Calgary: Your Post-Grad Permit Just Got Wheels.

Table of Contents

- Calgary: Your Post-Grad Permit Just Got Wheels.

- Key Takeaways: Navigating Your First Car Loan as a PGWPH in Calgary

- 1. The Calgary Drive: Why a Car is More Than Convenience for PGWPH

- 2. Cracking the Code: How Lenders View 'No Canadian Credit History' for Newcomers

- 3. The Numbers Game: Demystifying Interest Rates, Loan Terms, and the Full Cost of Ownership in Alberta

- 4. Your Approval Blueprint: Essential Documentation & Strategic Positioning for Success

- 5. Where to Turn for Financing: Banks, Dealerships, and Other Avenues in Calgary

- 6. Choosing Your Ride: Smart Car Selection for Calgary's Roads and Your PGWPH Budget

- 7. Beyond the Loan: Building Credit and Planning for Your Future in Canada

- 8. Your Next Steps to Driving Success in Calgary: A Strategic Action Plan for PGWPH

- FAQ: Calgary Post-Grad Car Loans - Your Burning Questions Answered

Calgary: Your Post-Grad Permit Just Got Wheels.

Arriving in Calgary on a Post-Graduate Work Permit (PGWP) is an exciting new chapter, filled with opportunities to build a thriving career and a fulfilling life in one of Canada’s most dynamic cities. You’ve successfully navigated your studies, secured your permit, and are ready to contribute to the Canadian economy. But as you settle in, a common question quickly emerges: How do I get around this sprawling, vibrant city? For many, the answer quickly becomes "I need a car."

Public transit in Calgary is excellent, connecting many key areas, but the sheer size of the city, combined with its distinct seasons and the wealth of outdoor activities in the surrounding Rocky Mountains, often makes personal transportation a practical necessity, not just a luxury. Whether it’s commuting to a job outside the city centre, exploring Banff National Park on a weekend, or simply doing a large grocery run, having your own vehicle can significantly enhance your independence and quality of life in Alberta.

However, securing a car loan when you’re a newcomer to Canada, especially without a well-established Canadian credit history, can seem like a daunting task. Many Post-Graduate Work Permit Holders (PGWPH) arrive with questions about how lenders will view their situation, what documentation they’ll need, and what the true cost of vehicle ownership in Calgary really entails. This comprehensive guide from SkipCarDealer.com is designed to demystify the process, providing you with the knowledge and strategies to confidently secure your first car loan in Calgary and hit the road to success.

Key Takeaways: Navigating Your First Car Loan as a PGWPH in Calgary

- Yes, It's Possible: Securing a car loan in Calgary as a Post-Graduate Work Permit Holder (PGWPH) is achievable, even without a long Canadian credit history, but requires strategic preparation and understanding of lender expectations.

- Beyond the Credit Score: Lenders assess your stability, consistent income, and permit validity more heavily than just your credit score initially. They want to see a clear picture of your financial responsibility and ability to repay.

- Calgary Specifics Matter: From daily commuting distances and the necessity for winter-ready vehicles to insurance rates and local dealership programs, your location in Alberta plays a significant role in every aspect of vehicle ownership and financing.

- The True Cost: Always factor in a holistic view of expenses, including insurance, maintenance, essential winterizing, and registration fees, alongside your monthly loan payment. These can often be significant, especially for newcomers.

- Building Your Future: Your first car loan is not just about transportation; it's a powerful and effective tool for establishing a strong, positive Canadian credit history, which is crucial for future financial endeavours like renting an apartment or securing a mortgage.

1. The Calgary Drive: Why a Car is More Than Convenience for PGWPH

Life's New Chapter: Settling into Alberta with a Post-Graduate Work Permit marks a pivotal moment in your Canadian journey. You've transitioned from student life to professional life, and with that comes a new set of needs and opportunities. Calgary, as a major economic hub in Alberta, offers diverse employment across sectors like energy, technology, finance, and logistics. While public transit serves key corridors, the reality of living and working in a large, modern Canadian city often points towards the necessity of personal transportation.

Mapping Out Your Calgary Life: From Foothills Campuses to Professional Hubs. Calgary is not just a city; it's a sprawling metropolitan area. Universities like the University of Calgary and Mount Royal University are well-connected, but many professional opportunities and residential areas are dispersed across quadrants. Imagine living in the north and working in the south, or needing to access industrial parks or suburban business centres not directly on a C-Train line. A car significantly cuts down commute times, reduces stress, and allows you to be more flexible with your work and personal schedule. It means less time waiting in the cold at a bus stop and more time enjoying your new life.

Beyond Public Transit: Unlocking Job Markets and Lifestyle in a Sprawling City. The ability to drive opens up a wider array of job prospects, particularly in industries where locations are varied or require travel. It also transforms your lifestyle. Calgary is the gateway to the Canadian Rockies. Imagine spontaneous weekend trips to Banff, Canmore, or Lake Louise without relying on expensive tour buses or carpooling. A vehicle allows you to fully embrace the Alberta experience, from exploring national parks to visiting friends and family across the city or even venturing to Edmonton. For many PGWPH, a car is not just a convenience; it’s an essential tool for career advancement and social integration. It empowers you to truly take control of your new life in Canada.

2. Cracking the Code: How Lenders View 'No Canadian Credit History' for Newcomers

The RBC Precedent: What 'No Credit History Required' Really Means for Post-Graduate Work Permit Holders. Many major Canadian banks, like Royal Bank of Canada (RBC), have recognized the growing influx of skilled newcomers and offer programs that advertise "no credit history required" for certain financial products, including car loans. While this sounds incredibly appealing, it's crucial to understand what it truly signifies. It doesn't mean they don't assess your financial situation; rather, it means they evaluate factors beyond a traditional Canadian credit score. For PGWPH in Calgary, this often involves a deeper look into your current financial stability, employment status, and the validity of your work permit, rather than solely relying on a number that simply doesn't exist yet for you. They understand that a lack of Canadian credit isn't a reflection of poor credit, but simply an absence.

Your Financial Narrative: What Lenders Actually Scrutinize Beyond a Score (e.g., consistent income, stable employment, residency history). When a credit score isn't available, lenders construct your financial narrative through other means. They are primarily interested in your ability and willingness to repay the loan. Key indicators for PGWPH include:

- Consistent Income: Do you have stable, full-time employment? Lenders want to see regular pay stubs from a reputable employer in Calgary.

- Debt-to-Income Ratio: Is your income sufficient to comfortably cover the proposed car loan payments, insurance, and your existing living expenses?

- Employment Stability: How long have you been employed? A longer tenure with your current employer strengthens your application.

- Residency History: Can you provide proof of stable residency in Calgary, such as a lease agreement or utility bills? This demonstrates stability.

- Banking History: Consistent activity in a Canadian bank account, with regular deposits and responsible management, shows financial maturity.

This comprehensive review helps them mitigate the risk associated with an unknown credit profile. For those looking for deeper insights into how to approach financing without an established credit score, consider reading our article: Zero Credit? Perfect. Your Canadian Car Loan Starts Here.

The Weight of Your Permit: Understanding its Role in Loan Eligibility and Terms, especially concerning its validity period in Alberta. Your Post-Graduate Work Permit is a critical document in this process. Its validity period directly influences the maximum loan term you might be approved for. Lenders typically prefer the loan to be repaid before your permit expires, or at least for the permit to have significant remaining validity (e.g., 18-24 months) beyond the desired loan term. If your permit has a shorter remaining period, lenders may offer shorter loan terms, require a larger down payment, or ask for a co-signer. They need assurance that your legal status in Canada allows you to fulfill the entire loan obligation. Demonstrating an intention to apply for Permanent Residency (PR) or extend your permit, if applicable, can also be beneficial, though not a guarantee.

3. The Numbers Game: Demystifying Interest Rates, Loan Terms, and the Full Cost of Ownership in Alberta

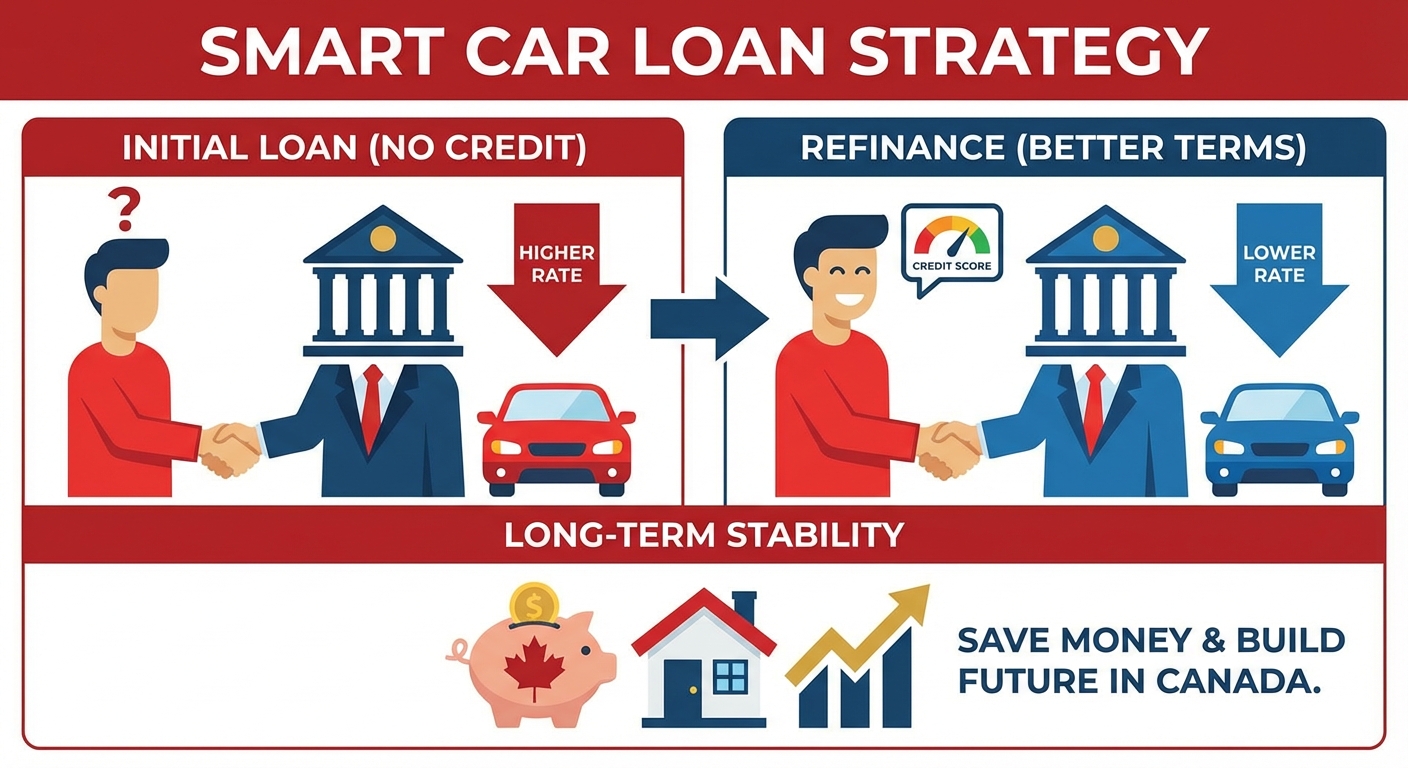

Navigating Newcomer Interest Rates: Realistic Expectations and How to Improve Them Over Time. As a Post-Graduate Work Permit Holder with limited or no Canadian credit history, it's realistic to expect a slightly higher interest rate on your first car loan compared to someone with excellent, long-standing credit. This isn't a penalty; it's a reflection of the perceived higher risk for lenders when they have less data to assess. Rates can vary significantly depending on the lender, the vehicle's age and type, and your overall financial profile. While a prime rate might be in the 5-8% range, newcomers might see rates starting from 8-15% or even higher. The good news is that consistently making on-time payments on this first loan will rapidly build your Canadian credit history, paving the way for lower rates on future loans or the opportunity to refinance at a better rate later on. For more on how your credit score impacts car loans, even when it's not the primary factor, read: Alberta Car Loan: What if Your Credit Score Doesn't Matter?

Loan Length & Limits: Aligning Your PGWP with Financing Options (e.g., RBC's advertised 96 months and up to $75,000, and how this applies specifically to PGWPH in Calgary). Major banks like RBC might advertise attractive terms like loan lengths up to 96 months (8 years) and financing up to $75,000. While these options exist, they are often reserved for borrowers with strong credit and established financial profiles. For PGWPH, the actual loan term and amount will be heavily influenced by your work permit's expiry date and your proven income stability. Lenders will typically try to align the loan term with your permit's validity. If your PGWP has 2.5 years remaining, a 36-month loan might be challenging without a strong down payment or co-signer. A 24-month loan would be more likely. It’s crucial to be realistic and choose a loan term that you can comfortably manage within your permit’s timeframe and budget, as well as considering your future plans in Canada.

The Unseen Costs: Beyond the Monthly Payment in Calgary. Your monthly loan payment is just one piece of the puzzle. The true cost of car ownership in Calgary includes several other significant expenses that newcomers often underestimate:

- Insurance in Alberta: A Deep Dive into Rates, Factors (age, driving record, vehicle type), and How to Save in a Competitive Market. Car insurance in Alberta can be notoriously expensive, especially for new drivers or newcomers without a Canadian driving history. Factors influencing your rates include your age, gender, postal code in Calgary, driving record (even international history if verifiable), type of vehicle, and how much you drive. To save money, always shop around for multiple quotes, consider a higher deductible, look for discounts (e.g., winter tire discount, multi-policy discount), and choose a less expensive-to-insure vehicle. Some insurers offer newcomer programs that may recognize international driving experience, so be sure to inquire.

- Registration, Licensing, and Provincial Fees specific to Alberta: Beyond the purchase price, you'll incur costs for vehicle registration, license plates, and an Alberta driver's license (if you haven't obtained one yet). These are annual or one-time fees that must be budgeted for. Alberta has a graduated licensing system, and transitioning your international license to an Alberta one is a necessary step that might involve tests and fees.

- Fuel, Maintenance, and Essential Winter Readiness for navigating Calgary's diverse driving conditions: Calgary experiences harsh winters. Budget for regular fuel costs, which fluctuate, and essential maintenance like oil changes, tire rotations, and brake checks. Crucially, prepare for winter: purchasing a set of dedicated winter tires is highly recommended for safety and often required by insurance for specific discounts. A block heater might also be a wise investment for reliable cold-weather starting, and general emergency kits are essential for Alberta winters.

4. Your Approval Blueprint: Essential Documentation & Strategic Positioning for Success

The Definitive Checklist: What Every PGWPH Needs for a Car Loan Application in Calgary. Preparation is key to a smooth and successful car loan application. Having all your documents organized and ready will not only speed up the process but also demonstrate your seriousness and responsibility to lenders. Here’s a comprehensive checklist for Post-Graduate Work Permit Holders in Calgary:

- Valid Post-Graduate Work Permit and Passport: Ensure both documents are current and have sufficient remaining validity. Lenders will verify your legal status in Canada.

- Proof of Employment: This is paramount. Provide an official offer letter, your most recent two to three pay stubs, and potentially contact information for your employer for verification. The longer your employment history in Canada, the better.

- Calgary Residency Verification: Lenders need to confirm your stable address. This can include a copy of your lease agreement, utility bills (electricity, gas, internet), or official mail addressed to you at your Calgary residence.

- Canadian Bank Statements: Present recent bank statements (typically 3-6 months) from your Canadian bank account. These statements demonstrate consistent income flow, responsible spending habits, and proof of savings.

- International Driving Permit/Alberta Driver's License: While you might start with an International Driving Permit, lenders and insurers prefer to see that you are actively working towards or already possess an Alberta driver's license. This shows commitment to long-term residency and adherence to local regulations.

For a more general guide on required documentation for car financing in Alberta, you can check out: Approval Secrets: Exactly What Paperwork You Need for Alberta Car Financing.

The Power of a Down Payment: Why It's Your Strongest Ally in Securing Favorable Terms. While some lenders may offer zero down payment options, making a significant down payment (even 10-20% of the vehicle's price) can dramatically improve your chances of approval and secure more favourable loan terms. A down payment reduces the amount you need to borrow, thereby lowering the lender's risk. This can translate into a lower interest rate, smaller monthly payments, and a greater likelihood of approval, especially when you have limited credit history. It also demonstrates your financial commitment and ability to save, which is a strong positive signal to lenders. Even if you're exploring options with no down payment, understanding its benefits is crucial. For information on financing without a down payment, see: No Down Payment? Your Gig Just Bought a Hybrid. Seriously.

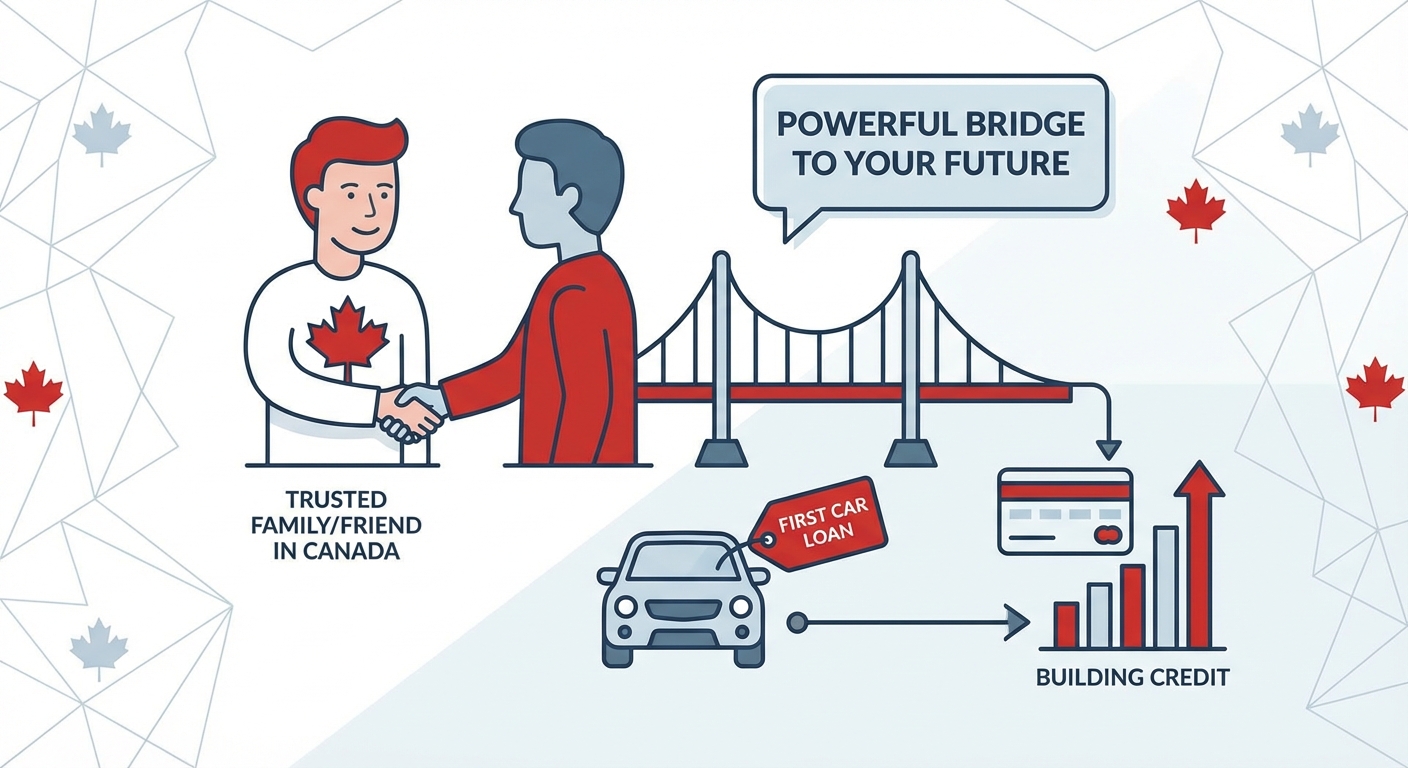

Co-Signers: Understanding the Benefits and Responsibilities, and when this option makes sense for a PGWPH. If you're struggling to get approved on your own, or if you want to secure better terms, a co-signer can be an invaluable asset. A co-signer is someone with good credit history and a stable financial standing who agrees to be equally responsible for the loan if you default. This significantly reduces the risk for the lender. However, this is a serious commitment for the co-signer, as their credit will be affected if you miss payments. Consider this option only if you have a trusted family member or close friend in Canada who understands and is willing to accept this responsibility. It can be a powerful bridge to your first car loan and a stepping stone to building your own credit.

An infographic titled 'Your PGWPH Car Loan Application Checklist for Calgary' detailing required documents, their purpose, and tips for preparation. This visually reinforces the critical information for applicants.

5. Where to Turn for Financing: Banks, Dealerships, and Other Avenues in Calgary

Major Canadian Banks: Advantages, Hurdles, and Newcomer Programs (e.g., Royal Bank of Canada's offerings, as highlighted by competitor insights). Major banks like Royal Bank of Canada, TD Bank, Bank of Montreal, and Canadian Imperial Bank of Commerce are often the first choice for car loans. They typically offer competitive interest rates and a wide range of loan products. Many have specific newcomer programs designed to assist individuals like PGWPH, acknowledging the challenge of establishing credit in a new country. The advantage is generally lower rates if approved, and the ability to manage your loan with your existing banking relationship. The hurdle can be their sometimes stricter requirements for credit history, even with newcomer programs. While they might advertise "no credit history required," they still scrutinize income, employment stability, and permit validity very closely. Engaging with a financial advisor at your Canadian bank is an excellent first step to understand their specific offerings for PGWPH in Calgary.

Dealership Financing: The Convenience Factor and Specialized Newcomer Programs. Exploring major dealership groups in Calgary (e.g., Shaw GMC, Hyatt Auto Group, CMP Auto, Calgary Auto Mall) and their specific offerings for PGWPH. Understanding captive finance (e.g., Toyota Financial Services, Honda Financial Services) versus third-party lenders at dealerships. Dealerships offer incredible convenience. They act as a one-stop shop, helping you choose a vehicle and arrange financing all in one place. Many large dealership groups in Calgary, such as those found at the Calgary Auto Mall or independent dealerships like Shaw GMC, Hyatt Auto Group, and CMP Auto, are highly experienced in working with newcomers. They often have relationships with a broader network of lenders, including both major banks and specialized subprime lenders, increasing your chances of approval. Furthermore, many vehicle manufacturers have their own "captive finance" arms (e.g., Toyota Financial Services, Honda Financial Services, Ford Credit) that sometimes offer specific programs or incentives for recent graduates or newcomers, potentially with more flexible criteria. While rates might sometimes be slightly higher than a direct bank loan, the ease of application and higher approval rates can make dealership financing an attractive option for PGWPH.

Alternative Lenders: When They're an Option and When to Proceed with Extreme Caution (discussing higher interest rates and potential risks). If traditional banks and dealership-affiliated lenders prove challenging, alternative lenders exist. These lenders specialize in financing for individuals with challenging credit situations, including those with no credit history. While they offer a higher chance of approval, it comes at a cost: significantly higher interest rates, often in the 20-30% range or even more. They may also have stricter terms or shorter loan periods. While they can be a last resort to get approved and start building credit, it's crucial to proceed with extreme caution. Thoroughly research any alternative lender, understand every detail of the loan agreement, and ensure you can comfortably afford the payments without putting yourself in financial distress. Always verify their legitimacy and read reviews. Our advice is to exhaust all other options before considering alternative lenders due to the high cost of borrowing.

6. Choosing Your Ride: Smart Car Selection for Calgary's Roads and Your PGWPH Budget

New vs. Used: Maximizing Value on a Post-Graduate Work Permit Budget, with a focus on depreciation and initial costs. For most Post-Graduate Work Permit Holders, a reliable used car often presents the most financially sensible option for a first vehicle in Calgary. New cars experience significant depreciation in their first few years, meaning they lose a substantial portion of their value very quickly. Opting for a used vehicle, typically 2-5 years old, allows you to avoid this initial depreciation hit while still getting a modern, reliable car. Used cars also generally have lower insurance premiums and registration fees compared to their brand-new counterparts. While some new car financing programs for newcomers can offer competitive rates, the overall lower purchase price and associated costs of a used vehicle usually make it the more budget-friendly choice, freeing up funds for other essential expenses as you establish yourself in Canada.

Reliability Reigns: Top Car Brands Known for Durability and Lower Maintenance Costs (e.g., Toyota, Honda, Mazda, Hyundai, Kia). Considerations for Alberta's Climate: The importance of All-Wheel Drive (AWD), Block Heaters, and dedicated Winter Tires for safety and performance in Calgary. When selecting a vehicle, prioritize reliability. Brands like Toyota, Honda, Mazda, Hyundai, and Kia are consistently praised for their durability, fuel efficiency, and lower long-term maintenance costs. These brands often have readily available parts and a strong network of service centres across Canada, including Calgary. Beyond general reliability, consider Calgary's specific climate. All-Wheel Drive (AWD) is highly recommended for navigating snowy and icy roads, providing superior traction and control. A block heater is a prudent investment for vehicles parked outside in Calgary's frigid winter temperatures, ensuring easier starting and reducing engine wear. Most critically, investing in a set of dedicated winter tires (distinct from all-season tires) is not just a recommendation but a safety imperative for driving on Alberta's winter roads. They offer superior grip in snow and ice, significantly improving braking and handling.

The Pre-Purchase Inspection: A Non-Negotiable Step for Used Vehicles in Calgary, ensuring mechanical soundness and avoiding costly surprises. Never skip a pre-purchase inspection (PPI) when buying a used vehicle, especially from a private seller or a smaller, less reputable dealership. A qualified, independent mechanic (one not affiliated with the seller) will thoroughly inspect the vehicle for any underlying mechanical issues, hidden damage, or potential problems that could lead to expensive repairs down the line. This inspection provides peace of mind, can be used as a negotiation tool if minor issues are found, and most importantly, protects you from buying a lemon. The small cost of a PPI is a worthwhile investment that can save you thousands of dollars and countless headaches in the long run, ensuring your first car in Calgary is a safe and reliable one.

7. Beyond the Loan: Building Credit and Planning for Your Future in Canada

Your Loan as a Credit-Building Catalyst: The Path to a Stronger Financial Footprint in Canada. Your first car loan isn't just a means to get around Calgary; it's a powerful financial tool for building a robust Canadian credit history. By consistently making your monthly payments on time, you are actively demonstrating financial responsibility to credit bureaus. Every on-time payment is a positive mark on your credit report, which in turn helps establish and improve your credit score. A strong credit score is invaluable for future financial endeavours, such as renting an apartment, securing a cell phone plan, obtaining a credit card with better terms, and eventually, qualifying for a mortgage if you decide to purchase property in Canada. Treat your car loan as an investment in your financial future.

Navigating PGWP Expiry: Strategies for Loan Continuity and Permit Renewal or Transition to Permanent Residency. As your Post-Graduate Work Permit approaches its expiry date, it's crucial to have a plan, especially if your car loan term extends beyond it or if you plan to keep the vehicle. If you intend to stay in Canada, actively pursue avenues for permit renewal, or transition to Permanent Residency (PR). Lenders will want to see continuity in your legal status. If you secure an approved PR application or another valid work permit before your current PGWP expires, you can often continue your loan without issue. If your permit is not renewed or you plan to leave Canada, you'll need to consider selling the vehicle to pay off the remaining loan balance, or exploring options with your lender regarding early repayment or transfer of ownership, if applicable. Proactive planning and communication with your lender are essential.

The Option to Refinance: Lowering Rates as Your Credit Grows and Financial Stability Solidifies. As you consistently make payments and build a positive Canadian credit history, you may become eligible to refinance your car loan. Refinancing involves taking out a new loan to pay off your existing one, often with a lower interest rate, a different loan term, or both. This can significantly reduce your monthly payments or the total interest paid over the life of the loan. Typically, you'd consider refinancing after 12-24 months of perfect payment history, once your credit score has demonstrably improved. This strategy allows you to initially secure a car loan when you have no credit, and then leverage your newly built credit to get more favourable terms, saving you money in the long run and further solidifying your financial stability in Canada.

A visual timeline illustrating the journey from PGWP issuance to loan approval, consistent payment history, credit score improvement, and potential permit renewal/Permanent Residency application, showing key financial milestones and opportunities.

8. Your Next Steps to Driving Success in Calgary: A Strategic Action Plan for PGWPH

Consolidate Your Documents: Be Prepared and Organized to streamline the application process. The first and most critical step is to gather and organize all necessary documentation. This includes your valid Post-Graduate Work Permit and passport, proof of employment (offer letter, pay stubs), residency verification (lease agreement, utility bills), Canadian bank statements, and your driving license information. Having everything readily accessible demonstrates your readiness and professionalism, making the application process smoother and quicker for both you and the lender. Think of it as presenting a complete financial portfolio.

Research and Compare: Don't Settle for the First Offer – explore options from various banks and dealerships. Just as you researched your post-graduate studies, apply the same diligence to your car loan. Don't feel pressured to accept the first offer you receive. Contact multiple major banks to inquire about their newcomer car loan programs. Visit several reputable dealerships in Calgary and discuss their financing options, including any manufacturer-specific programs for recent graduates or immigrants. Comparing interest rates, loan terms, and overall conditions will empower you to make an informed decision and find the best possible deal for your situation.

Negotiate with Confidence: Leverage Your Preparation and understanding of market rates. Equipped with your organized documents and comparative research, you can negotiate with confidence. If you've received a pre-approval from your bank, use that as leverage at the dealership. Be clear about your budget, what you're looking for in a vehicle, and what loan terms you're comfortable with. Don't be afraid to ask questions about fees, warranty options, and any specific clauses related to your PGWP status. Your preparation is your power in these discussions.

Understand Every Detail: Read the Fine Print of your loan agreement, especially regarding early payment penalties or specific clauses for newcomers. Before you sign any agreement, read it meticulously. Understand the total cost of the loan, including all fees and charges. Pay close attention to the interest rate, the repayment schedule, and any clauses regarding early payment penalties or specific conditions tied to your Post-Graduate Work Permit. If anything is unclear, ask for clarification until you fully understand it. A clear understanding of your obligations is crucial for responsible financial management and avoiding future surprises. Your car loan is a significant commitment, and being fully informed protects your financial well-being.