That '69 Charger & Your Low Credit? We See a Future, British Columbia.

Table of Contents

- Key Takeaways: Your Fast Track to Classic Car Restoration Financing

- The Roar of the Dream: Why Your '69 Charger Needs More Than Just Passion (And a Loan)

- Decoding 'Low Credit' in the Canadian Lending Landscape: What Lenders Really See

- Unlocking the Vault: Beyond the Big Banks for Your Restoration Dream

- Credit Unions: Your Local Allies in British Columbia (and Beyond)

- Specialized Auto Lenders: The Niche Navigators

- Dealership & Restoration Shop Financing: A Worthwhile Inquiry?

- Personal Loans & Lines of Credit: When They Fit (or Don't)

- Secured Loans: Leveraging What You Have

- Comparing Lending Options for Classic Car Restoration with Low Credit

- The 'How-To' of Approval: Crafting Your Irresistible Application for Lenders

- The Restoration Project Plan: Your Business Case to Lenders

- Professional Valuation & Appraisal: Proving Future Worth

- Income Stability & Debt-to-Income Ratio: Showing You Can Pay It Back

- The Co-Signer Advantage: Sharing the Risk, Doubling the Odds

- Beyond the Car: What Other Collateral Can You Offer?

- Pre-Approval Power: Shop with Confidence (and Leverage)

- Beyond the Loan: Navigating the Real Costs and Protecting Your Investment in Canada

- Interest Rates & Fees: The Low Credit Premium

- The Unforeseen: Hidden Costs of Classic Car Restoration

- Insurance Implications in British Columbia

- Ongoing Maintenance & Storage: The Long-Term Commitment

- The Investment Angle: Does Restoration Always Increase Value?

- Regional Deep Dive: British Columbia's Classic Car Pulse & Resources

- Vancouver & Victoria: Hubs of Classic Car Culture

- Finding Reputable Restoration Shops in British Columbia

- British Columbia's Regulatory Nuances

- Local Car Clubs & Enthusiast Networks

- Your Credit Score: From Low to Lofty (Strategies for Future Financial Freedom)

- Building Credit While You Restore

- Credit Monitoring & Management

- Secured Credit Cards & Credit Builder Loans

- The Broader Benefits of a Good Credit Score

- Your Next Steps to Approval: Igniting Your Restoration Journey in British Columbia

- FAQ: Your Most Pressing Questions About Classic Car Restoration Financing Answered

The rumble of a big block, the gleam of chrome, the unmistakable silhouette of a classic ‘69 Charger – for many in British Columbia, it’s more than just a car; it’s a dream, a piece of automotive history waiting to be resurrected. But what if your credit score isn't quite as pristine as the paint job you envision? What if the path to restoration feels blocked by past financial hurdles? At SkipCarDealer.com, we understand that passion often outweighs perfection, and we believe a low credit score shouldn’t automatically derail your dream of bringing that iconic machine back to life. It’s a challenging road, certainly, but with the right strategy, knowledge, and a determined spirit, your ‘69 Charger – or any other classic – and your low credit score can indeed see a future, right here in the stunning landscapes of British Columbia.

Key Takeaways: Your Fast Track to Classic Car Restoration Financing

- It's Possible, But Not Easy: Securing financing for classic car restoration with a low credit score in Canada is challenging but achievable with the right strategy.

- Beyond Big Banks: Traditional lenders are often a dead end. Explore credit unions, specialized auto lenders, and secured loan options.

- Your Restoration Plan is Key: A detailed, professionally vetted restoration plan acts as your business case, boosting lender confidence.

- Leverage Assets & Relationships: Consider co-signers or collateral. Build relationships with reputable restoration shops and niche lenders.

- British Columbia Specifics: Understand local resources, classic car communities, and provincial regulations to navigate your journey effectively.

The Roar of the Dream: Why Your '69 Charger Needs More Than Just Passion (And a Loan)

There's a unique symphony that plays when you mention a ‘69 Charger to an enthusiast. It’s the roar of a V8, the whisper of air through a carburetor, the visual poetry of its muscular lines. Whether it's the raw power of a Ford Mustang, the elegant curves of a vintage Porsche, or the brute force of a ‘69 Charger, the allure of classic cars in Canada transcends mere transportation. It's about nostalgia, craftsmanship, a connection to a bygone era of automotive excellence. For many, owning and restoring one isn't just a hobby; it's a profound personal project, a labour of love, and a tangible link to history.

However, beneath that romantic veneer lies the unvarnished truth of restoration costs. This isn't just about an initial purchase – that's often the cheapest part. We're talking about a comprehensive undertaking that can easily eclipse the car's initial value. Imagine the meticulous bodywork required to strip decades of rust and imperfections, the multiple layers of paint to achieve that show-stopping finish. Then there's the heart of the beast: an engine rebuild, requiring precision machining, new components, and expert assembly. The interior needs attention too, from re-upholstering seats to replacing carpets and dashboard elements, all while sourcing authentic or period-correct parts. Factor in specialized tools, expert labour rates in places like Vancouver or Calgary, and the often-exorbitant cost of rare parts sourcing from across North America or even internationally, and the numbers can quickly escalate into tens of thousands, or even hundreds of thousands of dollars for a full, concourse-level restoration.

Your credit score, in this scenario, acts as an unseen gatekeeper. A low credit score signals to lenders a higher risk of default, making them hesitant to finance what they perceive as a “luxury” or “discretionary” project, especially when significant funds are needed for value addition rather than an immediate, tangible asset. This isn’t like financing a new car, where the vehicle's market value is relatively stable and easily assessed. With classic car restoration, you're financing an asset that requires substantial investment to realize its potential value. Lenders are looking at the ‘future’ value of the car, and that future value is highly dependent on the quality and completion of the restoration work itself – a significant variable.

Pro Tip: Before you even think about financing, get a preliminary assessment from a reputable classic car restoration shop in your area (e.g., in Vancouver, Kelowna, or even a specialized shop near Calgary if you're willing to travel). This will give you a realistic understanding of the scope, potential costs, and timeline, which is crucial for building a credible financing application.

Decoding 'Low Credit' in the Canadian Lending Landscape: What Lenders Really See

What exactly does 'low credit' mean in Canada? Generally, a credit score below 600-650 (using the FICO equivalent, which is a common benchmark) is considered low by most prime lenders. This range signals to banks and financial institutions that you may have struggled with credit in the past, perhaps missed payments, carried high debt, or even experienced more severe financial events like a consumer proposal or bankruptcy. For more on navigating challenging credit situations, you might find our article No Credit? Great. We're Not Your Bank. insightful.

However, ‘low credit’ isn’t a monolithic category. Lenders differentiate between:

- Bad Credit: This typically indicates a history of missed payments, defaults, collections, or even a recent consumer proposal or bankruptcy. It shows a pattern of financial difficulty.

- Thin Credit: This means you have very little credit history – perhaps only one credit card, or no loans at all. While not necessarily “bad,” it makes it hard for lenders to assess your repayment behaviour because there isn’t enough data.

- Recovering Credit: You might have had bad credit in the past, but you’ve been diligently making payments, reducing debt, and showing improvement over time. Lenders might see potential here, but still view it with caution.

Each scenario is viewed differently, and the options available will vary significantly. A lender's risk assessment is paramount. For a classic car restoration, especially with low credit, it's perceived as high risk for several reasons:

- Discretionary vs. Essential: A classic car is often seen as a luxury, not a necessity like a primary vehicle or a home.

- Uncertain Value Appreciation: While a ‘69 Charger can appreciate, its value depends heavily on the quality of restoration, market demand, and unforeseen issues. It’s not a guaranteed return.

- Extended Timeline: Restoration projects can take months, even years, meaning a longer period before the “finished” collateral exists.

- Specialized Collateral: Classic cars require specialized knowledge to appraise and, if necessary, liquidate, making them less attractive collateral for general lenders.

The inherent challenge lies in the “asset dilemma.” Most car loans are for a depreciating asset that is immediately drivable. Here, you’re financing an investment that needs extensive work before its true value can be realized. This makes it a unique proposition for lenders accustomed to more straightforward vehicle financing.

Pro Tip: Obtain a copy of your credit report from both Equifax and TransUnion, Canada's two main credit bureaus. Dispute any errors immediately, as even small inaccuracies can negatively impact your score. Knowing your exact score and history is the first, crucial step to addressing it effectively and preparing your case for lenders. For a deeper dive into credit scores, consider reading our article on The Truth About the Minimum Credit Score for Ontario Car Loans, which offers valuable context applicable across Canada.

Unlocking the Vault: Beyond the Big Banks for Your Restoration Dream

If your credit score is on the lower side, your first stop – the major Canadian banks like RBC, TD, BMO, CIBC, or Scotiabank – will likely be a dead end for a specialized classic car restoration loan. These institutions operate on strict, standardized lending criteria, prioritizing low-risk, high-volume transactions. A low credit score combined with a niche, high-variable project like classic car restoration simply doesn't fit their typical risk profile. They prefer financing new vehicles or established assets with clear, predictable valuations.

This means you need to get creative and look beyond the traditional banking giants. Here are your more promising avenues:

Credit Unions: Your Local Allies in British Columbia (and Beyond)

Credit unions, such as Vancity, Coast Capital Savings, or other community-focused lenders across British Columbia like Prospera Credit Union in Surrey or Integris Credit Union in Prince George, often offer more personalized assessments. Unlike big banks, credit unions are member-owned and tend to be more flexible, evaluating your entire financial picture and personal circumstances rather than just a credit score. They might be more willing to understand your passion for the ‘69 Charger and the potential value of a completed restoration, especially if you have a strong relationship with them or can offer additional collateral or a solid business case. Their local presence and community focus can make a significant difference.

Specialized Auto Lenders: The Niche Navigators

These are companies that specialize in high-risk loans, subprime financing, or unique vehicle financing in Canada. They are built to assess risk differently and often have more flexible criteria than traditional banks. While their interest rates might be higher to compensate for the increased risk, they are often the only viable option for individuals with low credit. They might focus more on your income stability, the value of the collateral (even if it needs work), or the presence of a co-signer. Many alternative lenders are willing to look past a less-than-perfect credit history, understanding that everyone deserves a second chance.

Dealership & Restoration Shop Financing: A Worthwhile Inquiry?

While high-end operations like Pfaff Reserve in Ontario cater to very specific, affluent clientele for luxury classics, it's still worth inquiring with reputable classic car dealerships or restoration shops in British Columbia. Some shops, particularly those with a long-standing presence in areas like Victoria or Kelowna, might have established relationships with specialized lenders. They might even offer payment plans for portions of the work, though direct in-house financing for the entire project, especially for low-credit applicants, is less common. However, their endorsement of your project and its potential value can be a powerful recommendation to a lender they work with.

Personal Loans & Lines of Credit: When They Fit (or Don't)

An unsecured personal loan or line of credit can be an option if the amount needed isn't excessively high and your credit isn't severely damaged. However, with a low credit score, interest rates on unsecured loans will be significantly higher, potentially making the restoration prohibitively expensive. Lines of credit offer flexibility, but again, the rates can be steep. These are generally better suited for smaller gaps in financing or for individuals with recovering, rather than severely low, credit scores.

Secured Loans: Leveraging What You Have

This is often your strongest play when you have a low credit score. A secured loan means you put up collateral – an asset you own – to “secure” the loan. This reduces the lender’s risk considerably, making them far more likely to approve your application and potentially offer better terms. Common collateral options include:

- Property Equity: If you own a home or other real estate, you can use the equity as collateral. This is a very strong option.

- Another Vehicle: A fully paid-off daily driver or another valuable asset could serve as collateral.

- The Classic Car Itself: Some lenders might accept the ‘69 Charger as collateral, but they will likely value it at its current, unrestored state, and might require additional security due to the variable nature of restoration.

Pro Tip: Look for lenders who truly understand classic cars, not just lending. Their appreciation for the asset’s potential value post-restoration can make a significant difference in their willingness to work with you. A lender who sees the ‘69 Charger not just as a piece of metal, but as an investment in automotive heritage, is more likely to view your project favourably.

Comparing Lending Options for Classic Car Restoration with Low Credit

To help you navigate, here's a comparison of typical lender types you might encounter in Canada when seeking classic car restoration financing with a low credit score:

| Lender Type | Typical Approach to Low Credit | Interest Rates (Low Credit) | Collateral Requirements | Flexibility & Personalization | Best For |

|---|---|---|---|---|---|

| Major Banks (e.g., RBC, TD) | Generally unwilling to lend for this niche with low credit. Strict criteria. | N/A (unlikely to approve) | High, prefer established assets. | Very low. Standardized processes. | Applicants with excellent credit & clear-cut new car purchases. |

| Credit Unions (e.g., Vancity, Coast Capital) | More flexible, assess overall financial picture, not just score. Member-focused. | Moderate to High (depending on severity of low credit) | May require collateral, but open to discussing options. | Higher. Personalized approach. | Members with strong community ties, or those who can offer some collateral. |

| Specialized Auto Lenders / Subprime Lenders | Built to serve low-credit applicants; assess risk differently. | High to Very High (to offset risk) | Often require collateral (the car itself, or other assets). | Moderate. Focus on ability to repay & collateral. | Applicants with significant credit challenges, but steady income. |

| Secured Personal Loans (via various lenders) | Possible if significant collateral is offered, reducing lender risk. | Moderate to High (depends on collateral & lender) | Mandatory (e.g., home equity, other vehicle). | Moderate. Based on asset value & borrower's repayment capacity. | Applicants who own valuable assets to use as security. |

| Restoration Shop Partnerships | Indirect – shops may connect to specific lenders, not direct financing. | Varies by partner lender | Varies by partner lender | High, as shops understand the project. | Applicants with a strong relationship with a reputable shop. |

The 'How-To' of Approval: Crafting Your Irresistible Application for Lenders

When you're approaching lenders with a low credit score and a unique project like a classic car restoration, your application needs to be more than just a request for money; it needs to be a compelling business case. You're selling the lender on the vision, the value, and your ability to execute. This is where meticulous planning and presentation become your greatest assets.

The Restoration Project Plan: Your Business Case to Lenders

This is arguably the most critical component. Lenders need to see that you've thought this through, that you're not just chasing a whim. Your plan should be comprehensive, detailed, and professional:

- Detailed Scope of Work: Outline every single aspect of the restoration. From the precise engine rebuild specifications (e.g., “383 cubic inch engine bored .030 over, new pistons, crankshaft balancing”) to the interior re-trim (e.g., “full interior re-upholstery in black vinyl with custom stitching, new headliner, dashboard repair and re-paint”), and bodywork (e.g., “full strip to bare metal, rust repair, panel alignment, 3-stage paint application in original F8 Green”). Provide a line-item breakdown of labour and parts.

- Cost Estimates & Quotes: This is non-negotiable. Secure multiple, detailed quotes from reputable classic car restoration shops in British Columbia (e.g., in Surrey, Nanaimo, or Chilliwack). These quotes should validate your budget and demonstrate market competitive pricing.

- Timeline & Milestones: A clear project schedule demonstrates foresight and accountability. Break the restoration into phases (e.g., bodywork 3 months, engine 2 months, interior 1 month) with estimated completion dates and payment milestones.

- Chosen Restoration Partner: Highlight the expertise, experience, and reputation of your selected shop. A shop with a proven track record of quality restorations adds immense credibility to your plan.

Professional Valuation & Appraisal: Proving Future Worth

This is crucial for both you and the lender. Get an independent appraisal of the classic car in its current, unrestored state. More importantly, work with an appraiser who can provide an estimate of the vehicle’s value once the restoration is completed to your specified standards. This “agreed value” post-restoration can help justify the loan amount and assure the lender of the asset's future worth, making it a more attractive proposition. This shows the lender that your investment will yield a valuable asset.

Income Stability & Debt-to-Income Ratio: Showing You Can Pay It Back

Even with a low credit score, demonstrating consistent, reliable income is paramount. Lenders want to see that you have the capacity to make regular payments. Provide proof of income (pay stubs, tax returns, employment letters). Your debt-to-income (DTI) ratio is also critical; it shows how much of your monthly income goes towards existing debt payments. A lower DTI indicates more disposable income available for the new loan. If you're self-employed, proving income stability might require more documentation, but it's essential. For more detailed information on the necessary paperwork for car financing, even if it's for a different province, our guide Approval Secrets: Exactly What Paperwork You Need for Alberta Car Financing offers valuable insights into what lenders generally expect.

The Co-Signer Advantage: Sharing the Risk, Doubling the Odds

Finding a reliable co-signer with good credit can significantly boost your approval odds. A co-signer essentially guarantees the loan, taking on equal responsibility for repayment if you default. This dramatically reduces the lender's risk. Be sure to have an open conversation with any potential co-signer about the responsibilities involved and the impact on their credit if payments are missed.

Beyond the Car: What Other Collateral Can You Offer?

As mentioned, a secured loan is often the best path with low credit. If the ‘69 Charger itself isn't enough, consider what other assets you could offer. This could include equity in a property, another fully owned vehicle, or even other valuable possessions. The more collateral you can provide, the lower the risk for the lender, and the higher your chances of approval. This also gives you negotiating power for better interest rates.

Pre-Approval Power: Shop with Confidence (and Leverage)

Seeking pre-approval from a few potential lenders is a smart move. It gives you a clear understanding of your borrowing capacity before you commit to the restoration project or even finalize the purchase of the classic car. Knowing you have financing secured provides leverage when negotiating with restoration shops or purchasing parts, as you're a serious buyer with funds ready.

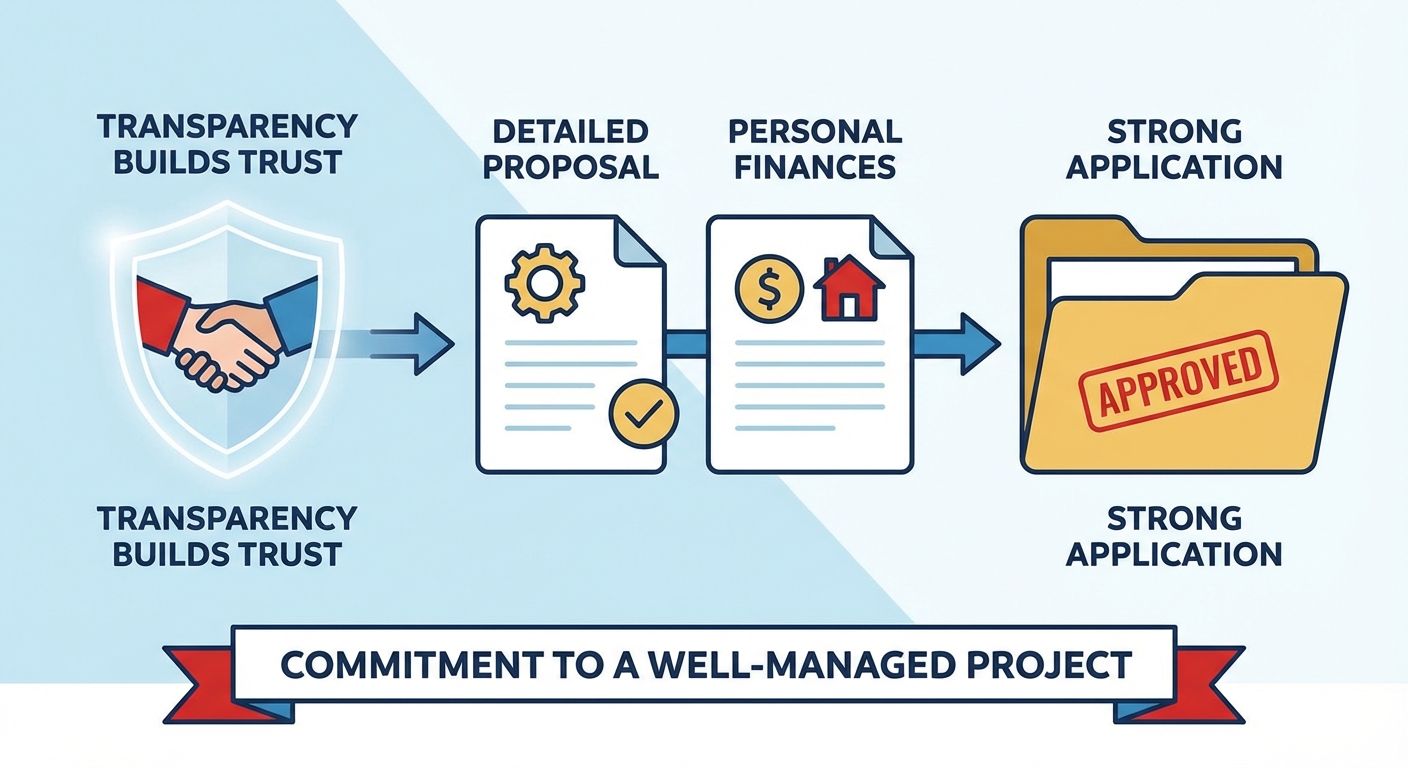

Pro Tip: Work closely with your chosen restoration shop to develop a comprehensive and realistic budget. This transparency builds trust with lenders and demonstrates your commitment to a well-managed project. A professional, detailed proposal from the shop, presented alongside your personal financial information, creates a much stronger application.

Beyond the Loan: Navigating the Real Costs and Protecting Your Investment in Canada

Securing the loan is just one piece of the puzzle. The journey of classic car restoration involves ongoing financial considerations, and it’s crucial to budget for these realities, especially with the ‘low credit premium’ that often comes with specialized financing.

Interest Rates & Fees: The Low Credit Premium

Be realistic about interest rates. With a low credit score, you should expect to pay significantly higher interest rates than someone with excellent credit. While prime rates might be in the single digits, you could be looking at rates anywhere from 10% to 25% or even higher, depending on the lender, the loan type, and the severity of your credit challenges. Additionally, some lenders might charge loan origination fees, appraisal fees, or other administrative costs. Always read the fine print and understand the total cost of borrowing.

The Unforeseen: Hidden Costs of Classic Car Restoration

Classic car restoration is notorious for unexpected expenses. Budgeting for contingencies is not just advisable; it's essential. What starts as a minor rust spot can turn into extensive panel replacement. A “simple” engine rebuild can uncover a cracked block or require rare, expensive components. Hidden costs can include:

- Unexpected Repairs: Rust in hidden areas, damaged wiring harnesses, seized components.

- Rare Parts Sourcing: The cost and time involved in finding original or high-quality reproduction parts can be substantial, often requiring international shipping and customs duties.

- Specialized Tools & Labour: Restoration shops use highly skilled technicians, and their hourly rates reflect that expertise.

- Transport Costs: Moving the car between various specialists (e.g., body shop to engine builder to upholstery shop) adds up.

- Storage: If your project takes longer than expected, storage fees can accumulate.

A contingency fund of 15-25% of your total estimated project cost is a wise allocation.

Insurance Implications in British Columbia

Insurance for a classic car, especially one undergoing restoration, is distinct from a standard daily driver. In British Columbia, ICBC is the primary insurer for basic auto insurance, but specialized classic car insurance providers operate nationally and provincially.

- Classic Car Insurance: Look for ‘agreed value’ policies from specialized providers like Hagerty, Lant & Co., or Silver Wheels in Canada. Unlike standard policies that pay out market value (which can be subjective for classics), an ‘agreed value’ policy ensures you’re paid a pre-determined amount if the car is a total loss. This value should reflect the car's increasing worth as the restoration progresses.

- Restoration-Specific Coverage: Ensure your policy covers the car while it’s in the shop, during transport, and for the value of parts and labour invested so far. This protects your investment at every stage.

- Impact of Modifications: If you plan non-original modifications (e.g., modern engine swap, custom paint), discuss this with your insurer, as it can affect both your premium and the agreed value.

Ongoing Maintenance & Storage: The Long-Term Commitment

Once restored, a classic car isn't like a new vehicle. It requires specialized ongoing maintenance, often from mechanics familiar with vintage automobiles. Budget for regular tune-ups, specific fluid changes, and potential repairs. Secure, climate-controlled storage is also advisable, especially in British Columbia’s varied climate, to protect your investment from moisture, extreme temperatures, and theft.

The Investment Angle: Does Restoration Always Increase Value?

While a quality restoration can significantly increase a classic car's value, it's not always a guaranteed financial windfall. For highly sought-after models like a ‘69 Charger, a meticulous, period-correct restoration often yields a strong return. However, for less common models or “over-restored” vehicles (where the cost far exceeds market value), it can be purely a passion project. Research market trends, consult with appraisers, and understand that some restorations are undertaken for the sheer joy of it, rather than for profit.

Pro Tip: Always get multiple quotes for insurance. Specialized classic car insurers often offer better rates and coverage than general providers for unique vehicles, and they understand the specific needs of a car undergoing or having completed restoration.

Regional Deep Dive: British Columbia's Classic Car Pulse & Resources

British Columbia, with its breathtaking scenic routes and vibrant automotive culture, is an ideal place for classic car enthusiasts. Understanding the local landscape can significantly aid your restoration journey.

Vancouver & Victoria: Hubs of Classic Car Culture

The Lower Mainland and Vancouver Island are particularly active centres for classic car culture. Vancouver hosts numerous car shows, cruises, and swap meets throughout the warmer months, such as the VanDusen All British Field Meet or the annual “Hot Rods & Harleys” events. Victoria also boasts a strong classic car scene, with events like the Concours d'Elegance at VanDusen Garden showcasing impeccably restored vehicles. These cities are where you'll find a higher concentration of specialized services, parts suppliers, and a robust community of fellow enthusiasts.

Finding Reputable Restoration Shops in British Columbia

Choosing the right restoration partner is paramount. When looking for shops in cities like Richmond, Abbotsford, Kamloops, or even smaller communities, consider these criteria:

- Experience & Specialization: Do they have a proven track record with your specific make and model (e.g., Mopar muscle cars)?

- Certifications & Training: Are their technicians certified in relevant skills (e.g., welding, paint, engine building)?

- Reviews & References: Look for online reviews, testimonials, and ask for references from past clients. Visit their shop to see ongoing projects.

- Classic Car Focus: A shop that primarily works on classics understands the nuances and specific needs, from sourcing rare parts to period-correct techniques.

- Insurance & Security: Ensure they are fully insured and have secure premises to protect your valuable asset.

British Columbia's Regulatory Nuances

Navigating provincial regulations is crucial. For classic cars, especially those undergoing significant modification or being registered from out-of-province, you’ll need to understand:

- Provincial Safety Inspections: All vehicles registered in British Columbia from out-of-province or those with major modifications require a provincial inspection by a designated inspection facility. This ensures the vehicle meets BC’s safety standards.

- Registration Processes for Modified Vehicles: If your restoration involves significant modifications that alter the vehicle’s original specifications, ICBC has specific guidelines for how these are declared and registered.

- Emissions Standards: While many older classics are exempt from stringent modern emissions testing, it's vital to confirm this for your specific vehicle year and type to avoid future issues.

If you're navigating other financial aspects in British Columbia, such as getting a car loan with specific income sources, our article British Columbia EI? Your Car Loan Just Called 'Shotgun' might provide useful context on how local factors can influence financing options.

Local Car Clubs & Enthusiast Networks

These communities are invaluable resources. Join local car clubs (e.g., Mopar clubs, Mustang clubs, general classic car clubs in Vancouver, Victoria, or the Okanagan). They offer:

- Advice & Knowledge: Tap into the collective wisdom of experienced restorers.

- Parts Sourcing: Members often know where to find rare parts or have spares themselves.

- Trusted Contacts: Get recommendations for mechanics, body shops, and specialized services.

- Networking: You might even find leads on private financing or investors who appreciate the value of classic cars.

Pro Tip: Attend local classic car shows and meetups. These are excellent places to network with owners, mechanics, and even potential lenders or investors who understand the market and appreciate the value of a well-restored classic. You'll gain insights, find resources, and build connections that can prove invaluable.

Your Credit Score: From Low to Lofty (Strategies for Future Financial Freedom)

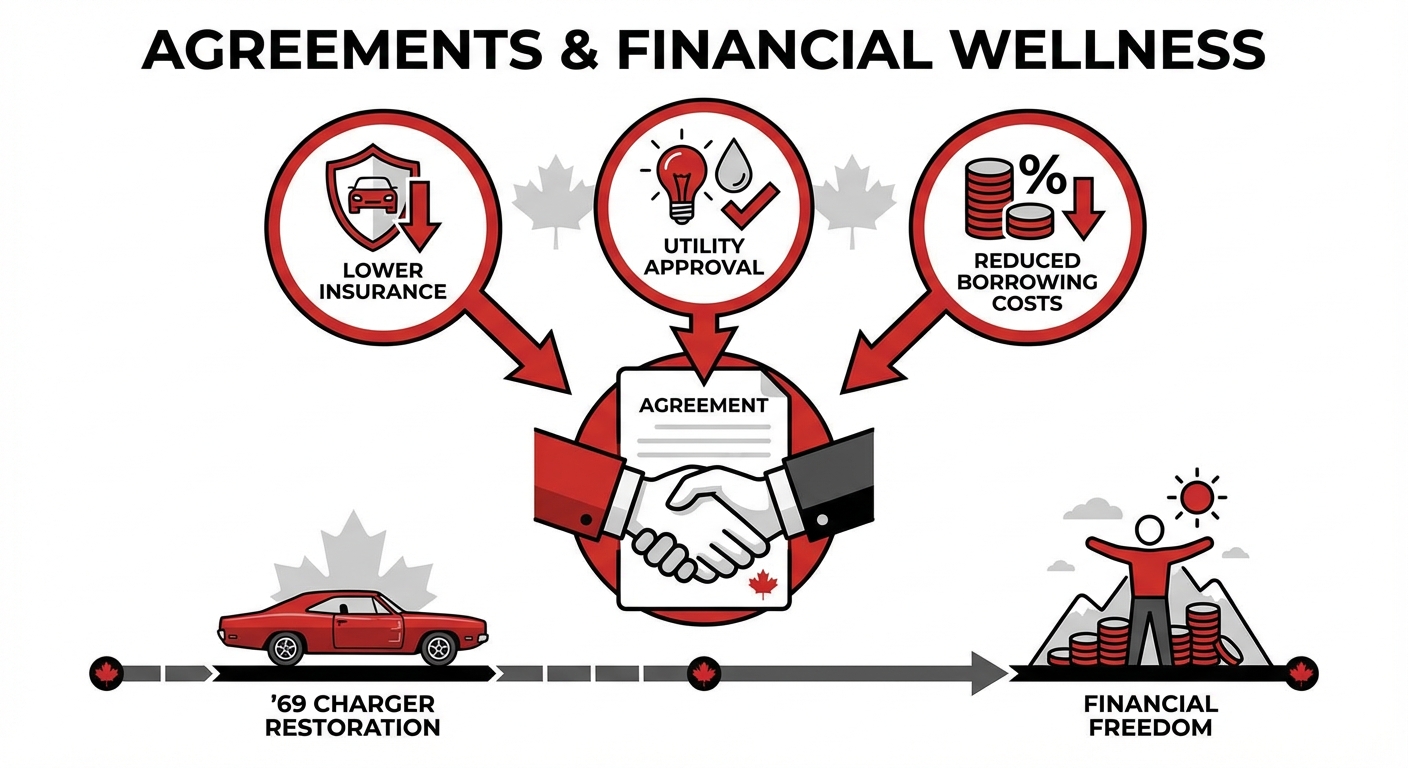

Embarking on a classic car restoration journey, even with a low credit score, presents a unique opportunity for financial growth. Your restoration loan isn't just about the car; it's a powerful tool for rebuilding and improving your credit profile, provided you manage it responsibly.

Building Credit While You Restore

Every on-time payment you make towards your classic car restoration loan is a positive mark on your credit report. Over the months and years of your repayment term, this consistent, responsible financial behaviour will gradually but steadily improve your credit score. Lenders look for a history of timely payments, and this specialized loan can be a significant contributor to that positive history. It demonstrates your ability to manage a substantial debt, which bodes well for future lending opportunities.

Credit Monitoring & Management

As you work on your credit, make credit monitoring a regular habit. Utilize free credit monitoring services offered by Canadian banks or credit bureaus (TransUnion and Equifax) to track your progress. Understand the factors influencing your score – payment history, credit utilization, length of credit history, types of credit, and new credit. Actively manage your existing credit cards, keeping balances low and making payments on time. The more you understand your credit, the better you can manage it.

Secured Credit Cards & Credit Builder Loans

If your credit is very low, consider adding secured credit cards or credit builder loans to your financial toolkit. A secured credit card requires a deposit, which acts as your credit limit, making it low risk for lenders. A credit builder loan involves a small loan placed in a savings account, which is released to you after you’ve made all the payments. Both are excellent, low-risk ways to actively rebuild or establish credit history and demonstrate responsible borrowing habits.

The Broader Benefits of a Good Credit Score

The advantages of an improved credit score extend far beyond financing your next classic car project. A healthy credit profile opens doors to better interest rates on mortgages, personal loans, lines of credit, and even rental agreements. It can lower your insurance premiums, make it easier to get approved for utilities, and generally reduce the cost of borrowing throughout your life. Your ‘69 Charger restoration could be the catalyst for broader financial freedom.

Your Next Steps to Approval: Igniting Your Restoration Journey in British Columbia

The dream of a fully restored ‘69 Charger, gleaming in the British Columbia sunshine, is within reach – even with a low credit score. It requires diligence, a strategic approach, and a willingness to explore unconventional paths. At SkipCarDealer.com, we understand these challenges and are here to help guide you.

- Consolidate Your Vision: Refine your restoration plan and budget with professional input from reputable BC restoration shops. Get those detailed quotes and appraisals.

- Strengthen Your Application: Gather all necessary documentation – income proof, credit reports, and your comprehensive project plan. Seriously consider the co-signer advantage or leveraging other assets for a secured loan.

- Target Your Search: Don't waste time with major banks. Focus your efforts on credit unions and specialized lenders who are more attuned to unique financing needs and who understand the value of classic cars.

- Persistence Pays Off: Be prepared for potential rejections; view each one as a learning opportunity to refine your approach. Adjust your plan, seek more collateral, or improve your financial standing.

The ultimate reward? Envisioning the moment you turn the key, hear that legendary engine roar to life, and drive your fully restored classic ‘69 Charger (or your chosen dream car) on the scenic roads of British Columbia – along the Sea-to-Sky Highway, through the Fraser Valley, or cruising the streets of Vancouver Island. It will be a testament not only to automotive heritage but to your own determination and strategic financial planning. Your dream is closer than you think.