Your 2026 Contract: New Job Car Loan Proof, Ontario

Table of Contents

- Key Takeaways

- Navigating Your New Beginning: Securing a Car Loan with a Fresh Employment Contract

- The Lender's Lens: Why 'New Job' Raises Eyebrows (and How to Lower Them)

- Understanding the Risk Equation: Stability vs. Potential

- From Promise to Proof: Deconstructing What Constitutes Verifiable Income

- Building Your Unstoppable Application Package: Beyond the Contract

- Fortifying Your Financial Narrative with Complementary Documentation

- The Power of the Down Payment: Immediately Reducing Lender Risk

- Strategic Co-Signers: Leveraging Established Credit for Approval

- The Timing Game: When to Apply for Maximum Impact and Favorable Terms

- The 'Wait and See' vs. 'Strike While the Iron's Hot' Dilemma

- Anticipating 2026: Future Trends in Loan Application Timing and Verification

- Choosing Your Champion: Navigating Lender Types and Their Nuances

- Traditional Banks vs. Credit Unions: Understanding Their Appetites for Risk

- Dealership Financing: Balancing Convenience with Potential Costs

- Online Lenders and Specialty Finance Companies: When to Consider Them

- Optimizing Your Outcome: Strategies for Better Rates and Terms

- The Art of Pre-Approval: Why it's Your Secret Weapon

- Negotiating Beyond the Sticker Price: Focusing on the Loan Itself

- Choosing the Right Vehicle: Aligning Car Value with Your Financial Footprint

- When the Road Gets Bumpy: Alternatives and Next Steps

- Navigating a Denial: Understanding the 'Why' and Re-strategizing

- Short-Term Solutions: Bridging the Gap to Approval

- Your Next Steps to Approval: A Comprehensive Checklist for Success

- Frequently Asked Questions (FAQ)

Landing a new job in 2026 is an exciting milestone, especially in Ontario's dynamic job market. It often signals career growth, better pay, and the opportunity for a fresh start. For many, this also means it's time for a new set of wheels to match their enhanced professional life. But how do you secure a car loan when your income, while promising, is still fresh on the books? Proving income for a car loan with a new employment contract can seem like navigating a financial maze, but with the right strategy and documentation, it's entirely achievable.

At SkipCarDealer.com, we understand the unique challenges and opportunities that come with new employment. This comprehensive guide will walk you through the precise steps, required documentation, and insider tips to prove your income effectively and drive off in your new vehicle, even with a brand-new 2026 employment contract in hand.

Key Takeaways

- A robust, signed employment contract is your primary income proof, but it's rarely enough on its own for most lenders.

- Lenders prioritize stability; strategically mitigating perceived risk is crucial when you have new employment, especially in competitive markets like Toronto or Vancouver.

- Comprehensive documentation, extending beyond just the contract, significantly boosts your application's strength and can lead to better terms.

- Your credit history and debt-to-income ratio remain pivotal factors, even with a strong new job offer in Ontario.

- Strategic timing for your application and careful selection of lenders can significantly impact your approval odds and financing terms in 2026.

Navigating Your New Beginning: Securing a Car Loan with a Fresh Employment Contract

For individuals in Ontario and across Canada, proving income for a car loan with a new employment contract primarily involves presenting a fully executed, unconditional employment agreement, often supplemented by bank statements showing consistent savings, previous employment history, and sometimes a down payment. Lenders seek assurance that your new income is stable and verifiable, despite its recent commencement.

The Lender's Lens: Why 'New Job' Raises Eyebrows (and How to Lower Them)

You've just landed a fantastic new role in Calgary, Montreal, or right here in Toronto. Your salary is higher, your prospects are bright, and you're ready to upgrade your commute. So why might a lender hesitate, viewing your new employment as a potential risk rather than a clear asset?

Understanding the Risk Equation: Stability vs. Potential

From a lender's perspective, consistency and a proven track record are paramount. A new job, despite its potential for higher pay, lacks the established history of income stability that lenders prefer. They operate on a 'what has been' rather than 'what could be' basis when assessing risk. This isn't a judgment on your capabilities; it's a standard practice to mitigate financial exposure.

The 'probationary period' dilemma is a significant factor. Many new employment contracts include a 3- to 6-month probationary period, during which either party can terminate the employment with little notice. Lenders perceive this as an elevated risk. They worry that if employment ends during this period, your ability to repay the loan would be severely compromised. This can lead to outright denial, higher interest rates, or a requirement for a larger down payment or a co-signer.

The critical distinction between a verbal offer, a signed offer letter, and a fully executed employment contract cannot be overstated. A verbal offer holds no weight. A signed offer letter is better, but a fully executed employment contract, clearly outlining all terms, conditions, start date, and compensation, is what lenders truly need. It's a legally binding document that solidifies your employment status.

Pro Tip: Always present a fully signed, unconditional employment contract that clearly outlines your start date, base salary, and terms for the strongest possible case. Ensure it’s dated for 2026 and reflects your current employment status.

From Promise to Proof: Deconstructing What Constitutes Verifiable Income

To move from the promise of income to verifiable proof, you need to understand the hierarchy of documentation. For new employment, this typically starts with your comprehensive employment contract. However, many mainstream lenders will ideally want to see at least one or two pay stubs to confirm that income flow has actually begun.

Specific details lenders meticulously scrutinize in your employment contract include a confirmed start date (preferably in the past or very near future), your base salary (guaranteed income is key), and any guaranteed bonus structures. If your income includes commission structures or performance-based pay, you'll need to effectively present these future income streams. This might involve an employer letter detailing expected earnings, or, if available, historical earnings from a similar role at a previous company. Lenders prioritize predictable income over variable earnings.

The vital role of employer verification is also a critical step. Lenders will often contact your HR department or direct manager to confirm your employment, start date, and salary. It's proactive to inform your HR department that they may receive such inquiries, ensuring a smooth and timely verification process. This can significantly speed up your application in places like Vancouver or Montreal.

Building Your Unstoppable Application Package: Beyond the Contract

Your employment contract is the cornerstone, but a truly robust application package extends far beyond that single document. Think of it as building a compelling financial narrative that assures lenders of your ability and commitment to repay.

Fortifying Your Financial Narrative with Complementary Documentation

Context: An infographic showing a clear, concise checklist of essential documents for a new employment car loan application, visually connecting each document to its purpose (e.g., 'Contract -> Income Proof', 'Bank Statements -> Stability').

Context: An infographic showing a clear, concise checklist of essential documents for a new employment car loan application, visually connecting each document to its purpose (e.g., 'Contract -> Income Proof', 'Bank Statements -> Stability').

Your credit score acts as your silent co-signer. With new employment, a strong credit history becomes even more critical. Lenders will heavily rely on your credit score (e.g., Equifax or TransUnion scores above 680-700 are considered good) to assess your past financial responsibility, especially when current income history is limited. A strong score can offset some of the perceived risk of a new job. For those with zero credit, proving income with new employment presents a unique challenge, requiring even stronger supplementary documentation.

Your Debt-to-Income (DTI) Ratio is another pivotal factor. This ratio compares your total monthly debt payments (including the proposed car loan) to your gross monthly income. Lenders typically prefer a DTI below 40-45%. Accurately calculating and strategically optimizing your DTI (e.g., by paying down other debts before applying) can significantly boost lender confidence. For a $60,000 annual salary (gross $5,000/month), with existing debts of $800/month and a proposed car payment of $500/month, your DTI would be ($800 + $500) / $5,000 = 26%, which is excellent.

Showcasing existing assets and savings demonstrates financial responsibility and provides a buffer for unexpected expenses. Providing recent bank statements showing consistent savings or an emergency fund signals financial prudence and capacity to handle payments, even if your new job income hasn't fully accumulated yet. Bank statements can often serve as primary income verification, especially in situations where traditional pay stubs are scarce.

Proof of address and residency (e.g., utility bills, lease agreements) further establishes stability and roots beyond just your employment status. This reassures lenders that you are a stable resident, not a transient risk.

Pro Tip: Provide recent bank statements showing consistent savings or an emergency fund; this signals financial prudence and capacity to handle payments and can significantly strengthen your application, especially if you're applying early in your new role.

The Power of the Down Payment: Immediately Reducing Lender Risk

A substantial down payment is one of the most effective tools at your disposal when applying for a car loan with new employment. It directly reduces the loan-to-value (LTV) ratio, meaning the lender is financing a smaller portion of the car's total value. This immediately offsets the perceived risk associated with your new employment status.

For a typical car loan in 2026, aiming for a down payment of 10-20% is generally advisable, but with new employment, pushing towards the higher end or even more (25%+) can be a game-changer. For a $35,000 vehicle, a 20% down payment is $7,000. This not only lowers your monthly payments and total interest paid but also sends a strong signal of financial commitment to the lender.

The significant psychological impact of a strong down payment on loan officers cannot be overstated. It tells them you have skin in the game, reducing their exposure and demonstrating your ability to save and manage money. You can explore diverse sources for your down payment, including personal savings, the trade-in value of your current vehicle, or even gifted funds (with appropriate documentation).

Strategic Co-Signers: Leveraging Established Credit for Approval

When is a co-signer genuinely beneficial? A co-signer can be an invaluable asset if your credit history is limited, your new employment status makes lenders hesitant, or you're aiming for a better interest rate. They essentially "vouch" for you, adding their creditworthiness to your application.

Lenders specifically look for impeccable credit, stable income, and a low DTI in a co-signer. This means someone with a long, positive credit history, consistent employment (preferably with the same employer for several years), and minimal existing debt. A co-signer effectively mitigates the risk associated with your new employment.

However, it's crucial to understand the legal responsibilities and long-term implications for both parties. A co-signer is equally responsible for the loan. If you default, their credit will suffer, and they will be legally obligated to make the payments. This can strain relationships, so both parties must enter into the agreement with full awareness and trust.

The Timing Game: When to Apply for Maximum Impact and Favorable Terms

Timing your car loan application with new employment is a delicate balance. Applying too early can lead to rejection or unfavourable terms, while waiting too long might delay your transportation needs. For the 2026 market, understanding this balance is key.

The 'Wait and See' vs. 'Strike While the Iron's Hot' Dilemma

Applying before your official start date presents significant challenges. Without an income stream, lenders have very little to go on, making approval highly unlikely unless you have an exceptionally strong credit history and a massive down payment. Some niche lenders or those specializing in unique situations might consider it with a fully executed contract, but it's not the norm.

Applying after you've received your first pay stub is often considered the 'gold standard' for many mainstream lenders. This provides concrete proof that your employment has commenced and that income is consistently flowing. Two pay stubs are even better, as they demonstrate a pattern of income.

Navigating probationary periods also plays a role. As mentioned, lenders are wary of these. Some may defer approval until your probation is successfully passed (typically 3-6 months). Others might offer conditional terms, such as a higher interest rate, or require a co-signer to mitigate the risk during this period. Be prepared for these possibilities, especially in competitive urban centres like Toronto or Vancouver.

Pro Tip: If financially feasible, waiting until you have received at least one or two pay stubs can dramatically strengthen your application by demonstrating actual, consistent income flow. This moves your income from a 'promise' to a 'proven' reality for lenders.

Anticipating 2026: Future Trends in Loan Application Timing and Verification

The landscape of lending is constantly evolving. In 2026, advancements in digital verification and AI might streamline income proof processes for new employment. We could see more lenders accepting direct API connections to payroll systems (with your consent) or utilizing sophisticated algorithms to assess the stability of new employment based on industry trends, employer reputation, and your overall financial behaviour.

The increasing importance of real-time financial data versus traditional static documents is a notable trend. Instead of just pay stubs, lenders might increasingly look at aggregated bank transaction data (with your permission) to get a comprehensive, real-time view of your income and spending habits. This could potentially offer more flexibility for 'new job' applicants as technology evolves, allowing for quicker and more nuanced risk assessments.

Choosing Your Champion: Navigating Lender Types and Their Nuances

Not all lenders are created equal, especially when you're navigating a car loan with a new employment contract. Understanding their different appetites for risk and their typical lending criteria can significantly impact your approval odds and the terms you receive.

Traditional Banks vs. Credit Unions: Understanding Their Appetites for Risk

Major bank lending policies, such as those from TD, RBC, or Scotiabank, are often stricter and more risk-averse. They typically prefer applicants with a long, stable employment history (2+ years at the same employer) and excellent credit. While they may offer the lowest rates for exceptionally strong applicants, a new employment contract might make them hesitant. You'll need a very robust overall financial profile to secure a loan from a traditional bank with a new job.

Credit unions, on the other hand, often present distinct advantages. Being member-focused, they tend to be more flexible and willing to consider unique individual circumstances. If you have an existing relationship with a credit union in Alberta or Quebec, they might be more understanding of your new employment situation, especially if you demonstrate overall financial prudence. Building a relationship with a credit union can positively influence your approval chances, as they value their members' loyalty and broader financial picture.

| Lender Type | Typical Interest Rate Range (2026, Prime) | Likelihood of Approval with New Job | Key Considerations |

|---|---|---|---|

| Major Banks | 6.99% - 8.99% | Moderate (requires strong overall profile) | Stricter criteria, often prefer 1-2 years employment history. Best rates for low-risk. |

| Credit Unions | 7.29% - 9.49% | Good (more flexible, relationship-based) | Member-focused, may consider unique circumstances. Good option for new employment. |

| Dealership Financing | 7.49% - 12.99% (varies wildly) | High (access to multiple lenders) | Convenient, but rates can be higher if not negotiated. Access to subprime lenders. |

Dealership Financing: Balancing Convenience with Potential Costs

The crucial role of dealership finance managers cannot be overstated. They act as intermediaries, working with a network of various lenders – from major banks to specialized finance companies – to find you an approval. This often means they have more options for applicants with new employment, as they can match you with a lender more willing to take on the perceived risk.

The benefits of one-stop shopping at a dealership are undeniable: a streamlined process, potential for manufacturer-backed incentives (though these are often for prime borrowers), and the convenience of handling everything in one place. However, there are potential drawbacks. Dealerships may have a more limited range of lender options compared to truly shopping around, and interest rates can be higher if not carefully negotiated. Always be prepared to negotiate the rate, not just the monthly payment.

Pro Tip: Always secure a pre-approval from an external lender (a bank or credit union) before you step into a dealership. This provides you with vital negotiating leverage and a benchmark against which to compare dealership offers.

Online Lenders and Specialty Finance Companies: When to Consider Them

The rapid rise of online lending platforms has transformed the car loan landscape in Canada. They offer speed, accessibility, and often connect you with a diverse network of lenders, including those specializing in unique credit profiles. If traditional banks are hesitant due to your new employment, online lenders might be a viable avenue.

These platforms often cater to specific credit profiles, including those with higher-risk or unique applicant situations. Subprime lenders, for instance, are designed to serve individuals with lower credit scores or less stable income histories. For applicants with new employment, these specialty finance companies might be more flexible, though often at the cost of higher interest rates to compensate for the increased risk.

Thoroughly understanding the terms is paramount. Be aware of potentially higher rates, shorter loan terms, and associated fees with alternative lenders. Always read the fine print, understand the total cost of the loan, and ensure the payments are manageable within your 2026 budget.

Optimizing Your Outcome: Strategies for Better Rates and Terms

Once you've navigated the initial hurdles of proving income with a new job, your next objective is to secure the most favourable rates and terms possible. This requires strategic planning and informed negotiation.

The Art of Pre-Approval: Why it's Your Secret Weapon

What a pre-approval truly means is that a lender has reviewed your financial information (including your new employment contract and any available pay stubs) and has conditionally approved you for a specific loan amount at a particular interest rate. This is especially crucial for new employment applicants, as it provides a concrete offer that validates your borrowing power.

Obtaining a pre-approval significantly strengthens your bargaining position at the dealership. Instead of being an unknown quantity, you walk in as a cash buyer, able to focus solely on the vehicle price rather than getting bogged down in financing details. This leverage can save you thousands of dollars.

It's important to understand the distinct difference between a pre-qualification (which is typically a soft credit pull and a preliminary estimate) and a full pre-approval (which involves a hard credit pull and a firm offer). Aim for a full pre-approval from a bank or credit union before you start serious car shopping.

Negotiating Beyond the Sticker Price: Focusing on the Loan Itself

When negotiating, focus on the loan term vs. monthly payment. A longer loan term (e.g., 84 months) will result in lower monthly payments, but you'll pay significantly more in total interest. A shorter term (e.g., 60 months) means higher monthly payments but less interest over the life of the loan. Finding the optimal balance for your personal budget and long-term financial goals is key.

| Loan Amount | Interest Rate | Term (Months) | Estimated Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| $35,000 | 8.5% | 60 | $717 | $7,998 |

| $35,000 | 8.5% | 72 | $615 | $9,305 |

| $35,000 | 8.5% | 84 | $546 | $10,668 |

The profound impact of interest rates cannot be overstated. Even small differences can accumulate into significant costs over the loan's life. For instance, a $35,000 loan at 7.5% over 72 months might cost you approximately $601/month, while at 9.5%, it jumps to about $637/month – a difference of $36/month, or over $2,500 in total interest over the loan term.

Avoiding unnecessary add-ons is another crucial negotiation point. Scrutinize extended warranties, GAP insurance, and rustproofing. While some, like GAP insurance, can be genuinely worth the investment (especially if you have a small down payment), others may be overpriced or unnecessary. Understand their value and negotiate them separately from the vehicle price. For those with less conventional income streams, like gig workers in Ontario, understanding these financial products is even more critical.

Pro Tip: Never discuss your preferred monthly payment until you have firmly agreed upon the vehicle price and the interest rate. This prevents 'payment packing' by the dealership, where they might manipulate the loan terms or add-ons to reach your desired monthly payment, often at a higher overall cost.

Choosing the Right Vehicle: Aligning Car Value with Your Financial Footprint

Lenders prefer reasonable loan-to-value (LTV) ratios, particularly when assessing new employment applications. A lower LTV (meaning you're borrowing less relative to the car's value) reduces their risk. They want to ensure the car's value adequately covers the loan amount, especially considering depreciation.

Finding the sweet spot means selecting a car that realistically aligns with your current income and credit profile. While your new job might come with a higher salary, it's wise to be conservative with your first car purchase under the new contract. Overstretching your budget can lead to financial strain down the road.

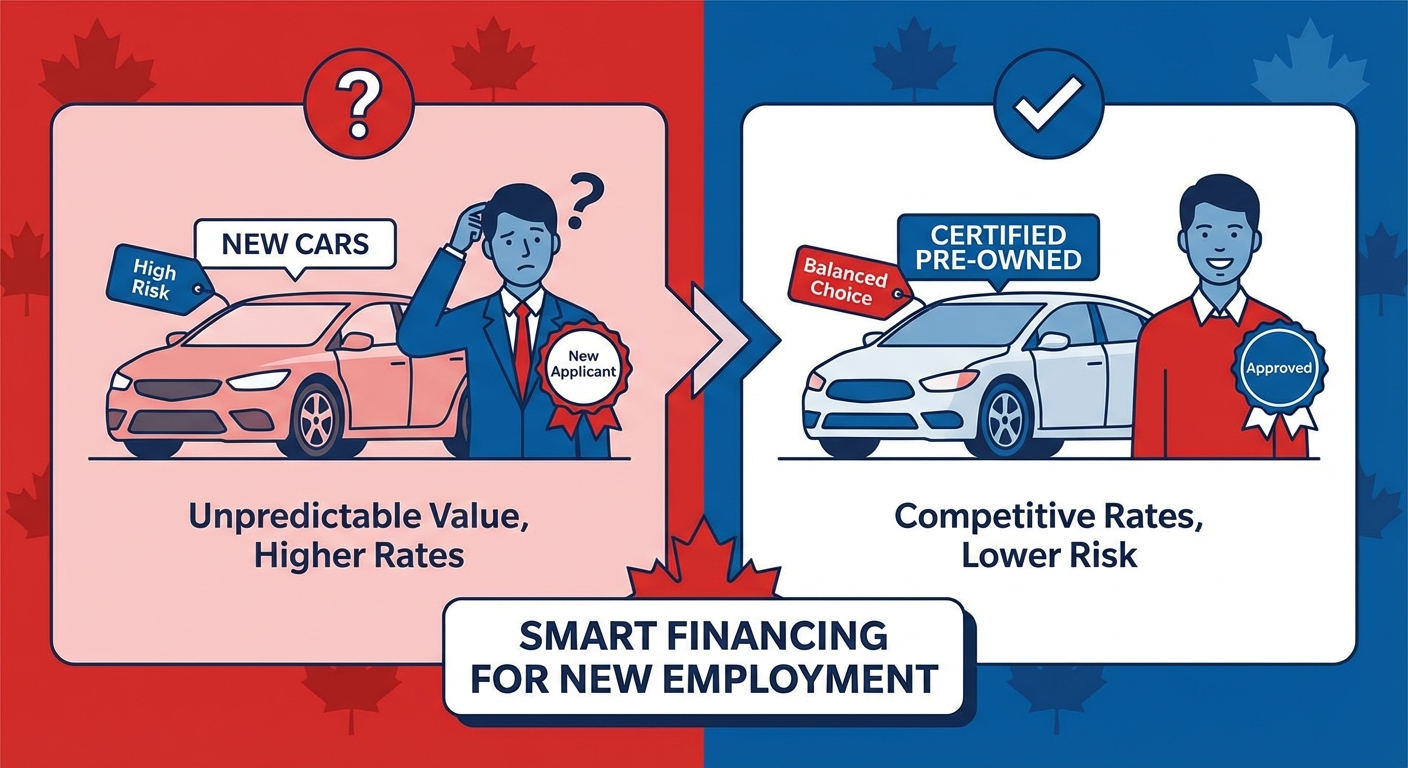

New vs. Used: Which is typically easier to finance with new employment and the underlying reasons why? New cars generally come with lower interest rates for prime borrowers due to their higher resale value and often manufacturer incentives. However, they also depreciate faster. Used cars can be harder to finance at competitive rates for new employment applicants, as the car's value is less predictable, and lenders might perceive higher maintenance risks. A slightly used, certified pre-owned vehicle often strikes a good balance.

Context: A visual comparison chart clearly outlining the pros and cons of new versus used car financing specifically for applicants with new employment contracts, highlighting factors like depreciation, warranty, and loan terms.

Context: A visual comparison chart clearly outlining the pros and cons of new versus used car financing specifically for applicants with new employment contracts, highlighting factors like depreciation, warranty, and loan terms.

When the Road Gets Bumpy: Alternatives and Next Steps

Despite your best efforts, sometimes a car loan application with new employment might face hurdles. Understanding how to navigate a denial and explore alternatives is just as important as preparing for approval.

Navigating a Denial: Understanding the 'Why' and Re-strategizing

The critical importance of requesting and understanding the specific reasons for any loan denial cannot be overstated. Lenders are legally required to provide this information. Was it your DTI? Your short employment history? Your credit score? Knowing the exact reason allows you to re-strategize effectively.

Thoroughly revisiting your application means identifying what can be improved, clarified, or added. Perhaps you can provide more recent pay stubs, update your credit report, or offer a larger down payment. Strategically considering a different lender or exploring alternative loan products might be your next best step. Some lenders are simply more risk-averse than others.

Short-Term Solutions: Bridging the Gap to Approval

If an immediate purchase isn't feasible, consider leasing as a viable alternative. Leasing often involves lower monthly payments compared to financing a purchase, as you're essentially paying for the car's depreciation during the lease term. However, understand the different ownership implications – you don't own the car, and there are mileage restrictions and potential end-of-lease fees.

Delaying your purchase, if possible, is often the most prudent strategy. Leverage this time to build credit, save a larger down payment, or establish a longer employment history (e.g., getting past your probationary period). Each month of consistent income and on-time payments strengthens your future application.

Considering a more affordable vehicle is another practical step. Prioritize immediate transportation needs over aspirational wants. A less expensive car reduces the loan amount, lowers your monthly payments, and significantly improves your approval chances with a new job, allowing you to build equity and credit for a future upgrade.

Your Next Steps to Approval: A Comprehensive Checklist for Success

To summarize, here's your comprehensive checklist to maximize your chances of car loan approval in 2026 with a new employment contract:

- Thoroughly review your new employment contract for all key financial and employment details. Ensure it's fully signed and unconditional.

- Methodically gather all necessary supporting financial documentation: recent pay stubs (if available), bank statements (showing savings and income flow), proof of address, and your driver's license.

- Actively check and strategically optimize your credit score. Address any discrepancies and consider paying down small debts to improve your DTI.

- Realistically determine your ideal down payment amount, aiming for 10-20% or more to mitigate lender risk.

- Diligently research various lenders – banks, credit unions, and online platforms – to understand their specific criteria for new employment applicants and secure pre-approval options.

Securing a car loan with a new employment contract in Ontario or anywhere in Canada in 2026 is a journey that requires preparation and strategic thinking. By presenting a strong application package, understanding lender perspectives, and timing your approach wisely, you can confidently navigate this process and get behind the wheel of your next vehicle.