Landing at Pearson, Trudeau, or Vancouver International is just the beginning of your Canadian journey. Once the initial excitement of the move settles, reality hits: Canada is massive. Whether you are navigating the suburban sprawl of the Greater Toronto Area or the winter chill of the Prairies, a reliable vehicle isn't just a luxury-it is a lifeline. But for many newcomers, the first visit to a dealership ends in frustration. You have a good job, you have savings, but you have no Canadian credit history. This "thin file" status often leads to a quick "no" from traditional lenders.

The good news? There are specialized "Approval Secrets" designed specifically for people in your exact situation. You don't need to wait years to build a credit score from scratch. By leveraging programs like Scotiabank's StartRight and understanding the specific documentation lenders crave, you can drive off the lot in a vehicle that fits your lifestyle and helps you build a financial foundation in your new home.

Key Takeaways

- No Credit, No Problem: You can qualify for a car loan with zero Canadian credit history through specialized newcomer programs.

- The 3-Year Rule: Major institutions like Scotiabank offer up to $75,000 in financing for those who have been in Canada for less than 36 months.

- Vehicle Age Matters: To protect their collateral, lenders usually limit newcomer loans to vehicles that are 4 years old or newer.

- Documentation is King: Your PR card, Work Permit, and COPR are more important than a credit score in the early stages.

- Credit Building: An auto loan is one of the most effective ways to jumpstart your Canadian credit score, paving the way for future mortgages.

Introduction: The Newcomer's Dilemma in the Canadian Auto Market

You might have been a high-scoring borrower in your home country. Perhaps you had a platinum credit card in London, a perfect mortgage record in Mumbai, or a long history of car ownership in Manila. Unfortunately, the moment you cross the Canadian border, your credit history stays behind. Canadian credit bureaus-Equifax and TransUnion-start your file at zero. This is the "Thin File" dilemma. When a computer at a big bank looks at your application, it sees a blank slate, which it often interprets as a high risk.

In many parts of the world, public transit is the default. In Canada, unless you live and work directly on a subway line in downtown Toronto or Montreal, a car is essential for groceries, taking kids to school, and commuting to work. The "Approval Secrets" we are discussing today are about bypassing the standard automated systems and tapping into the human-centric newcomer programs that recognize your potential as a new Canadian resident.

Decoding the Canadian Credit System for Newcomers

Why your international credit score doesn't follow you

It seems unfair, doesn't it? In a globalized world, you'd think your financial reputation would travel with you. However, Canadian privacy laws and the lack of standardized reporting between international bureaus mean that Canadian lenders cannot verify your history in another country. They operate on a "show me what you've done here" basis. This is why even wealthy newcomers can be rejected for a basic credit card or auto loan if they walk into a branch without a plan.

The 'Catch-22': Needing credit to get credit

You need a credit history to get a loan, but you need a loan to build a credit history. This paradox keeps many newcomers stuck in the cycle of buying "beater" cars with cash-vehicles that often break down and cost more in repairs than a monthly loan payment would. Breaking this cycle requires finding a lender that looks at "alternative data" like your employment status, your residency permit, and your down payment rather than just a three-digit score.

How specialized newcomer programs bypass traditional credit scoring

Recognizing the massive influx of skilled immigrants, major Canadian banks have created "Newcomer to Canada" packages. These programs are designed to ignore the lack of credit history. Instead, they focus on your stability. Are you a Permanent Resident? Do you have a valid Work Permit? Do you have a confirmed income? If you can answer yes to these, the "Secret" is that the credit score becomes secondary.

The Scotiabank StartRight Advantage: A Case Study in Newcomer Financing

One of the most robust tools in the newcomer's arsenal is the Scotiabank StartRight program. It is widely considered the gold standard for auto financing in the immigrant community because of its clear rules and high approval ceilings.

| Feature | StartRight Program Details | Traditional Loan Comparison |

|---|---|---|

| Maximum Loan Amount | Up to $75,000 | Often capped at $15,000 for "No Credit" |

| Eligibility Window | Up to 3 years in Canada | Requires 2+ years of Canadian credit history |

| Vehicle Age | Up to 4 years old | Varies, but often higher rates for older cars |

| Down Payment | Minimum 10% to 20% (depending on status) | Often 0% (but only with high credit) |

Understanding the $75,000 Financing Limit

A $75,000 limit is significant. It means you aren't restricted to just base-model economy cars. You can finance a reliable family SUV, a well-equipped truck, or even a luxury sedan. This limit is designed to give newcomers the same purchasing power as established Canadians, provided they have the income to support the payments.

Eligibility Criteria: The 3-Year Rule

The program defines a "newcomer" as someone who has arrived in Canada within the last 36 months. If you have been here for 3 years and one day, you might be moved into the "standard" credit pool. This is why it is often better to secure your primary vehicle loan within those first three years while you still qualify for these specialized entry requirements.

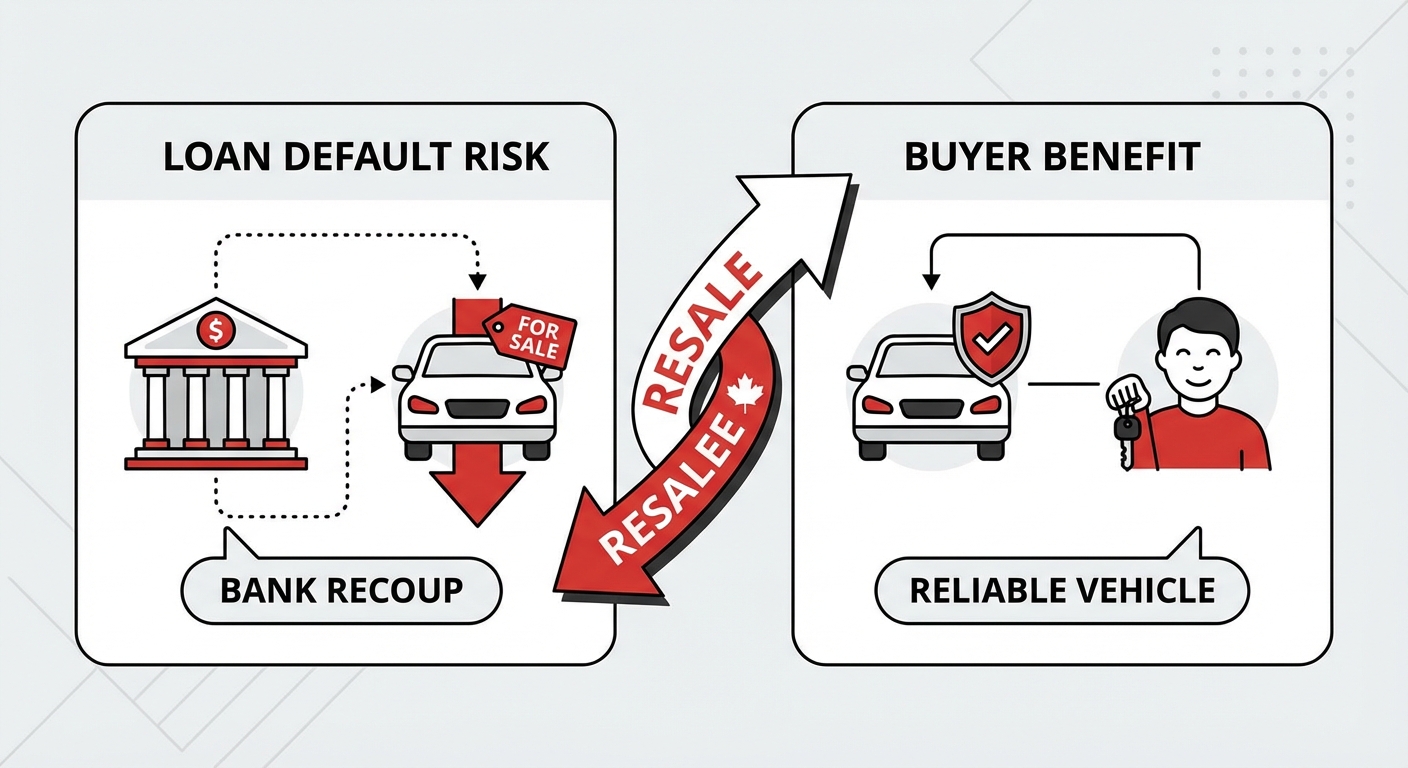

Vehicle Restrictions: Why the 4-year-old limit exists

You might wonder why you can't use a newcomer loan to buy a 10-year-old car. Lenders see newer vehicles as lower risk. A car that is under 4 years old is likely still under some form of manufacturer warranty and has a higher resale value. If you were to default on the loan, the bank needs to know they can sell the car to recoup their money. For you, this is actually a benefit; it ensures you are buying a reliable vehicle rather than someone else's mechanical problems.

Essential Documentation: The 'Approval Secrets' Checklist

When you walk into a dealership, the "Finance Manager" is the person who will pitch your case to the bank. To help them win, you need to provide a "Decision-Ready" file. If you have all your papers organized, you move from a "maybe" to a "yes" in minutes.

Proof of Residency: PR Cards vs. Foreign Worker Permits

Permanent Residents (PR) have the easiest path, as they are seen as long-term fixtures in the Canadian economy. However, Foreign Workers on a valid permit are also highly eligible. The key is the expiry date on your permit. Lenders generally want to see that your permit lasts at least as long as the loan term, though some programs are flexible if you have applied for an extension or PR status.

Proof of Income: Employment Letters and Paystubs

If you are newly employed, you will need an employment letter on company letterhead stating your position, your salary, and that you have passed your probationary period. If you are still job hunting but have significant savings or a spouse with a job, some lenders may still consider you, but a steady Canadian income is the single biggest "Approval Secret" there is.

Choosing the Right Vehicle for Your First Loan

New vs. Certified Pre-Owned (CPO)

New cars are enticing, especially with the 0% or low-interest incentives often offered by manufacturers. However, for a newcomer, a Certified Pre-Owned (CPO) vehicle is often the smartest financial move. CPO vehicles have undergone rigorous inspections and usually come with extended warranties, but you avoid the massive "drive-off-the-lot" depreciation of a brand-new car.

Why lenders prefer vehicles under 4 years old for newcomers

As mentioned, the 4-year limit is a risk-mitigation strategy. But there's another reason: modern safety features. Newer cars have better safety ratings, which can actually lower your insurance premiums-a major cost for newcomers who also have "zero history" in the Canadian insurance system.

Calculating the Total Cost of Ownership (TCO)

Your car payment is only one part of the equation. In Canada, you must factor in:

- Insurance: Can be very high for newcomers (often $200-$400/month).

- Fuel: Prices fluctuate significantly across provinces.

- Winter Tires: A non-negotiable safety expense in most of Canada (budget $800-$1,200).

- Maintenance: Oil changes and scheduled service to keep your warranty valid.

Resale Value: The Toyota and Honda Factor

Banks love brands like Toyota, Honda, and Subaru. Why? Because they hold their value incredibly well. If a bank is financing a Honda Civic for a newcomer, they know that even three years from now, that car will be worth a significant percentage of its original price. This makes the bank more comfortable approving the loan compared to a brand with poor reliability ratings.

The Financial Mechanics of a Newcomer Car Loan

Understanding the "math" behind your loan will save you thousands of dollars over the life of the contract. Don't just look at the monthly payment; look at the total interest paid.

| Loan Component | What to Expect | Strategy for Newcomers |

|---|---|---|

| Interest Rate (APR) | 6.99% to 9.99% (Typical) | Aim for the lowest rate by offering a higher down payment. |

| Down Payment | 10% to 20% | Put down as much as possible to reduce the "Loan-to-Value" ratio. |

| Loan Term | 24 to 60 months | Avoid terms longer than 60 months to prevent being "underwater." |

| Payment Frequency | Monthly or Bi-weekly | Bi-weekly aligns with most Canadian pay cycles. |

Interest Rates: What is a 'fair' rate for a newcomer?

You might see advertisements for 0% or 1.9% financing. These are typically reserved for those with a 750+ credit score. As a newcomer, a "fair" rate is usually between 6% and 10%. While this feels high, remember that this is a "bridge loan" to establish your credit. After 12-18 months of perfect payments, you can often refinance at a lower rate or trade the vehicle in for a better deal.

Down Payments: The Guarantee of Approval

If you are on the edge of an approval, a larger down payment is the "Secret Sauce" that tips the scales. If you are asking the bank to lend you $30,000 for a $30,000 car, they are taking 100% of the risk. If you put down $6,000 (20%), the bank only risks $24,000 on a $30,000 asset. This makes them much more likely to say yes.

Navigating the Dealership Experience

The dealership can be an intimidating place, especially if you are unfamiliar with the Canadian sales process. The most important thing to remember is that you are in control. You are the customer, and your business is valuable.

Why you should ask for Scotiabank financing specifically

Many dealerships work with multiple lenders. Some lenders are "sub-prime," meaning they specialize in bad credit but charge very high interest rates (15% to 25%). By specifically asking the Finance Manager to check your eligibility for the Scotiabank StartRight program, you ensure you are being looked at as a "Newcomer" rather than a "Bad Credit" borrower. There is a massive difference in the interest you will pay.

Understanding the 'Finance Office'

After you pick the car, you will be taken to a small office to sign the paperwork. This is where the dealership makes a significant portion of its profit. They will offer you "add-ons." While some are useful, many are unnecessary for a newcomer on a budget.

Avoiding 'Add-ons': What you really need

- Gap Insurance: Useful if you have a very small down payment. It covers the "gap" between what you owe and what the car is worth if it's totaled.

- Rust Coating: Canada uses a lot of salt on roads in winter. While useful, you can often get this done cheaper at a third-party shop.

- Extended Warranties: If you are buying a 4-year-old car, the factory warranty might be expiring. An extended warranty offers peace of mind but read the fine print carefully.

Beyond the Approval: Managing Your Loan and Building Credit

Getting the keys is a victory, but the real goal is what happens over the next 12 to 24 months. This car loan is a tool to build a "Financial Passport" in Canada.

The Impact of Late Payments

In the Canadian credit system, "Payment History" accounts for roughly 35% of your total score. A single payment that is more than 30 days late can tank your score by 100 points and stay on your record for six years. For a newcomer, this can be devastating. You must ensure that your car payment is treated with the same priority as your rent.

How to make extra payments

Most newcomer car loans in Canada are "Open Loans." This means you can pay them off early without penalty. If you get a tax refund or a work bonus, putting that money toward your car loan reduces the total interest you pay and builds your credit equity faster.

Common Pitfalls and Red Flags to Avoid

As you search for your first car, you will see many tempting offers. Being able to spot a "trap" is just as important as knowing the "secrets" to approval.

'No Credit Check' Dealerships

Avoid these at all costs. These are often "Buy Here, Pay Here" lots. They don't report your on-time payments to the credit bureaus, so you aren't building any credit history. Furthermore, their interest rates are often predatory, sometimes reaching 29.9%.

The 'Negative Equity' Trap

This happens when you take an 84-month or 96-month loan. Because cars depreciate (lose value) faster than you pay off a long-term loan, you will owe more than the car is worth for almost the entire duration. If you need to sell the car or if it gets into an accident, you will be stuck paying for a car you no longer own. Stick to a 60-month (5-year) term or shorter.

Permit Expiry Alignment

Always ensure your loan term doesn't significantly outlast your legal status in Canada. While banks are flexible, they are much more comfortable if they see that you have a path to stay in Canada (like a PR application in progress) for the duration of the loan.

Frequently Asked Questions (FAQ)

Can I get a car loan with a G2 license?

Yes, you can. In Ontario (and similar graduated licensing provinces), a G2 is a valid driver's license that allows you to drive independently. Most lenders will accept a G2 for financing purposes, though your insurance rates will be higher than if you had a full G license.

Do I need a Canadian co-signer as a newcomer?

If you utilize a specialized program like Scotiabank StartRight, you typically do NOT need a co-signer. These programs are designed to stand on your own merits as a newcomer. However, if you are looking for a vehicle that exceeds the program's price limits or if your income is low, a co-signer with established Canadian credit can help you get approved.

What is the maximum amount I can borrow?

Under the StartRight program, the maximum is currently $75,000. However, the actual amount you are approved for will depend on your "Debt-to-Income" ratio. Lenders generally want to see that your total monthly debt payments (including the new car and your rent) do not exceed 40% of your gross monthly income.

Can I get a loan if I am on a study permit?

Financing on a study permit is more challenging but possible. Lenders will look closely at your work authorization (usually 20 hours per week) and may require a larger down payment (often 20-30%). Some specialized lenders focus on international students, but the interest rates may be higher than the standard newcomer programs.

How long does the approval process typically take?

If you have all your documentation ready (PR card/Work Permit, employment letter, and paystubs), an approval can often be secured within 24 to 48 hours. The longest part of the process is usually the bank verifying your employment with your HR department.

Conclusion: Driving Toward Your Canadian Future

Securing your first car loan in Canada is a major milestone. It represents more than just a way to get from point A to point B; it is a declaration of your intent to build a stable, successful life in this country. By using the "Secrets" of newcomer-specific programs, you bypass the traditional hurdles that stop so many others.

Remember that the best strategy is a combination of preparation and patience. Gather your documents, choose a vehicle that holds its value, and use your loan as a stepping stone to a perfect credit score. Canada is a country built on the contributions of newcomers, and the financial system has evolved to help you succeed. Take advantage of these programs, stay disciplined with your payments, and enjoy the freedom that comes with owning your first vehicle in your new home.