Finance a Delivery Van, No Down Payment | 2026 ON Guide

Table of Contents

- Your Quick Route: Key Takeaways for Financing a Van with $0 Down

- Decoding the '$0 Down Deal': What Lenders in Ontario Really See

- Building Your 'Approval-Ready' Application: A 4-Pillar Strategy

- Choosing Your Lender: Dealership vs. Bank vs. Specialist Financier

- Selecting the Right Cargo Van for Your Ontario Routes (And Your Loan)

- The Fine Print: Understanding Your Loan Agreement & Hidden Costs

- Beyond the Loan: Maximizing Your Van as a Business Asset in Canada

- Your Next Steps to Getting Approved and On the Road

- Frequently Asked Questions About No Down Payment Van Financing

You've got the contracts lined up—Amazon Flex, Purolator, or your own local delivery service. The only thing standing between you and earning is a reliable cargo van. But the thought of a hefty down payment feels like a roadblock. This guide is your roadmap to navigating that roadblock.

This isn't just about finding a 'no down payment' offer; it's about securing a smart, sustainable loan that builds your business. We'll break down how lenders in Ontario evaluate $0 down applications for delivery work and give you the exact strategy to get approved and on the road.

Your Quick Route: Key Takeaways for Financing a Van with $0 Down

- 'No Down Payment' Isn't Free: While possible, $0 down loans typically mean higher interest rates and a larger total loan amount. The lender is taking on more risk, and you'll pay for it over time.

- Your Credit & Income are Paramount: With no cash down, lenders scrutinize your credit score and proof of stable income (or a solid business plan) more intensely. A score above 680 significantly improves your odds.

- Lender Type Matters: Dealership financing might be convenient, but banks, credit unions, and specialized equipment financing companies in places like Mississauga or Ottawa often offer better terms. Always compare.

- Business vs. Personal Loan: Financing under a registered business name offers liability protection and clearer tax benefits, but may require more paperwork than a personal loan.

- The Van Itself is Collateral: The age, mileage, and condition of the cargo van you choose directly impact your loan approval chances. Lenders prefer newer, reliable models like the Ford Transit or Ram ProMaster.

Decoding the '$0 Down Deal': What Lenders in Ontario Really See

To get approved for a cargo van loan with no money down, you first need to understand how a lender sees your application. It’s a game of risk, and without a down payment, you’re asking them to take on 100% of it. This changes their entire calculation and directly impacts the terms you’re offered.

The Lender's Risk Equation

A down payment is a lender's safety net. It proves you have skin in the game and reduces the total amount they have to lend. When you remove that safety net, two major red flags go up for the lender:

- Risk of Default: Statistically, borrowers who make no initial investment are more likely to default on their loan if they hit a financial snag.

- Immediate Negative Equity: The moment you drive a new or used van off the lot, it depreciates. Without a down payment, you immediately owe more on the loan than the van is worth.

Interest Rate Premiums

To compensate for this increased risk, lenders charge a higher Annual Percentage Rate (APR). This "risk premium" can add thousands of dollars to the total cost of your van over the life of the loan. Let's look at a realistic scenario for a $45,000 used Ford Transit in Ontario.

| Financing Scenario (60-Month Term) | With 10% Down Payment ($4,500) | With $0 Down Payment |

|---|---|---|

| Loan Amount | $40,500 | $45,000 |

| Assumed APR (Good Credit) | 7.99% | 9.99% |

| Estimated Monthly Payment | ~$819 | ~$954 |

| Total Interest Paid | ~$8,640 | ~$12,240 |

| Extra Cost for $0 Down | $3,600 | |

As you can see, the convenience of no money down costs an extra $3,600 in interest alone in this scenario. Your monthly cash flow also takes a hit, with a payment that's $135 higher.

Negative Equity Explained

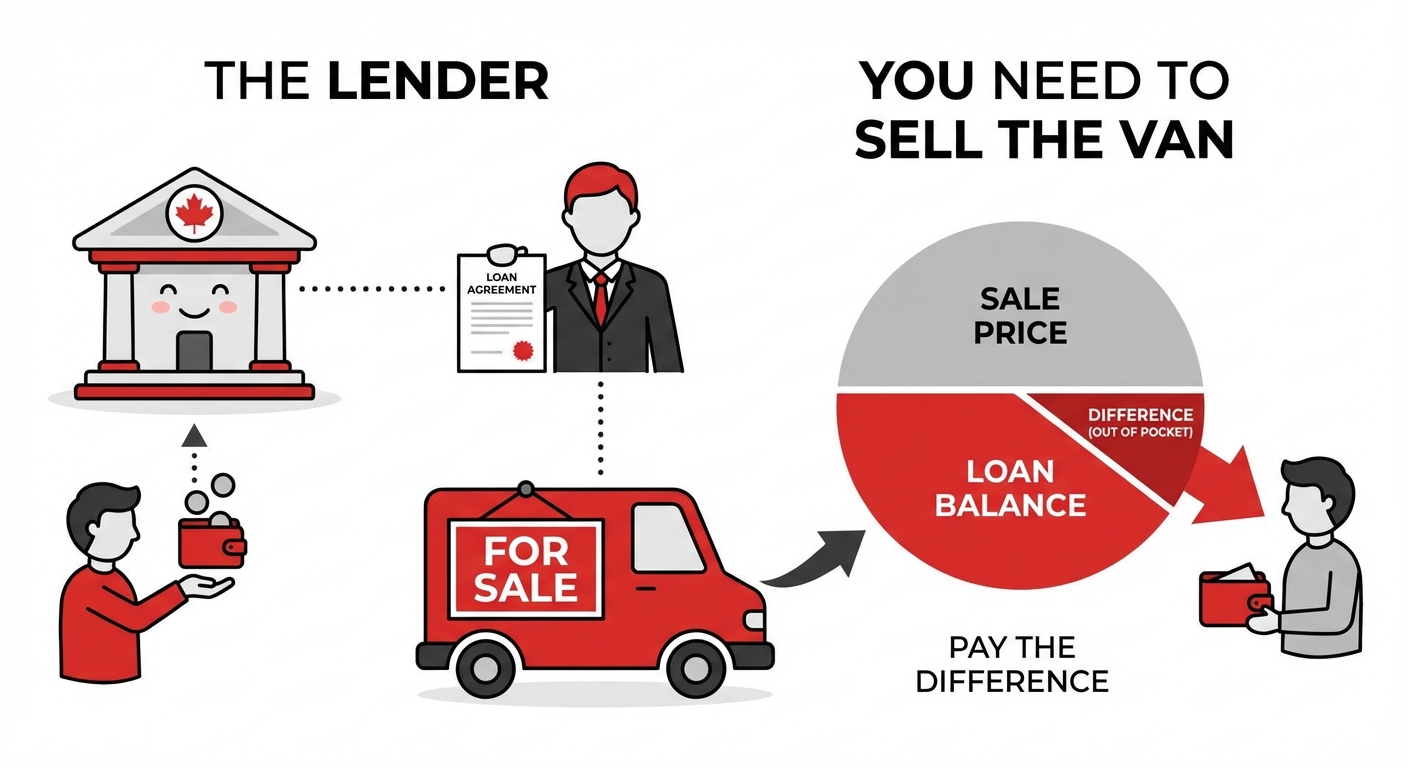

Negative equity, often called being "underwater" or "upside-down," means you owe more on your loan than the vehicle is worth. With a $0 down loan, you are in this position from day one. This becomes a serious problem if:

- The van is in a major accident: Your insurance company will only pay out the van's current market value. If you owe $35,000 but the van is only worth $30,000, you are still responsible for paying the $5,000 difference to the lender, even though you no longer have a vehicle.

- You need to sell the van: If your business plan changes and you need to sell, you'll have to pay the lender the difference between the sale price and the loan balance out of your own pocket.

Building Your 'Approval-Ready' Application: A 4-Pillar Strategy

Getting approved for a zero-down commercial loan isn't about luck; it's about preparation. By strengthening four key pillars of your application, you present yourself as a reliable business owner, not a high-risk borrower.

Pillar 1: The Credit Score Deep Dive

With no cash on the line, your credit history becomes the lender's primary tool for predicting your future behaviour.

- Beyond the Number: Lenders look past the three-digit score. They want to see a strong payment history with no late payments, credit utilization below 30% on your credit cards, and a decent length of credit history.

- Scenario Planning: An applicant with a 720+ score can often walk in and get approved with minimal questions. If you have a 650 score, you need to be prepared to explain any past issues and provide stronger proof of income to compensate. For a detailed breakdown of what lenders are looking for, our guide on The Truth About the Minimum Credit Score for Ontario Car Loans is a must-read.

Pillar 2: Proving Your Earning Power (The Delivery Driver's Dilemma)

For a delivery driver, especially one who is self-employed or a gig worker, proving stable income is the biggest hurdle. You need to make it easy for the lender to see your profitability.

- For Gig Workers (Uber, Amazon Flex): Don't just show your gross earnings. Print out 6-12 months of detailed earning statements from the app. Use a highlighter to show consistent weekly or monthly deposits into your bank account.

- For Incorporated Businesses: A simple one-page business plan can work wonders. It should include your target clients, expected weekly mileage, estimated fuel/maintenance costs, and projected revenue. If you have signed contracts, include them! They are gold to a lender.

- For Newcomers to Canada: If you lack a Canadian credit history, you must build an alternative case. Provide letters of employment, proof of consistent rent and utility payments, and bank statements showing healthy savings. Some specialized lenders are more flexible with newcomers.

Proving your income when you don't have traditional pay stubs is a common challenge. We've helped countless drivers by showing them that for the self-employed, Your Bank Account *Is* Your Proof. Get Approved.

Pillar 3: The Right Documentation Checklist

Being disorganized is a red flag. Walk in with a folder containing everything they might ask for. It shows you're a serious professional.

- Valid Ontario Driver's License (G Class)

- Proof of Address (e.g., utility bill, bank statement from the last 30 days)

- Proof of Income:

- For employees: Last two pay stubs and a letter of employment.

- For self-employed/gig workers: Last two years' Notice of Assessments (NOAs) from the CRA, 6 months of bank statements showing deposits, and any contracts.

- Business Registration Documents (if financing under a business name)

- Void Cheque or Pre-Authorized Debit Form

Pillar 4: A Tale of Two Drivers (Case Study)

Consider two applicants in Toronto, both wanting to finance a $40,000 Ram ProMaster with $0 down.

Driver A (Approved): Maria has a 690 credit score. She presents the lender with a folder containing 12 months of Amazon Flex earnings statements, her business registration, and a one-page projection of her expected weekly routes and income. She has already researched specific ProMasters on AutoTrader.ca and knows the fair market value. She looks prepared and credible. The lender approves her at 10.5% APR.

Driver B (Declined): John has a similar 685 credit score. He walks in with no documents, says he "makes good money with Uber Eats," and wants to finance a top-of-the-line, brand-new Sprinter van for $75,000. He can't provide clear income history and his vehicle choice seems unrealistic for his stated business. The lender sees disorganization and high risk, and declines the application.

Choosing Your Lender: Dealership vs. Bank vs. Specialist Financier

Where you get your loan is just as important as the van you choose. Each lender type has distinct advantages and disadvantages for a commercial borrower.

| Lender Type | Pros | Cons | Best For... |

|---|---|---|---|

| Dealership Financing | Convenient one-stop-shop; can work with multiple lenders; sometimes has special manufacturer offers. | Rates are often marked up; high-pressure sales for add-ons (warranties, coatings); focus is on selling a car, not the best loan. | Borrowers who prioritize speed and convenience over getting the absolute lowest rate. |

| Bank or Credit Union (RBC, TD, etc.) | Potentially lower rates if you have a good existing relationship; transparent terms. | Stricter approval criteria; slower process; often uncomfortable with gig work or non-traditional income. | Borrowers with excellent credit, a long-standing relationship with the bank, and traditional T4 income. |

| Specialist Financier (Equipment Finance Co.) | Understands commercial vehicles and business income; more flexible on credit; values the asset (the van) heavily. | May have slightly higher rates than a prime bank; less known than major banks. | Self-employed drivers, new businesses, and those with imperfect credit. Common in industrial hubs like Brampton and Hamilton. |

Selecting the Right Cargo Van for Your Ontario Routes (And Your Loan)

The specific van you choose is not just a tool for your business; it's the collateral for the loan. Lenders are far more willing to approve a $0 down loan on a vehicle that holds its value and is known for reliability.

The Lender's Viewpoint

Why is it easier to finance a 2-year-old Ford Transit with 80,000 km for $40,000 than a 10-year-old GMC Savana with 200,000 km for $15,000? It comes down to asset quality. The newer Transit has a predictable resale value, lower risk of major mechanical failure, and is in high demand. The older Savana is a wildcard. Lenders want predictable assets, especially when they are taking on all the risk.

Popular Models Breakdown for Delivery Work

Choosing the right tool for the job will make you more profitable and your loan more attractive.

- Ford Transit: The all-around workhorse. Its rear-wheel-drive platform is great for handling heavy loads, and it comes in multiple roof heights and lengths. It drives more like a large SUV than a traditional van, making it comfortable for long days.

- Ram ProMaster: The front-wheel-drive champion. Its FWD layout gives it an incredibly low load floor, making it easy to get in and out of hundreds of times a day. It also has a best-in-class turning radius, perfect for navigating tight city streets in downtown Ottawa or condo parking garages in Toronto.

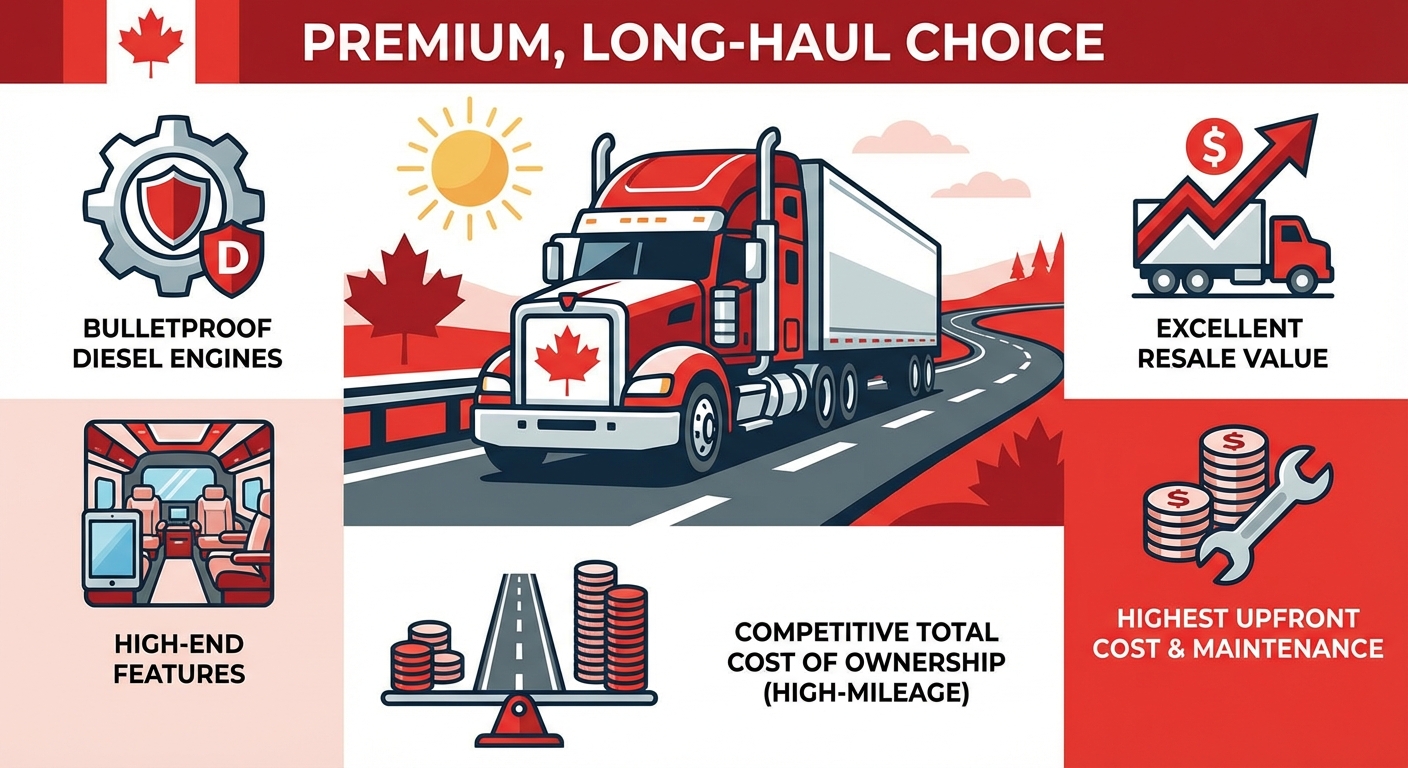

- Mercedes-Benz Sprinter: The premium, long-haul choice. Known for its bulletproof diesel engines, high-end features, and excellent resale value. The upfront cost and maintenance are the highest, but for high-mileage highway routes, the total cost of ownership can be competitive.

New vs. Certified Pre-Owned (CPO)

For a $0 down loan, a 1-3 year old Certified Pre-Owned (CPO) van is often the sweet spot. You avoid the steepest part of the depreciation curve that new buyers face, but you still get a modern, reliable vehicle, often with a remaining factory or extended warranty. Lenders offer very competitive rates on CPO vehicles because they are seen as less risky than older, higher-mileage vans.

The Fine Print: Understanding Your Loan Agreement & Hidden Costs

Getting approved is only half the battle. You must understand the contract you're signing to avoid costly surprises down the road.

Deep Dive: APR vs. Interest Rate

The Interest Rate is simply the percentage cost of borrowing the money. The Annual Percentage Rate (APR) is the true cost. It includes the interest rate PLUS any mandatory fees the lender rolls into the loan (like origination or documentation fees). Always compare loans based on APR, not just the advertised interest rate.

Decoding Fees

Read your bill of sale and loan agreement carefully. Watch for fees like:

- Origination Fees: A fee for processing the loan application.

- Documentation / Admin Fees: A dealership fee for paperwork. This can often be negotiated.

- PPSA Registration Fees: In Ontario, this is a government fee to register the lender's lien against your van. It's legitimate but should only be around $10-$20, not hundreds.

The Prepayment Penalty Trap

Ask one critical question: "Can I pay this loan off early without any penalty?" As your business grows, you may want to pay down your debt faster. Some subprime lenders include prepayment penalties, meaning you'll be charged a fee for being financially responsible. Ensure your loan is "open" and can be paid off at any time.

Insurance Shock

The cost of commercial auto insurance is not a small detail; it's a major monthly expense. It is significantly more expensive than personal insurance because you're on the road more, often in heavier traffic, and carrying goods for business. Get insurance quotes *before* you sign the loan papers to ensure the total monthly cost (loan payment + insurance + fuel) fits your budget.

Beyond the Loan: Maximizing Your Van as a Business Asset in Canada

Once you have the keys, your focus should shift to making the van a profitable asset. A huge part of this is understanding the tax benefits available to you as a business owner in Canada.

Expertise Corner: CRA Tax Deductions for Your Delivery Van

The Canada Revenue Agency (CRA) allows you to deduct a wide range of vehicle expenses against your business income, which lowers your taxable income and saves you money. These include:

- Loan Interest: The interest portion of your monthly van payment is a deductible business expense.

- Fuel & Oil: Every litre of gas or diesel is deductible.

- Insurance: Your entire commercial insurance premium is deductible.

- Maintenance & Repairs: Oil changes, new tires, brake jobs—it's all deductible.

- Capital Cost Allowance (CCA): This is the big one. You can't deduct the full price of the van in one year. Instead, the CRA lets you deduct a percentage of its value (depreciation) each year. For most cargo vans (Class 10), this is 30% per year on a declining balance.

To claim these expenses, you MUST be able to separate business use from personal use. This is non-negotiable.

Your Next Steps to Getting Approved and On the Road

Feeling ready to take the next step? Here is your actionable checklist to move from reading this guide to starting your engine.

- Check Your Credit Score: Use a free service like Borrowell or Credit Karma to know exactly where you stand. No surprises.

- Organize Your Income Docs: Gather the last 3-6 months of your earnings statements, contracts, and bank statements into one digital or physical folder.

- Research Your Van: Identify 1-2 target models and browse sites like AutoTrader.ca to understand the fair market price for the year and mileage you're targeting in your area.

- Seek Pre-Approval: This is the most important step. Apply with a trusted financing specialist (like us!) or your bank to establish your budget and get a firm rate offer. If you're a gig worker, this is where a specialist shines. As we always say, Banks Need Pay Stubs. We Need Your Drive. Gig Worker Car Loans.

- Start Shopping: With a pre-approval in hand, you can negotiate with confidence, knowing your financing is already secured.