What If Your Consumer Proposal *Unlocks* Your Car Loan, Ontario?

Table of Contents

- What If Your Consumer Proposal *Unlocks* Your Car Loan, Ontario?

- Key Takeaways

- The Ontario Reality Check: Consumer Proposals and Your Wheels

- Cracking the Code: The 'Limited Income Proof' Puzzle for Ontario Drivers

- Navigating the 'During Consumer Proposal' Labyrinth for Ontario Car Loans

- Who's Lending in Ontario? Decoding Your Lender Options

- Traditional Banks vs. Dealership Finance Departments in Ontario:

- Specialty Lenders: Your Lifeline for a Car Loan in Ontario:

- The Anatomy of Approval: What Ontario Lenders *Really* Look For (Beyond Your Credit Score)

- Beyond the Interest Rate: Unmasking Hidden Costs and Protecting Yourself in Ontario

- Your Road Ahead: Solidifying Your Financial Future in Ontario

- FAQ: Your Burning Questions About Car Loans During a Consumer Proposal in Ontario Answered

- Final Thoughts: Driving Forward with Confidence in Ontario

What If Your Consumer Proposal *Unlocks* Your Car Loan, Ontario?

For many Ontarians, navigating a consumer proposal feels like hitting a financial roadblock, especially when it comes to essential needs like reliable transportation. The silent struggle is real: a pervasive perception that securing a car loan, let alone a good one, becomes an impossibility while managing a consumer proposal. You might envision endless rejections, exorbitant interest rates, or simply being told "no" at every turn.

This article is here to challenge that myth. A consumer proposal isn't necessarily a dead end for car loan approval; it can, in fact, be a strategic pivot point towards regaining financial stability and mobility. Far from being a permanent barrier, it can be a structured path that, when managed correctly, actually demonstrates your commitment to financial responsibility. With the right knowledge and approach, that car loan you thought was out of reach might just be waiting to be unlocked.

Key Takeaways

- Specialty Lenders are Key: Traditional banks are often a tough sell; specialty lenders are your most viable route, but thorough due diligence is paramount to avoid predatory terms.

- Income Stability Trumps 'Proof': Lenders prioritize consistent, reliable income over just traditional pay stubs, especially with limited documentation.

- LIT Approval is Non-Negotiable: Open communication and explicit approval from your Licensed Insolvency Trustee (LIT) are critical before applying for any new credit.

- Strategic Down Payment: Even a modest down payment can significantly improve car loan terms, reduce interest, and boost approval odds in Ontario.

- Credit Rebuilding Opportunity: A car loan, managed responsibly, can serve as a powerful tool for actively rebuilding and demonstrating responsible credit behaviour within Ontario's financial landscape.

The Ontario Reality Check: Consumer Proposals and Your Wheels

Let's demystify the consumer proposal in Ontario. It's a legally binding agreement between you and your creditors, negotiated by a Licensed Insolvency Trustee (LIT), to pay back a portion of your debts over a set period, typically up to five years. This process allows you to avoid bankruptcy while still significantly reducing your overall debt burden. It provides a structured payment plan, often with no interest on the debt itself, offering a clear path to financial recovery.

Beyond the basics, it's crucial to understand how a consumer proposal differs fundamentally from bankruptcy, and why this distinction significantly impacts your car loan application prospects. While both are insolvency solutions, bankruptcy involves surrendering assets and a more severe, longer-lasting impact on your credit report. A consumer proposal, conversely, allows you to keep your assets, and while it does affect your credit score, it's generally viewed more favourably by lenders than bankruptcy. It signals that you're proactively addressing your financial challenges, rather than defaulting entirely. For more on this, check out our guide on Consumer Proposal? Good. Your Car Loan Just Got Easier.

The immediate and long-term effects on your credit score are undeniable. Upon filing, your credit score will take a dip, and a note indicating the consumer proposal will appear on your credit report. This note typically remains for three years after your proposal is paid in full, or six years from the date it was filed, whichever comes first. Setting realistic expectations for recovery during and after your proposal is key. While the immediate hit might seem daunting, demonstrating consistent payments on your proposal and other obligations is the first step in actively rebuilding that score.

To further clarify the distinction and its impact on your car loan eligibility, here's a comparative look:

| Feature | Consumer Proposal in Ontario | Bankruptcy in Ontario |

|---|---|---|

| Debt Resolution | Negotiated payment of a portion of debt; no interest on principal. | Surrender of assets (non-exempt) to pay debts; discharge from most debts. |

| Asset Retention | Generally retain all assets (car, house, etc.). | May lose non-exempt assets. |

| Credit Report Impact Length | Removed 3 years after completion OR 6 years from filing date (whichever is sooner). | Removed 6-7 years after discharge (first-time bankruptcy). |

| Perception by Lenders | Viewed as a proactive step to manage debt; greater likelihood of future credit. | More severe impact; often seen as last resort; greater challenge for future credit. |

| Impact on Car Loan Eligibility *During* | Possible with specialty lenders, especially with strong income/down payment. | Extremely difficult, often requires a co-signer or significant down payment. |

| Credit Rebuilding Potential | Starts sooner and is generally more straightforward post-completion. | Longer and more challenging path to rebuild credit. |

Cracking the Code: The 'Limited Income Proof' Puzzle for Ontario Drivers

What exactly does 'limited income proof' mean in the Ontario context? It's a common scenario for many hard-working individuals whose income doesn't neatly fit into a traditional bi-weekly pay stub. This category often includes gig workers hustling in Toronto, self-employed professionals consulting in Ottawa, seasonal employees in cottage country, contract staff in Mississauga, and even new immigrants across the province establishing their financial footing. Their income is real, but the documentation isn't always standardized, making it a "puzzle" for conventional lenders.

However, the good news is that there are many acceptable alternatives for robust income verification in Ontario that go beyond the simple pay stub. Lenders, especially those specializing in non-traditional credit situations, understand that the modern workforce is diverse.

- The Power of Consistency: Leveraging Bank Statements. Your bank statements are a powerful tool. By providing several months (typically 3-6) of statements, you can clearly demonstrate a regular and reliable pattern of income deposits over time, even if they come from various sources. This consistency speaks volumes to a lender about your ability to meet financial obligations.

- Utilizing Your Tax Returns: How Your Notice of Assessment (NOA) Can Serve as a Comprehensive Indicator. Your Canada Revenue Agency (CRA) Notice of Assessment (NOA) is one of the most trusted forms of income verification. It provides an official summary of your declared income, deductions, and taxes for a given year. For self-employed individuals or those with varied income streams, a recent NOA offers a comprehensive and verifiable snapshot of your earnings.

- Contracts and Invoices: For the Self-Employed. If you're self-employed, a clear and verifiable paper trail of earnings and client agreements is crucial. This can include service contracts, invoices issued to clients, and records of payments received. These documents prove the existence of your business and its revenue generation. For more insights, check out our article on Self-Employed? Your Bank Account *Is* Your Proof. Get Approved.

- Benefit Statements: Legitimate Sources of Income. Provincial benefits like Employment Insurance (EI), Workers' Safety and Insurance Board (WSIB) payments, or Ontario Disability Support Program (ODSP) can absolutely be presented as legitimate and stable sources of income. Lenders understand that these are consistent, government-backed payments. For those relying on EI, our article Your EI Is Your Down Payment. (Seriously, No Cash Needed.) might be helpful.

Navigating the 'During Consumer Proposal' Labyrinth for Ontario Car Loans

Securing a car loan while actively in a consumer proposal in Ontario can feel like navigating a labyrinth, but it's far from impossible. The first, and arguably most important, step involves your Licensed Insolvency Trustee (LIT). Your LIT is not just there to manage your proposal; they are a key resource and your financial guide. Open communication and obtaining their explicit consent or guidance is paramount when seeking new credit. Why? Because taking on new debt during a proposal can sometimes impact your ability to fulfill your proposal terms, or even be perceived as undermining your recovery efforts. Your LIT can advise you on the best timing, the amount of new debt that is reasonable, and even help you understand how a car loan fits into your overall financial plan.

Understanding the *ongoing* impact on your credit score *during* the active proposal period is also critical. While your credit score has already taken a hit, making consistent payments on your consumer proposal demonstrates financial discipline. Lenders, especially specialty lenders, will look at this payment history as a strong indicator of your commitment to rebuilding. New inquiries for credit will cause minor temporary dips, but the overall trajectory of your credit score will be more influenced by your payment behaviour on existing obligations.

So, when and how do you strategically approach lenders while your consumer proposal is active? The "green light" largely depends on your specific situation and, again, your LIT's advice. Generally, it's advisable to allow initial CP payments to stabilize and demonstrate commitment. Once you have several months of on-time proposal payments under your belt, you're in a much stronger position. When you do approach lenders, frame your financial situation honestly and confidently. Explain that the consumer proposal is a responsible step you've taken to manage past debt, and that you are now actively rebuilding. Highlight your stable income and any down payment you can offer.

Your Debt-to-Income Ratio (DTI) is a crucial metric for lenders, and here's where your consumer proposal can actually work in your favour. Because your proposal has structured and often significantly reduced your overall debt payments, your DTI can look much more appealing than it did prior to filing. This improved DTI, combined with stable income, signals to lenders that you have the capacity to take on and manage a new car loan payment. This demonstrates to them that you are now in a more manageable financial position.

Who's Lending in Ontario? Decoding Your Lender Options

When you're looking for a car loan in Ontario while in a consumer proposal, understanding your lender landscape is critical. Not all lenders are created equal, and knowing where to focus your efforts can save you time and frustration.

Traditional Banks vs. Dealership Finance Departments in Ontario:

- The Big Banks (e.g., RBC, TD, CIBC, Scotiabank, BMO): These financial institutions typically have stringent criteria. They prioritize applicants with excellent credit scores and low debt-to-income ratios. While they offer the lowest interest rates if approved, they are often a long shot *during* an active consumer proposal, especially for those with limited traditional income proof. Their automated systems are not typically set up to evaluate the nuances of a rebuilding credit situation.

- Dealership Financing: This is where things get interesting. Dealerships, whether in bustling Hamilton, vibrant London, or growing Brampton, often have 'in-house' finance departments. What this means is they don't necessarily lend their own money but act as intermediaries, working with a network of various lenders. This network often includes both traditional banks (for prime customers) and a crucial group of 'specialty lenders' (for subprime customers). While convenient, always remember that the dealership's primary goal is to sell you a car, so be vigilant about the terms presented.

Specialty Lenders: Your Lifeline for a Car Loan in Ontario:

For individuals managing a consumer proposal, specialty lenders are often your most viable path to a car loan. These are financial institutions that explicitly specialize in 'subprime' or 'non-prime' credit situations. They understand that life happens, and people need second chances or support while rebuilding their financial health. They are designed for those who are actively working to improve their credit profile.

- Who they are: Specialty lenders, sometimes called subprime lenders, focus on the borrower's current ability to pay and their commitment to financial recovery, rather than solely on past credit blemishes. They are more willing to look beyond a low credit score to your income stability, down payment, and the fact that you are actively managing a consumer proposal.

- The Mechanics: It's important to understand the trade-off. Because these lenders take on a higher perceived risk by lending to individuals with challenged credit, that higher risk translates to higher interest rates. This is a fundamental aspect of how the financial market prices risk. While the rates will be higher than what someone with perfect credit would receive, these loans often represent the only viable path to approval and acquiring essential transportation.

- Identifying Reputable Specialty Lenders vs. Predatory Ones: This is crucial. In the subprime market, there can be less scrupulous lenders. Crucial vetting strategies for Ontario consumers include:

- Check their reputation: Look for reviews, Better Business Bureau ratings, and testimonials.

- Transparency: Reputable lenders will be transparent about all fees, interest rates (APR), and terms.

- No upfront fees: Avoid any lender asking for significant upfront fees before you've even received a loan.

- Clarity in contract: Ensure you understand every clause in the loan agreement before signing. Don't be rushed.

- Consult your LIT: Your Licensed Insolvency Trustee can often provide guidance or warnings about certain types of lenders.

The Anatomy of Approval: What Ontario Lenders *Really* Look For (Beyond Your Credit Score)

While your credit score is undeniably a factor, especially with a consumer proposal, it's not the only thing Ontario lenders consider. In fact, for specialty lenders, a holistic view of your financial situation often takes precedence. They want to see evidence that you're a reliable borrower moving forward, despite past challenges.

- Debt-to-Income Ratio (DTI): The Unsung Hero. Your DTI is a critical metric. It's the percentage of your gross monthly income that goes towards debt payments. With your consumer proposal structuring and often reducing your overall debt payments, your DTI can significantly improve. To calculate it, sum all your monthly debt payments (including your CP payment, credit cards, other loans) and divide that by your gross monthly income. A lower DTI indicates you have more disposable income to comfortably make new loan payments. Lenders typically prefer a DTI below 40-45%. Optimizing this means reducing other debts where possible, or increasing your verifiable income.

- Stability & Consistency: Lenders are looking for predictability. A stable employment history (e.g., holding the same job for a year or more), consistent income (as proven by your alternative documentation), and established residency (whether you're in a busy city like Ottawa or a smaller community like Windsor) all reassure lenders of your reliability. They want to see that your life is settled and you have a consistent ability to earn and live in one place.

- Down Payment Power: This is a game-changer. Why? Because a down payment reduces the amount you need to borrow, which in turn lowers the lender's risk. Even a modest down payment of 5-10% can drastically improve your approval odds, lead to a lower interest rate, and significantly reduce your monthly payments. It also shows the lender you have "skin in the game" and are financially invested in the purchase.

- Vehicle Choice: The type of vehicle you choose impacts your loan. A very expensive, brand-new luxury car will be a harder sell than a reliable, moderately priced used vehicle. Lenders want to see that your vehicle choice is practical and aligns with your current financial situation. Opting for a vehicle that holds its value well and is known for reliability can also be favourable, as it reduces the risk for the lender in case of repossession.

- Proof of Responsibility: Beyond your DTI and income, lenders will look at your behaviour. Demonstrating a consistent and committed payment history towards your consumer proposal itself is powerful evidence of financial discipline. It shows you're serious about getting back on track and are capable of managing ongoing financial commitments.

Beyond the Interest Rate: Unmasking Hidden Costs and Protecting Yourself in Ontario

Securing a car loan while in a consumer proposal in Ontario is a victory, but it's crucial to look beyond just the advertised interest rate. Hidden costs and confusing terms can quickly inflate the true cost of your loan. Being informed is your best defence.

- The APR vs. Interest Rate: A Crucial Distinction. The interest rate is the cost of borrowing money, expressed as a percentage of the principal. The Annual Percentage Rate (APR), however, is the *true, total cost* of borrowing, including not only the interest rate but also any additional fees and charges associated with the loan, spread out over the loan term. Always focus on the APR when comparing offers, as it gives you the most accurate picture of your overall financial commitment.

- Loan Fees and Charges: Scrutinizing the Fine Print. Be vigilant about common fees. These can include administration fees, PPSA (Personal Property Security Act) registration fees (Ontario-specific, this registers the lender's security interest in your vehicle), loan origination fees, and other potential levies. These can add hundreds, sometimes thousands, to your loan. Always ask for a full breakdown of all fees.

- Mandatory Add-ons: Worth the Cost? Dealerships often present "mandatory" add-ons like extended warranties, GAP (Guaranteed Asset Protection) insurance, and credit protection plans. While some of these might offer genuine value in specific circumstances, they are often significant profit centers for the lender or dealership.

- Extended Warranties: Research the vehicle's reliability and the cost of potential repairs versus the warranty price.

- GAP Insurance: This covers the difference between what you owe on your loan and what your car insurance will pay if your car is written off or stolen. It can be valuable, especially if you have a high loan-to-value ratio.

- Credit Protection Plans: These typically cover your payments if you lose your job or become disabled. Consider if you already have adequate personal insurance coverage.

- Understanding Your Legalities: Your Rights in Ontario. Ontario's Consumer Protection Act provides important protections for consumers, including rules around disclosure of loan terms, cancellation rights for certain contracts, and prohibitions against unfair practices. Familiarize yourself with your rights and how to identify red flags or unfair contract terms. For example, lenders must clearly disclose the total cost of borrowing.

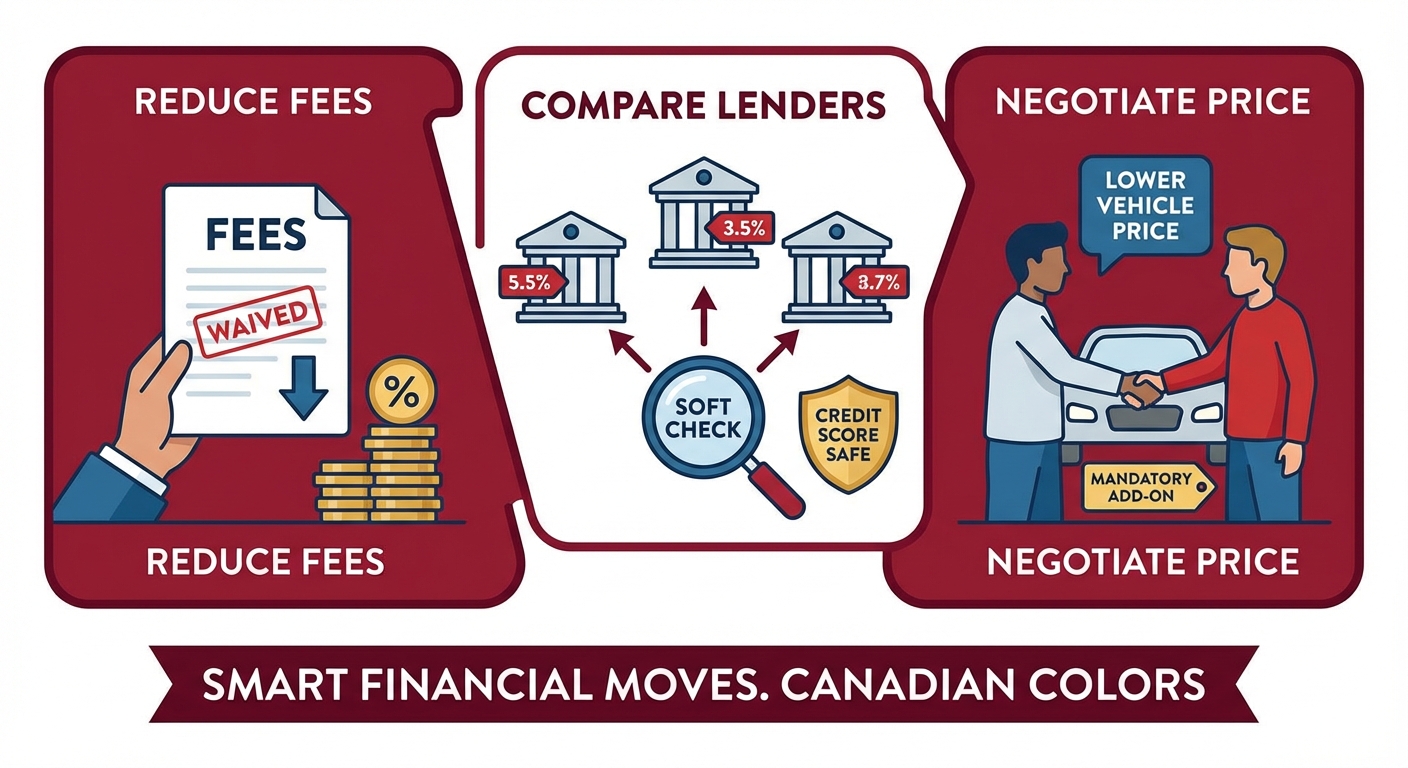

- Negotiation Strategies: Empowering Yourself. Don't be afraid to negotiate. Challenge unnecessary costs, ask if fees can be reduced or waived, and compare offers from multiple lenders (where possible, without impacting your credit score too much). If a specific add-on is truly mandatory, try to negotiate a lower price on the vehicle itself to offset the cost.

Here's a simple illustration of common car loan costs:

| Cost Component | Description | Impact on Total Loan Cost |

|---|---|---|

| Principal Loan Amount | The actual amount borrowed for the vehicle. | Base of all calculations. |

| Interest Rate | Percentage charged on the principal; determines interest payments. | Directly increases monthly payments and total cost. |

| APR (Annual Percentage Rate) | Total cost of borrowing, including interest and some fees, expressed as an annual rate. | The most comprehensive measure of loan cost. |

| Administration Fees | Fees charged by the lender/dealership for processing the loan. | Adds to the total amount financed or is an upfront cost. |

| PPSA Registration Fees | Ontario-specific fee to register the lender's security interest. | A small, but mandatory, addition to costs. |

| Extended Warranty | Covers repairs beyond the manufacturer's warranty. | Can add thousands; assess necessity. |

| GAP Insurance | Covers deficiency if insurance payout is less than loan balance. | Adds to monthly payment; often recommended for high loan-to-value. |

| Credit Protection Insurance | Covers payments in case of job loss, disability, etc. | Adds to monthly payment; assess existing coverage. |

| Taxes & Licensing | Provincial sales tax (HST) on vehicle, license plates, registration. | Significant upfront or financed cost, mandatory. |

Your Road Ahead: Solidifying Your Financial Future in Ontario

Getting a car loan while in a consumer proposal in Ontario is not just about securing transportation; it's a powerful opportunity to leverage that loan to actively rebuild your credit. Making consistent, on-time payments on your car loan is one of the most effective ways to demonstrate positive credit behaviour to credit bureaus and future lenders. Each successful payment contributes to improving your credit score, proving that you are capable of managing new credit responsibly after your proposal. This deliberate action helps to counteract the negative impact of your past financial challenges.

Budgeting for success goes far beyond just the car payment. Many Ontarians, particularly in high-cost-of-living areas like the Greater Toronto Area (GTA), overlook the full spectrum of vehicle ownership costs. Beyond your monthly car loan payment, you must meticulously factor in often-overlooked expenses such as insurance (which can be significantly high in cities like Brampton for those with challenged credit), fuel costs, regular maintenance (oil changes, tire rotations), unexpected repairs, and annual registration fees in Ontario. Create a comprehensive budget that includes all these variables to ensure your car remains an asset, not another source of financial stress.

The post-CP landscape holds even more promise. What happens after your consumer proposal is completed? Once you've successfully fulfilled your proposal terms, the note on your credit report regarding the consumer proposal will eventually be removed (typically three years after completion or six years from filing, whichever comes first). At this point, you'll be in a much stronger position to access better lending rates and a wider array of financial products. Your diligent payments on your consumer proposal and any new credit, like your car loan, will have paved the way for a significantly improved credit profile. You can then look forward to potentially refinancing your car loan at a lower rate or qualifying for other loans with more favourable terms.

Proactive financial management is key to maintaining long-term financial stability and avoiding future debt accumulation. This includes continuing to live within your means, maintaining a realistic budget, building an emergency fund, and regularly reviewing your credit report. Don't fall back into old habits; use the lessons learned from your consumer proposal to build a robust financial future.

FAQ: Your Burning Questions About Car Loans During a Consumer Proposal in Ontario Answered

Final Thoughts: Driving Forward with Confidence in Ontario

The journey through a consumer proposal in Ontario, while challenging, is a strategic and empowering step towards financial recovery. It's crucial to reiterate this empowering message: a consumer proposal is not an insurmountable barrier to essential needs like reliable transportation. Instead, it's a structured process that demonstrates your commitment to managing debt and rebuilding your financial life. With the right approach, knowledge, and support, securing a car loan can become a powerful tool in that recovery, helping you re-establish positive credit and regain your independence.

We empower Ontario residents to take control of their transportation needs and financial future. Through informed decisions, proactive planning, and understanding the options available, you can navigate this period with confidence. Don't let past financial difficulties define your future mobility. Your road ahead is clear, and with SkipCarDealer.com, you have a partner ready to help you drive forward.