BC: Your Consumer Proposal Just Plugged Into an EV Loan.

Table of Contents

- Key Takeaways: Navigating Your EV Loan Journey in BC After a Consumer Proposal

- The BC Road Ahead: Why an EV Post-Consumer Proposal Isn't Just a Dream

- Beyond the Credit Score: The Long-Term Value Proposition of EV Ownership in BC

- Setting the Stage: What Lenders Really See When You Mention 'Consumer Proposal'

- Decoding the 'Consumer Proposal' Label: From Lender's Scrutiny to Your Advantage

- The CP Timeline: When is the 'Right' Time to Apply for an EV Loan?

- Beyond Bankruptcy: How Your CP Signals Responsibility (and Why it Matters for an EV)

- Navigating BC's EV Lending Landscape: Banks, Credit Unions, and Specialized Solutions

- The Big Banks vs. Local Credit Unions: Who's More Flexible Post-CP?

- Specialized Lenders in BC: The Hidden Gems for Challenged Credit

- Dealer Financing: Convenience vs. Cost for Your EV Dream

- Cracking the EV Loan Code: Strategies for High Approval Odds in British Columbia

- The Power of the Down Payment: How It Supercharges Your EV Application

- Debt-to-Income Ratio (DTI) Post-CP: Optimizing Your Financial Snapshot for an EV

- The Co-Signer Advantage: When Two Signatures Are Better Than One

- Building Your Credit, One EV Payment at a Time: Strategies for Post-CP Recovery

- The True Cost of Plugging In: Interest Rates, Hidden Fees, and Smart Budgeting for Your EV

- Demystifying EV Loan Interest Rates After a Consumer Proposal: What to Expect and How to Negotiate

- Beyond the Sticker Price: Insurance, Charging, and Maintenance Costs for BC EVs (and Your Budget)

- Leasing vs. Buying Your EV Post-CP: A Strategic Financial Decision

- BC's Green Advantage: Unlocking Government Incentives for Your Electric Ride

- Federal and Provincial EV Rebates: How to Qualify and Maximize Your Savings (A Post-CP Perspective)

- Charging Infrastructure Incentives: Reducing Your Home EV Setup Costs

- Your Next Steps to Approval: From Application to Driving Your EV in BC

- Preparing Your Application Package: A Checklist for Success

Navigating financial recovery after a consumer proposal can feel like driving through a dense BC fog – challenging, but with the right guidance, you can still reach your destination. And what if that destination was a brand-new (or new-to-you) electric vehicle, not just as a mode of transport, but as a crucial step in your financial resurgence? In British Columbia, where the natural beauty inspires a collective push towards sustainability, an EV isn't just an eco-conscious choice; it's a financially savvy one, even for those rebuilding their credit.

For many Canadians, a consumer proposal is a responsible, proactive step to manage overwhelming debt, an alternative to bankruptcy. It signals a commitment to repayment and a fresh start. Yet, the lingering impact on your credit score can make traditional financing for big-ticket items like a car seem out of reach. Add the perceived complexity and cost of an electric vehicle, and it’s easy to feel discouraged. But here's the exciting truth: BC's unique landscape of green incentives, combined with evolving lending practices, means your dream of plugging into an EV loan post-consumer proposal is more attainable than you might think.

At SkipCarDealer.com, we understand that your financial past doesn't define your future. We specialize in helping Canadians, including those with consumer proposals, find the financing they need. This comprehensive guide will illuminate the path to securing an EV loan in British Columbia, transforming what many see as an obstacle into an opportunity for sustainable living and robust credit rebuilding.

Key Takeaways: Navigating Your EV Loan Journey in BC After a Consumer Proposal

- EVs are a Smart Move Post-CP: Despite initial credit challenges, the long-term savings of an Electric Vehicle can significantly aid your financial recovery and credit rebuilding.

- BC's Green Advantage is Real: Leverage provincial and federal incentives specifically designed for EV adoption to make your purchase more affordable.

- Lender Selection is Crucial: Traditional banks might be tougher, but BC's credit unions and specialized lenders are often more understanding of consumer proposals.

- Preparation is Power: A strong down payment, optimized Debt-to-Income (DTI) ratio, and meticulous documentation are your best tools for approval.

- Negotiate Everything: Don't settle for the first interest rate or vehicle price. Even post-CP, there's room to negotiate for better terms and save money.

The BC Road Ahead: Why an EV Post-Consumer Proposal Isn't Just a Dream

British Columbia stands at the forefront of Canada's green revolution, encouraging its residents to embrace sustainable practices, particularly in transportation. This progressive environment creates a unique intersection where financial recovery (through a consumer proposal) can align seamlessly with sustainable living (EV ownership). It's not just about getting from point A to point B; it's about making choices that benefit your wallet, your future, and the planet.

Beyond the Credit Score: The Long-Term Value Proposition of EV Ownership in BC

When you're rebuilding your credit after a consumer proposal, every dollar saved is a victory. This is where an EV truly shines. Imagine significantly reduced fuel costs – especially in BC, where petrol prices can be notoriously high. Electric vehicles often boast lower maintenance requirements compared to their gasoline counterparts, with fewer moving parts and no oil changes. This translates into tangible, consistent monthly savings that can free up crucial funds for your loan payments and other financial goals. Furthermore, BC's robust network of charging stations and a plethora of government incentives make the transition even more appealing. These aren't just environmental perks; they are financial lifelines designed to make EV ownership accessible and affordable, even for those navigating a consumer proposal.

Responsible EV ownership, with its predictable costs and potential for significant savings, can become a cornerstone of the financial discipline fostered by your consumer proposal. It's a tangible asset that actively contributes to your budget, rather than draining it. This foresight and commitment to smart financial decisions can be a powerful narrative when presenting your case to potential lenders.

Setting the Stage: What Lenders Really See When You Mention 'Consumer Proposal'

Let's be candid: when a lender sees 'consumer proposal' on your credit report, their initial reaction might be caution. It signals a past financial challenge. However, this isn't the end of the story. A savvy lender, particularly those who understand rehabilitative finance, will look beyond the label. They want to see how you've handled it. A consumer proposal, unlike a bankruptcy, is a voluntary agreement where you commit to repaying a portion of your debts. It demonstrates responsibility, a willingness to address financial issues head-on, and a structured plan for repayment. It shows you're not running from your debts, but actively working to resolve them.

Your ability to consistently make payments on your consumer proposal, adhere to its terms, and manage your finances post-proposal are all strong indicators of your renewed financial stability. Reframing your consumer proposal not as a failure, but as a strategic pivot towards financial health, is key. It's proof that you've faced adversity and emerged with a stronger understanding of financial management, making you a more disciplined borrower going forward.

Decoding the 'Consumer Proposal' Label: From Lender's Scrutiny to Your Advantage

Understanding how lenders view your consumer proposal is the first step towards turning a perceived disadvantage into an actual strength. It's not just about what happened, but what you've done since, and what you plan to do next.

The CP Timeline: When is the 'Right' Time to Apply for an EV Loan?

Timing is everything when it comes to securing a loan after a consumer proposal. Your eligibility and the interest rates you'll be offered can vary significantly depending on where you are in your CP journey:

- During the Proposal: It's possible, but generally more challenging. Lenders will see that you're still actively managing debt, and your Debt-to-Income (DTI) ratio might be higher. You'll likely need a substantial down payment and potentially a co-signer. Interest rates will also be higher to compensate for the increased risk.

- Upon Completion: This is a significantly better time. Once you've made all your payments and received your Certificate of Full Performance, it shows lenders that you've successfully completed your agreement. This demonstrates commitment and reliability.

- After Discharge: The optimal time. Once your consumer proposal is fully discharged, and it begins to age on your credit report (which can take up to three years from completion or six years from filing, whichever is sooner), your credit score will slowly start to improve. The further away you are from the discharge date, the less impact it will have on your loan application.

While waiting until your CP is fully discharged offers the best rates and approval odds, we understand that life happens, and sometimes a vehicle is needed sooner. For more insights into navigating financing during or immediately after a consumer proposal, you might find our article The Consumer Proposal Car Loan You Were Told Was Impossible particularly helpful.

Beyond Bankruptcy: How Your CP Signals Responsibility (and Why it Matters for an EV)

It's crucial to distinguish a consumer proposal from bankruptcy. Bankruptcy is often seen as a last resort, a complete liquidation of debts. A consumer proposal, conversely, is a structured repayment plan, often allowing you to keep your assets and demonstrating a proactive approach to debt resolution. This distinction is vital for lenders. A consumer proposal indicates a willingness to repay, a commitment to a budget, and a desire to rebuild. These are all positive signals for someone seeking an EV loan.

For an EV loan, this commitment is even more poignant. Choosing an EV is often a long-term decision, reflecting a forward-thinking mindset. Lenders appreciate borrowers who make responsible, sustainable choices, as it suggests stability and a strategic approach to their finances. Your successful completion of a consumer proposal, coupled with your desire for an EV, paints a picture of a responsible individual making calculated decisions for a better financial future.

Pro Tip: Gathering Your CP Documentation: The Non-Negotiables

Always have your Certificate of Full Performance, official proposal documents, and proof of payments readily available. These demonstrate your commitment and adherence to the agreement, which lenders value. Being organized and transparent about your financial journey can significantly bolster your credibility and improve your chances of loan approval.

Navigating BC's EV Lending Landscape: Banks, Credit Unions, and Specialized Solutions

Finding the right lender is paramount when seeking an EV loan post-consumer proposal. Not all financial institutions view challenged credit the same way, and understanding their different approaches can save you time, frustration, and money.

The Big Banks vs. Local Credit Unions: Who's More Flexible Post-CP?

Major Canadian banks often have stringent, automated lending criteria heavily reliant on credit scores. A consumer proposal, even if completed, can trigger an automatic rejection or push you into a higher-risk category with less favourable terms. While it's worth checking with your primary bank, especially if you have a long-standing relationship, don't be surprised if they're less flexible.

BC-based credit unions, however, often operate differently. As member-owned institutions, they tend to take a more holistic, human-centric approach to lending. They are more likely to consider your entire financial story, including the reasons for your consumer proposal, your current income, stability, and your commitment to rebuilding credit. They often have more discretion and can be a fantastic option for post-CP applicants.

| Feature | Major Banks | BC Credit Unions |

|---|---|---|

| Credit Score Focus | High reliance on automated scores; less flexibility for challenged credit. | More holistic review; consider personal circumstances beyond just the score. |

| Consumer Proposal View | Often a significant barrier; higher risk categorization. | More understanding; may view successful CP as a sign of responsibility. |

| Interest Rates (Post-CP) | Typically higher due to risk algorithms, if approved at all. | Potentially more competitive, depending on individual assessment. |

| Customer Service | Standardized, less personalized. | Often more personalized and community-focused. |

| Approval Odds (Post-CP) | Lower for direct applications without significant mitigating factors. | Higher, especially with good income and down payment. |

Specialized Lenders in BC: The Hidden Gems for Challenged Credit

Beyond traditional institutions, there are specialized lenders and finance companies in BC and across Canada who focus specifically on individuals with challenged credit, including those who have undergone a consumer proposal. These lenders understand that life happens and that a past financial event doesn't define a borrower's future potential. They are often more willing to look at your current income, employment stability, and ability to make payments, rather than solely focusing on your credit history.

While interest rates from specialized lenders might be higher than prime rates, they offer a vital pathway to financing when other doors are closed. They provide an opportunity to get into an EV and start rebuilding your credit through consistent, on-time payments. These lenders are often partnered with dealerships, making the process seamless.

Dealer Financing: Convenience vs. Cost for Your EV Dream

Many dealerships offer in-house financing or work with a network of lenders, including specialized ones. This can be incredibly convenient, allowing you to handle the entire car-buying and financing process in one place. Dealerships often have access to various loan programs, some of which are designed for individuals with less-than-perfect credit. They can also sometimes bundle manufacturer incentives directly into the financing, making the deal more attractive.

However, it's crucial to approach dealer financing with caution. While convenient, the interest rates offered might not always be the most competitive, especially if you haven't shopped around beforehand. Always compare their offer with any pre-approvals you've secured. The key is to leverage the convenience while ensuring you're getting a fair deal. Dealerships want to sell cars, and if you present yourself as a prepared and responsible borrower, they have an incentive to find you the best possible financing solution.

A diverse group of people (representing various financial backgrounds) confidently interacting with different types of EV charging stations across a scenic BC backdrop, symbolizing accessibility and future-forward thinking in their financial journey.

Cracking the EV Loan Code: Strategies for High Approval Odds in British Columbia

Securing an EV loan after a consumer proposal requires a strategic approach. It's about demonstrating your reliability and minimizing perceived risk for lenders. Here are the key strategies to maximize your approval odds in British Columbia.

The Power of the Down Payment: How It Supercharges Your EV Application

For post-CP applicants, a substantial down payment is perhaps your most potent tool. It directly reduces the amount you need to borrow, which in turn lowers the lender's risk. A larger down payment signals your commitment to the purchase and your financial discipline in saving. Lenders see this as a strong indicator of your ability to manage debt. Aim for at least 10-20% of the vehicle's purchase price, but if you can manage more, it will significantly improve your chances of approval and potentially secure a better interest rate. This upfront investment demonstrates that you have skin in the game and are serious about your financial recovery.

Debt-to-Income Ratio (DTI) Post-CP: Optimizing Your Financial Snapshot for an EV

Your Debt-to-Income (DTI) ratio is a critical metric lenders use to assess your ability to take on new debt. It's the percentage of your gross monthly income that goes towards debt payments. After a consumer proposal, lenders will scrutinize this even more closely. A lower DTI indicates you have more disposable income to comfortably manage a new EV loan payment.

To calculate your DTI: Add up all your monthly debt payments (consumer proposal payments, credit card minimums, existing loan payments, rent/mortgage) and divide that by your gross monthly income. Multiply by 100 to get a percentage.

Strategies to improve your DTI:

- Reduce other debts: Pay down credit card balances or small loans.

- Increase income: If possible, consider a side hustle or seek a raise.

- Budget carefully: Ensure your proposed EV loan payment fits comfortably within your existing budget without straining your finances.

Lenders typically prefer a DTI of 36% or lower, though some specialized lenders might accept higher ratios, especially with a strong down payment. Optimizing your DTI shows financial prudence and makes you a more attractive borrower.

The Co-Signer Advantage: When Two Signatures Are Better Than One

If you're finding it challenging to get approved on your own, or if the interest rates are too high, a co-signer can be a game-changer. A co-signer, typically someone with excellent credit and stable income, agrees to be equally responsible for the loan. Their strong credit profile mitigates the lender's risk, often leading to approval and better interest rates. However, using a co-signer comes with significant responsibility for both parties. The co-signer's credit will be affected by the loan, and they will be legally obligated to make payments if you default. Choose a co-signer you trust implicitly and ensure they fully understand their obligations.

Building Your Credit, One EV Payment at a Time: Strategies for Post-CP Recovery

Securing an EV loan after a consumer proposal isn't just about getting a car; it's a powerful opportunity to actively rebuild your credit history. Each on-time payment you make on your EV loan will be reported to credit bureaus, demonstrating your renewed financial responsibility. This consistent positive reporting will gradually improve your credit score, opening doors to better financial products and opportunities in the future. It's a tangible step towards proving that your consumer proposal was a turning point, not an endpoint. For those who have recently completed their consumer proposal, understanding how quickly you can start rebuilding credit is vital. Our article Discharged? Your Car Loan Starts Sooner Than You're Told provides further insights into this process.

Pro Tip: Pre-Approval Power: Getting Your EV Loan Offer Before You Shop

Seek pre-approval from multiple lenders (credit unions, specialized lenders) before you even set foot in a dealership. This not only gives you bargaining power at the dealership by knowing what you can afford, but also provides a clear understanding of the interest rates and terms you qualify for, avoiding unnecessary credit inquiries later on. It also separates the financing from the vehicle negotiation, allowing you to focus on getting the best price for the EV itself.

The True Cost of Plugging In: Interest Rates, Hidden Fees, and Smart Budgeting for Your EV

An EV loan, like any car loan, involves more than just the monthly payment. Understanding the full financial picture, especially after a consumer proposal, is crucial for sustainable ownership and continued financial health.

Demystifying EV Loan Interest Rates After a Consumer Proposal: What to Expect and How to Negotiate

Let's be realistic: an EV loan interest rate after a consumer proposal will likely be higher than what someone with pristine credit would receive. This is a reflection of the perceived risk by lenders. However, "higher" doesn't mean "unaffordable" or "non-negotiable." Expect rates to be in the double digits, potentially ranging from 10-20% or even higher, depending on your specific circumstances, the lender, the down payment, and whether you have a co-signer. The key is to understand the factors influencing these rates:

- Your Credit History: How recently was your CP discharged? Have you been rebuilding credit?

- Down Payment: A larger down payment reduces the loan amount and lender risk.

- Vehicle Type: Newer, more expensive EVs might carry different risk profiles.

- Loan Term: Shorter terms often have slightly lower rates but higher monthly payments.

- Lender: Different lenders have different risk appetites and pricing structures.

Negotiation Tactics: Don't accept the first offer. Leverage pre-approvals from other lenders. Highlight your stable income, low DTI, and substantial down payment. Emphasize your successful completion of the consumer proposal as a testament to your financial responsibility. Sometimes, even a percentage point or two can save you thousands over the life of the loan.

Beyond the Sticker Price: Insurance, Charging, and Maintenance Costs for BC EVs (and Your Budget)

The total cost of EV ownership extends beyond the loan payment. It's vital to factor these into your post-CP budget:

- Insurance: EV insurance in BC can sometimes be slightly higher than comparable gasoline cars due to higher repair costs for specialized components. However, this varies by model and insurer. Always get quotes before committing to a purchase.

- Charging:

- Home Charging: Installing a Level 2 charger (240V) at home is a significant upfront cost (typically $1,000-$3,000, but often offset by incentives). However, charging at home is usually the cheapest option, utilizing BC Hydro's relatively affordable electricity rates.

- Public Charging: Public DC fast charging stations are more expensive per kilowatt-hour but offer rapid charging on the go. Plan for these costs if you frequently travel long distances or don't have home charging.

- Maintenance: EVs generally have lower maintenance costs. No oil changes, spark plugs, or exhaust systems. However, tires might wear faster due to instant torque, and specialized EV components could be more expensive if they need repair. Battery degradation is a long-term factor, but modern EV batteries are warranted for 8+ years.

By budgeting for these ongoing costs, you ensure your EV ownership is sustainable and doesn't derail your financial recovery.

Leasing vs. Buying Your EV Post-CP: A Strategic Financial Decision

Both leasing and buying have different implications for someone after a consumer proposal:

| Feature | Leasing an EV Post-CP | Buying an EV Post-CP |

|---|---|---|

| Down Payment | Often lower or zero, but a larger down payment can reduce monthly payments significantly. | A substantial down payment is highly recommended to improve approval odds and rates. |

| Monthly Payments | Generally lower, as you're only paying for the depreciation of the vehicle during the lease term. | Higher, as you're paying for the full purchase price of the vehicle. |

| Credit Impact | Lease payments build credit history similarly to loan payments. | Loan payments build credit history and demonstrate ability to manage larger debt. |

| Ownership & Equity | No ownership; no equity built. Return the car at lease end or buy it out. | You own the car; build equity over time. |

| Flexibility | Good for those who want a new car every few years; mileage limits apply. | Full freedom to drive unlimited kilometres, customize, and sell/trade at any time. |

| Long-Term Cost | Can be more expensive over many years if you always lease. | Potentially cheaper in the long run if you keep the car for many years after paying it off. |

| Access to Incentives | Often still qualify for federal and provincial EV rebates, which reduce the lease cost. | Directly reduces the purchase price of the vehicle. |

For some, leasing might offer lower monthly payments, making an EV more accessible immediately after a consumer proposal. However, buying allows you to build equity and eventually own the vehicle outright. Consider your long-term financial goals and how quickly you want to rebuild significant credit. If you're considering a lease buyout after your proposal, our article Lease Buyout After Proposal: Your 'Impossible' Just Became Our 'Tuesday' offers specific guidance.

Pro Tip: The Art of Negotiation: Securing the Best EV Deal (Even with Imperfect Credit)

Your post-CP status doesn't mean you can't negotiate. Research market values for your desired EV model (new or used). Get quotes from multiple dealerships. Be prepared to walk away if the deal isn't right. Negotiate the car price, any trade-in value, and then the interest rate. Having a pre-approved loan offer in hand gives you tremendous leverage. Remember, every dollar saved on the purchase price reduces the loan amount, which can significantly impact your total cost of ownership.

BC's Green Advantage: Unlocking Government Incentives for Your Electric Ride

British Columbia is a leader in EV adoption, thanks in large part to generous government incentives that significantly reduce the financial barrier to entry. These programs are a huge advantage for anyone considering an EV, and your consumer proposal status generally does not impact your eligibility for them.

Federal and Provincial EV Rebates: How to Qualify and Maximize Your Savings (A Post-CP Perspective)

These rebates can make a substantial difference in the overall cost of your EV, making it a more viable option for your post-CP budget:

- Canada's iZEV Program (Federal):

- Provides up to $5,000 for the purchase or lease of new eligible battery-electric, plug-in hybrid, and hydrogen fuel cell vehicles.

- Eligibility depends on the vehicle's MSRP and seating capacity.

- The rebate is applied directly at the dealership at the point of sale, reducing the purchase price or leased amount.

- BC's CleanBC Go Electric Program (Provincial):

- Offers additional provincial rebates on top of the federal iZEV program, making BC one of the best places in Canada to buy an EV.

- Rebates can be up to $4,000 for eligible new battery-electric and plug-in hybrid vehicles, depending on income level. Lower-income individuals may qualify for higher rebates.

- Eligibility also depends on vehicle MSRP.

- Like iZEV, these rebates are typically applied at the dealership.

Combining these federal and provincial incentives can result in significant savings, potentially reducing the purchase price of a new EV by up to $9,000! This directly lowers the amount you need to finance, making your loan more manageable and potentially improving your approval odds. Your consumer proposal status does not disqualify you from these programs, as they are based on vehicle eligibility and BC residency. Ensuring you meet the income thresholds for the CleanBC program can further maximize your savings. For more on navigating BC-specific financial support, our article British Columbia EI? Your Car Loan Just Called 'Shotgun' offers additional context on how various income sources are viewed in the province.

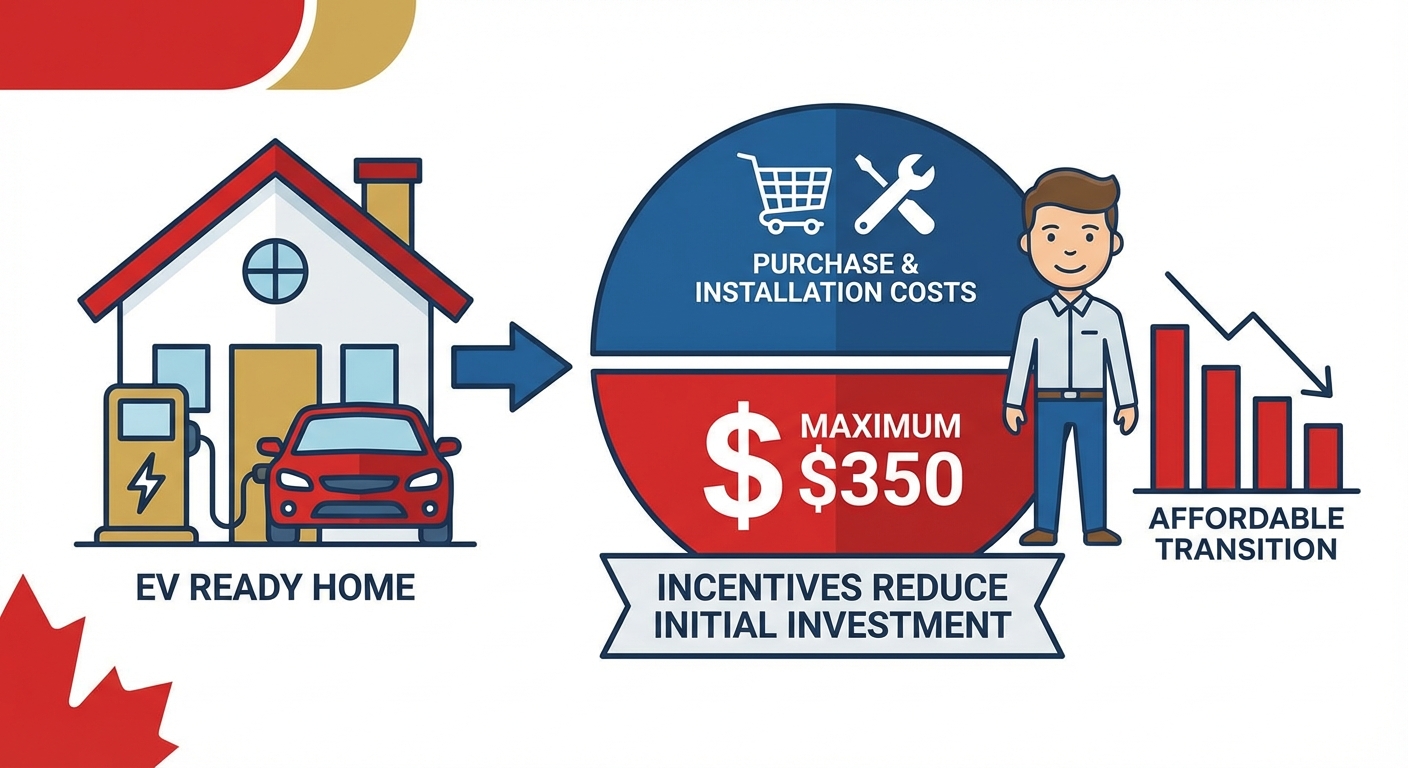

Charging Infrastructure Incentives: Reducing Your Home EV Setup Costs

Beyond vehicle rebates, BC also offers programs to help with the cost of installing home charging stations, which is a key component of convenient EV ownership:

- CleanBC Go Electric EV Charger Rebate Program: This program provides rebates for the purchase and installation of eligible Level 2 (240V) charging stations for single-family homes, multi-unit residential buildings (MURBs), and workplaces.

- For single-family homes, rebates can be up to 50% of the purchase and installation costs, to a maximum of $350.

These incentives can substantially reduce the initial investment required to get your home ready for an EV, making the overall transition more affordable and practical for your budget post-CP.

An infographic or stylized illustration clearly depicting the various federal and provincial EV incentives available in BC, with icons representing different types of savings (rebates, charging subsidies) and a timeline for application, making complex information easily digestible.

Your Next Steps to Approval: From Application to Driving Your EV in BC

You've done your research, understood the landscape, and prepared your finances. Now it's time to take the concrete steps towards securing your EV loan and hitting the road in British Columbia.

Preparing Your Application Package: A Checklist for Success

Being organized and thorough with your application can significantly streamline the process and improve your chances of approval. For post-CP applicants, extra diligence is key:

- Proof of Identity: Valid Canadian driver's license, passport, or BC Services Card.

- Proof of Residency: Utility bills, lease agreement, or property tax statement.

- Proof of Income: Recent pay stubs (3-6 months), employment letter, T4s, notice of assessment (NOA) for self-employed individuals, or proof of government benefits.

- Bank Statements: Recent statements (3-6 months) to show financial stability and consistent income.

- Consumer Proposal Documentation: Your Certificate of Full Performance (if applicable), official proposal documents, and proof of consistent payments.

- Down Payment Funds: Proof of funds for your down payment.

- Co-Signer Information (if applicable): All financial and identity documents for your co-signer.

- Trade-in Vehicle Information (if