Your Credit Score is NOT Your Rate. Get a Fair Loan, Toronto.

Table of Contents

- Key Takeaways

- Beyond the FICO Number: What Lenders Really See When You Apply for a Car Loan in Ontario

- Your Financial Story: Income Stability, Debt-to-Income, and the Power of a Down Payment

- The Car Itself: Asset Value, Loan-to-Value Ratio, and Lender Risk

- The Loan Term: Short vs. Long – The True Cost of 'Affordable' Monthly Payments

- Strategic Preparation for Toronto Buyers: Crafting Your Application Arsenal

- Mastering Your Credit Report: Identify Errors, Understand Your Narrative, and Plan Your Rebuttal

- Budgeting Beyond the Payment: Insurance, Maintenance, and Fuel Costs in the Greater Toronto Area (GTA)

- The Power of a Down Payment: Why More Upfront Means Less Interest Later

- Navigating the Toronto Lending Landscape: Who's Who in Auto Finance for Poor Credit

- Direct Lenders (Banks & Credit Unions): The Traditional Route and Its Hurdles for Poor Credit

- Dealership Finance Departments: Specialists or Salespeople? Understanding Their Incentives in Toronto

- Online & Subprime Lenders: Speed, Accessibility, and the Need for Due Diligence

- The Application Arsenal: Building Your Case for a Fair Loan in Toronto

- Co-Signers: A Double-Edged Sword for Approval and Rates

- Trading In Your Old Vehicle: Maximizing Its Value as a Down Payment

- Proof of Stability: Documents That Speak Louder Than Your Credit Score

- Negotiating Your Loan, Not Just Your Car: Securing the Best Rate in Ontario

- Separate the Deals: Car Price vs. Interest Rate – Why This Matters

- Understanding the APR: Beyond the Quoted Interest Rate

- Walking Away Power: When to Say No in a Toronto Dealership

- Avoiding the Traps: Hidden Costs and Predatory Practices in Canadian Auto Lending

- Excessive Fees: Documentation, Administration, and Extended Warranties You Don't Need

- Balloon Payments & Variable Rates: The Rare but Risky Exceptions in Canada

- The 'Payment Shopper' Fallacy: Focusing Only on Monthly Payments

- Your Journey Beyond Approval: Building a Better Financial Future from Toronto

- Making Timely Payments: The Cornerstone of Credit Repair

- Refinancing Opportunities: When and How to Lower Your Rate Later

- Financial Literacy Resources in Ontario: Where to Get Help and Advice

- Your Next Steps to Approval in Toronto: A Concrete Action Plan

- Frequently Asked Questions (FAQ) About Car Loans with Poor Credit in Ontario

Navigating the world of auto financing in Toronto, especially when your credit history isn't perfect, can feel like a daunting task. Many believe that a low credit score automatically locks them into exorbitant interest rates, or worse, denies them access to a car loan altogether. This widespread misconception, however, is far from the truth. Your credit score, while important, is just one piece of a much larger puzzle that lenders consider. It's time to demystify the process and empower Toronto residents to secure a fair and affordable car loan, regardless of past financial hiccups.

This guide is your comprehensive roadmap, designed to help you understand the true dynamics of auto lending in Ontario. We'll dismantle the myth that your credit score is the sole determinant of your interest rate, revealing the other crucial factors that hold significant weight with lenders. From the stability of your income to the strategic power of a down payment, and even the type of vehicle you choose, you'll discover how to present a compelling financial story that goes beyond a single number. Get ready to unlock the secrets to securing a great car loan in Toronto, proving that a less-than-perfect credit score doesn't have to dictate your driving future.

Key Takeaways

- Your credit score is just one piece of the puzzle; income stability, down payment, and vehicle choice are equally vital.

- Strategic preparation (budgeting, credit report review) can significantly improve your loan terms.

- Not all lenders are created equal – understand the nuances of banks, dealerships, and online platforms.

- Negotiate the loan separately from the car price to secure the best rates.

- Beware of hidden fees and focus on the Annual Percentage Rate (APR), not just the monthly payment.

- A car loan can be a powerful tool for rebuilding your credit if managed responsibly.

Beyond the FICO Number: What Lenders Really See When You Apply for a Car Loan in Ontario

It's easy to feel disheartened when you check your credit score and see a number lower than you'd hoped. Many believe this number is a definitive judgment, sealing their fate for high-interest car loans or outright rejection. But here's the crucial insight: lenders, particularly those specializing in non-prime financing across Ontario, look far beyond just your FICO score. They're interested in your entire financial narrative, viewing your application through a holistic lens that encompasses several key elements.

Think of it this way: your credit score is a snapshot of your past borrowing behaviour, but it doesn't always tell the full story of your current financial capacity or your commitment to future payments. Lenders want to assess risk, yes, but they also want to approve loans. By understanding what truly influences their decisions, you can strategically position yourself for a much fairer deal, even if your credit score has seen better days.

Your Financial Story: Income Stability, Debt-to-Income, and the Power of a Down Payment

When you apply for a car loan, lenders are primarily evaluating your ability to repay the debt. This ability is often best demonstrated not by your credit score, but by your consistent income and manageable debt levels. Income stability is paramount. A steady job, even if your income isn't exceptionally high, signals reliability. Lenders want to see a history of employment, ideally with the same employer for a significant period. This demonstrates a predictable income stream, which directly translates to your capacity to make monthly loan payments.

Another critical metric is your debt-to-income (DTI) ratio. This ratio compares your total monthly debt payments (including the proposed car loan) to your gross monthly income. A high DTI suggests you might be stretched thin, even with a decent income, making you a higher risk. Conversely, a lower DTI indicates you have sufficient disposable income to comfortably manage another payment.

Pro Tip: Aim for a debt-to-income ratio below 40% to demonstrate financial capacity, even with past credit challenges. This shows lenders you have ample room in your budget for the new car payment and other expenses.

The power of a down payment cannot be overstated, especially for those with less-than-perfect credit. A substantial down payment reduces the amount you need to borrow, which in turn lowers the lender's risk. It also demonstrates your commitment to the purchase and your ability to save money. A significant down payment can often be the tipping point for approval or for securing a more favourable interest rate, as it immediately creates equity in the vehicle. For more on how to leverage your existing assets, read our article Your Car Title Just Got a Job. You Still Get to Drive, Toronto.

The Car Itself: Asset Value, Loan-to-Value Ratio, and Lender Risk

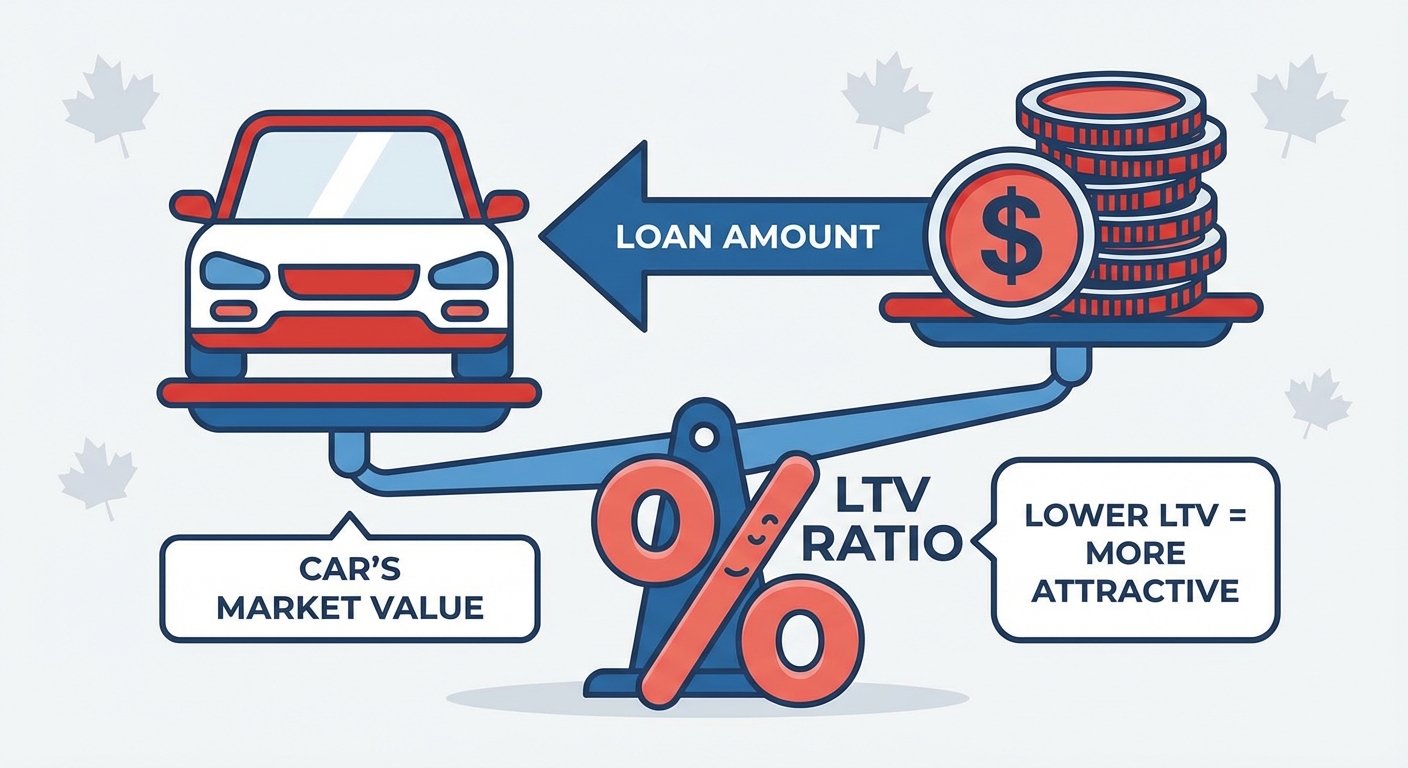

Believe it or not, the specific vehicle you choose plays a significant role in your loan approval and interest rate. Lenders view the car as collateral for the loan. Should you default, they need to be confident they can recoup their losses by repossessing and selling the vehicle. Therefore, the car's market value, its age, and its expected depreciation are all critical factors.

Vehicles that hold their value well (e.g., popular makes and models, newer used cars) are generally considered lower risk. These cars have a more predictable resale value, which lenders prefer. Conversely, older, high-mileage, or less common vehicles may pose a higher risk due to faster depreciation and potentially higher maintenance costs, which could impact your ability to pay. The loan-to-value (LTV) ratio is crucial here: it compares the loan amount to the car's actual market value. A lower LTV (meaning you've borrowed less relative to the car's worth, often due to a down payment) is always more attractive to lenders.

Context: Infographic illustrating the relationship between vehicle depreciation, loan-to-value ratio, and lender risk, perhaps showing examples of 'safer' vs. 'riskier' car choices for poor credit.

Context: Infographic illustrating the relationship between vehicle depreciation, loan-to-value ratio, and lender risk, perhaps showing examples of 'safer' vs. 'riskier' car choices for poor credit.

The Loan Term: Short vs. Long – The True Cost of 'Affordable' Monthly Payments

When you're eager to get behind the wheel, the monthly payment often becomes the primary focus. Lenders know this, and sometimes they'll offer extended loan terms (e.g., 72 or 84 months) to make the monthly payment seem more affordable. While a lower monthly payment can be enticing, especially for those on a tight budget, it often comes at a significant cost: more interest paid over the life of the loan.

With a longer loan term, you're paying interest for a greater number of months, and the total amount of interest can accumulate dramatically. This effect is amplified when you have a higher interest rate due to poor credit. A seemingly "affordable" monthly payment on an 84-month loan could result in you paying thousands of extra dollars in interest compared to a 60-month loan, even if the monthly payment is slightly higher. Always consider the total cost of the loan, not just the monthly installment. Understanding this distinction is key to making a financially sound decision.

Consider this simplified example for a $20,000 loan at a 10% interest rate:

| Loan Term | Monthly Payment (approx.) | Total Interest Paid (approx.) | Total Cost of Loan (approx.) |

|---|---|---|---|

| 60 Months (5 years) | $424 | $5,440 | $25,440 |

| 72 Months (6 years) | $369 | $6,568 | $26,568 |

| 84 Months (7 years) | $329 | $7,636 | $27,636 |

As you can see, stretching the loan term to lower the monthly payment significantly increases the total interest you pay over time.

Strategic Preparation for Toronto Buyers: Crafting Your Application Arsenal

The key to securing a fair car loan in Toronto, especially with poor credit, lies in preparation. You wouldn't go into a negotiation without your facts straight, would you? Approaching a car loan application is no different. By taking the time to assess your financial situation and organize your resources, you can present yourself as a responsible and reliable borrower, immediately improving your chances of approval and potentially securing a better rate.

Mastering Your Credit Report: Identify Errors, Understand Your Narrative, and Plan Your Rebuttal

Your credit report is more than just a score; it's a detailed history of your borrowing and repayment behaviour. Before you even think about applying for a loan, you must obtain and meticulously review your credit reports from both Equifax and TransUnion Canada. These are the two primary credit bureaus in Canada, and their reports might contain slightly different information.

What are you looking for? First, accuracy. Errors on credit reports are surprisingly common and can unfairly lower your score or paint a misleading picture of your financial habits. Look for accounts you don't recognize, incorrect payment statuses, or outdated negative information. If you find errors, dispute them immediately with the credit bureau. This process can take time, so start early.

Pro Tip: Dispute any inaccuracies on your credit report immediately. A single error can unfairly inflate your perceived risk and interest rate. Correcting these can sometimes boost your score surprisingly quickly.

Second, understand your credit narrative. Why is your score what it is? Identify any past financial difficulties, such as late payments, collections, or bankruptcies. While you can't erase these, understanding them allows you to prepare explanations for lenders. Being transparent and proactive about past challenges, rather than hoping they go unnoticed, can build trust. For more specific guidance on navigating credit challenges, consider our article Flat Tire, Flat Credit? Toronto, We've Got Your Fix.

Budgeting Beyond the Payment: Insurance, Maintenance, and Fuel Costs in the Greater Toronto Area (GTA)

A common pitfall for new car owners, especially in a major metropolitan area like Toronto, is underestimating the true cost of car ownership. It's not just about the monthly loan payment. You need to factor in a host of other expenses that can quickly drain your budget if not planned for.

- Car Insurance: Insurance rates in the Greater Toronto Area (GTA) are notoriously high due to traffic density, theft rates, and collision frequency. Get multiple insurance quotes *before* committing to a car purchase.

- Fuel Costs: Gasoline prices fluctuate, but they are a consistent expense. Consider your daily commute and weekend travel when estimating fuel consumption.

- Maintenance and Repairs: All cars require regular maintenance (oil changes, tire rotations, brake checks). Older vehicles, or certain makes and models, might incur higher repair costs. Allocate a monthly budget for these.

- Parking and Tolls: If you work or live downtown Toronto, parking fees can add up quickly. Consider 407 ETR tolls if your commute involves it.

- Licensing and Registration: Annual fees are mandatory in Ontario.

Creating a comprehensive budget that includes all these costs will give you a realistic picture of what you can truly afford, preventing financial strain down the road. This foresight not only benefits you but also demonstrates responsible financial planning to potential lenders.

The Power of a Down Payment: Why More Upfront Means Less Interest Later

We touched on this earlier, but it bears repeating: a substantial down payment is one of your most potent tools when seeking a car loan with poor credit. It directly reduces the principal loan amount, which means you'll pay interest on a smaller sum. This not only lowers your monthly payments but significantly decreases the total interest paid over the life of the loan.

Furthermore, a larger down payment improves your loan-to-value ratio, making you a less risky borrower in the eyes of lenders. It shows that you have skin in the game and are committed to the purchase. If you're struggling to save, consider setting up an automatic transfer to a dedicated savings account each payday. Even small, consistent contributions add up. Selling an existing vehicle or other assets can also contribute to a stronger down payment.

Navigating the Toronto Lending Landscape: Who's Who in Auto Finance for Poor Credit

The auto finance market in Toronto and across Ontario is diverse, with various types of lenders offering different products and catering to different credit profiles. Understanding these players is crucial for knowing where to direct your application and what to expect. Each has its own set of requirements, advantages, and disadvantages, especially for individuals navigating poor credit.

Direct Lenders (Banks & Credit Unions): The Traditional Route and Its Hurdles for Poor Credit

Major Canadian banks like RBC, TD, BMO, Scotiabank, and CIBC, along with local credit unions across Toronto, represent the traditional route for auto loans. They typically offer the most competitive interest rates to borrowers with excellent credit scores. Their lending criteria are often stringent, requiring a strong credit history, stable income, and a low debt-to-income ratio.

For individuals with poor credit, securing a loan directly from a major bank can be challenging. They are generally risk-averse and may view a low credit score as a significant red flag. However, if you have an existing banking relationship (e.g., your primary chequing account, mortgage, or other loans) with a particular institution, they might be more willing to consider your application based on your overall financial history with them, rather than solely your credit score. Credit unions, being community-focused, can sometimes be more flexible than large banks, especially if you're a long-standing member.

Pro Tip: If you have an existing relationship with a bank or credit union, start there. They may be more willing to work with you based on your overall financial history, not just your credit score, potentially offering slightly better terms than a lender you have no history with.

While the hurdles might be higher, if you manage to secure a loan from a traditional bank or credit union, it often comes with the lowest possible interest rates available for your credit profile.

Dealership Finance Departments: Specialists or Salespeople? Understanding Their Incentives in Toronto

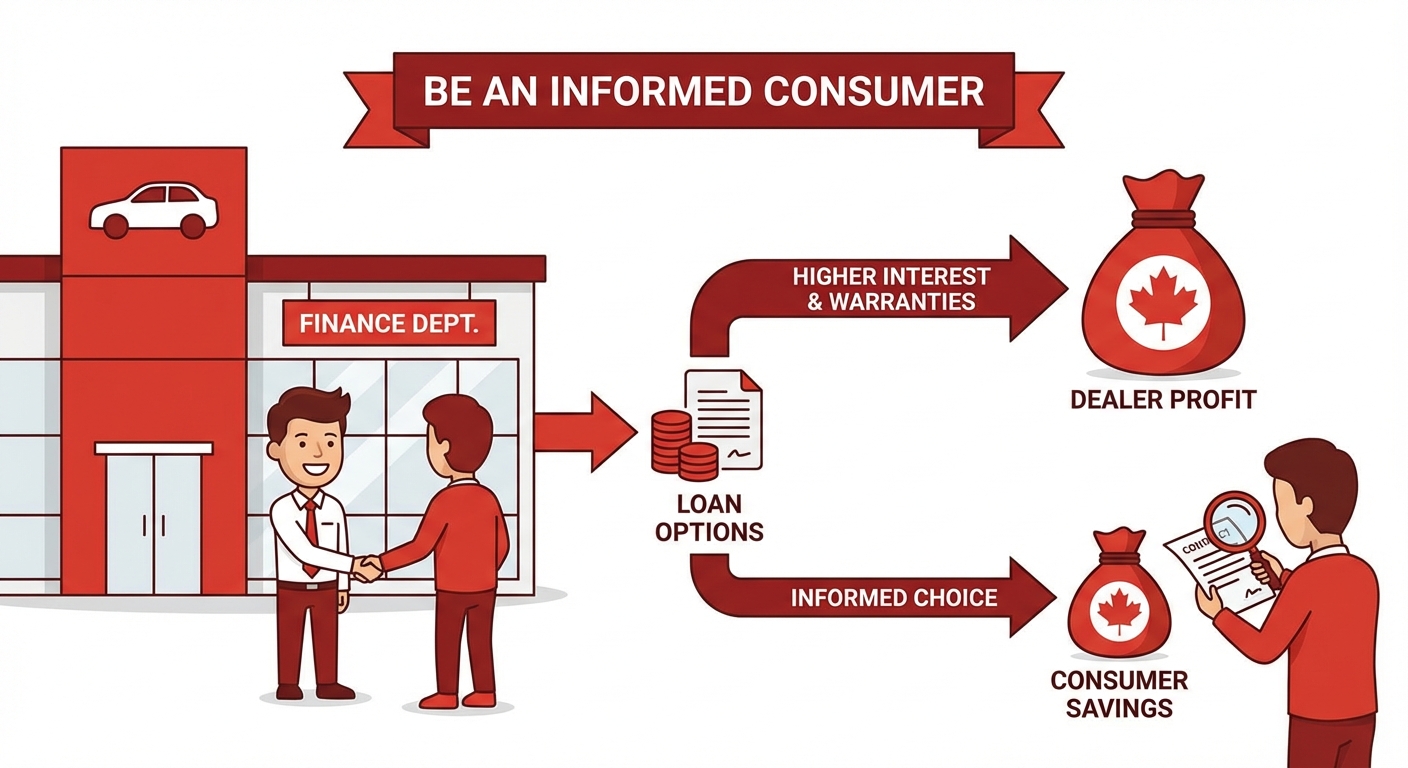

Dealership finance departments, found in abundance along bustling automotive strips like those on the Danforth in East York or in North York, Toronto, are often the most convenient and common route for securing an auto loan. These departments act as intermediaries, working with a network of various lenders – including major banks, captive finance companies (like Ford Credit or Toyota Financial Services), and specialized subprime lenders.

The finance manager's role is to find a loan that fits your budget and credit profile. They can be incredibly helpful, especially for those with poor credit, as they have access to lenders who specialize in non-prime financing. However, it's essential to understand their incentives. Finance managers often earn commissions on the loans they facilitate, which can sometimes mean they push for higher interest rates or extended warranties that benefit the dealership more than you. It's crucial to be an informed consumer when dealing with dealership finance departments.

Context: A flowchart or diagram illustrating the various paths a car loan application can take from a dealership, showing how they connect with different lenders (banks, subprime, in-house finance).

Context: A flowchart or diagram illustrating the various paths a car loan application can take from a dealership, showing how they connect with different lenders (banks, subprime, in-house finance).

The advantage here is speed and convenience; you can often secure financing and drive away in your new car on the same day. However, this convenience can come at a cost if you don't negotiate diligently. Always remember that the dealership is a business, and their goal is to maximize profit. For those with no income history, getting approved can seem impossible, but there are avenues. Our article No Income History? That's Your Car Loan Approval. Drive, Toronto! provides insights into this specific challenge.

Online & Subprime Lenders: Speed, Accessibility, and the Need for Due Diligence

The digital age has ushered in a new era of online auto loan platforms and subprime lenders that specifically cater to individuals with poor credit or unique financial situations. Companies like ours, SkipCarDealer.com, connect borrowers with a network of lenders who understand that a credit score isn't the whole story. These platforms prioritize speed and accessibility, often providing pre-approvals within minutes.

Subprime lenders specialize in higher-risk loans, meaning they are more willing to approve applicants with lower credit scores. While their interest rates will typically be higher than those offered by prime lenders, they provide a vital service to those who might otherwise be denied. The convenience of applying from the comfort of your Toronto home, receiving multiple offers, and comparing terms is a significant advantage.

However, due diligence is paramount. The online lending space, while beneficial, can also attract less reputable players. Always research the reputation of any online lender or platform. Look for transparent terms, clear communication, and positive customer reviews. Ensure they are legitimate businesses operating within Canadian regulations. Focus on the Annual Percentage Rate (APR) and read all terms and conditions carefully before committing.

The Application Arsenal: Building Your Case for a Fair Loan in Toronto

Even with poor credit, you can present a strong case for a fair auto loan by strategically leveraging all available resources. Think of your application as a presentation of your reliability and financial stability, regardless of past credit issues. Gathering the right support and understanding how to use it will significantly bolster your position.

Co-Signers: A Double-Edged Sword for Approval and Rates

A co-signer can be a game-changer for individuals with poor credit. A co-signer is someone with good credit who agrees to share legal responsibility for the loan. If you, the primary borrower, fail to make payments, the co-signer is obligated to pay. This reduces the lender's risk significantly, often leading to approval and potentially a much lower interest rate than you could secure on your own.

However, co-signing is a serious commitment. The loan will appear on the co-signer's credit report, impacting their debt-to-income ratio and potentially their ability to secure other loans. If you miss payments, it will negatively affect both your credit and your co-signer's. It's crucial for both parties to fully understand the responsibilities and potential risks involved. Ensure open communication and a clear agreement before pursuing this option. In Ontario, co-signer agreements are legally binding, so both parties should be fully aware of the implications.

Trading In Your Old Vehicle: Maximizing Its Value as a Down Payment

If you currently own a vehicle, trading it in can be an excellent way to generate an instant down payment for your new car. The value of your trade-in directly reduces the amount you need to borrow, which, as discussed, can lead to better loan terms and lower interest rates, especially for those with poor credit. To maximize your trade-in value:

- Clean and Detail: A clean, well-maintained car always presents better.

- Minor Repairs: Address small, inexpensive issues (e.g., burned-out lights, minor dents) that could detract from its value.

- Research Its Value: Use online tools (e.g., Canadian Black Book, AutoTrader) to get an estimate of your car's market value. This empowers you during negotiation.

- Get Multiple Offers: Don't just accept the first trade-in offer from a Toronto dealership. If time permits, get quotes from other dealerships or even consider selling privately if you think you can get a significantly higher price. However, selling privately requires more effort and time.

Proof of Stability: Documents That Speak Louder Than Your Credit Score

Even if your credit score is low, you can present a compelling case for your current financial stability by providing robust documentation. Lenders want to see evidence that you can afford the loan today. Prepare a comprehensive package of documents before you apply:

- Proof of Income: Recent pay stubs (at least 2-3 months), employment letters, or tax assessments if you're self-employed. For those with alternative income sources, like government benefits, bank statements showing consistent deposits are vital.

- Bank Statements: Recent statements (3-6 months) demonstrating consistent income deposits, responsible spending habits, and sufficient funds for a down payment (if applicable).

- Proof of Residence: Utility bills, a lease agreement, or property tax statements showing your current address in Toronto or elsewhere in Ontario. Stability of residence is another key indicator for lenders.

- Valid ID: Government-issued photo identification (e.g., driver's license, passport).

Presenting these documents readily and clearly demonstrates your organization and commitment, often making a positive impression that can outweigh a less-than-ideal credit score.

Negotiating Your Loan, Not Just Your Car: Securing the Best Rate in Ontario

Many buyers focus solely on negotiating the car's price, overlooking the equally critical negotiation of the loan terms. This is a mistake, especially for those with poor credit. The interest rate and loan terms can add thousands of dollars to the total cost of your vehicle. By separating these two negotiations, you empower yourself to secure the best possible deal in Ontario.

Separate the Deals: Car Price vs. Interest Rate – Why This Matters

When you're at a dealership, it's easy for the finance manager to bundle the car price and loan terms into one "monthly payment" discussion. This practice, often called "payment shopping," makes it incredibly difficult to see where the money is truly going. A seemingly low monthly payment might be masking a high interest rate or an excessively long loan term, or a combination of both.

The most effective strategy is to negotiate the price of the vehicle first, as if you were paying cash. Once you've agreed on a final price, then shift your focus to the financing. This compartmentalization ensures transparency. You know exactly how much you're paying for the car and how much you're paying in interest for the loan. This prevents the dealer from inflating the interest rate to compensate for a lower car price, or vice-versa.

Understanding the APR: Beyond the Quoted Interest Rate

While the interest rate is a significant factor, the Annual Percentage Rate (APR) is the most crucial number to focus on when comparing loan offers. The APR represents the true annual cost of borrowing, expressed as a percentage. It includes not just the interest rate, but also any additional fees or charges rolled into the loan (e.g., administration fees, origination fees, where applicable).

By comparing the APRs from different lenders, you get a clear, apples-to-apples comparison of the total cost of each loan. A loan with a slightly lower quoted interest rate but higher fees might actually have a higher APR than a loan with a slightly higher interest rate but no additional fees. Always ask for the APR and use it as your primary metric when evaluating offers. Ensure you understand what is included in that APR.

Walking Away Power: When to Say No in a Toronto Dealership

The most powerful tool in any negotiation is the ability to walk away. This means you should never feel pressured to accept an offer that doesn't feel right or that doesn't align with your budget and research. This is where pre-approvals become invaluable. By getting pre-approved by at least two different lenders *before* you step into a dealership, you arm yourself with concrete offers.

Pro Tip: Get pre-approved by at least two different lenders *before* stepping into a dealership. This gives you a benchmark and strengthens your negotiating position on the interest rate. If a dealership can't beat or match your pre-approval, you know you're getting a fair deal elsewhere.

These pre-approvals serve as a benchmark. If the dealership's finance department can't beat or at least match your pre-approved rate, you have a strong reason to decline their offer and take your business elsewhere. Remember, there are many dealerships and lenders in Toronto and across Ontario. Don't be afraid to take your time, compare offers, and choose the one that truly benefits you the most. The car you want today will likely still be available tomorrow, and a better loan offer could save you thousands of dollars over time.

Avoiding the Traps: Hidden Costs and Predatory Practices in Canadian Auto Lending

While many lenders and dealerships operate ethically, it's crucial for consumers, especially those with poor credit, to be aware of common traps and predatory practices. Being informed helps you protect your financial interests and ensures you get a genuinely fair loan in Canada.

Excessive Fees: Documentation, Administration, and Extended Warranties You Don't Need

One of the most common ways the total cost of a loan can be inflated is through excessive or unnecessary fees. When reviewing your loan contract, scrutinize every line item. Common fees include:

- Documentation Fees (Doc Fees): These are charges for processing paperwork. While some are legitimate, ensure they are reasonable and not inflated.

- Administration Fees: Similar to doc fees, these can vary wildly. Question any fee that seems unusually high or unclear.

- Extended Warranties & Protection Packages: While some extended warranties can offer peace of mind, they are often heavily marked up and may not be necessary. Do not feel pressured to buy them. If you want one, research third-party options and negotiate the price separately.

- Fabric Protection, Rust Proofing, VIN Etching: These are often high-profit add-ons that offer questionable value. Decline them if you don't genuinely need them.

Always ask for a full breakdown of all fees and their purpose. If you don't understand a charge, ask for clarification. If you're not comfortable with it, negotiate its removal or reduction. In Ontario, dealerships must disclose all fees, but it's up to you to question them.

Balloon Payments & Variable Rates: The Rare but Risky Exceptions in Canada

For the vast majority of auto loans in Canada, particularly for consumers, fixed interest rates are the standard. This means your interest rate remains the same throughout the life of the loan, providing predictable monthly payments. However, you should be aware of less common but potentially risky loan structures:

- Balloon Payments: These loans feature lower monthly payments throughout the term, but at the end, a large lump sum payment (the "balloon") is due. If you can't pay this amount, you might have to refinance (potentially at a higher rate) or sell the car. These are rare for typical consumer auto loans but can appear in certain financing arrangements.

- Variable Rates: While common for mortgages, variable interest rates are rare for consumer auto loans in Canada. A variable rate can change over time based on market conditions (e.g., prime rate). If interest rates rise, your monthly payments could increase.

Always confirm that your auto loan has a fixed interest rate and no hidden balloon payments. If a lender proposes anything other than a standard fixed-rate, fully amortizing loan, proceed with extreme caution and seek independent financial advice.

The 'Payment Shopper' Fallacy: Focusing Only on Monthly Payments

This is perhaps the biggest trap for car buyers, particularly those with credit challenges who are eager to get approved. Focusing solely on the monthly payment without considering the total cost, the interest rate (APR), and the loan term is a recipe for financial regret. A dealership might offer you a seemingly "affordable" monthly payment, but achieve this by:

- Extending the loan term to 84 or even 96 months.

- Adding expensive, unnecessary add-ons into the loan.

- Inflating the interest rate.

While the monthly payment might fit your immediate budget, you could end up paying significantly more for the car over time due to accrued interest and hidden fees. Always ask for the total cost of the loan, including all interest and fees. Divide that by the number of months to get a true sense of what you're paying, and compare that to the car's actual value. Don't let the allure of a low monthly payment blind you to the long-term financial implications.

Your Journey Beyond Approval: Building a Better Financial Future from Toronto

Securing a car loan, especially with poor credit, isn't just about getting a vehicle; it's an incredible opportunity to rebuild your financial health. By managing your new loan responsibly, you can take significant steps toward improving your credit score and opening doors to better financial opportunities in the future. This journey starts the moment your loan is approved and your car keys are in hand.

Making Timely Payments: The Cornerstone of Credit Repair

This cannot be stressed enough: consistent, on-time payments are the single most important factor in rebuilding your credit. Payment history accounts for a substantial portion of your credit score. Every single payment made on time is a positive mark on your credit report, demonstrating reliability to future lenders. Conversely, even a single missed payment can severely damage your progress.

To ensure you never miss a payment, establish robust strategies:

- Set Up Automated Payments: Link your bank account to your loan and schedule payments to be automatically deducted a few days before the due date.

- Calendar Reminders: Use digital calendars or physical planners to set up reminders a week before and a day before your payment is due.

- Budget Review: Regularly review your budget to ensure you always have enough funds allocated for your car payment.

Treat your car loan payment as a top financial priority. Over time, this consistent positive behaviour will significantly improve your credit score, making future borrowing easier and more affordable.

Refinancing Opportunities: When and How to Lower Your Rate Later

One of the most rewarding aspects of successfully managing a car loan with initial poor credit is the opportunity to refinance. Once you've made 12-24 consecutive, on-time payments and your credit score has demonstrably improved, you may qualify for a new loan with a significantly lower interest rate.

Refinancing essentially means taking out a new loan to pay off your existing car loan. The goal is to secure a lower interest rate, which will reduce your monthly payments, the total interest paid, or both. When to consider refinancing:

- Your credit score has improved significantly.

- Interest rates in the market have dropped.

- You've been making consistent, on-time payments for at least a year.

Shop around for refinancing options, just as you did for your initial loan. Check with your current lender, other banks, credit unions, and online platforms specializing in auto loans. Many local Toronto lenders will offer competitive refinancing options to attract new customers. The savings from refinancing can be substantial, freeing up more money in your budget each month.

Financial Literacy Resources in Ontario: Where to Get Help and Advice

Building a stronger financial future is an ongoing process, and you don't have to do it alone. Ontario offers numerous resources to help residents improve their financial literacy and manage their debt effectively:

- Credit Counselling Services: Non-profit organizations like Credit Canada Debt Solutions or the Credit Counselling Society offer free or low-cost confidential advice on budgeting, debt management, and credit repair. They can provide personalized action plans.

- Government Resources: The Financial Consumer Agency of Canada (FCAC) provides unbiased information and tools on a wide range of financial topics, including debt management, budgeting, and understanding credit.

- Public Libraries: Many Toronto Public Library branches offer workshops, books, and online resources on personal finance.

- Online Educational Platforms: Websites from reputable financial institutions and consumer advocacy groups often provide free articles, calculators, and courses to enhance your financial knowledge.

Taking advantage of these resources can provide you with the knowledge and tools to maintain your financial health long after your car loan is paid off, setting you on a path to greater financial freedom.

Your Next Steps to Approval in Toronto: A Concrete Action Plan

You now have a wealth of information at your fingertips. The key is to turn this knowledge into action. Here's a concise, step-by-step plan to guide you toward securing a fair car loan in Toronto, even with poor credit:

- Step 1: Pull your credit reports from Equifax and TransUnion Canada and review them meticulously. Dispute any inaccuracies immediately to ensure your report is fair and accurate.

- Step 2: Create a detailed budget, including all car ownership costs specific to the GTA (insurance, fuel, maintenance, parking, etc.), not just the loan payment. Understand what you can truly afford.

- Step 3: Gather all necessary documentation to prove income stability (pay stubs, employment letter) and residency (utility bills). Organize these so they are ready to present to lenders.

- Step 4: Research and obtain pre-approvals from at least two different lenders (banks, credit unions, or online specialists like SkipCarDealer.com). This gives you negotiating power.

- Step 5: Be prepared to negotiate both the car price and the loan terms separately. Focus on the Annual Percentage Rate (APR) as the most important number, not just the monthly payment.

- Step 6: Read all loan documents carefully, questioning any unfamiliar fees, clauses, or add-ons before signing. Do not feel rushed or pressured.

By following these steps, you're not just applying for a car loan; you're taking control of your financial future and demonstrating to lenders that you are a responsible, informed borrower ready to make a commitment. Your credit score is not your rate – your preparation and strategy are.