Unmasking 'Bad Credit' Car Lenders: Red Flags You Miss, Quebec.

Table of Contents

- Unmasking 'Bad Credit' Car Lenders: Red Flags You Miss in Quebec

- Key Takeaways

- The Allure of the 'Easy Approval': Why Desperation Breeds Vulnerability in Quebec's Auto Market

- The Stigma of Bad Credit: Feeling Trapped and Limited Options

- Quick Fix Promises: The Appeal of 'Instant' or 'Guaranteed' Approvals

- Misleading Advertising: Deciphering the Fine Print in Quebec-centric Ads

- The Urgency Trap: How Pressure Tactics Cloud Judgment

- The Art of Deception: 15+ Red Flags of Predatory Bad Credit Car Lenders in Quebec

- Red Flag 1: The 'Guaranteed Approval' Myth – Even with Bankruptcy.

- Pro Tip:

- Red Flag 2: Upfront Fees for Application, Insurance, or 'Processing'.

- Red Flag 3: Demanding Sensitive Information Too Soon (e.g., SIN, Bank Account Details) Without Pre-Approval.

- Red Flag 4: High-Pressure Sales Tactics and 'Act Now' Urgency.

- Red Flag 5: No Physical Address, Poor Online Presence, or Generic Contact Info.

- Red Flag 6: Unrealistic Interest Rates – Too Low for Bad Credit or Excessively High (Loan Shark Territory).

- Red Flag 7: Ignoring Your Credit History Entirely or Claiming It Doesn't Matter.

- Red Flag 8: Pushing Specific, Often Overpriced, Vehicles You Don't Want or Need.

- Red Flag 9: Vague or Incomplete Loan Terms and Conditions.

- Red Flag 10: Refusal to Provide a Written Contract Before Signing.

- Red Flag 11: Insistence on Signing a Blank Contract or Forms.

- Red Flag 12: Requesting Payment via Non-Traceable Methods (e.g., Gift Cards, Wire Transfers).

- Red Flag 13: Promises of 'No Credit Check' While Still Requiring a SIN or Bank Info.

- Red Flag 14: Inflated Prices for Add-ons (e.g., Extended Warranties, Rust Protection) That You Don't Need.

- Red Flag 15: Difficulty Getting Clear Answers to Your Questions.

- Red Flag 16: The 'Apply Without Cosigner or SIN #' Gambit – When it's a Trap vs. a Niche Offering.

- Understanding Your Legal Shield: Consumer Protection in Quebec's Auto Loan Landscape

- The Office de la protection du consommateur (OPC): Your Provincial Watchdog

- Quebec's Specific Interest Rate Regulations and Caps on Credit Costs

- Mandatory Disclosures: What Lenders MUST Tell You Under Quebec Law

- Cooling-Off Periods and Cancellation Rights for Car Loan Contracts

- Reporting Suspected Scams: How and Where to File a Complaint in Montreal, Laval, or Gatineau

- Pro Tip:

- Navigating the Legitimate Path: How to Spot Legitimate Bad Credit Car Lenders in Canada (and Quebec)

- Beyond the Banks: Types of Legitimate Bad Credit Lenders

- The Power of Pre-Approval: Why It Matters for Bad Credit Borrowers

- Pro Tip:

- What Legitimate Lenders Actually Look For (Even with Bad Credit)

- The Role of a Co-Signer: When it Helps and When it's a Risk

- Building Your Case: Preparing Your Documentation for a Stronger Application

- Decoding the Numbers: Interest Rates, Loan Terms, and Hidden Costs for Bad Credit Loans

- Understanding APR vs. Simple Interest: What You're Really Paying

- The Impact of Loan Terms: Why Longer Terms Cost More in the Long Run

- The Down Payment Dilemma: How Much is Enough for Bad Credit?

- Unmasking Hidden Fees: Administration Fees, Documentation Fees, and Other Sneaky Charges

- Pro Tip:

- Secured vs. Unsecured Auto Loans: Why Most Car Loans are Secured

- The True Cost of a 'Good Deal': Calculating Total Interest Paid Over the Loan Term

- Your Vehicle Choice Matters: Smart Car Buying Strategies for Bad Credit Borrowers in Quebec

- New vs. Used: Which is Better for Rebuilding Credit?

- Reliability Over Luxury: Focusing on Affordable and Maintainable Cars

- The Dangers of High-Mileage or Problematic Vehicles with Bad Credit Loans

- Independent Mechanic Inspections: A Non-Negotiable Step for Used Cars in Quebec

- Beyond the Loan: Rebuilding Your Credit and Financial Future in Quebec

- Consistent On-Time Payments: The Cornerstone of Credit Repair

- Understanding Your Credit Report: Equifax and TransUnion in Canada

- Diversifying Credit (Responsibly): Small Steps After Your Car Loan

- Budgeting and Financial Planning Resources in Quebec (e.g., local credit counselling services in Quebec City or Sherbrooke)

- Your Next Steps to Approval: A Checklist for Securing a Legitimate Bad Credit Car Loan in Quebec

- Frequently Asked Questions (FAQ) About Bad Credit Car Loans in Canada

Unmasking 'Bad Credit' Car Lenders: Red Flags You Miss in Quebec

In the bustling streets of Montreal, the historic charm of Quebec City, or the vibrant communities of Laval and Sherbrooke, having a reliable vehicle isn't just a convenience – it's often a necessity. Yet, for many Quebecers grappling with the challenges of a less-than-perfect credit score, the dream of car ownership can quickly turn into a desperate search. This desperation, unfortunately, creates fertile ground for predatory lenders who prey on vulnerability, promising "guaranteed approval" with dazzling smiles while hiding sinister terms in the fine print.

You're not alone if you've felt the sting of rejection or the anxiety of limited options. The journey to securing a car loan with bad credit in Quebec can feel like navigating a minefield. But here's the truth: legitimate solutions exist. This no-nonsense guide is your essential shield, designed to equip you with the knowledge to distinguish trustworthy lenders from dangerous traps, ensuring your path to car ownership is safe, fair, and ultimately, successful.

Key Takeaways

- Never pay upfront fees for a loan application or 'insurance.' Legitimate lenders don't operate this way.

- Guaranteed approval with no credit check is a myth and a major red flag, especially for significant purchases like a car.

- Always verify the lender's physical address and online reputation, particularly in a province like Quebec with strong consumer protection.

- Understand your rights under Quebec's robust consumer protection laws, enforced by the Office de la protection du consommateur (OPC).

- Don't be pressured into signing anything immediately; always take time to review terms and seek clarification.

The Allure of the 'Easy Approval': Why Desperation Breeds Vulnerability in Quebec's Auto Market

Imagine needing a car for work, for family, or simply to escape the daily grind, but every traditional bank has shown you the door. This isn't just a hypothetical scenario; it's the stark reality for thousands of Canadians, including many here in Quebec. When faced with financial hurdles, the appeal of a quick, seemingly effortless solution becomes incredibly powerful. Predatory lenders understand this deeply, and they exploit it with calculated precision.

The Stigma of Bad Credit: Feeling Trapped and Limited Options

A bad credit score can feel like a scarlet letter, making you feel judged and marginalized. This stigma often leads individuals to believe that "no one else will approve me," pushing them towards desperate choices. The fear of continued rejection makes the promise of "guaranteed approval" irresistible, even if it feels too good to be true. It's a psychological trap, designed to make you overlook common sense and critical thinking.

Quick Fix Promises: The Appeal of 'Instant' or 'Guaranteed' Approvals

Who doesn't want an instant solution? Scammers capitalize on this desire, plastering ads across the internet and even local classifieds in Montreal, Quebec City, or Gatineau, promising "instant approval," "no credit check loans," or "100% guaranteed financing." These phrases are siren calls, designed to hook those who feel time is running out or that their options are non-existent. The reality is far more complex; legitimate lenders, even those specializing in bad credit, always conduct some form of due diligence.

Misleading Advertising: Deciphering the Fine Print in Quebec-centric Ads

Predatory lenders are masters of deceptive marketing. Their ads might feature smiling families or sleek cars, often using vague language or highlighting only the most attractive (and often unrealistic) aspects of their offers. They might mention "low monthly payments" without disclosing the exorbitant interest rates or extended loan terms that make those payments possible. In Quebec, these tactics are particularly insidious as they target individuals who might not fully understand the nuances of financial contracts or their legal rights.

The Urgency Trap: How Pressure Tactics Cloud Judgment

"This offer is only available today!" "Sign now before rates go up!" These high-pressure sales tactics are classic red flags. Predatory lenders want to prevent you from doing your research, comparing offers, or seeking independent advice. They create a false sense of urgency, knowing that a rushed decision is often a poor decision. Never let anyone pressure you into signing a financial agreement on the spot.

The Art of Deception: 15+ Red Flags of Predatory Bad Credit Car Lenders in Quebec

Identifying a predatory lender isn't always obvious. They often mimic legitimate operations, making it crucial for you to be vigilant. Here are specific warning signs to watch out for, especially when seeking a car loan in Quebec:

Red Flag 1: The 'Guaranteed Approval' Myth – Even with Bankruptcy.

No legitimate lender can guarantee approval without any form of assessment. Even bad credit lenders need to verify identity, income, and ability to repay. "Guaranteed approval" often means guaranteed high interest, hidden fees, and unfavourable terms.

Pro Tip:

Legitimate lenders always perform some form of credit assessment, even for bad credit loans. Guaranteed approval often means guaranteed high interest and hidden fees. If a lender claims they don't care about your credit history at all, proceed with extreme caution.

Red Flag 2: Upfront Fees for Application, Insurance, or 'Processing'.

This is a classic scam. Legitimate lenders deduct any applicable fees (which should be minimal and clearly disclosed) from the loan amount or incorporate them into the Annual Percentage Rate (APR). Demanding payment upfront for a loan you haven't even received yet is a sure sign of fraud.

Red Flag 3: Demanding Sensitive Information Too Soon (e.g., SIN, Bank Account Details) Without Pre-Approval.

While legitimate lenders will eventually require your Social Insurance Number (SIN) and banking information, they typically do so after a preliminary assessment or pre-approval, and always with clear security protocols. If a lender asks for this sensitive data right off the bat, especially over unsecured channels, be wary.

Red Flag 4: High-Pressure Sales Tactics and 'Act Now' Urgency.

As discussed, creating a sense of urgency is a common manipulation tactic. A reputable lender will give you ample time to review the terms, ask questions, and make an informed decision.

Red Flag 5: No Physical Address, Poor Online Presence, or Generic Contact Info.

Legitimate dealerships and lenders in Quebec will have a verifiable physical address. A lack of a professional website, generic email addresses (e.g., Gmail, Hotmail), or only a mobile phone number are significant red flags. Verifying a lender's physical location, especially in major Quebec cities like Montreal or Quebec City, is crucial. Check if they are registered with the Office de la protection du consommateur (OPC).

Red Flag 6: Unrealistic Interest Rates – Too Low for Bad Credit or Excessively High (Loan Shark Territory).

If an interest rate seems impossibly low for someone with bad credit, it's probably a bait-and-switch. Conversely, rates that are astronomically high should immediately raise alarms. Quebec has regulations on maximum interest rates, and anything exceeding these limits is illegal. For more on how legitimate lenders approach challenging credit situations, consider reading our article on The Consumer Proposal Car Loan You Were Told Was Impossible.

Red Flag 7: Ignoring Your Credit History Entirely or Claiming It Doesn't Matter.

While some lenders specialize in bad credit, they still use your credit history to assess risk and determine appropriate rates. A lender claiming your credit history is completely irrelevant is likely misleading you about other crucial aspects of the loan.

Red Flag 8: Pushing Specific, Often Overpriced, Vehicles You Don't Want or Need.

Some predatory operations are disguised dealerships. They might have a limited, overpriced inventory of unreliable vehicles and pressure you into buying one, regardless of your preferences or budget. Their goal isn't to get you a car, but to sell a specific high-profit margin vehicle.

Red Flag 9: Vague or Incomplete Loan Terms and Conditions.

Every legitimate loan contract should clearly detail the principal amount, interest rate, total cost of borrowing, payment schedule, and all associated fees. Vague language or missing information is a deliberate attempt to obscure the true cost.

Red Flag 10: Refusal to Provide a Written Contract Before Signing.

Never, ever sign anything you haven't had a chance to read thoroughly. A reputable lender will always provide a written contract for your review.

Red Flag 11: Insistence on Signing a Blank Contract or Forms.

This is a highly dangerous practice. A blank contract can be filled in later with terms you never agreed to, leaving you legally bound to predatory conditions.

Red Flag 12: Requesting Payment via Non-Traceable Methods (e.g., Gift Cards, Wire Transfers).

Legitimate financial transactions are conducted through verifiable means like bank transfers, cheques, or credit card payments. Requests for gift cards, untraceable wire transfers, or cryptocurrency are definitive signs of a scam.

Red Flag 13: Promises of 'No Credit Check' While Still Requiring a SIN or Bank Info.

This is contradictory and deceptive. If they require your SIN or bank account details, they likely *are* performing some form of check, or they're collecting your information for malicious purposes.

Red Flag 14: Inflated Prices for Add-ons (e.g., Extended Warranties, Rust Protection) That You Don't Need.

While some add-ons can be valuable, predatory lenders often bundle highly overpriced and unnecessary products into the loan, significantly increasing your total cost and monthly payments without real benefit.

Red Flag 15: Difficulty Getting Clear Answers to Your Questions.

If the lender is evasive, changes the subject, or gives inconsistent answers to your questions about loan terms, fees, or their company, it's a huge warning sign.

Red Flag 16: The 'Apply Without Cosigner or SIN #' Gambit – When it's a Trap vs. a Niche Offering.

While some legitimate lenders specialize in loans for newcomers or those without a traditional credit history, promising approval without a SIN or cosigner for a bad credit loan is often too good to be true. Always verify their legitimacy and terms rigorously. For those navigating unique income situations, you might find our article Self-Employed Ontario: They Want a Pay Stub? We Want You Driving helpful, even if it's focused on another province, the principles of income verification for non-traditional employment apply across Canada.

Understanding Your Legal Shield: Consumer Protection in Quebec's Auto Loan Landscape

Quebec boasts some of the strongest consumer protection laws in Canada, providing a vital shield against predatory lending. Knowing your rights and how to exercise them is paramount.

The Office de la protection du consommateur (OPC): Your Provincial Watchdog

The OPC is Quebec's primary consumer protection agency. It enforces the Consumer Protection Act, oversees businesses, and handles consumer complaints. Any legitimate car dealer or lender operating in Quebec should be aware of and comply with OPC regulations. You can check their website to verify a business's registration and complaint history.

Quebec's Specific Interest Rate Regulations and Caps on Credit Costs

Quebec's Consumer Protection Act (CPA) includes provisions regarding interest rates and credit costs. While there isn't a hard cap on all interest rates like the Criminal Code's 60% per annum, the CPA requires full disclosure and prohibits lenders from charging excessive, unconscionable, or abusive rates. If a rate feels exploitative, the OPC can intervene.

Mandatory Disclosures: What Lenders MUST Tell You Under Quebec Law

The CPA mandates that lenders provide clear, comprehensive information about the loan. This includes:

- The exact amount being financed.

- The interest rate and how it's calculated.

- The total cost of borrowing (interest + all fees).

- The number and amount of payments.

- The total amount repayable.

- Details of any additional charges (e.g., administration fees, extended warranties).

This information must be presented in writing before you sign any agreement.

Cooling-Off Periods and Cancellation Rights for Car Loan Contracts

Under Quebec's Consumer Protection Act, specific rules govern the cancellation of contracts, particularly for certain types of sales. While not all car loans automatically come with a cooling-off period, some situations (like door-to-door sales or certain distance contracts) may trigger cancellation rights. Always inquire about cancellation policies and review them carefully in your contract.

Reporting Suspected Scams: How and Where to File a Complaint in Montreal, Laval, or Gatineau

If you suspect you've been targeted by a predatory lender or scam, don't hesitate to act. Contact the Office de la protection du consommateur (OPC) immediately. You can file a complaint online, by phone, or in person at their offices. Provide all documentation you have. You can also contact local police services if you believe criminal activity has occurred.

Pro Tip:

Always document all communications and keep copies of every document signed or received. This includes emails, text messages, advertisements, and the final loan agreement. This paper trail is invaluable if you need to file a complaint with the OPC.

Navigating the Legitimate Path: How to Spot Legitimate Bad Credit Car Lenders in Canada (and Quebec)

Even with bad credit, legitimate avenues for car financing exist. The key is knowing where to look and what to expect from reputable institutions.

Beyond the Banks: Types of Legitimate Bad Credit Lenders

- Traditional Banks & Credit Unions: While often stricter, major banks (e.g., National Bank of Canada, RBC, TD) and credit unions (like Desjardins, Quebec's largest financial cooperative, or local Caisse populaire branches in Sherbrooke or Saguenay) may offer bad credit loans or subprime financing to existing customers or those with a strong down payment.

- Specialized Auto Finance Companies: Many reputable companies focus specifically on subprime lending. These are often affiliated with established dealerships and have programs designed for various credit situations.

- In-House Dealership Financing (with caution and verification): Some larger dealerships offer their own financing. While convenient, always compare their terms with external lenders. Ensure they are transparent about rates and fees.

- Online Lending Platforms (with rigorous vetting): Several online platforms connect borrowers with a network of lenders, including those specializing in bad credit. Always verify the platform's reputation and the legitimacy of the lenders they partner with.

The Power of Pre-Approval: Why It Matters for Bad Credit Borrowers

Pre-approval is a game-changer. It means a legitimate lender has reviewed your financial situation and determined how much they are willing to lend you, at what interest rate, before you even step onto a car lot. This knowledge empowers you to:

- Set a realistic budget for your vehicle purchase.

- Negotiate with confidence, knowing your financing is already secured.

- Avoid being pressured into unsuitable loans by dealerships.

Pro Tip:

Pre-approval gives you negotiating power and clarity on your budget before stepping onto a lot. It separates the car-buying process from the loan-getting process, reducing stress and potential for manipulation.

What Legitimate Lenders Actually Look For (Even with Bad Credit)

Even with bad credit, legitimate lenders assess several factors to determine your creditworthiness:

- Proof of stable income and employment: They want to see that you have a consistent ability to make payments. This could include pay stubs, employment letters, or tax assessments for self-employed individuals.

- Debt-to-income ratio: This ratio measures how much of your gross monthly income goes towards debt payments. A lower ratio indicates you have more disposable income to cover a car loan.

- Down payment capability: A down payment reduces the loan amount and shows the lender you're committed. Even a small down payment can significantly improve your chances and terms. For guidance on what paperwork you'll need, even if it's for another province, the general requirements are similar across Canada. Check out Approval Secrets: Exactly What Paperwork You Need for Alberta Car Financing.

- Residency and identification: You'll need valid government-issued ID (e.g., driver's license) and proof of residency (e.g., utility bills in Quebec City or Sherbrooke).

The Role of a Co-Signer: When it Helps and When it's a Risk

A co-signer with good credit can significantly improve your chances of approval and secure better interest rates. However, it's a serious commitment: the co-signer is equally responsible for the loan. If you miss payments, their credit score will also be negatively impacted, and they'll be legally obligated to pay. Only consider this option with someone you trust implicitly and who understands the risks.

Building Your Case: Preparing Your Documentation for a Stronger Application

The more prepared you are, the smoother the application process. Gather these documents:

- Valid photo ID (e.g., Quebec driver's license).

- Proof of residency (e.g., utility bill, lease agreement).

- Proof of income (e.g., recent pay stubs, employment letter, T4s, notice of assessment for self-employed).

- Bank statements (recent 3-6 months).

- List of current debts and monthly payments.

- Information on any down payment you plan to make.

Decoding the Numbers: Interest Rates, Loan Terms, and Hidden Costs for Bad Credit Loans

Understanding the financial specifics of your loan is crucial, especially when your credit isn't perfect. Don't just look at the monthly payment; delve into the total cost.

Understanding APR vs. Simple Interest: What You're Really Paying

Simple Interest: Calculated only on the principal amount of the loan. Annual Percentage Rate (APR): This is the true cost of borrowing, expressed as a yearly rate. It includes not only the interest rate but also any additional fees or charges rolled into the loan. Always compare APRs, not just advertised interest rates, to get an accurate picture of the total cost.

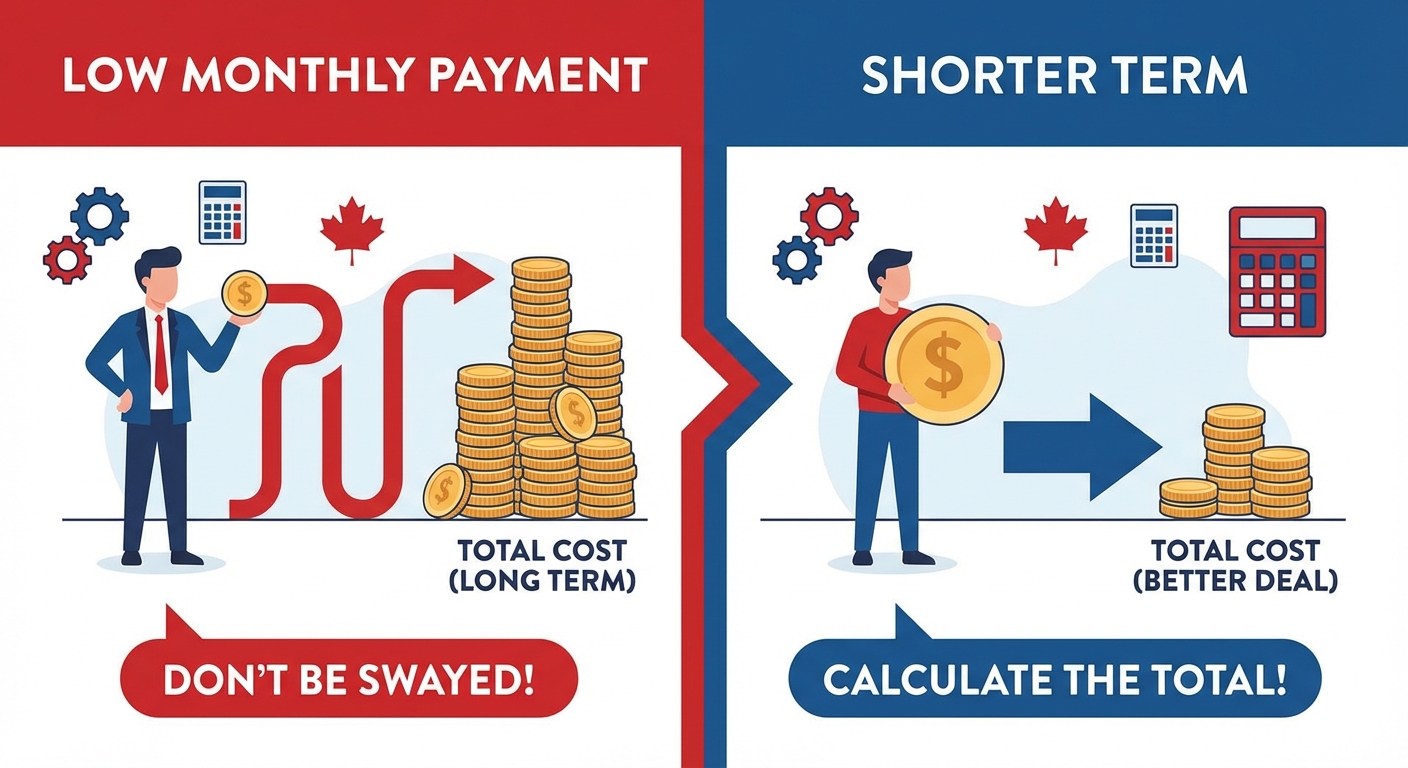

The Impact of Loan Terms: Why Longer Terms Cost More in the Long Run

While longer loan terms (e.g., 72 or 84 months) result in lower monthly payments, they significantly increase the total amount of interest you'll pay over the life of the loan. A shorter term, though with higher monthly payments, saves you money in the long run. Consider this example:

| Loan Amount | Interest Rate (APR) | Term (Months) | Monthly Payment (Approx.) | Total Interest Paid (Approx.) | Total Cost (Approx.) |

|---|---|---|---|---|---|

| $20,000 | 15% | 60 | $476 | $8,560 | $28,560 |

| $20,000 | 15% | 84 | $385 | $12,340 | $32,340 |

As you can see, extending the term by 24 months adds nearly $4,000 in interest.

The Down Payment Dilemma: How Much is Enough for Bad Credit?

A down payment is highly recommended for bad credit car loans. It reduces the amount you need to borrow, which lowers your monthly payments and the total interest paid. It also signals to lenders that you're a lower risk. While there's no magic number, aiming for 10-20% of the vehicle's price is a good starting point. Even a few hundred dollars can make a difference. If you're struggling with a down payment, our article Your Down Payment Just Called In Sick. Get Your Car might offer some alternative perspectives.

Unmasking Hidden Fees: Administration Fees, Documentation Fees, and Other Sneaky Charges

Beyond interest, look out for various fees that can inflate your loan cost:

- Administration or Processing Fees: Charges for setting up the loan.

- Documentation Fees: For preparing paperwork.

- PPSR/RDPRM Fees: For registering the lien on the vehicle (Personal Property Registry/Registre des droits personnels et réels mobiliers in Quebec).

- Extended Warranty or Insurance Products: These can be legitimate but are sometimes heavily marked up or unnecessary.

Pro Tip:

Request a full breakdown of all fees in writing before signing any agreement. If a fee isn't clearly explained or seems excessive, question it. Under Quebec's Consumer Protection Act, lenders must disclose all charges.

Secured vs. Unsecured Auto Loans: Why Most Car Loans are Secured

Most car loans are "secured" loans, meaning the vehicle itself acts as collateral. If you fail to make payments, the lender has the right to repossess the car. This reduces the risk for the lender, which is why they are often willing to lend to individuals with bad credit, albeit at higher interest rates. Unsecured loans (like personal loans) are much harder to obtain with bad credit and typically carry even higher interest rates.

The True Cost of a 'Good Deal': Calculating Total Interest Paid Over the Loan Term

Don't be swayed solely by a low monthly payment. Always calculate the total amount you will pay over the entire loan term, including all interest and fees. Sometimes, a slightly higher monthly payment on a shorter term is a much better "deal" in the long run.

Your Vehicle Choice Matters: Smart Car Buying Strategies for Bad Credit Borrowers in Quebec

The type of vehicle you choose can significantly impact your financial success and ability to rebuild credit.

New vs. Used: Which is Better for Rebuilding Credit?

For most bad credit borrowers, a reliable used car is the smarter choice. New cars depreciate rapidly the moment they leave the lot, and their higher price tag means a larger loan, more interest, and higher monthly payments. A well-chosen used car reduces your financial burden, making payments more manageable and increasing your chances of successfully repaying the loan and improving your credit score.

Reliability Over Luxury: Focusing on Affordable and Maintainable Cars

Resist the urge for a luxury vehicle. Your priority should be a reliable, fuel-efficient car with a proven track record for low maintenance costs. Research common issues, parts availability, and insurance costs for models you're considering. A cheap car with high repair bills will quickly negate any savings from a lower purchase price.

The Dangers of High-Mileage or Problematic Vehicles with Bad Credit Loans

Predatory lenders sometimes push high-mileage, unreliable vehicles because they can sell them at inflated prices. Getting a loan for such a car is a double trap: you're paying high interest on a depreciating asset that will likely incur significant repair costs, putting your ability to make loan payments at risk.

Independent Mechanic Inspections: A Non-Negotiable Step for Used Cars in Quebec

Before purchasing any used vehicle, especially from a used car dealership in Montreal, Laval, or anywhere in Quebec, insist on an independent pre-purchase inspection by a certified mechanic of your choosing. This small investment can save you thousands of dollars by uncovering hidden mechanical issues, accident damage, or other problems that the seller might not disclose.

Beyond the Loan: Rebuilding Your Credit and Financial Future in Quebec

A bad credit car loan, when secured responsibly, can be a powerful tool for credit rebuilding. Here's how to make the most of it:

Consistent On-Time Payments: The Cornerstone of Credit Repair

This is the most critical step. Every on-time payment you make is reported to credit bureaus and positively impacts your credit score. Set up automatic payments or calendar reminders to ensure you never miss a due date. This demonstrates financial responsibility and commitment.

Understanding Your Credit Report: Equifax and TransUnion in Canada

In Canada, Equifax and TransUnion are the two main credit bureaus. Regularly check your credit report from both agencies for accuracy. You are entitled to a free copy of your credit report annually. Review it for any errors or fraudulent activity that could be harming your score. Understanding your report helps you identify areas for improvement.

Diversifying Credit (Responsibly): Small Steps After Your Car Loan

Once you've established a good payment history with your car loan, consider responsibly diversifying your credit. This could mean a secured credit card or a small line of credit, used sparingly and paid off in full each month. Diversification, when managed well, can further boost your credit score.

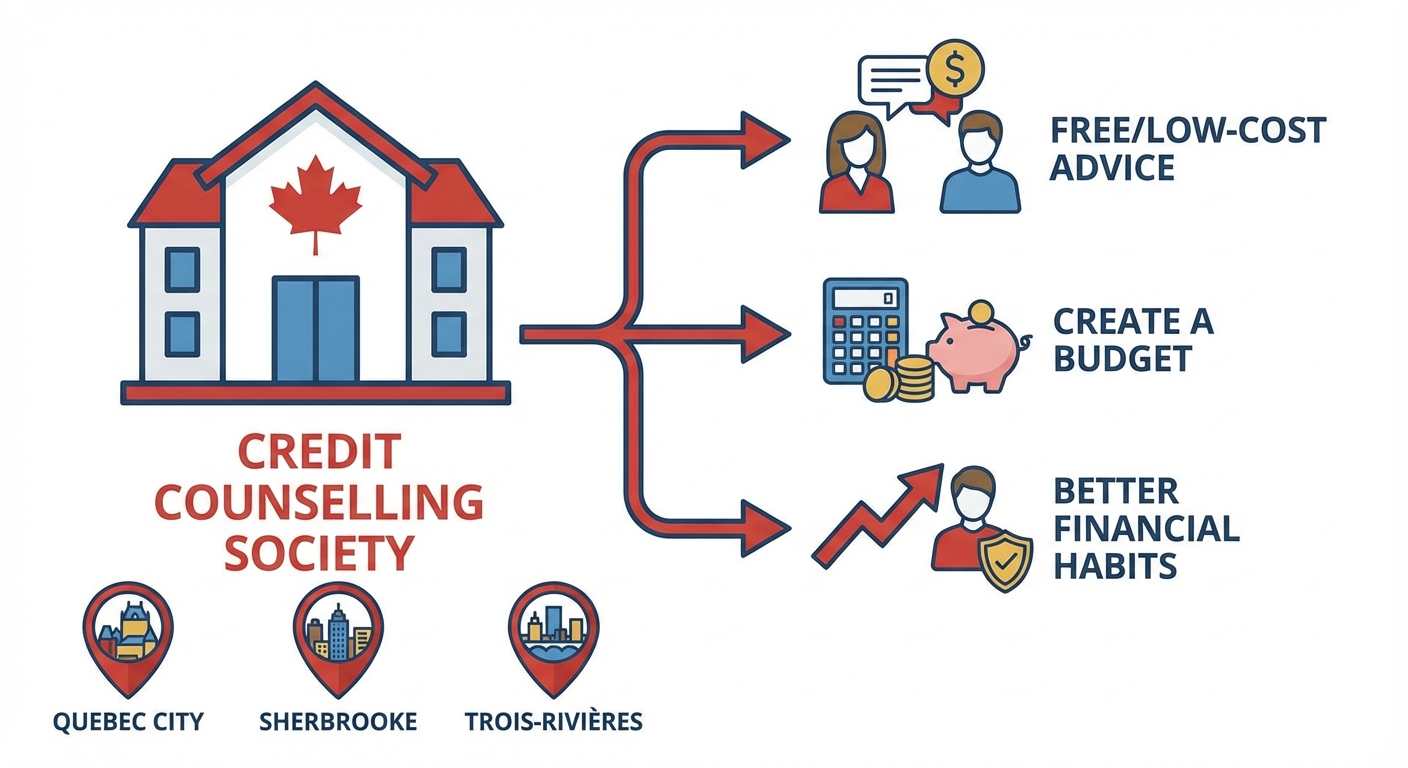

Budgeting and Financial Planning Resources in Quebec (e.g., local credit counselling services in Quebec City or Sherbrooke)

Don't be afraid to seek help. Quebec has numerous resources to assist with budgeting and financial planning. Non-profit credit counselling services (e.g., local branches of Credit Counselling Society) can provide free or low-cost advice, help you create a budget, and guide you towards better financial habits. These services are available in major centres like Quebec City, Sherbrooke, or Trois-Rivières.

Your Next Steps to Approval: A Checklist for Securing a Legitimate Bad Credit Car Loan in Quebec

Ready to move forward? Use this checklist to navigate the process confidently and securely:

- Assess Your Financial Situation Honestly: Understand your income, expenses, and what you can realistically afford for a monthly car payment.

- Research and Vet Lenders Thoroughly: Look for reviews, check their registration with the OPC, and verify their physical address. Don't just trust online ads.

- Gather All Necessary Documentation: Have your ID, proof of income, and residency documents ready to streamline the application.

- Apply for Pre-Approval (if possible): This strengthens your position and clarifies your budget before you shop for a car.

- Compare Offers Meticulously: Focus on the APR, total cost of the loan, and all terms and conditions, not just the monthly payment.

- Read Every Word of the Contract Before Signing: Don't be rushed. Ask questions about anything you don't understand. If something seems off, it probably is.

- Don't Be Afraid to Walk Away: If a deal feels wrong, the lender is pushy, or the terms are unclear, simply walk away. There are always other legitimate options.