Blank Slate Credit? Buy Your Car Canada 2026

Table of Contents

- Key Takeaways

- The 'Blank Slate' Unpacked: What No Established Credit Truly Means for Car Buyers

- Beyond the Score: Discovering Your 'Alternative Credit Footprint'

- The Strategic Approach to Securing Your First Automotive Loan

- Navigating the Lending Ecosystem: Pathways for First-Time Buyers

- The Cost Equation: Decoding Interest Rates, Fees, and the True Price Tag

- Crafting Your Application Story: What Lenders Truly Want to See

- The Horizon of 2026: Anticipating Market Shifts and Lending Innovations

- Beyond the Purchase: Leveraging Your First Loan to Build a Stronger Financial Future

- Your Next Steps to Approval: A Strategic Action Plan

Are you looking to buy a car in Canada but find yourself staring at a blank credit report? Perhaps you're a recent graduate, a newcomer to Canada, or someone who's simply never needed to borrow money before. The thought of securing a car loan without any established credit can feel daunting, like trying to navigate a complex roadmap without a compass. But what if we told you that buying a car in Canada in 2026, even with a 'blank slate' credit history, is not only possible but can be a strategic move to build your financial future?

The Canadian automotive market, along with its lending landscape, is constantly evolving. As we look towards 2026, lenders are becoming increasingly sophisticated in how they assess risk, moving beyond traditional credit scores to consider a broader spectrum of your financial life. This means that your consistent rent payments, stable employment history, and responsible banking habits can speak volumes, even if your credit file is empty.

This comprehensive guide from SkipCarDealer.com is designed to demystify the process, providing you with the knowledge and actionable strategies needed to secure your first car loan. We'll explore how to leverage your existing financial stability, navigate different lending options, and ultimately drive away in a vehicle that meets your needs, all while laying a solid foundation for your credit profile. Get ready to turn that blank slate into a powerful launchpad for your financial journey.

Key Takeaways

- It's possible to buy a car without a credit history, but requires a strategic approach.

- Alternative data (rent, utilities, employment) plays a crucial role in lender assessment.

- Understanding different lender types (dealerships, specialty lenders) is key.

- This first loan is a powerful tool for establishing and building your credit profile.

The 'Blank Slate' Unpacked: What No Established Credit Truly Means for Car Buyers

When lenders talk about "no established credit," they're referring to an applicant who lacks a documented history of borrowing and repaying debt. This is distinct from "bad credit," which indicates a history of missed payments, defaults, or other negative financial events. For someone with no credit, there's simply no data for traditional credit bureaus like Equifax or TransUnion to compile into a score. This means no credit cards, no previous loans, no mortgage history, and often, no prior interactions with lenders that would generate a credit report.

From a lender's perspective, a blank slate, while not inherently negative, presents a higher perceived risk. Why? Because there's no track record to demonstrate your ability to manage debt responsibly. Lenders rely on credit history to predict future repayment behaviour. Without it, they have less certainty about your reliability as a borrower. This often translates into stricter approval criteria, potentially higher interest rates, and a greater emphasis on other financial indicators.

The initial challenge for new borrowers is proving creditworthiness without a traditional score. It's a classic catch-22: you need credit to get credit. This can lead to frustration, as perfectly responsible individuals might find themselves initially denied for loans that seem straightforward to others. However, it's crucial to understand that many lenders in Canada are equipped to work with no-credit applicants, especially those who demonstrate strong alternative financial indicators.

Common misconceptions about no-credit financing often include the belief that it's impossible, or that you'll automatically be forced into predatory loans. While vigilance is always required to avoid unscrupulous lenders, many reputable options exist. The key is to be informed, prepared, and strategic in your approach. For more on navigating the lending landscape, you might find our article on No Credit? Great. We're Not Your Bank. insightful.

Here's a quick comparison of what lenders see:

| Factor | No Established Credit (Blank Slate) | Bad Credit (Negative History) | Good Credit (Positive History) |

|---|---|---|---|

| Credit Report | Minimal or no entries; no score. | Negative entries (missed payments, defaults); low score. | Positive entries (on-time payments); high score. |

| Lender Perception | Unknown risk; relies on alternative data. | High risk; history of payment issues. | Low risk; proven responsible borrower. |

| Typical Interest Rates | Moderate to high (e.g., 9-18% APR) | Very high (e.g., 15-29.9% APR) | Low (e.g., 6-9% APR) |

| Approval Likelihood | Possible with strong alternative data, down payment, co-signer. | Challenging; often requires specific subprime lenders. | High, with competitive terms. |

Pro Tip: Start by obtaining a copy of your credit report (even if blank) to understand your official standing and identify any existing entries, however minimal. You can get free copies annually from Equifax and TransUnion Canada.

Beyond the Score: Discovering Your 'Alternative Credit Footprint'

In the evolving lending landscape of 2026, a credit score isn't the only metric that matters. Lenders are increasingly recognizing the value of "alternative data" – non-traditional information that paints a more complete picture of your financial responsibility. This is your 'alternative credit footprint,' and for those with no established credit, it's your most powerful asset.

The rising importance of alternative data in lending decisions is a game-changer. It acknowledges that many financially responsible individuals simply haven't had the need or opportunity to build a traditional credit history. Lenders are now using sophisticated algorithms and manual reviews to assess consistent payments for everyday services.

One of the most impactful pieces of alternative data is your consistent rent payment history. If you've been paying rent on time, every month, for several years, this demonstrates reliability and a commitment to meeting financial obligations. While rent payments aren't typically reported to credit bureaus, many landlords can provide verification letters, or you can supply bank statements showing regular rent transfers. Similarly, a solid track record of paying utility bills (electricity, gas, internet, phone) on time, without interruption, reinforces your financial discipline. These consistent payments, even if not part of your credit file, show lenders you can manage recurring expenses.

Showcasing stable employment and income is a primary indicator of repayment ability. Lenders want to see that you have a reliable source of income to cover your car loan payments. This means providing pay stubs, employment letters, and T4s. Long-term employment with the same employer is particularly favourable, as it signals job security. Even if your income varies, demonstrating consistent earnings over time can be beneficial. For insights into how lenders assess income, especially variable income, check out our guide on Variable Income Auto Loan 2026: Your Yes Starts Here.

Your banking history also plays a significant role. Lenders will often review your bank statements to look for consistent savings habits, a lack of overdrafts, and responsible account management. A healthy savings account indicates financial prudence and provides a buffer in case of unexpected expenses. Conversely, frequent overdrafts or bounced cheques can signal financial instability. A strong debt-to-income ratio (even without debt) can be a positive. If your income is substantial relative to your existing (or lack thereof) debt obligations, it shows you have ample room in your budget for a car loan.

To summarize key alternative data points:

- Rent Payments: Proof of consistent, on-time rent payments (e.g., landlord letters, bank statements).

- Utility Bills: History of timely payments for electricity, gas, internet, and phone services.

- Employment Stability: Pay stubs, employment letters, and T4s demonstrating consistent income and job tenure.

- Banking History: Bank statements showing regular deposits, responsible spending, and minimal overdrafts.

- Savings Account: Evidence of a healthy savings buffer.

The Strategic Approach to Securing Your First Automotive Loan

Securing your first car loan with no established credit requires a thoughtful and strategic approach. It’s not just about finding a lender; it’s about presenting yourself as a reliable borrower and making smart financial choices from the outset.

First, setting realistic expectations for vehicle type and loan terms is paramount. As a first-time borrower with no credit, you might not qualify for the latest luxury SUV with a zero-down payment and a super-low interest rate. Focus on reliable, affordable used vehicles that meet your essential transportation needs. Lenders will be more comfortable approving a loan for a more modest amount, especially when it aligns with your income and financial profile.

The undeniable power of a substantial down payment cannot be overstated. A larger down payment reduces the amount you need to borrow, which in turn reduces the lender's risk. It also signals your commitment and financial preparedness. For a no-credit borrower, a down payment of 10-20% of the vehicle's price can significantly improve your chances of approval and potentially secure a better interest rate. For example, on a $15,000 vehicle, a $3,000 down payment can make a huge difference.

Understanding the benefits and responsibilities of involving a co-signer is another crucial step. A co-signer is someone with good credit who agrees to take on the responsibility of the loan if you fail to make payments. This significantly reduces the lender's risk, as they have a second, creditworthy party to pursue if you default. While a co-signer can be a powerful tool for approval, it’s a serious commitment for them. Ensure you understand the full implications and are confident in your ability to make payments on time to protect their credit.

Comprehensive budgeting is critical, extending beyond just the monthly car payment. You must factor in all total vehicle ownership costs, including insurance, fuel, maintenance, and unforeseen repairs. Insurance costs, in particular, can be substantial for new drivers or those without a long driving history, especially in provinces like Ontario or British Columbia. Don't forget registration fees, potential winter tire costs, and emergency funds for unexpected mechanical issues.

Let's look at an example budget breakdown for a typical entry-level used car:

| Expense Category | Estimated Monthly Cost (CAD) | Notes |

|---|---|---|

| Car Loan Payment | $300 - $450 | Based on a $15,000 loan, 12-15% APR, 60-72 months. |

| Car Insurance | $150 - $350+ | Highly variable by age, location, driving record, vehicle type. |

| Fuel | $100 - $250 | Depends on vehicle efficiency and daily commute (e.g., 1,500 km/month). |

| Maintenance & Repairs | $50 - $100 | Average for oil changes, tire rotations, unexpected issues. |

| Registration & Licensing | $10 - $20 | Annual fees amortized monthly. |

| Emergency Fund (Car Specific) | $25 - $50 | Saving for larger, unexpected repairs. |

| Total Estimated Monthly Cost | $635 - $1,220+ | Significant range; highlights need for careful budgeting. |

Finally, researching affordable vehicle options that align with your financial capacity is essential. Look for models known for their reliability, lower insurance costs, and good fuel economy. This demonstrates to lenders that you've done your homework and are making a responsible choice, further increasing your appeal as a borrower.

Pro Tip: Develop a detailed personal budget before approaching any lender. This demonstrates financial literacy and commitment to responsible repayment. Be prepared to show it if asked.

Navigating the Lending Ecosystem: Pathways for First-Time Buyers

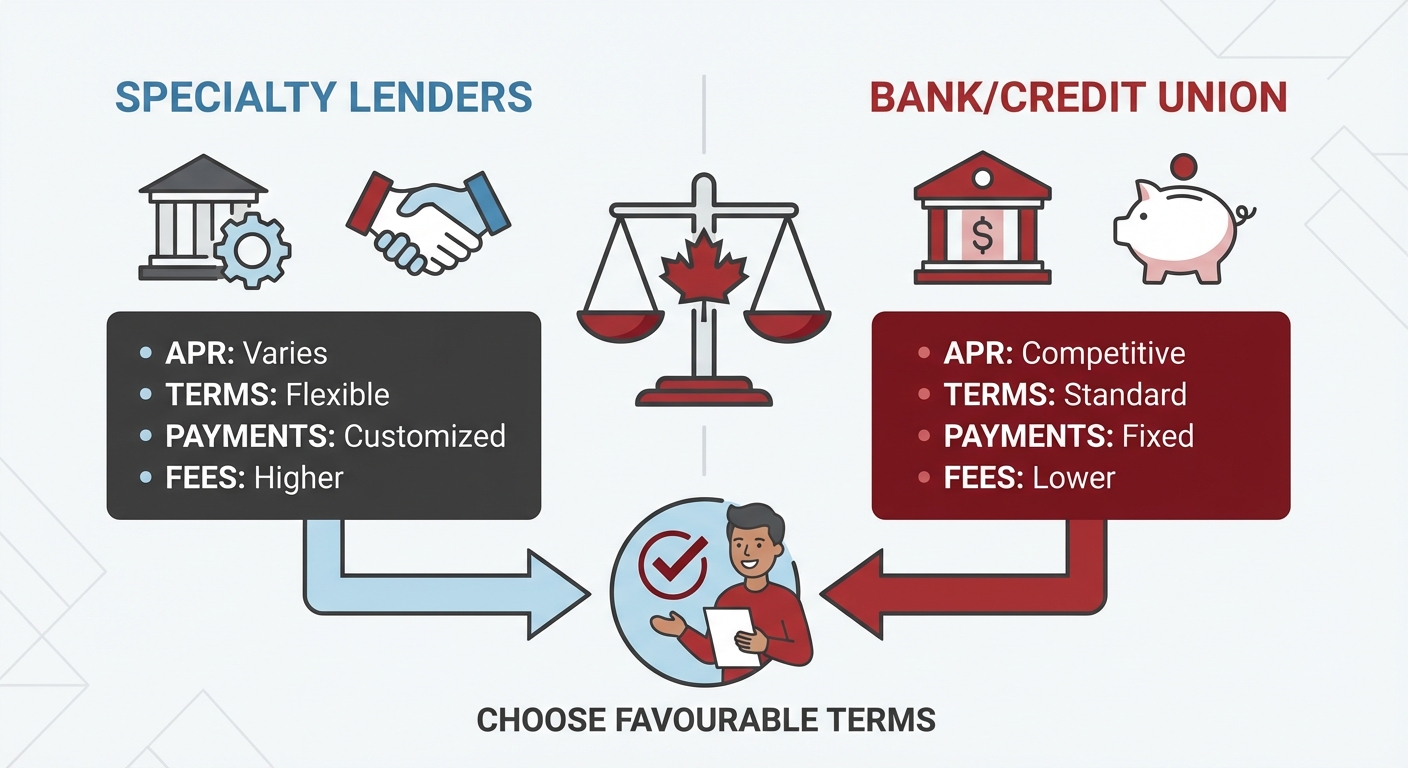

The Canadian lending landscape offers several avenues for individuals looking to buy a car, even with no established credit. Understanding the pros and cons of each pathway is crucial for making an informed decision. By 2026, the diversity of these options continues to grow, making it easier for first-time buyers to find a suitable solution.

Dealership financing is often the first stop for many car buyers. Dealerships work with a network of lenders, including both 'captive' lenders (financing arms of car manufacturers like Toyota Financial Services or GM Financial) and third-party banks or credit unions. For no-credit buyers, dealerships can be a good option because they often have relationships with lenders who specialize in varying credit profiles. They can submit your application to multiple lenders, increasing your chances of approval. However, be aware that interest rates might be higher than for prime borrowers, and you'll need to scrutinize the terms carefully. While convenient, dealership financing can sometimes lead to less competitive rates if you don't compare offers.

The role of specialty lenders is particularly significant for higher-risk profiles, which includes individuals with no established credit. These lenders specialize in subprime auto loans and are more willing to look beyond traditional credit scores. They place a greater emphasis on alternative data, your income stability, and your ability to make a down payment. What to expect? Higher interest rates are almost guaranteed due to the increased risk they undertake. However, they can be a lifeline for securing your first loan and starting to build credit. Ensure any specialty lender is reputable and transparent about all fees and terms. For more on ensuring your loan is legitimate, refer to our guide on How to Check Car Loan Legitimacy 2026: Canada Guide.

Traditional banks and credit unions represent another pathway, though often with a higher hurdle for no-credit borrowers. These institutions typically prefer applicants with a solid credit history. However, if you have an existing banking relationship with a particular institution (e.g., your primary chequing and savings accounts are there), they might be more inclined to work with you. Strategies for approaching them include applying for a smaller, secured loan (where the car acts as collateral) or having a strong co-signer. Showing a history of responsible banking (no overdrafts, consistent savings) can also make a difference. Some credit unions, being member-focused, may offer more flexibility than large banks.

Identifying and avoiding predatory lenders and high-pressure sales tactics is critical. Predatory lenders often target vulnerable borrowers with no credit, offering loans with exorbitant interest rates, hidden fees, and unfavourable terms designed to trap you in a cycle of debt. Always read the fine print, ask questions, and never feel pressured to sign anything on the spot. If a deal seems too good to be true, or if a lender guarantees approval without asking for any financial details, proceed with extreme caution.

The importance of comparing multiple loan offers cannot be stressed enough. Don't take the first offer you receive. Apply to several lenders – dealerships, specialty lenders, and your bank/credit union if applicable. Compare the Annual Percentage Rate (APR), loan terms, monthly payments, and any associated fees. This comparison empowers you to choose the most favourable terms available for your situation.

The Cost Equation: Decoding Interest Rates, Fees, and the True Price Tag

Understanding the full financial implications of buying a car, particularly with no established credit, goes far beyond the advertised monthly payment. For no-credit borrowers, interest rates and associated fees can significantly inflate the total cost of ownership. Transparency in all financial agreements is not just a preference; it's a necessity.

Why do interest rates tend to be higher for no-credit borrowers? Lenders categorize borrowers based on perceived risk. Without a credit history, you represent an unknown quantity, which translates into a higher risk for the lender. To offset this increased risk, they charge a higher interest rate. Factors influencing these rates include your income stability, the size of your down payment, whether you have a co-signer, the vehicle's age and value, and the overall economic conditions (e.g., the Bank of Canada's prime lending rate).

Understanding Annual Percentage Rate (APR) is crucial. APR is not just the interest rate; it's the total cost of borrowing expressed as a yearly rate, including both the interest and any mandatory fees rolled into the loan. A higher APR means you're paying more over the life of the loan. For instance, a loan with a 10% interest rate and $500 in fees might have an APR closer to 11% or 12%, depending on the loan term. Always compare APRs, not just interest rates, when evaluating offers. For insights into how your rate isn't solely tied to a score, read Your Credit Score is NOT Your Rate. Get a Fair Loan, Toronto.

Dissecting loan terms involves understanding the trade-offs. A shorter loan term (e.g., 36 or 48 months) typically means higher monthly payments but lower total interest paid over the life of the loan. A longer loan term (e.g., 72 or 84 months) results in lower monthly payments, making the car seem more affordable, but you'll pay significantly more in total interest. For a no-credit borrower, a slightly longer term might be necessary to keep payments manageable, but aim for the shortest term you can comfortably afford to minimize interest costs.

Unmasking hidden fees is essential before signing any agreement. These can include:

- Administrative Fees: For processing paperwork.

- Loan Origination Fees: Charged for setting up the loan.

- Documentation Fees: For preparing sales and financing documents.

- PPSA (Personal Property Security Act) Registration: A provincial fee to register the lender's interest in the vehicle.

- Optional Add-ons: Extended warranties, rustproofing, paint protection, or credit insurance. While some may be beneficial, they add to your loan amount and total cost. Be assertive in declining those you don't want or need.

Consider this hypothetical loan scenario for a $20,000 used car with a $2,000 down payment ($18,000 loan amount):

| Scenario | Interest Rate (APR) | Loan Term (Months) | Monthly Payment (Approx.) | Total Interest Paid (Approx.) | Total Cost of Car (Approx.) |

|---|---|---|---|---|---|

| Good Credit Borrower | 6.99% | 60 | $356 | $3,360 | $23,360 |

| No Credit Borrower (Optimistic) | 12.99% | 60 | $409 | $6,540 | $26,540 |

| No Credit Borrower (Realistic) | 18.99% | 72 | $395 | $10,440 | $30,440 |

*Note: Calculations are approximate and for illustrative purposes only. Actual rates and payments vary.

The significant impact of insurance costs, especially for new drivers and specific vehicle types, cannot be overlooked. Your car loan approval doesn't guarantee affordable insurance. Young drivers, individuals new to Canada, or those with no prior insurance history often face higher premiums. Certain vehicle models (e.g., sports cars, popular theft targets) also command higher rates. Get insurance quotes before finalizing your car purchase to avoid a shock.

Pro Tip: Always request a full, itemized breakdown of all costs, including the vehicle price, interest, and any fees, before signing. Don't be afraid to ask for clarification on every line item. If something seems unclear, demand an explanation.

Crafting Your Application Story: What Lenders Truly Want to See

When you have no established credit, your loan application isn't just a form; it's your story. Crafting this story effectively – presenting a stable financial picture and clearly communicating your reliability – is paramount to securing approval from potential lenders in 2026.

Start by meticulously gathering essential documentation. Lenders need proof of who you are, where you live, and how you earn money. This typically includes:

- Proof of Income: Recent pay stubs (3-6 months), employment letters stating your position, salary, and tenure, or T4 slips. If self-employed, tax returns and bank statements are crucial.

- Proof of Residency: Utility bills (electricity, gas, internet), rental agreement, or mortgage statements showing your current address.

- Identification: Valid government-issued ID (e.g., driver's license, passport).

- Banking Statements: Recent statements (3-6 months) from your primary chequing and savings accounts to demonstrate consistent cash flow, responsible spending, and lack of overdrafts.

- References: Sometimes, lenders may request personal or professional references.

Preparing for the lender interview means being honest, transparent, and confident. Be ready to discuss your financial situation openly. If there are gaps in employment or unique income situations, explain them clearly and logically. Confidence comes from preparation – knowing your budget, understanding your alternative credit footprint, and being clear about the vehicle you need. Avoid making excuses; instead, focus on demonstrating your current stability and commitment to repayment.

Highlighting stability is key. Lenders are looking for consistency. Demonstrate consistent employment with the same employer (or a clear career progression). Show long-term residency at your current address. Emphasize responsible financial habits, such as a history of paying rent and utilities on time, maintaining a positive bank balance, and avoiding unnecessary debt. Even small details, like having the same phone number for years, can subtly contribute to an image of stability.

The strategic advantage of a well-researched and affordable vehicle choice cannot be understated. When you apply for a loan for a car that is clearly within your financial means, it shows maturity and responsibility. Conversely, applying for a luxury vehicle far beyond your realistic budget signals a lack of financial planning and can deter lenders. Demonstrate that you've considered the full cost of ownership, including insurance, fuel, and maintenance, and that the vehicle choice makes sense for your lifestyle and income.

Finally, present a clear plan for repayment and demonstrate financial responsibility. This ties back to your detailed budget. Show the lender how you plan to incorporate the car payment, insurance, and other costs into your existing expenses without financial strain. Be proactive in explaining how you will manage your finances to ensure timely payments. This proactive approach can make a significant positive impression.

Pro Tip: Bring more documentation than you think you'll need. Showing preparedness and having all necessary papers readily available can significantly streamline the application process and make a positive impression.

The Horizon of 2026: Anticipating Market Shifts and Lending Innovations

As we advance into 2026, the automotive and lending landscapes are continuously evolving, bringing both new opportunities and challenges for first-time car buyers with no established credit. Staying informed about these shifts can give you a strategic edge.

Emerging trends in automotive financing for first-time and no-credit buyers indicate a move towards more inclusive lending practices. We're seeing more lenders willing to consider a wider array of data points beyond the traditional credit score. This includes greater emphasis on income stability, employment history, and alternative payment data, often facilitated by new technologies. Some lenders are exploring "micro-loans" or smaller, shorter-term car loans to help new borrowers establish credit more easily.

Potential shifts in lending regulations and consumer protection laws could also impact the market. Governments across Canada are increasingly focused on protecting vulnerable consumers. This might lead to stricter regulations on interest rates for subprime loans, greater transparency requirements for lenders, and enhanced dispute resolution processes. While this could make it slightly harder for some high-risk lenders to operate, it ultimately benefits consumers by fostering a fairer and more secure lending environment.

The growing role of Artificial Intelligence (AI) and advanced analytics in credit assessment is perhaps the most significant innovation. AI algorithms can process vast amounts of alternative data much faster and more accurately than traditional methods. This allows lenders to identify creditworthy individuals even without a credit score, by analyzing patterns in banking transactions, utility payments, and employment history. This data-driven approach means that your 'alternative credit footprint' becomes even more powerful.

How vehicle electrification (EVs) might create new financing opportunities or challenges is another area to watch. As the Canadian government pushes for EV adoption, there could be incentives or specialized loan programs designed to make electric vehicles more accessible. However, EVs often have a higher upfront cost, which could be a barrier for no-credit buyers. Lenders might also be cautious about financing EVs until their long-term resale value and battery degradation patterns are fully established. On the flip side, the lower operating costs of EVs (fuel and maintenance) could make them more attractive to lenders once the initial financing hurdle is cleared.

Forecasting economic factors, such as interest rate predictions, will always impact loan affordability. If the Bank of Canada continues to raise or maintain high policy rates, it will translate into higher interest rates for all borrowers, including those with no credit. Conversely, a period of economic stability or rate decreases could make car loans more affordable. Staying abreast of economic forecasts from reputable sources can help you time your car purchase more effectively, potentially securing a lower rate.

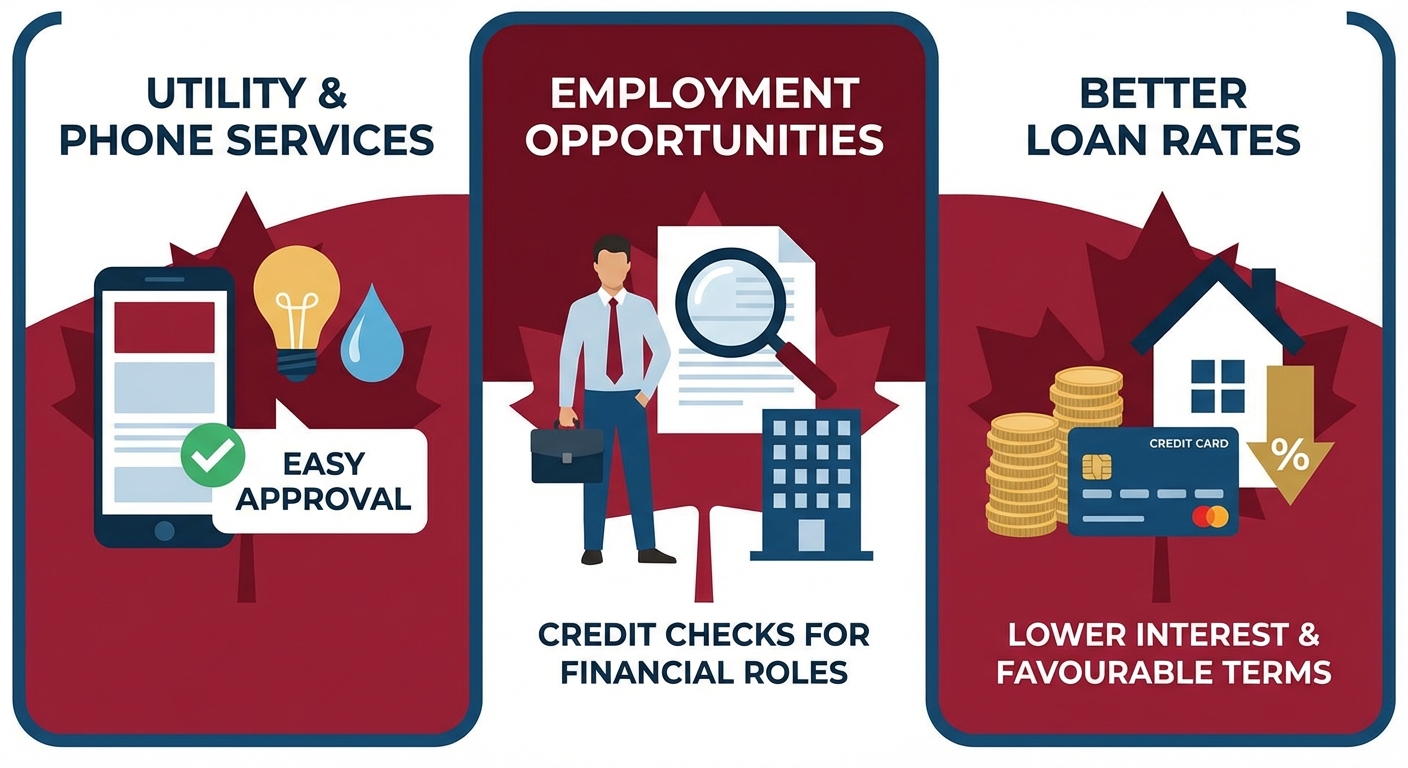

Beyond the Purchase: Leveraging Your First Loan to Build a Stronger Financial Future

Securing your first car loan with no established credit is a significant achievement, but the journey doesn't end there. In fact, the purchase marks the beginning of a crucial phase: leveraging this loan to build a robust and positive credit profile that will benefit you for years to come.

The paramount importance of consistent, on-time loan payments for credit building cannot be overstated. Every single payment you make on time is a positive entry on your credit report. It demonstrates to future lenders that you are reliable and capable of managing debt. Even one missed payment can significantly damage your nascent credit score and erase much of the progress you've made. Set up automatic payments to ensure you never miss a due date.

Strategies for monitoring your credit report and understanding score evolution are vital. Once you have your first loan, a credit file will begin to form. Regularly check your credit report (at least once a year, or more frequently if you're actively building credit) from Equifax and TransUnion. Look for accuracy and ensure all payments are reported correctly. Understanding how your credit score is calculated (factors like payment history, credit utilization, length of credit history, types of credit, and new credit) will empower you to make informed financial decisions. Your score won't jump overnight, but consistent positive activity will show gradual improvement.

Utilizing secured credit cards or small personal loans as supplementary credit-building tools can accelerate your progress. A secured credit card requires a cash deposit as collateral, which then becomes your credit limit. This is a low-risk way to demonstrate responsible credit card use. Small personal loans, especially from a credit union or a lender you have a relationship with, can also contribute positively to your credit mix, provided they are managed well. The key is to keep utilization low and pay balances in full and on time.

Planning for future vehicle purchases: how a stronger credit profile unlocks better terms. As your credit score improves, you'll gain access to more competitive interest rates and more flexible loan terms. This means that your next car purchase will likely be more affordable, with lower monthly payments and significantly less total interest paid. Building credit now is an investment in your future purchasing power, not just for cars, but for other major life expenses.

The broader impact of a good credit score extends far beyond car loans. A strong credit rating can positively influence other financial aspects of your life:

- Housing: Easier approval for mortgages and rental applications.

- Insurance: Potentially lower premiums for car and home insurance.

- Utilities: Waived security deposits for electricity, internet, or phone services.

- Employment: Some employers conduct credit checks, especially for positions of financial responsibility.

- Better rates on other loans: Personal loans, lines of credit, and credit cards will all come with more favourable terms.

Your Next Steps to Approval: A Strategic Action Plan

Embarking on the journey to buy your first car in Canada with no established credit can feel overwhelming, but with a clear strategy, it's an entirely achievable goal for 2026. By focusing on preparation, informed decision-making, and patience, you can turn your blank slate into a strong financial beginning.

Here’s your strategic action plan:

- Assess Your Financial Readiness and 'Alternative Credit Footprint':

- Review your current income, expenses, and savings.

- Compile proof of consistent rent and utility payments.

- Gather employment history and income verification.

- Examine your banking statements for responsible management.

- Gather All Necessary Documentation Meticulously:

- Prepare government ID, proof of address, and income verification.

- Organize bank statements and any relevant alternative data.

- Having everything ready streamlines the application process.

- Research and Compare Different Lenders and Loan Products:

- Explore dealership financing, specialty lenders, and your existing bank/credit union.

- Understand the differences in rates, terms, and approval criteria for no-credit buyers.

- Don't commit to the first offer; compare multiple options.

- Create and Stick to a Realistic Budget for Your Vehicle Purchase and Ownership:

- Determine a comfortable monthly car payment, including insurance, fuel, and maintenance.

- Choose a vehicle that aligns with your financial capacity, not just your desires.

- A significant down payment can dramatically improve your chances and terms.

- Be Patient, Persistent, and Prepared to Negotiate:

- Approval might not happen instantly; be prepared for some back-and-forth.

- Don't be afraid to ask questions, clarify terms, and negotiate for better rates or fees.

- Remember, this first loan is a stepping stone to a stronger credit future.

Your first car loan is more than just a means of transportation; it's a powerful tool for establishing your financial credibility in Canada. By following this strategic action plan, you're not just buying a car; you're investing in your financial future.