Private Sale Car Loan After Bankruptcy | Edmonton Blueprint

Table of Contents

- Key Takeaways

- The Private Sale Paradox: Why Cheaper Cars Mean a Tougher Loan Approval

- Decoding the Lender's Scorecard: What They Scrutinize After a Bankruptcy

- Time Since Discharge: The Magic Number

- Stability Over Score: Proving Consistent Income and Employment

- The Debt-to-Income (DTI) Equation: How to Calculate Yours

- The Power of the Down Payment

- The Pre-Approval Gauntlet: Your Step-by-Step Plan BEFORE You Shop

- 1. Gathering Your Arsenal: The Document Checklist

- 2. Choosing Your Lender

- 3. The Application: Honesty is the Best Policy

- 4. Understanding Your Pre-Approval

- Deep Dive: Mastering the Vehicle Due Diligence Lenders Demand

- The Lien Search Explained

- Beyond the CARFAX: The Pre-Purchase Inspection (PPI)

- Verifying Ownership

- The Paperwork Puzzle: A Guide to the Bill of Sale and Other Must-Haves

- Anatomy of a Perfect Bill of Sale

- The Seller's Role

- The Lender's Documents

- Unpacking the Numbers: Interest Rates, Loan Terms, and Total Cost

- Why Post-Bankruptcy Rates Are Higher

- Term Length vs. Payment: The Pros and Cons

- The Rebuilding Effect

- Your Next Steps to Approval: The Final Pre-Purchase Checklist

- Frequently Asked Questions

Navigating life after bankruptcy in Edmonton is a journey of rebuilding, and securing reliable transportation is a massive step towards financial independence. You've done the hard work of getting a fresh start, but now you face a new challenge: financing a car. You've found the perfect vehicle from a private seller—it's cheaper, it's exactly what you need—but getting a loan for it feels like hitting a wall. You're not alone in this.

The path to a private sale car loan approval after bankruptcy in Edmonton is fundamentally different from walking into a dealership. It's more complex, requires more diligence, and demands a strategic approach. Traditional lenders often see a private sale combined with a past bankruptcy as a stack of red flags. But it's not impossible. Not by a long shot.

This is your blueprint. We're not just going to give you vague advice; we're going to lay out the exact, step-by-step process that lenders use to evaluate your application. We'll decode the paperwork, unpack the numbers, and give you the tools to walk into this process with the confidence of an expert. Consider this your guide to turning a 'no' from the bank into a 'yes' that gets you the keys.

Key Takeaways

- Pre-Approval is Non-Negotiable: For a private sale after bankruptcy, securing a pre-approved loan before you even look at a car is the single most important step. It defines your budget and proves to sellers you're a serious buyer.

- The Vehicle is Under Scrutiny: Lenders are just as concerned about the car as they are about your credit history. They will demand a comprehensive lien search and a professional mechanical inspection to protect their investment.

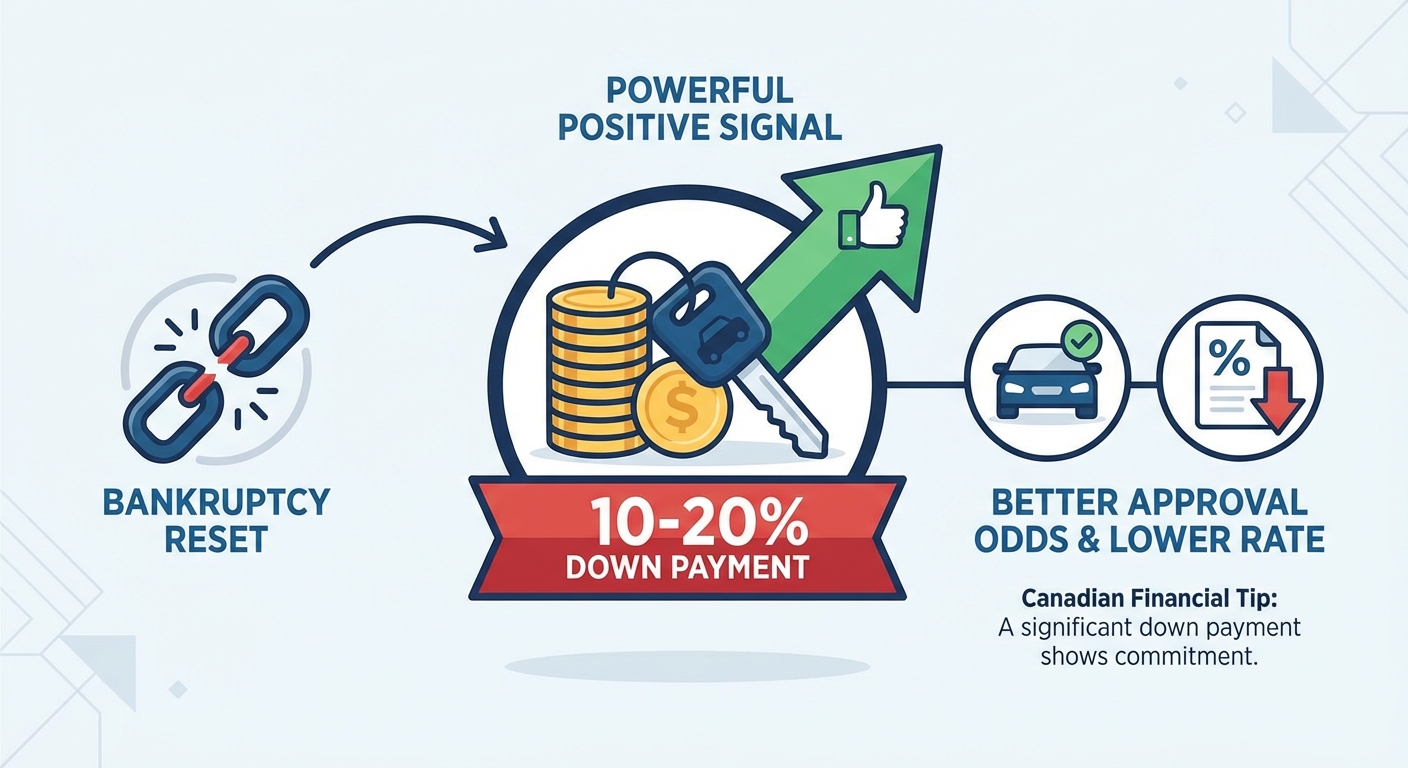

- A Down Payment is Your Superpower: In the world of post-bankruptcy financing, a significant down payment (10-20% or more) dramatically reduces the lender's risk, which can increase your approval odds and potentially lower your interest rate.

- Discharge Date is Crucial: Your bankruptcy status matters immensely. Lenders have very different rules for "discharged" versus "undischarged" bankruptcies. Being fully discharged is almost always a prerequisite for a private sale loan.

- Stability Trumps Your Old Score: Lenders look for recent, positive history. Demonstrating stable income and residence for at least 6-12 months post-discharge is more powerful than a credit score that's still recovering.

The Private Sale Paradox: Why Cheaper Cars Mean a Tougher Loan Approval

Getting a private sale car loan approval after bankruptcy in Edmonton is challenging because lenders view the transaction as having multiple layers of risk. Unlike a dealership, which is a known business entity, a private seller is an unknown individual, and the vehicle lacks any form of guarantee, making the entire process more complex for the financial institution putting up the money.

So, why is this so hard? You've found a great deal on Kijiji or Facebook Marketplace, a car that's thousands cheaper than at a dealership. This should be a good thing, right? From a lender's perspective, that "great deal" is a giant question mark. Here’s the breakdown of their risk assessment:

- No Dealership Backing: Dealerships have a reputation to uphold. They are registered businesses that vet their vehicles, handle paperwork professionally, and have established relationships with lenders. A private seller has none of this. There's no one to call if the paperwork is wrong or if the car breaks down a week later.

- Vehicle Condition Uncertainty: A dealership vehicle, especially a certified pre-owned one, has typically undergone a multi-point inspection. A private sale car's condition is completely unknown. Is there hidden rust? A pending engine failure? Lenders worry they are financing an asset that could be worthless tomorrow.

- The Lien Labyrinth: This is a massive hurdle. The seller might still owe money on the car, meaning there's a lien registered against it. If a lender gives you money to buy that car, and the seller doesn't pay off their original loan, the first lender can repossess the vehicle—leaving you with a loan and no car. This is a catastrophic risk for a new lender.

- Complicated Transaction Process: With a dealership, the financing and sale happen in one smooth transaction. In a private sale, the lender has to coordinate paying a private individual, ensuring the ownership is transferred correctly, and verifying all documents are legitimate. It’s more work and more potential for fraud or error.

This combination of factors means that even if you're on the right track financially, the nature of the private sale itself requires a much higher level of proof and diligence from both you and the lender. While the principles are similar across Canada, the process for an Ontario Private Car Loan 2026: Skip the Dealership Drama involves the same core challenges as one in Edmonton.

Decoding the Lender's Scorecard: What They Scrutinize After a Bankruptcy

When you've been through a bankruptcy, your old credit score is shattered. Lenders know this. They aren't looking for a 750 score; they're looking for evidence of a new, responsible financial chapter. They use a different scorecard, one that prioritizes recent stability over past mistakes. Here's what they're actually looking at for your 2026 loan application.

Time Since Discharge: The Magic Number

This is arguably the most important metric. A bankruptcy "discharge" is the court order that releases you from your debts. Before you're discharged, getting any loan is nearly impossible. After discharge, the clock starts.

In our experience, most specialized lenders want to see a minimum of 6 to 12 months of clean history after your discharge date. This period proves that your financial troubles are truly in the past and that you've started rebuilding with new, positive credit habits (like a secured credit card or a small cell phone plan).

Stability Over Score: Proving Consistent Income and Employment

A high credit score shows a good past; a steady pay stub shows a good future. Lenders will focus intensely on your income and employment stability.

- Employment Length: Have you been at your current job for at least 3-6 months? Frequent job-hopping is a red flag.

- Income Consistency: They need to see a predictable income that can comfortably cover the new car payment plus your other living expenses. For hourly or commission-based workers, they'll typically look at a 3-month average.

- Proof of Income: Be prepared with your last 2-3 recent pay stubs and possibly a letter of employment.

For those with non-traditional income, the challenge can be greater, but not impossible. If you're a gig worker or self-employed, understanding how lenders view your situation is key. For more on this, see our guide: Banks Need Pay Stubs. We Need Your Drive. Gig Worker Car Loans.

Pro Tip: The Ultimate Proof of Income

Use your Notice of Assessment (NOA) from the Canada Revenue Agency (CRA) as undeniable proof of income. For self-employed individuals, gig workers, or anyone with variable pay in Edmonton, the "Line 15000 - Total Income" on your most recent NOA is a number lenders trust implicitly. It cuts through any confusion from variable pay stubs and demonstrates your true earning power over a full year.

The Debt-to-Income (DTI) Equation: How to Calculate Yours

Your DTI ratio is a snapshot of your monthly financial health. It tells a lender what percentage of your gross monthly income is already committed to debt payments.

Calculation: (Total Monthly Debt Payments) / (Gross Monthly Income) = DTI

Your "Total Monthly Debt Payments" include rent/mortgage, credit card minimums, student loans, and any other loan payments.

Most non-prime lenders want to see a DTI ratio below 40-45%, including the estimated new car payment. A lower DTI shows you have plenty of room in your budget to handle the loan without stress.

The Power of the Down Payment

A down payment is more than just money; it's a statement. It shows the lender three critical things:

- You have skin in the game: You're less likely to default on a loan if you have your own money invested.

- It reduces their risk: The loan amount is smaller, meaning they have less to lose if something goes wrong.

- It demonstrates financial discipline: You've managed to save a lump sum of cash, which is a powerful positive signal after a bankruptcy.

While some loans are possible with zero down, a down payment of 10% to 20% of the vehicle's price will massively increase your chances of approval and can lead to a better interest rate.

Caption: A flowchart comparing the simpler dealer financing path with the more complex private sale path, highlighting extra steps like 'Independent Mechanical Inspection' and 'Lien Search Coordination' for the private sale.

The Pre-Approval Gauntlet: Your Step-by-Step Plan BEFORE You Shop

Do not, under any circumstances, start shopping for a private sale car in Edmonton without a loan pre-approval in hand. A pre-approval is your golden ticket. It tells you exactly how much you can spend, what your interest rate will be, and transforms you from a window shopper into a buyer with negotiating power.

1. Gathering Your Arsenal: The Document Checklist

Before you apply, get your paperwork in order. Lenders need to verify everything. Having these ready will speed up the process immensely.

- Proof of Income: Your last 2-3 pay stubs. If self-employed, your last two years of NOAs from the CRA.

- Bank Statements: The last 90 days of statements from your primary bank account to show income deposits and regular bill payments.

- Proof of Residence: A recent utility bill or cell phone bill in your name at your current address.

- Valid ID: Your Alberta Driver's Licence.

- Bankruptcy Discharge Papers: This is the official document proving you are legally free from your past debts. It's non-negotiable.

Having a complete file is half the battle. For a comprehensive list tailored for Alberta, check out our guide on Approval Secrets: Exactly What Paperwork You Need for Alberta Car Financing.

2. Choosing Your Lender

Your bank, which may have been part of your bankruptcy, is unlikely to approve you. You need a specialist.

- Specialized Non-Prime Lenders (Like SkipCarDealer): We work specifically with individuals in situations like yours. We understand the nuances of post-bankruptcy credit and have partnerships with lenders who look beyond the credit score to your overall financial picture.

- Credit Unions: Local credit unions in Edmonton can sometimes be more flexible than big banks, but they may still be hesitant about the private sale aspect.

3. The Application: Honesty is the Best Policy

When you fill out the application, be 100% truthful. Discrepancies between your application and your documents are the fastest way to get declined. Lenders will verify your income, your employment, and your address. Be upfront about your bankruptcy; they already know about it from your credit file.

4. Understanding Your Pre-Approval

A pre-approval isn't a blank cheque. It's a specific offer with clear terms:

- Maximum Loan Amount: The absolute ceiling you can spend on the car's purchase price.

- Interest Rate (APR): The annual percentage rate you'll be charged. This will be a "not to exceed" rate.

- Loan Term: The number of months you have to repay the loan (e.g., 60, 72, or 84 months).

With this document in hand, you can now shop with confidence, knowing exactly what you can afford.

Deep Dive: Mastering the Vehicle Due Diligence Lenders Demand

Once you're pre-approved, the focus shifts from you to the car. For a private sale, the lender needs you to act as their eyes and ears. You must perform rigorous due diligence to prove the vehicle is a sound investment. Skipping these steps will kill your loan approval.

The Lien Search Explained

A lien is a legal claim against a property (in this case, a vehicle) to secure a debt. If the seller you're buying from still owes money on their car loan, their lender has a lien on it.

Why it kills loan applications: No lender will finance a vehicle that already has a lien from another institution. It creates a messy legal situation where it's unclear who has the right to the asset.

How to perform a search in Alberta: You can get a vehicle information report (VIR) from any Alberta Registry Agent. It costs a small fee and requires the vehicle's Vehicle Identification Number (VIN). This report will show the vehicle's registration history in Alberta and, most importantly, if there are any active liens. This is a mandatory step.

Beyond the CARFAX: The Pre-Purchase Inspection (PPI)

A CARFAX or CarVertical report is essential for checking accident history, but it doesn't tell you the car's current mechanical condition. A lender needs to know they aren't financing a lemon that's about to die.

You must arrange for a pre-purchase inspection (PPI) by a licensed, third-party mechanic in Edmonton. This is non-negotiable for you and the lender. The mechanic will put the car on a hoist and check the engine, transmission, brakes, frame, and electronics for any existing or potential issues. The written report from this inspection provides the lender with the confidence they need in the vehicle's value.

Pro Tip: Use the Inspection as a Negotiation Tool

The PPI isn't just for the lender; it's for you. If the mechanic's report finds that the car needs new tires ($800) and a brake job ($500), you now have documented proof to negotiate the price down. Present the report to the seller and say, "I'm still very interested, but given the $1,300 in immediate repairs needed, I can offer you [original price minus $1,300]." This can save you real money and demonstrates to your lender that you're a savvy buyer.

Verifying Ownership

This sounds simple, but it's a critical fraud-prevention step. Ask the seller to show you their driver's licence and the current vehicle registration. The name and address on both documents must match perfectly. If they don't, or if the seller is hesitant, walk away. This is a major red flag for "curbsiders"—unlicensed dealers posing as private sellers.

The Paperwork Puzzle: A Guide to the Bill of Sale and Other Must-Haves

With a great car vetted and a pre-approval secured, the final step is the paperwork. Getting this right is crucial for the lender to release the funds and for you to legally take ownership.

Anatomy of a Perfect Bill of Sale

The Bill of Sale is the legal contract transferring ownership. In Alberta, you can download a standard form or create your own, but it MUST include this information:

- Full Legal Names and Addresses: Of both the buyer (you) and the seller.

- Vehicle Details: Year, make, model, colour, and most importantly, the 17-digit VIN. Double-check the VIN against the car's dash and registration.

- Odometer Reading: The exact kilometres at the time of sale.

- Sale Price: The final agreed-upon price in Canadian dollars.

- Date of Sale: The date the transaction is taking place.

- Signatures: Both buyer and seller must sign and date the document.

- 'As-Is, Where-Is' Clause: Most private sales include a clause stating the vehicle is being sold in its current condition with no warranties.

Your lender will need a clean, legible copy of this document before they can finalize the loan.

Caption: An annotated example of an Alberta Bill of Sale, with callout boxes pointing to the critical fields like 'VIN Number,' 'Sale Price,' and the 'Signatures' section.

The Seller's Role

To finalize the sale at the registry, you will need the seller to provide you with the signed ownership/registration document. Ensure they have signed the "seller" portion. You will also need to see their government-issued ID again to verify their signature.

The Lender's Documents

Before any money changes hands, your lender will provide you with the final loan agreement. Read it carefully. Confirm that the loan amount, interest rate (APR), and term match your pre-approval. Understand the payment schedule and the total cost of borrowing. This is your last chance to ask questions before you are legally committed.

Unpacking the Numbers: Interest Rates, Loan Terms, and Total Cost

Let's talk about the elephant in the room: the cost. A post-bankruptcy car loan will have a higher interest rate than a loan for someone with perfect credit. This isn't personal; it's a direct reflection of the lender's risk. Being transparent about these numbers is key to making an informed decision.

Why Post-Bankruptcy Rates Are Higher

Lenders use risk-based pricing. The higher the perceived risk of default, the higher the interest rate. A recent bankruptcy places you in a "subprime" or "non-prime" credit category. Here's a realistic look at what that means for rates in the current market.

| Credit Tier | Typical Credit Score | Estimated Interest Rate (APR) | Notes |

|---|---|---|---|

| Prime | 720+ | 6.99% - 9.99% | Excellent credit history, often secured through banks/dealerships. |

| Near-Prime | 620 - 719 | 10.00% - 17.99% | Some past credit blemishes but generally stable. |

| Subprime (Post-Bankruptcy) | Below 620 | 18.00% - 29.99% | Recent major credit event; requires specialized lenders. |

Note: These rates are estimates for illustrative purposes and can vary based on the lender, vehicle age, loan term, and your specific financial profile.

Term Length vs. Payment: The Pros and Cons

A longer loan term will result in a lower monthly payment, which can be tempting. However, it also means you'll pay significantly more in interest over the life of the loan. Let's look at a $15,000 loan at a 22.99% APR.

| Loan Term | Estimated Monthly Payment | Total Interest Paid | Total Loan Cost |

|---|---|---|---|

| 48 Months (4 years) | $481 | $8,088 | $23,088 |

| 60 Months (5 years) | $423 | $10,380 | $25,380 |

| 72 Months (6 years) | $385 | $12,720 | $27,720 |

As you can see, extending the loan from 4 to 6 years lowers your payment by nearly $100, but costs you an extra $4,632 in interest. Choose the shortest term you can comfortably afford.

Pro Tip: Ask About Open Loans

Always ask your lender one critical question: "Is this an open loan, and are there any penalties for early repayment?" An 'open' loan allows you to make extra payments or pay off the entire loan early without any fees. As your financial situation improves in the years after your bankruptcy, you may be able to pay the car off faster, saving you thousands in interest. Insist on an open loan.

The Rebuilding Effect

This loan is more than just a car; it's a powerful credit-rebuilding tool. Every on-time payment you make is reported to the credit bureaus (Equifax and TransUnion). Over the course of the loan, you will be building a new, positive payment history that will dramatically improve your credit score. This is a crucial step to graduating from subprime rates back into the world of prime lending. A successful car loan is often the first major milestone after completing a debt program or bankruptcy. For more on this journey, see our Get Car Loan After Debt Program Completion: 2026 Guide.

Your Next Steps to Approval: The Final Pre-Purchase Checklist

You've absorbed a lot of information. Before you move forward, use this final checklist to ensure all your bases are covered. This is your roadmap to a successful private sale car loan approval in Edmonton.

- [ ] I have a copy of my bankruptcy discharge papers.

- [ ] I have proof of stable income for the last 3+ months (pay stubs or NOAs).

- [ ] I am pre-approved for a specific loan amount from a specialized lender.

- [ ] I have the VIN for the target vehicle and have performed a lien search.

- [ ] A licensed mechanic has completed a pre-purchase inspection and I have the report.

- [ ] I have verified the seller's identity matches the vehicle registration.

- [ ] I have reviewed the loan agreement and understand the interest rate, term, and total cost of my loan.

If you can check every box on this list, you are in an excellent position to finalize your purchase and get back on the road.