Seasonal Employment Car Loan? Calgary's 2026 Approval Plan

Table of Contents

- Key Takeaways

- Decoding the Lender's Mindset: Why 'Seasonal' Spells 'Risk' in Calgary

- The Consistency Gap

- Alberta's Boom/Bust Cycle

- The Automated 'No'

- Pro Tip

- The Seasonal Worker's Approval Blueprint: A 3-Part Strategy

- Part 1: The Art of Timing - When to Apply for Your Car Loan

- Part 2: The 'Proof of Income' Portfolio - Documents That Speak Louder Than Pay Stubs

- Pro Tip

- Part 3: Choosing Your Financial Partner - The Big Banks vs. The Specialists

- Pro Tip

- Calgary's 2026 Auto Finance Outlook: What's Changing for Seasonal Buyers

- Interest Rate Forecasts & Affordability

- The Rise of AI Underwriting

- Vehicle Affordability in Alberta: The Work Truck Dilemma

- Case Study: How a Calgary Landscaper Financed His Work Truck

- Your Next Steps: The Calgary Seasonal Buyer's Final Checklist

- Frequently Asked Questions About Seasonal Car Loans

The roar of a new truck engine is the soundtrack to success in Alberta. For thousands of Calgarians in construction, oil and gas, landscaping, and tourism, that success is seasonal. You work hard when the sun shines or the rigs are active, but when the season ends, traditional lenders often see a red flag, not a well-earned break.

If you've ever typed "can I get a car loan with seasonal employment income" into a search bar, you've likely been met with confusing advice and frustrating dead ends. The old rules are changing. The lending landscape in Calgary is shifting, and what worked in 2024 won't cut it in 2026. This isn't just another guide; this is your strategic blueprint for getting approved.

We're going to dismantle the myths, show you the exact documents lenders actually want to see, and provide a clear plan to secure the vehicle you need—whether you're applying in the peak of your work season or during your time off.

Key Takeaways

- The '3-Month Rule' is a Myth: While helpful, a strong application with 2+ years of consistent seasonal history is far more powerful to a lender than just having 3 months of pay stubs at a new job.

- Income Averaging is Your Key: Lenders don't just look at your on-season pay stubs. They average your income over 12 or 24 months to determine your true borrowing power. We'll show you exactly how to calculate this.

- Documentation Defeats Doubt: A detailed Letter of Employment, your previous two years of T4s, and bank statements showing consistent off-season savings are your most crucial tools for approval.

- Calgary's 2026 Outlook: Expect lenders to scrutinize debt-to-service ratios more closely as interest rates fluctuate. We'll outline a concrete strategy to prepare for this coming shift.

- Dealer vs. Bank Isn't the Question: The real choice is between traditional lenders who use rigid algorithms and specialized lenders who understand Alberta's seasonal economy (oil & gas, construction, tourism).

Decoding the Lender's Mindset: Why 'Seasonal' Spells 'Risk' in Calgary

To get a 'yes' from a lender, you first need to understand why they're so quick to say 'no'. It's not personal; it's about predictable risk assessment, and seasonal work throws a wrench in their standard formulas.

Yes, you can get a car loan with seasonal employment income in Canada. The key is to shift the lender's focus from your temporary gaps in employment to your consistent annual earnings. This is achieved by providing at least two years of T4s, a strong Letter of Employment, and bank statements to prove a stable, predictable year-over-year income pattern.

Here’s what an underwriter sees when your application lands on their desk:

The Consistency Gap

A traditional lender's algorithm is built for the 9-to-5 employee who gets a paycheque every two weeks, 12 months a year. When they see your income stop for three or four months, their system flags it as "unstable employment." They see a 4-month gap; you see a planned, predictable part of your annual work cycle. Your job is to bridge that perception gap with documentation.

Alberta's Boom/Bust Cycle

Lenders in Calgary are uniquely aware of the province's economic landscape. They've seen the fluctuations tied to oil, gas, and construction projects. This history makes them inherently cautious about income tied to these sectors. They aren't just evaluating you; they're evaluating the perceived stability of your entire industry. To overcome this, you must present an application that screams personal financial stability, regardless of broader market trends.

The Automated 'No'

Ever filled out an online pre-approval form and received an instant rejection? That was likely a computer algorithm. These systems are programmed with simple rules: if "months at current job" is low or "income source" isn't a standard salaried position, it can trigger an automatic 'no'. This is why speaking to a human—a finance manager at a dealership or a specialist broker—is absolutely critical for seasonal workers. They can override the algorithm by looking at the complete picture.

Pro Tip

Never just list 'Seasonal' on your application. Be specific and professional. Use your actual job title, like 'Project Scaffolder', 'Landscape Construction Lead', or 'Rocky Mountain Tour Guide'. Then, specify your typical employment period (e.g., 'Employed March-November annually since 2021'). This reframes you from a temporary worker to a professional with a consistent, recurring career.

The Seasonal Worker's Approval Blueprint: A 3-Part Strategy

Getting approved isn't about luck; it's about a deliberate, well-executed strategy. We've broken it down into three critical components: timing, documentation, and choosing the right lending partner.

Part 1: The Art of Timing - When to Apply for Your Car Loan

When you apply can be just as important as what you apply with. Both on-season and off-season applications have distinct advantages if you know how to play them.

On-Season Pro: Applying with Momentum

The ideal time to apply is typically 2-3 months into your work season. This gives you a series of fresh, recent pay stubs showing your maximum earning potential. Lenders love recent documentation. It removes all guesswork about your current income. This is the simplest and most straightforward path to approval.

Off-Season Strategy: The Power of Preparation

What if your truck breaks down in February? Applying when you're not actively working is harder, but far from impossible. This is where your financial discipline shines. An off-season application can succeed if you leverage two key assets:

- A Large Down Payment: Nothing reduces a lender's risk like a significant down payment (20% or more). It shows you're financially responsible and reduces the loan-to-value ratio, making approval much more likely. For more on how a down payment can transform your application, see our guide: Your Missed Payments? We See a Down Payment.

- Strong Employment History: This is where your 2+ years of T4s and a rock-solid Letter of Employment become non-negotiable. You're proving that this "off-season" is a predictable part of a stable career.

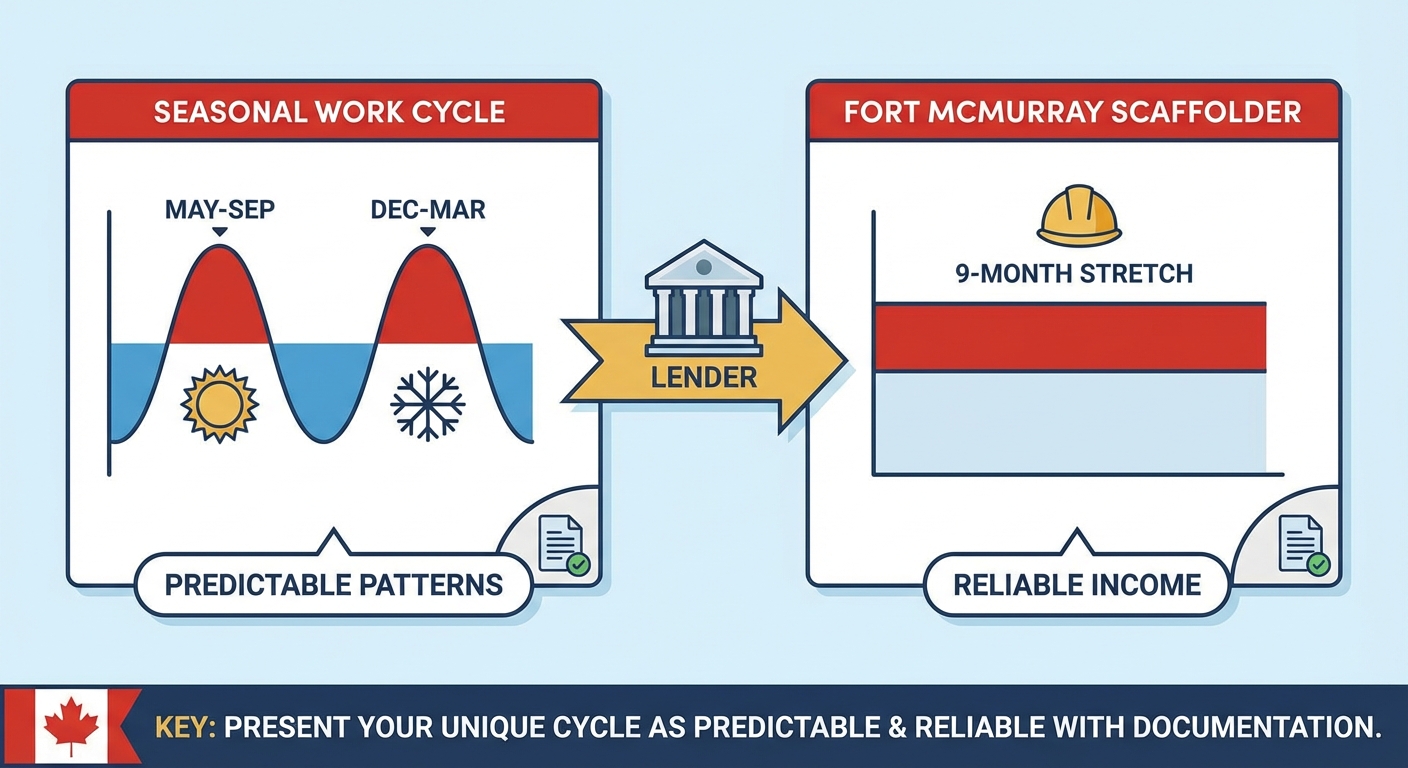

The Banff/Canmore Tourism Worker vs. The Fort McMurray Oil Patch Worker

Timing strategy can differ by industry. A Canmore-based hotel manager with two distinct seasons (May-Sep & Dec-Mar) has a different income pattern than a Fort McMurray scaffolder who works a solid 9-month stretch. The key is to present your unique work cycle as predictable and reliable to the lender, using the documentation we'll cover next.

Part 2: The 'Proof of Income' Portfolio - Documents That Speak Louder Than Pay Stubs

A seasonal worker's application is a portfolio, not just a form. You need to build an undeniable case that proves your ability to make payments year-round. Here is your checklist:

The Essentials:

- T4 Slips (Last 2 Years): This is the single most important document. It shows your total annual income and proves your history.

- Record of Employment (ROE): Your ROE from your last season shows the official end date and reason for the work stoppage ("Shortage of work / End of contract or season"), which legitimizes your seasonal status.

- Detailed Letter of Employment: This letter from your employer should confirm your job title, start date, wage/salary, average hours worked per week, and—most importantly—your seasonal status and the high likelihood of you being rehired for the next season.

The Game Changers:

- Bank Statements (3-6 Months): Provide statements covering the end of your last work season and the beginning of your off-season. Highlight a healthy savings balance. This proves you save money during your on-season to cover expenses during your downtime. It's direct evidence of financial responsibility.

- Proof of EI Benefits (If Applicable): Don't hide your Employment Insurance income. It shows a lender you have a stable, predictable income source to cover the gaps. It's a sign of good planning, not a weakness.

Deep Dive: How Lenders Calculate Your 'Real' Income

Lenders don't care about your best month; they care about your average month. They annualize your income to get a clear picture. Here’s the formula they use:

(Total Gross Income from T4) / 12 Months = Your Approved Monthly Income

Let's see it in action:

- You're a Calgary landscaper who earned $60,000 last year, working for 8 months.

- During those 8 months, your monthly income was $7,500.

- A lender won't approve you for a loan based on $7,500/month.

- They will calculate: $60,000 / 12 = $5,000/month.

This $5,000 figure is what they will use to calculate your debt-to-service ratio and determine how much car you can afford. Knowing this number *before* you shop is your biggest advantage.

Pro Tip

When presenting bank statements, don't just hand over a stack of paper. Use a highlighter to mark your last few paycheques from the on-season and the consistent balance you maintained during the off-season. Add a sticky note that says, "Shows savings of $X,XXX maintained during the off-season." You are making the underwriter's job easier and building your case for them.

Part 3: Choosing Your Financial Partner - The Big Banks vs. The Specialists

Where you apply matters immensely. Not all lenders are equipped to understand the nuances of seasonal work in Alberta.

| Lender Type | Approval Odds (Seasonal) | Typical Interest Rates | Pros | Cons |

|---|---|---|---|---|

| Major Banks (RBC, TD) | Low to Moderate | Prime: 7% - 10% | Best rates if you have excellent credit and a long banking history with them. | Highly reliant on algorithms; often inflexible with non-traditional income. |

| Credit Unions (Servus, ATB) | Moderate to High | Prime: 8% - 12% | More community-focused, often willing to manually review files and understand local economies. | May require membership; rates can be slightly higher than major banks. |

| Alternative & In-House Lenders | High | Subprime: 12% - 29.9% | Specialize in complex situations like seasonal work, bad credit, or new to Canada. High approval rates. | Significantly higher interest rates. Crucial to verify all fees. |

For many seasonal workers, especially those without a perfect credit score, alternative and in-house dealership lenders are the most effective route. They have underwriters who work with industrial and trades workers from Edmonton to Calgary every day. They know what a scaffolder's T4 looks like and understand the cyclical nature of the work. While a credit score is part of the equation, these lenders often place more weight on income and stability. For a deeper look at this, explore our article on Alberta Car Loan: What if Your Credit Score Doesn't Matter?

Pro Tip

When getting your Letter of Employment, ask your employer to include a specific sentence that underwriters love to see. Something like: 'Based on past performance and projected project availability, we fully expect to re-hire [Your Name] for the upcoming [Year] season, commencing approximately [Date].' This single sentence can be the difference between a 'maybe' and a 'yes'.

Calgary's 2026 Auto Finance Outlook: What's Changing for Seasonal Buyers

The world of auto finance is not static. Looking ahead to 2026, several key trends will directly impact how seasonal workers in Calgary get approved for vehicle loans.

Interest Rate Forecasts & Affordability

With the Bank of Canada's overnight rate in flux through 2024 and 2025, we can anticipate a more volatile interest rate environment in 2026. For seasonal workers, this means affordability calculations will be stricter. A lender might have approved a $45,000 loan in 2023, but with higher rates, that same income might only qualify for a $38,000 loan in 2026 to keep the payment within their required debt-to-service ratio. Planning for a larger down payment will be the best way to counteract this.

The Rise of AI Underwriting

New fintech lenders are increasingly using Artificial Intelligence to assess risk. This is a double-edged sword. An advanced AI could potentially look at your bank statements and recognize a responsible pattern of saving for the off-season, helping your application. Conversely, a poorly programmed AI might just see the income gap and issue an instant rejection. The key takeaway for 2026 is that the human element offered by experienced dealership finance managers will become even more valuable in navigating these new systems.

Vehicle Affordability in Alberta: The Work Truck Dilemma

The cost of new and used trucks—the lifeblood of many trades in Alberta—continues to rise. Financing a $40,000 used F-150 or Ram 1500 requires a significant, stable income. It's crucial to analyze the total cost of ownership, not just the monthly payment.

| Vehicle Scenario | Purchase Price | Estimated Monthly Payment (15% Rate / 72 mo) | Estimated Monthly Fuel & Insurance | Total Monthly Cost |

|---|---|---|---|---|

| 2019 Ford F-150 | $40,000 | ~$850 | ~$500 | ~$1,350 |

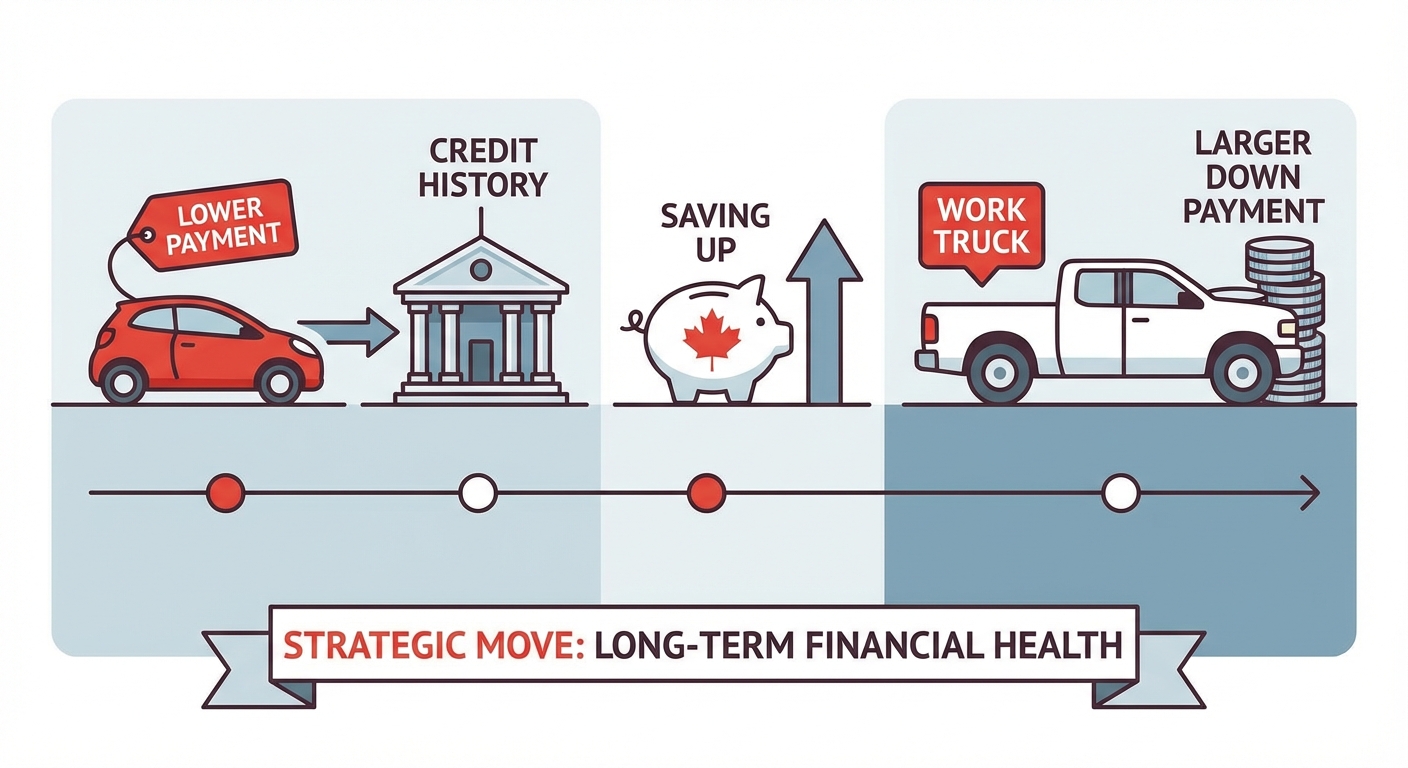

| 2021 Toyota Corolla | $22,000 | ~$470 | ~$300 | ~$770 |

As you can see, the work truck costs nearly double per month. For 2026, a viable strategy for some seasonal workers might be to finance a more affordable, reliable commuter car to secure a lower payment and build a credit history, saving up for a larger down payment on a work truck in the future. It's a strategic move that prioritizes long-term financial health.

Case Study: How a Calgary Landscaper Financed His Work Truck

Let's look at a real-world example we see often. Meet 'Dave', a landscape construction lead in Southeast Calgary. He works a solid 8 months a year, from March to November, and has done so with the same company for three years.

The Initial Rejection

In April, just one month into his season, Dave's old truck died. He needed a replacement fast. He saw an ad from a major bank, filled out their online form, and uploaded his two most recent pay stubs. He was automatically rejected. The algorithm saw only one month of recent income and flagged him as high-risk.

The Winning Strategy

Frustrated, Dave visited a dealership known for working with tradespeople. The finance manager told him to ignore the online form and instead assemble a 'Proof of Income' portfolio. Dave went home and gathered:

- His T4s from the last two years, showing an average annual income of $65,000.

- A detailed Letter of Employment from his boss confirming his role and expected return each year.

- Six months of bank statements showing he consistently kept over $8,000 in savings through the winter.

He also had a down payment of $5,000 ready to go.

The Outcome

Dave reapplied in June, two months later, through the dealership's finance office. They didn't just submit his pay stubs; they submitted his entire portfolio to a specialized lender. The underwriter saw the full picture: a consistent multi-year income, responsible savings, and a significant down payment. Dave was approved for a 2020 GMC Sierra at a reasonable rate. His documentation proved his year-round ability to pay, something his pay stubs alone could never do.

This story is a powerful reminder for anyone in a similar position. If you're a gig worker or self-employed, the principles are the same: documentation is everything. Learn more in our guide: Self-Employed? Your Bank Statement is Our 'Income Proof'.

Your Next Steps: The Calgary Seasonal Buyer's Final Checklist

Feeling empowered? Good. Now it's time to turn knowledge into action. Follow these five steps to prepare for your 2026 vehicle purchase.

- Calculate Your Annualized Income: Don't guess. Take your last T4, divide the total income by 12, and get your real, lender-approved monthly income. Use this number to set a realistic budget.

- Assemble Your 'Proof of Income' Portfolio: Don't wait until your car breaks down. Contact your employer for that detailed Letter of Employment now. Download your T4s from the CRA website and organize your bank statements. Be prepared.

- Check Your Credit Score: Know your number. Use a free service like Borrowell or Credit Karma to see where you stand. If there are small errors or debts you can clear up, do it before you apply.

- Get Pre-Qualified with a Specialist: Skip the frustrating automated rejections. Work with a finance team (like ours at SkipCarDealer) that explicitly states they work with seasonal, contract, and trade employees in Alberta. This is the single most important step.

- Test Drive and Negotiate: Once you have a pre-approval in hand, you are in the driver's seat—literally. You can walk into any dealership and negotiate like a cash buyer, focusing on the price of the vehicle, not the financing.