Skip Bank Financing: Private Vehicle Purchase Alternatives

Table of Contents

- Key Takeaways

- The 'Computer Says No' Problem: Why Banks Often Reject Private Vehicle Loans

- Tier 1 Alternatives: The Smartest First Stops

- Deep Dive: The Credit Union Advantage for Car Buyers in Ontario and B.C.

- Securing a Personal Loan or Line of Credit (HELOC): The 'Use Your Own Money' Strategy

- Tier 2 Alternatives: Specialized & Relationship-Based Financing

- Decoding Online & Fintech Lenders: Who Are They and Can You Trust Them?

- The Family & Friends Loan: How to Borrow Without Breaking Trust

- Unlocking Seller Financing and Lease Takeovers: A High-Risk, High-Reward Play

- The Mechanics of the Deal: From Handshake to Highway

- The Non-Negotiable Paperwork: A Province-by-Province Checklist (AB vs. ON)

- Cost Analysis: How a 2% Rate Difference on a $20,000 Loan Costs You Over $1,000

- Future-Proofing Your Purchase

- The 2026 Horizon: How AI and New Regulations Are Shaping Private Car Loans

- Your 5-Step Action Plan to Secure Financing and Drive Away

- Frequently Asked Questions

You’ve found the perfect car. It’s a private sale, the price is right, and the owner has kept it in immaculate condition. You head to your big bank, confident you’ll walk out with a loan, only to be hit with a firm "no." It's a frustratingly common scenario for Canadians. The big banks often have rigid rules that make financing a vehicle from another person, rather than a dealership, a non-starter.

But that rejection isn't the end of the road. It's just a detour. A world of flexible, often more affordable, financing options exists specifically for savvy buyers like you who are skipping the dealership lot. This guide is your roadmap to navigating those alternatives, securing the funds you need, and driving away in the car you actually want.

Key Takeaways

- Credit Unions First: Your local credit union should be your first call. They are member-focused, often offer lower rates than big banks for private sales, and are more flexible with older vehicles.

- Private Lenders Offer Flexibility: Online and fintech lenders specialize in situations banks avoid. They can be a great option for unique income situations or less-than-perfect credit, but watch the interest rates.

- Seller Financing is Possible, But Risky: In rare cases, the seller might finance the car for you. This requires iron-clad legal paperwork and is a high-risk, high-reward strategy.

- Paperwork is Non-Negotiable: A proper Bill of Sale, a lien check, and provincially-required documents (like Ontario's UVIP) are your best protection. Never skip these steps.

The 'Computer Says No' Problem: Why Banks Often Reject Private Vehicle Loans

Alternatives to bank financing for private vehicle purchase include credit unions, which offer lower rates and flexible terms; personal loans or lines of credit for speed and simplicity; specialized online fintech lenders for non-traditional credit profiles; and, in some cases, seller financing structured with a formal legal agreement.

So, why is your bank so hesitant? The answer boils down to one word: risk. From their perspective, a private sale is full of unknowns that don't exist in their cozy relationships with established dealerships.

Here’s what’s happening behind the banker’s desk:

- No Dealership Partnership: Banks have established processes and agreements with dealerships. They trust the dealership to have vetted the vehicle, handled the paperwork correctly, and guaranteed the title is clean. With a private sale, the bank has to do all that legwork themselves, increasing their administrative costs and perceived risk.

- Higher Perceived Vehicle Risk: A dealership often sells certified pre-owned vehicles with warranties. A private seller is offering a car "as-is." The bank worries about the vehicle's mechanical condition. If the car breaks down and you stop making payments, they're stuck trying to repossess a vehicle that might be worth far less than the loan amount.

- Inflexible Underwriting: Big banks use rigid, automated systems. Let's say you found the perfect 2018 Honda Civic on Autotrader in Calgary, but your bank's computer system is programmed to only finance vehicles from 2020 or newer, and only from a registered dealer. The loan officer can't override the system. You get a rejection, even if you have perfect credit.

This "computer says no" problem is the core frustration we're here to solve. The system isn't built for the smart buyer who finds value on the private market—but other systems are.

Tier 1 Alternatives: The Smartest First Stops

Before you venture into more specialized options, these two avenues represent the most powerful and often most affordable ways to finance a private vehicle purchase.

Deep Dive: The Credit Union Advantage for Car Buyers in Ontario and B.C.

If you only explore one alternative, make it a credit union. Unlike banks, which serve shareholders, credit unions are non-profit cooperatives that serve their members. This fundamental difference in structure translates into real-world benefits for car buyers.

We often see members get approvals where a bank said no, for several key reasons:

- Member-Focused Philosophy: They are more willing to look at the whole picture of your financial health, not just a credit score. A long-standing relationship can go a long way.

- Lower Interest Rates: Because they are non-profits, they return value to members through better rates. It’s not uncommon for a credit union's auto loan rate to be 1-2% lower than a major bank's offer.

- Flexibility on Private Sales: Credit unions are far more accustomed to and comfortable with financing private vehicle sales. They have the processes in place and understand the nuances.

- Wider Vehicle Acceptance: That 2018 Honda Civic the big bank rejected? A credit union is much more likely to see it as a reliable vehicle and approve the financing.

Let's look at a real-world comparison. A member at Meridian in Ontario or Vancity in B.C. with a good credit score might get approved for a 7.5% rate on a private sale vehicle. The same person might have been quoted 9.5% by a big bank for a dealership purchase, or simply been refused for the private sale altogether.

Pro Tip: Become a Cash Buyer

Get a pre-approved draft or certified cheque from your credit union *before* you even meet the seller. Walking in with guaranteed funds in hand transforms you from a "maybe" buyer into a cash buyer. This gives you immense negotiating power to get a better price on the vehicle.

Securing a Personal Loan or Line of Credit (HELOC): The 'Use Your Own Money' Strategy

Sometimes, the easiest way to buy a car is to not get a "car loan" at all. Using a personal loan or an existing line of credit can be a faster and more straightforward path to getting the keys.

The Pros:

- Simplicity and Speed: If you're already pre-approved for a line of credit, the money is yours to use instantly. Applying for a personal loan can also be quicker than a secured vehicle loan.

- No Lien on the Car: This is a major advantage. Because the loan isn't secured against the vehicle itself, the lender has no claim on it. This makes the paperwork with the seller simpler, and it's easier to sell the car later if you need to.

The Cons:

- Potentially Higher Rates: Unsecured personal loans and lines of credit often carry higher interest rates than secured car loans because the lender is taking on more risk.

- Variable Rate Risk: Most lines of credit are variable rate, tied to the prime lending rate. If the Bank of Canada raises rates, your monthly payment could increase.

For homeowners, the Home Equity Line of Credit (HELOC) is the ultimate power tool here. A HELOC is secured against your home equity, resulting in much lower interest rates—often close to the prime rate. This can be the single cheapest way to finance a vehicle purchase, but it requires discipline to pay it back promptly.

Tier 2 Alternatives: Specialized & Relationship-Based Financing

When credit unions or personal loans aren't the right fit, it's time to look at lenders who specialize in the exact situations that make traditional institutions nervous.

Decoding Online & Fintech Lenders: Who Are They and Can You Trust Them?

A growing number of online-only and financial technology (fintech) lenders have entered the Canadian auto market. Companies like Fairstone and others specialize in vehicle financing, including private sales that banks won't touch. Their business model is built on speed and accessibility.

They often cater to buyers who may have difficulty at traditional lenders. This could be due to a lower credit score, being new to the country, or having a non-traditional income source. For those struggling with past financial hurdles, exploring options detailed in our Car Loan After Bankruptcy & 400 Credit Score 2026 Guide can be a crucial next step.

The Trade-Off: The convenience and broader acceptance criteria often come at a cost. Interest rates and administrative fees can be significantly higher than those from a credit union. It's a classic case of paying for speed and risk tolerance.

Before you sign with any online lender, vet them carefully. Here's a checklist of questions to ask:

- What is the exact Annual Percentage Rate (APR), including all fees?

- Is the interest rate fixed or variable?

- Is there a penalty for paying the loan off early? (This is called a prepayment penalty).

- Are there any administrative, documentation, or other hidden fees?

- How is my personal information protected?

- What are your customer service reviews like? Check Google, Trustpilot, and the BBB.

- Are you licensed to operate in my province?

The Family & Friends Loan: How to Borrow Without Breaking Trust

Borrowing from family or friends is a common path, but it's fraught with peril if not handled professionally. To protect your relationship, you must treat it like a formal business transaction, not a casual favour.

Moving beyond a simple handshake and verbal promise is essential. The key is a formal, written Loan Agreement signed by both parties. This isn't about mistrust; it's about clarity and preventing future misunderstandings. Your agreement should include:

- The Principal Amount: The exact dollar amount being borrowed.

- The Interest Rate: Even if it's 0%, state it explicitly. If there is interest, define how it's calculated.

- The Payment Schedule: The amount of each payment, the due date (e.g., the 1st of every month), and the total number of payments.

- Method of Payment: How will payments be made? E-transfer, post-dated cheques?

- Late Payment Penalties: What happens if a payment is missed?

- Default Clause: What happens if you stop paying altogether? This is uncomfortable to discuss but critical to define.

- Vehicle Clause: What happens if the car is written off in an accident or stolen? The loan is still owed, and this should be stated.

Creating this document transforms a potentially awkward situation into a clear, respectful financial arrangement that protects both the lender and the borrower.

Unlocking Seller Financing and Lease Takeovers: A High-Risk, High-Reward Play

These are the most "outside-the-box" options and should be approached with extreme caution and, ideally, legal advice.

Seller Financing: In this scenario, the seller of the car acts as the bank. You agree on a purchase price, a down payment, an interest rate, and a payment schedule, and you pay them directly over time. This is rare but can happen when a seller is highly motivated. For instance, a seller in Edmonton needs to move for a job and offers to let you take over payments on their F-150 because they can't sell it quickly enough.

The risks are enormous. The seller still legally owns the car until the final payment is made. You need a lawyer to draft an agreement that protects you and ensures the title is transferred correctly upon completion. If you are looking to take over a lease, our guide on Your Lease Buyout Is Due. We're Buying It (For You) provides valuable insights into the process.

Pro Tip: Use an Escrow Service

For any seller financing deal, insist on using a third-party escrow service. You make your payments to the escrow company, and they forward them to the seller. This creates an impartial, professional record of all payments and protects both you and the seller from disputes.

Lease Takeovers: This isn't buying, but it's an alternative to a traditional purchase. You take over an existing lease from someone who wants out of it. It can be a great way to get into a newer car with a lower monthly payment and no down payment. However, you are bound by the original lease terms, including kilometre limits and wear-and-tear clauses.

The Mechanics of the Deal: From Handshake to Highway

Securing the financing is only half the battle. Executing the private sale correctly is critical to protecting your investment.

The Non-Negotiable Paperwork: A Province-by-Province Checklist (AB vs. ON)

The paperwork required for a private vehicle sale varies by province. Getting this wrong can lead to major headaches with registration and could even void the sale. A generic Bill of Sale template you downloaded online is not enough.

Let's contrast two major provinces:

- In Alberta: The process is managed through a Registry Agent. Before handing over any money, you MUST get a lien search from the Registry Agent Network. This confirms that the seller owns the vehicle outright and hasn't used it as collateral for another loan. The Bill of Sale is a critical document, but the lien search is your primary protection.

- In Ontario: The seller is legally required to provide you with a Used Vehicle Information Package (UVIP). This package contains a description of the vehicle, its registration history in Ontario, and lien information. You cannot register the car without it. The Bill of Sale portion is included right in the UVIP.

Regardless of your province, a "bulletproof" Bill of Sale should always contain:

- Full names and addresses of both the buyer and seller.

- The final sale price.

- The vehicle's make, model, year, and colour.

- The Vehicle Identification Number (VIN) - double-check this against the car itself.

- The exact odometer reading at the time of sale.

- A statement that the vehicle is being sold "as-is, where-is" (this protects the seller).

- The signatures and date of the transaction.

An annotated infographic titled 'Anatomy of a Bulletproof Bill of Sale for Ontario,' highlighting key fields like VIN, 'as-is' clause, and signatures.

An annotated infographic titled 'Anatomy of a Bulletproof Bill of Sale for Ontario,' highlighting key fields like VIN, 'as-is' clause, and signatures.

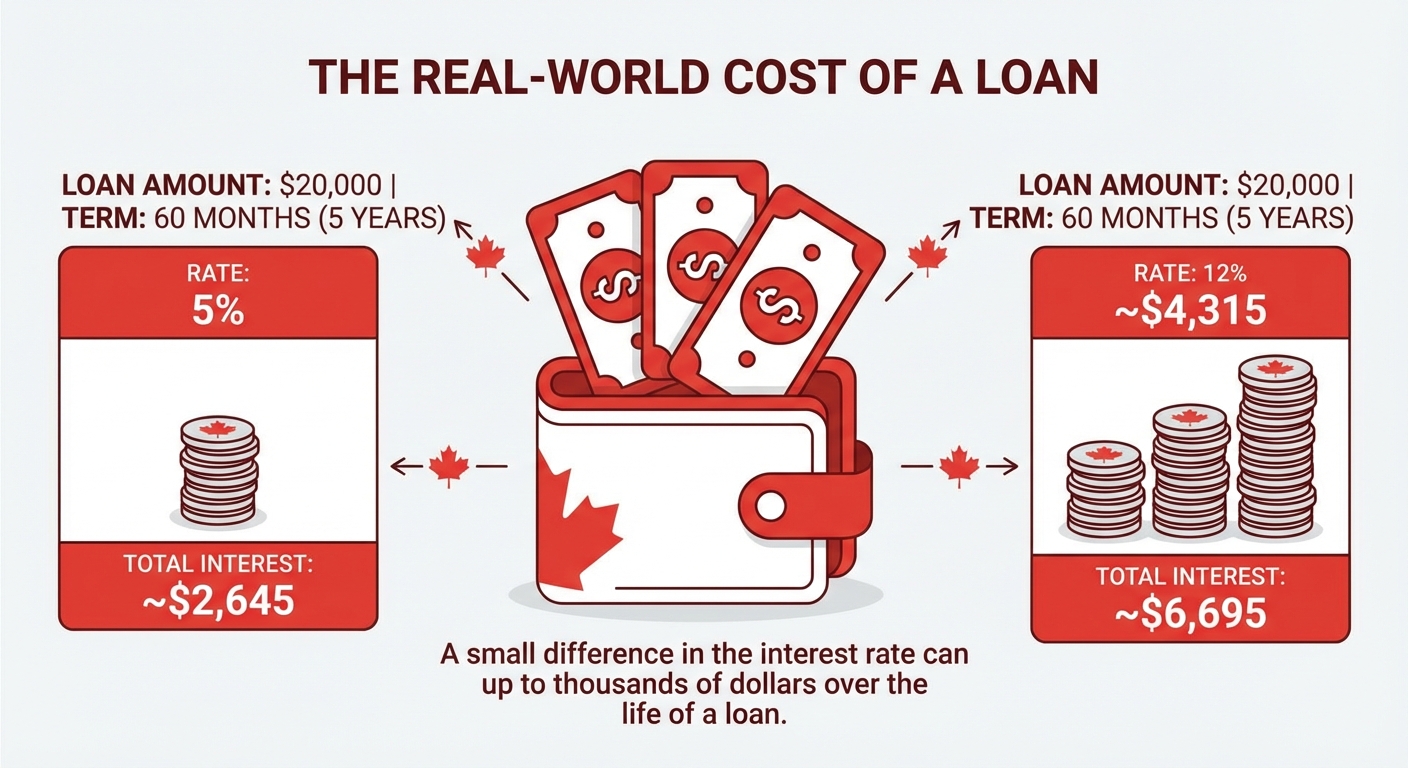

Cost Analysis: How a 2% Rate Difference on a $20,000 Loan Costs You Over $1,000

Shopping around for the best financing option isn't just an academic exercise; it has a significant impact on your wallet. A small difference in the interest rate can add up to thousands of dollars over the life of a loan.

Let's break down the real-world cost of a $20,000 loan paid over 60 months (5 years) at three different interest rates you might encounter.

A clean, easy-to-read comparison chart or table visualizing the cost analysis from this section. Title: 'The Real Cost of Your Car Loan: A 5-Year Breakdown'.

| Lender Type | Example Interest Rate (APR) | Estimated Monthly Payment | Total Interest Paid Over 5 Years |

|---|---|---|---|

| Credit Union (Prime Credit) | 6.5% | $391 | $3,480 |

| Big Bank (Dealership Loan) | 8.5% | $410 | $4,624 |

| Fintech Lender (Fair Credit) | 12.5% | $450 | $6,996 |

As the table clearly shows, choosing the Credit Union over the Fintech Lender in this scenario saves you $3,516 in interest alone. The difference between the 6.5% and 8.5% rates is over $1,100. This is why taking the time to secure the best possible financing is one of the most important steps in the car-buying process.

Future-Proofing Your Purchase

The world of auto finance is constantly evolving. Staying aware of emerging trends can give you an edge in your next vehicle purchase.

The 2026 Horizon: How AI and New Regulations Are Shaping Private Car Loans

The process you use to get a loan today might look different in a few years. Keep an eye on these developments:

- AI-Driven Underwriting: Lenders are increasingly using artificial intelligence to assess risk. This could be great news for gig workers or self-employed individuals in places like Alberta. AI can analyze bank statements and cash flow to prove income, moving beyond traditional pay stubs. This shift is already happening, as highlighted in articles like Bank Statements: The Only Resume Your Car Loan Needs. Drive, Alberta!.

- Integrated Platforms: Expect to see more one-stop-shop platforms that combine vehicle listings, financing applications, lien checks, and digital paperwork into a single, seamless experience. This will simplify and secure the private sale process significantly.

- Regulatory Changes: Provincial governments may introduce stronger consumer protection laws for private vehicle sales, potentially mandating things like pre-sale mechanical inspections or standardized digital Bills of Sale to reduce fraud.

Your 5-Step Action Plan to Secure Financing and Drive Away

Feeling overwhelmed? Don't be. Here is your simple, step-by-step action plan to successfully finance and purchase a private-sale vehicle.

- Get Your Credit in Order: Before you apply anywhere, pull your credit report. Know your score and check for any errors that could be holding you back.

- Secure Pre-Approval from a Credit Union: This is your most important step. Walk into your local credit union, discuss your plans, and get a pre-approval for a specific loan amount. This defines your budget and gives you negotiating power.

- Find Your Vehicle & Get a Pre-Purchase Inspection (PPI): Once you find the right car, make your offer conditional on it passing a PPI from a trusted, independent mechanic. This $100-$200 investment can save you thousands in unexpected repairs.

- Execute the Paperwork Flawlessly: Use your province-specific documents (UVIP in Ontario, etc.), perform a lien search, and complete a detailed Bill of Sale. Do not hand over money until the paperwork is signed and correct.

- Insure and Register Your New Car: Call your insurance broker to add the vehicle to your policy *before* you drive it home. Then, take all your paperwork to the provincial licensing office to officially register the car in your name.

Navigating the world of private car sales can feel complex, but by avoiding the rigid structure of big banks and embracing these powerful alternatives, you put yourself in the driver's seat—both literally and financially.