Crypto Car Loan: Your Key to a Non-Dealership Purchase

Table of Contents

- Key Takeaways

- The Private Seller's Handshake and the Banker's Cold Shoulder

- Why Traditional Lenders Dislike Private Party Sales

- The Cash-Only Dilemma for Crypto Holders

- The Collateral Conundrum: How Your Crypto Unlocks a Fiat Loan

- Deep Dive: The Engine Room of Your Crypto Car Loan

- Decoding the Loan-to-Value (LTV) Ratio: The Single Most Important Number

- The Margin Call Minefield: Protecting Your Collateral from Market Swings

- Interest Rates Unmasked: Are They Really Better?

- From Wallet to Wheels: Your Step-by-Step Playbook for a Non-Dealership Purchase

- Phase 1: Vetting the Lenders

- Phase 2: The Application & Underwriting

- Phase 3: Executing the Private Sale

- The Tax Tightrope: Navigating CRA Rules Without Slipping

- Why a Loan Isn't a Taxable Event

- The Hidden Tax Danger: Collateral Liquidation

- Your Roadmap to Approval: A Final Checklist

- Frequently Asked Questions

You've found the perfect car. It's not on a gleaming dealership lot; it's in a private seller's driveway, meticulously maintained and priced just right. The problem? Your bank won't touch a private party auto loan, and you don't want to sell your crypto portfolio to pay cash, triggering a massive tax bill and losing your position in the market. This guide is the bridge across that gap.

For years, the worlds of decentralized finance and traditional auto sales have run on parallel tracks. But now, they're converging. A car loan backed by cryptocurrency is no longer a niche concept for the ultra-technical; it's a practical tool for savvy Canadians who want to leverage their digital assets without liquidating them. This is your key to unlocking the vast market of private car sales, giving you the power of a cash buyer while keeping your investment strategy intact.

Key Takeaways

- Unlock Private Sales: Crypto-backed loans provide liquid cash (fiat currency) to buy from any private seller in Canada, bypassing dealership and traditional bank restrictions.

- No Sale, No Tax Event: You are borrowing against your crypto, not selling it. This can help you avoid immediate capital gains taxes that would be triggered by a sale.

- LTV is King: The Loan-to-Value (LTV) ratio is the most critical number, determining your loan amount and risk. A lower LTV (e.g., 50%) is safer and standard for volatile assets like cryptocurrency.

- Volatility is the Risk: A significant drop in your crypto's value can trigger a 'margin call,' requiring you to add more collateral or risk the lender selling your assets to cover the loan.

- Credit Score is Secondary: These loans are primarily asset-backed, meaning your credit history is often less important than the value of your crypto collateral.

The Private Seller's Handshake and the Banker's Cold Shoulder

A car loan backed by cryptocurrency for a non-dealership purchase allows you to use your digital assets, like Bitcoin or Ethereum, as collateral. This provides you with liquid cash (fiat currency) to buy a vehicle from any private seller, bypassing the restrictions often imposed by traditional banks and credit unions across Canada.

The appeal of a private sale is undeniable. You often find better prices, unique models, and sellers who are as passionate about their vehicle as you are. It feels personal and direct. But when you bring this perfect scenario to a traditional lender, the door often slams shut. Why?

Why Traditional Lenders Dislike Private Party Sales

From a bank's perspective, a private car sale is a field of red flags. Unlike a dealership, which is a licensed, regulated, and vetted business, a private seller is an unknown entity. Here's what goes through a loan officer's mind:

- Risk of Fraud: Is the seller the legitimate owner? Does the vehicle have a hidden lien against it from a previous loan? The bank has no established relationship or recourse if the sale goes sideways.

- Vehicle Condition & Inspection: Dealerships typically certify their pre-owned vehicles. With a private sale, the bank has no guarantee of the car's mechanical soundness, making it a riskier asset to secure a loan against.

- Title Transfer Complexity: The process of transferring the vehicle title (or ownership) and registering the bank's lien can be messy. It requires coordination between you, the seller, and the provincial licensing authority, with many points of potential failure.

In our experience, most major banks simply have a policy against financing private sales to avoid these headaches. They prefer the clean, predictable process of working with a dealership partner. For a deeper dive into navigating these challenges, our guide on the Ontario Private Car Loan 2026: Skip the Dealership Drama offers more specific insights.

The Cash-Only Dilemma for Crypto Holders

This leaves many buyers in a frustrating position. You have the assets, just not in a form the seller can accept. If you're holding a significant amount of Bitcoin, Ethereum, or other digital assets, your options seem limited:

- Sell Your Crypto: This is the most obvious path, but it's often the least attractive. Selling triggers a taxable event with the Canada Revenue Agency (CRA), meaning you'll owe capital gains tax on any appreciation. You also lose your position in the market, potentially missing out on future gains.

- Get a Personal Loan: An unsecured personal loan is an option, but it comes with much higher interest rates than a secured auto loan because there's no collateral. Your credit score will also be heavily scrutinized.

This is the exact dilemma the crypto-backed loan was designed to solve. It allows you to tap into the value of your assets without giving up ownership of them.

The Collateral Conundrum: How Your Crypto Unlocks a Fiat Loan

Think of a crypto-backed loan like a home equity line of credit (HELOC), but instead of using your house as collateral, you use your digital assets. The fundamental principle is the same: you're borrowing against the value of an asset you own.

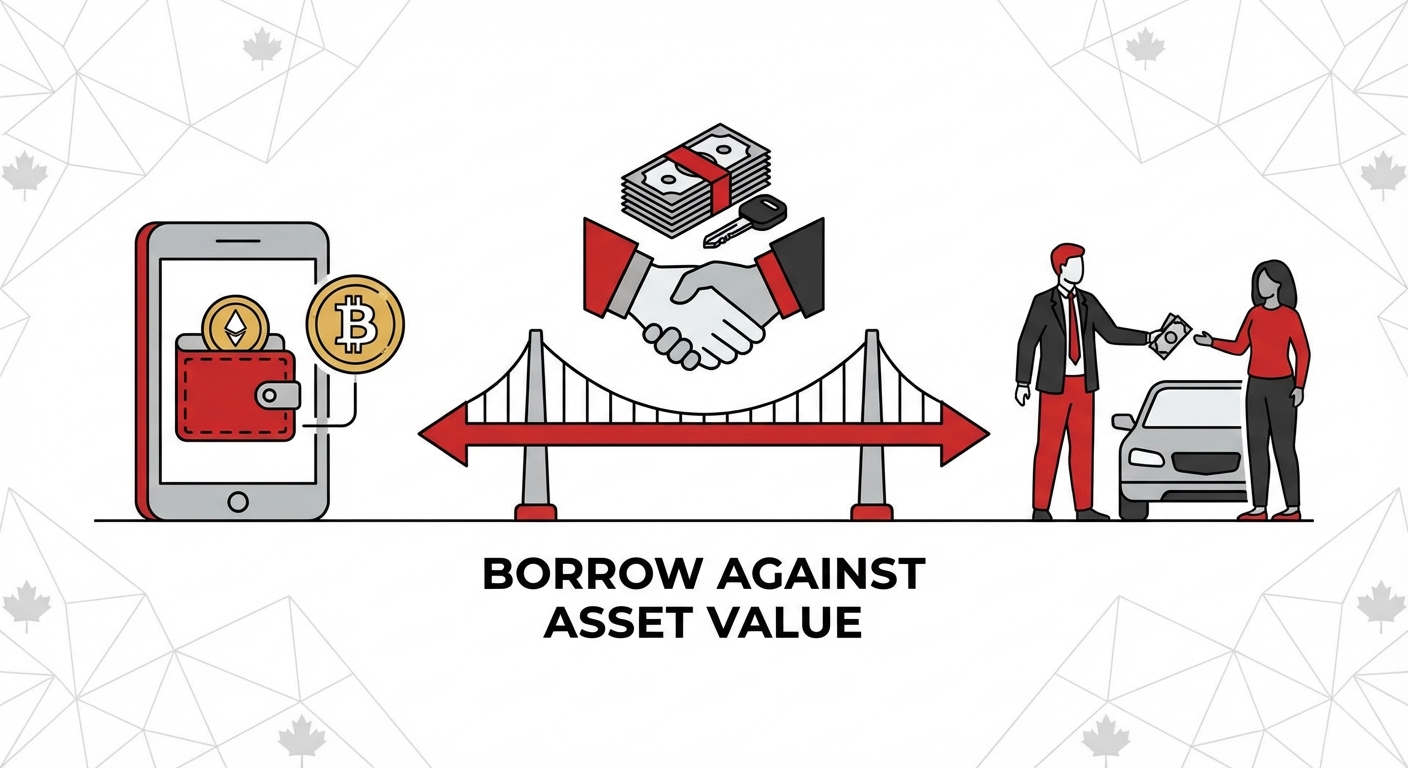

The process is surprisingly straightforward. It bridges the digital world of your crypto wallet with the physical world of handing cash to a private car seller.

: A clean, professional infographic illustrating the process: 1. User deposits BTC/ETH into a lender's secure custody wallet. 2. Lender issues a CAD loan to the user's bank account. 3. User pays the private car seller. 4. User repays the loan over time to unlock their crypto.

: A clean, professional infographic illustrating the process: 1. User deposits BTC/ETH into a lender's secure custody wallet. 2. Lender issues a CAD loan to the user's bank account. 3. User pays the private car seller. 4. User repays the loan over time to unlock their crypto.

Here’s the breakdown:

- Collateral Deposit: You transfer an agreed-upon amount of cryptocurrency (e.g., Bitcoin) to a secure, insured custody wallet controlled by the lender.

- Fiat Loan Disbursement: Based on the value of your collateral and a pre-determined Loan-to-Value (LTV) ratio, the lender deposits Canadian dollars directly into your bank account.

- The Purchase: You now have cash. You can e-transfer the funds, get a bank draft, or use an escrow service to pay the private seller, just like any cash buyer. You are now in the driver's seat, literally.

- Repayment & Release: You make regular loan payments (principal and interest) over the agreed-upon term. Once the loan is fully paid off, the lender releases your crypto collateral back to your personal wallet.

The beauty of this model is its simplicity and efficiency. It sidesteps the entire infrastructure of traditional auto lending, which is built around dealerships. You get the freedom of a cash buyer without the tax consequences of selling your assets.

Deep Dive: The Engine Room of Your Crypto Car Loan

While the concept is simple, the mechanics require a closer look. Understanding these three core components—LTV, margin calls, and interest rates—is non-negotiable before you commit your assets. This is where the real expertise comes into play.

Decoding the Loan-to-Value (LTV) Ratio: The Single Most Important Number

The Loan-to-Value (LTV) ratio is the percentage of your collateral's value that the lender is willing to give you as a loan. It is the lender's primary tool for managing the risk of crypto's famous price volatility.

The formula is simple: Loan Amount / Value of Collateral = LTV

For example, if you want to borrow $40,000 for a used truck and the lender offers a 50% LTV on Bitcoin, you will need to deposit $80,000 worth of Bitcoin as collateral ($40,000 / $80,000 = 50%).

LTVs are not uniform. They vary based on the volatility and liquidity of the asset you're using as collateral. Lenders see established assets as less risky.

| Collateral Asset | Typical LTV Ratio | Reasoning |

|---|---|---|

| Bitcoin (BTC) | 40% - 60% | Highest market cap, most liquid, and perceived as the most stable crypto asset. Lenders are most comfortable with it. |

| Ethereum (ETH) | 35% - 50% | Second highest market cap and highly liquid, but historically has shown slightly more volatility than Bitcoin. |

| Large-Cap Altcoins (e.g., SOL, ADA) | 25% - 40% | Higher volatility and lower liquidity mean more risk for the lender, resulting in a lower LTV. Many lenders don't accept them at all. |

A lower LTV is safer for both you and the lender. It creates a larger buffer to absorb price drops before things get critical.

Pro Tip: Always Over-Collateralize

Always over-collateralize. If you need a $30,000 loan and the LTV is 50%, the minimum required collateral is $60,000 worth of crypto. We strongly recommend depositing more if you can—for instance, $75,000. This immediately lowers your starting LTV to 40% ($30k / $75k). This simple step creates a significant buffer against market volatility and dramatically reduces your margin call anxiety.

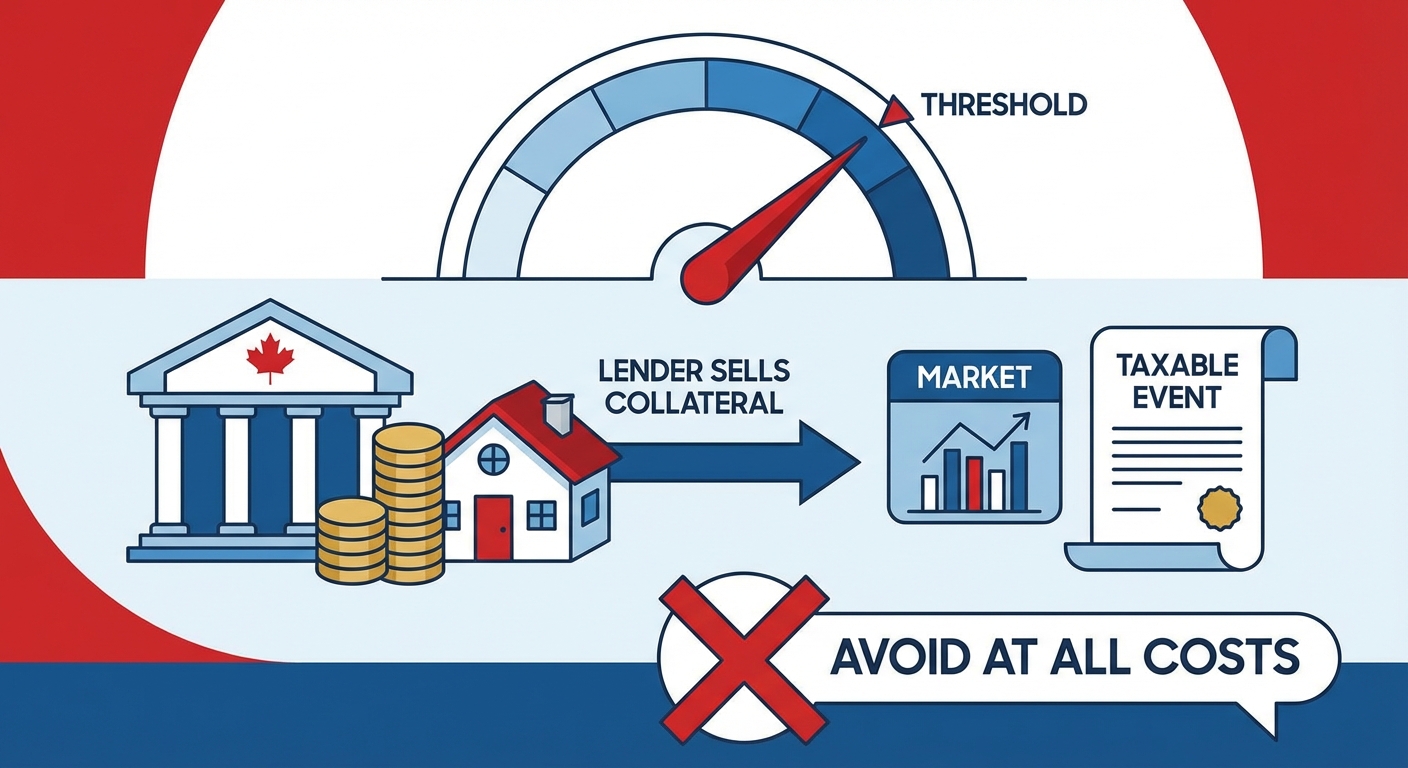

The Margin Call Minefield: Protecting Your Collateral from Market Swings

This is the single biggest risk of a crypto-backed loan. A margin call occurs when the value of your collateral drops, causing your LTV to rise to a dangerous, pre-defined threshold.

Let's walk through a scenario:

- Initial Loan: You borrow $50,000 against $100,000 of BTC. Your LTV is 50%.

- Lender's Terms: The lender has a margin call threshold at 70% LTV and a liquidation threshold at 85% LTV.

- Market Drop: The price of Bitcoin corrects, and the value of your collateral drops to $70,000.

- The Trigger: Your LTV is now recalculated: $50,000 (loan) / $70,000 (new collateral value) = ~71.4%.

Because your 71.4% LTV has breached the 70% margin call threshold, the lender will contact you immediately. You must act quickly. Your options are:

- Add More Collateral: Deposit more crypto into the custody wallet to bring the LTV back down to a safe level.

- Pay Down the Loan: Make a lump-sum payment on the loan principal to reduce the loan amount and lower the LTV.

If you fail to act and the collateral's value continues to fall, hitting the 85% liquidation threshold, the lender has the right to automatically sell a portion (or all) of your collateral on the open market to repay the loan and protect their capital. This is a worst-case scenario you must avoid at all costs, as it triggers a taxable event.

: A line graph showing the inverse relationship between the price of a crypto asset and the LTV percentage of a fixed loan amount, with a clear red line indicating the 'Margin Call Threshold'.

: A line graph showing the inverse relationship between the price of a crypto asset and the LTV percentage of a fixed loan amount, with a clear red line indicating the 'Margin Call Threshold'.

Interest Rates Unmasked: Are They Really Better?

Because these loans are secured by a liquid asset, their interest rates are often more competitive than unsecured personal loans. However, they are typically slightly higher than a traditional prime auto loan from a bank (which you can't get for a private sale anyway). Here’s how they stack up in the current Canadian market:

| Loan Type | Typical APR Range (Canada) | Key Factors |

|---|---|---|

| Crypto-Backed Loan | 7% - 11% | Secured by your crypto. Credit score is less of a factor. LTV is the primary risk metric. |

| Unsecured Personal Loan | 10% - 20%+ | Unsecured (no collateral). Highly dependent on your credit score and income. Riskier for the lender, hence higher rates. |

| Traditional Private Party Loan (from Credit Union) | 8% - 14% | Hard to find. Heavily reliant on excellent credit and vehicle age/kilometres. Many institutions don't offer them. |

The primary advantage is accessibility. For someone with a high net worth in crypto but perhaps a less-than-perfect credit file or non-traditional income (like many in the tech and gig economy), the crypto loan is a powerful tool. For those with alternative income sources, exploring options like those in our guide Banks Need Pay Stubs. We Need Your Drive. Gig Worker Car Loans. can also be beneficial.

From Wallet to Wheels: Your Step-by-Step Playbook for a Non-Dealership Purchase

Ready to move forward? Following a structured process is key to a smooth and secure transaction. This is your practical guide from initial research to driving away in your new car.

Phase 1: Vetting the Lenders

Not all crypto lenders are created equal. This is the most important research you will do. Look for platforms that prioritize security and transparency. Key criteria include:

- Security Protocols: Do they use qualified, third-party custodians? Is the collateral held in cold storage?

- Insurance: Do they have a robust insurance policy covering assets held in custody against theft or loss?

- Interest Rates & Terms: Compare APRs, loan terms (e.g., 12 to 60 months), and LTV ratios for your specific collateral type.

- Supported Collateral: Ensure they accept the crypto you hold (most focus on BTC and ETH).

- Customer Reviews: Look for independent reviews on platforms like Trustpilot or Reddit to gauge real-world user experiences with their margin call process and customer service.

Phase 2: The Application & Underwriting

Once you've chosen a lender, the application process is typically fast and digital. Be prepared for:

- KYC/AML Verification: This is a standard identity verification process (Know Your Customer/Anti-Money Laundering) required by financial regulations in Canada. You'll need to submit a government-issued photo ID and proof of address.

- Wallet Ownership: You may need to prove you own the wallet you're sending the collateral from, often through a small "message signing" transaction.

- Bank Account Linking: You'll link the Canadian bank account where you want to receive the loan funds.

Because the loan is asset-backed, underwriting is often completed in hours, not days. This speed is a major advantage when you've found a seller who wants a quick sale.

Phase 3: Executing the Private Sale

With cash in your bank account, you are now in control. To ensure the final step is safe for both you and the seller, follow these best practices:

- Get a Pre-Purchase Inspection (PPI): Never skip this. Have a trusted mechanic thoroughly inspect the vehicle before any money changes hands.

- Verify Ownership and Liens: Run a CARFAX or similar vehicle history report to check for accident history and, most importantly, any existing liens on the vehicle.

- Use an Escrow Service: This is the gold standard for private sales. An escrow service acts as a neutral third party, holding your payment until you have confirmed the vehicle's condition and the seller has signed over the title. This eliminates the risk of fraud for both parties.

- Proper Title Transfer: Meet the seller at a provincial service centre (like ServiceOntario or ICBC) to complete the ownership transfer and registration in person. This ensures all paperwork is filed correctly on the spot.

Pro Tip: Insist on a Vehicle Escrow Service

Insist on using a reputable third-party vehicle escrow service. The service holds your cash until you've confirmed the vehicle's condition and received the signed title, protecting you and the seller from fraud. The small fee (often a few hundred dollars) is invaluable for peace of mind, especially on a high-value purchase. This transforms a potentially risky transaction into a secure, professional exchange.

This process gives you the power to Skip the Dealership. Pre-Approved for Your Neighbour's Car, Ontario. and access a market of vehicles you couldn't finance before.

The Tax Tightrope: Navigating CRA Rules Without Slipping

One of the biggest attractions of a crypto-backed loan is its tax efficiency. However, it's crucial to understand the nuances to avoid costly mistakes. Always consult with a Canadian tax professional who is knowledgeable about digital assets.

Why a Loan Isn't a Taxable Event

Under Canada Revenue Agency (CRA) rules, taking out a loan is not considered a disposition of property. You are not selling your cryptocurrency; you are merely using it as security. You retain ownership and are still exposed to its price fluctuations (both up and down).

Because there is no sale, there is no capital gain to report. This allows you to access liquidity from your investment without immediately triggering a tax liability, keeping your capital working for you in the market.

The Hidden Tax Danger: Collateral Liquidation

This is the critical exception. If you fail to meet a margin call and the lender liquidates your collateral, the CRA views this as a sale. At that moment, a taxable event is triggered.

Here’s how it works: The lender sells your crypto at the current market price. The difference between that sale price and your original cost basis (what you paid for the crypto) is your capital gain or loss. You will be required to report this on your tax return for that year.

For example, if the lender liquidates $50,000 worth of BTC that you originally acquired for $10,000, you have realized a $40,000 capital gain. This is the scenario that careful planning and over-collateralization are designed to prevent.

Your Roadmap to Approval: A Final Checklist

Feeling empowered? Good. A crypto-backed car loan is a sophisticated financial tool. Approaching it with a clear strategy is the key to success. Use this checklist to guide your next steps.

- Assess Your Risk Tolerance: Are you comfortable with the volatility of cryptocurrency and the risk of a margin call? Be honest with yourself about the potential for market downturns.

- Calculate Your Required Collateral: Based on the price of the car you want and the typical LTVs (40-50%), determine exactly how much crypto you need to lock up. Do you have enough of a buffer?

- Research and Compare Lenders: Shortlist 2-3 reputable platforms. Create a spreadsheet comparing their LTVs, interest rates, insurance policies, and security measures.

- Prepare Your Documents: Have your government ID (driver's license or passport) and proof of address ready for the KYC/AML verification process.

- Plan Your Private Sale Strategy: Before you even apply for the loan, identify a trusted mechanic for a PPI, research a vehicle escrow service, and review your province's rules for vehicle title transfers.