 months.

- Your average monthly gross income.

- Your key business expenses (fuel, maintenance, insurance, phone plan related to work).

- Your average monthly net income after these expenses.

This proactive approach helps lenders quickly grasp your financial health and shows you're organized and serious about your finances. It's a powerful tool, especially when combined with our guidance on Self-Employed? Your Bank Statement is Our 'Income Proof'.

Cracking the Code: How Lenders Say 'Yes' to Negative Equity in Vancouver

The Consolidation Strategy: Rolling Negative Equity into a New Loan

This is the most common approach to dealing with negative equity when buying a new vehicle. Essentially, the remaining balance of your old loan (including the negative equity) is added to the principal of your new car loan. So, if you have $3,000 in negative equity and want a $20,000 car, your new loan will be for $23,000 (plus taxes, fees, and interest). While this sounds like a lot, it gets you into a reliable vehicle now. The implications are a higher overall loan amount, which often means slightly higher monthly payments and/or a longer loan term. It's a viable option when your current vehicle is a financial drain, but it's crucial to understand the total cost.

Understanding the Risk: Why Lenders are Cautious and How to Mitigate It

Lenders view negative equity as increased risk. If you default on a loan with rolled-over negative equity, they stand to lose more money because the vehicle securing the loan is worth less than the outstanding balance. However, you can mitigate this risk:

- Strong Application: Present all your income documents clearly and consistently.

- Consistent Income: Highlight your stable (even if variable) income from SkipTheDishes.

- Good Down Payment: Even a small down payment can significantly reduce the amount of negative equity rolled over, improving your loan-to-value ratio.

- Choose a Sensible Vehicle: Opting for a more affordable, reliable vehicle shows financial prudence.

The Power of the Down Payment (Even a Small One): Why It Matters

While often challenging for gig workers, even a modest down payment can make a huge difference. A down payment directly reduces the amount of negative equity that needs to be rolled into your new loan. This lowers your total loan amount, decreases your monthly payments, and improves your loan-to-value (LTV) ratio. A better LTV makes you a more attractive borrower to lenders, potentially securing you a better interest rate. It also signals your commitment and ability to save, which lenders appreciate.

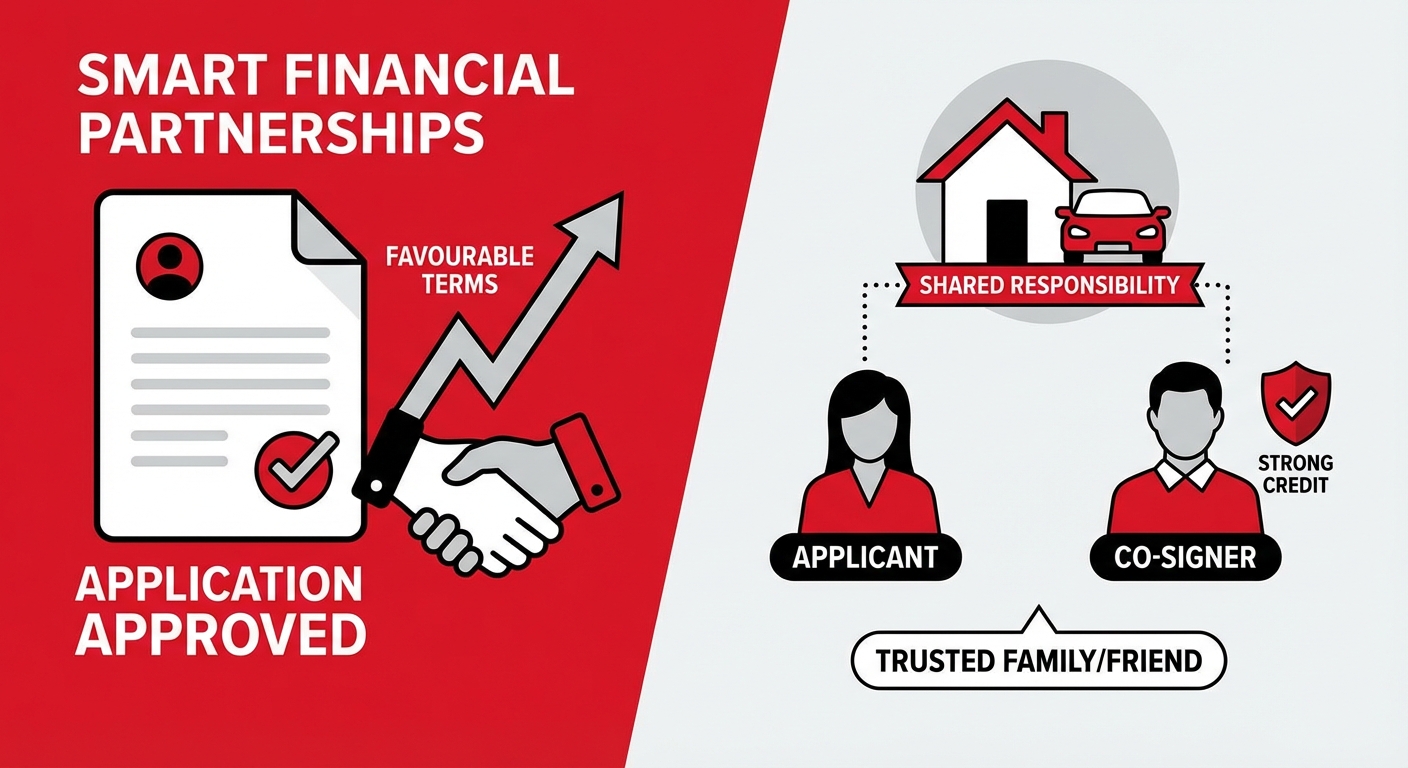

Exploring Co-Signers: When a Helping Hand Makes All the Difference

If you're struggling to get approved, or want a better interest rate, a co-signer can be a game-changer. A co-signer is someone with good credit who agrees to take responsibility for the loan if you default. This reduces the risk for the lender, making them more likely to approve your application and offer more favourable terms. A good co-signer is typically a close family member or friend with a strong credit history and stable income. However, they must understand the significant responsibility they are taking on.

The Overwhelmed Hustler: A visual of a delivery driver looking at a pile of bills and car repair receipts, representing the stress of a failing vehicle and negative equity, contrasted with a hopeful image of a reliable car.

The Overwhelmed Hustler: A visual of a delivery driver looking at a pile of bills and car repair receipts, representing the stress of a failing vehicle and negative equity, contrasted with a hopeful image of a reliable car.

Navigating the Loan Landscape: Banks, Dealers, and Specialty Lenders in British Columbia

Traditional Banks vs. Credit Unions: The Pros and Cons for Challenging Credit

When seeking car financing in Vancouver, your first thought might be the big banks like RBC, TD Canada Trust, or Scotiabank. They generally offer the lowest interest rates for borrowers with excellent credit. However, they tend to be less flexible with negative equity and gig economy income, often requiring traditional pay stubs and a pristine credit history. Credit unions, such as Vancity or Coast Capital Savings in British Columbia, can sometimes be more accommodating. As member-owned institutions, they may have a slightly more personal approach and could be more willing to consider your overall financial picture rather than just rigid criteria, especially if you have an existing relationship with them.

Here's a quick comparison:

| Lender Type | Pros for Gig Workers/Negative Equity | Cons for Gig Workers/Negative Equity |

|---|---|---|

| Traditional Banks | Lowest rates for prime borrowers. | Strict criteria; often require traditional pay stubs; less flexible with negative equity or lower credit scores. |

| Credit Unions | Potentially more flexible for existing members; community-focused; slightly more lenient than big banks. | Still prefer strong credit; may not have specialized programs for gig workers. |

Dealership Financing: The 'One-Stop Shop' Advantage for Negative Equity

Dealerships in Vancouver and across British Columbia often act as a crucial bridge between you and a network of lenders. They have established relationships with multiple financial institutions, including traditional banks, credit unions, and subprime lenders. This means they can often shop around on your behalf to find the best possible financing solution, even if you have negative equity or non-traditional income. Many dealerships also have in-house financing options or special programs designed for higher-risk profiles, which can be invaluable when you're upside down on your current vehicle. They are equipped to handle the complexities of rolling over negative equity and can help structure a deal that works for your budget.

Subprime Lenders: Understanding the Role of Specialty Finance Companies Across Canada

Subprime lenders specialize in providing financing to individuals with less-than-perfect credit, limited credit history, or non-traditional income sources like your SkipTheDishes earnings. These companies, operating across Canada in cities like Toronto, Ontario, Calgary, Alberta, and Halifax, Nova Scotia, understand the unique challenges faced by gig workers and those with negative equity. The trade-off for this increased flexibility is usually higher interest rates compared to prime loans. However, for many, a subprime loan is the only path to securing a reliable vehicle and rebuilding their credit. It's a stepping stone, not a permanent solution, and crucial for getting back on your feet.

The Broker Advantage: Why Working with an Auto Finance Broker Can Save Time and Money

An auto finance broker, like SkipCarDealer.com, acts as your advocate. We don't lend money directly; instead, we work with a vast network of lenders to find the best possible car loan for your specific situation. This is particularly beneficial for Vancouver drivers dealing with negative equity and gig economy income because we:

- Streamline the Process: You fill out one application, and we send it to multiple lenders, saving you time and effort.

- Access a Wider Range of Lenders: We often have access to specialty lenders that you might not find on your own.

- Negotiate on Your Behalf: We understand the market and can help negotiate terms, potentially securing you a better deal than you might get alone.

- Expert Guidance: We guide you through the complexities of negative equity and gig income requirements.

Pro Tip: Questions to Ask Every Lender Before Signing

Pro Tip: Questions to Ask Every Lender Before Signing

Empower yourself by asking these critical questions before committing to any loan:

- What is the exact Annual Percentage Rate (APR)?

- What is the total cost of the loan, including all interest and fees?

- Are there any prepayment penalties if I pay off the loan early?

- What are all the fees associated with this loan (administration, documentation, etc.)?

- What is the loan term in months?

- Does this loan include any rolled-over negative equity, and how much?

- Is there an option to refinance in the future if my credit improves?

Getting clear answers helps you avoid surprises and make the most informed decision.

The Smart Wheels for the Smart Hustler: Choosing Your Next Delivery Vehicle

Fuel Efficiency is King: Prioritizing Low Consumption for Vancouver Traffic and Long Shifts

For a SkipTheDishes driver, every litre of fuel directly impacts your profit margin. In Vancouver's often congested traffic, fuel efficiency is paramount. When choosing your next vehicle, prioritize models known for excellent gas mileage. Hybrid vehicles are becoming increasingly popular for gig workers due to their superior fuel economy, especially in stop-and-go city driving. Compact sedans and hatchbacks also generally offer better efficiency than larger SUVs. Consider vehicles with features like automatic start/stop systems or eco-modes.

Reliability Over Luxury: Best Car Brands and Models for High-Mileage Work

Your delivery vehicle is a workhorse, not a show pony. You need reliability above all else. Focus on brands and models with a proven track record for longevity and low maintenance needs. In British Columbia's climate and demanding driving conditions, some top contenders include:

- Toyota Corolla & Prius: Legendary for reliability, fuel efficiency, and low maintenance costs. The Prius is a hybrid superstar for city driving.

- Honda Civic & Fit: Known for durability, good fuel economy, and generally affordable parts. The Fit offers surprising cargo space for its size.

- Hyundai Elantra & Kona: Modern, fuel-efficient, and come with excellent warranties (for newer models), making them a solid choice.

- Kia Forte & Rio: Similar to Hyundai, offering great value, good fuel economy, and often modern features.

- Mazda 3: While not quite as ubiquitous as Honda or Toyota, the Mazda 3 offers a great balance of reliability, driving dynamics, and fuel efficiency.

Look for vehicles that are well-regarded by mechanics for their straightforward design and readily available parts.

Maintenance Matters: Looking for Vehicles with Affordable Parts and Service Costs

Beyond initial purchase and fuel, ongoing maintenance is a significant expense for high-mileage drivers. Before committing to a vehicle, do some research into the average cost of common repairs and the price of replacement parts. Vehicles from popular brands (like those listed above) often have more affordable parts and a wider network of mechanics familiar with their service needs, which can save you money in the long run. Avoid exotic or niche vehicles where parts might be expensive or hard to find.

Depreciation Watch: Selecting Cars That Hold Their Value Better

To avoid future negative equity traps, consider vehicles that tend to hold their value well over time. While all cars depreciate, some do so slower than others. Japanese brands, particularly Toyota and Honda, often have excellent resale value. This can be a critical factor if you anticipate needing to trade in or sell your vehicle again in a few years. Researching resale value trends for specific models can provide valuable insight.

Used vs. New: Making the Financially Savvy Choice for a Delivery Driver

For most gig economy drivers, a reliable, certified pre-owned (CPO) vehicle offers the best financial advantage. New cars suffer significant depreciation the moment they leave the dealership lot – often 20-30% in the first year alone. As a delivery driver, you're going to put on a lot of kilometres very quickly, accelerating this depreciation. A used vehicle, particularly one that's 2-4 years old, has already taken the biggest depreciation hit and often offers a better balance of reliability, features, and affordability. Plus, the lower purchase price means a smaller loan, which helps manage negative equity more effectively.

Beyond the Monthly Payment: Unmasking Hidden Costs and Sneaky Fees

The True Cost of Interest: Understanding APR and How It Impacts Your Total Loan

The Annual Percentage Rate (APR) is more than just a number; it's the true cost of borrowing, encompassing your interest rate plus certain fees. When you have negative equity rolled into your loan and potentially higher interest rates due to non-traditional income or credit challenges, your APR can significantly increase the total amount you pay over the life of the loan. Even a seemingly small difference in APR can translate to thousands of dollars in extra payments. Always compare the total cost of borrowing, not just the monthly payment, to understand the long-term impact of your financing.

Administration Fees and Documentation Charges: What's Legitimate and What's Negotiable in British Columbia

When buying a car in Vancouver, you'll encounter various fees. Administration fees, documentation charges, and PPSA (Personal Property Security Act) fees are common. Some are legitimate and legally required, while others can be negotiable. For example, PPSA is a registration fee for the lien on your vehicle and is unavoidable. However, some "admin" or "documentation" fees can be inflated. Don't be afraid to question every charge. Ask for an itemized breakdown and inquire if any fees can be reduced or waived. A knowledgeable dealership or broker will be transparent about these costs.

The Insurance Nightmare: Why Vancouver Car Insurance Can Be Shockingly High for Delivery Drivers

Car insurance in British Columbia is primarily provided by ICBC, and it can be notoriously expensive, especially in urban centres like Vancouver. For delivery drivers, it gets even more complicated. Personal insurance policies typically do NOT cover commercial activities like SkipTheDishes. You need commercial insurance or a rideshare endorsement. Failing to declare your usage could lead to denied claims, leaving you financially devastated after an accident. This specialized coverage significantly increases your premiums. Be upfront with ICBC or your insurance broker about your delivery work to ensure you have adequate coverage, even if it adds to your monthly expenses. Getting quotes for commercial insurance should be an early step in your car-buying process.

Extended Warranties: Are They Worth It for a High-Mileage Vehicle?

For a vehicle used heavily for delivery, an extended warranty can be a double-edged sword. On one hand, it offers peace of mind against costly mechanical failures, which are more likely with high mileage. On the other hand, they can be expensive and often have strict terms and conditions. Carefully review what the warranty covers, what it excludes, and the deductible amount. Compare the cost of the warranty against the potential cost of common repairs for your chosen vehicle model. Sometimes, putting the warranty money into a dedicated "car repair" emergency fund might be a more flexible option.

Pro Tip: Demanding a Full Cost Breakdown

Pro Tip: Demanding a Full Cost Breakdown

Never sign anything until you have a detailed, itemized list of every single cost associated with your vehicle purchase and loan. This includes the vehicle price, taxes, all fees, interest, and any additional products like warranties. Compare this breakdown against your budget and the questions you've prepared. Transparency is key to avoiding hidden surprises and ensures you understand exactly what you're paying for.

Boosting Your Approval Odds: Strategic Moves for Vancouver Drivers

Credit Score CPR: Quick Ways to Improve Your Credit Before Applying

While negative equity and gig income present challenges, a healthy credit score significantly improves your approval odds and interest rates. Here are quick ways to give your credit score CPR:

- Check Your Credit Report: Obtain free copies of your credit report from Equifax and TransUnion Canada. Dispute any errors immediately.

- Pay Down Small Debts: Tackle any small outstanding balances on credit cards or lines of credit. Lowering your credit utilization ratio can boost your score quickly.

- Catch Up on Payments: Ensure all your bills (credit cards, utilities, phone) are paid on time. Payment history is the biggest factor in your credit score.

- Avoid New Credit Applications: Don't apply for new credit cards or other loans in the months leading up to your car loan application, as this can temporarily ding your score.

Debt-to-Income Ratio: Why It Matters and How to Present Your Best Financial Self

Your debt-to-income (DTI) ratio is a critical metric for lenders. It's the percentage of your gross monthly income that goes towards debt payments. Lenders want to see a manageable DTI, typically below 40%. Even with gig work, you can present a strong DTI by accurately documenting your gross income and clearly listing your monthly debt obligations (rent/mortgage, credit card minimums, other loan payments). If your DTI is high, consider paying down some smaller debts to improve this ratio before applying. Remember, for more insights into securing loans with specific income types, consider reading Your New Job's First Act: Getting You a Car. Zero Down, Vancouver.

Proof of Residence and Stability: Showing You're a Reliable Resident of Vancouver, British Columbia

Lenders want to see stability. Demonstrating consistent residence in Vancouver reassures them. Have these documents ready:

- Utility bills (hydro, internet) in your name at your current address (3-6 months).

- Rental agreements or lease documents.

- Property tax statements (if you own).

- Driver's license or other government-issued ID with your current address.

The longer you've lived at your current address, the better, as it signals stability.

The Art of Negotiation: Don't Be Afraid to Haggle on Price, Trade-In, and Interest Rates

Many people shy away from negotiation, but it can save you thousands. When dealing with negative equity, you'll be negotiating on three fronts: the price of the new vehicle, the value of your trade-in (which impacts how much negative equity is rolled over), and the interest rate of your new loan. Do your research on vehicle values. Be firm but polite. If you have a pre-approval, use it as leverage. A dealership might be willing to absorb some of your negative equity into the new car's price if it means closing a sale, especially if you've done your homework. For a candid look at how dealerships handle various credit situations, our article Vancouver: Your Private Car Deal, Our Bad Credit Cash. Zero Bank Drama. might offer further insights.

The Confident Driver: A person shaking hands with a car finance specialist or dealership manager, looking confident and in control of their car buying process, with a new car in the background.

The Confident Driver: A person shaking hands with a car finance specialist or dealership manager, looking confident and in control of their car buying process, with a new car in the background.

The Fast Track: Expediting Your Urgent Car Financing in Vancouver

Pre-Approval Power: Getting a Head Start Before Hitting the Dealerships

Getting pre-approved for a car loan is perhaps the most powerful step you can take to expedite the process. A pre-approval means a lender has already reviewed your financial situation (including your gig economy income and negative equity details) and determined how much they are willing to lend you, at what interest rate. This gives you:

- A Clear Budget: You know exactly how much car you can afford.

- Negotiating Leverage: You walk into a dealership as a cash buyer, which strengthens your position to negotiate vehicle price and trade-in value.

- Speed: The financing is largely sorted, significantly shortening the time from choosing a car to driving it home.

Gathering Documents *Now*: A Checklist for Swift Application

To ensure a swift application, have these documents ready before you even start the process:

- Government-issued ID (Driver's License, Canadian Passport).

- Proof of Residence (utility bills, rental agreement).

- 3-6 months of bank statements (highlighting SkipTheDishes deposits).

- Recent tax returns (T4As, T2125).

- SkipTheDishes earnings summaries/reports.

- Proof of existing insurance (if you have it).

- Current vehicle loan payoff statement.

Having everything organized will prevent delays and show lenders you are serious and prepared.

Communicating Urgency: How to Convey Your Need to Lenders and Dealers Without Sounding Desperate

There's a fine line between communicating urgency and sounding desperate. Be clear and direct about your situation: "My current vehicle is unreliable and impacting my ability to earn income. I need a new, dependable vehicle as soon as possible." Explain why your current car is no longer viable and how a new one will stabilize your livelihood. Frame it as a business necessity, not a luxury. A professional and prepared approach will always yield better results than panic.

What to Expect: The Typical Timeline from Application to Driving Away in Vancouver

The timeline can vary, but with proper preparation and working with a specialized broker or dealership, urgent financing can often be quite fast in Vancouver:

- Application & Initial Review: Hours to 1 business day.

- Lender Approval: 1-2 business days (can be faster with pre-approval or direct lender relationships).

- Vehicle Selection & Final Paperwork: 1-2 business days.

In many cases, if you have all your documents ready and choose a vehicle quickly, you could be driving away in your new car within 2-3 business days. Some immediate needs can even be fulfilled within 24-48 hours.

Beyond the Loan: Building a Stronger Financial Future in British Columbia

Escaping the Negative Equity Cycle: Strategies for Future Vehicle Purchases

Once you've secured your new car and tackled negative equity, your goal should be to prevent it from happening again. Here's how:

- Make Larger Down Payments: Even small increases in your down payment significantly reduce the financed amount.

- Choose Vehicles That Hold Value: Research models with low depreciation rates.

- Pay Down Loans Faster: If your budget allows, make extra payments towards your principal. Even an extra $20-$50 a month can shorten your loan term and reduce total interest.

- Don't Over-Finance Extras: Avoid rolling expensive warranties or aftermarket products into your loan if you can pay for them separately.

Credit Score Ascension: Long-Term Habits for Improving Your Financial Health

A stronger credit score opens doors to better interest rates, lower insurance premiums, and overall financial flexibility. Maintain these habits:

- Consistent On-Time Payments: This is the most crucial factor. Never miss a payment on any debt.

- Responsible Credit Card Use: Keep your credit card balances low relative to your limits (ideally below 30% utilization).

- Regular Credit Monitoring: Check your credit report annually for errors and to track your progress.

- Diversify Credit (Carefully): A mix of credit types (e.g., credit card, car loan) can be beneficial, but only if managed responsibly.

Budgeting for the Hustle: Managing Income Variability and Unexpected Car Expenses

The variable nature of gig economy income requires a robust budgeting strategy. Track your income and expenses meticulously. Calculate your average monthly income and budget based on a slightly lower figure to create a buffer. Set aside funds specifically for vehicle maintenance, fuel, and insurance. Consider using the "envelope system" or budgeting apps to allocate funds for different categories, ensuring you're prepared for both regular bills and unexpected car repairs.

The Power of Savings: Creating an Emergency Fund for Your Delivery Vehicle

An emergency fund is your financial safety net. For a delivery driver, this fund should specifically account for car repairs, unexpected maintenance, or income loss due to vehicle downtime. Aim to save at least 3-6 months' worth of essential living expenses, with a dedicated portion for car-related emergencies. This prevents you from relying on credit cards or high-interest loans when your car needs urgent attention, protecting your livelihood and your financial progress.

Resources for Financial Literacy in British Columbia

If you need further guidance, British Columbia offers various resources for financial literacy. Organizations like the Credit Counselling Society of British Columbia provide free, confidential counselling on debt management, budgeting, and financial planning. Government programs or local community centres may also offer workshops or resources to help you build a stronger financial foundation.

Your Next Steps to Approval: Driving Forward in Vancouver

Recap of Crucial Actions: Your Immediate To-Do List

You've absorbed a lot of information, now it's time for action:

- Assess Your Negative Equity: Get your current loan payoff amount and your vehicle's market value.

- Gather All Documents: Collect bank statements, tax returns, and SkipTheDishes earnings summaries.

- Review Your Credit: Check your credit reports for errors and identify areas for improvement.

- Define Your Budget: Understand what monthly payment and total loan amount you can realistically afford.

- Explore Your Options: Start by reaching out to specialists like SkipCarDealer.com who understand gig economy financing and negative equity.

Empowerment Message: Taking Control of Your Financial Journey

It's easy to feel overwhelmed when facing negative equity and the demands of the gig economy. But remember, you are a hustler. You navigate Vancouver's streets, meet tight deadlines, and build your own income stream. That same determination and resourcefulness will serve you well in securing the financing you need. With the right information, preparation, and partners, you can overcome negative equity and get into a reliable vehicle that supports your valuable work.

Call to Action: Start Your Engine, Vancouver!

Don't let a failing car or financial hurdles slow your hustle. Take the first step towards a reliable vehicle and a stronger financial future today. SkipCarDealer.com is ready to help Vancouver's SkipTheDishes drivers get approved, even with negative equity. Your drive is your income, and we're here to ensure you keep driving forward.