Broken Work Vehicle Financing | Same Day Cash in Calgary

Table of Contents

- Your Fast-Track Guide: Key Takeaways

- Calculating the True Cost of Downtime: Why Every Hour Matters in Alberta

- Scenario: The Calgary Plumber's Van Breaks Down

- From Edmonton to Lethbridge: A Province-Wide Problem

- What 'Same-Day Financing' Actually Means (And What You Need to Do)

- The 24-Hour Funding Clock: When Does It Start?

- Your Pre-Approval Checklist: The Documents to Have in Hand NOW

- The Big Three: Where to Get Your Repair Financed in Calgary

- Option 1: The Dealership's Service Department (e.g., CMP Auto)

- Option 2: Your Bank (e.g., RBC, TD)

- Option 3: The Specialized Work Vehicle Lender (The Ideal Choice)

- Deep Dive: How Lenders See Your Application

- Beyond the Credit Score: The 'Three Cs' of Repair Financing

- Does the Type of Repair Matter? (Engine vs. Transmission vs. Body Work)

- Navigating Bad Credit: A Calgary Case Study

- Understanding the Numbers: Interest Rates, Fees, and Tax Benefits

- Decoding Your Interest Rate: What's Fair and Why?

- Watch Out for Hidden Fees: Admin, Origination, and Payout Penalties

- Expert Angle: Can You Write Off This Loan? A Guide for Canadian Tradespeople

- Your 3-Step Action Plan for Same-Day Approval in Calgary

- Frequently Asked Questions About Work Vehicle Repair Financing

Your work truck is sputtering on the side of the Deerfoot Trail. The engine light is flashing, your phone is buzzing with calls from clients you can't get to, and every tick of the clock is money draining from your pocket. This isn't just an inconvenience; it's a full-blown business crisis. Your work vehicle is your income, and right now, your income is stopped dead. This guide isn't about getting a loan; it's about solving a business-crippling problem and getting you the repair cash you need in Calgary, today.

Your Fast-Track Guide: Key Takeaways

- The Real Problem: A broken work vehicle isn't a repair bill; it's lost revenue, potentially costing you $500-$2000+ per day in Calgary's competitive market.

- 'Same Day' is Possible: With the right documents prepared, specialized lenders can often approve and fund repair loans within 24 hours, unlike traditional banks.

- Beyond the Dealership: You have multiple options in Calgary, including dealership service financing, bank loans, and independent lenders. We'll break down which is fastest and most flexible for your 2026 needs.

- Credit Isn't the Only Factor: Your vehicle's value, business history, and the urgency of the repair are key factors that can secure approval, even with imperfect credit.

- Action is Key: The faster you gather your documents and apply, the faster you get back on the road. We provide a checklist.

Calculating the True Cost of Downtime: Why Every Hour Matters in Alberta

To get same-day financing for a broken work vehicle in Calgary, you need to prepare key documents like your driver's license, vehicle ownership, and a professional repair quote. Then, contact a specialized lender that focuses on asset-based and income-based approvals, as they can often process applications and transfer funds within 24 hours, bypassing the lengthy delays of traditional banks.

Let's be brutally honest. The $6,000 quote for a new transmission isn't your real problem. Your real problem is the income haemorrhaging from your business every single hour that truck is sitting in the shop. The cost of financing is a calculated business expense; the cost of inaction is a catastrophic loss.

We see this every day. A professional in Calgary, Edmonton, or Red Deer thinks they need to save up for the repair, not realizing that the waiting period costs them more than the interest on a loan ever would.

Scenario: The Calgary Plumber's Van Breaks Down

Imagine you're a plumber with a fully-booked schedule. Your 2019 Ford Transit Connect van dies on Glenmore Trail. The diagnosis: a complete transmission failure. The quote is $7,500.

Let's do the math:

- Daily Lost Revenue: You average four service calls a day at $350 each, plus a small project worth $600. That's $2,000 per day in gross revenue you're losing.

- Cost of Waiting: If you wait just one week to "find the money," you've lost $10,000 in revenue (assuming a 5-day work week).

- Cost of Financing: A specialized loan for $7,500 might cost you around $350 per month. The interest over the first week is negligible compared to the lost income.

The choice is clear. The loan isn't a debt; it's a tool that saves you thousands of dollars and protects your professional reputation. The financing transforms a business-ending event into a manageable monthly payment.

From Edmonton to Lethbridge: A Province-Wide Problem

This isn't just a Calgary issue. We work with tradespeople across Alberta who face the same crisis. An oilfield technician in Fort McMurray with a blown head gasket on his Ram 3500 can't get to site. A contractor in Red Deer with a damaged F-150 can't haul materials to a job.

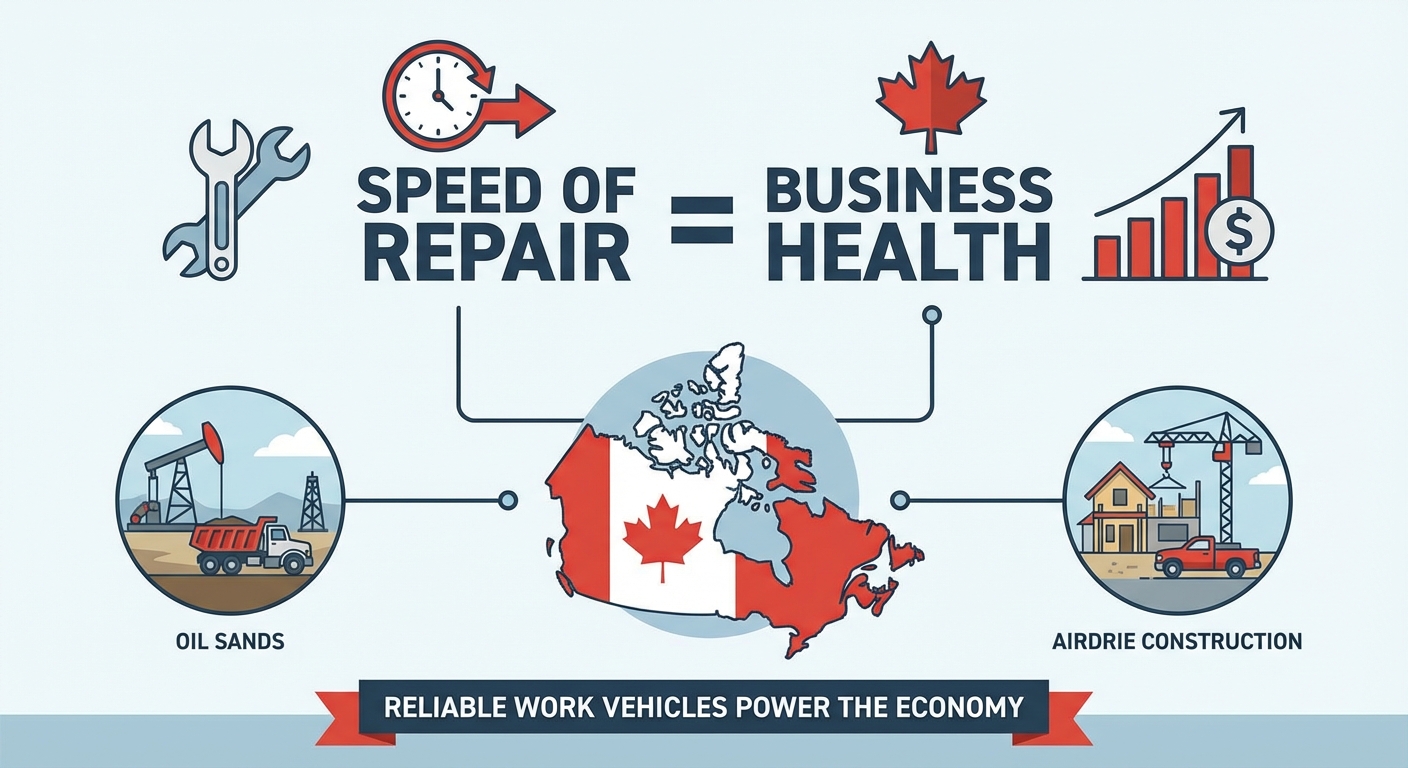

In every case, the equation is the same: the speed of the repair directly correlates to the health of their business. The entire provincial economy, from the oil sands to new home construction in Airdrie, runs on reliable work vehicles.

A work van or truck being loaded onto a tow truck on a busy Calgary road like Glenmore Trail, with the driver looking stressed on their phone. This visual immediately connects with the reader's current situation.

What 'Same-Day Financing' Actually Means (And What You Need to Do)

The term "same-day" can be misleading. It's not an instant E-transfer the moment you call. It refers to a highly accelerated process that can take you from application to approved, with funds on the way, within a single business day. This is a world away from the weeks-long process at a traditional bank.

The 24-Hour Funding Clock: When Does It Start?

The clock starts the second you submit a complete application with all necessary documents. Here’s the typical timeline we see:

- Application (10 Minutes): You fill out a form online or over the phone.

- Document Submission (5 Minutes): You email your prepared documents.

- Underwriting (1-3 Hours): A real person reviews your file, assesses the vehicle's value, your income, and the repair's necessity. They might call you with a few questions.

- Approval & Offer (Contemporaneous): You receive a call with the approved amount, interest rate, and term.

- Funding (Same Day/Next Morning): Once you accept the terms, the funds are typically sent via direct deposit or directly to the repair shop. If approved late in the day, the cash might land in the account the next morning.

Your Pre-Approval Checklist: The Documents to Have in Hand NOW

This is the most critical step. Having these items ready before you make the first call can be the difference between getting back on the road this week or next. Don't wait to be asked—be proactive.

- Valid Driver's License: Clear photo, front and back.

- Vehicle Ownership/Registration: Must be in your name or your company's name.

- Professional Repair Quote: A detailed, typed quote from a certified Calgary mechanic. It should clearly list parts and labour costs.

- Proof of Business/Income: This is where self-employed individuals shine. Provide one or two of the following:

- Business registration documents.

- Recent invoices sent to clients (3-4 examples).

- Recent business bank statements showing cash flow (3 months).

Being self-employed shouldn't be a barrier to getting the cash you need. For a deeper look into how we handle these situations, check out our guide: Self-Employed, Car Stuck? Skip the Pay Stub. Get Repair Cash.

Pro Tip: Use your phone to scan and save these documents to a cloud folder (like Google Drive or iCloud) before you even call a lender. Apps like Adobe Scan or even your phone's Notes app can create clean PDFs. Emailing them instantly can cut hours off your approval time.

The Big Three: Where to Get Your Repair Financed in Calgary

When your livelihood is on the line, you don't have time to shop around for weeks. You need to know who is fast, who is flexible, and who understands your situation. Here’s a breakdown of your main options in Calgary.

Option 1: The Dealership's Service Department (e.g., CMP Auto)

Pros: The biggest advantage is convenience. The financing is integrated directly with the repair service at the dealership. It's a one-stop-shop experience.

Cons: This convenience often comes at a cost. Interest rates can be significantly higher than other options. They may only offer financing for the brands they sell (e.g., a GMC dealer might not finance a major repair on a Ram). The terms are often rigid, and their approval criteria can be surprisingly strict, tied to their own internal credit policies.

Option 2: Your Bank (e.g., RBC, TD)

Pros: If you have an excellent credit score (750+) and a long, positive history with your bank, you might secure the lowest interest rate. This is their main selling point.

Cons: Speed. Or rather, the complete lack of it. Banks are notoriously slow. Applying for a personal loan or line of credit for a vehicle repair can take days, if not weeks. They require extensive paperwork, pay stubs (a problem for the self-employed), and are often hesitant to approve unsecured loans for vehicle repairs, seeing them as a high risk.

Option 3: The Specialized Work Vehicle Lender (The Ideal Choice)

Pros: This is where we operate, and it's a model built for your exact situation.

- Speed is the #1 Priority: We understand that every hour of downtime costs you money. The entire process is designed for 24-hour turnaround.

- Understand Your Business: We don't get scared by "self-employed" or "gig worker." We know how to assess income from invoices and bank statements.

- Higher Approval Rates: We focus on the asset's value (your truck) and your ability to earn, not just a three-digit credit score. Bad credit is often not a deal-breaker.

- Flexibility: Terms can be tailored to your cash flow, and funds can be sent directly to your trusted mechanic.

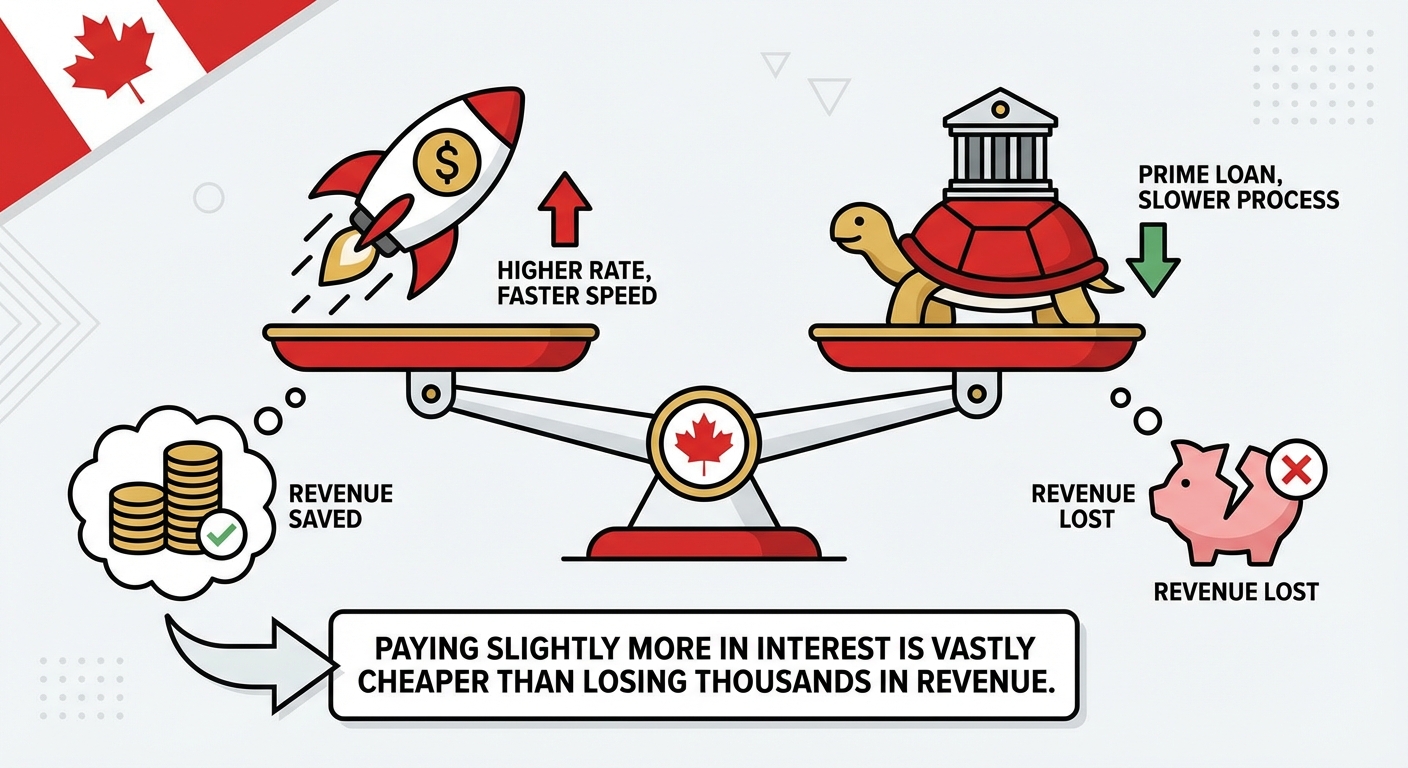

Cons: To compensate for the higher risk and provide incredible speed, the interest rate might be a few points higher than a prime loan from a big bank. However, as our earlier calculation showed, paying slightly more in interest is vastly cheaper than losing thousands in revenue.

An infographic or comparison table. Columns: 'Lender Type', 'Approval Speed', 'Credit Requirements', 'Flexibility'. Rows: 'Dealership', 'Big Bank', 'Specialized Lender'. Use checkmarks and X's for quick visual understanding.

Deep Dive: How Lenders See Your Application

Understanding the "why" behind the approval process empowers you. It’s not a mysterious black box. A specialized lender isn't just looking at your credit score; they're looking at the complete picture of you as a business owner.

Beyond the Credit Score: The 'Three Cs' of Repair Financing

Traditional banks are obsessed with one C: Credit. We look at a more holistic picture, especially for work vehicles.

- Collateral: This is your truck or van. What is the value of your Ford F-150, Ram 2500, or Sprinter Van *after* the repair is complete? A lender is more confident financing a $7,000 engine repair on a truck worth $30,000 than on one worth $8,000.

- Capacity: This is your ability to pay. Can you demonstrate consistent business cash flow? Your recent invoices and bank statements are more important here than a traditional pay stub. We want to see that your business is active and generating revenue.

- Character: This is your business history and stability. How long have you been in your trade? Do you have a registered business? A track record of completing jobs and getting paid gives a lender confidence.

This approach means that a 620 credit score doesn't lead to an automatic rejection. If you have strong Collateral and Capacity, we can often find a path to approval. Many business owners face this, and solutions exist. For more on this, see how Your 'Impossible' Car Loan Just Got Approved. Self-Employed, Poor Credit.

Does the Type of Repair Matter? (Engine vs. Transmission vs. Body Work)

Yes, absolutely. Lenders view repairs through the lens of value and function.

They are far more willing to finance "mission-critical" repairs that restore the vehicle's core function and income-generating potential. This includes engine replacements, transmission rebuilds, and major drivetrain work. These repairs add significant value back to the vehicle.

Cosmetic repairs, like extensive bodywork after a minor fender-bender or a new paint job, are seen as less critical and may be harder to finance unless they are part of a larger, essential repair job.

Navigating Bad Credit: A Calgary Case Study

Let's look at a real-world, anonymized example we handled recently. 'John' is a roofer based in Airdrie. His credit score was 580 due to a past business venture that didn't work out. His 2018 Ram 1500 needed a new transmission, with a quote for $8,000.

- The Bank Said: "No. Your credit score is too low."

- The Dealership Said: "Maybe, but at 29.9% APR."

- Our Approach: We ignored the 580 score for a moment and focused on the Three Cs.

- Collateral: His truck, post-repair, was valued at $28,000. The $8,000 loan was well-secured by the asset.

- Capacity: He provided the last 6 months of invoices, showing consistent, profitable roofing jobs totalling over $20,000 per month.

- Character: He'd been operating his roofing business successfully for four years.

By focusing on his consistent business income and the solid value of his truck, we secured him an approval for the full $8,000 the same day. The funds were sent to his mechanic the next morning. John lost one day of work, not weeks.

Pro Tip: Get your repair quote from a reputable, certified shop in Calgary, like a NAPA AUTOPRO or a dealership service centre. A detailed, professional quote typed on company letterhead gives lenders far more confidence than a handwritten estimate on a piece of paper. It shows you're serious and have had the vehicle properly diagnosed.

Understanding the Numbers: Interest Rates, Fees, and Tax Benefits

Let's talk about the money. Transparency is crucial for trust. You need to know what you're paying and why. The goal is to get you back on the road with a payment that your business cash flow can comfortably handle.

Decoding Your Interest Rate: What's Fair and Why?

Your interest rate is determined by risk. A lower risk profile (higher credit score, high-value vehicle, strong income) results in a lower rate. Here’s a realistic look at what you might expect in the current 2026 market for a work vehicle repair loan.

| Credit Profile | Typical Credit Score Range | Estimated Interest Rate (APR) | Example Monthly Payment on $8,000 (48 months) |

|---|---|---|---|

| Excellent (Prime) | 720+ | 9.99% - 14.99% | ~$203 - $223 |

| Fair (Near-Prime) | 650 - 719 | 15.00% - 21.99% | ~$223 - $251 |

| Challenged (Subprime) | 550 - 649 | 22.00% - 29.99% | ~$251 - $284 |

Disclaimer: These are estimates for illustrative purposes only. Your actual rate and payment will depend on your specific situation, the lender, and the vehicle.

While the rates for challenged credit may seem high, compare them to a credit card cash advance (often 24%+) or the cost of losing $1,500 a day in revenue. The loan is almost always the smarter financial move.

Watch Out for Hidden Fees: Admin, Origination, and Payout Penalties

A reputable lender is upfront about all costs. When you get an offer, ask these specific questions:

- Is there an administration or origination fee? Is it rolled into the loan or due upfront?

- Is this an open loan? Can I pay it off early without any payout penalties?

- Are there any late payment fees I should be aware of?

Transparency is key. If a lender is cagey about these details, it's a red flag.

Expert Angle: Can You Write Off This Loan? A Guide for Canadian Tradespeople

Here’s a high-value tip that many people miss. Since the vehicle is used for your business, the financing costs are often a tax-deductible business expense.

The interest portion of your loan payments can typically be claimed against your business income, reducing your overall tax burden at the end of the year. This applies to self-employed individuals and incorporated businesses across Canada, from British Columbia to Ontario.

Always consult with your accountant for advice specific to your business structure, but this is a significant financial benefit that effectively lowers the real cost of your repair loan.

Your 3-Step Action Plan for Same-Day Approval in Calgary

You're in a crisis, and you need a clear plan. Forget stress and uncertainty. Follow these three steps to get from the side of the road to back on the job site as quickly as possible.

- Step 1: Assess & Document (The Next 30 Minutes): Don't delay. Get your vehicle to a trusted mechanic for a detailed, written quote. While they're looking at it, use your phone to gather the documents from our checklist above (License, Ownership, Proof of Income). Save them in one place, ready to send.

- Step 2: Make the Call (The Next 5 Minutes): Contact a specialized lender like SkipTheCarDealer. Be ready to clearly explain your situation, the vehicle details (year, make, model, kilometres), and the required repair. Tell them you have your documents ready to email immediately. Big banks want pay stubs, but we're different. We understand the gig economy. As our guide says, Banks Need Pay Stubs. We Need Your Drive. Gig Worker Car Loans.

- Step 3: Review & Approve (Today): A good lender will call you back quickly with a decision and a clear offer. They will walk you through the interest rate, the term (number of months), and the total cost of borrowing. Once you're comfortable and approve the terms, the funds can be sent directly to the repair shop, allowing them to order parts and start work immediately.