Owning a car in Canada isn't just about the freedom of the open road; for most of us, it is a fundamental necessity. Whether you are navigating a February blizzard in Winnipeg, commuting from the GTA suburbs to downtown Toronto, or exploring the rugged terrain of British Columbia, a reliable vehicle is often the bridge between you and your livelihood. However, the path to the driver's seat is paved with financial jargon, credit score anxiety, and a complex lending landscape that can feel overwhelming.

The Canadian car loan market operates under a unique set of rules. From provincial regulations like OMVIC in Ontario and AMVIC in Alberta to the specific ways our "Big Five" banks assess risk, getting approved isn't always as simple as walking into a dealership and picking a colour. Many Canadians-especially newcomers, students, and those recovering from financial setbacks-find themselves facing the dreaded 'Rejected' notice without understanding why. This guide is designed to peel back the curtain, providing you with the "insider secrets" to move from a rejection to an approval with the best possible terms.

Key Takeaways

- Credit is King: Your score with Equifax or TransUnion is the single biggest factor in determining your interest rate, but it isn't the only factor for approval.

- Newcomer Advantage: Canada has specific "New-to-Canada" programs that allow financing even with a zero local credit history, provided you have the right permit status.

- The Power of Pre-Approval: Walking into a dealership with a pre-approval shifts the power dynamic, turning you into a "cash buyer" in the eyes of the salesperson.

- Look Beyond the Monthly Payment: The Total Cost of Ownership (TCO) includes insurance (which is high in Canada), maintenance, and fuel. Always calculate the total interest paid over the life of the loan.

Understanding the Canadian Credit Ecosystem

In Canada, your financial reputation is managed primarily by two major credit bureaus: Equifax and TransUnion. While they often hold similar data, they use slightly different algorithms to calculate your score. It is a common secret in the industry that some lenders prefer one over the other. For instance, a "Big Five" bank might pull your Equifax report, while a specialized subprime lender might rely on TransUnion. If there is an error on one and not the other, it could be the difference between a 5% and a 15% interest rate.

Decoding the Credit Score Ranges for Auto Loans

Lenders categorize borrowers into "tiers." Knowing where you fall helps you set realistic expectations for your interest rate. While these ranges can fluctuate based on the Bank of Canada's prime rate, the general brackets remain consistent:

| Category | Score Range | Typical Interest Rate Outlook |

|---|---|---|

| Super Prime | 780+ | Lowest available rates (often promotional 0%-4.9%) |

| Prime | 661-780 | Standard bank rates; highly competitive options |

| Near Prime | 600-660 | Slightly higher rates; may require a small down payment |

| Subprime | Below 600 | Specialized lenders; rates can range from 10% to 20%+ |

The Car Loan Approval Process: A Step-by-Step Secret Roadmap

Most people think the car loan process starts at the dealership. They are wrong. To get the best deal, the process starts in your home office with a stack of paperwork. Think of it like an IRCC application-the more organized you are, the faster the "Visa" (or in this case, the loan) is granted.

Step 1: Document Preparation

Lenders in Canada are becoming increasingly strict about "Stated Income." They want proof. You should have your most recent two pay stubs ready. If you are self-employed, you will need your last two years of Notices of Assessment (NOA) from the CRA. Lenders look for stability; if you have been at your job for more than six months, your odds of approval skyrocket.

Step 2: The Soft-Pull Pre-Qualification

Before you commit to a specific car, look for lenders who offer "soft-pull" pre-qualification. This gives you an estimated rate and loan amount without a formal inquiry hitting your credit report. It allows you to shop around with different institutions to see who is hungriest for your business.

Step 3: Hard Inquiry and Final Underwriting

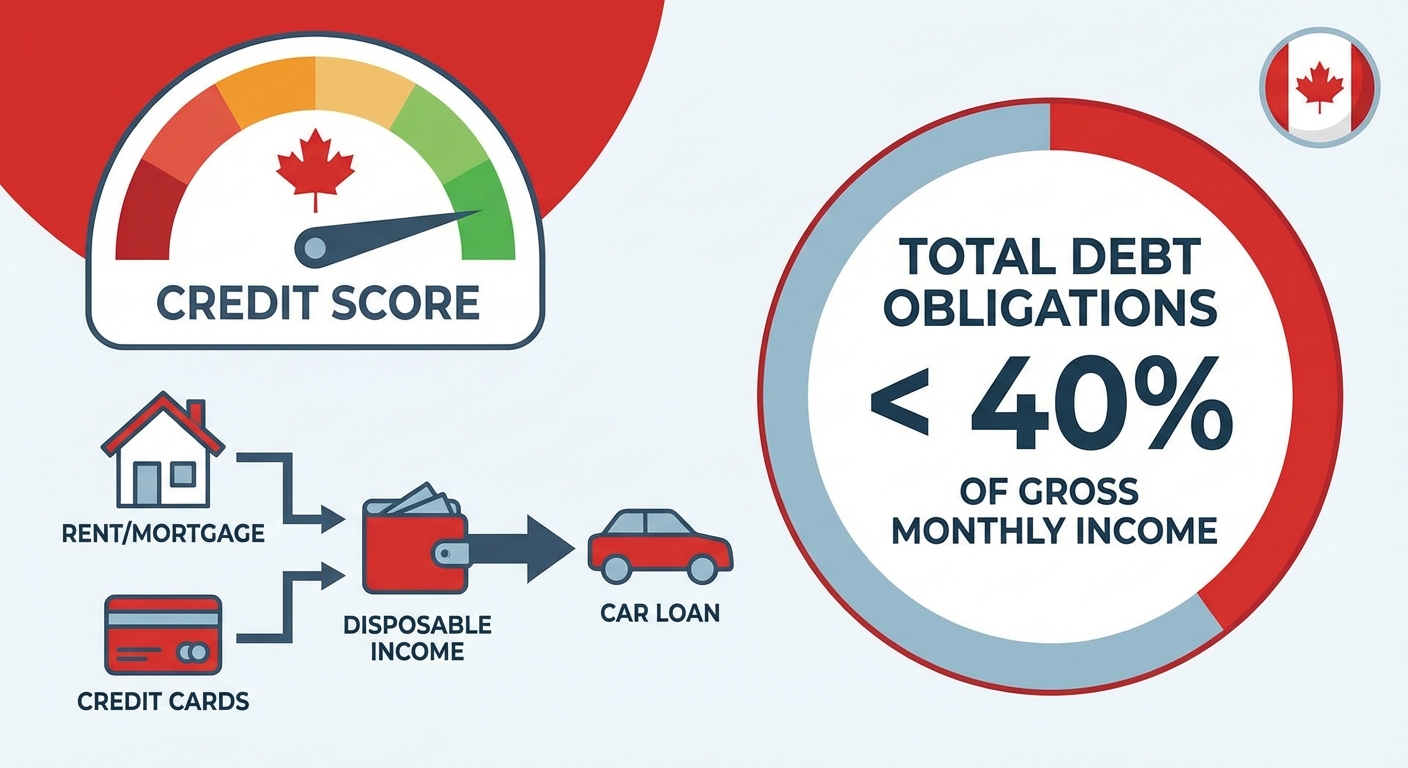

Once you've chosen a vehicle, the lender will perform a "hard pull." This is where the underwriter looks at your Debt-to-Income (DTI) ratio. They don't just care about your credit score; they care if you have enough money left over after paying your rent/mortgage and credit cards to actually afford the car. In Canada, most lenders want to see your total debt obligations stay below 40% of your gross monthly income.

Financing Sources in Canada: Where to Look

Where you get your money is just as important as the car you buy. Canadians have four main avenues for financing, each with its own "secret" advantage.

- The Big Five Banks: RBC, TD, Scotiabank, BMO, and CIBC. These are the most conservative. If you have great credit and a long history, they offer the most stability. However, they are often the quickest to say "no" to anyone with a slightly bruised credit history.

- Captive Lenders: These are the financial arms of the manufacturers (e.g., Toyota Financial Services, Ford Credit). Their "secret" is that they aren't necessarily trying to make a huge profit on the loan; they want to sell the car. This is why you see 0% or 1.9% offers-but these are almost always reserved for Super Prime borrowers.

- Credit Unions: Often overlooked, local credit unions (like Vancity or Meridian) can be more flexible. Because they are member-owned, they may look at your "character" and local community standing rather than just a computer-generated score.

- Online Lenders: Companies that specialize in auto finance often have faster approval times and more modern interfaces. They are excellent for Near-Prime or Subprime borrowers who need a more tailored approach.

Special Secrets for Newcomers and International Students

Canada is a land of immigrants, and the financial system has evolved to reflect that. If you just arrived on a Work Permit or as a Permanent Resident, you likely have a "thin file"-meaning no Canadian credit history. To a traditional algorithm, you are a high risk, but many lenders have "New to Canada" programs that bypass this.

The secret here is leveraging your IRCC status. Lenders will often approve a loan that matches the length of your work permit. For international students, if you have a GIC (Guaranteed Investment Certificate) as part of your study permit requirements, some banks will use that as collateral for a car loan. This allows you to build Canadian credit while you study, making it much easier to get a mortgage later in life.

Another "hidden" factor for newcomers is insurance. In provinces like Ontario, insurance can cost as much as the car payment itself. A secret way to lower this cost-and thus improve your debt-to-income ratio for the loan approval-is to get an "Experience Letter" from your previous insurance company in your home country. If it's in English or French, many Canadian insurers will credit you for those years of driving experience.

Interest Rates and Loan Terms: The Math Behind the Secrets

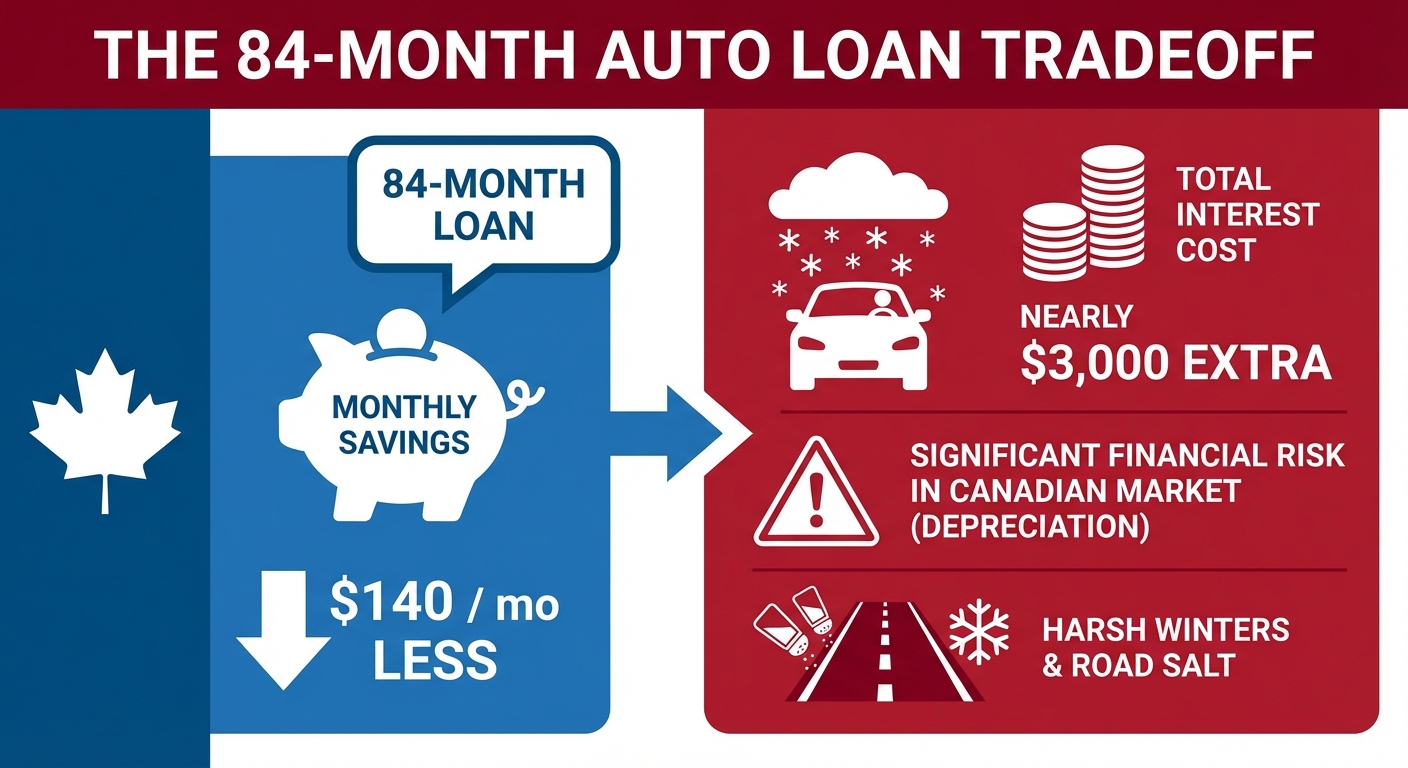

The most dangerous trap in Canadian car finance is the "long-term loan." In an effort to make monthly payments look affordable, many dealerships will push 84-month (7-year) or even 96-month (8-year) terms. While the payment is low, you will likely find yourself "underwater" or in "negative equity" within three years. This means you owe more on the car than it is actually worth.

| Loan Amount | Interest Rate | Term (Months) | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| $30,000 | 6% | 60 | $579.98 | $4,799 |

| $30,000 | 8% | 60 | $608.29 | $6,497 |

| $30,000 | 8% | 84 | $467.59 | $9,277 |

As the table shows, stretching the loan from 60 to 84 months might save you $140 a month, but it costs you nearly $3,000 extra in interest. In the Canadian market, where vehicle depreciation is accelerated by harsh winters and road salt, being in an 84-month loan is a significant financial risk.

The 'Hidden' Factors That Lead to Rejection

Sometimes, you have a decent credit score and a good job, yet the bank still says no. Why? Usually, it's one of these three "hidden" factors:

- Vehicle Age and Mileage: Most Canadian banks will not finance a vehicle that is more than 10 years old or has more than 160,000 kilometres. They view these cars as high-risk because a major mechanical failure could lead the borrower to stop making payments.

- Employment Stability: If you are still in your "probationary period" at a new job (usually the first 3 to 6 months), lenders will often hesitate. They want to see that your income is "permanent."

- The "Payment-to-Income" Ratio: Even if your total debt is low, lenders don't want your car payment alone to exceed 15-20% of your gross monthly income. If you earn $4,000 a month, a $900 car payment is a red flag, regardless of your credit score.

Frequently Asked Questions (FAQs in Canada)

What is a 'Good' car loan interest rate in Canada right now?

Interest rates are tied to the Bank of Canada's overnight rate. Currently, a "good" rate for a new car with Prime credit ranges between 4.9% and 7.9%. For used cars, expect 8.9% to 12.9%. Anything below 4% is usually a manufacturer-subsidized promotional rate and is considered excellent.

Can I get a car loan while on a Work Permit or Study Permit?

Yes. Many Canadian lenders have specific programs for permit holders. The key requirement is usually that the loan term cannot exceed the remaining duration of your permit. You will likely need to provide your permit document (IMM 1442) and proof of employment or a GIC.

How does a car loan impact my path to Permanent Residency or Citizenship?

While a car loan itself isn't a requirement for PR or Citizenship, having a healthy Canadian credit history is a sign of "financial establishment." Paying off a car loan on time builds your credit score, which is vital when you eventually apply for a mortgage or other financial products as a PR.

Can I pay off my Canadian car loan early without penalties?

In Canada, most consumer auto loans are "simple interest" loans and are required by law to be open-ended. This means you can pay the loan off in full at any time without a prepayment penalty. However, always double-check the "Prepayment" section of your specific contract before signing.

What is the difference between a 'Co-signer' and a 'Co-applicant' in Canada?

A co-applicant (or co-borrower) shares ownership of the vehicle and the responsibility for the loan from day one. A co-signer is a guarantor; they don't own the car, but they legally promise to pay the loan if you fail to do so. Co-signers are often used to help someone with no credit or poor credit get approved.

How do I check the status of my loan application?

If you apply through an online platform or a dealership, you can usually request a "portal login" or an "Application Status Tracker" link. Most approvals in Canada are automated and happen within minutes, but if your application requires "manual underwriting" (common for self-employed or newcomers), it can take 24 to 48 hours.

What happens if I can't make my payments?

Canada has strict repossession laws that vary by province. Generally, if you miss 2-3 payments, the lender has the right to seize the vehicle. In some provinces, like British Columbia and Alberta, the "Seize or Sue" rule applies, meaning the lender can either take the car back OR sue you for the money, but often not both. Always contact your lender immediately if you face financial hardship; many offer "payment deferrals" for a small fee.

Your Action Plan for Approval

Navigating the Canadian car finance world doesn't have to be a mystery. By understanding that your credit score is just one piece of the puzzle, you can position yourself for success. Before you head to the dealership, ensure your "paperwork fortress" is built: have your ID, your pay stubs, and your residency documents in order. Check your own credit score to ensure there are no surprises, and most importantly, understand the math of your loan beyond the monthly payment.

A car loan is more than just a way to get a vehicle; it is a powerful tool for building your financial future in Canada. When handled correctly, it strengthens your credit profile, providing a foundation for future goals like homeownership. Treat the process with the respect it deserves, stay informed, and you will find yourself behind the wheel with a deal that makes sense for your wallet and your life.