The Canadian economy has undergone a seismic shift over the last decade. The traditional 9-to-5 office job is no longer the only way to build a career. From the streets of Toronto to the suburbs of Vancouver, hundreds of thousands of Canadians are now earning their living through gig platforms like Uber, SkipTheDishes, DoorDash, and freelance marketplaces like Upwork. While this shift offers unprecedented flexibility, it has created a significant friction point in the world of finance: the "Financing Gap."

If you are a gig worker, you know the frustration. You might be earning more than you ever did in a salaried position, but the moment you walk into a traditional "Big Five" bank to apply for a car loan, the atmosphere changes. To a traditional loan officer, your fluctuating weekly income and lack of a T4 slip look like a red flag. They see risk where you see a thriving business. This guide is designed to dismantle those barriers. We are diving deep into the "Approval Secrets" that bridge the gap between being a self-employed hustler and getting the keys to your next vehicle.

Key Takeaways

- Documentation is King: You cannot walk into a dealership empty-handed. Your Notice of Assessment (NOA) and 6 months of bank statements are your primary tools for proving stability.

- The Tax Paradox: While maximizing write-offs is great for saving money in April, it can shrink your "qualifying income" for a loan. Balance is required in the year you plan to buy.

- Lender Specialization: Don't waste time with rigid traditional banks. Specialized auto finance companies are built to understand the nuances of the gig economy.

- The 3-Month Window: Start cleaning up your bank statements and credit utilization at least 90 days before you apply to present the strongest financial profile.

- Down Payments are Risk-Mitigators: Putting 10-20% down can turn a "No" into a "Yes" by lowering the lender's exposure to your income fluctuations.

1. Understanding the Lender's Perspective: Risk vs. Reality

To master the car loan process, you first have to understand the person on the other side of the desk. Lenders are not trying to be difficult; they are trying to predict the future. They want to know that if you have a slow week or if your car breaks down, you will still be able to make your monthly payment. For a T4 employee, this is easy to predict because their paycheque is the same every two weeks. For you, it's more complex.

Why Gig Work is Flagged as 'High Risk'

Lenders worry about income volatility. If you're a ride-share driver, your income depends on demand, weather, and your health. There are no paid sick days or employer-sponsored benefits. If you don't work, you don't get paid. This lack of a "safety net" is what makes traditional lenders nervous. Furthermore, the high mileage typically associated with gig work means the vehicle (the collateral for the loan) depreciates faster than a standard personal-use vehicle.

The 'Stability' Metric

Lenders use a specific formula to calculate your "Average Monthly Income." Generally, they will take your last two years of tax returns, add them together, and divide by 24. This provides a smoothed-out average. However, the gig economy moves faster than tax seasons. If you've only been doing this for 8 months but you're consistently hitting $5,000 a month, a specialized lender will look at your bank deposits rather than just your previous year's tax return. They look for "consistent deposits"-the rhythm of your income matters as much as the total amount.

2. Pre-Approval Preparation: Gathering Your 'Secret' Weaponry

The biggest mistake gig workers make is walking into a dealership and saying, "I make about $4,000 a month." In the world of finance, if it isn't on paper, it didn't happen. You need to build a "Loan Bible"-a folder of documents that proves you are a reliable borrower.

The Notice of Assessment (NOA) & T2125

Your NOA is the gold standard. It's the official document from the Canada Revenue Agency (CRA) that confirms your income. But for gig workers, the T2125 form (Statement of Business or Professional Activities) is equally important. This form shows your gross income before you started taking off expenses for gas, maintenance, and home office costs. Some specialized lenders will "add back" certain expenses like depreciation to give you a higher qualifying income.

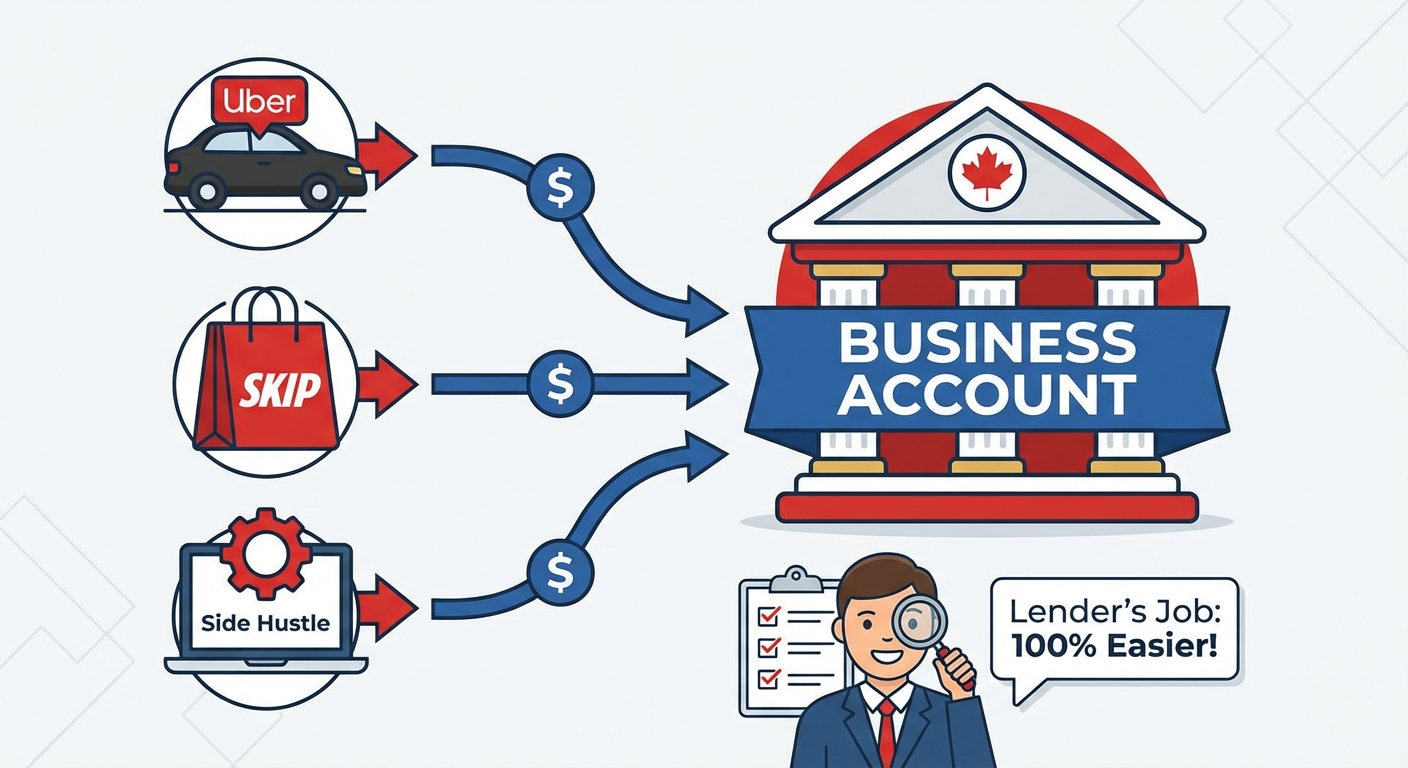

Bank Statements: The 6-Month Deep Dive

Lenders want to see your "Gross Deposits." They aren't just looking at the final balance at the end of the month; they are looking at the total amount of money flowing into your account. If you use multiple apps (Uber, Skip, and a side hustle), try to have all those payments deposit into one single "Business" account. This makes the lender's job 100% easier because they can see one clear stream of income.

Proof of Platform Activity

Don't rely solely on bank statements. Export your annual and monthly earnings reports directly from your gig platforms. These reports often break down your "Active Hours" versus "Online Hours," which proves to a lender that you are working consistently. It shows that your income isn't just a fluke; it's the result of a structured work schedule.

3. The Credit Score Strategy for Freelancers

Your credit score is the gatekeeper, but for gig workers, how you manage that score is different. Many freelancers use personal credit cards to fund business expenses-buying gas, paying for repairs, or upgrading equipment. This can lead to a "High Utilization" trap.

Credit Utilization in the Gig World

Even if you pay your balance in full every single month, if your credit card statement closes while you have a high balance (e.g., $4,000 on a $5,000 limit), your credit score will drop. Lenders see high utilization as a sign of financial stress. To a computer algorithm, it looks like you are living off credit because your gig income isn't enough.

Rapid Score Repair Before Applying

In the 60 days leading up to your car loan application, aim to keep your credit card balances below 30% of their limit. If you have a $10,000 limit, never let the reported balance exceed $3,000. This simple move can jump your score by 20 to 50 points almost overnight, potentially moving you from a "Subprime" interest rate to a "Near-Prime" rate, saving you thousands of dollars over the life of the loan.

| Credit Score Range | Likely Approval Status | Estimated Interest Rate (APR) | Typical Requirements |

|---|---|---|---|

| 750+ (Excellent) | Instant Approval | 5.9% - 8.9% | Minimal documentation needed. |

| 650 - 749 (Good) | High Approval Rate | 9.0% - 14.9% | Standard NOA and bank statements. |

| 550 - 649 (Fair) | Specialized Approval | 15.0% - 22.9% | Proof of 6+ months income, 10% down. |

| Below 550 (Poor) | Alternative Lenders | 23% + | Significant down payment or co-signer. |

4. Navigating the Tax Write-Off Paradox

This is the single biggest hurdle for self-employed Canadians. As a gig worker, you are encouraged to write off everything: every kilometre driven, every car wash, a portion of your cell phone bill, and even your home office. This is great for reducing the amount of tax you owe to the CRA. However, it creates a paradox when you want a loan.

The Conflict Between Tax Savings and Loan Approval

If you earned $60,000 last year but wrote off $35,000 in expenses, your "Net Income" on your tax return is only $25,000. When a traditional bank looks at your application, they see a person making $2,083 a month. If the car payment you want is $500, plus insurance and rent, your Debt-to-Income (DTI) ratio will be too high for approval. They don't care that you "actually" have the cash; they only care what the CRA document says.

Strategies for the Tax Year Prior to Buying

If you know you need a new car next year, you might need to be less aggressive with your write-offs this year. While you will pay slightly more in tax, your higher "Net Income" will qualify you for a much larger loan at a lower interest rate. Alternatively, seek out lenders who perform "Add-Backs."

What are Add-Backs?

Specialized lenders understand that some of your tax deductions aren't "real" cash out of your pocket. The most common is Capital Cost Allowance (CCA) or depreciation. If you wrote off $5,000 for the depreciation of your current vehicle, a specialized lender will often "add that back" to your net income because it's a non-cash expense. This can be the difference between a rejection and an approval.

5. Choosing the Right Vehicle for Gig Work

Lenders don't just look at you; they look at the car. For a gig worker, the car is the "tool of the trade." If the tool breaks, the income stops. This makes the vehicle choice a critical part of the risk assessment.

Reliability vs. Luxury

You might want that 10-year-old BMW because it looks great, but a lender will see it as a liability. Older luxury cars have high maintenance costs and a higher chance of mechanical failure. For gig workers, lenders prefer newer (under 5 years old), low-mileage vehicles with a reputation for reliability-think Toyota Corolla, Honda Civic, or Hyundai Elantra. These vehicles hold their value and are less likely to leave you stranded and unable to earn.

The Commercial Use Clause

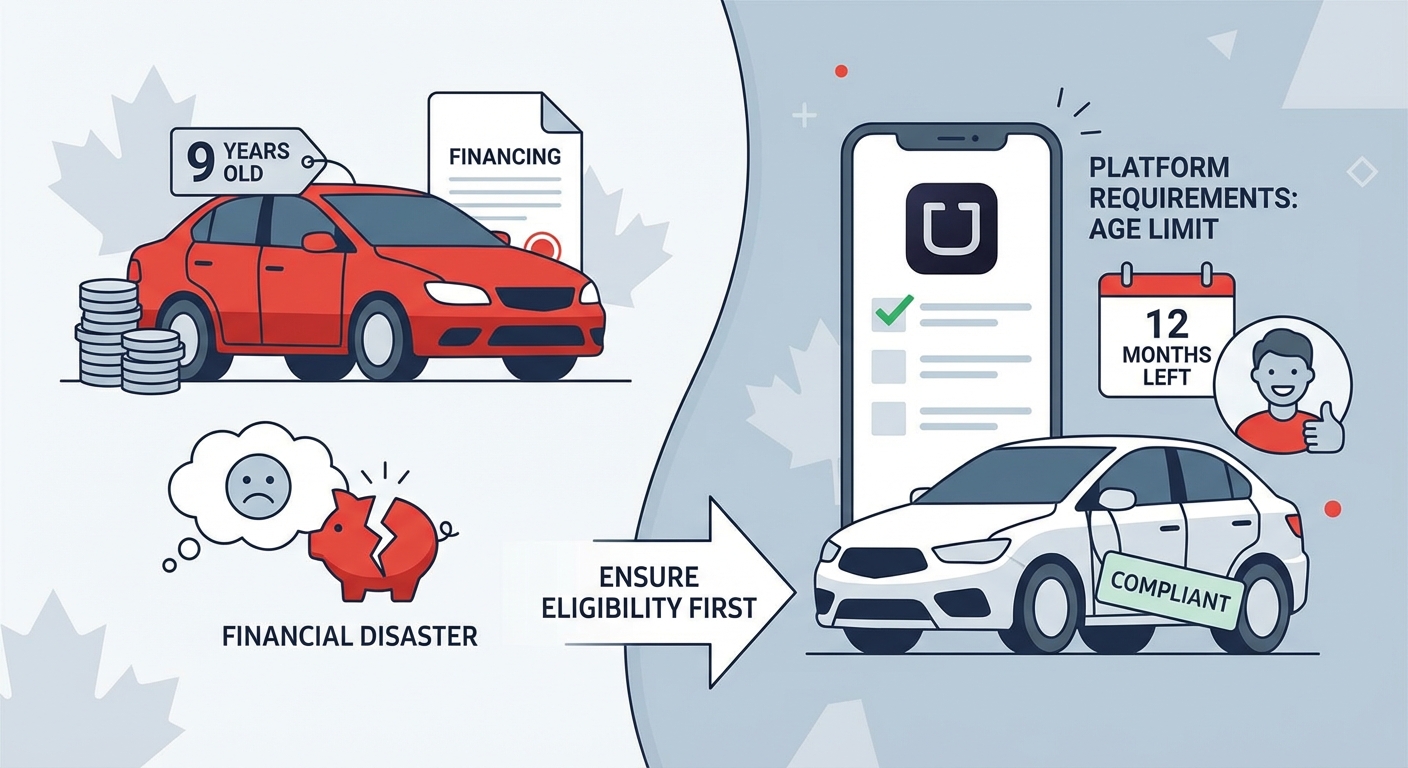

If you are using the car for Uber or delivery, you must be honest with the lender. Most standard personal car loans have clauses against "commercial use." However, many specialized lenders now have "Gig-Friendly" loan products specifically designed for this. Furthermore, ensure the vehicle meets the platform's requirements. Uber, for example, has strict rules about the age of the vehicle. Financing a car that is 9 years old only to find out it will be ineligible for the platform in 12 months is a financial disaster.

6. Finding the Right Lender: Beyond the Big Banks

If you have a 10-year history with a major bank and a perfect credit score, by all means, start there. But for 90% of gig workers, the "Big Five" are a dead end. Their systems are automated and don't have the nuance to handle "unstated" or "fluctuating" income.

Specialized Auto Finance Companies

Dealerships like SkipCarDealer specialize in what we call "Non-Prime" or "Alternative" lending. These dealerships have relationships with dozens of lenders who specifically look for self-employed and gig worker applications. They have the leverage to call an underwriter and explain your specific situation-something a computer algorithm can't do.

Credit Unions: The Local Advantage

Credit unions are member-owned and often more flexible than national banks. They take a more holistic view of your financial health. If you can show them that you are a hard-working member of the community with a clear plan for your gig business, they are often more willing to manually override a strict income requirement.

In-House Financing (Buy Here, Pay Here)

This should be your last resort. In-house financing is when the dealership itself lends you the money. While it's almost a guaranteed approval, the interest rates are very high, and many of these lenders do not report your on-time payments to Equifax or TransUnion. If they don't report, your car loan won't help you build your credit for the future.

7. The Power of the Down Payment and Co-Signers

If your income proof is a bit shaky or your credit is in the "Fair" range, you have two powerful levers to pull: Cash and People.

Lowering the Loan-to-Value (LTV) Ratio

The LTV ratio is the amount of the loan compared to the value of the car. If you are buying a $20,000 car and you put $0 down, the LTV is 100%. If you put $4,000 down, the LTV drops to 80%. This significantly reduces the lender's risk. If you default, they only need to sell the car for 80% of its value to get their money back. For gig workers, a 15% down payment is often the "magic number" that triggers an approval on a file that was previously on the fence.

The Strategic Co-Signer

A co-signer is someone with a stable T4 income and a good credit score who agrees to take responsibility for the loan if you stop paying. This "borrows" their credibility. It is a massive favor to ask, as it affects their debt capacity and credit score, but for a new gig worker with only 3 months of history, it might be the only way to get a reasonable interest rate. Ensure you have a written agreement with your co-signer and a plan to refinance the loan in your name only after 12-18 months of consistent payments.

8. Insurance Secrets for Gig Workers in Canada

You've got the approval, you've got the car, but there is one more hurdle: Insurance. Most Canadians don't realize that a standard personal auto insurance policy does NOT cover you while you are "on the clock" for a gig platform.

The Gap Insurance Necessity

Because gig workers drive more than the average person, the risk of an accident is statistically higher. If your car is totaled, the insurance company will only pay the "Actual Cash Value." If you have a high-interest loan or put very little money down, you might owe $20,000 on a car that the insurance company says is only worth $15,000. Gap Insurance covers that $5,000 difference. For gig workers, this is not an "extra"-it is a necessity.

Commercial Endorsements

In provinces like Ontario, Alberta, and BC, insurance companies now offer "Rideshare Endorsements." This is an add-on to your personal policy that covers you during the "Period 1" of gig work (when the app is on, but you haven't accepted a fare yet). Without this, if you have an accident while waiting for a SkipTheDishes order, your insurance company could deny the claim and cancel your policy for misrepresentation. Always be transparent with your insurer about your gig work.

9. Step-by-Step: The Gig Worker's Path to Purchase

- Step 1: Audit Your Paperwork. Download your last two years of NOAs and your most recent T2125. If you haven't filed taxes yet, gather 12 months of bank statements.

- Step 2: Clean Up Your DTI. Pay off small credit card balances and close any unused lines of credit that might look like potential debt to a lender.

- Step 3: Calculate Your Real Budget. Don't just look at the monthly payment. Factor in the increased cost of commercial insurance, fuel, and a "Maintenance Fund" (essential for gig workers).

- Step 4: Get Pre-Qualified. Use a specialized online application to see what you qualify for without a hard credit hit.

- Step 5: Select a Reliable Vehicle. Focus on cars that meet platform requirements for at least the next 3-4 years.

- Step 6: Review the Contract. Ensure there are no "Pre-payment Penalties." As a gig worker, you might have a "flush" month where you want to pay off an extra $1,000 of the principal. Ensure your loan allows this.

10. Frequently Asked Questions (FAQ)

Can I get a car loan with only 3 months of gig work history?

Yes, but it is more challenging. You will likely need a larger down payment (20%+) or a co-signer. Lenders will also look closely at your previous employment history. If you were an accountant for 10 years and now you're a freelance bookkeeper, they see "industry stability" even if the business is new.

What is the minimum credit score for a gig worker car loan in Canada?

There is no hard "minimum," but 500 is generally the floor for specialized lenders. If your score is between 500 and 600, expect higher interest rates and a requirement for a GPS starter-interrupt device to be installed in the vehicle.

Does Uber income count as 'Self-Employed' or 'Business' income?

For the CRA and most lenders, it is considered "Self-Employed Business Income." You are an independent contractor, which means you report your earnings on the T2125 form. Lenders will treat you the same way they treat a plumber or a freelance graphic designer.

Can I finance a car if I haven't filed my taxes yet?

Yes, through "Bank Statement Programs." These lenders look at the average of your last 6-12 months of deposits to estimate your annual income. However, these loans often come with slightly higher interest rates than those backed by a formal NOA.

Are interest rates higher for gig workers?

Not necessarily. If you have a high credit score and a solid down payment, you can get the same rates as a T4 employee. However, because gig work is perceived as higher risk, many gig workers fall into "Risk-Based Pricing" categories where the rate is 2-5% higher than the prime rate.

What happens if my income drops for a month?

This is why having an emergency fund is vital. Most car loans in Canada do not have "flexible" payment options. If you miss a payment, it will damage your credit score immediately. Always aim for a monthly payment that is no more than 10-15% of your *lowest* earning month.

Driving Your Career Forward

The Canadian financial landscape is finally catching up to the reality of the gig economy. While it still requires more preparation and documentation than a traditional job, being a gig worker is no longer a barrier to owning a reliable, high-quality vehicle. By treating your gig work as the professional business it is-complete with organized books, a clean credit profile, and a strategic approach to taxes-you can unlock financing options that were once reserved for the 9-to-5 crowd.

Remember, the goal isn't just to get a car; it's to get a loan that builds your credit and a vehicle that fuels your income. Use the "secrets" in this guide to stop guessing and start driving. Your career is on the move, and your financing should be too.