Zero Credit? Perfect. Your Canadian Car Loan Starts Here.

Table of Contents

- Zero Credit? Perfect. Your Canadian Car Loan Starts Here: Key Takeaways for Newcomers

- The Myth of 'No Credit, No Car' in Canada: Your Real Starting Line

- Beyond 'Zero Credit': What Canadian Lenders *Really* Scrutinize for Newcomers

- The 'Four Cs' of Newcomer Lending (and how they apply to you):

- Pro Tip:

- The Anatomy of Your First Canadian Car Loan: Unpacking Every Dollar

- Demystifying Loan Terms:

- Beyond the Sticker Price: Essential Fees and Taxes:

- Crafting Your Approval Blueprint: A Step-by-Step Action Plan for Newcomers

- Phase 1: Pre-Application Preparation (The Document Arsenal):

- Phase 2: The Application Process:

- Phase 3: The Waiting Game & Decision:

- Pro Tip:

- Navigating the Lender Landscape: Who Will Give You a Chance?

- 1. The Big Banks (TD, RBC, Scotiabank, CIBC, BMO):

- 2. Dealership Finance Departments (The Hub of Newcomer Loans):

- 3. Credit Unions & Regional Lenders:

- 4. Specialty/Subprime Lenders:

- The Game Changers: Your Down Payment, a Co-Signer, and Strategic Trade-Ins

- The Power of Your Down Payment:

- Unlocking Approval with a Co-Signer:

- Trade-Ins (If Applicable):

- Pro Tip:

- Picking Your First Ride: New, Used, and What Your Budget *Truly* Allows

- New Cars for Newcomers:

- Used Cars for Newcomers (Often the Sweet Spot):

- Realistic Budgeting for Your First Car:

Welcome to Canada! As you embark on this exciting new chapter, establishing your life here often means needing a reliable mode of transportation. Whether it's for commuting to work, exploring your new surroundings, or simply managing daily errands, a car can be an indispensable tool. But if you're like many newcomers, you might be facing a common hurdle: a lack of Canadian credit history. The good news? At SkipCarDealer.com, we understand that "zero credit" doesn't mean "zero options." In fact, it’s often the perfect starting point for your Canadian car loan journey. The idea that you need years of established credit to get a car loan in Canada is a persistent myth, especially for those new to the country. Canadian lenders, particularly those specializing in newcomer financing, recognize that everyone starts somewhere. They look beyond a simple credit score to understand your unique financial situation and your potential as a responsible borrower. This comprehensive guide is designed to empower you with the knowledge and strategies needed to secure your first Canadian car loan, build your credit, and drive confidently into your new life.

Zero Credit? Perfect. Your Canadian Car Loan Starts Here: Key Takeaways for Newcomers

- Your Credit History Isn't Everything: Canadian lenders understand newcomers have no local credit. They focus on other indicators like stable income, employment, and down payment, which often matter more than a non-existent credit score.

- Preparation is Power: Gather all your essential documents – ID, work permit, job letter, bank statements – *before* you apply. Being organized streamlines the process and demonstrates your readiness to lenders.

- Shop Smart, Not Just Hard: Compare offers from multiple lenders – major banks, dealerships, and credit unions – to find the best rates and terms tailored to your newcomer status. Don't settle for the first offer you receive.

- The True Cost Goes Beyond the Loan: Budget comprehensively for insurance (often higher for newcomers), registration, maintenance, and the crucial investment in winter tires. Understanding these additional costs is vital for long-term financial stability.

- This Loan Builds Your Future: Successfully managing your first car loan by making consistent, on-time payments is a crucial step towards establishing a strong Canadian credit history, opening doors to future financial opportunities like mortgages and lower interest rates.

The Myth of 'No Credit, No Car' in Canada: Your Real Starting Line

For many newcomers to Canada, the phrase "no credit, no car" can feel like an insurmountable barrier. You’ve just arrived, you’re building a new life, and the last thing you need is to be told that your lack of a Canadian credit score prevents you from accessing essential services like vehicle financing. Let's dispel this biggest fear right now: 'zero credit' is absolutely not a dead end for newcomers in Canada. In fact, for many, it’s simply the real starting line. The Canadian lending landscape is often more welcoming and understanding than you might initially assume, especially for individuals who are clearly establishing roots and contributing to the economy. Lenders here recognize that credit history is a localized concept. Your excellent payment record in your home country, while valuable, doesn't automatically translate into a Canadian credit score. However, this doesn't mean you're invisible to lenders. Instead, they pivot to alternative factors that paint a clearer picture of your financial responsibility and capacity to repay a loan. Rather than fixating on a non-existent credit score, Canadian lenders prioritize tangible evidence of stability and income. They want to see that you have a steady job, a reliable income stream, and a plan for your future in Canada. This approach is designed to help you get on the road, not to keep you off it. The overarching goal for many financial institutions, and certainly for us at SkipCarDealer.com, is not just to provide you with a car, but to help you establish a strong financial foundation in your new home. Your first car loan can be a powerful tool in building that foundation, serving as a crucial first step in demonstrating your creditworthiness.

Beyond 'Zero Credit': What Canadian Lenders *Really* Scrutinize for Newcomers

When you don’t have a Canadian credit score, lenders don't simply throw up their hands. Instead, they delve into other aspects of your financial profile to assess your risk and ability to repay. We often refer to these as the "Four Cs" of lending, and for newcomers, they take on an even more significant role. Understanding these will help you prepare a compelling application.

The 'Four Cs' of Newcomer Lending (and how they apply to you):

1. Capacity (Your Ability to Pay):

This is arguably the most critical factor for newcomers. Lenders want concrete proof that you can comfortably afford your monthly car payments.

- Stable Employment: The Golden Ticket. Having a steady job is paramount. Lenders will assess how long you’ve been in your current position. A permanent, full-time role is ideal, as it signals long-term stability. If you're on a contract, the length and renewability of that contract will be scrutinized. Self-employed newcomers might face additional hurdles but can still qualify by demonstrating consistent income through bank statements and business records. For more insights on this, you might find our article on Self-Employed? Your Bank Account *Is* Your Proof. Get Approved. helpful.

- Income Verification: Pay Stubs, Employment Letters, Bank Statements. What truly counts as 'provable income'? Lenders will typically ask for recent pay stubs (usually 2-3 months), an official employment letter from your employer stating your position, salary, and start date, and bank statements showing consistent direct deposits of your salary. Any additional income, such as rental income or a second job, should also be documented.

- Debt-to-Income Ratio: Lenders assess your existing financial commitments (rent, other loan payments, credit card minimums) against your gross monthly income. While you might not have much existing debt in Canada, your rent payments will be a significant factor. A lower debt-to-income ratio indicates you have more disposable income to dedicate to a car payment, making you a less risky borrower.

2. Collateral (The Car Itself):

The vehicle you choose acts as collateral for the loan. Its value and marketability play a role in the lender's decision.

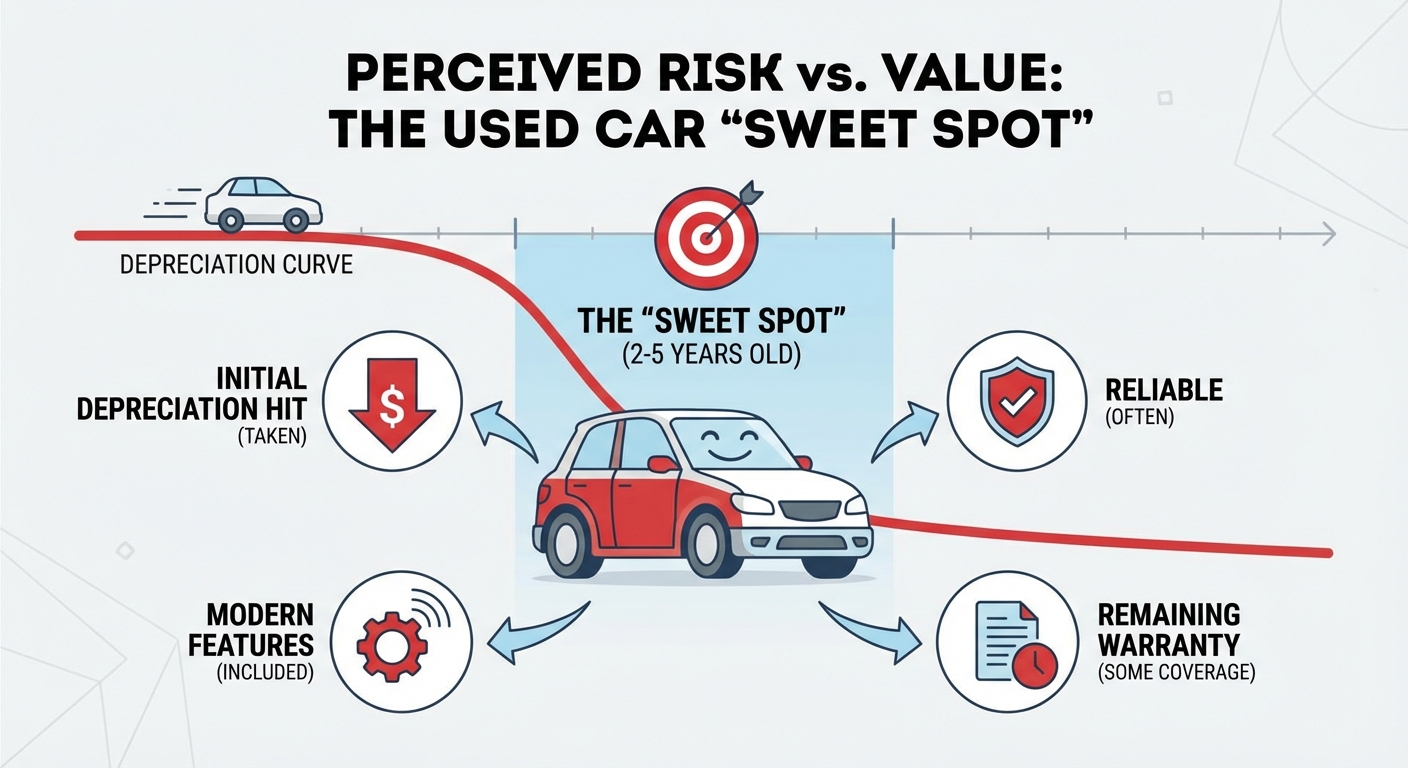

- New vs. Used: Generally, new cars are more expensive and depreciate quickly, which can make them harder to finance for newcomers without credit. Used cars, particularly those 2-5 years old, often present a more manageable risk for lenders due to their lower price point and slower depreciation.

- Age and Mileage: Older cars with very high mileage are typically harder to finance. This is because their resale value is lower, and the risk of significant mechanical issues is higher, making them less desirable collateral for a lender should you default. Lenders prefer vehicles that retain their value well.

3. Capital (Your Investment):

This refers to the money you put into the deal yourself.

- The Power of a Down Payment: This is one of the most powerful tools a newcomer has. A significant down payment (even 5-10% of the car's price) drastically reduces the lender's risk, as you have a personal stake in the vehicle. It can also lead to lower interest rates and more favourable loan terms.

- Other Assets: While not always required, demonstrating other financial stability through savings accounts, investments, or even property ownership in your home country can strengthen your application. It shows a pattern of responsible financial management.

4. Conditions (Your Situation):

Your personal circumstances in Canada are also taken into account.

- Residency Status: Lenders differentiate between Permanent Residents, Temporary Foreign Workers, and International Students. Permanent Residents generally have an easier time, as their long-term commitment to Canada is clear. Temporary Foreign Workers and International Students can still qualify, but the loan term might be limited to the duration of their permit, and the lender will scrutinize their employment or study plans more closely.

- Time in Canada: While "zero credit" is understood, having been in Canada for a few months and establishing a stable routine (job, address, bank account) can be more favourable than applying immediately after arrival.

- Other Financial Relationships: Existing bank accounts, utility payments (like hydro or internet bills in your name), and consistent rent payments (if you can provide proof) can act as 'soft' indicators of your financial reliability, even if they don't appear on a credit report.

Pro Tip:

Even if you have no Canadian credit, bring any credit reports or payment history from your home country. While Canadian credit bureaus don't directly use this information, presenting a history of responsible borrowing to a sympathetic lender, especially a dealership finance manager, can demonstrate your character and commitment to financial obligations. It provides a narrative of your past financial behaviour.The Anatomy of Your First Canadian Car Loan: Unpacking Every Dollar

Understanding the components of a car loan is crucial for any borrower, but especially for newcomers who are navigating a new financial system. Your loan isn't just a single number; it's a combination of several factors that determine your total cost.

Demystifying Loan Terms:

- Principal: This is the actual amount of money you are borrowing to purchase the car. It's the sticker price of the vehicle minus any down payment or trade-in value.

- Interest Rate: This is the cost of borrowing money, expressed as a percentage of the principal. For newcomers with no Canadian credit history, interest rates are likely to be higher than for established residents with excellent credit. This is because lenders perceive a higher risk without a track record. You'll often see two types:

- Nominal Rate: The stated annual interest rate.

- APR (Annual Percentage Rate): This includes the nominal interest rate plus any other fees or charges associated with the loan, giving you a more accurate picture of the total annual cost of borrowing. Always compare APRs, not just nominal rates.

- Loan Term: This is the duration over which you agree to repay the loan, typically expressed in months (e.g., 36, 60, 84 months).

- Shorter Terms (e.g., 36-60 months): Result in higher monthly payments but you pay less total interest over the life of the loan.

- Longer Terms (e.g., 72-84 months): Result in lower monthly payments, making the car more "affordable" on a month-to-month basis, but you will pay significantly more in total interest over the life of the loan. As a newcomer, balancing affordability with the total cost is key.

Beyond the Sticker Price: Essential Fees and Taxes:

The price you see on the windshield is rarely the final price you pay. Several additional costs are part of buying a car in Canada.

- Sales Tax (GST/PST/HST): Canada has a Goods and Services Tax (GST) of 5%. Provinces also have their own Provincial Sales Tax (PST) or a harmonized sales tax (HST) which combines GST and PST.

- HST: Ontario, New Brunswick, Nova Scotia, Newfoundland and Labrador, and Prince Edward Island use HST, which is applied as a single tax (e.g., 13% in Ontario).

- GST + PST: British Columbia, Saskatchewan, and Manitoba apply GST and PST separately.

- GST Only: Alberta has no provincial sales tax, so you only pay the 5% GST.

- PPSA/Lien Registration Fee: The Personal Property Security Act (PPSA) allows lenders to register a lien against the vehicle. This means the car serves as collateral, and the lender has a legal claim to it until the loan is fully repaid. This fee is typically a small, one-time charge (e.g., $10-$50) but is mandatory.

- Dealership Admin Fees: These are fees charged by the dealership for processing paperwork, detailing the car, or other administrative tasks. They can range from a couple of hundred dollars to over a thousand. Are they negotiable? Sometimes. Always ask for a breakdown of these fees and question any that seem excessive or unclear. Some are legitimate; others are pure profit.

- Other Potential Add-ons: Dealerships may offer various optional products:

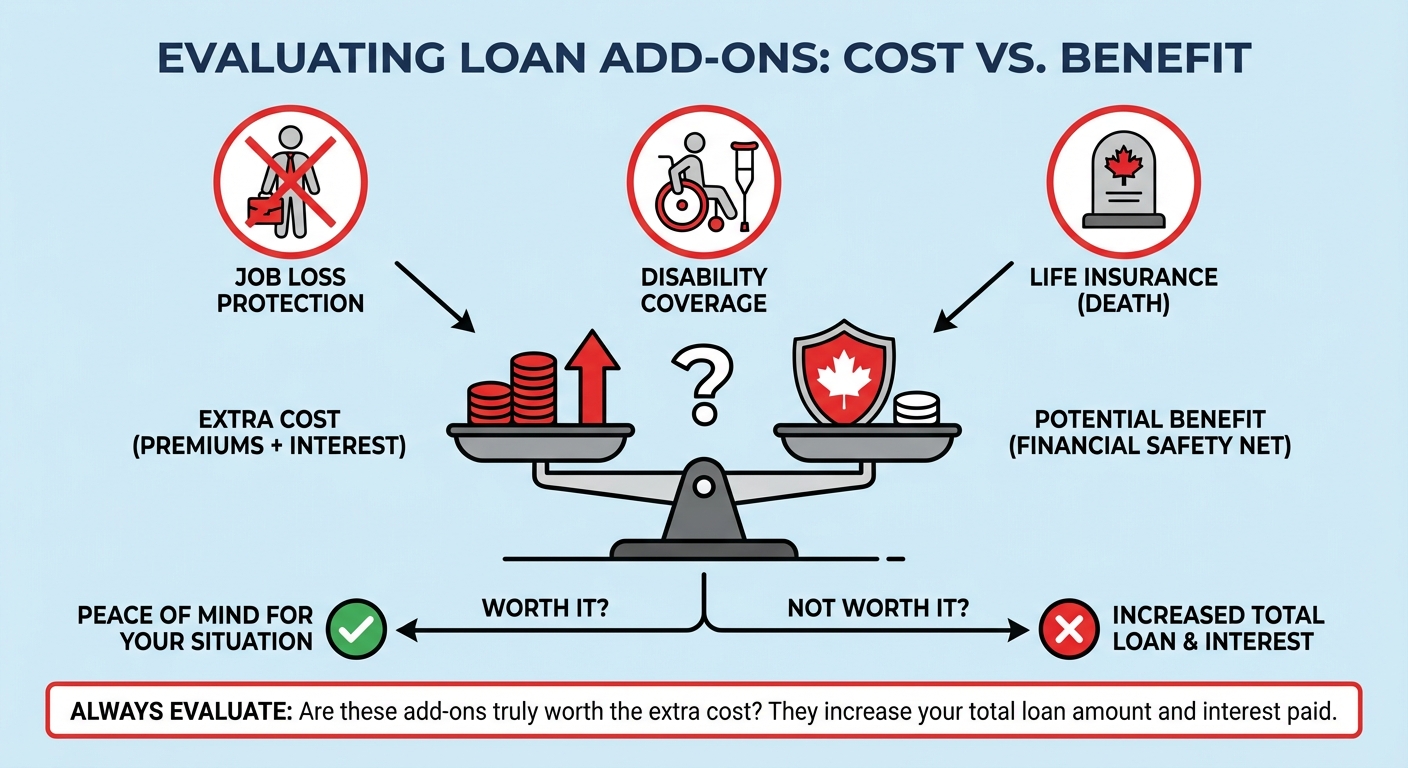

- Extended Warranties: Can provide peace of mind for future repairs but come at a significant cost. Consider the car's reliability and your budget.

- Rustproofing: Given Canada's climate and road salt, this can be appealing, but modern cars are much better protected than older models. Research if it's truly necessary.

- Credit Insurance: Designed to cover your payments in case of job loss, disability, or death. Assess if the cost is worth the benefit for your personal situation.

Understanding the total cost of ownership before you sign is paramount. Don't just focus on the monthly payment; consider the entire financial picture.

Crafting Your Approval Blueprint: A Step-by-Step Action Plan for Newcomers

Getting approved for your first car loan in Canada as a newcomer without an established credit history requires meticulous preparation. Lenders need to feel confident in your stability and ability to repay. Here’s a comprehensive action plan to build your strongest application.

Phase 1: Pre-Application Preparation (The Document Arsenal):

Organization is your best friend here. Gather these documents and have them readily accessible.

- Valid Canadian ID:

- Provincial Driver's License: This is ideal and often required for insurance and registration.

- Provincial ID Card: If you don't yet have a driver's license.

- Passport: Your primary international identification.

- Proof of Residency: Lenders need to verify your Canadian address.

- Lease agreement or rental contract.

- Recent utility bills (hydro, gas, internet, phone bill) in your name.

- Bank statements with your Canadian address.

- Proof of Income: This is critical for demonstrating your capacity to pay.

- Official Employment Letter: On company letterhead, stating your position, annual salary, start date, and whether your employment is full-time/permanent.

- Recent Pay Stubs: Typically, the last 2-3 consecutive pay stubs.

- T4 Slip (if you have one from previous Canadian employment).

- Bank Statements: Showing consistent direct deposits of your salary over the last few months.

- Immigration Documents: Your legal status in Canada is a key factor.

- Work Permit.

- Study Permit.

- Permanent Resident Card (PR Card).

- Confirmation of Permanent Residence (COPR) document.

- Proof of Down Payment Funds: If you plan to make a down payment, show you have the funds available.

- Bank statement showing the funds in your Canadian account.

- Reference Letters (Optional but Can Help):

- From employers (if not covered by your employment letter).

- From landlords, confirming consistent rent payments. These can act as character references and demonstrate financial reliability outside of formal credit.

Phase 2: The Application Process:

Once your documents are ready, you're set to apply.

- Filling out the application form: Whether online or in person, ensure all information is accurate and complete. Any discrepancies can raise red flags.

- The initial soft credit check (if applicable, for basic ID verification): Some lenders might perform a "soft" credit check, which doesn't impact your credit score, primarily for identity verification purposes. This is different from a "hard" inquiry that happens when you formally apply for credit.

- What to expect during the interview/discussion with a finance manager: Be prepared to discuss your employment, income, living situation, and why you need a car. Be honest and transparent. This is your chance to explain your unique situation as a newcomer.

Phase 3: The Waiting Game & Decision:

- How long does approval take? This can vary widely. Some applications, especially with strong profiles, can be approved within hours. Others, particularly for newcomers requiring more manual review, might take a few days.

- Understanding conditional approvals and what they mean: A conditional approval means the lender is willing to approve your loan, but with certain conditions. This might include a higher down payment requirement, a shorter loan term, a co-signer, or specific documentation that still needs to be provided or verified.

Pro Tip:

Create a dedicated folder (both digital and physical) for all your financial and immigration documents. Being organized not only makes the application process smoother for you but also makes you look prepared, reliable, and serious to lenders, which can subtly influence their decision.Navigating the Lender Landscape: Who Will Give You a Chance?

Knowing where to apply for a car loan as a newcomer is just as important as having your documents in order. Different lenders have different appetites for risk and varying experience with newcomer profiles.

1. The Big Banks (TD, RBC, Scotiabank, CIBC, BMO):

- Pros: Generally offer the lowest interest rates *if* you qualify, have established reputations, and often have extensive branch networks.

- Cons: Can have stricter criteria for newcomers, especially without a pre-existing Canadian credit history, a substantial down payment, or a Canadian co-signer. Many may prefer you to have an existing banking relationship with them for a certain period.

- Strategy: It's worth trying your current bank first if you have a strong job, a good down payment, or a Canadian co-signer. They might be more willing to work with an existing customer.

2. Dealership Finance Departments (The Hub of Newcomer Loans):

- Pros: Dealerships are often your best bet. They work with a multitude of lenders – not just major banks, but also captive finance companies (like Toyota Financial Services, Honda Financial Services) and specialized subprime lenders. Many dealerships have dedicated programs or finance managers experienced in dealing with newcomer applications, making them more flexible.

- Cons: While flexible, they may push higher-interest loans or unnecessary add-ons if you're not careful. Transparency can be an issue if you don't actively compare offers and question everything.

- Strategy: This is a very common and often successful route for newcomers. Be prepared to negotiate not just the car price, but also the loan terms and any additional products. Don't feel pressured to make a decision on the spot.

3. Credit Unions & Regional Lenders:

- Pros: Credit unions are community-focused and often pride themselves on a more personalized approach. They might be more flexible and understanding of individual situations than big banks, especially if you can establish a personal relationship with them.

- Cons: They may have smaller loan portfolios, potentially fewer specialized newcomer programs, and geographic limitations (you might need to live or work in a specific area to join).

- Strategy: Worth exploring, especially if you have a local connection, an existing membership, or if you've been turned down by larger institutions.

4. Specialty/Subprime Lenders:

- Pros: These lenders specialize in approving individuals with limited credit, bad credit, or higher perceived risk, including many newcomers. They have higher approval rates because their business model caters to this demographic.

- Cons: The major drawback is significantly higher interest rates, which can sometimes be very close to the legal maximum. There's also a potential for less favourable terms or even predatory practices if you're not diligent.

- Strategy: This should generally be considered a last resort. If you go this route, ensure you fully understand the true cost of the loan and can comfortably afford the payments without straining your budget. The goal is to use this loan to build credit, with a plan to refinance to a better rate down the line.

For newcomers in specific provinces, there are often tailored resources. For instance, if you're in Alberta, you might find additional information on Approval Secrets: How to Secure the Best Car Loan Rates for Alberta Newcomers.

The Game Changers: Your Down Payment, a Co-Signer, and Strategic Trade-Ins

When you're starting with zero Canadian credit, you need every advantage you can get. A few key elements can dramatically improve your chances of approval and help you secure better loan terms.

The Power of Your Down Payment:

A down payment is your upfront cash contribution to the purchase of the vehicle. It's not just a nice-to-have; it's a powerful statement to lenders.

- Why even 5-10% makes a huge difference: When you put money down, you immediately reduce the amount you need to borrow, which in turn reduces the lender's risk. It shows commitment and financial responsibility. Even a modest 5% can significantly improve your application compared to seeking a 100% financed loan.

- How a larger down payment reduces your monthly payments and total interest paid: A smaller principal loan amount means lower monthly payments. Crucially, it also means you'll pay less interest over the life of the loan, saving you a substantial amount of money in the long run.

- Strategies for saving for a down payment as a newcomer: Prioritize saving immediately upon arrival. Set a budget, track your expenses, and dedicate a portion of each paycheque to your car fund. Consider temporary public transit or ride-sharing to save up faster.

Unlocking Approval with a Co-Signer:

A co-signer is someone who agrees to be equally responsible for your loan. If you fail to make payments, the lender can pursue the co-signer for the outstanding debt.

- Who qualifies as a good co-signer: An ideal co-signer will have excellent Canadian credit history, stable employment, and a strong income. They are typically a trusted friend, family member, or spouse who has been in Canada for a while and has a solid financial footing.

- The responsibilities of a co-signer: What they're signing up for: It's crucial for both you and your co-signer to understand this is a serious legal obligation. If you miss payments, their credit score will be negatively impacted, and they will be legally responsible for the entire loan amount.

- How a co-signer can dramatically improve your approval odds and secure better rates: A co-signer essentially 'lends' their good credit to your application. This significantly reduces the perceived risk for the lender, making them much more likely to approve your loan and offer you a more favourable interest rate, as if you had good credit yourself.

- Navigating the conversation: Asking someone to co-sign for you: This is a delicate conversation. Be transparent about the responsibilities, assure them of your commitment to on-time payments, and have a clear plan for repayment.

Trade-Ins (If Applicable):

If you already own a vehicle in Canada, or perhaps managed to bring one with you, trading it in can act as a powerful down payment.

- How trading in an existing vehicle can act as a down payment: The value of your trade-in is deducted from the purchase price of the new vehicle, reducing the amount you need to finance. This works exactly like a cash down payment.

- Valuation: Getting a fair price for your trade-in: Research the market value of your vehicle beforehand using online tools (like Canadian Black Book or Kelley Blue Book Canada) to ensure you're getting a fair offer from the dealership. Be prepared to negotiate.

Pro Tip:

If you have a trusted friend or family member with excellent Canadian credit, asking them to co-sign can be the single most effective way to secure a favourable loan as a newcomer. It can open doors to prime interest rates that would otherwise be inaccessible. Ensure they understand their full legal obligation and that you are committed to protecting their credit.Picking Your First Ride: New, Used, and What Your Budget *Truly* Allows

Choosing the right vehicle is a critical step, especially for newcomers managing a new budget. The decision between new and used cars has significant implications for your loan approval, interest rates, and overall ownership costs.

New Cars for Newcomers:

- Pros: Come with full manufacturer warranties, the latest safety features and technology, and a fresh start with no previous owner issues. Some manufacturers offer special newcomer incentives, though these are less common for those with no credit history.

- Cons: Rapid depreciation (a new car loses a significant portion of its value in the first few years), higher initial purchase cost, and often harder to get approved for with no credit history due to the larger loan amount and higher perceived risk. Insurance costs can also be higher.

Used Cars for Newcomers (Often the Sweet Spot):

- Pros: Lower purchase price, less rapid depreciation, a much wider range of options within your budget, and generally easier to get approved for a loan due to the smaller principal amount.

- Cons: Potential for unexpected repairs, shorter or no manufacturer warranty (though some certified pre-owned programs offer warranties), and older models might command slightly higher interest rates due to their age and perceived risk.

- The 'sweet spot': Used cars that are 2-5 years old often offer the best value. They've already taken the initial depreciation hit, usually still have modern features, and are often reliable with some remaining warranty coverage.

Realistic Budgeting for Your First Car:

Many newcomers make the mistake of only considering the monthly car payment. True car ownership costs extend far beyond that.

- Don't just consider the monthly payment: You must factor in car insurance, fuel, maintenance, and potential parking fees. These can add hundreds of dollars per month to your overall transportation budget.

- The 20/4/10 rule: This is a common guideline in personal finance: aim for at least a 20% down payment, a loan term no longer than 4 years (48 months), and ensure your monthly car payment (including insurance) is no more than 10% of your gross monthly income. For newcomers, this rule might need adjustment; a 5-10% down payment might be more realistic, and a 60-