British Columbia: Your Business Model Evolved. So Did Your Car Loan.

Table of Contents

- Key Takeaways: Navigating British Columbia's Entrepreneurial Auto Financing Landscape

- The New BC Entrepreneur: A Glimpse into the Evolving Work Landscape

- Why Traditional Car Loans Miss the Mark for BC's Self-Employed Innovators

- Cracking the Code: Proving Income When It's Not a Paycheck in British Columbia

- Beyond the Big Banks: Specialized Auto Financing Avenues in British Columbia

- Dealer Financing: Your First Stop for Flexibility in British Columbia?

- Credit Unions: The Local Advantage for BC Entrepreneurs

- Online Lenders & Brokers: Speed, Specialization, and Reach Across British Columbia

- The Approval Odds Playbook: Maximizing Your Chances as a BC Entrepreneur

- Credit Score: More Than Just a Number, It's Your Financial Footprint

- The Down Payment Dilemma: How Much is Enough to Make a Difference?

- Co-Signers & Collateral: Leveraging Your Network and Assets in British Columbia

- Decoding the Dollars: Interest Rates, Fees, and the True Cost of Your BC Car Loan

- Understanding Interest Rates for Inconsistent Income

- Hidden Fees to Watch Out For

- The Total Cost of Ownership: Beyond the Monthly Payment in British Columbia

- Smart Wheels for the Self-Starter: Car Choices That Align with Your Business & Budget in BC

- Reliability & Resale Value: Investing Wisely for the Long Haul

- Fuel Efficiency: A Must for British Columbia's Diverse Travel Needs

- Vehicle Utility: Does Your Car Work as Hard as You Do?

- Building Your Financial Foundation: How a British Columbia Car Loan Can Be a Stepping Stone

- Credit Building: The Long-Term Game for BC Entrepreneurs

- Business Growth & Mobility: Fueling Your Entrepreneurial Ambitions Across British Columbia

- British Columbia's Unique Landscape: Local Insights for Your Loan Journey

- ICBC Insurance: A Mandatory Consideration for All BC Drivers

- Regional Differences: Navigating Markets in Vancouver, Victoria, Kelowna, Prince George, and Beyond

- Local Support & Resources

- Your Next Steps to Approval: Charting Your Course for a British Columbia Car Loan

- Frequently Asked Questions (FAQ) for British Columbia Entrepreneurs

British Columbia, a province renowned for its breathtaking natural beauty, is also a crucible of innovation and entrepreneurial spirit. From the bustling tech hubs of Vancouver to the vibrant artisan communities of Victoria and the agricultural innovators of the Okanagan, the traditional 9-to-5 workday is steadily giving way to a more dynamic, flexible, and often self-directed career path. You, the modern British Columbia entrepreneur, freelancer, or gig economy worker, are at the forefront of this evolution, building businesses and livelihoods on your own terms.

But with this exciting freedom comes a unique set of challenges, particularly when it comes to navigating the established financial landscape. Securing a car loan, a seemingly straightforward process for those with traditional employment, can feel like an uphill battle when your income isn't a predictable, bi-weekly paycheque. Traditional auto financing models, often rigid and reliant on T4s and fixed pay stubs, frequently miss the mark for individuals whose income streams ebb and flow with projects, seasons, or client demands.

This isn't about whether you can afford a car; it's about how the system recognizes your ability to pay. At SkipCarDealer.com, we understand that your business model has evolved, and so too should your car loan options. This comprehensive, British Columbia-specific guide is designed to empower you with the knowledge, strategies, and resources needed to confidently secure the vehicle that fuels your entrepreneurial journey, even with inconsistent income.

Key Takeaways: Navigating British Columbia's Entrepreneurial Auto Financing Landscape

- Documentation is King: Proactive and thorough financial record-keeping is your strongest asset.

- Embrace Alternatives: Look beyond traditional banks to credit unions, dealerships, and specialized lenders in British Columbia.

- Build Your Narrative: Frame your business story and income fluctuations positively for lenders.

- Strategic Car Choice: Opt for reliability, efficiency, and utility that supports your business and budget.

- Long-Term Credit Building: View your car loan as a stepping stone to stronger financial health and future opportunities.

The New BC Entrepreneur: A Glimpse into the Evolving Work Landscape

British Columbia's economic fabric is increasingly woven with the threads of independent contractors, innovative freelancers, and agile small business owners. Across cities like Vancouver, Victoria, Kelowna, and Prince George, individuals are embracing the autonomy of self-employment. This shift is driven by a desire for flexibility, the pursuit of passion projects, and the ability to dictate one's own professional trajectory. From graphic designers and IT consultants to construction contractors, real estate agents, and ride-share drivers, the entrepreneurial spirit is thriving.

While this evolving landscape offers unparalleled freedom, it also introduces a characteristic financial challenge: inconsistent income. Unlike a salaried employee who receives a predictable sum every pay period, an entrepreneur's earnings might fluctuate wildly from month to month. One quarter could be booming with major projects, while the next might see leaner periods between contracts. This variability, while entirely normal and manageable within a well-run business, presents a hurdle when dealing with financial institutions programmed for regularity. It's a reality that demands a different approach to proving your financial stability. For more on how diverse income streams can be leveraged, you might find our article Your Income's a Playlist, Not a Single. Get Your Car, Edmonton. particularly insightful, as it touches on similar themes.

Pro Tip 1: Embrace Your Story – How to Frame Your Entrepreneurial Journey for Lenders.

Instead of apologizing for inconsistent income, explain the seasonality or project-based nature of your work. Highlight long-term client relationships, future contracts, and strategies for managing fluctuations (e.g., setting aside funds, diversified income streams). Lenders are people too, and a compelling, confident narrative can often bridge gaps that numbers alone might create. Show them you're in control of your financial destiny.

Why Traditional Car Loans Miss the Mark for BC's Self-Employed Innovators

The fundamental disconnect between traditional lending criteria and the vibrant reality of entrepreneurial finances is often stark. Conventional banks are designed to assess risk based on easily verifiable, consistent income. They favour the simplicity of a T4 statement, regular pay stubs, and employment letters that confirm stable, long-term employment. For them, these documents represent a clear, predictable path to loan repayment.

When you present income that varies—even if your overall annual earnings are substantial—it can automatically be flagged as higher risk. This isn't necessarily a judgment on your financial acumen or the viability of your business; it's a limitation of their rigid, standardized assessment models. For new entrepreneurs, or those who have been self-employed for less than two years, the hurdles are even higher. Without a lengthy track record of business tax returns, many traditional lenders struggle to project future income and stability. This means that even a highly profitable new venture in Burnaby or a rapidly expanding freelance career in Kamloops might struggle to secure a loan from a big bank that prioritizes historical consistency over current potential.

Their systems are simply not built to understand the ebb and flow of project-based work, the strategic reinvestment of profits back into a growing business, or the seasonal peaks and troughs common in many entrepreneurial fields, from tourism in Whistler to construction in Surrey. This is where knowing your options and how to present your unique financial picture becomes absolutely critical.

Cracking the Code: Proving Income When It's Not a Paycheck in British Columbia

This is where the rubber meets the road for British Columbia's self-employed. Demystifying income verification is your superpower. Lenders need to see a clear and consistent ability to repay, and while your methods of proof differ from a salaried employee, they are no less valid. The key is to be thorough, organized, and proactive in presenting your financial health.

Here’s a comprehensive list of acceptable documents and strategies:

- Bank Statements (Personal & Business): Provide 6-12 months of statements. These are invaluable for painting a picture of your cash flow, even if it fluctuates. Lenders look for regular deposits, evidence of client payments, and responsible money management. Consistent deposits, even if varying in amount, demonstrate activity and income.

- Tax Returns (Notice of Assessment, T1 General): These are the gold standard for proving annual income to lenders. Your Notice of Assessment (NOA) from the Canada Revenue Agency (CRA) confirms the income you've declared and the taxes paid. Filing accurately and on time for at least the past two years is crucial, as it provides a verifiable, government-backed record of your earnings.

- Business Invoices & Contracts: Demonstrate current and future revenue streams. A portfolio of recent paid invoices shows active work, while signed contracts for upcoming projects provide confidence in your future earning potential. This is especially useful for project-based work or consulting.

- Accounting Software Reports: If you use platforms like QuickBooks, FreshBooks, or Xero, leverage their reporting capabilities. Profit and loss statements, balance sheets, and cash flow reports generated directly from these systems offer a professional and organized view of your business's financial health.

- Letters from Your Accountant: A professional endorsement from your chartered professional accountant (CPA) can significantly bolster your application. This letter can confirm your business's viability, average income over a period, and your financial management practices.

- Strategies for Explaining Fluctuations: Don't just present the numbers; be ready to explain them. Prepare a brief, clear explanation for seasonal dips (e.g., "my landscaping business peaks in spring and summer") or project gaps ("I secured a large, multi-month contract that just finished, and new ones are in negotiation"). Transparency builds trust.

- Building a Strong Business Case: Present your business model, its stability, and your market position. What makes your business resilient? What's your unique selling proposition? Who are your long-term clients? A concise summary of your business's strengths can make a significant difference.

Pro Tip 2: The Power of the Paper Trail – Documenting Every Dollar.

Maintain meticulous records from day one. Digitalize everything. Use cloud storage for invoices, receipts, contracts, and bank statements. A well-organized financial portfolio speaks volumes about your reliability and seriousness as a borrower, even with varying income. It shows a lender that you are a responsible business owner who understands their finances inside and out.

To further illustrate the difference, consider this comparison:

| Income Verification Aspect | Traditional Employee | Self-Employed Entrepreneur (BC) |

|---|---|---|

| Primary Documents | T4 slips, Pay Stubs (2-3 most recent), Employment Letter | Tax Returns (NOA, T1 General - 2 years+), Business Bank Statements (6-12 months), Personal Bank Statements (6-12 months) |

| Supplementary Documents | N/A | Invoices/Contracts, Accounting Software Reports (P&L), Letters from Accountant, Business Plan Summary |

| Income Consistency | Highly predictable, fixed salary/hourly wage | Often fluctuating, project-based, seasonal; assessed on annual average or trend |

| Lender Perception of Risk | Generally lower due to clear, stable income | Historically higher; mitigated by strong documentation and explanation of fluctuations |

| Key Strategy | Provide standard documents | Build a comprehensive financial narrative with multiple supporting documents |

Beyond the Big Banks: Specialized Auto Financing Avenues in British Columbia

While traditional banks might seem like the obvious first choice, their rigid structures often mean they're not the best fit for British Columbia's self-employed. Thankfully, a diverse ecosystem of lenders understands and caters to your unique financial situation. Exploring these alternatives can significantly increase your chances of securing a favourable car loan.

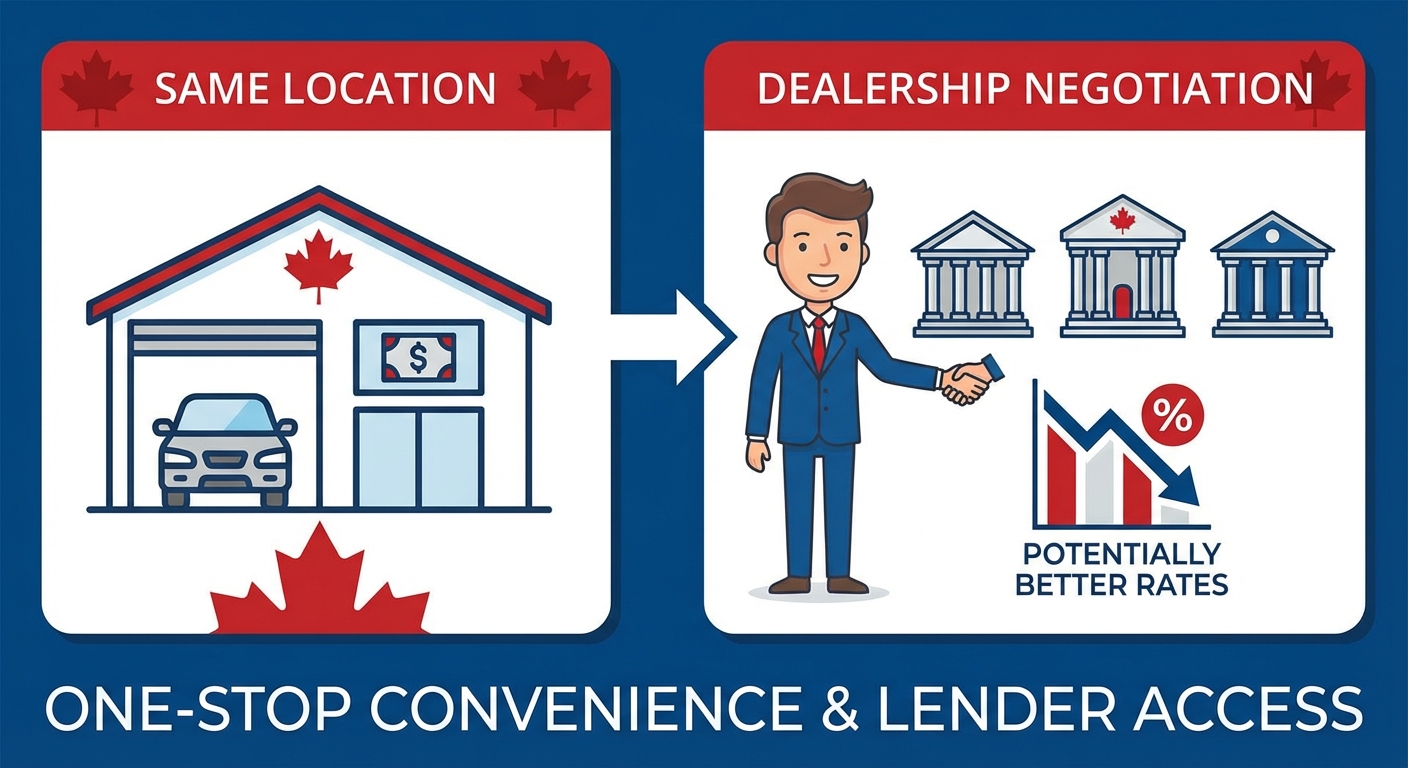

Dealer Financing: Your First Stop for Flexibility in British Columbia?

Many entrepreneurs find that starting their car loan journey at a dealership, such as those in the busy auto rows of Richmond or the family-run lots in Vernon, can be incredibly advantageous. Dealerships don't just sell cars; they often act as financial intermediaries, partnering with a broad network of lenders. This network typically includes not only major banks but also specialized financial institutions that are more accustomed to working with non-traditional income profiles or even those seeking zero credit car loans.

Their incentive to sell a vehicle means they are often more motivated to find a financing solution that works for you. This can translate into more flexible terms, a willingness to look beyond a single income metric, and a greater understanding of the nuances of self-employment. The convenience of one-stop shopping – finding your car and securing financing in the same location – is also a significant benefit. Furthermore, dealerships can sometimes negotiate on your behalf with various lenders, potentially securing better rates or more accommodating terms than you might find approaching a bank directly.

Credit Unions: The Local Advantage for BC Entrepreneurs

British Columbia boasts a robust and community-focused credit union sector. Institutions like Vancity, Coast Capital Savings, and Prospera Credit Union are pillars of local communities from the Lower Mainland to the Kootenays. Unlike large, national banks, credit unions are member-owned and often operate with a more personalized, human-centric approach to lending. This philosophy can be a huge advantage for entrepreneurs.

Credit unions are often more willing to look beyond strict algorithms and take the time to understand your individual story, your business model, and your long-term financial stability. Their community-focused mandate means they are more attuned to local business nuances and may be more flexible in assessing your financial situation. For members, this often translates into more competitive rates or more accommodating terms, as they prioritize member well-being over shareholder profits. A face-to-face meeting with a loan officer at a credit union in your community, armed with your detailed financial narrative, can often yield positive results where a big bank might decline.

Online Lenders & Brokers: Speed, Specialization, and Reach Across British Columbia

The digital age has brought forth a new wave of lenders and brokers who specialize in serving niche markets, including self-employed individuals and those with inconsistent income. These digital platforms offer unparalleled speed in application and approval processes, often leveraging advanced algorithms to assess risk differently. They understand that modern income streams are diverse and are built to accommodate that complexity.

Online lenders can be a great option for quick approvals, especially if you have a strong documentation package ready. Online brokers, on the other hand, act as intermediaries, connecting you with a network of lenders—often a mix of traditional and specialized ones—to find the best fit for your profile. While the convenience and speed are undeniable, it's crucial to be aware that interest rates from specialized online lenders can sometimes be higher, reflecting the perceived higher risk associated with non-traditional income. Always compare offers carefully and understand all terms and conditions before committing.

| Lender Type | Pros for BC Entrepreneurs | Cons for BC Entrepreneurs |

|---|---|---|

| Dealership Financing | Access to broad lender networks (including specialized), motivated to approve, convenient one-stop shop, potential for negotiation. | Rates can vary, focus often on selling vehicle first, may not always find the absolute lowest rate. |

| Credit Unions | Community-focused, personalized assessment, understanding of local business, potentially better rates for members, flexible terms. | May require membership, often slower approval process than online, sometimes limited branch network. |

| Online Lenders & Brokers | Speedy applications/approvals, specialization in non-traditional income, wide reach across British Columbia. | Potentially higher interest rates, less personalized service, requires careful vetting of lender reputation. |

The Approval Odds Playbook: Maximizing Your Chances as a BC Entrepreneur

Securing a car loan when you're self-employed with inconsistent income isn't about luck; it's about strategic preparation. By understanding what lenders look for and proactively addressing potential concerns, you can significantly boost your approval probabilities and secure more favourable terms. Consider this your playbook for navigating the application process.

Credit Score: More Than Just a Number, It's Your Financial Footprint

Your credit score is a numerical representation of your creditworthiness, reflecting your history of borrowing and repayment. Lenders use it as a primary indicator of risk. In Canada, you can obtain your credit report and score from major credit bureaus like Equifax and TransUnion. Understand that even as an entrepreneur, a strong personal credit score is incredibly valuable, as most car loans are issued to individuals, not directly to businesses.

Practical steps to improve your credit score include:

- Pay Bills on Time: This is the single most important factor. Set up automatic payments for all your bills.

- Reduce Debt: Especially revolving debt like credit card balances. Keep your credit utilization ratio (how much credit you're using versus how much you have available) low.

- Avoid New Credit Applications: Don't open multiple new credit accounts in the months leading up to a car loan application, as each application can temporarily ding your score.

- Review Your Report: Regularly check your credit report for errors and dispute any inaccuracies.

The Down Payment Dilemma: How Much is Enough to Make a Difference?

A substantial down payment is perhaps the most powerful tool in your arsenal, especially with inconsistent income. It illustrates your financial commitment, reduces the loan amount, and signals to lenders that you have cash reserves and are a lower risk. The profound impact of a down payment extends to:

- Approval Chances: A larger down payment significantly increases your likelihood of approval, particularly if your income or credit profile is less than ideal.

- Interest Rates: Lenders often offer lower interest rates on loans with higher down payments, as their risk is reduced.

- Overall Loan Cost: A smaller principal loan amount means less interest paid over the life of the loan, saving you thousands of dollars.

- Equity: You start with more equity in the vehicle, protecting you from negative equity if the car depreciates quickly.

Strategies for saving for a down payment, even with fluctuating income, include setting aside a percentage of every payment you receive, dedicating "bonus" income periods entirely to savings, or even using a separate savings account specifically for your vehicle fund.

Co-Signers & Collateral: Leveraging Your Network and Assets in British Columbia

Sometimes, despite your best efforts, you might need an extra boost. A co-signer can be a viable option. When someone with a strong credit history and stable income co-signs your loan, they legally agree to be responsible for the debt if you default. This significantly reduces the risk for the lender, often making approval possible and potentially securing a better interest rate. However, ensure both parties fully understand the responsibilities involved, as it impacts the co-signer's credit as well.

Exploring the possibility of using existing assets as collateral is another avenue. If you own another paid-off vehicle, for example, some lenders might accept it as collateral against your new car loan, providing additional security. This is less common for standard car loans but can be an option with certain specialized lenders, particularly in cases where the primary collateral (the car you're buying) might not fully cover the perceived risk. For those navigating complex financial situations, understanding options like these is key. You might find our resource on Bankruptcy? Your Down Payment Just Got Fired. helpful, as it delves into how various financial states can impact loan requirements and strategies.

Pro Tip 3: Don't Just Apply – Prepare Your Narrative. How to Present Your Business Story.

Before approaching a lender, have a concise, positive explanation of your business, its stability, and how you manage income fluctuations. This personal touch can make a difference, especially with local lenders or credit unions. Highlight your experience, client testimonials if applicable, and any significant achievements. A well-articulated story demonstrates professionalism and confidence.

Decoding the Dollars: Interest Rates, Fees, and the True Cost of Your BC Car Loan

Beyond the monthly payment, understanding the full financial implications of your car loan is paramount, particularly for entrepreneurs managing fluctuating income. Getting a clear picture of interest rates, potential fees, and the total cost of ownership ensures you're making an informed decision that aligns with your financial strategy.

Understanding Interest Rates for Inconsistent Income

For self-employed individuals with inconsistent income, interest rates might be higher than those offered to traditionally employed individuals with identical credit scores. This premium reflects the perceived higher risk associated with variable income streams. Lenders need to compensate for the uncertainty. However, this doesn't mean you're stuck with exorbitant rates.

- Strategies to Negotiate or Mitigate Rates: A larger down payment, a strong credit score, a co-signer, or choosing a less expensive, reliable vehicle can all help lower your rate. Shopping around with multiple lenders (dealerships, credit unions, online specialists) and comparing offers is crucial.

- Fixed vs. Variable Rates: Most car loans are fixed-rate, meaning your interest rate and monthly payment remain constant for the life of the loan. This offers predictability, which is often preferable for entrepreneurs managing variable income. Variable rates, while potentially starting lower, can fluctuate with market rates, making budgeting more challenging.

Hidden Fees to Watch Out For

The sticker price and advertised interest rate are just part of the equation. Be vigilant for various fees that can add to your loan's total cost. These can include:

- Administration Fees: For processing your loan application.

- PPSA (Personal Property Security Act) Registration Fees: A legal fee for registering the lender's interest in the vehicle. This is standard in British Columbia.

- Loan Origination Fees: A fee for setting up the loan.

- Documentation Charges: For preparing the loan paperwork.

Always ask for a full breakdown of all fees. While some are unavoidable, others may be negotiable, especially at dealerships. Don't hesitate to question any charges that seem unclear or excessive.

| Common Car Loan Fees in British Columbia | Description | Negotiable? |

|---|---|---|

| Administration Fee | Cost for processing loan application and paperwork. | Sometimes (especially at dealerships). |

| PPSA Registration Fee | Legal fee for registering lender's security interest in the vehicle. | No (mandated by provincial law). |

| Loan Origination Fee | Fee charged by lender for creating the loan. | Sometimes (depends on lender). |

| Documentation Fee | Cost for preparing and handling loan documents. | Sometimes (often bundled with admin fee). |

| Early Prepayment Penalty | Fee for paying off the loan before its term ends. | Varies by lender/contract (check terms carefully). |

The Total Cost of Ownership: Beyond the Monthly Payment in British Columbia

Your car loan payment is just one piece of the puzzle. For British Columbia residents, understanding the full cost of ownership is particularly crucial due to some unique provincial factors:

- ICBC Insurance: A mandatory consideration in British Columbia's public auto insurance system. ICBC (Insurance Corporation of British Columbia) is the sole provider of basic vehicle insurance in the province. Insurance costs can vary significantly based on your driving history, the type of vehicle, where you live (e.g., Vancouver vs. Prince George), and how much you drive. This is often a substantial monthly expense and must be factored into your overall vehicle budget.

- Maintenance, Fuel, Depreciation, and Unexpected Repairs: Don't forget these ongoing costs. Fuel prices in British Columbia can be among the highest in Canada. Regular maintenance is essential for vehicle longevity. All cars depreciate, meaning they lose value over time. And unexpected repairs can quickly drain your reserves. A comprehensive budget should account for all these elements to give you a realistic picture of affordability.

Pro Tip 4: Calculate Your 'Real' Monthly Payment – Include Everything!

Don't just focus on the loan payment. Add estimated monthly insurance (ICBC), fuel costs based on your driving habits, and a buffer for maintenance and unexpected repairs (e.g., $50-$100/month). This gives you a truly realistic picture of affordability and prevents financial surprises down the road.

Smart Wheels for the Self-Starter: Car Choices That Align with Your Business & Budget in BC

For the British Columbia entrepreneur, a car isn't just transportation; it's often a vital business tool and a significant investment. Making an informed vehicle choice that supports both your personal needs and your entrepreneurial venture, while respecting your unique financial situation, is key to long-term success.

Reliability & Resale Value: Investing Wisely for the Long Haul

When your income fluctuates, every dollar counts. Choosing a vehicle known for its reliability and strong resale value is a shrewd financial move. Brands like Toyota, Honda, Mazda, and Hyundai consistently rank high in durability and low maintenance costs. Why is this crucial for entrepreneurs? Because minimizing unexpected repair bills and ensuring your vehicle retains its value means you're maximizing your investment. A reliable car reduces downtime, ensuring you can always get to clients or deliver products, and a strong resale value provides better equity should you need to upgrade or sell in the future.

Fuel Efficiency: A Must for British Columbia's Diverse Travel Needs

British Columbia's vast and varied geography means you might be driving from downtown Victoria to the Fraser Valley, or from Kelowna to a remote work site. Fuel costs, especially in major urban centres like Vancouver, can be a significant ongoing expense. Prioritizing fuel-efficient vehicles—whether it's a gasoline-powered compact car, a hybrid, or an electric vehicle (EV)—can lead to substantial long-term savings. Consider your typical commute and business travel patterns. An EV, while a higher initial investment, offers significant savings on fuel and maintenance, along with potential provincial incentives, making it an attractive option for the environmentally conscious and budget-savvy entrepreneur.

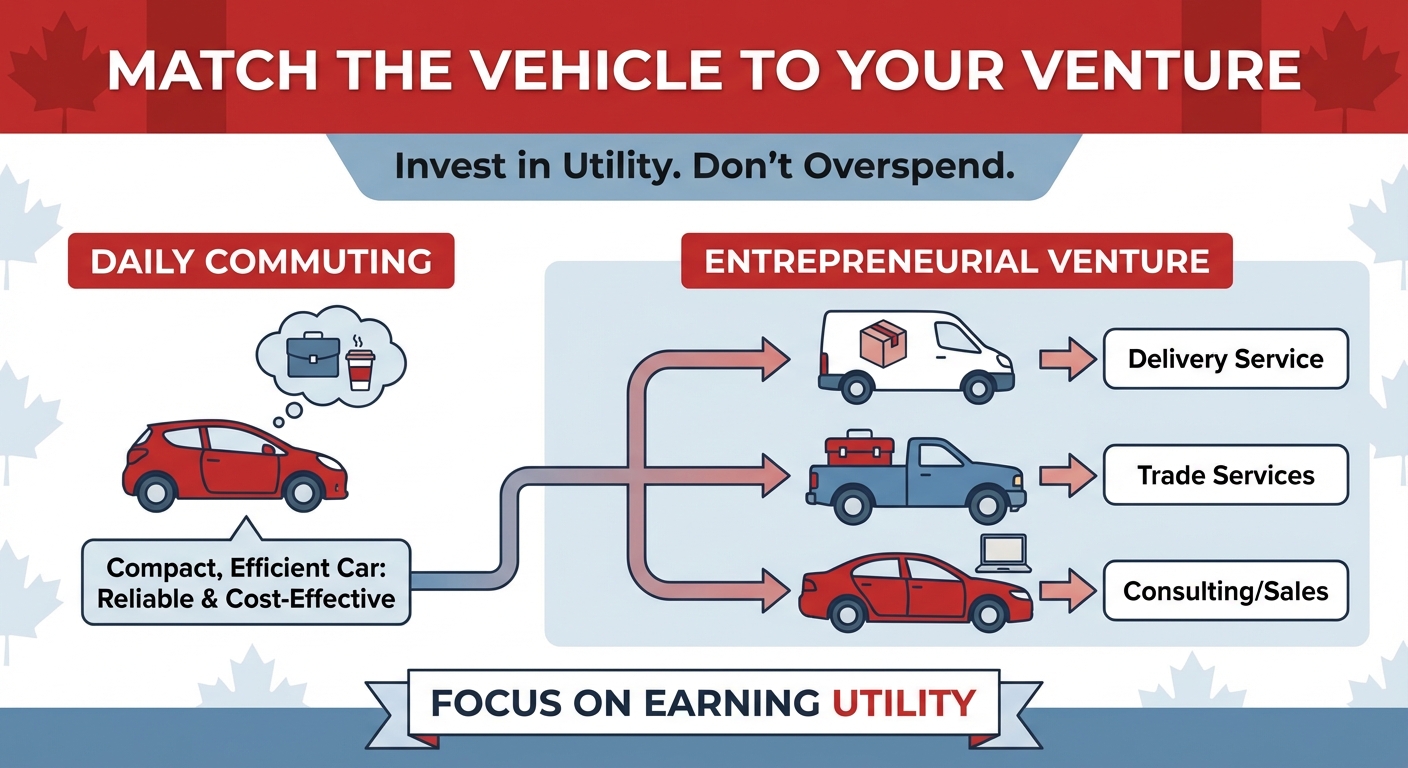

Vehicle Utility: Does Your Car Work as Hard as You Do?

Your car should be an extension of your business. Consider its practical applications:

- Carrying tools or equipment? A small pickup truck or a van might be essential for a contractor or a mobile service provider.

- Transporting goods or products? An SUV or a larger hatchback offers versatile cargo space.

- Meeting clients and projecting a professional image? A reliable, clean sedan or a modern SUV might be more appropriate.

- Simply reliable daily commuting? A compact, efficient car suffices.

Match the vehicle type to your entrepreneurial venture. Don't overspend on features you don't need, but invest in the utility that directly supports your ability to earn.

Building Your Financial Foundation: How a British Columbia Car Loan Can Be a Stepping Stone

Think of your car loan as more than just a means to acquire a vehicle. For the savvy British Columbia entrepreneur, it can be a strategic financial tool, a stepping stone towards building a stronger credit profile and fueling future business growth. It's about leveraging a necessary purchase into a long-term financial advantage.

Credit Building: The Long-Term Game for BC Entrepreneurs

One of the most significant benefits of a car loan, especially for those with developing credit histories or inconsistent income, is its potential to build a robust credit score. Responsible, on-time payments on a car loan demonstrate to credit bureaus and future lenders that you are a reliable borrower. This positive payment history significantly improves your credit score over time, which is invaluable for an entrepreneur.

A strong credit score opens doors for future financing opportunities that are crucial for business expansion and personal milestones. This includes securing better interest rates on mortgages for a home in Surrey, lower rates on business expansion loans for your venture in Nanaimo, or even more favourable terms on lines of credit. Each successful, on-time car loan payment is a brick in the foundation of your financial credibility, proving your ability to manage debt effectively.

Business Growth & Mobility: Fueling Your Entrepreneurial Ambitions Across British Columbia

Reliable transportation is not merely a convenience; it's often a prerequisite for business growth. Imagine the practical advantages:

- Accessing New Clients: Easily travel from Richmond to Burnaby, or from Kamloops to Penticton, to meet new clients and expand your service area.

- Delivering Products: Efficiently transport goods to customers across the Lower Mainland or the Okanagan.

- Attending Networking Events: Participate in industry conferences and networking events throughout the province, vital for making connections and securing new opportunities.

- Projecting a Professional Image: Arriving in a well-maintained, reliable vehicle enhances your professional image, instilling confidence in clients and partners.

A reliable vehicle minimizes downtime, reduces stress, and allows you to seize opportunities across the diverse landscape of British Columbia. It's an investment that directly fuels your entrepreneurial ambitions and enhances your capacity to earn.

Pro Tip 5: Automate Payments – Never Miss a Beat and Boost Your Credit.

Set up automatic payments from your bank account to ensure your car loan payments are always on time. This eliminates stress, removes the risk of late fees, and consistently builds a positive credit history, which is critical for an entrepreneur.

British Columbia's Unique Landscape: Local Insights for Your Loan Journey

Navigating auto financing in British Columbia involves understanding certain provincial specificities that can impact both your loan and your overall cost of vehicle ownership. These local insights can help you prepare more effectively.

ICBC Insurance: A Mandatory Consideration for All BC Drivers

As previously mentioned, ICBC provides mandatory basic auto insurance for all vehicles registered in British Columbia. This isn't an optional add-on; it's a significant and unavoidable monthly expense that must be factored into your budget. Your insurance premium is influenced by many factors, including your driving history, where you live (urban centres like Vancouver and Victoria often have higher rates), the type of vehicle you drive, and how you use it (personal vs. business use).

Tips for managing ICBC expenses:

- Drive Safely: A clean driving record is your best defence against high premiums.

- Choose Wisely: Some vehicles are more expensive to insure than others. Research insurance costs before you buy.

- Consider Usage: If your business use is minimal, ensure it's accurately reflected.

- Explore Discounts: Ask ICBC about any available discounts you might qualify for.

For British Columbia parents, specific benefits like the Child Tax Benefit can sometimes be leveraged to reduce car payments or secure more favourable loan terms. Our article British Columbia Parents: Your Child Tax Benefit Just Cut Your Car Payments. provides more detail on this unique provincial advantage.

Regional Differences: Navigating Markets in Vancouver, Victoria, Kelowna, Prince George, and Beyond

British Columbia is a diverse province, and the auto market reflects this. Vehicle prices, availability, and even lender attitudes can differ significantly between regions:

- Major Urban Centers (Vancouver, Victoria): These are highly competitive markets with a wide selection of vehicles and numerous dealerships. However, vehicle prices can sometimes be higher due to demand and higher operational costs for dealerships. Lenders here are accustomed to a diverse population, including many self-employed individuals.

- Interior Cities (Kelowna, Kamloops, Prince George): While selection might be slightly less vast than in Vancouver, these markets often offer competitive pricing. Lenders in these regions may have a deeper understanding of local industries (e.g., forestry, agriculture, tourism) that often involve seasonal or project-based work, potentially leading to more empathetic assessments of entrepreneurial income.

- Rural Areas: Finding specialized lenders might require looking beyond your immediate community, often leveraging online resources or larger regional dealerships. Vehicle utility (e.g., 4x4 capability) becomes a more significant factor in purchasing decisions.

Local Support & Resources

British Columbia offers a wealth of resources for entrepreneurs that can indirectly support your car loan journey. Local business development centers, chambers of commerce in cities like Burnaby and Richmond, and financial literacy programs can provide guidance on managing business finances, improving credit, and even connecting you with local lenders who understand the entrepreneurial landscape. Don't hesitate to tap into these community resources for additional support and advice.

Your Next Steps to Approval: Charting Your Course for a British Columbia Car Loan

The journey to securing a car loan as a self-employed individual with inconsistent income in British Columbia might seem complex, but with the right preparation and strategy, it is entirely achievable. You've embraced the challenge of entrepreneurship; now, apply that same drive and ingenuity to your financial planning.

Your next steps should be clear and actionable:

- Gather Your Documents: Start compiling 6-12 months of bank statements, your last two years of tax returns (NOA), invoices, and any other proof of income. Organization is your ally.

- Know Your Credit: Obtain your credit report and score. Understand where you stand and take steps to improve it if necessary.

- Define Your Narrative: Prepare a clear, confident explanation of your business, its income fluctuations, and how you manage your finances.

- Determine Your Budget: Factor in the full cost of ownership, including loan payments, ICBC insurance, fuel, and maintenance, to set a realistic budget.

- Explore Your Options: Don't limit yourself to traditional banks. Engage with dealerships, credit unions, and online lenders specializing in non-traditional income.

- Consider a Down Payment: Even a modest down payment can significantly improve your odds and terms.

At SkipCarDealer.com, we believe that your ambition and hard work as a British Columbia entrepreneur should not be hindered by traditional lending models. We are here to help you navigate this landscape, connect you with understanding lenders, and get you behind the wheel of the vehicle that will drive your business forward. Your business model has evolved, and with our guidance, so too will your car loan.