Your Deliveries Are Your Credit. Get the Car.

Table of Contents

- Key Takeaways

- The Road Less Traveled: Why 'No Credit' Doesn't Mean 'No Car' for Delivery Drivers

- The Delivery Driver's Dilemma

- Challenging the Credit Paradigm

- Your Deliveries ARE Your Credit

- Unlocking Approval: The 'Alternative Data' Advantage for Gig Workers

- Beyond the FICO Score

- Proof of Income: Your Golden Ticket

- Stability Signals

- The Power of the Down Payment

- Navigating the Lender Landscape: Who Will Say 'Yes'?

- Dealership Financing: The Path of Least Resistance?

- Specialized Online Lenders for 'No Credit' Situations

- Credit Unions: The Community Advantage

- The Co-Signer Strategy: A Double-Edged Sword

- Decoding the Numbers: Rates, Terms, and Total Cost of Ownership

- Realistic Expectations for Interest Rates

- The Loan Term Trap

- Hidden Costs and Fees to Watch Out For

- Calculating Your True Monthly Payment

- The Smart Car for the Smart Driver: Vehicle Selection for Maximum ROI

- Reliability Over Luxury

- Used vs. New: Making Your Money Go Further

- Insurance Implications

- Building Your Credit Empire: Using Your First Loan as a Springboard

- The Power of On-Time Payments

- Beyond the Car Loan: Other Credit-Building Strategies

- Monitoring Your Progress

- Your Next Steps to Approval: A Strategic Blueprint

- Step 1: Financial Self-Assessment

- Step 2: Documentation Gathering

- Step 3: Research & Pre-qualification

- Step 4: Prepare for the Application

- Step 5: Negotiate Smart

- Step 6: Maintain Diligence

- FAQ: Your 'No Credit' Car Loan Questions Answered

As a dedicated delivery driver in Canada, you're on the road day in and day out, connecting customers with their orders and keeping the economy moving. Whether it's zipping through city streets for Uber Eats, navigating neighbourhoods for DoorDash, or making crucial drop-offs for SkipTheDishes and Amazon Flex, your vehicle isn't just a mode of transport; it's your office, your lifeline, and your primary tool for earning a living. But what happens when that essential tool needs an upgrade, or you need to replace a vehicle, and you find yourself facing the daunting prospect of securing a car loan with little to no traditional credit history?

It's a common paradox for many self-employed and gig economy workers: you need a reliable car to earn money, but often, the traditional banking system requires a established credit history to get that car. This can feel like a frustrating Catch-22, leaving many talented and hardworking drivers feeling stuck. Here at SkipCarDealer.com, we understand this unique challenge. We believe that your consistent income, your dedication, and your daily deliveries are, in themselves, a powerful form of credit. This guide is designed to empower you with the knowledge and strategies to turn your driving hustle into car loan approval, helping you get the reliable vehicle you need to keep earning and building your financial future.

Key Takeaways

- Your consistent income as a delivery driver is a powerful asset, even without traditional credit history.

- Specialized lenders and dealerships are often more flexible than traditional banks for this niche.

- A strong down payment, proof of stable income, and a solid financial plan significantly boost your approval odds.

- This isn't just about getting a car; it's about using the loan to build a positive credit history.

- Beware of predatory lenders; understand rates, fees, and the total cost of the loan.

The Road Less Traveled: Why 'No Credit' Doesn't Mean 'No Car' for Delivery Drivers

The Delivery Driver's Dilemma

You're out there, day after day, putting in the hours, making deliveries, and earning a steady income. Yet, when you approach a traditional bank for a car loan, they often look for a FICO score – a three-digit number that summarizes your past borrowing and repayment behaviour. If you've never had a credit card, a mortgage, or another significant loan, that score might be non-existent, or "thin." This creates the ultimate delivery driver's dilemma: you desperately need a reliable vehicle to continue generating income, but the very system designed to facilitate such purchases seems to put up a roadblock because you haven't previously engaged with traditional credit products.

It's a frustrating cycle, especially when you know your bank account is consistently seeing deposits from your hard work. You're not asking for a handout; you're asking for an investment in your career, an investment that will enable you to continue contributing to the economy and reliably repay your debt.

Challenging the Credit Paradigm

The traditional credit paradigm was built for a different era, one where employment meant a single, consistent paycheque from one employer. The rise of the gig economy has dramatically shifted this landscape. Millions of Canadians, like you, are now self-employed contractors, piecing together income from multiple platforms. This doesn't make your income any less legitimate or reliable; it just makes it different to document in the eyes of old-school lenders.

Progressive lenders and specialized financial institutions are beginning to understand this shift. They recognize that 'creditworthiness' isn't solely defined by a FICO score. Instead, they're looking at a broader picture, focusing on your actual ability to repay a loan, which is directly tied to your consistent earnings and responsible financial habits, regardless of how your income is structured.

Your Deliveries ARE Your Credit

This is the core message: your consistent income from delivering for platforms like Uber Eats, DoorDash, SkipTheDishes, and Amazon Flex can absolutely serve as a substitute for a traditional credit score. Think of every delivery you complete, every successful shift, and every deposit into your bank account as building blocks for your financial credibility. These regular earnings demonstrate a clear capacity to meet financial obligations.

When you approach a lender that understands the gig economy, they're less interested in a number they can't see and more interested in the tangible evidence of your financial activity. They want to see that money is coming in regularly and that you're managing your finances responsibly. This means your bank statements, your earnings summaries from the platforms, and even your carefully kept personal records become your most powerful tools for proving your creditworthiness.

[PRO TIP] Document Everything

Start tracking all income, expenses, and work hours meticulously. This isn't just good practice for tax season; it will be your financial resume when applying for a car loan. Keep digital records of all earnings statements from your delivery apps, categorize your expenses, and maintain organized bank statements. The more detailed and consistent your records, the stronger your case will be. Consider using budgeting apps or simple spreadsheets to keep everything in order.

Unlocking Approval: The 'Alternative Data' Advantage for Gig Workers

Beyond the FICO Score

When you have no credit history, or a "thin file," traditional lenders often struggle to assess your risk. This is where 'alternative data' comes into play. Forward-thinking lenders don't just look at credit scores; they analyze a wider range of financial indicators to build a more complete picture of your financial responsibility. For a delivery driver, this means your consistent cash flow and payment history on other bills become incredibly valuable.

For more on how your self-employed income can be leveraged for approval, check out our guide on Self-Employed? Your Bank Account *Is* Your Proof. Get Approved.

Proof of Income: Your Golden Ticket

This is arguably the most critical component of your application. Since you don't have traditional pay stubs, you need to provide clear, consistent evidence of your earnings. Lenders want to see stability and an ability to comfortably cover your potential car payments.

- Bank Statements (6-12 months showing consistent deposits): This is your primary document. Lenders will scrutinize these for regular deposits from your delivery platforms. They're looking for consistency, not necessarily massive amounts, but predictable income streams. Highlight these deposits to make it easy for the lender to see your earnings.

- Tax Returns (T4A, T2125 for self-employed, if applicable): If you've been filing taxes as a self-employed individual, your T4A slips (for certain contract work) or your T2125 Statement of Business or Professional Activities (for more extensive self-employment) are official government documentation of your income. These are highly credible.

- Earnings Statements from Delivery Platforms: Most platforms provide weekly or monthly summaries of your earnings. Collect these. They show the gross income before expenses, which is useful for demonstrating your earning potential.

- Trip Histories/Delivery Logs: While less formal, detailed logs of your trips and deliveries can supplement other documents, especially if there are any discrepancies or gaps in your official statements. These demonstrate your active engagement in work.

Stability Signals

Beyond direct income, lenders also look for other indicators of stability and responsibility. These 'stability signals' silently build your case and reassure lenders about your overall reliability:

- Residency History: A consistent address over several years suggests stability. If you've moved frequently, be prepared to explain why.

- Utility Bill Payments: Proof of consistent, on-time payments for utilities (electricity, gas, internet) demonstrates your ability to manage regular financial obligations. While not credit, it shows responsibility.

- Phone Contracts: A long-standing phone contract with a major provider, especially one that has been paid on time, can also serve as a positive indicator.

The Power of the Down Payment

A significant upfront investment drastically reduces the lender's risk and can have a profound impact on your approval odds and loan terms. The more you put down, the less you need to borrow, which means lower monthly payments and often, a lower interest rate.

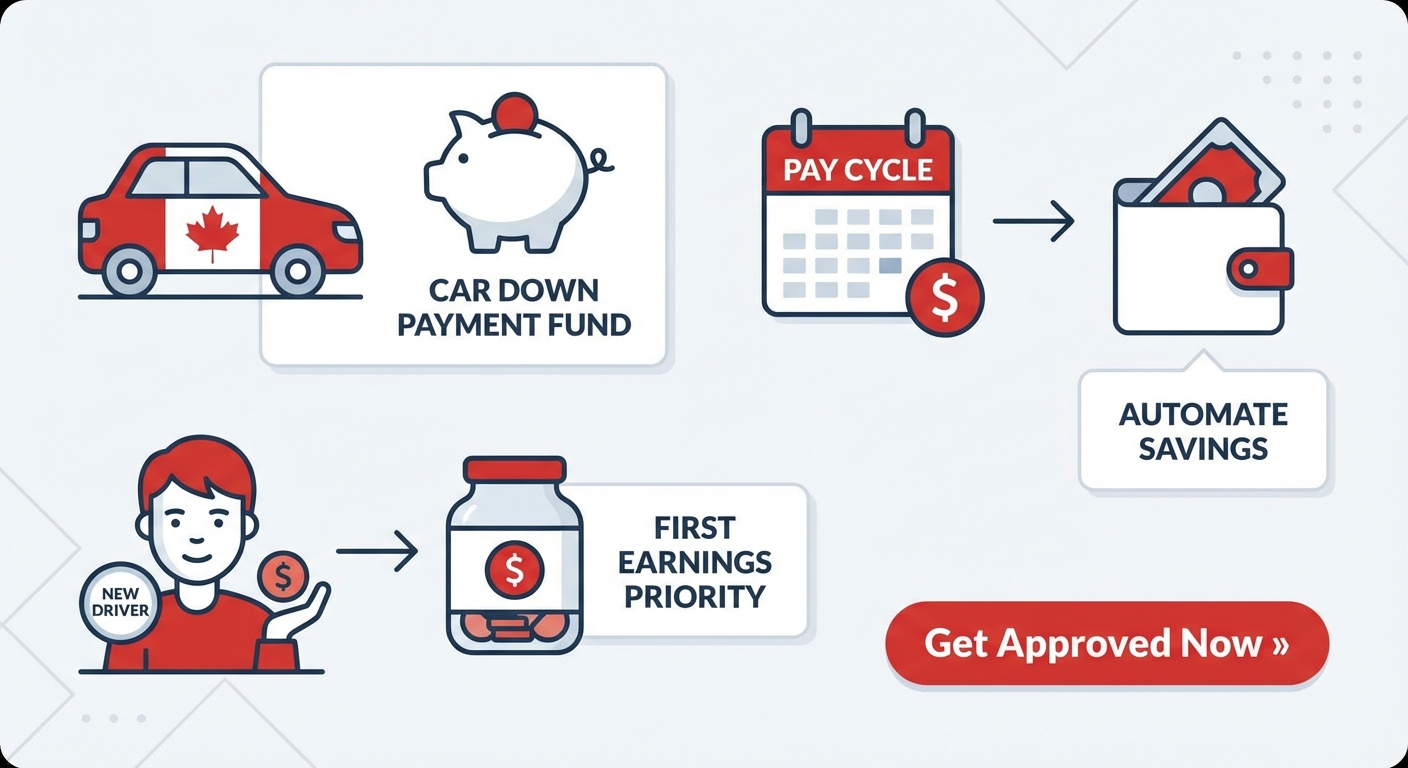

- Strategies for Saving: Even while actively working, setting aside a portion of each delivery payment can quickly accumulate. Consider creating a separate savings account specifically for your car down payment. Automate transfers, even small ones, after each pay cycle. For new drivers, prioritize this saving from your very first earnings.

(Context: A delivery driver showing their earnings on a phone app, with a car key and stack of cash/bank statements in the foreground. Caption: 'Your consistent earnings are your strongest asset. Gather your proof of income like a pro.')

(Context: A delivery driver showing their earnings on a phone app, with a car key and stack of cash/bank statements in the foreground. Caption: 'Your consistent earnings are your strongest asset. Gather your proof of income like a pro.')

Navigating the Lender Landscape: Who Will Say 'Yes'?

Finding the right lender is crucial when you have no credit history. Not all financial institutions are created equal, and some are far more accustomed to working with individuals in unique financial situations, such as gig workers.

Dealership Financing: The Path of Least Resistance?

Many dealerships offer in-house financing or work directly with a network of lenders, including subprime lenders who specialize in loans for individuals with less-than-perfect or no credit. This can often be the quickest route to approval.

| Pros of Dealership Financing | Cons of Dealership Financing |

|---|---|

| Often More Flexible: Dealerships are motivated to sell cars, so they might be more willing to work with your specific income situation. | Potentially Higher Interest Rates: Because of the perceived higher risk, subprime loans often come with higher interest rates. |

| Quick Approval Process: You can often get approved and drive away with a car on the same day, assuming you have all your documentation ready. | Limited Car Selection: You might be limited to vehicles that fit within the dealership's specific lending programs for no-credit buyers. |

| Convenience: One-stop shop for car shopping and financing. | Less Negotiation Room: With higher interest rates, you might have less leverage to negotiate the car's price. |

Specialized Online Lenders for 'No Credit' Situations

The digital age has brought forth a new breed of lenders, often referred to as fintech solutions, that are specifically designed to cater to underserved markets, including those with no traditional credit history. These lenders are often more adept at utilizing alternative data points to assess risk.

- Researching Reputable Online Platforms: Look for lenders specifically advertising 'no credit car loans Canada' or 'gig worker car loans.' Check for transparent terms, clear eligibility requirements, and, most importantly, positive customer reviews. Be wary of any lender that asks for upfront fees or guarantees approval without any financial assessment.

- What to Look For: Prioritize lenders who clearly explain their process for evaluating self-employed income, offer clear terms and conditions, and have readily available customer support.

Credit Unions: The Community Advantage

Credit unions are member-owned financial cooperatives, and they often have a more community-focused approach to lending. This can make them more sympathetic to unique financial situations compared to large, traditional banks.

- Membership Requirements and Benefits: You typically need to become a member (which usually involves a small deposit) to access their services. The benefit is often more personalized service and potentially more flexible lending criteria.

- Relationship-Based Lending: Credit unions are more likely to consider your overall financial relationship with them, not just a credit score. If you've been a responsible member, even without a credit history, they might be more willing to work with you.

The Co-Signer Strategy: A Double-Edged Sword

If you're struggling to get approved on your own, a co-signer with good credit can significantly improve your chances. A co-signer essentially guarantees the loan, promising to make payments if you default.

- Responsibilities and Risks: This is a serious commitment for both parties. The co-signer's credit will be affected if you miss payments, and they are legally obligated to repay the loan.

- Protecting the Relationship: Only consider this option if you are absolutely confident in your ability to make payments on time, every time. Have an open and honest conversation with your potential co-signer about the risks and responsibilities involved.

[PRO TIP] Shop Around, But Wisely

When seeking a car loan, it's wise to compare offers from 2-3 different lenders. However, be strategic. Apply to these lenders within a short timeframe (e.g., 14-30 days). Credit bureaus often group multiple inquiries for the same type of loan within this window as a single 'hard inquiry,' minimizing the impact on your (future) credit score. This allows you to compare rates without undue penalty.

Decoding the Numbers: Rates, Terms, and Total Cost of Ownership

Securing a car loan when you have no credit is a significant achievement, but it's equally important to understand the financial implications beyond just getting approved. The terms of your loan will dictate your long-term financial health.

Realistic Expectations for Interest Rates

It's important to have realistic expectations. Loans for individuals with no credit history generally carry higher interest rates than those for buyers with excellent credit. This is because lenders perceive a higher risk when there's no established repayment history to review.

- Factors Influencing Your Rate: Your income stability, the size of your down payment, the length of the loan term, and even the age and type of car you're buying all play a role. A newer, more reliable car might actually get a slightly better rate because it's less likely to break down, affecting your ability to work and repay.

- APR vs. Interest Rate: The Annual Percentage Rate (APR) is often a more comprehensive measure than the simple interest rate. APR includes the interest rate plus any additional fees or costs associated with the loan, giving you a truer picture of the total cost of borrowing. Always ask for the APR.

The Loan Term Trap

The loan term refers to the length of time you have to repay the loan. While a longer term might seem appealing due to lower monthly payments, it almost always results in paying significantly more interest over the life of the loan.

| Loan Term | Monthly Payment (Example) | Total Interest Paid (Example) | Pros | Cons |

|---|---|---|---|---|

| 36 Months (3 Years) | Higher | Lowest | Pay off faster, less total interest, build equity quicker. | Higher monthly payments, requires stronger cash flow. |

| 60 Months (5 Years) | Moderate | Moderate | Balanced payments, manageable total cost. | Still pay more interest than a shorter term. |

| 84 Months (7 Years) | Lowest | Highest | Most affordable monthly payments, easier on budget. | Significantly more total interest, car depreciates faster than you pay it off, higher risk of being "underwater." |

Balancing affordability with financial prudence means finding a term that you can comfortably manage without extending the loan unnecessarily and incurring excessive interest charges. For more on getting approved for a car loan with no credit, consider reading our article on Zero Credit? Perfect. Your Canadian Car Loan Starts Here.

Hidden Costs and Fees to Watch Out For

The sticker price and interest rate aren't the only costs. Always read the fine print to identify potential hidden fees that can inflate your total cost:

- Origination Fees: A fee charged by the lender for processing the loan.

- Documentation Fees: Dealerships often charge a fee for preparing the sales paperwork.

- Lien Fees: A small fee to register the lender's lien on the vehicle title.

- Pre-payment Penalties: Some loans might charge a fee if you pay off the loan early. This is less common in Canada but always worth checking.

- Extended Warranties/Add-ons: Be cautious of being pressured into purchasing expensive add-ons you don't need.

Calculating Your True Monthly Payment

Your car loan payment is just one piece of the puzzle. For a delivery driver, understanding the full monthly cost of ownership is paramount to ensuring your vehicle remains profitable.

- Insurance Costs: As a new driver (to credit, not necessarily to driving) and with a new loan, your insurance premiums might be higher. Furthermore, if you're using your vehicle for commercial purposes (deliveries), you'll need commercial auto insurance, which is more expensive than personal insurance. Get quotes *before* you finalize your car purchase.

- Maintenance Budget: A delivery vehicle endures significant wear and tear. Factor in regular oil changes, tire rotations, brake service, and unexpected repairs. A good rule of thumb is to budget at least $50-$100 per month for maintenance.

- Fuel Costs: This is a major ongoing expense for delivery drivers. Research the fuel efficiency of any car you're considering and factor in current fuel prices. This directly impacts your net income.

[PRO TIP] Pre-qualify, Don't Just Apply

Many lenders offer pre-qualification tools that allow you to get an idea of potential rates and terms without undergoing a hard credit check. A hard inquiry can temporarily ding your credit score. Use pre-qualification to gauge your options and narrow down lenders before committing to a full application, saving your potential (future) credit score.

The Smart Car for the Smart Driver: Vehicle Selection for Maximum ROI

For a delivery driver, your car is an income-generating asset. Choosing the right vehicle isn't about flashy features; it's about maximizing your return on investment (ROI) through reliability, efficiency, and low running costs.

Reliability Over Luxury

Your primary concern should be a vehicle that can withstand the demands of constant driving, day after day, without frequent breakdowns. Downtime means lost income.

- Best Car Types for Delivery: Compact sedans (e.g., Honda Civic, Toyota Corolla, Hyundai Elantra), small SUVs (e.g., Honda CR-V, Toyota RAV4, Mazda CX-5), and hybrids are often ideal. They offer a good balance of fuel efficiency, cargo space, and maneuverability in urban environments.

- Researching Maintenance Costs: Look up common issues and average repair costs for models you're considering. Brands known for reliability often have lower long-term maintenance expenses. Consumer reports and owner forums are excellent resources.

Used vs. New: Making Your Money Go Further

For many delivery drivers, a well-maintained used vehicle offers the best value proposition.

- Depreciation Curve: New cars depreciate rapidly in their first few years. Buying a 2-3 year old used car means someone else has absorbed the steepest part of that depreciation, allowing you to get more car for your money.

- Certified Pre-Owned (CPO) Programs: CPO vehicles are used cars that have undergone rigorous inspections and come with an extended warranty from the manufacturer. They often represent a sweet spot, offering the reliability and peace of mind of a new car, but at a significantly reduced price.

Insurance Implications

The car you choose will directly impact your insurance premiums. Factors like the vehicle's safety ratings, theft risk, and the cost of parts and labour for repairs all contribute to how much you'll pay.

- Safety Ratings: Cars with higher safety ratings often qualify for lower premiums.

- Theft Risk: Certain models are more frequently stolen, leading to higher insurance costs.

- Repair Costs: Luxury or exotic cars, even if used, can have very expensive parts and specialized labour, driving up repair and insurance costs.

(Context: A diverse group of delivery drivers standing proudly next to a range of reliable, fuel-efficient used cars (e.g., Honda Civic, Toyota Corolla, Hyundai Elantra). Caption: 'Choose a vehicle that works as hard as you do: reliable, fuel-efficient, and easy on the wallet.')

(Context: A diverse group of delivery drivers standing proudly next to a range of reliable, fuel-efficient used cars (e.g., Honda Civic, Toyota Corolla, Hyundai Elantra). Caption: 'Choose a vehicle that works as hard as you do: reliable, fuel-efficient, and easy on the wallet.')

Building Your Credit Empire: Using Your First Loan as a Springboard

Getting your first car loan with no credit is more than just acquiring a vehicle; it's a strategic move to establish and build a positive credit history. This loan can be the foundation of your future financial success.

The Power of On-Time Payments

Every single on-time payment you make on your car loan is a step towards building a strong credit profile. Lenders report your payment history to credit bureaus in Canada (Equifax and TransUnion).

- Understanding How Payments Are Reported: When you consistently make your payments by the due date, this positive behaviour is recorded. Over time, this builds a history of responsible borrowing, which is exactly what future lenders want to see.

- Long-Term Benefits: A good payment history on your car loan will make it easier to qualify for other financial products in the future, such as credit cards with better terms, personal loans, and eventually, even a mortgage. It can also lead to lower interest rates on subsequent loans, saving you thousands of dollars over your lifetime.

Beyond the Car Loan: Other Credit-Building Strategies

While your car loan is a powerful tool, you can accelerate your credit-building journey with complementary actions:

- Secured Credit Cards: These cards require a cash deposit, which acts as your credit limit. They are an excellent way to safely demonstrate responsible credit use. Use it for small, regular purchases and pay the balance in full every month.

- Credit Builder Loans: Offered by some credit unions and specialized lenders, these loans are designed specifically to help you build credit. The loan amount is held in a savings account while you make payments. Once paid off, you receive the money.

- Paying Bills on Time: While not all bill payments (like rent, utilities, or phone bills) are automatically reported to credit bureaus, some companies offer services that allow them to be reported. Even if not, consistent on-time payments demonstrate financial responsibility and can be used as alternative data in future loan applications.

Monitoring Your Progress

As you build your credit, it's essential to monitor your progress. Understanding your credit score and report helps you track your improvements and spot any potential errors.

- Free Credit Monitoring Services: Many banks and financial apps offer free credit score monitoring. You can also get a free credit report from Equifax and TransUnion once a year upon request.

- Understanding the Components of Your Credit Score: Learn what factors influence your score (payment history, credit utilization, length of credit history, types of credit, new credit). This knowledge empowers you to make informed financial decisions.

Your Next Steps to Approval: A Strategic Blueprint

Ready to get your delivery career into a new set of wheels? Here's a clear, strategic blueprint to guide you through the process.

Step 1: Financial Self-Assessment

Before approaching any lender, take an honest look at your finances. Know exactly how much income you generate, what your fixed and variable expenses are, and what you can realistically afford for a car payment (including insurance, fuel, and maintenance). Don't just consider what you *can* afford, but what you *should* afford without straining your budget. Aim for your total car expenses to be no more than 15-20% of your gross monthly income.

Step 2: Documentation Gathering

This is where your meticulous record-keeping pays off. Gather all your proof of income (6-12 months of bank statements, earnings statements from platforms, tax returns), proof of residency (utility bills), and personal identification. Having everything organized and readily available will streamline the application process and present you as a responsible applicant. Remember our guide on Banks Need Pay Stubs. We Need Your Drive. Gig Worker Car Loans. for more tips on documentation.

Step 3: Research & Pre-qualification

Identify lenders known for working with individuals with no credit or those in the gig economy. Utilize pre-qualification tools offered by online lenders or dealerships to get initial rate estimates without impacting your credit score. This will help you understand your options and set realistic expectations.

Step 4: Prepare for the Application

When you apply, be ready to provide detailed information about your work, income sources, and living situation. Be transparent and honest. Lenders appreciate thoroughness and clarity, especially when assessing alternative data. If there are any gaps in your income or residency, be prepared to explain them confidently.

Step 5: Negotiate Smart

Once you receive offers, don't just accept the first one. Compare the APR, loan term, and any fees. Negotiate not just the price of the car, but also the terms of the loan. If you have a significant down payment, leverage that. Understand every line of the contract before you sign. Never feel rushed into a decision.

Step 6: Maintain Diligence

Once you have your loan, the most important step begins: making payments on time, every time. Set up automatic payments if possible, or mark your calendar with reminders. This consistent positive behaviour will not only secure your vehicle but also lay a strong foundation for your entire financial future, opening doors to better credit opportunities down the line.