Filing for bankruptcy in Canada often feels like hitting a financial brick wall. You might think that the dream of owning a reliable vehicle-something essential for commuting to work in our vast geography-is parked for the next seven years. The weight of an R9 credit rating can be heavy, but here is the reality: your financial life is not over. In fact, for many Canadians, a car loan is the very tool that jumpstarts their credit recovery.

Every year, thousands of Canadians navigate the insolvency process. Whether it was due to medical emergencies, job loss, or the rising cost of living, bankruptcy is a legal mechanism designed to give you a fresh start, not a life sentence of walking or taking the bus. The Canadian lending landscape has evolved significantly over the last decade. There is now a robust subprime market specifically designed to help people who have faced insolvency get back on the road. This guide pulls back the curtain on the "approval secrets" that specialist lenders use, providing you with a clear, actionable roadmap to securing a vehicle without getting trapped in predatory cycles.

Key Takeaways

- Bankruptcy is not a permanent barrier: Roughly 1 in 6 Canadians face insolvency at some point; lenders have specific programs designed for this demographic.

- Discharge status matters: While possible to get a loan while undischarged, being discharged opens doors to significantly better interest rates and more lender options.

- Preparation is the 'Secret': A solid down payment and proof of stable income are the two most powerful tools to offset a low credit score.

- Rebuilding starts immediately: A car loan is often the fastest way to rehabilitate a credit score from an R9 rating back to healthy levels through consistent reporting.

- Avoid 'Shotgunning' applications: Multiple hard inquiries in a short period can further damage a recovering score. Work with one specialist at a time.

Understanding the Impact: How Bankruptcy Affects Your Credit Report

To fix your credit, you first have to understand the damage. In Canada, your credit report is managed primarily by two bureaus: Equifax and TransUnion. When you file for bankruptcy, your accounts are assigned an "R9" rating. This is the lowest possible rating on the scale, indicating a "bad debt" or "debt written off."

The R9 Rating Explained

Lenders look at your credit report as a story of your reliability. An R9 tells them that the previous chapters ended in a total loss for your creditors. When a subprime lender pulls your report, they aren't looking for perfection; they are looking for the date of your filing and the date of your discharge. They want to see that the "old you" (pre-bankruptcy) is gone and the "new you" (post-bankruptcy) is managing current obligations responsibly.

The Timeline: How Long Does it Stay?

In Canada, a first-time bankruptcy typically stays on your Equifax report for six years after the date of discharge. TransUnion generally keeps it for six or seven years depending on the province. If you opt for a Consumer Proposal instead, it remains for three years after you've finished all payments or six years after you filed-whichever comes first. Understanding this timeline is vital because it dictates how long you will be dealing with higher interest rates. You aren't waiting for the bankruptcy to disappear to get a loan; you are getting a loan to prove you've moved past it.

Timing Your Application: Undischarged vs. Discharged

Can you get a car loan while still in the middle of your bankruptcy? The short answer is yes, but the long answer involves more hurdles. If you are "undischarged," you are technically still under the supervision of the court and your Licensed Insolvency Trustee (LIT).

Getting a Loan While Undischarged

To secure a loan while undischarged, you generally need a "Letter of Permission" from your Trustee. This letter informs the lender that the Trustee is aware of the new debt and that it won't interfere with your bankruptcy duties. Lenders who work with undischarged clients are rare and often charge the maximum allowable interest rates. You should only pursue this if your current vehicle has died and you absolutely need wheels to keep your job.

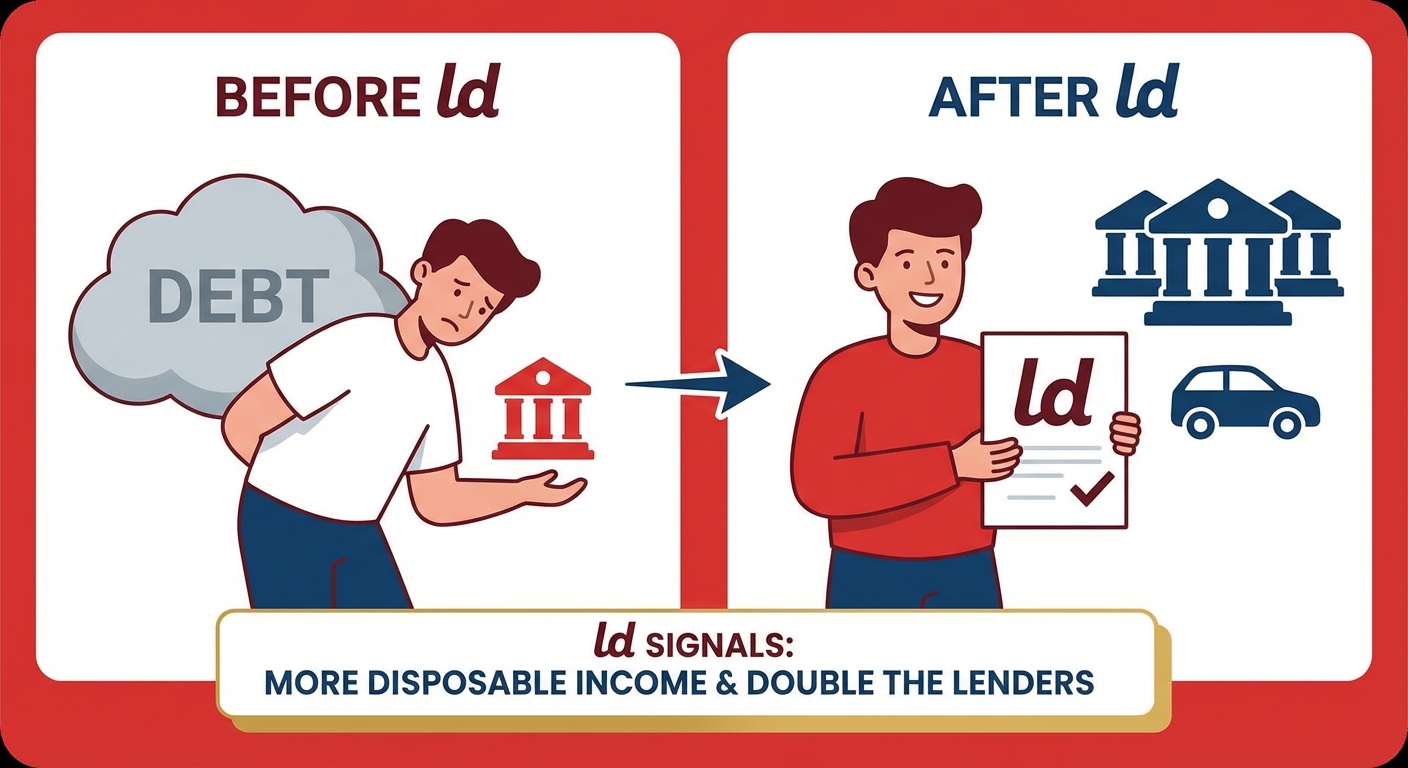

The Benefits of Waiting for Discharge

Once you receive your "Certificate of Discharge," you are legally free from your past debts. This piece of paper is gold. It signals to lenders that you no longer owe thousands to credit cards or banks, meaning you have more "disposable income" to put toward a car payment. The pool of lenders willing to work with you doubles the moment that discharge is finalized.

The 'Approval Secrets': How to Make Yourself Irresistible to Lenders

Lenders are in the business of managing risk. After a bankruptcy, you are considered "high risk." To get an approval, you need to provide "risk offsets." These are factors that prove you are likely to pay the loan back despite your history.

Secret #1: The 'Skin in the Game' Strategy

A down payment is the single most effective way to secure an approval. When you put $1,000 or $2,000 down, you are reducing the lender's "Loan-to-Value" (LTV) ratio. If you default, the lender has a better chance of recovering their money by selling the car. More importantly, it shows the lender that you have the discipline to save money-a trait they value highly in post-bankruptcy applicants.

Secret #2: Employment Stability

Subprime lenders care more about your pay stub than your credit score. They want to see that you have been at the same job for at least three to six months. If you have been with the same employer for over two years, your chances of approval skyrocket. They are looking for "garnishable income"-a steady stream of revenue that they know will be there every month.

Secret #3: Debt-to-Income (DTI) Ratios

Lenders use a formula to decide if you can afford the car. Generally, they don't want your total debt obligations (including the new car payment and insurance) to exceed 40-45% of your gross monthly income. For the car payment specifically, aim for the 15-20% rule. If you earn $4,000 a month, your car payment should ideally be under $600. Pushing for a luxury SUV when your income suggests a compact sedan is a quick way to get a "decline."

Secret #4: The Co-signer Option

If your bankruptcy is very recent or your income is on the lower side, a co-signer can bridge the gap. A co-signer with established, "Prime" credit (700+) essentially "loans" you their credit reputation. However, this is a massive responsibility. If you miss a payment, their credit score takes the hit alongside yours. Use this option only if you have a rock-solid relationship and a guaranteed plan to make payments.

Identifying the Right Lenders for Bankruptcy Car Loans in Canada

Not all lenders are created equal. If you walk into a "Big Five" bank (like RBC or TD) the week after your bankruptcy discharge, you will almost certainly be rejected. These institutions use automated "scorecard" systems that automatically decline anyone with a bankruptcy on file. You need to look elsewhere.

| Lender Type | Typical Interest Rates | Credit Score Required | Best For... |

|---|---|---|---|

| Traditional Banks | 5% - 9% | 680+ | People with 7+ years post-discharge history. |

| Specialist Subprime Lenders | 10% - 24.9% | 300 - 600 | Recent bankruptcy or consumer proposal discharge. |

| In-House (Buy Here Pay Here) | 25% - 30%+ | No Score Required | Absolute last resort; often does not report to credit bureaus. |

Online Auto Finance Platforms

The modern way to secure a post-bankruptcy loan is through specialized online platforms. These companies act as intermediaries between you and a network of subprime lenders and dealerships. They specialize in "pre-approvals," meaning they match your profile with a lender who has a high probability of saying yes before you ever step foot on a lot. This prevents the "shotgunning" of your credit-where multiple dealers run your credit simultaneously, causing your score to drop further.

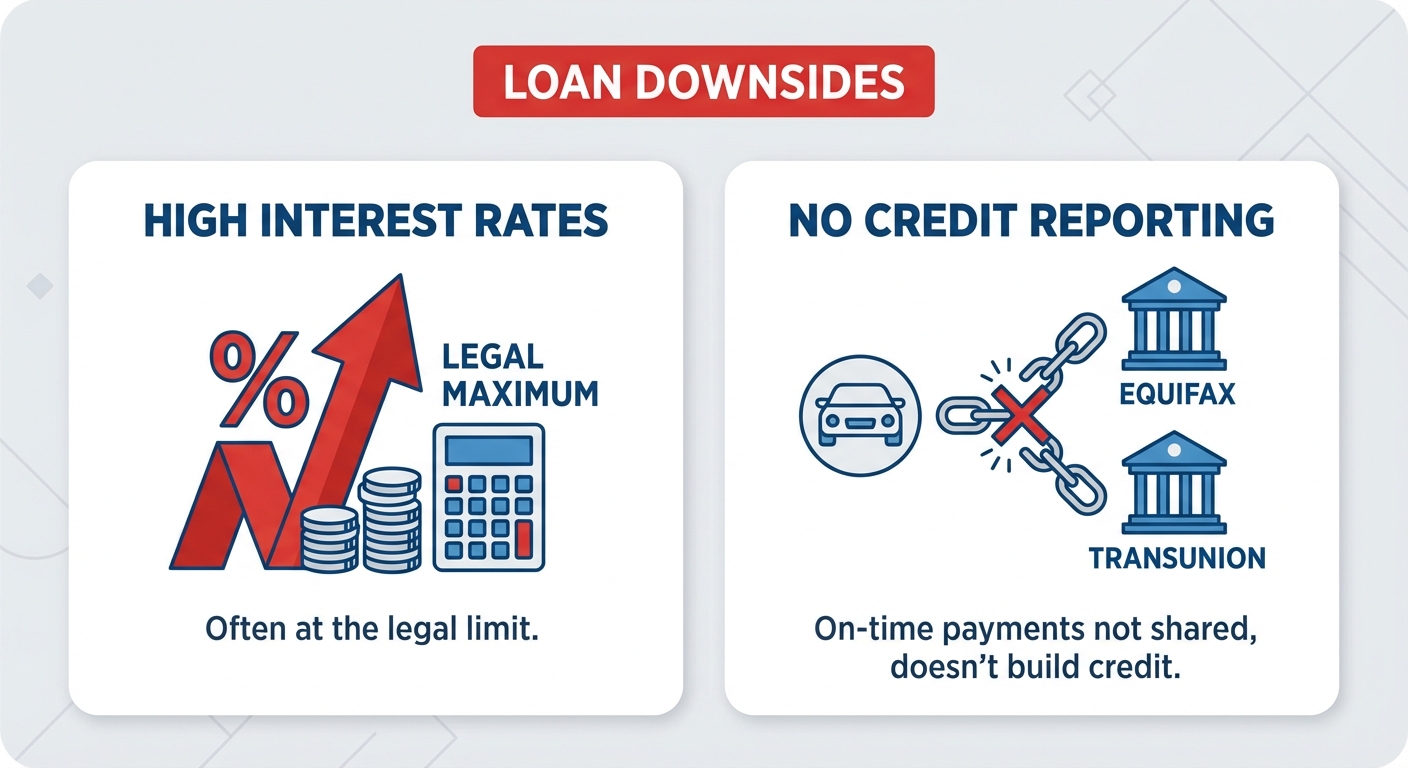

In-House Financing: A Word of Caution

You've likely seen the signs: "No Credit? No Problem! Everyone Approved!" These are typically "Buy Here Pay Here" (BHPH) dealerships. While they can get you into a car today, there are two major downsides. First, the interest rates are often the legal maximum. Second, many of these dealers do not report your on-time payments to Equifax or TransUnion. If they don't report, the loan does absolutely nothing to help you rebuild your credit.

Step-by-Step: The Application Process Post-Bankruptcy

Securing an approval is about presenting a professional "package" to the lender. If you show up organized, you look like someone who has learned from their past and is ready to be responsible.

1. Gathering Your 'Approval Kit'

Don't wait for the lender to ask. Have these documents scanned and ready in a digital folder:

- Discharge Papers: Your official Certificate of Discharge.

- Proof of Income: Your two most recent pay stubs.

- Proof of Residence: A utility bill or lease agreement in your name.

- Driver's License: Must be valid (not expired or suspended).

- Banking Info: A void cheque or direct deposit form for automated payments.

2. The Pre-Approval Phase

Before you fall in love with a specific car, find out what the bank will actually lend you. A pre-approval tells you your maximum loan amount and your estimated interest rate. This keeps you grounded. If you are approved for $15,000, looking at $25,000 trucks is a waste of your time and will lead to frustration.

3. Selecting the Right Vehicle

Lenders have "collateral rules." For a post-bankruptcy loan, they generally prefer vehicles that are less than 7-8 years old and have fewer than 120,000 kilometres. Why? Because if the car breaks down and you can't afford the repair, you are more likely to stop making the loan payments. Lenders want you in a reliable vehicle that will last the duration of the loan.

Navigating Interest Rates and Loan Terms

You need to accept that your first loan after bankruptcy will be expensive. You aren't paying for the car; you are paying for the privilege of rebuilding your reputation. However, there is a difference between a "fair" subprime rate and a predatory one.

What is a 'Fair' Rate?

In the current Canadian market, if you are freshly discharged from bankruptcy, expect a rate between 14% and 19%. If you have been discharged for a year and have a steady job, you might see 10% to 12%. Anything over 25% is entering the "danger zone" and should be scrutinized heavily.

The Danger of Long-Term Loans

To make monthly payments look smaller, some dealers will offer 72 or 84-month terms. Avoid this at all costs. Since your interest rate is high, a long term means you will be paying thousands more in interest. More importantly, you will be "upside down" (owing more than the car is worth) for almost the entire life of the loan. This is called negative equity, and it's a trap that can lead back to financial ruin.

Rebuilding Your Credit Through Your Car Loan

A car loan is an "installment loan." This is the best type of credit for rebuilding because it shows you can handle a large obligation over a long period. It provides a different "credit mix" than a credit card, which is "revolving credit."

Consistency is your only path forward. One single missed payment on your new car loan can set your credit recovery back by years. Set up automatic withdrawals from your bank account to align with your paydays. If you get paid on the 15th and 30th, set your car payment for the 16th. This ensures the money is gone before you have a chance to spend it elsewhere.

After about a year of perfect payments, check your credit score. You will likely see a jump of 50 to 100 points. At this stage, you can approach your lender or a new lender to discuss refinancing. If you started at 19% interest, dropping to 9% can save you hundreds of dollars a month and thousands over the life of the loan.

Red Flags: Avoiding Predatory Lending and Scams

The subprime industry is filled with honest professionals, but it also attracts "bottom feeders" who prey on the desperate. You must stay vigilant.

Guaranteed Approval Scams: No legitimate lender can guarantee an approval without seeing your credit and income. If they promise approval before they even know your name, they are likely a "Buy Here Pay Here" lot with predatory terms or a scam designed to collect your personal data.

Hidden Fees: Review your bill of sale carefully. Look for "Documentation Fees" that exceed $500, or mandatory "Window Etching" and "Nitrogen Tires" that cost hundreds. These are often "junk fees" used to inflate the price of the car. While some fees are standard, you have the right to question anything that seems excessive.

Pre-payment Penalties: Ensure your loan is "open-ended." This means you can pay it off early or refinance it without paying a penalty. Most major subprime lenders in Canada (like Santander or Rifco) offer open-ended loans. If a lender tries to lock you into a contract where you can't pay extra toward the principal, walk away.

Frequently Asked Questions (FAQ)

Can I get a car loan if I am currently in a Consumer Proposal?

Yes. In many ways, it is easier to get a car loan during a Consumer Proposal than during a bankruptcy. Since a proposal is an agreement to pay back a portion of your debt, lenders view it as a more "responsible" form of insolvency. You do not typically need a Trustee's letter of permission for a car loan under a proposal, provided the new debt doesn't cause you to default on your proposal payments.

How much down payment do I really need after bankruptcy?

While some lenders offer $0 down programs, they are difficult to qualify for immediately after bankruptcy. A down payment of $500 to $1,000 is usually enough to secure an approval for a modest used vehicle. If you can provide 10% of the vehicle's price, you will often qualify for a lower interest rate.

Will a car loan help me get a mortgage faster after bankruptcy?

Absolutely. Most mortgage lenders in Canada want to see "two re-established lines of credit" for at least two years post-discharge before they will consider a home loan. A car loan counts as one of those major lines. By the time you are ready to buy a home, your car loan history will prove you are a reliable borrower.

What happens if I lose my job during the loan term?

Communication is vital. If you lose your job, call your lender immediately-before you miss a payment. Many lenders have "hardship programs" or can offer a one-month payment deferral to give you time to find new employment. They would rather help you keep the car than go through the expensive process of repossession.

Can I trade in my current vehicle if I still owe money on it post-bankruptcy?

If the vehicle was not part of your bankruptcy filing (meaning you kept the loan and the car), you can trade it in. However, if the car is worth less than what you owe (negative equity), that debt will have to be rolled into your new loan. This can be difficult to get approved after bankruptcy, so it's usually better to pay the current loan down until you have some equity.

Your Path to Financial Recovery

The journey from the "R9" rating of bankruptcy back to financial stability is a marathon, not a sprint. Securing a car loan is one of the most significant steps you can take on that path. It provides the mobility you need to maintain employment and the data the credit bureaus need to see that you are a changed borrower.

Don't let the fear of rejection stop you. The "secrets" to approval aren't about magic tricks; they are about preparation, honesty, and choosing the right partners. By focusing on your employment stability, saving a modest down payment, and targeting the right specialist lenders, you can secure a vehicle that fits your budget and your life. Reclaiming your credit health starts with a single on-time payment. Take that first step today, get your pre-approval, and put the bankruptcy in your rearview mirror where it belongs.