Consumer Proposal? Good. Your Car Loan Just Got Easier.

Table of Contents

- Key Takeaways

- From Debt's Shadow to Driving Freedom: Why Your Consumer Proposal is Actually a Stepping Stone

- The 'R7' Rating: Understanding Your Credit Report Post-Proposal

- Beyond the Score: What Lenders Really Care About Now

- The Strategic Fork in the Road: Car Loans During vs. After Your Consumer Proposal

- Navigating the 'During' Phase: Essential Wheels When You're Still in the Tunnel

- The Open Highway: Unlocking Easier Car Loans After Your Consumer Proposal is Complete

- The Canadian Lender Landscape: Who Will Say 'Yes' and On What Terms?

- Alternative & Subprime Lenders: Your First Stop (and How to Choose Wisely)

- The Path to Prime: Banks, Credit Unions, and the Promise of Better Rates

- Dealer Financing vs. Bank Loans: Which Route is Best for You?

- Building Your Approval Arsenal: Strategies to Strengthen Your Application

- The Power of the Down Payment: More Than Just a Good Idea

- Co-Signers: A Double-Edged Sword? Understanding the Risks and Rewards

- Income Stability & Employment History: Your Best Testimonial

- Beyond the Monthly Payment: The True Cost of Car Ownership Post-Proposal

- Insurance Implications: Expect the Unexpected

- Fuel, Maintenance, and Hidden Fees: Budgeting for the Long Haul

- Your Next Steps to Approval: From Application to Keys in Hand

- Preparing Your Documentation: The Paperwork Power-Up

- Negotiation Tactics: Getting the Best Deal, Even with a CP

- The Road to Recovery Continues: Rebuilding Credit While You Drive

- On-Time Payments: Your New Best Friend

Navigating the aftermath of a consumer proposal in Canada can feel like you're walking through a financial maze, especially when it comes to significant purchases like a car. Many Canadians mistakenly believe that a consumer proposal slams the door shut on future financing, particularly for something as substantial as a vehicle loan. We're here to tell you that's simply not true.

At SkipCarDealer.com, we understand that life happens, and financial challenges are a part of many people's journeys. A consumer proposal is not a scarlet letter; it's a strategic, legally-binding agreement to repay a portion of your debts, and it's a powerful step towards regaining control of your financial future. Far from being a permanent barrier, completing a consumer proposal can actually be a stepping stone towards securing a car loan and, importantly, rebuilding your credit.

This comprehensive guide is designed to demystify the process, empower you with knowledge, and show you exactly how a car loan isn't just possible after a consumer proposal – it can be a logical, advantageous next step in your financial recovery. You can get back on the road, literally and figuratively, with a reliable vehicle and a stronger financial foundation.

Key Takeaways

- A consumer proposal is a financial reset, not a life sentence; car loans are attainable.

- Your approval chances and interest rates dramatically improve after your proposal is completed.

- Strategic preparation, including budgeting and understanding lender types, is your strongest asset.

- You can drive a reliable vehicle and actively rebuild your credit simultaneously in Canada.

From Debt's Shadow to Driving Freedom: Why Your Consumer Proposal is Actually a Stepping Stone

It's easy to view a consumer proposal as a negative mark on your financial record, a public declaration of past difficulties. However, this perspective misses the crucial point: a consumer proposal is a deliberate, responsible action. It's a structured approach to managing unmanageable debt, preventing bankruptcy, and demonstrating a commitment to getting your finances back on track. Lenders, especially those who specialize in helping Canadians with unique credit histories, often see this as a sign of financial maturity and a proactive step towards stability, rather than an ongoing problem.

Consider the alternative: accumulating more debt, missing payments, and facing collection calls. That scenario presents a far greater risk to lenders than an individual who has proactively dealt with their debt through a consumer proposal. Once you've completed your payments and received your Certificate of Full Performance, you emerge with a clean slate, a manageable debt-to-income ratio, and a newfound understanding of financial responsibility. This makes you a more attractive borrower in the long run, as you've proven your ability to meet obligations within a structured plan.

The 'R7' Rating: Understanding Your Credit Report Post-Proposal

During a consumer proposal, your credit report will typically show an R7 rating. In Canada, credit ratings range from R1 (paid as agreed) to R9 (bad debt, written off). An R7 rating specifically indicates that you are making regular payments under a debt management program or consumer proposal. It's a unique rating that tells potential lenders you are actively addressing your debts, rather than ignoring them.

This rating appears on your credit report from the time your proposal is filed and remains for three years after your consumer proposal is completed and discharged, or six years from the date you filed, whichever comes first. While it's certainly not an R1, it's also not an R9. Many specialized lenders understand the context of an R7 rating. They recognize that someone diligently making payments on a consumer proposal is often a more reliable borrower than someone with multiple missed payments, defaults, or collection actions.

Lenders who work with individuals post-proposal look beyond the R7 rating itself. They want to see that you've stuck to the plan, completed your payments, and are now building new, positive credit history. The timeline for its eventual removal from your credit report means that with each passing month after discharge, your credit profile improves, paving the way for better financing opportunities.

Beyond the Score: What Lenders Really Care About Now

While your credit score and history are important, lenders, especially those specializing in non-prime financing, look at a broader picture. For someone with a consumer proposal history, qualitative factors often weigh heavily in their decision-making process. These factors provide a more current and holistic view of your financial health:

- Income Stability: Do you have a steady job? How long have you been employed? Lenders want to see consistent income that can comfortably cover your new car loan payments, along with your other living expenses.

- Employment History: A long, stable employment history at the same company or within the same industry signals reliability. Frequent job changes can be a red flag, indicating potential instability.

- Down Payment Size: A significant down payment reduces the amount you need to borrow, lowering the lender's risk. It also demonstrates your commitment and ability to save, which is a powerful signal of financial responsibility.

- Overall Debt-to-Income (DTI) Ratio Post-Proposal: Lenders will assess your current DTI, looking at your total monthly debt payments (excluding the discharged debts) compared to your gross monthly income. A lower DTI indicates you have more disposable income to manage new debt.

- New Credit History: Have you started responsibly rebuilding credit since your proposal? Even a secured credit card or a small, successfully repaid loan can show new positive payment behaviour.

These elements paint a picture of your current financial health and your potential as a reliable borrower, often outweighing the lingering effects of a past consumer proposal.

The Strategic Fork in the Road: Car Loans During vs. After Your Consumer Proposal

Your approach to securing a car loan will differ significantly depending on whether you are currently making payments on a consumer proposal or if your proposal has been fully completed and discharged. Understanding these distinctions is crucial for setting realistic expectations and navigating the process effectively.

Navigating the 'During' Phase: Essential Wheels When You're Still in the Tunnel

Life doesn't stop just because you're in a consumer proposal. Sometimes, a reliable vehicle is not a luxury but a necessity for work, family, or daily life. Getting a car loan while actively making payments on a consumer proposal is more challenging than after discharge, but it's certainly not impossible. You'll need to manage expectations regarding interest rates and lender types.

- Your existing car loan: If you had a car loan before filing your consumer proposal and kept it out of the proposal (meaning you continued making payments on it), no changes are needed as long as payments are current. You've demonstrated responsibility with that specific debt.

- Seeking a new loan: If you need a new vehicle, expect to work with alternative or subprime lenders. Traditional banks and credit unions are unlikely to approve you during this phase. Interest rates will be higher to compensate for the increased perceived risk.

- The 'necessity' factor: Lenders are more inclined to approve loans for vehicles that are clearly essential for your employment or family responsibilities. Being able to articulate why a vehicle is crucial for your financial stability can strengthen your case.

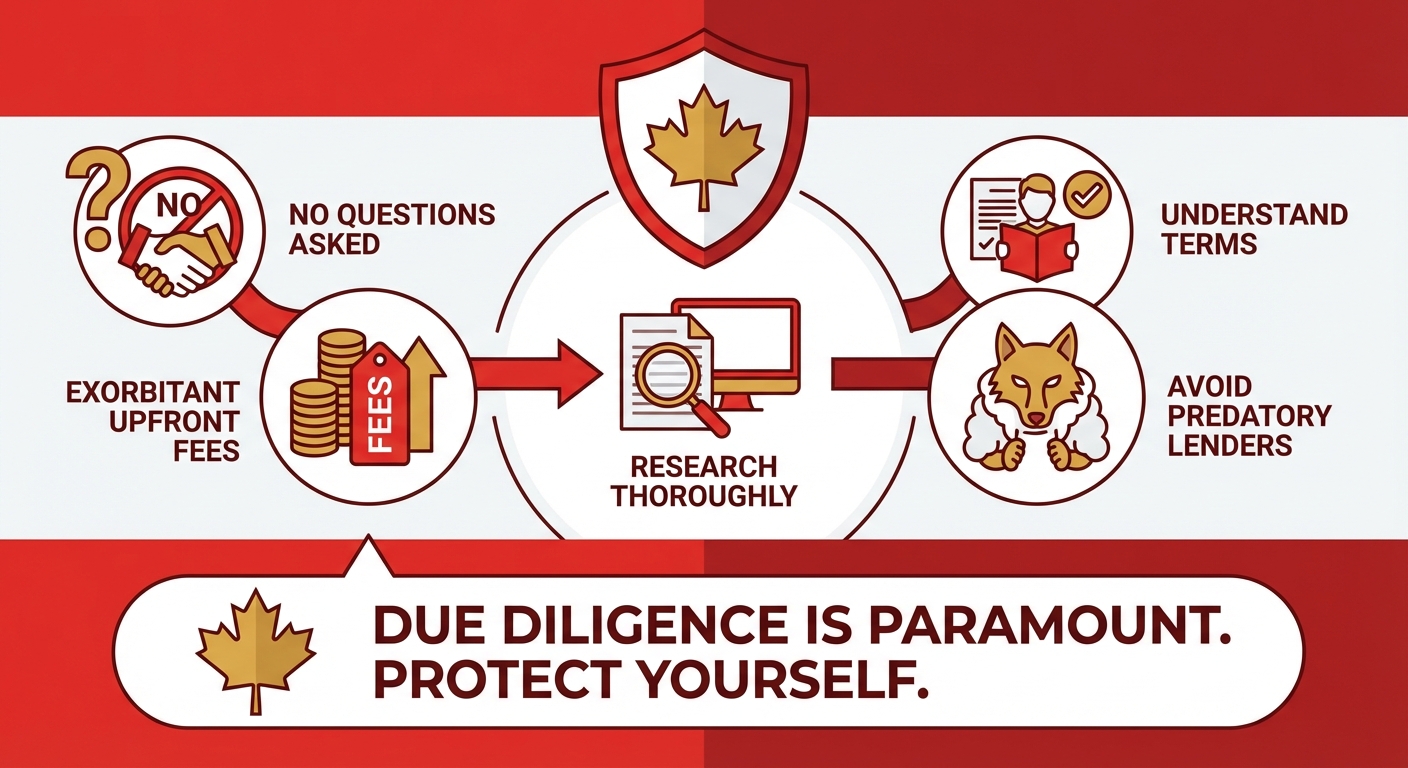

- Red flags: Be extremely wary of lenders promising guaranteed approval with no questions asked, or those demanding exorbitant fees upfront. Research any lender thoroughly and ensure you understand all terms and conditions before signing. Predatory lenders target vulnerable individuals, so due diligence is paramount.

(Context: A visual representation of navigating complex financial pathways, perhaps a simplified map showing a 'during' path with more obstacles and a 'after' path that is clearer and smoother, with a car moving confidently on the 'after' path.)

(Context: A visual representation of navigating complex financial pathways, perhaps a simplified map showing a 'during' path with more obstacles and a 'after' path that is clearer and smoother, with a car moving confidently on the 'after' path.)

The Open Highway: Unlocking Easier Car Loans After Your Consumer Proposal is Complete

This is where the real advantages of completing your consumer proposal come into play. Once your proposal is fully discharged, your financial landscape shifts dramatically. You've fulfilled your obligations, and your credit report will eventually reflect this significant achievement. This period marks a pivotal moment for securing a car loan with much more favourable terms.

- The immediate benefits of discharge: Your debt-to-income ratio improves significantly, and you no longer have the burden of the proposal payments. Lenders see you as having successfully completed a financial rehabilitation program. This is a huge positive step for your credit standing. For more on this, check out our guide on Discharged? Your Car Loan Starts Sooner Than You're Told.

- Access to near-prime and eventually prime lenders: While you might still start with subprime or alternative lenders immediately after discharge, the path to near-prime and even traditional prime lenders becomes much clearer. With a few months or a year of positive payment history post-discharge, your options will expand significantly.

- Lower interest rates and better terms: As your credit profile improves, so do your chances of securing lower interest rates and more flexible loan terms. This can save you thousands of dollars over the life of the loan.

- The power of a 'clean slate' for new lenders: While the R7 rating lingers for a period, new lenders will see that the proposal is completed. This demonstrates a clean break from past debt, allowing you to build new, positive credit history that truly reflects your current financial discipline.

The Canadian Lender Landscape: Who Will Say 'Yes' and On What Terms?

Understanding the different types of lenders in Canada is key to knowing where to apply for a car loan after a consumer proposal. Each category has its own criteria, interest rate ranges, and tolerance for credit challenges.

Alternative & Subprime Lenders: Your First Stop (and How to Choose Wisely)

For many Canadians with a consumer proposal history, alternative and subprime lenders will be the primary gateway to a car loan. These specialized lenders understand that life circumstances can lead to credit challenges, and they are structured to assess risk differently than traditional banks. They often look beyond just the credit score, focusing more on current income stability, employment, and the overall context of your financial situation.

- Dealership financing vs. independent lenders: Pros and cons. Many dealerships have relationships with a network of subprime lenders, making the application process convenient. However, it's always wise to compare their offers with independent alternative lenders. Dealerships might offer competitive rates to move inventory, but independent lenders might have more flexible terms.

- Interest rate expectations: What's reasonable vs. predatory. Expect interest rates to be higher than prime rates, especially if you are still in your consumer proposal or have just been discharged. Rates could range from 9% to 29% or even higher, depending on your specific circumstances, the vehicle, and the lender. Be wary of anything over 30-35% as potentially predatory. Always compare offers.

- Understanding fees and hidden charges. Carefully review all loan documents for administrative fees, loan origination fees, or other hidden charges. Ask for a full breakdown of the total cost of the loan.

For insights into how some lenders view your history, you might find our article Your Consumer Proposal? We Don't Judge Your Drive particularly helpful.

The Path to Prime: Banks, Credit Unions, and the Promise of Better Rates

While traditional banks and credit unions might be out of reach immediately after a consumer proposal, they represent the ultimate goal for lower interest rates and more flexible terms. The path to qualifying with these institutions involves time and consistent, positive financial behaviour.

- Building a positive payment history post-proposal. The most crucial step is to consistently make all your payments on time – not just for your new car loan, but for any other credit obligations you might acquire (like a secured credit card). This demonstrates reliability to future lenders.

- The role of secured credit cards and small loans. After discharge, consider opening a secured credit card and using it responsibly, paying the balance in full each month. A small, unsecured installment loan (if you can get one) that you pay off diligently can also help diversify your credit mix and show responsible borrowing.

- When to approach traditional institutions. Generally, it's advisable to wait at least 1-2 years after your consumer proposal discharge before approaching prime banks or credit unions for a car loan. By then, you will have established a new, positive credit history, and your credit score will have had time to improve significantly.

Dealer Financing vs. Bank Loans: Which Route is Best for You?

When you're ready to buy a car, you'll typically have two main avenues for financing: through the dealership itself or by securing a loan directly from a bank or credit union (pre-approval).

Dealership Financing:

- Pros: Convenience (one-stop shopping), dealerships work with many lenders (including subprime), potentially faster approval, might offer special rates or incentives on specific vehicles.

- Cons: Less transparency in comparing rates, may feel pressured to accept the first offer, focus might shift from car price to monthly payment.

Bank/Credit Union Loans (Pre-Approval):

- Pros: You know your budget before shopping, allows you to focus on negotiating the car price, can compare offers from multiple institutions, often better rates for prime borrowers.

- Cons: Requires an extra step before shopping, might be harder to get pre-approved with a challenging credit history.

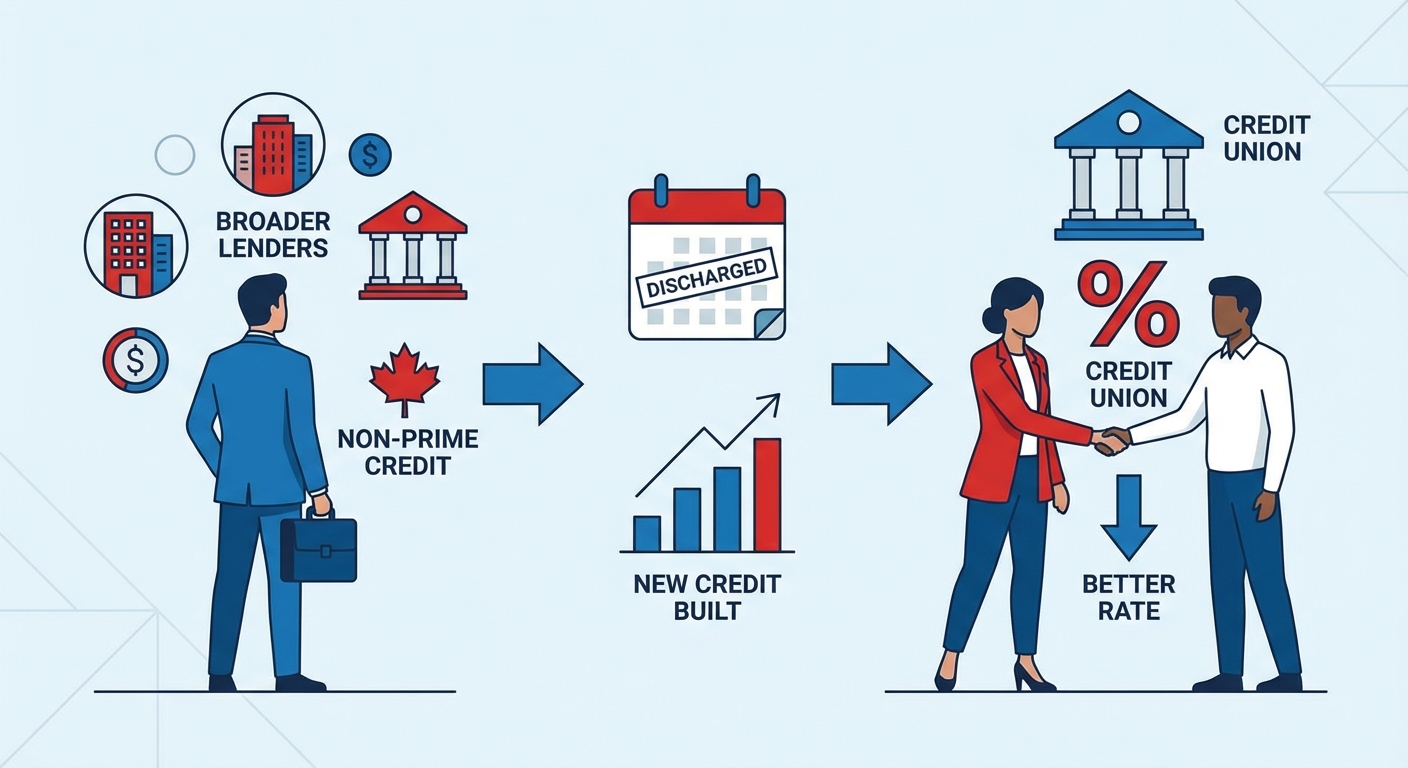

For individuals with a consumer proposal history, dealership financing often provides more immediate options, as they are accustomed to working with a broader range of lenders, including those specializing in non-prime credit. However, if you've been discharged for a while and have built up some new credit, seeking pre-approval from a credit union might yield a better rate.

(Context: An infographic or flow chart illustrating the different types of lenders (traditional banks, credit unions, subprime lenders, dealership finance) and their typical application criteria and interest rate ranges for someone with a consumer proposal history, highlighting the progression from higher to lower rates as credit improves.)

(Context: An infographic or flow chart illustrating the different types of lenders (traditional banks, credit unions, subprime lenders, dealership finance) and their typical application criteria and interest rate ranges for someone with a consumer proposal history, highlighting the progression from higher to lower rates as credit improves.)

Building Your Approval Arsenal: Strategies to Strengthen Your Application

Even with a consumer proposal in your past, there are concrete steps you can take to significantly improve your chances of car loan approval and secure more favourable terms. Think of it as building a robust financial resume for lenders.

The Power of the Down Payment: More Than Just a Good Idea

A down payment is perhaps the single most impactful factor you can control when seeking a car loan after a consumer proposal. It's not just about reducing your monthly payments; it fundamentally changes how lenders perceive your application.

- Reduces lender risk: When you put money down, the lender is financing a smaller amount, which inherently reduces their risk. This makes them more willing to approve your loan, even with a challenging credit history.

- Lowers monthly payments: A larger down payment means a smaller loan principal, resulting in lower monthly payments and less interest paid over the life of the loan.

- Unlocks better interest rates: With reduced risk, lenders are often more inclined to offer slightly lower interest rates, which can save you a significant amount over several years.

- Signals financial responsibility: Saving up a substantial down payment demonstrates discipline and financial planning, powerful signals to lenders that you are a responsible borrower.

Consider creative ways to save for a down payment, such as selling unused items, temporarily picking up extra work, or setting aside a portion of each paycheck specifically for your car fund.

Co-Signers: A Double-Edged Sword? Understanding the Risks and Rewards

Bringing a co-signer into your car loan application can be a powerful way to get approved or secure better terms, especially if you are still early in your credit rebuilding journey. A co-signer, typically someone with good credit, agrees to be equally responsible for the loan if you fail to make payments.

- Rewards: A co-signer significantly reduces the lender's risk, making approval much more likely and potentially lowering your interest rate. It can be the bridge you need to get into a reliable vehicle.

- Risks: This is a serious commitment for your co-signer. If you miss payments, their credit score will be negatively impacted, and they will be legally obligated to pay the loan. This can strain relationships if not managed carefully.

If you consider a co-signer, ensure both parties fully understand the legal and financial implications. Have open and honest discussions about payment responsibilities and what happens if circumstances change. While it can help you get approved, remember that the goal is for you to make all payments on time and build your own credit.

Income Stability & Employment History: Your Best Testimonial

Beyond your credit score, lenders prioritize your ability to repay the loan, and nothing speaks louder to that than stable income and a consistent employment history. This is your current financial reality, and it's what lenders will scrutinize heavily.

- Proof of income: Be prepared to provide recent pay stubs (typically 2-3 months), your T4s, and your Notice of Assessment (NOA) from the Canada Revenue Agency. If you're self-employed, provide bank statements and tax returns showing consistent income. For more on this, check out Self-Employed? Your Bank Doesn't Need a Resume.

- Long-term employment vs. new jobs: Lender preferences. Lenders prefer to see at least 6 months to a year of stable employment with your current employer. Longer tenure is even better, as it indicates reliability. If you've recently started a new job, it might be harder to get approved unless you have a strong history in the same field.

Presenting a clear, verifiable picture of your income and employment will significantly bolster your application, demonstrating to lenders that you have the financial capacity to meet your new car loan obligations.

Beyond the Monthly Payment: The True Cost of Car Ownership Post-Proposal

Securing a car loan is just the first step. To ensure your new vehicle doesn't become another source of financial strain, it's crucial to consider the holistic cost of car ownership. Many Canadians focus solely on the monthly loan payment, overlooking other significant expenses.

Insurance Implications: Expect the Unexpected

Your driving record, location, vehicle type, and age are the primary factors influencing car insurance rates in Canada. However, your credit history, including a consumer proposal, can sometimes indirectly play a role, as some insurers use credit scores as a factor in determining premiums (where permitted by provincial law). Even if not directly, the financial instability indicated by a proposal might lead some insurers to view you as a higher risk, resulting in higher rates.

Shop around extensively for insurance. Get quotes from multiple providers, use online comparison tools, and consider increasing your deductible to lower premiums (while ensuring you can afford the deductible if you need to make a claim).

Fuel, Maintenance, and Hidden Fees: Budgeting for the Long Haul

A car is a depreciating asset that requires ongoing investment. A realistic budget must account for more than just the loan payment.

- Fuel consumption: Choosing an efficient vehicle. Fuel costs can add up quickly, especially with current prices. Consider a fuel-efficient vehicle that fits your budget and driving habits. Research average fuel consumption for any car you're considering.

- Maintenance schedules and emergency fund planning. All vehicles require regular maintenance (oil changes, tire rotations, brake service). Factor these into your budget. More importantly, set aside an emergency fund specifically for unexpected repairs. A breakdown can be a major financial setback if you're not prepared.

- Annual registration and licensing fees. Don't forget provincial vehicle registration and license plate renewal fees, which are recurring annual expenses.

By thoroughly budgeting for these additional costs, you can ensure your car ownership experience remains positive and doesn't jeopardize your hard-earned financial recovery.

Your Next Steps to Approval: From Application to Keys in Hand

You've done the preparation, understood the landscape, and built your approval arsenal. Now it's time to put that knowledge into action. A smooth application process and smart negotiation tactics are your final steps to getting those keys.

Preparing Your Documentation: The Paperwork Power-Up

Lenders need to verify your identity, income, and financial stability. Having all your documents ready before you apply will streamline the process and demonstrate your preparedness. Here's a checklist of what you'll typically need:

- Proof of identity and residency: Valid Canadian driver's license, passport, or provincial ID. Recent utility bill or bank statement (within 90 days) showing your current address.

- Income verification: Recent pay stubs (2-3 months), T4 slips, employment letter stating your position, salary, and start date. If self-employed, notice of assessment (NOA) for the past 1-2 years and bank statements.

- Discharge papers from your consumer proposal: This is critical. It proves you've completed your obligations.

- Bank statements: Recent statements (3-6 months) to show your banking history and ability to manage funds.

- References: Some lenders may ask for personal or professional references.

Negotiation Tactics: Getting the Best Deal, Even with a CP

Don't assume your consumer proposal history means you can't negotiate. While your financing options might be more limited initially, you still have leverage, especially if you're prepared.

- Do your homework: Research the market value of the car you're interested in. Websites like Canadian Black Book or Kelley Blue Book can provide estimates.

- Compare offers: Don't jump on the first deal. Apply to a few different lenders (if possible) or dealerships to compare interest rates and terms.

- Be prepared to walk away: Your willingness to walk away is your most powerful negotiating tool. If a deal doesn't feel right or the terms are unfavourable, be ready to explore other options.

Even with a consumer proposal, you deserve a fair deal. Being informed and confident in your negotiations can save you hundreds or even thousands of dollars. If you've been told "no" before, remember that persistence and preparation pay off. For more guidance on navigating rejections, check out They Said 'No' After Your Proposal? We Just Said 'Drive!

The Road to Recovery Continues: Rebuilding Credit While You Drive

Your car loan isn't just a means of transportation; it's a powerful tool for credit rebuilding. Every on-time payment you make contributes positively to your credit history, demonstrating responsible financial behaviour to future lenders. This journey doesn't end when you drive off the lot; it's an ongoing process of financial empowerment.

On-Time Payments: Your New Best Friend

This cannot be stressed enough: making every single car loan payment on time is paramount. Your payment history is the most significant factor in your credit score. Consistent, on-time payments will steadily improve your credit score and open doors to even better financial products in the future.

- Setting up automatic payments: Consider setting up automatic payments from your bank account to ensure you never miss a due date.