No Down Payment? Your Gig Just Bought a Hybrid. Seriously.

Table of Contents

- Key Takeaways

- The Gig Economy's New Driving Force: Why a Hybrid is Your Ultimate Business Partner

- Beyond Fuel Economy: The Hybrid Advantage for Gig Workers

- Why 'No Down Payment' is a Game-Changer for Cash-Strapped Entrepreneurs

- Busting the 'No Down Payment' Myth: What It Really Means for Canadian Gig Workers

- Understanding the Offer

- The Credit Score Conundrum: Why a Good Credit Score is Your Golden Ticket to Zero Down Financing

- The Interest Rate Impact: How Zero Down Can Lead to Higher Interest Rates and Why

- Gig Income & Lender Confidence: How Lenders Assess Irregular Income Streams and What They Look For

- Cracking the Code: Lenders, Loans, and Navigating the Canadian Auto Finance Maze

- Who's Lending to Gig Workers?

- Types of Loans

- The Application Checklist: What Lenders REALLY Want to See

- The Approval Playbook: Boosting Your Odds for Zero Down Hybrid Financing

- Building Your Credit Foundation

- The Co-Signer Advantage

- Negotiating Like a Pro

- Hidden Hurdles & How to Leap Them: Beyond the Monthly Payment

- The True Cost of Ownership

- Extended Warranties & Add-ons

- Understanding Fine Print & Fees

- Hybrid Hotlist for Gig Pros: Top Picks & What to Look For in Canada

- Key Features for Gig Work

- Popular Hybrid Models in Canada for Gig Workers (New & Used)

- From Application to Ignition: Your Step-by-Step Journey to Hybrid Ownership

- Beyond the Purchase: Maximizing Your Hybrid's Gig Potential & Loan Management

- Smart Maintenance for Longevity

- Tracking Expenses for Tax Benefits

- Optimizing Your Gig Routes

- Paying Down Your Loan Strategically

In the dynamic world of the Canadian gig economy, your vehicle isn't just a mode of transport; it's your office, your lifeline, and your most crucial business asset. For many, the dream of upgrading to an efficient, eco-friendly hybrid car seems distant, especially when cash flow is tight and a significant down payment feels impossible. But what if we told you that your gig job, whether it's rideshare, food delivery, or mobile services, could be your ticket to hybrid ownership with no money down? Seriously.

At SkipCarDealer.com, we understand the unique financial landscape of Canadian gig workers. We know your income might not look like a traditional pay stub, but we also recognize the incredible potential and reliability that a consistent gig income represents. This comprehensive guide will demystify the process, showing you how to navigate the Canadian auto finance market and drive away in a hybrid that not only saves you money on fuel but also elevates your professional image.

Forget the old assumptions about car financing. Your hard work in the gig economy is a powerful asset, and with the right strategy, a fuel-efficient hybrid can be yours, even without an upfront cash payment. Let's dive in and unlock the road to your next business partner.

Key Takeaways

- Gig workers in Canada can secure hybrid car financing with no down payment, but it requires strategic planning and understanding the nuances.

- Your credit score, income stability (even if irregular), and choosing the right lender are paramount.

- Hybrids aren't just eco-friendly; they're a smart business investment for gig workers, significantly reducing fuel costs.

- Don't just look at the monthly payment; consider the total cost of ownership, including interest rates, insurance, and maintenance.

- Preparation is key: gather your income documents, understand your credit, and research suitable hybrid models before approaching lenders.

The Gig Economy's New Driving Force: Why a Hybrid is Your Ultimate Business Partner

The Canadian gig economy has exploded, transforming how millions earn a living. From bustling city streets to sprawling suburbs, rideshare drivers, food delivery couriers, and mobile service providers are the backbone of this new workforce. For these dedicated individuals, a reliable and cost-effective vehicle isn't a luxury; it's an absolute necessity. Your car is your primary tool, your income generator, and the better it performs, the better your business performs.

Beyond Fuel Economy: The Hybrid Advantage for Gig Workers

When you spend hours on the road, fuel costs quickly become your largest operating expense. This is where a hybrid vehicle truly shines, offering a compelling solution that goes far beyond just reducing trips to the gas station. Hybrids combine a gasoline engine with an electric motor and battery, optimizing fuel usage, especially in stop-and-go city traffic – the very environment many gig workers operate in daily.

Consider the cumulative impact of those small fuel savings over weeks, months, and years. What might seem like a minor difference per litre adds up to substantial savings that can be reinvested into your business, used for personal expenses, or even put towards paying down your loan faster.

Pro Tip: Calculate Your Potential Fuel Savings

Want to see the real impact? Here's a simple formula to estimate how much a hybrid could save you monthly:

(Current Vehicle's L/100km - Hybrid Vehicle's L/100km) / 100 * Kilometres Driven Per Month * Average Gas Price Per Litre = Monthly Savings

For example, if you drive 3,000 km/month, your current car gets 10 L/100km, a hybrid gets 5 L/100km, and gas is $1.70/litre:

(10 - 5) / 100 * 3,000 * $1.70 = $255.00 in monthly savings!

This calculation can be a powerful argument when discussing the affordability of a hybrid with a lender.

Beyond the immediate financial relief at the pump, hybrids offer several other advantages for the savvy gig entrepreneur:

- Reduced emissions and a greener image for your business: In an increasingly environmentally conscious market, driving a hybrid can enhance your professional appeal. Clients often appreciate businesses that demonstrate a commitment to sustainability.

- Lower maintenance costs compared to some traditional gasoline vehicles: Hybrid vehicles often experience less wear and tear on components like brake pads because they use regenerative braking, which converts kinetic energy into electricity to recharge the battery. This means less frequent brake replacements and potentially lower overall maintenance expenses.

- Potential for tax deductions on vehicle expenses (consult a Canadian tax professional): As a self-employed gig worker, a significant portion of your vehicle's operating costs, including fuel, maintenance, insurance, and even a portion of the vehicle's depreciation or interest on your loan, can be claimed as business expenses. This can significantly reduce your taxable income. For more on how your self-employment income can be verified, check out our guide on Self-Employed? Your Bank Statement is Our 'Income Proof'.

Why 'No Down Payment' is a Game-Changer for Cash-Strapped Entrepreneurs

For many gig workers, capital is king. Every dollar saved or freed up can be vital for covering unexpected personal expenses, investing in other business tools (like a new phone or specialized equipment), or simply building a financial cushion. Requiring a large upfront down payment can be a significant barrier to getting the reliable vehicle you need to keep your business running smoothly.

No down payment financing means you can acquire a essential business asset without depleting your savings or taking on additional personal debt to cover the initial cost. This preserves your liquidity, allowing you to maintain financial flexibility and respond to the unpredictable nature of gig work with greater confidence.

Busting the 'No Down Payment' Myth: What It Really Means for Canadian Gig Workers

The phrase "no down payment" sounds like a dream, and for many, it is achievable. However, it's crucial to understand precisely what it entails in the world of Canadian auto financing. It doesn't mean the car is free, nor does it mean there are no conditions attached. It simply means the lender is willing to finance 100% of the vehicle's purchase price.

Understanding the Offer

When a lender offers no down payment financing, they are essentially taking on a higher level of risk. In a traditional loan, the down payment acts as a buffer for the lender; if you default on the loan, they can repossess the car and the down payment helps cover the immediate loss of value (depreciation) and repossession costs. With no down payment, that buffer is gone, making the lender more selective about who they approve.

The Credit Score Conundrum: Why a Good Credit Score is Your Golden Ticket to Zero Down Financing

Your credit score is the single most influential factor in securing no down payment financing. It's a three-digit number that tells lenders how reliably you've managed debt in the past. A strong credit score signals to lenders that you are a low-risk borrower, making them more comfortable financing the entire cost of a vehicle.

- What constitutes a 'good' credit score in Canada? Generally, a score of 650 or higher is considered 'good' and will open doors to prime interest rates and more flexible financing options, including zero down. Scores above 720 are excellent and will put you in the best position for the most favourable terms.

The Interest Rate Impact: How Zero Down Can Lead to Higher Interest Rates and Why

While no down payment is attractive, it often comes with a trade-off: a potentially higher interest rate. Because the lender is taking on more risk, they compensate by charging more for the loan. This higher interest rate translates into a greater total cost of borrowing over the loan term.

Let's illustrate with an example:

| Loan Feature | No Down Payment Scenario | 10% Down Payment Scenario |

|---|---|---|

| Vehicle Price | $30,000 | $30,000 |

| Down Payment | $0 | $3,000 |

| Amount Financed | $30,000 | $27,000 |

| Interest Rate (Example) | 8.99% | 6.99% |

| Loan Term | 60 months | 60 months |

| Estimated Monthly Payment | ~$625 | ~$535 |

| Total Interest Paid | ~$7,500 | ~$5,100 |

| Total Cost of Loan | ~$37,500 | ~$32,100 (plus $3,000 down) |

As you can see, the total cost of borrowing can be significantly higher without a down payment, even with a relatively small difference in interest rates. This is why it's essential to look beyond just the monthly payment and consider the overall financial commitment.

Pro Tip: The Power of a Small Down Payment

Even if you're aiming for zero down, consider if you can scrape together a small amount – perhaps 5-10% of the vehicle's price. As the table above shows, a modest down payment can:

- Significantly reduce the total interest paid over the life of the loan.

- Lower your monthly payments, making the loan more manageable.

- Increase your chances of approval, especially if your credit isn't perfect.

- Reduce the loan-to-value (LTV) ratio, making you a less risky borrower in the eyes of lenders.

Every dollar you put down upfront is a dollar you don't pay interest on.

Gig Income & Lender Confidence: How Lenders Assess Irregular Income Streams and What They Look For

Lenders understand that gig income isn't traditional. They don't expect pay stubs, but they do require proof of consistent income. What they look for is a history of stable earnings, even if the amounts fluctuate week-to-week or month-to-month. They want to be confident that you have the capacity to meet your loan obligations reliably. For gig workers, your deliveries are your credit – and we know how to help you get the car you need. Learn more about this in our article: Your Deliveries Are Your Credit. Get the Car.

Cracking the Code: Lenders, Loans, and Navigating the Canadian Auto Finance Maze

Finding the right financing as a gig worker requires knowing where to look and what to ask for. The Canadian auto finance landscape offers several avenues, each with its own advantages and disadvantages.

Who's Lending to Gig Workers?

Not all lenders are created equal when it comes to assessing gig income. Here's a breakdown:

- Traditional Banks vs. Credit Unions:

- Traditional Banks: Often have strict lending criteria and may prefer applicants with traditional employment histories. While some may adapt, they can be less flexible with irregular income.

- Credit Unions: Often more community-focused and may be more willing to work with members whose income streams are non-traditional, as they take a more holistic view of your financial situation.

- Dealership Financing: This is a common and convenient option. Dealerships often work with a network of lenders, including banks, credit unions, and specialized finance companies. They can shop your application around to find the best fit. However, always compare their offers to what you might find independently.

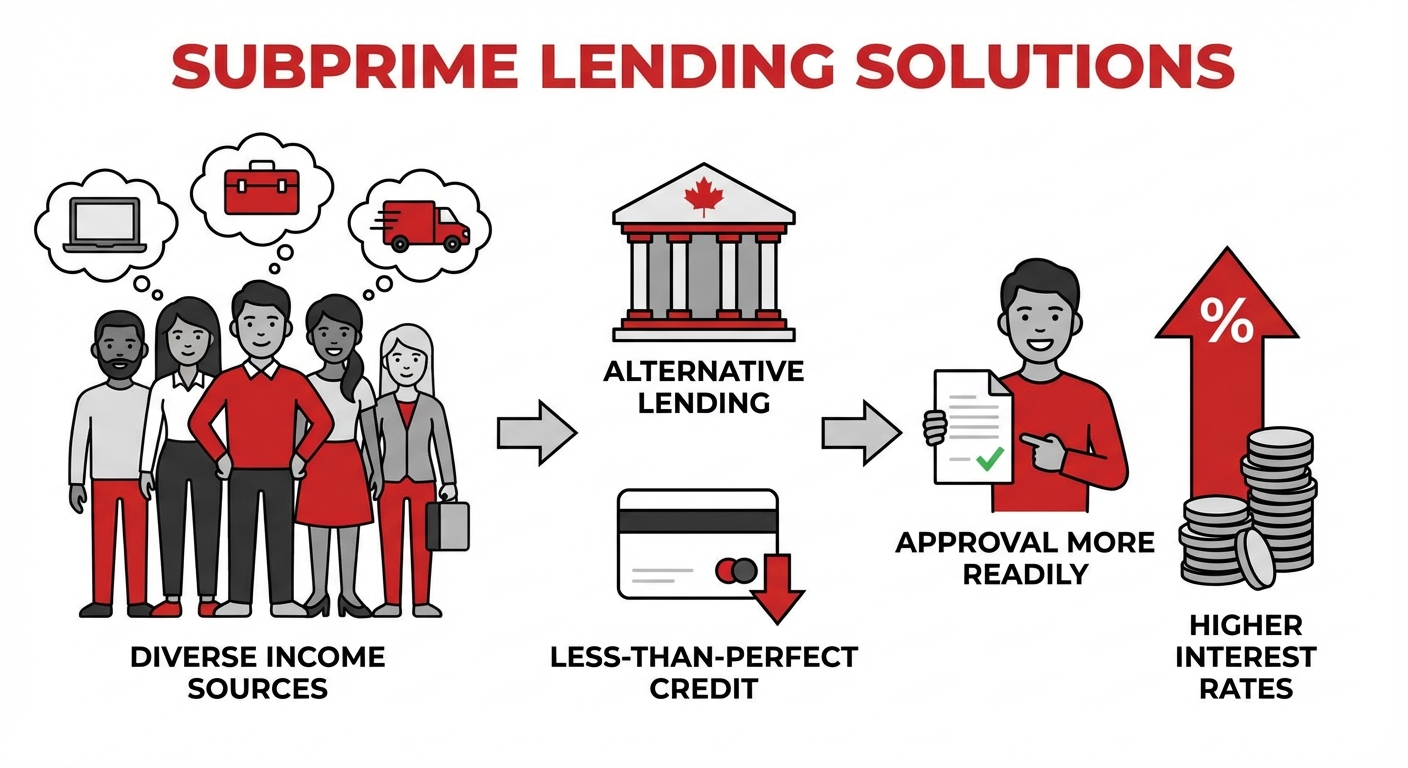

- Specialized Auto Finance Companies: These companies are often the most accommodating for gig workers or those with less-than-perfect credit. They specialize in "subprime" or "alternative" lending and are more accustomed to assessing diverse income sources. While they might offer approval more readily, their interest rates can sometimes be higher.

Types of Loans

- Standard auto loans: These are the most common, offering fixed rates and terms (e.g., 60 or 72 months). Once approved, your monthly payment remains consistent, making budgeting straightforward.

- Leasing vs. Buying: A critical decision for gig workers:

- Buying: You own the vehicle, build equity, and have no mileage restrictions. This is often preferred for gig workers who put a lot of kilometres on their vehicles.

- Leasing: You essentially rent the car for a set period, with lower monthly payments. However, leases come with strict mileage limits, and exceeding them can incur hefty penalties – a major drawback for high-mileage gig work. You don't build equity, and at the end of the lease, you either return the car or buy it out. For most gig workers, buying is usually the more financially sound option due to the high mileage involved.

The Application Checklist: What Lenders REALLY Want to See

Preparation is paramount. The more organized and transparent you are, the smoother the application process will be and the higher your chances of approval. Here’s what you’ll need:

- Proof of income: This is the big one for gig workers.

- Bank statements (3-6 months are typically requested) showing consistent deposits from gig platforms.

- Tax returns (T4As, T2125 Statement of Business or Professional Activities) from previous years.

- Income records directly from platforms like Uber, SkipTheDishes, DoorDash, Instacart, etc.

- Invoices or contracts if you offer specialized mobile services.

- Identification & Residency: Valid Canadian driver's license, proof of residency (utility bills, lease agreement), and potentially proof of Canadian citizenship or permanent residency.

- Credit history report: It's wise to obtain your free annual credit reports from Equifax and TransUnion beforehand. This allows you to check for errors and understand your score.

Pro Tip: Prepare Your 'Gig Resume'

Think of your income documentation as a "gig resume." Compile a detailed history of your earnings, clearly showing consistency and growth over time. If you have multiple gig streams, present them clearly. This demonstrates financial stability and reduces uncertainty for the lender, even if you don't have a traditional pay stub. Highlight your average weekly or monthly income, and any significant periods of high earnings.

The Approval Playbook: Boosting Your Odds for Zero Down Hybrid Financing

Even if your credit isn't perfect or your income is non-traditional, there are concrete steps you can take to significantly improve your chances of securing no down payment financing for a hybrid.

Building Your Credit Foundation

A strong credit score is your most powerful tool. If yours needs work, start now:

- Strategies for improving your credit score:

- Pay bills on time, every time: Payment history is the most significant factor in your credit score.

- Reduce existing debt: Lowering your credit utilization (how much credit you're using versus how much is available) can quickly boost your score.

- Keep old accounts open: A longer credit history is generally better.

- Check your credit report regularly: Dispute any errors immediately.

- Secured credit cards and credit-builder loans: These are excellent tools for those with limited or poor credit. A secured credit card requires a deposit (which becomes your credit limit), while a credit-builder loan involves you making payments into a savings account that unlocks after the loan term. Both help establish a positive payment history. If you're starting with zero credit, it's possible to get approved; explore our guide on Zero Credit? Perfect. Your Canadian Car Loan Starts Here.

The Co-Signer Advantage

If your credit score or income history isn't quite strong enough on its own, a co-signer can be a game-changer.

- When and why a co-signer can make all the difference: A co-signer, typically a family member or close friend with excellent credit, adds their financial strength to your application. This reduces the risk for the lender, making them more willing to approve a no down payment loan or offer a lower interest rate.

- Responsibilities and risks for both parties: It's crucial that both you and your co-signer understand the implications. A co-signer is equally responsible for the loan. If you miss payments, it impacts their credit score, and they are legally obligated to make the payments. This should only be considered with someone you trust implicitly and who understands the commitment.

Negotiating Like a Pro

Even with pre-approval, don't be afraid to negotiate.

- Don't just accept the first offer; shop around for rates: Apply with several lenders or leverage a dealership that works with multiple finance partners. This allows you to compare interest rates, terms, and total costs, giving you leverage to negotiate for the best deal.

- Focus on the total price of the car, not just the monthly payment: Dealers sometimes try to distract with low monthly payments, which can hide longer loan terms or higher interest rates. Always focus on the overall purchase price and the total cost of the loan (principal + interest).

Pro Tip: Get Pre-Approved First

Before you even step onto a dealership lot, get pre-approved for a loan. This accomplishes several critical things:

- You know exactly what you can afford, preventing you from falling in love with a car outside your budget.

- You understand the interest rate and terms you qualify for, giving you a baseline for comparison.

- It gives you significant leverage during negotiations, as you're essentially walking in with financing already secured. The dealership then has to beat or match your pre-approved rate.

Hidden Hurdles & How to Leap Them: Beyond the Monthly Payment

Securing a no down payment hybrid loan is a fantastic step, but it's only part of the financial picture. A truly smart gig worker understands the full cost of vehicle ownership.

The True Cost of Ownership

- Insurance premiums: Hybrids, especially newer models, can sometimes have higher initial insurance premiums due to their advanced technology and potentially higher repair costs for specialized components. Always get insurance quotes for specific models before committing to a purchase. Factor this into your monthly budget.

- Maintenance and repairs: While hybrids generally boast lower maintenance costs (e.g., less brake wear), they still require regular servicing. Hybrid-specific components (like the battery pack) have long warranties, but eventual replacement can be costly, especially on older models outside warranty. Budget for routine maintenance, tire replacements, and unexpected repairs.

- Depreciation: How quickly your hybrid's value will drop impacts its trade-in or resale value. New cars depreciate significantly in the first few years. While hybrids tend to hold their value better than some gasoline cars due to demand for fuel efficiency, it's still a factor to consider, especially if you plan to upgrade in a few years.

Extended Warranties & Add-ons

When you're finalizing a purchase, dealerships often present a range of add-ons, from extended warranties to paint protection. While some can offer peace of mind, others might be unnecessary profit boosters for the dealer.

- When they're worth it, and when they're just extra profit for the dealer: An extended warranty for a complex hybrid system might be a wise investment, especially if you plan to keep the car beyond the manufacturer's warranty. However, always read the fine print: what does it cover? What are the exclusions? How long does it last? Avoid pressure to add on items you don't fully understand or need.

Understanding Fine Print & Fees

The sticker price and the financed amount aren't the only numbers to watch. Be aware of additional fees common in Canada:

- Administration fees: Charged by dealerships for processing paperwork.

- PPSA registration (Personal Property Security Act): Registers the lender's interest in the vehicle.

- Lien search fees: Ensures there are no outstanding debts on the vehicle (especially for used cars).

- Other provincial charges: Sales tax (HST/GST/PST), tire levies, air conditioning fees, and licensing/registration costs.

Pro Tip: Read Every Line

Never rush through the financing agreement. This is a legally binding document. Take your time, read every line, and ask questions about anything you don't understand. Pay particular attention to interest rates, the total cost of borrowing, early payment penalties (some loans have them), and any hidden fees. If something feels off, don't sign until you're completely comfortable.

Hybrid Hotlist for Gig Pros: Top Picks & What to Look For in Canada

Choosing the right hybrid is as important as securing the right financing. Your vehicle needs to be a workhorse, designed to handle the demands of gig life while keeping your operating costs low.

Key Features for Gig Work

- Fuel efficiency (of course!): This is paramount. Look for models with excellent combined city/highway ratings.

- Reliability and low maintenance costs: Downtime means lost income. Choose brands known for durability and affordable parts.

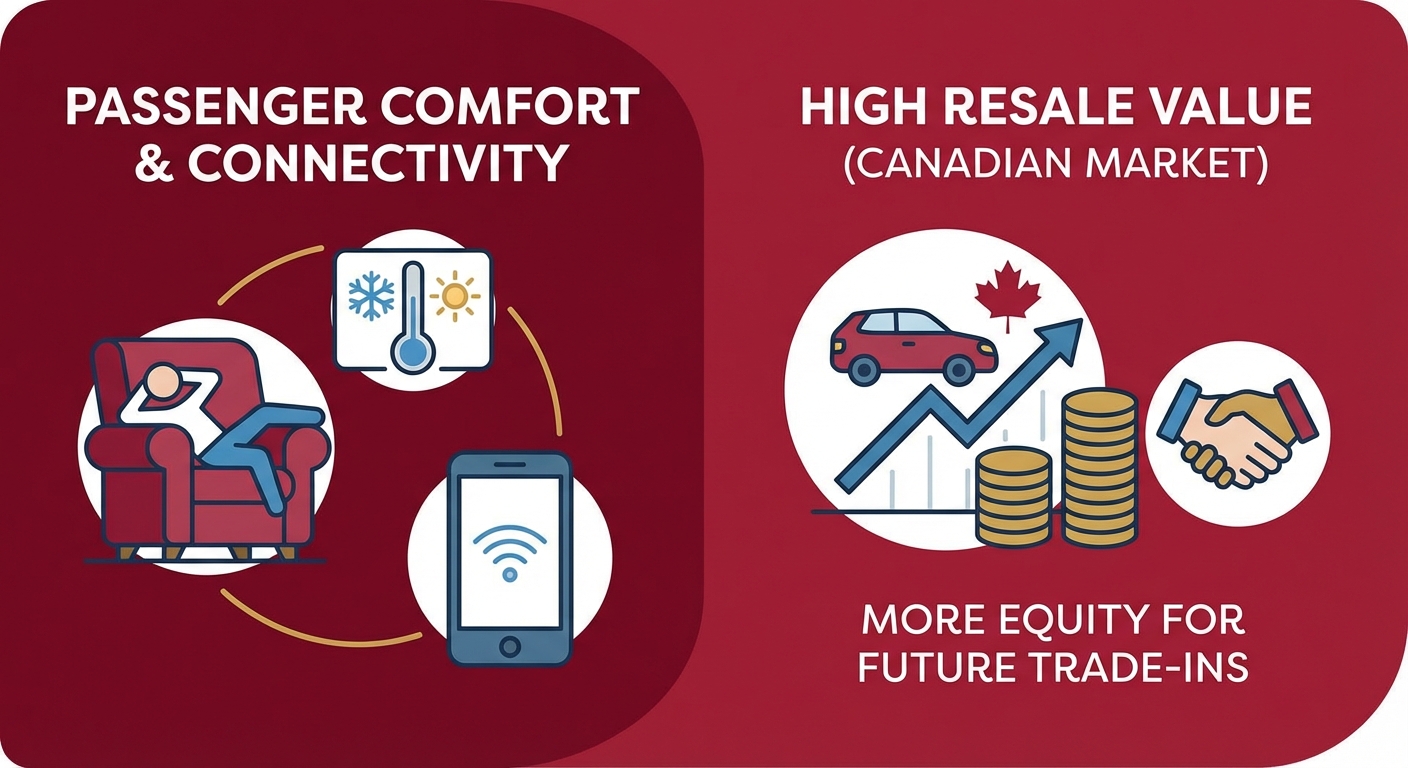

- Cargo space (for delivery drivers) or comfortable passenger space (for rideshare): Ensure the vehicle meets the specific needs of your gig. Delivery drivers need ample, easily accessible cargo volume, while rideshare drivers need comfortable seating, good climate control, and often connectivity options for passengers.

- Resale value in the Canadian market: A vehicle that holds its value well will give you more equity if you decide to trade up or sell in the future.

Popular Hybrid Models in Canada for Gig Workers (New & Used)

Here's a look at some top contenders that balance efficiency, reliability, and practicality for Canadian gig workers:

| Model | Key Advantages for Gig Work | Average Fuel Economy (L/100km Combined) | Considerations |

|---|---|---|---|

| Toyota Prius / Corolla Hybrid | Gold standard for reliability, exceptional fuel economy, low maintenance, strong resale. | 4.5 - 5.0 | Prius design may not appeal to all; Corolla Hybrid offers a more traditional sedan look. |

| Honda CR-V Hybrid / Insight | CR-V Hybrid offers versatile SUV utility and AWD for Canadian winters. Insight (discontinued but available used) is a reliable sedan. | 6.0 - 7.0 (CR-V Hybrid); 4.5 - 5.0 (Insight) | CR-V Hybrid is larger, potentially higher initial cost. Insight is sedan-only. |

| Hyundai Elantra Hybrid / Kona Electric (if considering EV) | Modern features, good value, comfortable ride. Kona Electric offers pure EV for those with charging access. | 4.5 - 5.0 (Elantra Hybrid); 1.8 - 2.0 Le/100km (Kona EV) | Hyundai's hybrid system is newer than Toyota's; Kona EV requires home charging solution. |

| Kia Niro Hybrid / PHEV | Crossover utility, good efficiency, attractive design, long warranty. PHEV offers plug-in flexibility. | 4.5 - 5.0 (Niro Hybrid); 2.2 Le/100km (Niro PHEV) | Can be harder to find used than Toyota/Honda. |

Pro Tip: Consider Used Hybrids

A used hybrid can be a more accessible entry point for no down payment financing. New cars experience significant depreciation the moment they leave the lot. Buying a 2-3 year old hybrid means someone else has absorbed that initial depreciation, giving you a vehicle that's still reliable, fuel-efficient, and often comes with remaining factory warranty, but at a lower price. A lower total loan amount can also make lenders more comfortable with zero-down financing.

From Application to Ignition: Your Step-by-Step Journey to Hybrid Ownership

Ready to make that hybrid a reality? Here's a clear roadmap to guide you through the process:

- Step 1: Financial Self-Assessment: Before anything else, get a clear picture of your finances. Understand your average monthly income from all gig sources, track your expenses, and obtain your credit score and report from Equifax and TransUnion. This will inform your budget and strategy.

- Step 2: Research & Budgeting: Identify suitable hybrid models that fit your gig work needs and budget. Beyond the monthly loan payment, factor in realistic estimates for insurance, fuel (even with hybrid savings!), maintenance, and any provincial registration fees.

- Step 3: Gather Documents: Proactively collect all necessary income proof (bank statements, tax returns, gig platform summaries) and identification. Having everything organized will streamline the application process.

- Step 4: Get Pre-Approved: Approach multiple lenders (banks, credit unions, specialized finance companies, or through a dealership like SkipCarDealer.com) for pre-approval. This step is crucial for understanding your borrowing power and securing the best possible interest rate.

- Step 5: Test Drive & Inspect: Once you have financing in place, thoroughly test drive your chosen hybrid model. For used vehicles, always consider a pre-purchase inspection by an independent mechanic to uncover any potential issues.

- Step 6: Finalize Financing & Purchase: Review all loan paperwork meticulously. Ensure all terms, rates, and fees are as agreed upon. Don't sign until every question is answered and you're fully comfortable.

- Step 7: Insure Your Investment: Before you drive off the lot, secure comprehensive insurance coverage. This protects your valuable asset and ensures you're legally permitted to drive.

Beyond the Purchase: Maximizing Your Hybrid's Gig Potential & Loan Management

Congratulations, you've got your hybrid! Now, let's talk about how to keep it running efficiently, manage your loan smartly, and maximize its benefits for your gig business.

Smart Maintenance for Longevity

Your hybrid is an investment. Protect it with diligent care:

- Follow manufacturer's service schedule: Adhere to the recommended maintenance intervals for oil changes, tire rotations, and system checks. This prevents minor issues from becoming costly problems.

- Monitor hybrid battery health (especially for older models): While hybrid batteries are designed to last the life of the vehicle, extreme temperatures and driving habits can affect them. Pay attention to any warning lights and have the hybrid system checked during routine maintenance.

Tracking Expenses for Tax Benefits

As a self-employed gig worker, meticulous record-keeping is your friend. Keep precise records of:

- Fuel purchases (receipts or app logs).

- All maintenance and repair costs.

- Insurance premiums.

- A detailed mileage log (start and end odometer readings for business vs. personal use).

These records are essential for claiming legitimate business expenses on your tax returns, significantly reducing your taxable income. Consult a Canadian tax professional to ensure you're maximizing all available deductions.

Optimizing Your Gig Routes

Leverage your hybrid's efficiency to its fullest. Plan your routes strategically to minimize unnecessary driving and maximize time spent in electric-only mode. Many gig apps offer navigation features that can help with this, but combining them with your knowledge of traffic patterns can lead to even greater savings.

Paying Down Your Loan Strategically

Even with a no down payment loan