Edmonton Skip Driver: Urgent Car Loan Approval 2026

Table of Contents

- Key Takeaways

- The Edmonton Skip Driver's Urgent Quest for a Reliable Ride (and Loan)

- The Race Against Time: Why a Car Loan is Critical for New Gig Workers in Edmonton

- Key Takeaways for Your Urgent Edmonton Car Loan Journey

- Decoding 'Urgent Approval' in Edmonton's Auto Finance Landscape: Reality vs. Expectation

- What 'Urgent' Really Means: From Application to Keys in Hand

- The Gig Economy Paradox: Why 'Urgent' is Different for Skip Drivers

- Your Vehicle, Your Business Partner: Selecting the Right Car for SkipTheDishes in Edmonton

- The Edmonton Commuter's Choice: Fuel Efficiency vs. Upfront Cost

- Beyond the Sticker Price: Maintenance, Insurance, and Depreciation for Gig Work

- The 'Sweet Spot' Car Budget for a New Skip Driver in 2026

- Navigating Loan Avenues: From Traditional Banks to Specialized Lenders for Edmonton's Gig Economy

- Traditional Banks & Credit Unions in Alberta: The Pros and Cons for New Skip Drivers

- Dealership Financing: Speed, Convenience, and the In-House Hook

- Online Lenders and Fintech Solutions: The Promise of Digital Speed for Edmontonians

- Niche Lenders for 'No Credit/Bad Credit': When Vehicle Value is Your Collateral

- The Credit Conundrum: Building Your Financial Footprint as a New Skip Driver in 2026

- Understanding Your Credit Score (or Lack Thereof) and Its Impact on Loan Approval

- Strategies for Building Credit Quickly and Responsibly in Alberta

- Debunking 'No Credit Check' Myths for Car *Purchase* Loans

- Unmasking the True Cost: Interest Rates, Hidden Fees, and the Small Print of Your Urgent Loan

- What Drives Interest Rates for Urgent, Low-Credit Car Loans in Edmonton?

- Beyond APR: Common Hidden Fees and Charges to Watch Out For

- The Power of the Loan Agreement: Your Shield Against Surprises

- Your Fast-Track Application Checklist for Edmonton's Gig Economy

- Essential Documents for a Skip Driver's Urgent Loan Application

- Beyond the Credit Score: What Lenders *Really* Look For in a New Gig Worker

- Streamlining Your Application: Tips for Expedited Processing in Alberta

- Beyond the Loan: Smart Financial Habits for Edmonton's Gig Workers

- Mastering Variable Income: Budgeting for a SkipTheDishes Lifestyle

- The Path to Refinancing: Securing Better Rates Down the Road

- Your Next Steps to Approval: Driving Forward with Confidence in Edmonton

- Recap: Your Action Plan for a Successful Car Loan in 2026

- Empowering Your Journey: From Application to Earning on Edmonton's Streets

- Frequently Asked Questions (FAQ) for Edmonton Skip Drivers Seeking Urgent Car Loans

Are you a new SkipTheDishes driver in Edmonton, staring down the barrel of 2026 with an urgent need for a reliable vehicle? You're not alone. The gig economy offers incredible flexibility, but it also presents unique challenges when it comes to securing essential tools like a car. Traditional lending institutions often struggle to understand the variable income and limited credit history common among new gig workers.

At SkipCarDealer.com, we understand your unique situation. We specialize in helping Edmonton's dedicated Skip drivers get on the road quickly and confidently. This comprehensive guide will walk you through every step of securing an urgent car loan in 2026, from understanding your options to driving away in your new earning machine.

Key Takeaways

- Urgency Meets Reality: While 'urgent approval' is possible, it typically means rapid pre-approval with final funding taking a few business days.

- Your Income Story Matters: Even as a new Skip driver, prepare to present your potential earnings and contract details to demonstrate repayment capacity.

- Vehicle Selection is Key: Opt for fuel-efficient, reliable models (e.g., Honda Civic, Toyota Corolla) to minimize operational costs in Edmonton.

- Explore Specialized Lenders: Traditional banks may be tough; dealerships and online lenders specializing in varied credit profiles often offer faster, more flexible solutions for gig workers.

- Understand the True Cost: Always scrutinize interest rates (which can be higher for new gig workers) and hidden fees. Don't be afraid to compare offers.

- Build Credit Responsibly: Your first car loan can be a powerful tool for establishing or rebuilding your credit history, leading to better rates in the future.

The Edmonton Skip Driver's Urgent Quest for a Reliable Ride (and Loan)

For a new SkipTheDishes driver in Edmonton, an urgent car loan approval means getting the necessary vehicle to start earning income without significant delays, typically aiming for pre-approval within hours and funding within 1-3 business days, depending on documentation and lender. This is crucial for leveraging the immediate opportunities of the gig economy in 2026.

The Race Against Time: Why a Car Loan is Critical for New Gig Workers in Edmonton

Imagine this: you've just signed up for SkipTheDishes in Edmonton, the app is buzzing with potential orders, and you're eager to start earning. But there's a catch – your current vehicle isn't reliable enough, or perhaps you don't have one at all. This isn't just an inconvenience; it's a direct barrier to income. For new gig workers, a reliable vehicle isn't a luxury; it's the primary tool of your trade.

The urgency stems from the immediate earning potential. Every day without a car is a day of lost income. Edmonton's sprawling layout, from the busy downtown core to the residential suburbs, demands a dependable vehicle for efficient food delivery. Public transit simply isn't a viable option for most Skip drivers, given the time sensitivity and package volume.

Traditional lending often falls short for new drivers because conventional metrics like a long-standing employment history or a robust credit score are often absent. You're building your career, and your financial footprint is still forming. This creates a unique pressure, but also an opportunity for specialized lenders who understand the gig economy's dynamics in 2026.

Key Takeaways for Your Urgent Edmonton Car Loan Journey

Navigating the world of car loans as a new Skip driver, especially when time is of the essence, requires a strategic approach. Here’s a concise summary of the most crucial advice to keep in mind:

- Be Realistic About Timelines: While pre-approval can be fast, final funding involves verification. Expect 1-3 business days.

- Prepare Your Financial Story: Gather all documents, even if your Skip income is prospective. Lenders want to see your plan.

- Focus on Affordability: Don't overextend. Choose a vehicle and loan terms that fit a variable income model.

- Prioritize Reliability: Your car is your business partner. Durability and fuel efficiency are paramount for Edmonton deliveries.

- Compare Lenders Diligently: Don't settle for the first offer. Specialized lenders are often more accommodating to gig workers.

- Understand All Costs: Beyond the monthly payment, factor in insurance, maintenance, and fuel to avoid surprises.

- Leverage the Loan to Build Credit: A successful car loan can be your stepping stone to a stronger financial future.

Decoding 'Urgent Approval' in Edmonton's Auto Finance Landscape: Reality vs. Expectation

What 'Urgent' Really Means: From Application to Keys in Hand

When you hear "urgent approval" or "fast car loan" in the Edmonton market, it's crucial to understand what that truly entails. It rarely means you'll be driving off the lot within an hour of your first inquiry. Instead, 'urgent' typically refers to the speed of the initial pre-approval process. Many online lenders and dealerships can provide a pre-approval decision within minutes or hours, especially during business hours.

This pre-approval is a conditional offer, based on the information you've provided. The real work begins after this. Final funding and getting the keys in your hand depend on several factors:

- Document Verification: Lenders need to verify your identity, income, and residency. This involves reviewing bank statements, ID, and any SkipTheDishes contracts.

- Credit Check: Even for 'no credit' loans, a background check is usually performed.

- Vehicle Selection: The car you choose must meet the lender's criteria for age, mileage, and value.

- Signing Paperwork: The loan agreement needs to be thoroughly reviewed and signed.

For a new Skip driver in Edmonton, a realistic timeline from application to driving away could be anywhere from 24 hours to 3-5 business days, assuming all your documents are in order and you've selected a suitable vehicle. Factors that can genuinely speed up the process include having a clear down payment ready, presenting comprehensive income proof, and working with a lender or dealership experienced with gig economy workers.

The Gig Economy Paradox: Why 'Urgent' is Different for Skip Drivers

The gig economy, by its very nature, creates a paradox for traditional lending. You need a car to earn, but you need proof of income and credit history to get a car loan. New SkipTheDishes drivers in Edmonton often face several specific challenges:

- Lack of Established Credit: Many new drivers are young or new to Canada, meaning they have a 'thin' credit file or no credit history at all.

- Variable Income: SkipTheDishes earnings fluctuate based on demand, hours worked, and tips. Lenders prefer stable, predictable income.

- Employment Status: As independent contractors, Skip drivers don't have traditional pay stubs or T4s, which are standard for loan applications.

- Immediate Need: The pressure to start earning means there's little time to build credit gradually before seeking a loan.

Lenders perceive this profile as higher risk. To mitigate this, they often require more documentation, may offer higher interest rates, or might suggest options like a co-signer or a larger down payment. The 'urgent' aspect for Skip drivers isn't just about speed; it's about finding a lender willing to look beyond traditional metrics and understand the future earning potential.

Your Vehicle, Your Business Partner: Selecting the Right Car for SkipTheDishes in Edmonton

The Edmonton Commuter's Choice: Fuel Efficiency vs. Upfront Cost

For a Skip driver in Edmonton, your car isn't just transportation; it's your primary income-generating asset. Choosing the right vehicle strikes a delicate balance between upfront cost and ongoing operational expenses. Fuel efficiency is paramount, especially with fluctuating gas prices in Alberta. You'll be covering many kilometres daily, so every litre counts.

Consider these popular and efficient choices common in Alberta:

- Compact Sedans: Honda Civic, Toyota Corolla, Mazda 3. These are renowned for their reliability, excellent fuel economy (often 6-8 L/100km city), and lower maintenance costs. They handle Edmonton's city driving well and are generally affordable to insure.

- Hybrid Vehicles: Toyota Prius, Hyundai Elantra Hybrid, Honda Insight. While the upfront cost might be slightly higher, the fuel savings (often 4-5 L/100km city) can be substantial over time, especially with the stop-and-go nature of delivery work.

- Small SUVs: Honda HR-V, Mazda CX-3, Hyundai Kona. These offer a bit more cargo space for larger orders or multiple deliveries and can handle Edmonton's diverse weather conditions, including snow, with greater ease. Fuel economy is generally good, though slightly less than compacts.

Newer used models (3-5 years old) often offer the best value, having depreciated from their new price but still retaining many years of reliable service. Avoid older, higher-mileage vehicles unless you have a robust emergency fund for unexpected repairs.

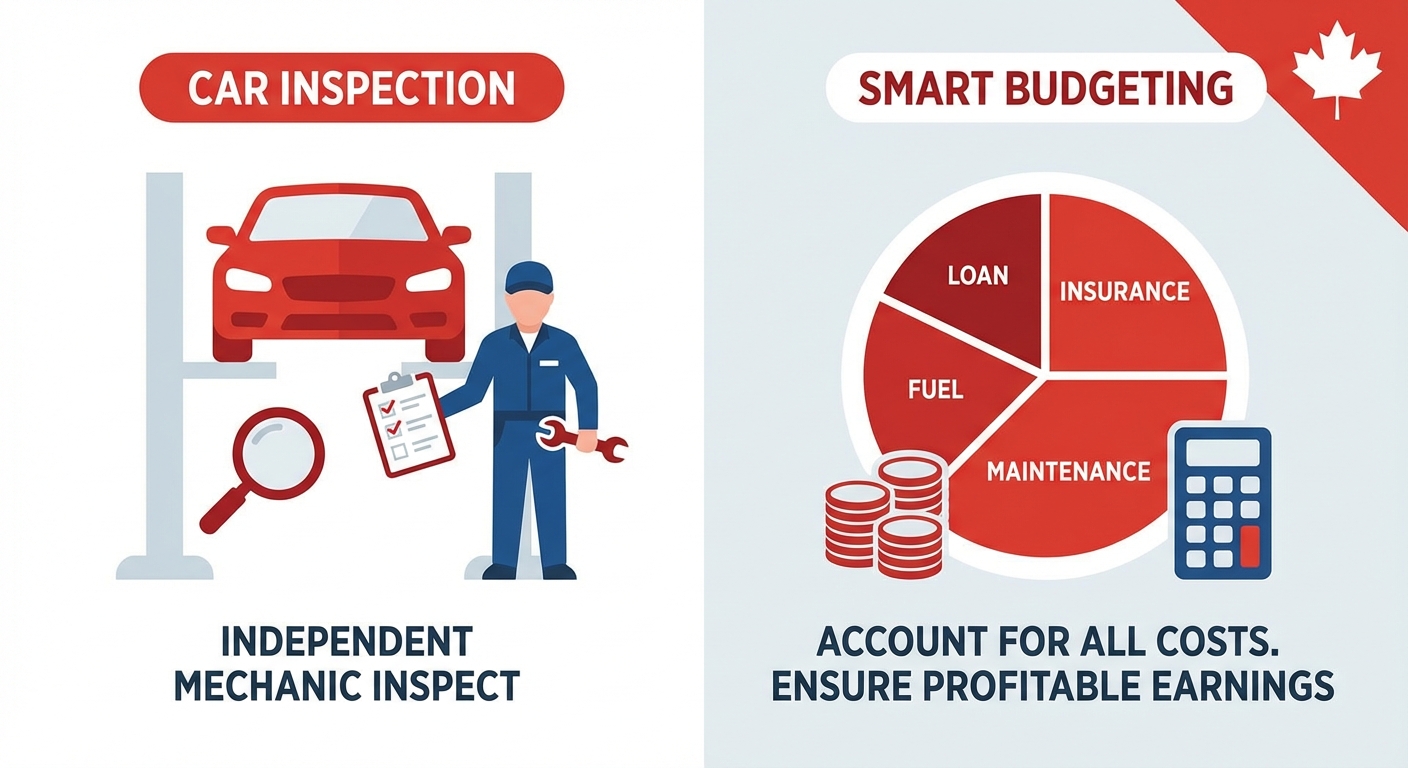

Beyond the Sticker Price: Maintenance, Insurance, and Depreciation for Gig Work

The sticker price of a car is just the beginning of its total cost. For a Skip driver, understanding these additional expenses is critical to maintaining profitability:

- Maintenance: Delivering food puts extra wear and tear on a vehicle. Expect more frequent oil changes (every 5,000-8,000 km), tire rotations, brake pad replacements, and other routine maintenance. Edmonton's cold winters can also accelerate wear on certain components. Budget at least $1,500-$2,500 annually for maintenance, especially for a used vehicle.

- Insurance: This is a major consideration. Standard personal auto insurance policies do NOT cover commercial use, even part-time gig work. You MUST inform your insurer that you're using the vehicle for SkipTheDishes. Failing to do so could result in denied claims. Many insurers offer specific "rideshare" or "gig economy" endorsements, but these will increase your premiums. Expect to pay anywhere from 15-30% more than a standard personal policy, depending on your driving record and the vehicle.

- Depreciation: Vehicles lose value over time, especially with high mileage. As a Skip driver, you'll accumulate kilometres faster than the average driver, accelerating depreciation. This impacts your vehicle's resale value and the equity you build (or don't build) in it. Choose a vehicle known for holding its value well, like a Honda or Toyota, to mitigate this.

When calculating your budget, don't just look at the monthly loan payment. Factor in these operational costs, fuel, and insurance to get a true picture of affordability. Overlooking these can quickly turn a profitable gig into a financial drain.

The 'Sweet Spot' Car Budget for a New Skip Driver in 2026

Determining a realistic car budget as a new Skip driver in 2026 is about balancing your immediate needs with your potential earnings, without overextending your finances. Overly expensive cars lead to high payments, insurance, and fuel costs that eat into your profits.

A good rule of thumb is to aim for a vehicle in the $10,000 to $20,000 range. This bracket typically offers a solid selection of reliable, fuel-efficient used sedans and small SUVs that are perfect for delivery work. For example:

| Vehicle Price | Interest Rate (Subprime) | Loan Term | Estimated Monthly Payment |

|---|---|---|---|

| $15,000 | 24.99% | 60 months | ~$440-$480 |

| $18,000 | 24.99% | 60 months | ~$520-$570 |

| $20,000 | 24.99% | 72 months | ~$510-$550 |

(Note: These are estimates for illustrative purposes in 2026, assuming minimal down payment and common subprime rates for new gig workers. Actual payments will vary based on credit, specific lender, and fees.)

What to look for:

- Used over New: Used cars have already taken the biggest depreciation hit. A 3-5 year old vehicle is often the smartest choice.

- Low Mileage for Age: Aim for a vehicle with lower than average kilometres for its age (e.g., less than 20,000 km/year).

- Clean History: Always get a vehicle history report (CarFax or CarProof) to check for accidents, liens, or flood damage.

- Pre-Purchase Inspection: If buying privately or from a non-certified dealer, have an independent mechanic inspect the car.

Setting a budget that accounts for all costs – loan payments, insurance, fuel, and maintenance – ensures your Skip earnings remain profitable and sustainable.

Navigating Loan Avenues: From Traditional Banks to Specialized Lenders for Edmonton's Gig Economy

Traditional Banks & Credit Unions in Alberta: The Pros and Cons for New Skip Drivers

Major banks like RBC, TD, BMO, and Scotiabank, along with Alberta-based credit unions such as ATB Financial and Servus Credit Union, are often the first thought for car loans. They typically offer the most competitive interest rates for borrowers with excellent credit histories and stable, verifiable income. However, for a new SkipTheDishes driver in Edmonton, they often present significant hurdles.

Pros:

- Lower Interest Rates: If you *do* qualify, rates are generally much lower than subprime options (e.g., 6.99% - 8.99% for prime borrowers in 2026).

- Reputable Institutions: Established and trustworthy.

- Flexible Payment Options: Often offer various payment frequencies.

Cons for New Skip Drivers:

- Higher Credit Score Thresholds: Typically require a minimum credit score of 650-700+. New gig workers often have little to no credit.

- Strict Income Verification: They prefer traditional pay stubs, T4s, and consistent employment history, which gig workers lack.

- Less Flexibility: Less likely to adapt to variable income models or new business ventures.

- Longer Approval Times: Can take longer to process applications, which isn't ideal for 'urgent' needs.

A traditional bank or credit union might be an option if you have a strong co-signer with excellent credit and stable income, or if you've been a Skip driver for over a year with consistent, well-documented earnings. For most new drivers, these avenues can be challenging.

Dealership Financing: Speed, Convenience, and the In-House Hook

Dealership financing is a popular choice for many car buyers, offering a 'one-stop shop' experience where you can select a vehicle and arrange financing simultaneously. Many Edmonton dealerships work with a network of lenders, including prime banks, subprime lenders, and even their own in-house financing.

Benefits:

- Speed and Convenience: Often the fastest way to get approved, sometimes even on the same day. The finance manager handles the application process with multiple lenders.

- Access to Multiple Lenders: Dealerships can submit your application to various banks and specialized lenders, increasing your chances of approval, even with limited credit.

- Special Programs: Some dealerships have programs for new Canadians, first-time buyers, or those with less-than-perfect credit.

Considerations:

- 'Buy Here Pay Here' (BHPH): Some dealerships, particularly those specializing in bad credit, offer 'Buy Here Pay Here' financing. These are in-house loans where the dealership is the lender. They can offer very fast approval and cater to almost any credit situation, but often come with significantly higher interest rates (e.g., 29.9% APR or more in 2026) and shorter loan terms.

- Pressure to Purchase: You might feel pressured to accept less favourable terms or a vehicle you didn't initially want due to the convenience factor.

- Limited Comparison: While they work with multiple lenders, you might not see *all* available options or get the best possible rate without independent comparison.

For urgent needs, dealership financing can be effective, but be prepared to scrutinize the terms, especially if you're directed to a BHPH option.

Online Lenders and Fintech Solutions: The Promise of Digital Speed for Edmontonians

The rise of online lenders and fintech companies has revolutionized car financing, offering quick, digital-first solutions that often cater to a broader range of credit profiles, including new gig workers in Edmonton.

Advantages:

- Rapid Application & Pre-Approval: Many platforms boast approval in minutes, with fully online processes. This is ideal for 'urgent' needs.

- Flexible Underwriting: Often more willing to consider alternative income sources, like SkipTheDishes earnings, or look beyond traditional credit scores.

- Convenience: Apply from anywhere, anytime, using your phone or computer.

- Comparison Shopping: Some platforms act as brokers, allowing you to compare offers from multiple lenders with a single application.

Things to Watch For:

- Reputation: Not all online lenders are created equal. Research reviews and ensure they are reputable and licensed in Alberta. Avoid predatory lenders with exorbitant fees or misleading terms.

- Interest Rates: While often more accessible, rates for those with limited credit can still be high (e.g., 19.99% - 29.99% in 2026).

- Data Security: Ensure the platform uses secure encryption to protect your personal information.

For an Edmonton Skip driver seeking urgent approval, online lenders can be a powerful tool, providing speed and accessibility that traditional banks often cannot match for this specific demographic. Companies like SkipCarDealer.com fall into this category, leveraging technology to connect you with suitable lenders.

Niche Lenders for 'No Credit/Bad Credit': When Vehicle Value is Your Collateral

When traditional avenues are closed, specialized lenders step in to serve individuals with poor, limited, or no credit history. These lenders understand that life happens, and they focus on your ability to repay now, rather than just your past financial footprint. In many cases, the vehicle itself serves as collateral for the loan.

How They Work:

- Secured Loans: The car acts as collateral, reducing the lender's risk. If you default, the car can be repossessed.

- Focus on Current Income: While your credit history is considered, these lenders place greater emphasis on your current income (even if variable from SkipTheDishes) and stability (residency, bank account history).

- Lease-to-Own Programs: Some offer lease-to-own options, which can be an alternative to a traditional loan, though often with different terms and conditions.

Key Distinctions:

- Unlike 'car repair' loans offered by competitors like Driver Capital (which focus on smaller, short-term repair financing), these niche lenders provide financing for the purchase of a vehicle.

- Interest rates will be significantly higher than prime rates, typically ranging from 19.99% to 29.99% or more, reflecting the increased risk.

- They often require a down payment, though some may offer $0 down options (often at even higher rates). For more information on securing a car loan without a down payment, read our article Down Payment? We Prefer 'Empty Wallet' Car Loans for Gig Workers, Ontario.

These specialized lenders are crucial for new Skip drivers who need a vehicle urgently but don't fit the mold for conventional financing. They are designed to get you approved and on the road, even if your credit history isn't perfect. For residents of Alberta facing credit challenges, understanding these options is vital. For example, if you've recently gone through a consumer proposal or even bankruptcy, there are still pathways to car ownership. Discover how we can help in Alberta: They See Bankruptcy. We See Your Next Car. Drive Today.

The Credit Conundrum: Building Your Financial Footprint as a New Skip Driver in 2026

Understanding Your Credit Score (or Lack Thereof) and Its Impact on Loan Approval

In Canada, your credit score is a three-digit number, typically ranging from 300 to 900, generated by credit bureaus like Equifax and TransUnion. It's essentially a report card of your financial reliability. Lenders use it to assess the risk of lending you money. A higher score indicates lower risk and usually qualifies you for better interest rates.

For new Skip drivers in Edmonton, the challenge often isn't a bad credit score, but a 'thin' credit file – meaning you have very little or no credit history. Lenders have nothing to base their risk assessment on, which can be just as problematic as bad credit. They can't see if you've paid bills on time, managed credit cards responsibly, or handled previous loans.

A lack of credit history can lead to:

- Higher Interest Rates: Lenders mitigate risk by charging more.

- Larger Down Payment Requirements: To reduce their exposure.

- Requirement for a Co-Signer: Someone with good credit to guarantee the loan.

- Limited Loan Options: Fewer lenders will be willing to approve you.

Understanding where you stand, even if it's at square one, is the first step. You can obtain a free copy of your credit report from Equifax and TransUnion annually to see what lenders see. Even if your credit history is limited, knowing its contents can help you address any discrepancies and understand your starting point. For individuals navigating challenging credit situations like a consumer proposal, it’s important to know that a less-than-perfect credit history doesn't always close the door on car ownership. Our article, Your Consumer Proposal? We Don't Judge Your Drive, offers further insight.

Strategies for Building Credit Quickly and Responsibly in Alberta

Securing an urgent car loan as a new Skip driver is not just about getting a car now; it's also an opportunity to start building a positive credit history for your future. Here are practical steps to establish or improve your credit in Alberta:

- Secured Credit Cards: These require a cash deposit that becomes your credit limit. Use it for small, regular purchases (like gas for Skip deliveries) and pay the balance in full every month. This demonstrates responsible credit use.

- Credit-Builder Loans: Offered by some credit unions or specialized lenders. You make payments into a savings account, which is released to you once the loan is paid off. It's a low-risk way to show payment history.

- Ensure All Bills Are Paid on Time: This includes rent, utilities, and phone bills. While not all report to credit bureaus, late payments can still appear on your record if sent to collections.

- Co-Signer: If you have a trusted friend or family member with good credit, they can co-sign your car loan. This significantly increases your chances of approval and can help you get a better rate. However, remember they are equally responsible for the debt if you can't pay.

- Keep Old Accounts Open: If you have any old credit accounts, even if unused, keeping them open can contribute to a longer credit history, which is positive.

The car loan itself, if managed responsibly with on-time payments, will be one of the most significant contributors to building your credit score. This loan could be your first major step towards financial stability in 2026 and beyond.

Debunking 'No Credit Check' Myths for Car *Purchase* Loans

The term "no credit check" often floats around in the lending world, but it's crucial to distinguish between different types of loans. For significant purchases like a car, a genuine "no credit check" loan is rare and often comes with substantial trade-offs.

The Reality:

- For Car Purchases: Most legitimate lenders offering car purchase financing will perform some form of credit assessment. This doesn't always mean a hard inquiry on your traditional credit score, but they will look at other factors.

- Alternative Data: Some specialized lenders will use alternative data points. This could include your bank account history (to see consistent deposits and no overdrafts), stability of residency, and employment history (even if it's gig work).

- Secured Loans: In 'no credit check' scenarios for car purchases, the loan is almost always secured by the vehicle itself. The lender's primary security is their ability to repossess the car if you default, not your credit history.

- Lease-to-Own: Some lease-to-own programs might advertise "no credit check," but they often involve higher weekly payments, a balloon payment at the end, and you don't own the vehicle until all terms are met. The total cost can be significantly higher.

Be wary of any lender promising a car loan with absolutely no credit check for a purchase, as these usually come with extremely high interest rates, hidden fees, or predatory terms. Instead, focus on lenders who are willing to look beyond your credit score and consider your full financial picture as a new Skip driver in Edmonton.

Unmasking the True Cost: Interest Rates, Hidden Fees, and the Small Print of Your Urgent Loan

What Drives Interest Rates for Urgent, Low-Credit Car Loans in Edmonton?

When seeking an urgent car loan with limited or no credit history as a new Skip driver in Edmonton, understanding the factors that influence your interest rate is paramount. These rates will invariably be higher than those offered to prime borrowers, reflecting the increased risk perceived by lenders.

Key drivers include:

- Credit History/Score: The most significant factor. Low or no credit history indicates higher risk, leading to higher rates.

- Income Stability & Source: Variable income from SkipTheDishes is seen as riskier than a stable salaried job. Lenders need confidence in your ability to make consistent payments.

- Down Payment Size: A larger down payment reduces the loan amount and the lender's risk, often resulting in a lower interest rate.

- Loan Term: Longer loan terms (e.g., 72 or 84 months) often come with slightly higher rates, as the lender's money is tied up for longer.

- Vehicle Type & Age: Older, higher-mileage, or less reliable vehicles are riskier collateral, potentially leading to higher rates. Newer, more reliable vehicles might qualify for slightly better terms.

- Lender Type: Specialized lenders for bad credit will naturally have higher rates than prime banks.

For new Skip drivers with limited credit in 2026, expect interest rates to typically range from 19.99% to 29.99% or even higher, depending on your unique situation. While these rates seem high, they are often the gateway to establishing credit and getting on the road to earn income.

| Credit Profile | Typical Interest Rate Range (2026) | Impact on $15,000 Loan (60 months) |

|---|---|---|

| Excellent (750+) | 6.99% - 8.99% | ~$300 - $320 / month |

| Good (680-749) | 9.99% - 14.99% | ~$340 - $370 / month |

| Limited/Bad (Under 600) | 19.99% - 29.99% | ~$440 - $520 / month |

(Note: These are illustrative figures for the Edmonton market in 2026. Actual rates and payments will vary.)

Beyond APR: Common Hidden Fees and Charges to Watch Out For

The interest rate (APR) is crucial, but it's not the only cost. Car loans, especially those for urgent or subprime borrowers, can come with a variety of fees that inflate the total price. Be vigilant and ask for a full breakdown of all charges before signing.

- Administration Fees: Often charged by dealerships or lenders for processing paperwork. Can range from $299 to $499.

- Documentation Fees: Separate from admin fees, covering the cost of preparing loan documents. Typically $100 to $300.

- Lien Registration Fees (PPSA): A provincial fee to register the lender's lien on the vehicle. Usually $40-$80 in Alberta.

- Extended Warranty Push: Salespeople might strongly encourage purchasing an extended warranty. While sometimes beneficial, it significantly adds to your loan principal and interest. Only consider if it genuinely offers value for your specific vehicle.

- Loan Protection Insurance: Optional insurance that covers your payments in case of critical illness, job loss, or death. While it offers peace of mind, it's often expensive and can be added to your loan, increasing the total interest paid.

- Late Payment Penalties: Understand the fees and interest hikes associated with missed or late payments. These can quickly spiral if you're not careful.

Always ask for a detailed breakdown of the "out-the-door" price, including all fees, before you commit. A reputable lender will be transparent about these costs.

The Power of the Loan Agreement: Your Shield Against Surprises

Even when you're under pressure for urgent approval, the loan agreement is your most important document. It's a legally binding contract, and once you sign it, you're bound by its terms. Rushing through it is a recipe for financial regret.

What to scrutinize, even when in a hurry:

- Total Loan Amount: Does this match the agreed-upon vehicle price plus all fees?

- Interest Rate (APR): Is it clearly stated and what you expected?

- Loan Term: How many months? Longer terms mean lower monthly payments but more interest paid overall.

- Total Cost of Borrowing: This is the sum of all interest and fees over the life of the loan. It gives you the true cost of the financing.

- Payment Schedule: Dates, amounts, and frequency of payments.

- Prepayment Penalties: Can you pay off the loan early without penalty? This is important if you plan to refinance later.

- All Fees: Ensure every fee discussed (or not discussed) is itemized and makes sense.

- Cancellation Clauses: What happens if you need to cancel or return the vehicle?

If anything is unclear, ask for clarification. Don't be afraid to take a photo of the document and send it to a trusted friend or family member for a second pair of eyes. A few extra minutes of careful review can prevent years of financial headaches.

Your Fast-Track Application Checklist for Edmonton's Gig Economy

Essential Documents for a Skip Driver's Urgent Loan Application

Preparedness is key to fast-tracking your loan approval. Having all your documents organized and ready will significantly cut down on processing time. For a new Skip driver in Edmonton in 2026, lenders will want a clear picture of your identity, residency, and potential to earn.

Here’s a comprehensive checklist:

- Government-Issued ID: Valid driver's license (essential for driving for Skip) and/or passport, PR card.

- Proof of Edmonton Residency: Utility bill (power, gas, internet), rental agreement, or mortgage statement. Must show your current address.

- Proof of Income (or potential income):

- SkipTheDishes Contract/Onboarding Documents: Show you've been approved to work as a contractor.

- Bank Statements (3-6 months): To show consistent deposits, financial stability, and no frequent overdrafts. Even if your Skip earnings haven't started, this shows your overall financial habits.

- Any Existing Income Proof: If you have another part-time job or benefits (e.g., Canada Child Benefit, AISH, EI), provide statements. For more on how alternative income can qualify you for a loan, see Your Government Cheque Just Rewrote Your Car Loan, Seriously, Vancouver.

- Tax Returns (if applicable): If you have previous self-employment income, your T1 Generals can be valuable.

- Proof of Insurance: While you'll get this after vehicle selection, having quotes or understanding the requirements for commercial use is helpful.

- References (if requested): Sometimes required for low-credit applicants.

Organize these into a digital folder or a physical binder. This shows lenders you are serious, organized, and reliable, which helps build trust.

Beyond the Credit Score: What Lenders *Really* Look For in a New Gig Worker

While credit scores are important, especially for those with limited history, specialized lenders understand they don't tell the whole story for new gig workers. They look at a broader picture to assess your overall financial stability and repayment capacity:

- Stability of Residency: A consistent address for a year or more indicates stability. Frequent moves can be a red flag.

- Bank Account History: Lenders scrutinize your bank statements for:

- Consistent Deposits: Even if small, regular deposits show income.

- Avoidance of Overdrafts: Frequent overdrafts suggest poor financial management.

- Bill Payments: Evidence of regular bill payments (rent, phone) on time.

- Existing Debt-to-Income Ratio: Even if your income is low, if your existing debts are also very low, it's a positive sign.

- Clear Plan for Generating Income: Your ability to articulate how you will generate consistent income with SkipTheDishes is crucial. This includes your understanding of peak hours, delivery zones, and projected earnings.

- Down Payment: Having any amount for a down payment, even a small one, demonstrates commitment and reduces the loan-to-value ratio, making you a less risky borrower.

- Communication & Responsiveness: Being prompt and clear in your communication with the lender shows professionalism.

Lenders want to see a responsible individual with a plan, even if the financial history isn't extensive. Presenting yourself professionally and transparently can make a significant difference.

Streamlining Your Application: Tips for Expedited Processing in Alberta

To truly achieve 'urgent' approval, you need to actively work with the lender to expedite the process. Don't just submit and wait. Here's how to speed things up:

- Accurate and Complete Information: Double-check every field on your application. Errors cause delays.

- Clear Communication: Be proactive in asking questions and responsive to any requests for additional information from the lender.

- Be Available: Ensure you can be reached by phone or email during business hours for follow-up questions.

- Have a Down Payment Ready: If you plan to make a down payment, have the funds easily accessible (e.g., in your chequing account). This can significantly speed up the finalization.

- Choose Your Vehicle Quickly: Once approved, narrow down your vehicle choice swiftly. Delays here can hold up the entire process.

- Work with a Specialist: Engaging with a dealership or online broker (like SkipCarDealer.com) that specializes in gig worker financing in Edmonton means they understand your situation and can guide you efficiently.

By being organized, transparent, and responsive, you empower the lender to process your application as quickly as possible, getting you into your Skip vehicle sooner.

Beyond the Loan: Smart Financial Habits for Edmonton's Gig Workers

Mastering Variable Income: Budgeting for a SkipTheDishes Lifestyle

Working for SkipTheDishes means your income will fluctuate. One week might be booming, the next slower. This variability can make traditional budgeting challenging, but it's essential for financial stability, especially with car loan payments. Here’s how to master it:

- Track Everything: Use an app or spreadsheet to meticulously track all your income and expenses. Categorize everything: fuel, maintenance, insurance, loan payment, personal expenses.

- Create a "Minimum Income" Budget: Base your core budget (rent, utilities, car payment) on your lowest expected Skip earnings. Any extra is a bonus.

- Prioritize Fixed Costs: Your car loan payment, insurance, and rent are non-negotiable. Ensure you always have enough set aside for these.

- Build an Emergency Fund: Aim for 3-6 months of essential living expenses. This is crucial for gig workers to cover slow weeks, unexpected car repairs, or illness. Start small, even $50 a week adds up.

- "Pay Yourself First": When you have a good week, immediately set aside money for your fixed costs, savings, and car maintenance fund before spending on discretionary items.

- Separate Business & Personal Finances: Consider a separate bank account for your Skip earnings and expenses. This makes tracking easier and simplifies tax time.

Effective budgeting for variable income ensures you can consistently meet your car loan obligations and build financial resilience, turning your Skip gig into a sustainable income source in Edmonton.

The Path to Refinancing: Securing Better Rates Down the Road

Getting your first car loan as a new Skip driver with limited credit often means accepting a higher interest rate. However, this isn't a life sentence! A successful first loan, combined with improved credit and stable Skip earnings, can open the door to refinancing opportunities for a lower interest rate in the future.

When to consider refinancing:

- After 12-18 Months of On-Time Payments: Consistently making your car loan payments on time is one of the fastest ways to build a positive credit history.

- Improved Credit Score: As your credit score improves (e.g., from 550 to 650+), you become eligible for better rates.

- Stable Skip Earnings: If your SkipTheDishes income has become more consistent and verifiable over time.

- Market Rate Changes: If interest rates generally drop, you might qualify for a better deal.

How to refinance:

- Shop Around: Contact banks, credit unions, and online lenders (including SkipCarDealer.com) to compare refinancing offers.

- Prepare Documentation: You'll need updated income proof, bank statements, and your current loan details.

- Review New Terms: Ensure the new interest rate, monthly payment, and total cost of borrowing are genuinely better. Watch out for new fees that might offset the savings.

Refinancing can significantly reduce your monthly payments and the total interest paid over the life of the loan, freeing up more of your Skip earnings for other financial goals. It's a smart long-term strategy for any gig worker in Edmonton.

Your Next Steps to Approval: Driving Forward with Confidence in Edmonton

Recap: Your Action Plan for a Successful Car Loan in 2026

Securing an urgent car loan as a new SkipTheDishes driver in Edmonton for 2026 is an achievable goal, but it requires a strategic and informed approach. Here's your condensed action plan:

- Understand 'Urgent': It means quick pre-approval, but allow 1-3 business days for final funding and vehicle acquisition.

- Craft Your Income Narrative: Even with new Skip income, prepare to present your potential earnings and a clear plan to lenders.

- Budget Smartly: Choose a fuel-efficient, reliable vehicle (e.g., Honda Civic, Toyota Corolla) in the $10,000-$20,000 range, considering total costs (insurance, maintenance, fuel) beyond just the loan payment.

- Explore All Avenues: Don't rely solely on traditional banks. Actively consider dealerships and specialized online lenders who cater to gig workers and varying credit profiles.

- Be a Savvy Shopper: Compare multiple loan offers, scrutinize interest rates (expect 19.99%-29.99% for limited credit), and meticulously review all fees and the entire loan agreement.

- Build Your Credit: Use this first car loan as a stepping stone. Pay on time, every time, and explore credit-building tools like secured credit cards.

- Prepare Your Documents: Have all government ID, proof of residency, bank statements, and SkipTheDishes onboarding documents ready for swift submission.

By following these steps, you significantly increase your chances of securing the financing you need.

Empowering Your Journey: From Application to Earning on Edmonton's Streets

The road to becoming a successful SkipTheDishes driver in Edmonton starts with a reliable vehicle. At SkipCarDealer.com, we believe that your potential to earn shouldn't be held back by your credit history. We're here to empower you through the process, connecting you with lenders who understand the unique financial landscape of the gig economy in 2026.

Imagine the freedom of hitting Edmonton's streets, knowing your car is dependable, your loan is manageable, and you're actively building a stronger financial future. With careful planning, diligent comparison, and the right lending partner, that vision can become your reality. Don't let the complexities of car financing deter you. Take the first step today, and let us help you get approved and on the road to success.