Toronto: Your Post-CP, No-Down Work Car. (Yes, *Today*.)

Table of Contents

- Key Takeaways: The Urgent Truth for Toronto's Post-CP Drivers

- The Post-CP Reality Check: Why Toronto Needs a Car (and Why Lenders are Wary)

- Decoding 'No Down Payment': The Myth vs. The Toronto Market Reality

- The 'Today' Factor: Accelerated Approval Strategies for Toronto's Urgent Needs

- Navigating Toronto's Lender Landscape: Where to Find Your Post-CP Loan

- Sub-Section 4.1: The Specialized Auto Finance Dealerships in the Greater Toronto Area

- Sub-Section 4.2: Private Lenders & Online Platforms Serving Ontario

- Sub-Section 4.3: The Traditional Bank Maze (and why to largely avoid it initially)

- Beyond the Loan: Vehicle Choices and Insurance Realities in Toronto

- What Kind of Car Can You Realistically Expect? New vs. Used for Post-CP Loans:

- Understanding the Total Cost of Ownership in Ontario:

- Toronto's Notoriously High Auto Insurance Rates:

- The Financial Architect: Building Your Credit (and Future) with Your New Car Loan

- Specific Toronto Case Studies & Success Stories (Anonymized)

- Case Study 1: The Dedicated Commuter from Oshawa

- Case Study 2: The Single Parent in North York

- Case Study 3: The Entrepreneur in Downtown Toronto

- FAQ: Your Final Questions Answered on Post-CP Car Loans in Toronto

- Your Next Steps to Approval: Driving Forward Post-CP in Toronto

Life in Toronto moves fast. One moment you're navigating the complexities of a Consumer Proposal (CP), the next you're discharged, facing a new financial chapter, and realizing your need for reliable transportation is more urgent than ever. Whether it's the daily commute from Mississauga to downtown, client visits across the Greater Toronto Area (GTA), or simply making sure you can get to work reliably, a car isn't a luxury for many Canadians; it's a necessity. But after a Consumer Proposal, the idea of securing a car loan, especially with no down payment and an urgent timeline, can feel like an impossible dream.

At SkipCarDealer.com, we understand this reality. We know that a Consumer Proposal is not a financial death sentence but a strategic fresh start. This article isn't about sugarcoating the challenges; it's about empowering you with the knowledge and strategies to secure the work car you need in Toronto, potentially sooner than you think, even with zero down.

Key Takeaways: The Urgent Truth for Toronto's Post-CP Drivers

- Yes, it's Possible, But 'Immediately' Has Nuances: While getting a car loan 'today' is ambitious, strategic planning can significantly accelerate the process post-Consumer Proposal discharge in Toronto. Understanding the steps can transform weeks into days.

- No Down Payment: A Reality with Specific Strategies: Zero down payment options exist, but they come with trade-offs. We'll show you how to navigate them effectively, focusing on what lenders prioritize when no cash is involved.

- Your 'Work Car' Aspect Can Be an Advantage: Lenders often view a car essential for employment more favorably, especially when paired with stable income. Highlighting this need strategically strengthens your application.

- Your Credit Score Isn't a Life Sentence: A Consumer Proposal is a fresh start. This article will guide you on leveraging your new financial chapter to secure the vehicle you need and rebuild your credit simultaneously. It's about demonstrating current stability, not dwelling on past challenges.

- Toronto Specifics Matter: From local lenders to insurance rates and public transit considerations, your location influences your options and the overall cost of vehicle ownership. We'll address Toronto's unique landscape.

The Post-CP Reality Check: Why Toronto Needs a Car (and Why Lenders are Wary)

Toronto, while having a robust public transit system in the TTC, is a sprawling metropolis. For many living in the outer boroughs or commuting from surrounding cities like Mississauga, Brampton, Vaughan, Markham, or Pickering, relying solely on public transit for work is simply not feasible. Long commutes, multiple transfers, and unpredictable delays can severely impact job performance and quality of life. A personal vehicle provides not just convenience, but often, a crucial link to employment stability and opportunity in the Greater Toronto Area.

After successfully completing your Consumer Proposal in Ontario, you receive a discharge certificate. This document is monumental; it signifies that you have fulfilled your obligations, and your debts included in the proposal are settled. On your credit report, the CP will show as "discharged," a significant improvement over an active proposal. Unlike bankruptcy, which remains on your credit report for 6-7 years after discharge (depending on the number of bankruptcies), a Consumer Proposal typically stays for 3 years after the date of completion, or 6 years from the date of filing, whichever is sooner. This means your pathway to rebuilding credit can be faster and less encumbered than after a full bankruptcy. For more on how your financial journey restarts after a discharge, consider reading Discharged? Your Car Loan Starts Sooner Than You're Told.

However, despite the discharge, lenders remain wary. A Consumer Proposal indicates a past financial distress, raising concerns about repayment risk. They'll scrutinize your current income, stability, and spending habits more closely. This psychological hurdle – the fear of rejection – is a common anxiety for post-CP individuals. Many wrongly assume they'll be denied outright. The truth is, specialized lenders understand that life happens, and they focus on your present capacity and future potential, rather than solely your past credit missteps. Overcoming this fear starts with understanding the process and preparing thoroughly.

Decoding 'No Down Payment': The Myth vs. The Toronto Market Reality

The allure of a 'no down payment' car loan is strong, especially when you're focusing on rebuilding your finances post-CP. However, it's crucial to understand why traditional lenders often balk at this proposition, particularly for recent post-Consumer Proposal borrowers. From their perspective, a down payment signifies a borrower's commitment and reduces the amount of risk they're taking on. With no money down, the lender is financing 100% of the vehicle's value, and in the event of default, they may struggle to recoup their investment, especially if the car depreciates quickly.

This increased risk perception for post-CP borrowers is amplified when there's no down payment. Lenders are already extending credit to someone with a recent history of financial difficulty, and a down payment acts as a buffer. Even a small down payment – a few hundred dollars or 5-10% of the vehicle's value – can significantly improve your approval odds. It signals responsibility and a greater stake in the purchase, potentially leading to better interest rates and lower overall loan costs. Consider this: a down payment directly reduces the principal amount you need to borrow, which in turn reduces the total interest you'll pay over the life of the loan and your monthly payments.

When 'no down payment' truly is the only option, be prepared for trade-offs. These often include higher interest rates, longer loan terms (stretching payments over 7 or even 8 years), and potentially additional fees. These factors can significantly increase the total cost of the vehicle. Lenders compensate for the increased risk by charging more. It's a risk-based pricing model, and post-CP, you're generally considered a higher risk borrower. For those navigating the challenges of getting a loan with no money down and a less-than-perfect credit history, our article Your Ex is History. Your Car Loan Isn't. Zero Down, Bad Credit offers additional insights.

Let's look at a hypothetical comparison to illustrate the impact:

| Scenario | Vehicle Price | Down Payment | Loan Amount | Interest Rate (Estimated Post-CP) | Term (Years) | Estimated Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|---|---|

| No Down Payment | $20,000 | $0 | $20,000 | 19.99% | 5 | $529 | $11,740 |

| 10% Down Payment | $20,000 | $2,000 | $18,000 | 17.99% | 5 | $456 | $9,360 |

As you can see, even a 10% down payment reduces the monthly payment by $73 and saves over $2,300 in interest over five years. This demonstrates the strategic advantage of even a modest down payment.

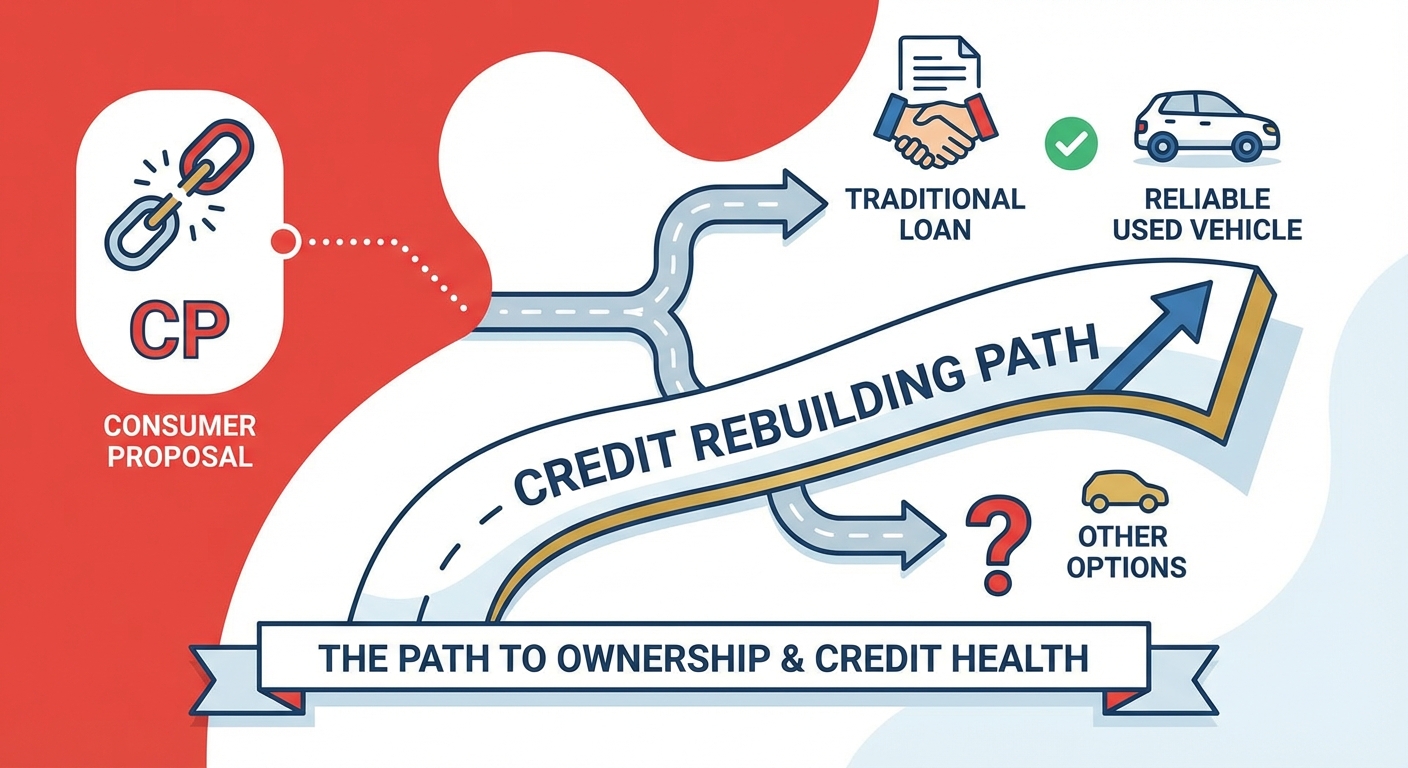

Another option to explore is lease-to-own versus traditional loans. Lease-to-own agreements can sometimes be more accessible for post-CP applicants as they focus heavily on your current income and ability to make monthly payments, with the option to purchase the vehicle at the end of the term. However, they can also come with higher overall costs and less flexibility. Traditional loans, while potentially harder to secure initially for no-down-payment post-CP clients, offer full ownership from the start and can be a more direct path to credit rebuilding. The best choice depends on your specific financial situation, credit profile, and long-term goals. For many, a traditional loan for a reliable used vehicle remains the most straightforward path to ownership and credit rebuilding after a CP.

Context: A visual comparison graph showcasing two hypothetical car loan scenarios: one with a 10% down payment and one with no down payment, illustrating the difference in total interest paid and monthly payments over a 5-year term for a $20,000 vehicle.

Context: A visual comparison graph showcasing two hypothetical car loan scenarios: one with a 10% down payment and one with no down payment, illustrating the difference in total interest paid and monthly payments over a 5-year term for a $20,000 vehicle.

The 'Today' Factor: Accelerated Approval Strategies for Toronto's Urgent Needs

When you need a work car in Toronto, the word 'today' often carries an understandable sense of urgency. However, it's vital to set realistic expectations. 'Immediately' in the context of a car loan for a post-CP borrower typically means a significantly accelerated process – think 24-72 hours for a pre-approval, not instant drive-away. While some specialized dealerships can process applications very quickly, the full process of approval, vehicle selection, and final paperwork usually takes a couple of business days. The key is to make that process as smooth and fast as possible.

Your secret weapon in this scenario is pre-approval. Getting pre-approved before you even step foot on a dealership lot gives you immense power. It means you know exactly how much you're approved for, what interest rate to expect, and which lenders are willing to work with you. This eliminates the guesswork and allows you to shop for a vehicle within your approved budget, rather than falling in love with a car you can't afford. It also transforms you from a hopeful applicant into a qualified buyer, giving you negotiating leverage on the vehicle's price and terms.

The power of preparation cannot be overstated. Gathering all necessary documentation *before* you apply is the single most impactful step you can take to accelerate the process. This includes:

- Proof of Income: Recent pay stubs (typically 2-3 months), an employment letter from your employer confirming your position, salary, and start date, and your latest T4s. For self-employed individuals, bank statements showing consistent deposits or recent tax assessments.

- Proof of Residence: Utility bills (hydro, gas, internet) in your name, a current lease agreement, or a property tax bill. These verify your address and stability.

- Consumer Proposal Discharge Documents: Your official certificate of discharge is paramount. It proves you've completed your obligations and are no longer actively under the proposal.

- Valid Ontario Driver's License: Essential for both identification and legal driving.

- Bank Statements: The last 3-6 months of your bank statements are critical. Lenders, especially those working with subprime credit, want to see consistent income deposits, responsible spending habits, and an absence of excessive NSF (non-sufficient funds) charges post-CP. This demonstrates your ability to manage money responsibly now.

Targeting the right lenders is equally important. Not all financial institutions are equipped or willing to work with post-CP clients. You'll have better luck with specialized auto finance dealerships and certain online lenders who focus on credit rebuilding. We'll delve deeper into this in the next section.

Navigating Toronto's Lender Landscape: Where to Find Your Post-CP Loan

Finding a car loan after a Consumer Proposal in Toronto requires a strategic approach to the lender landscape. Not all financial institutions are created equal when it comes to financing individuals rebuilding their credit. Knowing where to look first can save you time, reduce stress, and improve your chances of approval.

Sub-Section 4.1: The Specialized Auto Finance Dealerships in the Greater Toronto Area

These dealerships are often your best bet. Across Toronto, Scarborough, Etobicoke, North York, and the surrounding GTA, many dealerships have dedicated 'special finance' or 'credit rebuilding' departments. These departments are specifically structured to help individuals with challenging credit situations, including recent Consumer Proposal discharges. Their finance managers are experts in navigating subprime lending and have established relationships with a network of lenders who specialize in this market.

How do they operate? They act as intermediaries, understanding your unique situation and matching you with lenders who are more flexible than traditional banks. They will assess your income, stability, and the specifics of your post-CP status to present your case effectively to these specialized lenders. What can you expect from their inventory? Often, these dealerships focus on offering reliable used vehicles that fall within the loan parameters typically approved for high-risk borrowers. These are practical, fuel-efficient sedans, compact SUVs, or minivans – cars that meet the 'work car' requirement without being overly expensive or luxury models.

Sub-Section 4.2: Private Lenders & Online Platforms Serving Ontario

Beyond traditional dealerships, a growing number of reputable online lenders and brokers in Canada specialize in bad credit or post-CP auto loans. SkipCarDealer.com is one such platform, connecting you with lenders who understand your unique circumstances. These online platforms often have more flexible approval criteria, prioritizing your current income, employment stability, and ability to make payments over a pristine credit history. They understand that a Consumer Proposal is a fresh start, not a permanent scarlet letter.

The trade-off, as mentioned earlier, is acknowledging potentially higher interest rates. Because these lenders take on increased risk, their rates reflect that. However, for many, this is a necessary step to secure the transportation they need and begin rebuilding their credit. It's about getting approved for a reliable vehicle that allows you to get to work, secure your income, and make consistent payments to improve your credit score over time.

Sub-Section 4.3: The Traditional Bank Maze (and why to largely avoid it initially)

Major Canadian banks like RBC, TD, BMO, CIBC, and Scotiabank, while offering competitive auto loan rates for prime borrowers, are typically not the first stop for individuals with a recent Consumer Proposal discharge. Their lending criteria are generally much stricter, and a recent CP on your credit report will often lead to an immediate decline. They prioritize long, consistent credit histories and low-risk profiles.

When might a traditional bank consider you? This would usually be after a significant period post-discharge (e.g., 2-3+ years), with a substantial down payment, a very strong co-signer with excellent credit, or evidence of significant credit rebuilding through other means. For urgent needs right after your CP discharge, focusing your efforts on specialized dealerships and online lenders will yield much faster and more positive results.

Beyond the Loan: Vehicle Choices and Insurance Realities in Toronto

Securing your car loan post-CP is a significant achievement, but it's just one piece of the puzzle. Understanding the total cost of ownership, especially in a city like Toronto, is paramount to ensuring your new vehicle remains a financial asset, not a burden.

What Kind of Car Can You Realistically Expect? New vs. Used for Post-CP Loans:

For most post-CP borrowers, the focus should be on reliable, affordable used vehicles. Lenders specializing in subprime credit are often more comfortable financing used cars that have a proven track record of dependability and a lower price point. They look for vehicles that offer good value and are less susceptible to rapid depreciation, which minimizes their risk. Think fuel-efficient sedans (like a Honda Civic or Toyota Corolla), compact SUVs (like a Mazda CX-5 or Hyundai Kona), or practical hatchbacks. These vehicles meet the 'work' requirement without breaking the bank on monthly payments, fuel, or insurance.

New cars, with their higher price tags and immediate depreciation, are typically out of reach for recent CP discharges, especially with no down payment. Lenders view newer, more expensive vehicles as a higher risk, as the loan amount is larger, and the potential for negative equity (owing more than the car is worth) is greater early in the loan term. Aim for a vehicle that is 3-7 years old, with reasonable mileage (under 150,000 kilometres), and a strong maintenance history.

Understanding the Total Cost of Ownership in Ontario:

Your monthly car payment is only one part of the equation. You must budget for the full spectrum of vehicle ownership costs, particularly in Ontario:

- Fuel: Gas prices in Toronto can fluctuate wildly. Factor in your daily commute and weekend driving.

- Routine Maintenance: Oil changes, tire rotations, brake inspections, fluid top-ups. Regular maintenance is crucial for extending your car's life and preventing costly repairs.

- Unexpected Repairs: Even reliable used cars can have unexpected issues. Building an emergency fund for these situations is a smart financial move.

- Licensing and Registration: Annual fees to the provincial government.

- Parking: If you work or live in downtown Toronto, parking costs can be substantial.

Toronto's Notoriously High Auto Insurance Rates:

Ontario, and particularly the Greater Toronto Area, is known for some of the highest auto insurance rates in Canada. A post-CP credit score, even if improving, can still negatively impact your insurance premiums. Insurers often use credit scores as a predictor of claim likelihood, so a lower score can mean higher rates. However, there are strategies to mitigate these costs:

- Telematics Programs: Many insurers offer 'pay-as-you-drive' or telematics programs that use a device in your car to monitor driving habits. Safe driving can lead to significant discounts.

- Bundling Policies: If you have home insurance, bundling it with your auto insurance through the same provider can often result in savings.

- Higher Deductibles: Agreeing to pay a larger deductible in the event of a claim will lower your monthly premiums. Just ensure you can afford the deductible if an incident occurs.

- Choosing a Lower-Risk Vehicle: Some vehicles are statistically less likely to be stolen or involved in accidents, leading to lower premiums. Ask your insurer for quotes on different makes and models.

- Shopping Around: Get quotes from multiple insurance providers. Rates can vary dramatically between companies for the exact same coverage.

Here’s a comparison of typical monthly costs to give you a better idea:

| Cost Category | Estimated Monthly Cost (Toronto) | Notes for Post-CP Borrower |

|---|---|---|

| Loan Payment | $350 - $600+ | Depends heavily on loan amount, interest rate, and term. Can be higher with no down payment. |

| Auto Insurance | $200 - $450+ | Significantly impacted by credit history, vehicle type, age, and driving record. Higher in GTA. |

| Fuel | $150 - $300+ | Varies by commute, vehicle efficiency, and fluctuating gas prices. |

| Maintenance & Repairs | $50 - $150 | Budget for routine service and unexpected issues. Essential for older used cars. |

| Parking (if applicable) | $0 - $200+ | Highly variable based on work/home location. Downtown Toronto parking is expensive. |

| Total Estimated | $750 - $1700+ | A comprehensive view of your monthly car-related expenses. |

The Financial Architect: Building Your Credit (and Future) with Your New Car Loan

A Consumer Proposal is not the end of your financial journey; it's a strategic pivot. Your car loan, responsibly managed, can be one of the most powerful tools in rebuilding your credit and paving the way for a stronger financial future. This isn't just about getting a car; it's about leveraging that car to demonstrate renewed financial responsibility.

To understand how, let's look at the five pillars of credit scoring, as defined by major credit bureaus like Equifax and TransUnion in Canada:

- Payment History (35%): This is the most crucial factor. Every on-time payment you make on your car loan will positively impact this section of your credit report. Late payments, conversely, will damage it.

- Amounts Owed (30%): While a car loan is a significant amount, what matters here is your credit utilization ratio on revolving credit (like credit cards). A car loan is an installment loan, and managing it well shows you can handle debt.

- Length of Credit History (15%): The longer your credit accounts have been open and in good standing, the better. Your new car loan, over time, will contribute to this.

- New Credit (10%): While applying for the car loan will result in a hard inquiry (a temporary dip), successfully managing that new credit shows positive progress.

- Credit Mix (10%): Having a mix of credit types (e.g., an installment loan like a car loan and a revolving account like a credit card) demonstrates your ability to manage different forms of credit.

The impact of consistent, on-time payments on your credit report cannot be overstated. Each successful payment builds a positive history, gradually offsetting the negative impact of your Consumer Proposal. It signals to future lenders that you are a reliable borrower who has learned from past experiences and is committed to your financial obligations.

Strategies for ensuring on-time payments and maintaining financial discipline are simple but critical:

- Setting up Automatic Withdrawals: This is perhaps the easiest way to ensure you never miss a payment. Schedule the withdrawal to coincide with your paycheque.

- Creating a Realistic Monthly Budget: Factor in not just your car payment, but insurance, fuel, maintenance, and an emergency fund. Knowing exactly where your money goes prevents surprises.

- Building an Emergency Fund: Life happens. A flat tire, a minor repair, or an unexpected bill shouldn't derail your car payments. Aim for at least 3-6 months of essential expenses in savings.

The long game is about moving from subprime to prime lending. With diligent payments on your car loan, you can expect significant credit score improvement over 1-2 years post-CP discharge. Once your score has improved, you can consider refinancing your loan for a better interest rate. Refinancing allows you to replace your existing high-interest loan with a new one, often with lower monthly payments and substantial savings on total interest. For more detailed advice on this, check out our guide on Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit.

Specific Toronto Case Studies & Success Stories (Anonymized)

To illustrate that securing a post-CP car loan in Toronto is indeed possible, let's look at a few anonymized success stories from individuals who navigated similar challenges.

Case Study 1: The Dedicated Commuter from Oshawa

Mark, a skilled tradesperson living in Oshawa, needed a reliable truck for his work, which took him to various construction sites across the Greater Toronto Area. He had completed his Consumer Proposal six months prior and had a stable income but a limited down payment. Mark approached a specialized auto finance dealership in Scarborough. He brought all his documentation, including his CP discharge certificate, recent pay stubs, and bank statements showing consistent income. The finance manager worked with him to secure a loan for a 4-year-old Ford F-150 with 120,000 kilometres. Mark made a small down payment of $1,000, which helped reduce the interest rate slightly. His determination to commute for work, coupled with his stable employment, made him an attractive candidate to a subprime lender. He secured a loan at a moderate interest rate, allowing him to continue his valuable work and rebuild his credit simultaneously.

Case Study 2: The Single Parent in North York

Sarah, a single mother of two in North York, desperately needed a family-friendly sedan for school drop-offs, groceries, and her part-time job. Her Consumer Proposal had been discharged a year ago, but her income, while stable, was modest. Sarah's challenge was a tighter budget and a desire for a zero-down payment. Her mother, who had excellent credit, agreed to co-sign the loan. With her mother's strong credit history bolstering the application, Sarah was able to secure a no-down-payment loan for a reliable 5-year-old Honda Civic from an online auto lender. The co-signer significantly improved her approval odds and helped her get a more favourable interest rate than she would have received alone. This partnership allowed her to get the transportation she needed without an upfront cash outlay, and she is now diligently making payments, improving both her and her mother's credit profiles.

Case Study 3: The Entrepreneur in Downtown Toronto

David, a freelance graphic designer based in downtown Toronto, had recently discharged his Consumer Proposal. While his credit score was still recovering, his business income was strong and consistent, verifiable through 12 months of bank statements and recent tax filings. He needed a practical, fuel-efficient vehicle for client meetings across the city and occasional trips to suppliers. Despite not having a down payment, David leveraged his strong current business income to offset his recent CP. He worked with a broker specializing in self-employed loans and subprime credit. The lender focused on his consistent cash flow and the business necessity of the vehicle. David secured a loan for a compact SUV, recognizing the higher interest rate was a necessary step to get his business moving forward. This loan is now acting as a cornerstone for rebuilding his personal credit profile while supporting his entrepreneurial ventures.

Context: A stylized graphic titled 'Your Credit Rebuilding Journey' showing a rising arrow with milestones like 'CP Discharge', 'First Car Loan', '6 Months On-Time Payments', '1 Year On-Time Payments', 'Refinance Opportunity', and 'Improved Credit Score'.

Context: A stylized graphic titled 'Your Credit Rebuilding Journey' showing a rising arrow with milestones like 'CP Discharge', 'First Car Loan', '6 Months On-Time Payments', '1 Year On-Time Payments', 'Refinance Opportunity', and 'Improved Credit Score'.

FAQ: Your Final Questions Answered on Post-CP Car Loans in Toronto

Your Next Steps to Approval: Driving Forward Post-CP in Toronto

Your Consumer Proposal was a difficult but necessary step towards a fresh financial start. Now, it's time to leverage that clean slate and secure the reliable work car you need to thrive in Toronto. The path may require diligence and patience, but with the right strategy, success is well within reach.

Here’s your action plan:

Step 1: Gather Your Documents: Don't wait. Collect all necessary financial paperwork today: pay stubs, employment letter, bank statements, driver's license, and most importantly, your Consumer Proposal discharge certificate. Being prepared is half the battle.

Step 2: Assess Your Budget: Be brutally honest with yourself about what you can *truly* afford. This isn't just the monthly car payment, but also Toronto's high insurance rates, fuel, and maintenance. Use the table above as a guide.

Step 3: Seek Pre-Approval Strategically: Start with specialized dealerships in the GTA or reputable online lenders known for their expertise in post-CP financing. This will give you clarity on your budget and negotiating power.

Step 4: Be Realistic, Be Patient, Be Persistent: Understand that the process takes effort. You might not get the car of your dreams on day one, nor the lowest interest rate. But success is absolutely within reach if you remain persistent and approach the process with a clear understanding of your options.

Step 5: Focus on Rebuilding: View this car loan as more than just a means of transportation. It's a critical tool for long-term financial recovery. Make every payment on time, and watch your credit score steadily improve.

Your Consumer Proposal was a tough but necessary step. Now, it's time to leverage that fresh start and get the work car you need, driving confidently towards a stronger financial future in Toronto.