Skip the Dealership. Pre-Approved for Your Neighbour's Car, Ontario.

Table of Contents

- Key Takeaways

- Beyond the Dealership: Why Ontario's Private Car Market is Your Secret Weapon

- The Allure of Private Sales: Unlocking Better Value, Unique Finds, and Direct Negotiation

- Cost Advantages: How Skipping the Middleman Can Save You Thousands in Cities like Toronto, Ottawa, and Mississauga

- Wider Selection: Accessing Vehicles Not Found on Dealership Lots, from Vintage Gems to Specific Trims

- Understanding the 'Neighbour's Car' Appeal: Trust, Transparency, and Local Convenience

- Pre-Approval Unpacked: The Golden Ticket for Private Car Buyers in Ontario

- What 'Pre-Approved' Truly Means for a Private Vehicle Purchase in Ontario

- The Strategic Advantage: Shopping with a Confirmed Budget and Ready Financing, Akin to a Cash Buyer

- How Pre-Approval Empowers Your Negotiations with Private Sellers

- Key Differences: Pre-Approval for Private Sales vs. Dealership Financing – Why the Former Can Be More Complex but More Rewarding

- Setting Expectations: Understanding the Conditional Nature of Pre-Approval and What Can Still Go Wrong

- Navigating Ontario's Lender Landscape: Who Funds Your Neighbour's Ride?

- The Big Five & Beyond: Major Banks in Ontario (RBC, TD, Scotiabank, BMO, CIBC)

- Community Powerhouses: Ontario's Credit Unions (e.g., Meridian Credit Union, Alterna Savings, Libro Credit Union)

- The Digital Frontier: Online Lenders & Fintechs Specializing in Private Sales in Ontario

- Your Pre-Approval Journey: A Step-by-Step Guide for Ontario Buyers

- Phase 1: Self-Assessment and Preparation

- Phase 2: The Application Process

- Phase 3: Understanding Lender Criteria for Private Sales

- Beyond the Loan: Unmasking the True Costs of a Private Car Sale in Ontario

- Ontario Sales Tax (PST): The Mandatory 13%

- The Non-Negotiable Safety Standards Certificate (SSC)

- Registration and Licensing Fees at ServiceOntario

- Insurance Implications: Don't Get Caught Off Guard

- Potential for Hidden Lender Fees

- The Private Sale Due Diligence Checklist: Protecting Your Investment in Ontario

- Verifying the Vehicle's History: The Power of Data

- The All-Important Safety Standards Certificate (SSC) Review

- Independent Mechanical Inspection: Your Best Defence

- Test Drive Like a Pro: Sensory Checks

- Red Flags and Seller Scrutiny

- Sealing the Deal: Finalizing Your Pre-Approved Private Car Purchase in Ontario

- Negotiating with Confidence: Leveraging Your Pre-Approval

- The Ontario Bill of Sale: Your Legal Document

- Transferring Ownership at ServiceOntario

- Handling an Existing Lien: A Critical Step

- Special Scenarios in Ontario's Private Market

- Financing with Less-Than-Perfect Credit: Navigating Options for Securing Private Sale Pre-Approval in Ontario with a Challenging Credit History

- High-Value vs. Low-Value Private Sales: How Lender Requirements and Risk Assessment Might Shift

- Navigating an Existing Lien: Detailed steps for a smooth transaction when the seller still owes money on the car

- Your Next Steps to Approval: Driving Away with Confidence in Ontario

- Frequently Asked Questions About Private Car Sale Financing in Ontario

The quest for a new-to-you vehicle often begins with a trip to a car dealership, but what if your perfect ride isn't sitting on a lot? What if it's parked just down the street, in your neighbour's driveway, or listed by a private seller in another Ontario city? The private car market in Ontario is a treasure trove of unique finds and potential savings, but navigating the financing can feel like uncharted territory. That's where pre-approval comes in, transforming you from a hesitant browser into a confident, cash-equivalent buyer.

At SkipCarDealer.com, we believe that finding your dream car shouldn't be confined to a dealership. This comprehensive guide will illuminate the path to getting pre-approved for a private car sale in Ontario, empowering you to secure the best deals, understand the process, and drive away with confidence in your neighbour's car – or any private sale vehicle you choose.

Key Takeaways

- Pre-approval for a private car sale in Ontario is a powerful tool, offering budget clarity and negotiation leverage.

- Major banks, credit unions, and specialized online lenders all offer private sale financing options, but their requirements and processes vary.

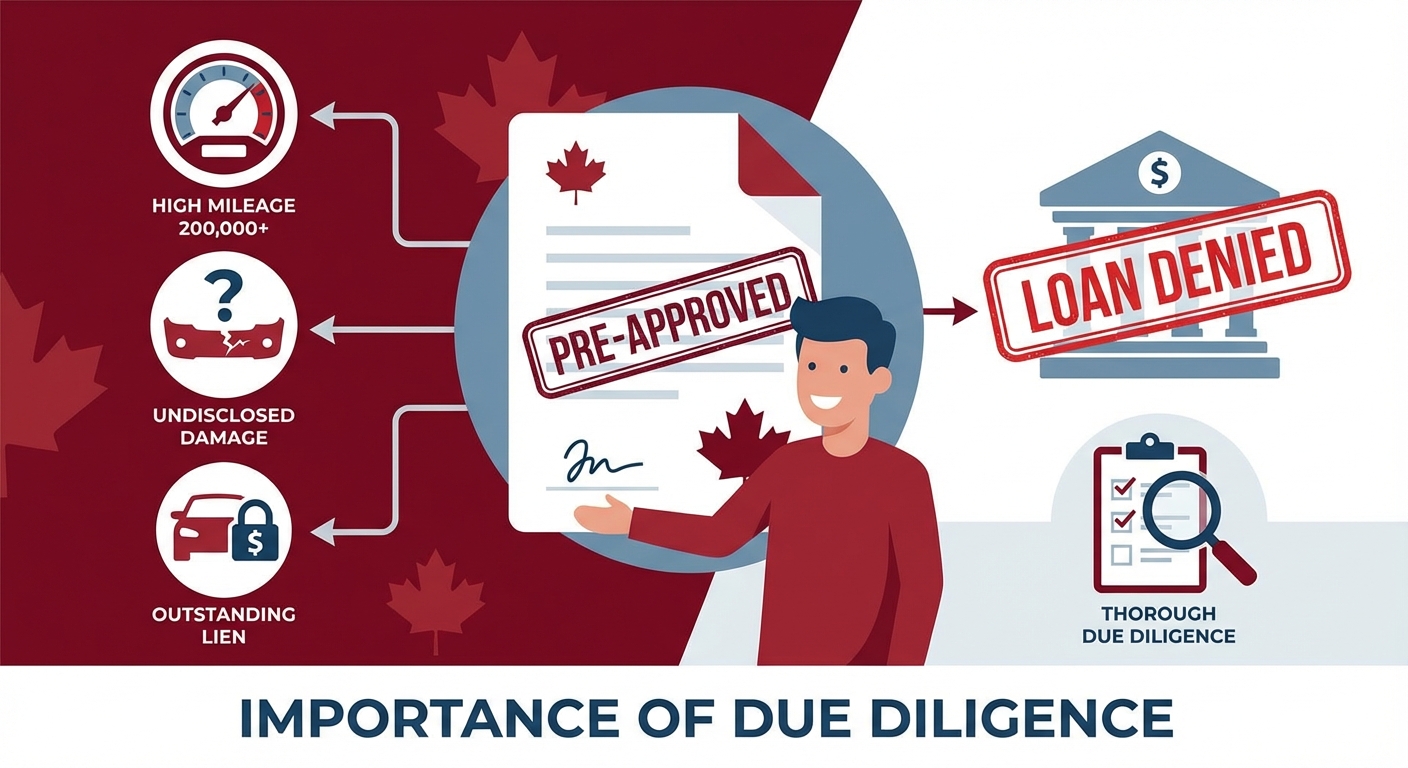

- Thorough due diligence (VIN check, lien search, independent mechanical inspection) is non-negotiable when buying privately in Ontario.

- Understanding all costs beyond the loan – including Ontario's PST, safety certificate, and registration fees – is crucial for an accurate budget.

- Knowing your credit profile and the vehicle's history are key factors in securing favourable pre-approval for a private sale.

Beyond the Dealership: Why Ontario's Private Car Market is Your Secret Weapon

For many car buyers, the dealership model is the default. Yet, a vast and often more rewarding world exists beyond the showroom floor: the private car market. In Ontario, this market is bustling, offering advantages that traditional dealerships simply can't match.

The Allure of Private Sales: Unlocking Better Value, Unique Finds, and Direct Negotiation

Imagine finding a meticulously maintained sedan, a rare vintage classic, or a specific trim level that's been discontinued – all from an individual seller who genuinely cares for their vehicle. Private sales often present these opportunities. You're not limited to a dealer's inventory; instead, you tap into a much wider pool of vehicles available across Ontario, from the urban sprawl of Toronto to the scenic routes of Northern Ontario.

Cost Advantages: How Skipping the Middleman Can Save You Thousands in Cities like Toronto, Ottawa, and Mississauga

The most compelling reason for many to consider a private sale is the potential for significant cost savings. Dealerships have overheads: sales commissions, lot maintenance, advertising, and reconditioning costs. These are all factored into the sticker price. When you buy privately, you're cutting out this middleman, often translating to a lower purchase price for a comparable vehicle. For instance, a quick comparison of similar year, make, and model cars in Toronto, Ottawa, or Mississauga often reveals a price difference of several thousand dollars between private and dealership listings.

Wider Selection: Accessing Vehicles Not Found on Dealership Lots, from Vintage Gems to Specific Trims

Dealerships typically focus on high-volume, popular models. The private market, however, is a mosaic of every car imaginable. Looking for a specific colour that was only offered for one model year? Want a manual transmission in a car typically sold as an automatic? Or perhaps you're after a classic car that's more of a passion project than a daily driver. The private market is where these unique finds thrive, offering a diversity that dealership inventories simply cannot replicate.

Understanding the 'Neighbour's Car' Appeal: Trust, Transparency, and Local Convenience

The term "neighbour's car" evokes a sense of familiarity and trust. While not every private seller is literally your neighbour, the private sale experience often feels more personal and transparent. You're dealing directly with the owner, who can share the vehicle's history, maintenance records, and stories in a way a salesperson might not be able to. This direct interaction can foster a level of trust and insight into the vehicle's true condition that's harder to achieve in a transactional dealership environment. Plus, finding a car locally in your Ontario community, whether it's Hamilton, Windsor, or Kingston, offers convenience in viewing and inspection.

To estimate your savings, find a comparable vehicle (same year, make, model, trim, mileage, condition) at both a private seller and a dealership. Note the price difference. Factor in potential reconditioning costs a dealership might absorb (e.g., new tires, brakes) that you might have to pay for in a private sale. Even after accounting for these, private sales often offer a net saving.

Pre-Approval Unpacked: The Golden Ticket for Private Car Buyers in Ontario

In the competitive world of car buying, pre-approval is your secret weapon. For private sales in Ontario, it's not just a convenience; it's a strategic advantage that puts you firmly in control.

What 'Pre-Approved' Truly Means for a Private Vehicle Purchase in Ontario

When a lender pre-approves you for a private vehicle purchase in Ontario, it means they've reviewed your financial profile (credit score, income, debt-to-income ratio) and determined that you qualify for a loan up to a certain amount, at a specific interest rate, and for a set term. This pre-approval is conditional; it's contingent on the actual vehicle you choose meeting the lender's criteria (e.g., age, mileage, condition, clear title). It essentially gives you a confirmed budget before you even find the car, transforming you into a powerful, informed buyer.

The Strategic Advantage: Shopping with a Confirmed Budget and Ready Financing, Akin to a Cash Buyer

Imagine walking into a negotiation with a private seller, knowing exactly how much you can spend and that your financing is already secured. This puts you in a position akin to a cash buyer. Sellers often prefer cash buyers because the transaction is simpler, faster, and involves less uncertainty. With pre-approval, you offer that same level of certainty, making your offer more attractive and giving you significant leverage to negotiate a better price. You won't be scrambling to secure financing after finding the perfect car; you'll be ready to move forward immediately.

How Pre-Approval Empowers Your Negotiations with Private Sellers

Private sellers, unlike dealerships, are often individuals who just want a fair price for their vehicle and a straightforward sale. When you present a pre-approval letter, it signals to them that you are a serious, qualified buyer. This eliminates one of their biggest concerns – whether the buyer can actually afford the car. This confidence empowers you to negotiate more aggressively on price, or on other terms like who pays for the Safety Standards Certificate, because the seller knows you're not going to waste their time with financing falling through.

Key Differences: Pre-Approval for Private Sales vs. Dealership Financing – Why the Former Can Be More Complex but More Rewarding

Dealership financing is often streamlined. The dealer acts as an intermediary, working with multiple lenders and handling much of the paperwork. For private sales, the process is slightly more hands-on. Your chosen lender will need to verify the private seller and the vehicle directly, ensuring it meets their collateral requirements. This might involve a lien search, verifying the vehicle's value, and confirming the seller's ownership. While this adds a few more steps, the reward is often a better deal and a car that truly fits your needs, without the added dealership markups or pressure tactics.

Setting Expectations: Understanding the Conditional Nature of Pre-Approval and What Can Still Go Wrong

It's vital to remember that pre-approval is conditional. It's a "yes, in principle." The final approval hinges on the specific vehicle you choose passing the lender's inspection and due diligence. Factors such as the car being too old, having excessively high mileage, undisclosed accident damage, or an outstanding lien that isn't properly cleared can all lead to a final loan denial. This underscores the importance of thorough due diligence on your part, even with pre-approval in hand.

An image depicting a diverse range of well-maintained used cars parked in various residential settings (driveways, quiet streets), symbolizing the broader selection and personal connection of private sales compared to a sterile dealership lot.

Navigating Ontario's Lender Landscape: Who Funds Your Neighbour's Ride?

Securing financing for a private car sale in Ontario requires understanding the various types of lenders available. While dealerships often have established partnerships, funding a private purchase means you're taking the lead in finding the right financial partner.

The Big Five & Beyond: Major Banks in Ontario (RBC, TD, Scotiabank, BMO, CIBC)

Canada's major banks are often the first stop for many seeking financing. They offer a range of products, but their approach to private sale auto loans can vary.

- Exploring their private sale loan products: While these banks are keen on auto loans, many prefer to work directly with dealerships due to the streamlined process and reduced risk. However, they do offer personal loans or sometimes secured car loans that *can* be used for private sales. These might not always be explicitly marketed as "private sale auto loans," so you'll need to inquire specifically about using a personal loan for a vehicle purchase.

- Typical requirements: Expect rigorous credit score benchmarks (generally good to excellent credit), stable income verification, and a low debt-to-income ratio. Existing customers often have an advantage, potentially securing slightly better rates or a smoother application process due to their established banking relationship.

- Specific examples: RBC offers secured car loans, which, depending on the terms, might be applicable. TD and Scotiabank also provide personal loan options that can be used for any major purchase, including a private car. Always confirm with a loan specialist if their product is suitable for a private vehicle purchase where the vehicle itself serves as collateral, or if it will be an unsecured personal loan.

Community Powerhouses: Ontario's Credit Unions (e.g., Meridian Credit Union, Alterna Savings, Libro Credit Union)

Credit unions, with their member-centric approach, often present a more flexible and personalized financing experience.

- The credit union advantage: Credit unions are known for their competitive rates, lower fees, and a willingness to look beyond strict credit score cut-offs, especially for long-standing members. Their personalized service can be a significant benefit when navigating the nuances of a private sale. They often have specific programs geared towards used car or private sale financing, understanding the unique needs of this market.

- Membership requirements: To access a credit union's services, you typically need to become a member, which usually involves opening an account and purchasing a small, refundable share. This is a straightforward process, and membership often extends across regions like Southwestern Ontario, the Greater Toronto Area, or Northern Ontario, allowing you to access branches and services wherever you are.

- Highlighting specific programs: Many credit unions, such as Meridian Credit Union, Alterna Savings, or Libro Credit Union, actively promote their used car loan options that are well-suited for private purchases, often requiring a valid Safety Standards Certificate and clear title verification.

The Digital Frontier: Online Lenders & Fintechs Specializing in Private Sales in Ontario

For speed, convenience, and a broader range of credit profiles, online lenders and fintech companies have carved out a significant niche.

- Identifying key players: Companies like CarLoansCanada, AutoCapital Canada, and even personal loan providers like Fairstone, often have platforms specifically designed to facilitate private sale financing. They understand the intricacies and are set up to verify vehicle details and seller information remotely.

- Advantages of online lenders: Their key strengths are speed and accessibility. Applications can often be completed in minutes, with pre-approval decisions sometimes within hours. They are frequently more accommodating to varied credit profiles – whether you have good, fair, or are rebuilding your credit – by having a wider network of lending partners. This makes them a great option for many Ontario buyers, especially those who might not meet the strict criteria of traditional banks.

- Understanding their application processes: Online lenders typically require you to input personal and financial details, and once you have a specific vehicle in mind, they will guide you through providing the VIN and seller's information for their due diligence. They often have dedicated teams to help coordinate the lien payout (if applicable) and direct funding to the seller.

When comparing loan offers, don't just look at the advertised interest rate. The Annual Percentage Rate (APR) provides the true cost of borrowing over a year, as it includes all fees (e.g., origination fees, administrative charges) in addition to the interest. Always ask for the full APR to make an apples-to-apples comparison between banks, credit unions, and online lenders.

Your Pre-Approval Journey: A Step-by-Step Guide for Ontario Buyers

Embarking on the pre-approval process for a private car sale in Ontario is a structured journey. By understanding each phase, you can navigate it efficiently and increase your chances of securing favourable terms.

Phase 1: Self-Assessment and Preparation

Before approaching any lender, a little groundwork on your part can make a world of difference.

- Understanding your credit score: Your credit score is a crucial factor in determining your eligibility and interest rate. In Canada, you can check your credit score for free through services like Credit Karma or Borrowell, or by requesting a credit report directly from Equifax or TransUnion. Aim to know your score well in advance to identify any discrepancies or areas for improvement. A higher score typically translates to lower interest rates and better loan terms.

- Calculating your debt-to-income ratio: Lenders look at your debt-to-income (DTI) ratio to assess your ability to manage additional debt. This is calculated by dividing your total monthly debt payments by your gross monthly income. Most lenders prefer a DTI ratio below 36-40%. Understanding this number helps you set a realistic budget for your car loan.

- Gathering your essential documents: Having your paperwork ready streamlines the application process. This typically includes:

- Proof of income: Recent pay stubs (for employed individuals), T4s, or notice of assessment. For self-employed individuals in Ontario, bank statements and income tax returns are often required. For more insights on how self-employed individuals can secure financing, check out our guide: Approval Secrets: Navigating the Best Used Car Finance Options for Ontario’s Self-Employed.

- Employment verification: Letter of employment or contact information for your employer.

- Banking information: Bank statements or void cheque for direct deposit/debit.

- Identification: Valid government-issued ID (e.g., driver's license, passport).

- Proof of residency: Utility bill or other document showing your Ontario address.

Phase 2: The Application Process

With your preparation complete, it's time to engage with lenders.

- Navigating online applications vs. in-branch visits: Online applications offer speed and convenience, allowing you to apply from anywhere in Ontario, at any time. Many online lenders specialize in private sales, making their process more tailored. In-branch visits, particularly with credit unions or your existing bank, offer personalized service and the opportunity to discuss your specific situation face-to-face. Choose the method that best suits your comfort level and time constraints.

- What information you'll provide: You'll typically be asked for personal details (name, address, date of birth), financial history (income, employment, existing debts), and the desired loan amount. For a private sale pre-approval, you won't need specific vehicle details yet, but you'll specify that you're looking for a used vehicle from a private seller.

- The waiting game: Pre-approval decisions can range from minutes with some online lenders to a few business days with traditional banks. Online platforms often use automated systems for initial screening, while banks may involve more manual review. Always clarify the expected timeline with your chosen lender.

Phase 3: Understanding Lender Criteria for Private Sales

Once you find a potential vehicle, the pre-approval becomes conditional on the car meeting certain requirements.

- Vehicle age and mileage restrictions: Most lenders have limits for private sales to mitigate risk. For example, a vehicle might need to be under 10 years old or have less than 150,000 kilometres. Older or higher-mileage vehicles may require a larger down payment or might only qualify for an unsecured personal loan rather than a secured auto loan.

- The role of the vehicle's value: Lenders need to ensure the loan amount aligns with the car's actual worth. They often use appraisal services (like Kelley Blue Book Canada or Canadian Black Book) or market data to determine the vehicle's fair market value. If the asking price significantly exceeds this value, or if the car requires substantial repairs, it could impact final approval.

- Specific requirements for the seller and vehicle title in Ontario: Lenders will verify the seller's identity and ensure they are the registered owner. They will also perform a lien search (PPSA search) on the vehicle to confirm there are no outstanding debts against it. A clear title is paramount for final approval.

Beyond the Loan: Unmasking the True Costs of a Private Car Sale in Ontario

Securing a pre-approved loan is a huge step, but the purchase price is only one part of the financial equation. When buying a car privately in Ontario, several other mandatory costs must be factored into your budget to avoid any unwelcome surprises.

Ontario Sales Tax (PST): The Mandatory 13%

Unlike some other provinces, Ontario levies a 13% Provincial Sales Tax (PST) on private used car sales. This is a significant cost you must account for.

- How PST is calculated: The PST is calculated on the greater of the purchase price or the vehicle's wholesale value (red book value) at the time of transfer. This is to prevent buyers and sellers from declaring a lower purchase price to avoid tax.

- When/where it's paid: You pay the PST directly at ServiceOntario when you register the vehicle in your name.

- Understanding fair market value assessments: ServiceOntario uses Canadian Red Book values to determine the wholesale value. If your purchase price is lower than this value, you'll pay PST on the Red Book value unless you can provide a valid reason (e.g., significant mechanical issues documented by an appraisal) for the lower price.

The Non-Negotiable Safety Standards Certificate (SSC)

An often-misunderstood requirement, the Safety Standards Certificate (SSC) is crucial for registering a used vehicle in Ontario.

- What the SSC covers: The SSC confirms that the vehicle meets the minimum safety standards set by the Ministry of Transportation of Ontario (MTO). It covers key components like brakes, steering, suspension, tires, lights, and exhaust. It does NOT guarantee the mechanical reliability or overall condition of the vehicle, only that it passed the safety inspection at that moment.

- Why it's essential for vehicle registration: You cannot transfer ownership of a used vehicle and register it in your name in Ontario without a valid SSC. The certificate is valid for 36 days from the date of inspection.

- Finding licensed inspection stations: You'll need to find a licensed Motor Vehicle Inspection Station in major Ontario cities like Hamilton, Windsor, or Kingston. Look for the green and white MTO-approved sign.

- Who pays for it: This is often a point of negotiation between buyer and seller. Legally, the buyer needs a valid SSC to register the vehicle, but a seller might offer to provide one to make their car more attractive. If the seller provides it, ensure it's current. If not, budget for this cost and any potential repairs needed to pass the inspection.

Registration and Licensing Fees at ServiceOntario

Beyond the PST, there are standard fees associated with officially becoming the new owner of the vehicle.

- Overview of fees: These include fees for transferring the vehicle permit (ownership), new licence plates (if you don't have existing ones to transfer), and annual licence plate renewal fees. These amounts are set by the MTO and can be found on the ServiceOntario website.

Insurance Implications: Don't Get Caught Off Guard

Insurance is a major ongoing cost, and rates in Ontario can be among the highest in Canada. It's imperative to address this before finalizing the purchase.

- Getting insurance quotes *before* finalizing the purchase: Contact several insurance providers to get quotes for the specific vehicle you intend to buy. Factors affecting rates in Ontario include your driving record, the vehicle's make/model, where you live (e.g., urban Toronto vs. rural Ontario), and your chosen coverage.

- The need for proof of insurance: You must have valid insurance coverage and proof of it to register the vehicle at ServiceOntario. You cannot drive the car legally without it.

Potential for Hidden Lender Fees

While your APR should capture most costs, always clarify any additional fees with your lender.

- Origination fees, administrative charges, early repayment penalties: Some lenders may charge an origination fee for processing the loan, or administrative charges throughout the loan term. It's also crucial to understand if there are any penalties for paying off your loan early. Ask for a full breakdown of all potential fees before signing any loan agreement.

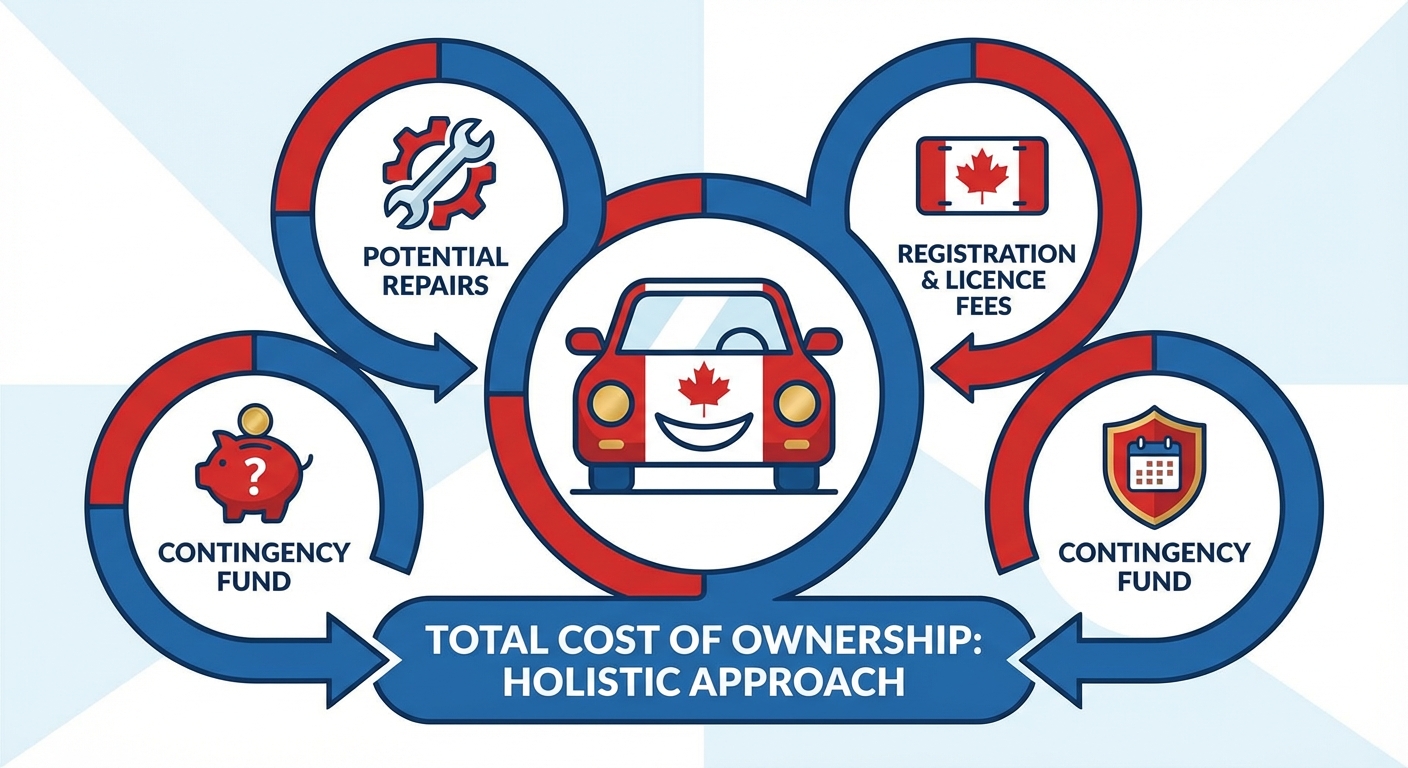

Don't just focus on the car's price. Use a spreadsheet to itemize all anticipated expenses: the negotiated purchase price, 13% Ontario PST, the cost of a Safety Standards Certificate (and potential repairs), registration and licence plate fees, at least six months of insurance premiums, and a contingency fund for immediate maintenance or unexpected repairs. This holistic approach ensures you have a realistic total cost of ownership.

An image showing a professional mechanic meticulously inspecting a used car on a lift in a well-equipped garage, with a magnifying glass or diagnostic tool, emphasizing the importance of a thorough independent inspection before purchase.

The Private Sale Due Diligence Checklist: Protecting Your Investment in Ontario

When buying privately in Ontario, you are responsible for your own protection. Unlike dealerships, private sellers don't offer warranties or guarantees. Your due diligence is your most powerful tool to safeguard your investment.

Verifying the Vehicle's History: The Power of Data

Knowledge is power, especially when it comes to a used car's past.

- Carfax/CarProof reports: These comprehensive reports are non-negotiable. They provide crucial information like accident history (including estimated damage costs), service records, odometer discrepancies, previous registrations in Ontario or other provinces, and whether the vehicle was ever reported stolen or salvaged. Look for a clean title, consistent mileage, and no major accident claims.

- Understanding lien status: A lien means someone else (usually a bank or lender) has a financial claim on the vehicle. If you buy a car with an undisclosed lien, you could become responsible for the seller's debt. You must perform a PPSA (Personal Property Security Act) search in Ontario to ensure there are no outstanding debts or liens against the vehicle. This search can be done online through ServiceOntario or by a registry agent. Your lender will typically perform this as part of their final approval, but it's wise to do it yourself as well.

The All-Important Safety Standards Certificate (SSC) Review

As discussed, the SSC is vital for registration, but it's also a snapshot of the vehicle's basic roadworthiness.

- Ensuring the SSC is current and legitimate: The SSC must be issued by an MTO-licensed mechanic and be dated within 36 days of your registration. Always verify its authenticity.

- Understanding what repairs might be needed: If the seller provides an SSC, it means the car passed at that moment. However, it doesn't mean the car is in perfect condition or won't need repairs soon. If the seller hasn't obtained an SSC, understand that any repairs needed to pass it will be your responsibility (unless negotiated otherwise).

Independent Mechanical Inspection: Your Best Defence

This is arguably the most critical step in private car buying. Never skip it.

- Why a pre-purchase inspection (PPI) by a trusted, third-party mechanic is non-negotiable: A professional mechanic will identify existing problems, potential future issues, and any hidden damage that might not be visible to the untrained eye. This unbiased assessment protects you from inheriting costly repairs.

- Finding reputable inspection services: Look for mechanics with good reviews or ask for recommendations in cities like London, Sudbury, or Thunder Bay. Ensure they are independent and not affiliated with the seller.

- Key areas of inspection: A thorough PPI covers the engine, transmission, brakes, suspension, tires, electrical system, body integrity (for rust, previous repairs), fluid levels, and overall structural soundness. They will also often check for recalls.

Test Drive Like a Pro: Sensory Checks

Your personal experience behind the wheel provides invaluable information.

- What to listen for, feel for, and observe: Drive the car on various road types (city streets, highway) and at different speeds. Listen for unusual noises (clunks, squeals, grinding). Feel for vibrations, pulling to one side, or strange pedal feedback. Observe how the transmission shifts, how the brakes respond, and if all lights and electronics function correctly. Test the air conditioning and heating.

Red Flags and Seller Scrutiny

Trust your instincts. If something feels off, it probably is.

- Warning signs: Be wary of sellers who refuse an independent inspection, insist on cash-only deals (especially for higher-value cars), have incomplete or questionable paperwork (e.g., a "missing" ownership document), or pressure you into a quick decision without proper due diligence. A price that seems too good to be true often is.

Always exercise caution if a seller: refuses an independent mechanical inspection; cannot provide a clear Carfax/CarProof report; insists on meeting in an unusual location or at strange hours; has an ownership document that doesn't match their ID; or pressures you to make a deposit or purchase decision without allowing time for proper checks. These are often indicators of potential fraud or undisclosed issues.

Sealing the Deal: Finalizing Your Pre-Approved Private Car Purchase in Ontario

With your due diligence complete and pre-approval secured, you're ready for the final stages of acquiring your privately sold vehicle in Ontario. This involves negotiation, paperwork, and official registration.

Negotiating with Confidence: Leveraging Your Pre-Approval

Your pre-approval is a powerful tool in the negotiation process.

- How knowing your budget empowers you: You know your absolute maximum spending limit, which prevents you from overpaying. More importantly, your readiness to buy with confirmed financing puts you in a strong position. You can confidently make a fair offer, knowing you're a serious buyer.

- Addressing any issues from the mechanical inspection during negotiation: If your independent mechanical inspection uncovered minor repairs (e.g., worn brakes, tire replacement), use this information to negotiate the price down or ask the seller to cover the cost of repairs before the sale. Be reasonable, but don't be afraid to walk away if the seller isn't willing to budge on significant issues.

The Ontario Bill of Sale: Your Legal Document

A Bill of Sale is your legal record of the transaction and is essential for transferring ownership.

- Key elements of a valid Bill of Sale in Ontario: Ensure it includes the full names and addresses of both buyer and seller, the vehicle's year, make, model, VIN (Vehicle Identification Number), odometer reading, the purchase price, and the date of sale. Both parties must sign it.

- Ensuring all conditions are met before signing: If your offer was conditional on a valid Safety Standards Certificate (SSC) or certain repairs, ensure these conditions are explicitly met and documented before you sign the Bill of Sale and hand over funds.

Transferring Ownership at ServiceOntario

This is where the car officially becomes yours.

- The step-by-step process: Head to your nearest ServiceOntario centre. You will need to bring:

- The original vehicle permit (ownership portion from the seller).

- A completed Bill of Sale.

- A valid Safety Standards Certificate (SSC).

- Proof of valid car insurance (pink slip).

- Your driver's license or other valid identification.

- Payment for Ontario PST and registration fees.

- Required documents: Make sure you have all these documents ready to ensure a smooth transfer.

Handling an Existing Lien: A Critical Step

If the seller still owes money on the car, managing the lien discharge is paramount to protect yourself.

- If the seller has an outstanding loan: Never pay the seller directly if there's an outstanding lien. The safest way to handle this is a three-way transaction. Your lender, after approving your loan, will typically pay off the seller's outstanding loan directly to their financial institution. Any remaining balance of your loan will then be paid to the seller. This ensures the lien is cleared, and you receive a vehicle with a clear title.

- Protecting yourself from inheriting the seller's debt: Always verify with a PPSA search that the lien has been discharged *before* the transaction is complete and before you take possession of the vehicle. Your lender will usually handle this, but it's good to be aware.

- What happens if the vehicle doesn't meet the lender's final requirements post-inspection? If, after your independent inspection, issues arise that compromise the vehicle's value or safety, your lender may revoke or adjust the pre-approval. This is why making your offer conditional on a successful inspection is vital. You would then need to renegotiate with the seller or find a different vehicle.

Special Scenarios in Ontario's Private Market

While the general process for private car financing in Ontario is clear, some situations require unique considerations.

Financing with Less-Than-Perfect Credit: Navigating Options for Securing Private Sale Pre-Approval in Ontario with a Challenging Credit History

A less-than-stellar credit score doesn't automatically close the door on private sale financing. It simply means you might need to explore different avenues.

- Identifying lenders and brokers who specialize in alternative financing solutions: Many online lenders and specialized brokers in Ontario focus on helping individuals with fair, poor, or rebuilding credit. They understand that life happens and look at your overall financial picture rather than just your credit score. They work with a network of lenders willing to take on higher-risk loans, often with higher interest rates but offering a pathway to approval. For more on this, check out our guide: Your Neighbour's Car. Your Poor Credit. Still a Match, Vancouver.

- Strategies for improving your approval odds:

- Larger down payments: A substantial down payment reduces the loan amount and the lender's risk, making you a more attractive borrower.

- Co-signers: Having a co-signer with good credit can significantly improve your chances of approval and potentially secure a better interest rate.

- Proving stable income: Even with poor credit, consistent, verifiable income (e.g., long-term employment, steady benefits) demonstrates your ability to repay the loan. If you're starting from scratch with your credit, there are still options available. Learn more about how to get approved for a car loan with no credit history here: Zero Credit? Perfect. Your Canadian Car Loan Starts Here.

High-Value vs. Low-Value Private Sales: How Lender Requirements and Risk Assessment Might Shift

The value of the vehicle can influence lender requirements and the type of financing available.

- Specific considerations for financing luxury or classic cars purchased privately in Ontario: For high-value vehicles, lenders might require more extensive appraisals, higher down payments, or may have stricter age/mileage limits. Specialized lenders catering to luxury or classic car financing often have bespoke products for these niche markets, sometimes requiring expert valuations.

- For lower-value vehicles: If the car is very old or inexpensive, traditional secured auto loans might not be available. In such cases, an unsecured personal loan from a bank or credit union might be the only viable financing option, which typically comes with higher interest rates than a secured loan.

Navigating an Existing Lien: Detailed steps for a smooth transaction when the seller still owes money on the car

Dealing with a seller who has an outstanding loan on their vehicle requires careful handling to avoid legal complications.

- The role of your lender in facilitating the lien discharge directly with the seller's lender: This is the safest and most common method. Your lender will verify the exact payoff amount of the seller's loan. They will then pay that amount directly to the seller's financial institution. The remaining balance of your approved loan (if any) is then disbursed to the seller. This ensures the lien is legally discharged before funds are released to the seller, protecting you.

- Why avoiding direct cash payment to the seller for a liened vehicle is crucial: If you pay the seller directly, there's a risk they might not use those funds to clear their loan, leaving the lien on the vehicle. You would then legally own a vehicle that is still collateral for someone else's debt, potentially leading to repossession or significant legal battles. Always insist on your lender managing the lien discharge directly.

- For those who have recently gone through a consumer proposal, navigating these financial waters can be challenging but not impossible. Learn how your consumer proposal doesn't have to be a roadblock to your next car: Your Consumer Proposal? We Don't Judge Your Drive.

Your Next Steps to Approval: Driving Away with Confidence in Ontario

The journey to owning your neighbour's car, or any privately sold vehicle in Ontario, begins with informed action. You've now been equipped with a comprehensive understanding of the pre-approval process, the hidden costs, due diligence essentials, and how to navigate special scenarios.

From understanding your credit score and gathering documents to exploring the diverse lender landscape of major banks, credit unions, and online fintechs, you have the knowledge to move forward confidently. Remember the importance of a thorough mechanical inspection, a Carfax report, and ensuring a clear title with no outstanding liens. These steps aren't just recommendations; they are your best defence in the private market.

Embrace the private sale market with informed decisions and strategic financing. The freedom to choose from a wider selection of vehicles, often at a better value, is within your reach. Don't let the financing aspect deter you. With pre-approval, you gain the leverage and peace of mind to make a smart purchase.