Down Payment? We Prefer 'Empty Wallet' Car Loans for Gig Workers, Ontario.

Table of Contents

- Key Takeaways

- The Gig Economy Grind: Why a Reliable Ride is Non-Negotiable for Ontario's Freelancers

- The Unspoken Reality of Ontario's Gig Workforce

- Navigating the 'Bad Credit' Stigma as a Gig Worker

- The 'Empty Wallet' Starting Line

- Deconstructing 'No Down Payment': The True Costs of an 'Empty Wallet' Car Loan

- Beyond the Zero: What 'No Down Payment' Truly Means

- The Interest Rate Tightrope for Bad Credit Borrowers

- Understanding Your Total Cost of Borrowing

- Navigating the Lender Labyrinth: Who's Really Offering 'Empty Wallet' Loans to Gig Workers in Ontario?

- The Dealership Advantage: In-House Financing & Specialty Programs

- The Rise of Specialty Lenders for 'Unique' Income

- Credit Unions vs. Big Banks: A Tale of Two Lending Philosophies

- Leveraging Broker Networks: Your Connection to Niche Financing

- Crafting Your Unconventional Application: Proving Your Worth to Skeptical Lenders

- Beyond the T4: What Income Documents Truly Matter for Gig Workers

- Building a 'Credit Story' When Your History is Sparse or Bruised

- The Power and Perils of a Co-Signer in Ontario

- Interest Rates, Hidden Fees, and the Predatory Pitfalls: Protecting Your 'Empty Wallet' in Ontario

- Understanding Annual Percentage Rate (APR) for Bad Credit, No Down Payment Loans

- Common Fees to Watch Out For (and How to Challenge Them)

- Spotting Red Flags in Loan Agreements: What to Avoid at All Costs

- Strategic Vehicle Selection: The Smart Car Choices for Ontario Gig Workers

- Reliability Over Luxury: Why a Used Toyota Corolla or Honda Civic is Often King

- Fuel Efficiency: The Unsung Hero for Gig Economy Profitability

- Does the Car's Value Impact Approval? (Older vs. Newer Used Models)

- Specific Considerations for Rideshare vs. Delivery in Ontario Cities

- Boosting Your Approval Odds: Beyond the Initial Application for Ontario Gig Workers

- Small Steps to Improve Your Credit Score Before Applying

- The Role of Trade-Ins (Even Small Ones) in Reducing Loan Amount

- Negotiating Tactics for Gig Workers at Dealerships in Windsor or Sault Ste. Marie

- The Ontario Advantage (and Challenges): What Local Gig Workers Need to Know

- Provincial Regulations Impacting Car Loans and Consumer Protection

- Regional Differences in Lender Availability and Vehicle Markets

- Connecting with Community Resources for Financial Literacy in Ontario

- Your Next Steps to Approval: From 'Empty Wallet' to Keys in Hand

- A Clear, Actionable Roadmap for Ontario Gig Workers

- The Pre-Approval Power Play

- What to Do Once Approved: Navigating the Final Paperwork

- Frequently Asked Questions (FAQ) for Ontario Gig Workers Seeking 'Empty Wallet' Car Loans

In the bustling gig economy of Ontario, where flexibility often comes with financial unpredictability, the dream of owning a reliable vehicle can feel miles away, especially for those navigating the waters of bad credit with an 'empty wallet'. This deep dive isn't just about finding a car loan; it's about empowering Ontario's gig workers – from the ride-share drivers of Toronto to the freelance creatives in Ottawa – to secure the wheels essential for their livelihood, without the burden of an upfront payment. We'll cut through the jargon, expose the myths, and equip you with the knowledge to drive away with confidence, even when your bank account looks sparse. This is your definitive guide to securing a no down payment car loan for bad credit gig workers across Ontario.

Key Takeaways

- Gig Income is Valid Income: Lenders are adapting. Your diverse income streams (Uber, DoorDash, freelance contracts) can be powerful proof of earning potential.

- 'No Down Payment' Has Nuances: While possible, it often means higher interest rates or longer terms. Understand the full cost, not just the upfront zero.

- Credit History is Fixable: Bad credit isn't a life sentence. Small, strategic steps can improve your profile, even as you apply. For more on rebuilding credit, see our article, What If Your Car Loan *Was* Your Best Credit Card? (Post-Proposal Speed-Rebuild, Toronto).

- Specialty Lenders are Your Allies: Traditional banks might be tough, but a growing number of lenders and dealerships in Ontario specialize in non-traditional profiles.

- Documentation is King: Consistent record-keeping of your earnings is crucial for proving stability to lenders.

- Vehicle Choice Matters: Opting for reliable, fuel-efficient used cars (think a Honda Civic in Hamilton or a Toyota Corolla in Mississauga) can significantly improve approval odds and affordability.

- Always Compare Offers: Never take the first deal. Shop around, understand the APR, and scrutinize all fees.

The Gig Economy Grind: Why a Reliable Ride is Non-Negotiable for Ontario's Freelancers

The gig economy has reshaped the landscape of work across Ontario, offering unparalleled flexibility but often posing unique financial hurdles. For millions of Canadians, especially those in bustling urban centres like Toronto, Mississauga, and Ottawa, a personal vehicle isn't merely a convenience; it's the very foundation of their livelihood. Think of the ride-share driver navigating the busy streets of downtown Toronto, the food delivery courier zipping through Kingston, or the skilled tradesperson needing to transport tools to a freelance job site in London. Without reliable transportation, their ability to earn is severely compromised, if not entirely eliminated.

This reliance on a vehicle creates a critical demand for accessible financing, even for those who don't fit the traditional mold of a salaried employee with a perfect credit score. How can you maintain your independence and continue to contribute to Ontario's vibrant gig economy if getting to your next job is a constant struggle?

The Unspoken Reality of Ontario's Gig Workforce

From the early morning rush of delivery cyclists in downtown Toronto to the rural contractors near Kingston, a vehicle isn't a luxury; it's the engine of their income. We explore the sheer necessity of a reliable car for maintaining and growing gig work opportunities. Imagine the impact of a vehicle breakdown on a DoorDash driver in Vaughan or an Uber driver in Hamilton; every hour spent off the road directly translates to lost income. This necessity underscores why securing a car loan, even with challenges, is a priority for many.

Navigating the 'Bad Credit' Stigma as a Gig Worker

One of the biggest hurdles gig workers face is the 'bad credit' stigma. Traditional lenders are often wary of inconsistent paychecks and a lack of conventional employment records. Your income might fluctuate weekly or monthly, and your payment history might not look like a steady stream of bi-weekly pay stubs. This creates unique challenges for credit assessment, as standard algorithms struggle to interpret diverse income streams. However, the lending landscape is evolving. A growing number of lenders are starting to see beyond the conventional, recognizing the stability and potential in varied income sources like those from Uber, SkipTheDishes, and freelance contracts. They are developing more flexible underwriting processes to accommodate the realities of the modern workforce. For those grappling with past credit issues, understanding The Truth About the Minimum Credit Score for Ontario Car Loans can provide valuable context.

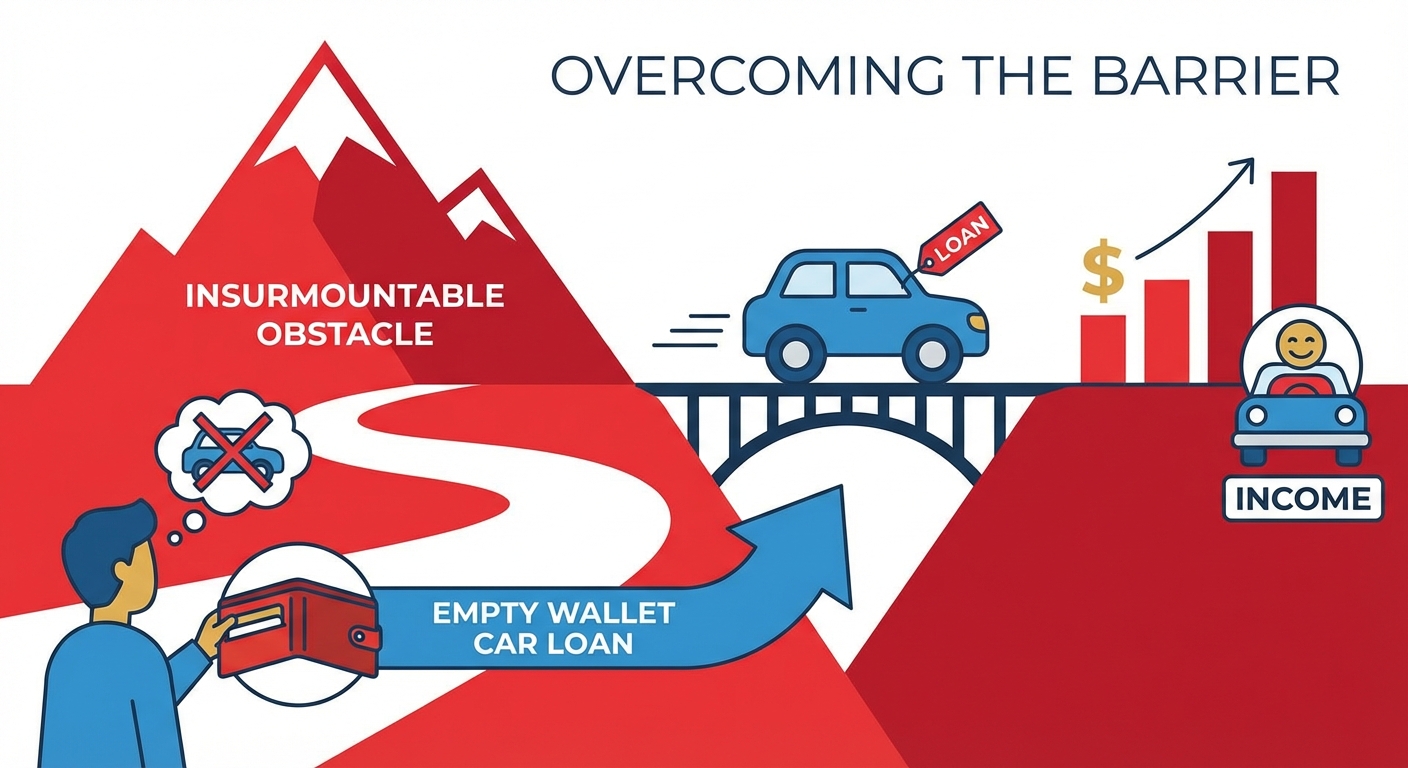

The 'Empty Wallet' Starting Line

Understanding the financial constraints that make a no down payment loan not just appealing, but often essential for gig workers in cities like Windsor and London. Many gig workers operate on tight margins, with disposable income often going towards immediate living expenses. The idea of saving thousands of dollars for a down payment can seem like an insurmountable obstacle, delaying their access to the very tool they need to earn more. An 'empty wallet' car loan addresses this immediate barrier, allowing individuals to get on the road and start generating income sooner, rather than later.

Deconstructing 'No Down Payment': The True Costs of an 'Empty Wallet' Car Loan

The allure of a 'no down payment' car loan is undeniable, especially when your savings account is looking sparse. It promises immediate access to a vehicle without the upfront financial strain. However, it's crucial to understand that 'no down payment' doesn't mean 'no cost.' There are inherent trade-offs that come with this type of financing, particularly for individuals with bad credit.

Beyond the Zero: What 'No Down Payment' Truly Means

Unpacking the mechanics of these loans – often a trade-off for higher interest rates, longer repayment terms, or additional fees rolled into the loan principal. When you don't provide a down payment, you're essentially borrowing 100% of the vehicle's purchase price. This increases the lender's risk, and they compensate for this by adjusting other aspects of the loan. This often manifests as a higher Annual Percentage Rate (APR), meaning you'll pay more in interest over the life of the loan. Alternatively, lenders might extend the repayment term, leading to lower monthly payments but a significantly higher total cost of borrowing. Sometimes, administrative or origination fees are rolled into the loan, further increasing the principal balance.

The Interest Rate Tightrope for Bad Credit Borrowers

A deep dive into how lenders calculate interest for high-risk profiles, and what you can expect in terms of Annual Percentage Rate (APR) in Ontario. For borrowers with bad credit, lenders perceive a higher risk of default. To mitigate this risk, they assign higher interest rates. While exact rates fluctuate with market conditions and individual credit profiles, it's not uncommon for subprime car loans in Ontario to carry APRs ranging from 10% to 25% or even higher. This is a stark contrast to the single-digit rates often offered to borrowers with excellent credit. Understanding this reality is key to setting realistic expectations and budgeting effectively.

Understanding Your Total Cost of Borrowing

Why focusing solely on monthly payments can be misleading, and how to calculate the real financial burden over the life of the loan. A low monthly payment might seem attractive, but if it's spread over 7 or 8 years with a high interest rate, you could end up paying significantly more than the car is worth. Always ask for the total cost of borrowing – the sum of all your monthly payments plus any fees. This figure provides a much clearer picture of the financial commitment you are undertaking. Use the table below to compare how different APRs and terms impact your total cost.

| Loan Amount | APR | Term (Months) | Monthly Payment (Approx.) | Total Interest Paid | Total Cost of Loan |

|---|---|---|---|---|---|

| $20,000 | 10% | 60 | $425 | $5,500 | $25,500 |

| $20,000 | 15% | 60 | $476 | $8,560 | $28,560 |

| $20,000 | 20% | 60 | $529 | $11,740 | $31,740 |

| $20,000 | 15% | 84 | $328 | $7,552 (longer term, lower payment) | $27,552 |

Navigating the Lender Labyrinth: Who's Really Offering 'Empty Wallet' Loans to Gig Workers in Ontario?

Finding a car loan when you're a gig worker with bad credit and no down payment can feel like searching for a needle in a haystack. Traditional banks often have rigid criteria that don't easily accommodate fluctuating income or past credit missteps. However, the landscape of auto financing is dynamic, and several avenues specialize in catering to non-traditional profiles. Knowing where to look is half the battle.

The Dealership Advantage: In-House Financing & Specialty Programs

Many Ontario dealerships, especially in major hubs like the Greater Toronto Area (GTA), Ottawa, and even regional centres like Sudbury and Thunder Bay, have dedicated finance departments with access to diverse lenders. Crucially, some of these lenders specialize in subprime financing and non-traditional income situations. These dealerships often work with a network of financial institutions that are more flexible and willing to assess applications based on a broader range of factors than just a credit score. They understand the gig economy and are equipped to present your income profile in the best possible light to these specialized lenders.

The Rise of Specialty Lenders for 'Unique' Income

Exploring non-bank financial institutions that are specifically designed to cater to borrowers with fluctuating income, bad credit, or limited history. These lenders, often referred to as subprime lenders, assess risk differently. Instead of relying solely on traditional credit scores, they delve deeper into your financial habits, looking at bank statements, income consistency (even if irregular), and overall ability to repay. They are more open to working with individuals who might have had past financial challenges but are now demonstrating a stable income through gig work. This is where your detailed income documentation becomes paramount.

Credit Unions vs. Big Banks: A Tale of Two Lending Philosophies

Why traditional banks might be a tougher sell, but credit unions (like Meridian or Alterna) in communities across Ontario might offer more personalized, flexible options. Big banks operate on scale and strict internal policies, making it harder for them to deviate from standard lending criteria. Credit unions, being member-owned and community-focused, often have more flexible lending practices. They may be more willing to consider your individual circumstances, build a relationship, and offer solutions that a large bank might overlook. It's always worth exploring your local credit union options, whether you're in Barrie, Peterborough, or Sault Ste. Marie.

Leveraging Broker Networks: Your Connection to Niche Financing

How car loan brokers in cities like Hamilton, Mississauga, and London act as intermediaries, matching gig workers with lenders willing to approve 'empty wallet' loans, even with bad credit. Brokers are experts in the subprime lending market. They have established relationships with multiple lenders, including those specialty institutions that might not be easily accessible to the public. By submitting one application through a broker, you gain access to a wider pool of potential lenders, significantly increasing your chances of approval. They understand what each lender is looking for and can help tailor your application to highlight your strengths as a gig worker.

Crafting Your Unconventional Application: Proving Your Worth to Skeptical Lenders

For gig workers, a car loan application isn't just about filling out forms; it's about telling a compelling financial story. Your income streams might be unconventional, and your credit history might have a few bumps, but with the right documentation and strategy, you can prove your reliability to lenders. The key is to anticipate their concerns and proactively provide the evidence they need.

Beyond the T4: What Income Documents Truly Matter for Gig Workers

Detailed guidance on compiling bank statements, app payment histories (Uber, SkipTheDishes), invoices from freelance clients, and tax returns (T2125 forms) to paint a clear picture of your income stability. Since you likely don't have a traditional T4 slip from a single employer, you need to be meticulous. Your bank statements, showing consistent deposits from various gig platforms or clients, become your primary proof of income. Lenders typically look for 3-6 months of statements to assess regularity. If you're self-employed, your T2125 Statement of Business or Professional Activities from your tax return is vital, as it officially declares your self-employment income. For more insights on this, you might find our article Self-Employed? Your Bank Statement is Our 'Income Proof' particularly useful.

Building a 'Credit Story' When Your History is Sparse or Bruised

Strategies for demonstrating financial responsibility, even with past missteps or a limited credit file. This includes utility bill payments, rent history, and other non-traditional credit references. If your credit score is low, or you're new to credit, you need to show lenders other indicators of your reliability. Provide proof of consistent rent payments (e.g., cancelled cheques or landlord letters), on-time utility bill payments (hydro, internet, phone), or even payments to subscription services. These demonstrate a history of meeting financial obligations, even if they aren't reported to major credit bureaus. A secured credit card, used responsibly, can also quickly help build a positive payment history.

The Power and Perils of a Co-Signer in Ontario

When to consider a co-signer, who makes an ideal candidate, and the significant risks involved for both parties. A co-signer with good credit can significantly boost your approval odds and potentially secure you a lower interest rate. They essentially guarantee the loan if you default, reducing the lender's risk. An ideal co-signer is someone with excellent credit, stable income, and a strong relationship with you (e.g., a trusted family member). However, it's crucial to understand the perils: if you miss payments, it negatively impacts both your credit scores, and the co-signer is legally responsible for the full debt. This can strain relationships, so it's a decision that requires careful consideration and open communication.

Interest Rates, Hidden Fees, and the Predatory Pitfalls: Protecting Your 'Empty Wallet' in Ontario

Securing a car loan as a gig worker with bad credit and no down payment is a significant achievement, but the work doesn't stop at approval. It's critical to understand the financial intricacies of your loan agreement to protect yourself from excessive costs and predatory practices. In the subprime lending market, vigilance is your best defence.

Understanding Annual Percentage Rate (APR) for Bad Credit, No Down Payment Loans

A deep dive into how APR is calculated and why it's the most crucial number to focus on when comparing loan offers, especially for higher-risk profiles. The APR is more than just the interest rate; it represents the total cost of borrowing, including the interest rate and most other fees, expressed as an annual percentage. For bad credit, no down payment loans, APRs can be substantially higher than prime rates. While you might see rates ranging from 10% to 25% or even more, comparing the APR across different offers gives you the most accurate picture of which loan is truly cheaper. Don't be swayed by just the monthly payment; a lower APR almost always means less money paid over the life of the loan.

Common Fees to Watch Out For (and How to Challenge Them)

Identifying administrative fees, loan origination fees, PPSR (Personal Property Security Registration) fees, and other charges that can inflate your loan cost. We'll discuss what's negotiable and what's standard practice in Ontario.

- Administrative Fees: These are common, covering the lender's internal processing costs. While often non-negotiable, their amount can sometimes be challenged or negotiated down, especially if you have competing offers.

- Loan Origination Fees: Similar to admin fees, these are charges for setting up the loan. Again, inquire if they can be reduced or waived.

- PPSR Fees: In Ontario, lenders register their interest in your vehicle as collateral with the Personal Property Security Registry. This fee is standard and usually non-negotiable (typically under $100).

- Documentation Fees: Charged by dealerships for preparing paperwork. These can sometimes be negotiated, especially if you're a strong buyer.

Always ask for a complete breakdown of all fees. Some fees are standard and legitimate, while others might be padded. Don't hesitate to ask for explanations and to challenge anything that seems excessive or unclear.

Spotting Red Flags in Loan Agreements: What to Avoid at All Costs

Warning signs of predatory lending practices, including excessively high interest rates, vague terms, pressure tactics, and clauses that seem too good to be true. Consumer protection resources in Ontario will be highlighted.

- Excessively High Interest Rates: While bad credit loans have higher APRs, rates exceeding 30-40% should raise a significant red flag. Be aware of the maximum legal interest rate in Canada (60% APR), but aim far below that.

- Vague Terms: If the contract is unclear about the loan term, interest rate, or total cost, walk away. Everything should be explicitly stated.

- Pressure Tactics: Any lender or dealership trying to rush you into signing or discouraging you from reading the fine print is a major warning sign.

- "Guaranteed Approval" Claims: While some lenders specialize in bad credit, no one can truly guarantee approval without reviewing your application. These claims are often misleading.

- Hidden Fees or Prepayment Penalties: Ensure there are no hidden charges not explicitly discussed, and understand any penalties for paying off your loan early.

In Ontario, the Ontario Motor Vehicle Industry Council (OMVIC) regulates vehicle sales and leasing, including financing aspects, providing consumer protection. If you suspect predatory practices, contact OMVIC or a consumer advocacy group.

Strategic Vehicle Selection: The Smart Car Choices for Ontario Gig Workers

For a gig worker, your vehicle isn't just transportation; it's your primary income-generating asset. Therefore, choosing the right car is a strategic decision that can significantly impact your profitability and financial stability. It's not about luxury; it's about reliability, efficiency, and smart financial planning.

Reliability Over Luxury: Why a Used Toyota Corolla or Honda Civic is Often King

Discussing the benefits of proven, low-maintenance vehicles that minimize unexpected repair costs – a critical factor for gig workers relying on their car for income. When your income depends on your car, breakdowns are catastrophic. This is why vehicles known for their bulletproof reliability are paramount. A used Toyota Corolla or Honda Civic, for example, consistently tops reliability charts. They are inexpensive to maintain, parts are readily available across Ontario (from Ottawa to Windsor), and mechanics are highly familiar with them. Prioritizing a car with a solid track record reduces the risk of costly repairs and lost working hours, protecting your 'empty wallet' from unexpected drains.

Fuel Efficiency: The Unsung Hero for Gig Economy Profitability

Analyzing how even small differences in fuel consumption can significantly impact a gig worker's net income over time, with examples relevant to Ontario gas prices. Gig work often involves a lot of driving. Whether you're delivering food in Mississauga or driving passengers in Toronto, fuel costs are a major operating expense. A car that gets an extra 2-3 litres per 100 kilometres can save you hundreds, if not thousands, of dollars annually. Consider models like the Hyundai Elantra, Mazda3, or Chevrolet Cruze, which offer good fuel economy without breaking the bank. These savings directly translate into higher net income, making your gig work more profitable.

Does the Car's Value Impact Approval? (Older vs. Newer Used Models)

How lenders assess the collateral value of the vehicle, and why a slightly newer, well-maintained used car might be easier to finance than a very old, high-mileage one, especially with bad credit. When you have bad credit and no down payment, the vehicle itself serves as the primary collateral for the loan. Lenders prefer vehicles that retain their value and are easily resalable if you default. A very old car with high mileage might be seen as a higher risk due to potential mechanical issues and lower resale value. A slightly newer used car (e.g., 3-7 years old) that is well-maintained often strikes the right balance: it's affordable, reliable, and holds enough collateral value to appeal to lenders, increasing your approval odds.

Specific Considerations for Rideshare vs. Delivery in Ontario Cities

Tailoring vehicle choice to the type of gig work – e.g., comfort for passengers in an Uber in Ottawa vs. cargo space for DoorDash deliveries in Vaughan.

- Rideshare (Uber, Lyft): Passenger comfort is key. Look for a vehicle with good legroom, working air conditioning, and a relatively clean interior. Mid-size sedans like a Toyota Camry or Honda Accord are popular choices in Toronto and Hamilton.

- Delivery (DoorDash, SkipTheDishes): Cargo space and fuel efficiency are paramount. Hatchbacks like a Honda Fit or Kia Rio, or even compact SUVs, offer flexibility for carrying various orders while remaining economical for city driving in places like Kitchener or London.

Boosting Your Approval Odds: Beyond the Initial Application for Ontario Gig Workers

Getting approved for a car loan, especially with no down payment and bad credit as a gig worker, is a strategic game. While your initial application is crucial, there are proactive steps you can take both before and during the process to significantly improve your chances and potentially secure better terms.

Small Steps to Improve Your Credit Score Before Applying

Actionable advice on credit-building strategies, such as securing a secured credit card, paying bills on time, and managing existing debt, even with a limited or bad credit history.

- Get a Secured Credit Card: This requires a deposit, but it acts like a regular credit card and reports to credit bureaus. Use it for small, recurring purchases and pay it off in full every month to build positive payment history.

- Pay All Bills On Time: This includes utilities, phone bills, and any existing loans. Consistency is key for credit improvement.

- Manage Existing Debt: If you have outstanding debts, try to pay them down, especially those with high interest. A lower credit utilization ratio (how much credit you're using vs. available credit) can boost your score.

- Check Your Credit Report: Obtain a free copy from Equifax and TransUnion annually. Dispute any errors, as these can negatively impact your score.

Even small improvements can make a difference in how lenders perceive your risk profile. If you've been denied elsewhere, don't despair. Read our article, Denied a Car Loan on EI? They Lied. Get Approved Here. for more encouragement and strategies.

The Role of Trade-Ins (Even Small Ones) in Reducing Loan Amount

How even a low-value trade-in can reduce the principal amount borrowed, potentially leading to better loan terms and easier approval. While the goal is 'no down payment,' if you have an older vehicle, even one with minimal value, trading it in can act as a de facto down payment. This reduces the total amount you need to borrow, which in turn lowers the lender's risk. A smaller loan amount can translate into lower monthly payments, a better interest rate, and a higher chance of approval, especially for bad credit borrowers. Every dollar you can put towards the vehicle, whether cash or trade-in, strengthens your application.

Negotiating Tactics for Gig Workers at Dealerships in Windsor or Sault Ste. Marie

Empowering borrowers with strategies for discussing their unique financial situation and negotiating for better rates or terms.

- Be Transparent: Clearly explain your income sources and consistency, and be upfront about your credit history. Honesty builds trust.

- Highlight Stability: Emphasize how long you've been doing gig work, your average monthly income, and any consistent contracts you have.

- Bring Organized Documentation: A well-prepared financial toolkit (bank statements, tax returns, etc.) shows you are responsible and serious.

- Shop Around for Pre-Approvals: Knowing what other lenders are willing to offer gives you leverage in negotiations.

- Negotiate the "Out-the-Door" Price: Focus on the total price of the car, not just the monthly payment. This helps avoid getting bogged down in financing details before agreeing on the vehicle's cost.

The Ontario Advantage (and Challenges): What Local Gig Workers Need to Know

Navigating the car loan market as a gig worker in Ontario involves understanding the provincial landscape. Specific regulations and regional differences can impact your options and protections. Being informed about these local nuances can give you a significant advantage.

Provincial Regulations Impacting Car Loans and Consumer Protection

A look at the specific laws and bodies (e.g., OMVIC for dealerships) in Ontario that protect consumers in vehicle purchases and financing. In Ontario, your rights as a consumer purchasing a vehicle are primarily protected by the Ontario Motor Vehicle Industry Council (OMVIC). OMVIC regulates registered dealers and salespersons, ensuring fair practices. This includes rules around advertising, disclosures, and contracts. For financing, the Ontario Consumer Protection Act also offers safeguards. For instance, lenders must disclose the full cost of borrowing, including all interest and fees. Always ensure you are dealing with an OMVIC-registered dealer, as this provides a layer of protection that private sales do not. Familiarize yourself with OMVIC's resources to understand your rights before you sign any agreement.

Regional Differences in Lender Availability and Vehicle Markets

How the options might vary between metropolitan areas (e.g., Toronto, Mississauga) and smaller cities or rural communities (e.g., Thunder Bay, North Bay).

- Metropolitan Areas (Toronto, Mississauga, Ottawa, Hamilton): These areas typically have a higher concentration of dealerships, including large chains with extensive finance networks. You'll likely find more specialty lenders and brokers who understand the gig economy. The vehicle market is also larger, offering more choice in reliable, fuel-efficient used cars.

- Smaller Cities/Rural Communities (Thunder Bay, North Bay, Sault Ste. Marie, Kingston): While options might be fewer, local dealerships often have stronger community ties and may be more willing to work with non-traditional profiles. Credit unions in these areas can also be excellent resources for personalized service. However, the selection of vehicles might be more limited, and prices could vary. It's crucial to compare offers diligently regardless of your location.

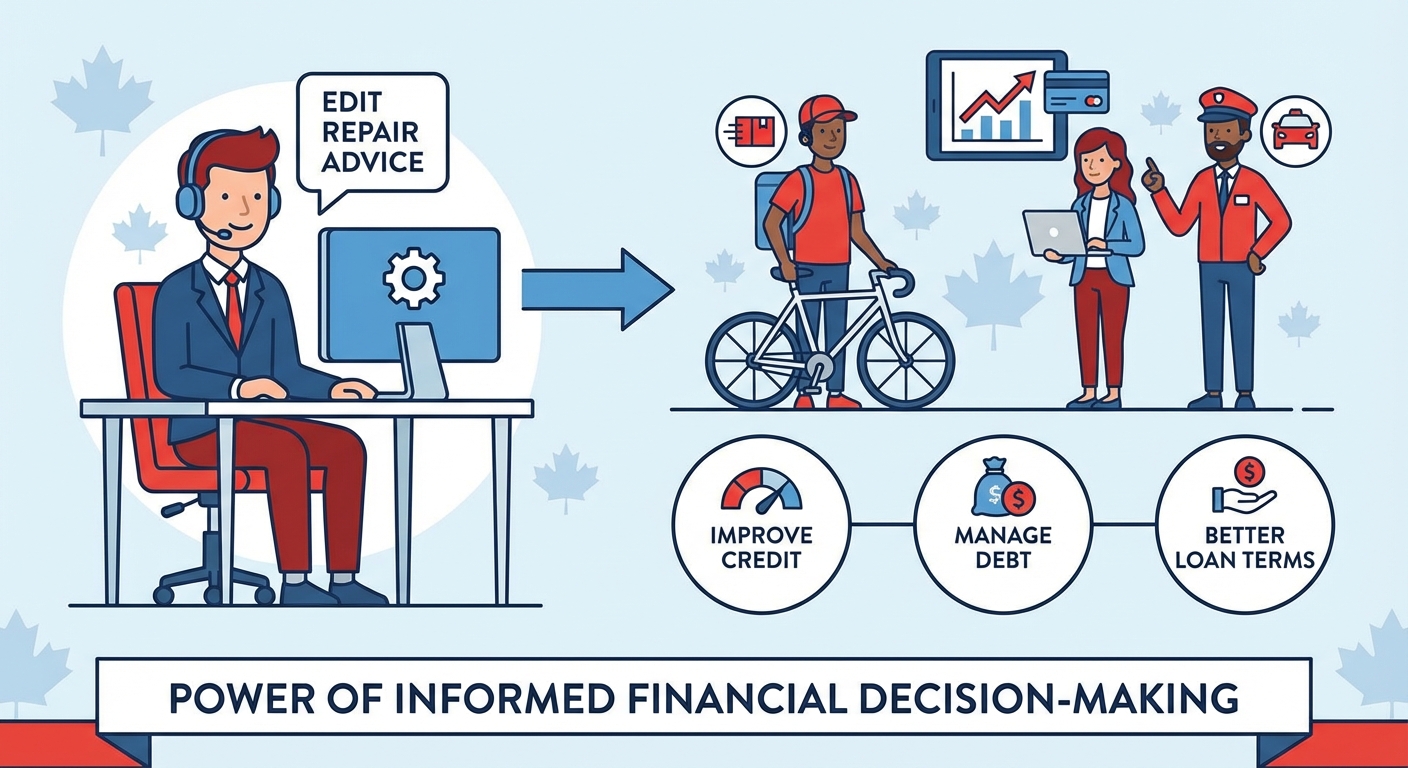

Connecting with Community Resources for Financial Literacy in Ontario

Highlighting non-profit organizations and government programs that offer free financial counselling and advice to help gig workers manage their finances and improve their credit. Numerous resources across Ontario can help you strengthen your financial position. Organizations like Credit Canada Debt Solutions or local community centres often offer free financial counselling, budgeting workshops, and credit repair advice. These services can be invaluable for gig workers looking to improve their credit score, manage debt, and ultimately qualify for better loan terms in the future. Don't underestimate the power of informed financial decision-making.

Your Next Steps to Approval: From 'Empty Wallet' to Keys in Hand

You've absorbed the knowledge, understood the nuances, and prepared your financial story. Now, it's time to put that preparation into action. Securing a car loan as a gig worker with no down payment and bad credit in Ontario is achievable with a structured approach.

A Clear, Actionable Roadmap for Ontario Gig Workers

A step-by-step guide from preparing your documents to driving off the lot.

- Gather Your Documents: Compile 3-6 months of bank statements, gig platform payment histories, invoices, and your latest tax returns (T1 General and T2125).

- Assess Your Credit: Get your free credit report and score from Equifax and TransUnion. Understand where you stand.

- Budget Realistically: Determine how much you can truly afford for a monthly payment, factoring in insurance, fuel, and maintenance.

- Seek Pre-Approval: Apply with multiple lenders or a reputable broker specializing in bad credit/gig worker loans.

- Shop Smart for a Vehicle: Focus on reliable, fuel-efficient used cars that fit your budget and gig work needs.

- Review Loan Offers Carefully: Scrutinize the APR, total cost of borrowing, and all fees before committing.

- Finalize and Drive Away: Complete the paperwork, secure insurance, and enjoy your new ride!

The Pre-Approval Power Play

Why getting pre-approved before hitting the dealership gives you significant leverage and clarity. Pre-approval means a lender has conditionally agreed to lend you a certain amount at a specific interest rate, based on a preliminary review of your finances. This is a game-changer. It transforms you from a speculative buyer into a confident cash buyer in the eyes of the dealership. You'll know exactly how much you can afford, which empowers you to negotiate vehicle prices more effectively and avoids the pressure of discussing financing at the same time you're trying to choose a car. It also confirms that your gig income is indeed valid income to a lender.

What to Do Once Approved: Navigating the Final Paperwork

Essential checks and questions before signing on the dotted line.

- Read Everything: Don't rush. Read the entire loan agreement and purchase contract carefully.

- Verify Details: Ensure all figures (loan amount, interest rate, term, monthly payment, total cost) match what you were offered.

- Understand Contingencies: Are there any conditions for your approval? Make sure you meet them.

- Check for Hidden Add-ons: Be wary of unexpected warranties, protection plans, or services added without your explicit consent.

- Ask Questions: If anything is unclear, ask for clarification until you fully understand.