You've spent weeks scouring online marketplaces, filtering through countless listings, and finally, you've found it: the perfect car. It's the right colour, has the exact trim level you wanted, and the price is significantly lower than what you'd pay at a big-box dealership. There's just one hurdle standing between you and the driver's seat-financing.

Most Canadians assume that car loans are a "dealer-only" perk. We've been conditioned to believe that if you aren't sitting in a glass-walled office at a franchise dealership, you're stuck paying cash or using a high-interest credit card. That assumption is not only wrong; it could be costing you thousands of dollars in potential savings. Financing a private party car sale in Canada is entirely possible, though it requires a slightly different roadmap than the traditional dealer route. This guide pulls back the curtain on the "Approval Secrets" that savvy buyers use to secure competitive rates on private sales, ensuring you don't miss out on a great deal just because you don't have $20,000 sitting in your chequing account.

Key Takeaways

- Cost Efficiency: Private sales often save you 10-20% compared to dealership retail prices, even after accounting for financing costs.

- Loan Variety: You can choose between secured loans (the car is collateral) and unsecured personal loans (based on your credit signature).

- The Age Limit: Most major Canadian banks (TD, RBC, Scotiabank) have strict cut-offs, typically refusing to finance private vehicles older than 7 to 10 years.

- Lien Protection: A PPSA (Personal Property Security Act) search is your only defense against buying a car that the seller still owes money on.

- Negotiation Power: Arriving with a pre-approval in hand transforms you from a "browser" into a "buyer," giving you immense leverage over the seller.

1. The Private Sale Advantage

Why are so many Canadians ditching the "free coffee" at the dealership for a meeting in a grocery store parking lot? It comes down to the bottom line. Dealerships have massive overhead-rent, sales commissions, service departments, and marketing budgets. All of that is baked into the "Sticker Price" of the car. A private seller, however, is usually just looking to get a fair market value for their vehicle to clear their driveway or fund their next purchase.

There is also the "Unique Find" factor. If you are looking for a specific enthusiast car, a well-maintained vintage model, or a truck with very specific modifications, you are far more likely to find it in the hands of a private owner who has babied it for years.

The "Financing Gap" exists because dealerships make it incredibly easy to say yes. They handle the paperwork, the registration, and the loan application right there. When you buy privately, you become the project manager of your own deal. You have to bridge the gap between the seller's desire for immediate payment and the bank's requirement for documentation. This guide is designed to give you the tools to manage that project like a pro.

2. Understanding Private Party Car Loans in Canada

How Private Sale Loans Differ from Dealership Financing

In a dealership, the finance manager acts as a broker, sending your profile to multiple lenders to find a match. In a private sale, you are the one approaching the lender. The biggest difference is the Asset Verification. A bank trusts a dealership to sell a car that actually exists and is in the condition described. When you buy from "Dave in Mississauga," the bank is naturally more skeptical. They will require more proof of the vehicle's value and its legal status before they cut a cheque.

The Role of Interest Rates: Fixed vs. Variable

Most Canadian private auto loans follow the "TD Model," where you can choose between fixed and variable rates. A fixed rate offers the security of knowing exactly what your payment will be for the duration of the term (usually 36 to 72 months). A variable rate is tied to the lender's prime rate. If the Bank of Canada drops rates, your interest cost goes down; if they raise them, your cost goes up. For private sales, fixed rates are generally preferred because they simplify your personal budgeting for a used asset that might eventually require maintenance costs.

Secured vs. Unsecured: Which one is right for you?

This is the most critical decision in your financing journey. A secured loan uses the vehicle itself as collateral. If you stop paying, the bank takes the car. Because the bank has this safety net, they usually offer lower interest rates. An unsecured loan (or personal loan) is granted based solely on your creditworthiness. There is no collateral. While the interest rate is higher, the process is much faster because the bank doesn't need to "approve" the specific car-only you.

| Feature | Secured Auto Loan | Unsecured Personal Loan |

|---|---|---|

| Interest Rate | Lower (Typically Prime + 2-5%) | Higher (Typically 8% - 15%+) |

| Vehicle Restrictions | Strict (Age/Mileage limits) | None (Buy any car you want) |

| Collateral | The Vehicle | None |

| Speed of Funding | Slower (Requires VIN/Appraisal) | Fast (Often same-day) |

3. The Approval Blueprint: What Lenders Really Want

Credit Score Thresholds for Private Sales

For a private sale, lenders are taking on more risk. Consequently, they often look for "Prime" credit scores-typically 660 or higher. If your score is below 600, you may find it difficult to get a traditional bank to finance a private sale, as they prefer the "safety" of a dealership's recourse agreements. However, specialized online lenders can often bridge this gap if you have a stable income.

Income Verification and Debt-to-Income (DTI) Ratios

Expect to provide your two most recent pay stubs or, if you are self-employed, your last two years of Notices of Assessment (NOA) from the CRA. Lenders want to see that your total debt obligations (including the new car payment) don't exceed roughly 40-45% of your gross monthly income. In the world of private sales, "Cash is King," but "Proof of Income is the Key to the Kingdom."

Vehicle Restrictions: The 'Goldilocks' Zone

Banks aren't just lending you money; they are investing in a piece of machinery. They want to ensure that if they have to repossess the car, it still has value. This leads to the "Goldilocks Zone":

- Age: Usually no older than 7-10 years by the end of the loan term.

- Mileage: Ideally under 150,000 kilometres.

- Condition: Must have a "Clean" title (no salvage or rebuilt brands).

4. Types of Financing Vehicles for Private Purchases

Dedicated Private Sale Vehicle Loans

Some institutions, most notably TD Canada Trust, have specific programs for private sales. They act as an intermediary, ensuring the seller gets paid and the buyer gets the title. They often require the seller to visit a branch with the buyer to sign the documents, which adds a layer of security for both parties.

Personal Loans (Unsecured)

As mentioned earlier, these are the simplest. You apply for $15,000, the bank puts $15,000 in your account, and you go buy the car. The bank doesn't care if the car is a 1998 Honda or a 2022 Tesla. You pay a premium in interest for this flexibility.

Peer-to-Peer Lending Platforms

Platforms like goPeer allow you to borrow from individual investors. These can be great for those who don't fit the traditional "bank box" but have a solid story and decent credit. The rates are competitive, and the process is entirely digital.

Specialized Online Auto Lenders

Companies that specialize in auto loans often have more flexible "Private Sale" departments than the big five banks. They understand the nuances of the used car market and can often move faster on approvals.

5. Step-by-Step: The Financing Process

Step 1: The Pre-Approval Phase

Before you even look at a car, get pre-approved. This tells you exactly how much you can spend and what your interest rate will be. It also shows sellers you are serious. In a hot market, a seller will choose the buyer with a pre-approval over the one who says, "I just need to talk to my bank."

Step 2: Finding the Vehicle and Verifying the VIN

Once you find a car, get the Vehicle Identification Number (VIN). Your lender will need this immediately to run their own internal checks. This 17-digit code is the "Social Insurance Number" of the car, and it holds all the secrets of its past.

Step 3: The Professional Inspection (PPI)

Never buy a private vehicle without a Pre-Purchase Inspection (PPI). Spend the $150-$200 to have a mechanic look at it. If the seller refuses, walk away. This isn't just for your peace of mind; some lenders will actually require a mechanical safety certificate before finalizing a secured loan.

Step 4: Submitting Vehicle Details to the Lender

Send your lender the VIN, the mileage, a copy of the seller's registration, and the agreed-upon price. The lender will then perform a "Book Value" assessment (usually using Canadian Black Book or CADA data) to ensure you aren't overpaying. If you are paying $20,000 for a car the bank says is only worth $15,000, they will only lend you $15,000.

Step 5: Finalizing the Loan Agreement

Once the car is vetted and your credit is confirmed, you'll sign the loan agreement. This document will outline your monthly payments, the interest rate, and the "Total Cost of Borrowing"-which is the amount of interest you'll pay over the life of the loan.

6. Navigating the Paperwork: Provincial Specifics

Canada is a federation, and that means car buying rules change the moment you cross a provincial border. Financing a car in Ontario is a different beast than in British Columbia.

Ontario: The Used Vehicle Information Package (UVIP)

In Ontario, the seller is legally required to provide you with a UVIP. This package contains the car's registration history in Ontario and, crucially, a section on liens. However, don't rely solely on this; lenders will still do their own search.

BC and Alberta: Provincial Inspection Requirements

If you are bringing a car from Alberta into BC (or vice versa), you will need a provincial out-of-province inspection. Lenders are often hesitant to release funds until they know the vehicle can be legally registered in your home province.

Understanding Sales Tax (PST/GST/HST) on Private Sales

This is where many buyers get blindsided. In most provinces, you don't pay sales tax to the seller. Instead, you pay it at the registry office when you transfer the ownership. You need to factor this 5% to 15% (depending on the province) into your total loan amount.

| Province | Tax Type | Rate (Approx) | Basis of Tax |

|---|---|---|---|

| Ontario | RST | 13% | Wholesale value or purchase price (whichever is higher) |

| Alberta | None | 0% | No provincial sales tax on used vehicles |

| British Columbia | PST | 12% - 20% | Based on a sliding scale of the vehicle's value |

| Quebec | QST | 9.975% | Estimated value by the SAAQ |

7. Protecting Your Investment: Liens and History Reports

Why a CARFAX Canada Report is Essential

A CARFAX report is the gold standard in Canada. It tells you about reported accidents, service history, and if the car was ever used as a police vehicle or taxi. More importantly for financing, it includes a Lien Search. If the current owner has an outstanding loan on the car, the lender "owns" a piece of that car. If you buy it without the lien being cleared, the bank can repossess your new car to pay off the seller's old debt.

How to Conduct a Lien Search (PPSA)

While CARFAX is great, your lender will perform a PPSA search. This is a provincial registry search that shows any registered "security interests" in the vehicle. If a lien is found, your lender will usually insist on paying the seller's bank directly to clear the debt, with the remaining balance going to the seller.

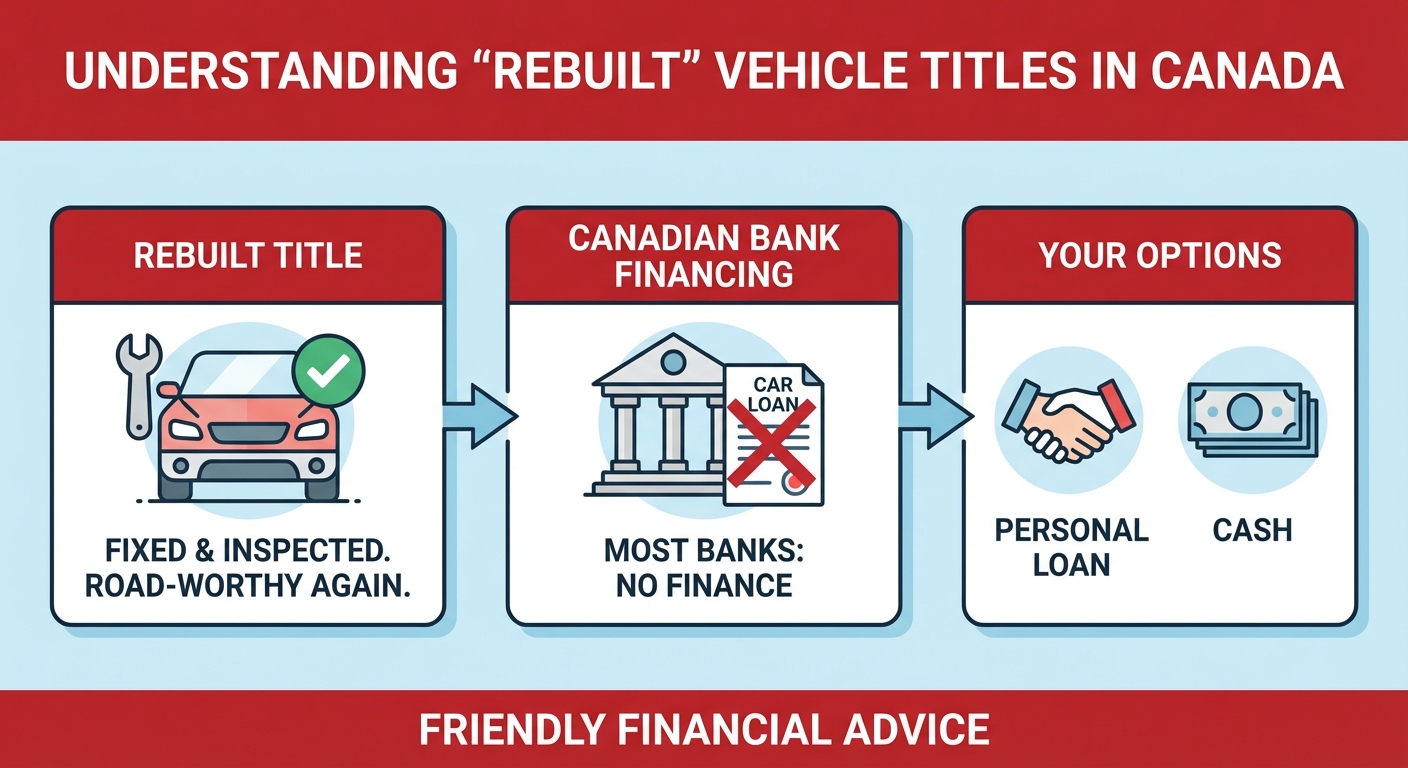

Identifying 'Rebuilt' or 'Salvage' Titles

A "Salvage" title means the car was declared a total loss by an insurance company. A "Rebuilt" title means it was fixed and inspected to be road-worthy again. Most Canadian banks will not finance a Rebuilt or Salvage title vehicle. If you are looking at one of these, you will almost certainly need an unsecured personal loan or cash.

8. Negotiation Secrets for Financed Buyers

Negotiating as a financed buyer is different than being a cash buyer. You need the seller to be patient.

How to Convince a Seller to Wait for Bank Processing

Sellers love cash because it's instant. To compete, you need to explain the process. "I am pre-approved through TD. They just need to verify the VIN and the Bill of Sale, which takes about 24-48 hours. I can give you a $500 deposit now to hold the car." This professionalism builds trust.

Using Pre-approval to Drive the Price Down

When you have a pre-approval, you know your "hard ceiling." You can honestly say to a seller, "I love the car, but my bank has capped my financing at $18,000 for this specific model based on its mileage. If you can meet me at $18,000, we can start the paperwork today." It shifts the "blame" for the lower offer onto the bank, making it less personal.

Handling the Deposit Safely

Never give a large deposit without a written agreement. A simple "Deposit Receipt" stating the VIN, the amount paid, the total purchase price, and the condition that the deposit is refundable if the car fails inspection or financing falls through, is essential.

9. Closing the Deal: The Exchange of Funds

The "Closing" is the most stressful part of a private sale. This is when the money and the metal change hands.

Drafting a Legal Bill of Sale

Your Bill of Sale should include:

- Full names and addresses of buyer and seller.

- The VIN, make, model, and year.

- The final purchase price.

- The date of the sale.

- The phrase "Vehicle sold as-is, where-is" (standard for private sales).

Bank Drafts vs. Wire Transfers

Most private sales are finalized with a Bank Draft. It is more secure than a personal cheque and more convenient than carrying $20,000 in cash. A wire transfer is also an option, but it can take hours or even days to clear, which makes the "hand-off" difficult to time.

Ensuring the Insurance Transfer

You cannot drive the car home until it is insured. Once you have the VIN and a closing date, call your insurance provider. They can set up a policy that becomes active the moment you take possession. You will need to show proof of insurance to the registry office to get your new plates.

10. Common Pitfalls and How to Avoid Them

The 'Curbsider' Trap

A "Curbsider" is an unlicensed dealer posing as a private seller. They often sell cars with rolled-back odometers or hidden accident damage. If the person's name isn't on the registration, or if they have five different cars for sale on Kijiji, you're dealing with a curbsider. Most banks will flag these transactions and deny the loan.

Overpaying for a Vehicle with High Depreciation

Because you are financing, you are paying interest. If you buy a car that is depreciating faster than you are paying off the loan, you will end up "underwater" (owing more than the car is worth). Use tools like Canadian Black Book to project what the car will be worth in three years.

Skipping the Mechanical Inspection

It bears repeating: skipping the inspection is the fastest way to financial ruin in a private sale. A "great deal" becomes a nightmare if the transmission fails two weeks after the bank sends the funds. You are still responsible for the loan even if the car is a paperweight.

Frequently Asked Questions (FAQ)

Can I finance a car from a family member?

Yes, you can. However, banks treat "Arm's Length" transactions (strangers) differently than "Non-Arm's Length" (family). If you are buying from a parent or sibling, the bank may be more scrutinizing of the purchase price to ensure it's not a "gift" disguised as a sale, which can complicate the loan-to-value calculations. Often, an unsecured personal loan is the easiest path for family sales.

What is the oldest car a Canadian bank will finance?

Generally, the limit is 10 years. Some credit unions and specialized lenders will go up to 12 years for well-maintained vehicles with low mileage. If the car is older than 12 years, you are almost certainly looking at an unsecured personal loan or a line of credit rather than a traditional auto loan.

Do I need a down payment for a private party loan?

While some lenders offer 0% down on private sales for those with excellent credit, most will require at least 10-20% down. This "skin in the game" reduces the bank's risk and often helps you secure a lower interest rate. It also ensures you don't immediately go "underwater" on the loan due to taxes and fees.

How long does the approval process take compared to a dealer?

A dealership can often get you approved and in a car in 2-4 hours. A private sale financing process typically takes 2 to 5 business days. This accounts for the time needed to verify the VIN, conduct the lien search, and coordinate the document signing between the buyer, seller, and lender.

Can I finance a private sale if I have bad credit?

It is significantly more difficult but not impossible. Major banks will likely say no, but alternative "B-lender" auto finance companies do exist. Be prepared for much higher interest rates (15-25%) and a requirement for a substantial down payment. In many cases, buyers with bad credit find it easier to finance through a "Buy Here Pay Here" dealership, though the vehicle quality may be lower than a true private sale.

Taking the Driver's Seat

Financing a private party car sale in Canada isn't the "impossible dream" many believe it to be. It is a strategic move that requires a bit more legwork but pays dividends in the form of lower purchase prices and better-maintained vehicles. By securing your pre-approval, performing your due diligence on the VIN and liens, and understanding your provincial tax obligations, you put yourself in a position of total control.

The days of being restricted to dealership inventory are over. Whether it's that pristine SUV from a neighbour or a fuel-efficient commuter from a seller halfway across the province, the financing tools are at your fingertips. Start by checking your credit, setting a realistic budget, and getting that pre-approval in place. Your perfect car-and a much better deal-is waiting for you out there in the private market.