They Said 'No' After Your Proposal? We Just Said 'Drive!

Table of Contents

- They Said 'No' After Your Proposal? We Just Said 'Drive!'

- Key Takeaways

- Beyond the 'No': Why a Car Loan is Your 'Yes' to Rebuilding Credit

- The Consumer Proposal Stigma: Debunked

- The 'R7' Rating: Understanding Your Current Credit Snapshot

- Strategic Rebuilding: How a Car Loan Becomes Your Credit Catalyst

- Decoding Your Post-Proposal Financial Landscape: What Lenders Really See

- Beyond the Score: The Holistic View Lenders Take

- The Power of a Down Payment: Speaking Volumes to Lenders

- Navigating the Lender Labyrinth: Your Guide to Who Will Say 'Yes' (and How to Pick Wisely)

- Alternative Lenders: Your First Port of Call (and How to Spot the Good Ones)

- The Big Banks: When Do They Re-Enter the Picture?

- Crafting Your Irresistible Application: More Than Just Numbers

- The Art of Presentation: What to Bring to the Table

- Leveraging Your Assets: The Strategic Trade-In

- The Co-Signer Conundrum: A Double-Edged Sword?

- Choosing the Right Vehicle: Affordability as Your Anchor

- The Drive for Better Rates: Strategies to Save Money and Avoid Hidden Costs

- Deconstructing the Interest Rate: Factors Influencing Your Payments

- Short-Term vs. Long-Term Loans: The True Cost of 'Low Payments'

- Beyond the Sticker Price: Unmasking Hidden Fees and Add-ons

- Crafting Your Irresistible Application: More Than Just Numbers

- The Art of Presentation: What to Bring to the Table

- Leveraging Your Assets: The Strategic Trade-In

- The Co-Signer Conundrum: A Double-Edged Sword?

- Choosing the Right Vehicle: Affordability as Your Anchor

- Beyond the Car: Your Roadmap to a Stronger Score and Financial Freedom

- Maximizing Your Credit Building Potential

- Complementary Credit Building: The Power of a Secured Credit Card (or Two)

- Monitoring Your Progress: The Importance of Regular Credit Checks

- Refinancing Your Way to Savings: The Mid-Journey Upgrade

- Your Next Steps to Approval: An Actionable Plan for the Road Ahead

- Step 1: Assess Your Readiness

- Step 2: Research and Compare Lenders

- Step 3: Prepare Your Application

- Step 4: Negotiate Like a Pro

- Step 5: Drive Off with Confidence

- The Long Game: Staying on Track for

They Said 'No' After Your Proposal? We Just Said 'Drive!'

The sting of rejection after a consumer proposal can feel like a dead end, especially when you need a car. You’ve worked hard to take control of your finances, made a commitment, and are now looking forward, only to be met with a frustrating "no" when you try to secure a necessary vehicle. It’s a common misconception that a consumer proposal permanently shuts the door on significant financing, leaving you stranded without reliable transportation. But what if we told you that not only can you get a car loan, but it can be your strategic vehicle to rebuild credit and reclaim financial freedom? This deep-dive article will dismantle the myths, empower you with knowledge, and provide a clear roadmap to securing a car loan specifically designed to rebuild your credit after a consumer proposal. We understand the challenges you face, and we're here to show you that a car loan isn't just about getting from A to B; it's a powerful tool to accelerate your journey back to a strong financial standing.

Key Takeaways

- A car loan after a consumer proposal is absolutely possible, both during and post-discharge.

- It's not just about getting a car; it's a powerful tool to actively rebuild your credit score.

- You'll likely start with alternative lenders, but understanding them is key to avoiding pitfalls.

- A strong down payment, stable income, and demonstrating responsibility are your biggest assets.

- Vigilance against predatory lending and hidden fees is crucial; smart comparison is your shield.

- This loan can be a stepping stone to better rates and traditional financing in the future.

Beyond the 'No': Why a Car Loan is Your 'Yes' to Rebuilding Credit

Hearing "no" can be disheartening, but it's crucial to understand that a consumer proposal is not a life sentence for your credit. In Canada, a consumer proposal is a legally binding agreement between you and your unsecured creditors, allowing you to pay back a portion of what you owe over a period of up to five years. While it certainly impacts your credit rating, it's designed to help you avoid bankruptcy and get a fresh start. Many people mistakenly believe that once a proposal is filed, all doors to financing slam shut indefinitely. This simply isn't true, especially when it comes to a secured loan like an auto loan.

The Consumer Proposal Stigma: Debunked

A consumer proposal, while a serious financial step, is often a responsible choice for Canadians overwhelmed by debt. It demonstrates that you've taken action to address your financial challenges rather than ignoring them. While it remains on your credit report for a period (typically three years after completion or six years from filing, whichever comes first), it doesn't mean you're unlendable. Lenders, particularly those specializing in non-prime credit, understand that life happens. They look for signs of stability, a willingness to repay, and a path forward. For more on this, check out our guide on Your Consumer Proposal? We're Handing You Keys.

The 'R7' Rating: Understanding Your Current Credit Snapshot

When you enter a consumer proposal, your credit report will typically show an R7 rating. This specific rating indicates that you are currently under a consumer proposal or making regular payments as agreed under a debt management program. It tells potential lenders that while you are managing your existing obligations as per the proposal, you are still considered a higher risk compared to someone with a perfect payment history (R1 rating). This R7 rating is precisely why traditional banks might initially hesitate, but it's also why a dedicated network of lenders exists to help you. Understanding this rating is your first step in navigating the lending landscape.

Strategic Rebuilding: How a Car Loan Becomes Your Credit Catalyst

Here’s the powerful truth: a car loan, especially after a consumer proposal, isn't just a means to transportation; it's a strategic tool for credit rebuilding. Unlike unsecured credit, an auto loan is secured by the vehicle itself. This reduces the risk for lenders, making them more willing to approve your application. When you make consistent, on-time payments on a car loan, you are actively demonstrating responsible financial behaviour. Each payment you make is reported to credit bureaus (Equifax and TransUnion), slowly but surely chipping away at the negative impact of your proposal and building a new, positive payment history. This consistent positive activity can significantly improve your credit score faster than many other methods, paving the way for better financial opportunities in the future.

Decoding Your Post-Proposal Financial Landscape: What Lenders Really See

When you apply for a car loan after a consumer proposal, lenders aren't just looking at your R7 rating. They're trying to piece together a comprehensive picture of your current financial health and your ability to manage new debt responsibly. Think of it as an interview where every piece of financial information tells a part of your story.

Beyond the Score: The Holistic View Lenders Take

While your credit score and history are important, they are not the only factors. Lenders specializing in non-prime loans understand that a consumer proposal doesn't define your future. They delve deeper into several key areas:

- Income Stability: Do you have a consistent and verifiable source of income? This includes employment income, but also other stable sources. For self-employed individuals, this might require different documentation. You might find our article on Self-Employed? Your Bank Statement is Our 'Income Proof'. helpful.

- Employment History: A long, stable employment history signals reliability. Frequent job changes can raise red flags.

- Residency: How long have you lived at your current address? Stability here also indicates a lower risk.

- Debt-to-Income Ratio (DTI): This ratio compares your total monthly debt payments (including the proposed car loan) to your gross monthly income. Lenders want to see that you have enough disposable income to comfortably afford the new payment. A lower DTI is always better.

- Down Payment: This is a crucial differentiator.

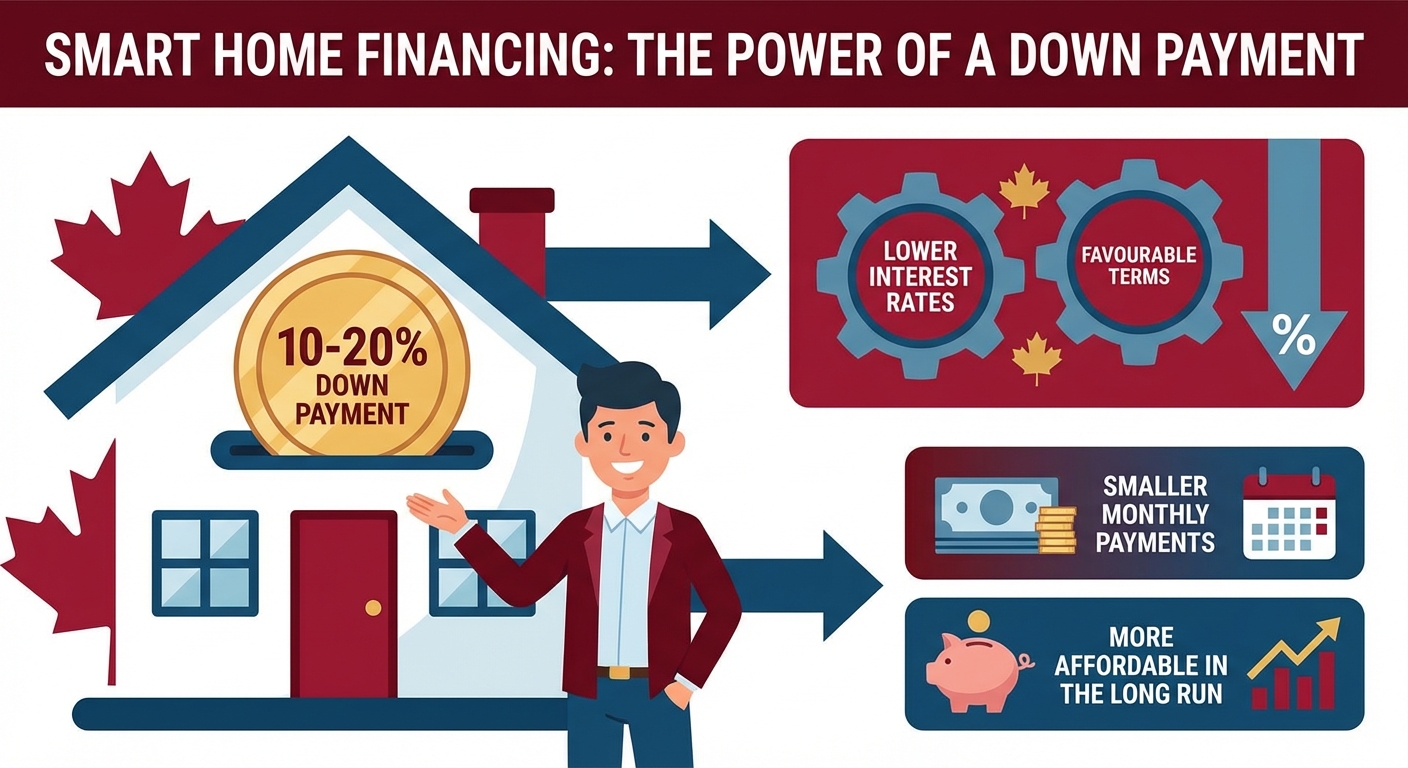

The Power of a Down Payment: Speaking Volumes to Lenders

A down payment is arguably one of your most powerful assets when seeking a car loan after a consumer proposal. Why?

- Reduces Lender Risk: The more you put down, the less the lender has to finance, and the lower their exposure if you default.

- Shows Commitment: It demonstrates your serious intent and ability to save, which speaks volumes about your financial discipline post-proposal.

- Better Terms: A substantial down payment (even 10-20%) can often lead to lower interest rates and more favourable loan terms, making the loan more affordable in the long run.

- Lower Monthly Payments: A smaller principal means smaller monthly payments, easing your budget.

(Context: Infographic illustrating the 'before/after' of a credit score journey, showing an R7 rating transitioning to improving scores with responsible credit use.)

Navigating the Lender Labyrinth: Your Guide to Who Will Say 'Yes' (and How to Pick Wisely)

After a consumer proposal, the traditional big banks might not be your first stop. That's perfectly normal. The good news is that Canada has a robust ecosystem of lenders who specialize in helping individuals rebuild their credit, including those who have completed or are still within a consumer proposal.

Alternative Lenders: Your First Port of Call (and How to Spot the Good Ones)

Alternative lenders are the backbone of non-prime auto financing. They have different lending criteria than traditional banks, often focusing more on your current income stability and willingness to pay, rather than solely your past credit history.

The World of Subprime Auto Lenders: These lenders specialize in providing loans to individuals with less-than-perfect credit. They understand the nuances of a consumer proposal. While their interest rates are generally higher than prime rates (reflecting the increased risk), they are often your best bet for approval. What to expect:

- Higher Interest Rates: Prepare for rates that could range from 9% to 29.99% or even higher, depending on your specific situation, province, and the lender.

- Flexible Criteria: They look at your overall financial picture, not just your credit score.

- Loan Terms: Terms can vary, but typically range from 36 to 72 months.

Credit Unions: Often More Forgiving, Community-Focused Options: Credit unions are member-owned financial institutions that often offer a more personalized approach. Because they are community-focused, they can sometimes be more flexible and understanding of individual circumstances, including consumer proposals. It's worth exploring local credit unions, as they might offer slightly better rates or terms than some subprime lenders, especially if you have an existing relationship with them.

Dealership Financing: The Convenience vs. The Cost: Many dealerships offer in-house financing or work with a network of lenders, including subprime ones. This can be incredibly convenient, allowing you to apply for a loan and purchase a vehicle all in one place. However, it's crucial to understand the difference between:

- In-house financing: The dealership itself is the lender. This can be quicker but sometimes comes with less competitive rates.

- Dealership-brokered loans: The dealership acts as an intermediary, connecting you with third-party lenders. They often have relationships with various banks and alternative lenders. This is often where you'll find the most options.

When dealing with dealership financing, always be prepared to negotiate. They want to sell you a car, and you want the best loan terms. Don't be afraid to walk away if the offer isn't right. For more insights into navigating post-proposal financing, read The Consumer Proposal Car Loan You Were Told Was Impossible.

The Big Banks: When Do They Re-Enter the Picture?

The major Canadian banks (RBC, TD, BMO, CIBC, Scotiabank, National Bank) will generally be hesitant to approve an auto loan while your consumer proposal is still active or for a period after its discharge. They typically prefer borrowers with an R1 credit rating and a clean credit history. However, once your proposal is fully discharged and you've spent 1-2 years consistently making payments on a new credit-building loan (like a car loan or secured credit card), your credit score will begin to recover significantly. At this point, refinancing your existing car loan with a traditional bank becomes a real possibility, often at a much lower interest rate.

- Extremely High-Pressure Sales: If you feel rushed or coerced into signing, take a step back.

- Vague Contract Terms: Ensure every detail, especially interest rates, fees, and payment schedules, is clearly outlined and understood.

- Unnecessary Add-ons: Be wary of mandatory, expensive add-ons like extended warranties or rust proofing that significantly inflate the loan amount.

- 'Loan Flipping': Where a lender encourages you to refinance your loan repeatedly, often adding more fees each time.

- Guaranteed Approval Claims: No legitimate lender can guarantee approval without reviewing your application.

Crafting Your Irresistible Application: More Than Just Numbers

An application isn't just a form; it's your opportunity to present yourself as a reliable borrower. After a consumer proposal, you need to go above and beyond to showcase your financial stability and commitment to rebuilding.

The Art of Presentation: What to Bring to the Table

Being prepared is half the battle. Having all your documents organized and ready will streamline the application process and demonstrate your seriousness to the lender. Here’s a comprehensive checklist:

- Proof of Income: Recent pay stubs (3-4), employment letter, or tax returns/bank statements if self-employed.

- Proof of Residency: Utility bills, lease agreement, or mortgage statement with your current address.

- Identification: Valid Canadian driver’s licence and another piece of government-issued ID.

- Bank Statements: Recent statements (3-6 months) to show financial activity and stability.

- Consumer Proposal Documents: Proof of filing and, if applicable, proof of discharge.

- References: Sometimes required, typically non-family members.

- Trade-in Documents: If applicable, vehicle ownership, lien release (if paid off), and service records.

Leveraging Your Assets: The Strategic Trade-In

If you currently own a vehicle, even one with some issues, consider using it as a trade-in. The value of your trade-in directly reduces the amount you need to finance, which lowers your monthly payments and overall interest paid. A trade-in acts much like a down payment, making your application more attractive to lenders. Ensure you get a fair valuation for your vehicle; research its market value beforehand.

The Co-Signer Conundrum: A Double-Edged Sword?

A co-signer with good credit can significantly improve your chances of approval and potentially secure a lower interest rate. They essentially guarantee the loan if you default.

When a co-signer might help: If your income is borderline, or your credit score is still very low, a co-signer can provide the additional security a lender needs.

The risks involved: For the co-signer, it’s a serious commitment. The loan will appear on their credit report, and they are legally responsible for the full debt if you can't pay. This can strain relationships if things go wrong. For you, it means you're relying on someone else's credit, which, while helpful, doesn't build your own credit independently as strongly as a solo loan would.

Alternatives: If a co-signer isn't available or desirable, focus on building up a larger down payment, proving income stability, and selecting a more affordable vehicle.

Choosing the Right Vehicle: Affordability as Your Anchor

This is perhaps the most critical decision. After a consumer proposal, your priority should be credit rebuilding and financial stability, not luxury.

- Reliability Over Flash: Opt for a reliable used vehicle that will get you where you need to go without constant, expensive repairs.

- Budget Alignment: Choose a car that comfortably fits within your budget, allowing you to make payments without stress. Remember, you want to build positive credit, and that means never missing a payment.

- Consider the Total Cost: Factor in insurance, fuel, maintenance, and registration when calculating affordability, not just the monthly loan payment.

The Drive for Better Rates: Strategies to Save Money and Avoid Hidden Costs

Securing a car loan after a consumer proposal often means starting with a higher interest rate. This is the reality of rebuilding credit. However, understanding how rates are determined and how to mitigate costs can save you a significant amount of money over the life of your loan.

Deconstructing the Interest Rate: Factors Influencing Your Payments

Lenders calculate interest rates based on a complex assessment of risk. For post-proposal borrowers, the key factors include:

- Your Credit History: The R7 rating and the time since your proposal was filed/discharged are primary drivers.

- Income and Employment Stability: A steady job and verifiable income reduce risk.

- Down Payment: A larger down payment significantly lowers the principal and thus the risk, often resulting in a better rate.

- Debt-to-Income Ratio: A lower DTI indicates you have more capacity to take on new debt.

- Vehicle Type: Older, less valuable cars might sometimes carry slightly higher rates due to lower resale value, but this is less common for established dealerships.

- Loan Term: Longer terms often come with slightly higher rates, as the lender is exposed to risk for a longer period.

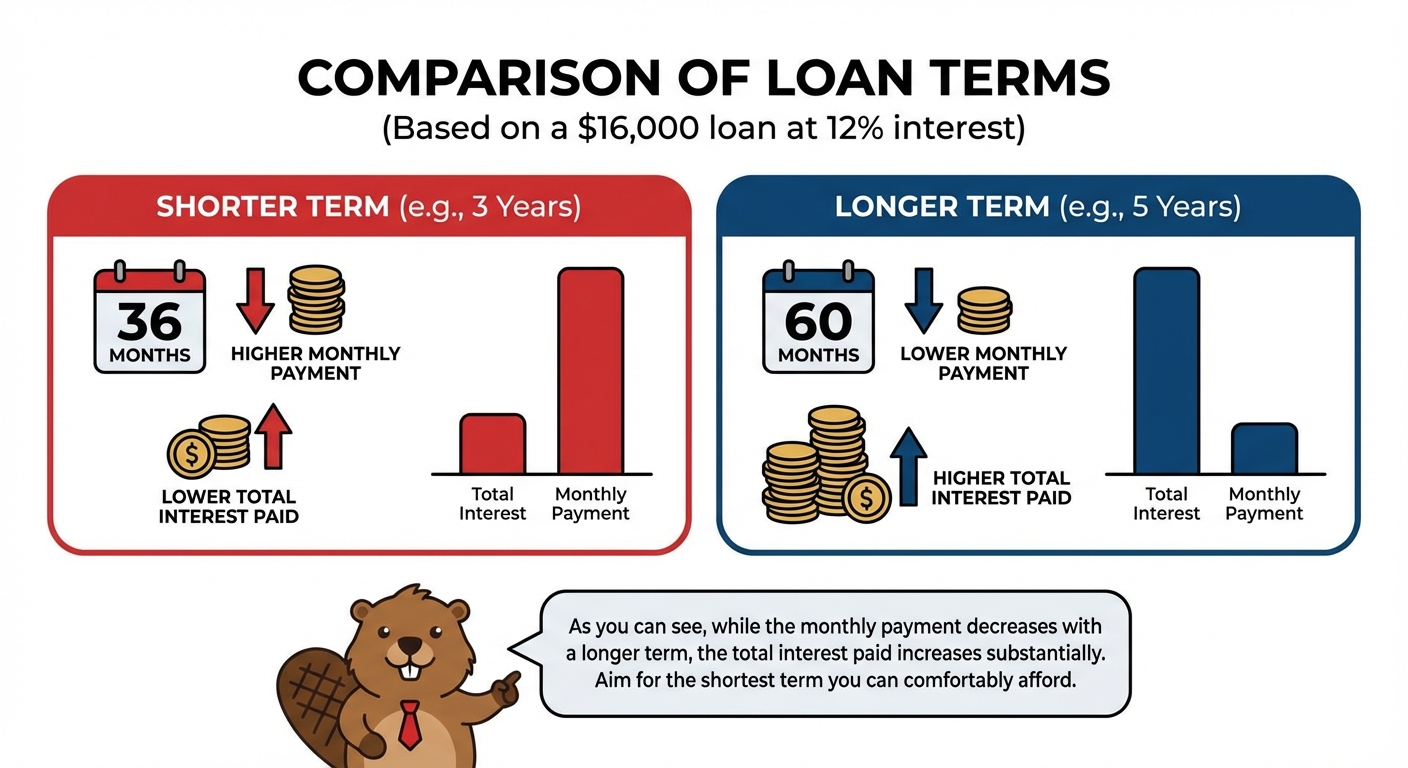

Short-Term vs. Long-Term Loans: The True Cost of 'Low Payments'

It's tempting to choose the longest loan term possible to achieve the lowest monthly payment. However, this often leads to paying significantly more in interest over the life of the loan.

| Loan Term (Months) | Monthly Payment (Example) | Total Interest Paid (Example) | Total Cost (Example) |

|---|---|---|---|

| 48 | $400 | $3,200 | $19,200 |

| 60 | $340 | $4,400 | $20,400 |

| 72 | $300 | $5,600 | $21,600 |

As you can see, while the monthly payment decreases with a longer term, the total interest paid increases substantially. Aim for the shortest term you can comfortably afford.

(Context: A comparison chart showing the total cost of a car loan with different interest rates and loan terms, emphasizing the impact of higher rates post-proposal.)

(Context: A comparison chart showing the total cost of a car loan with different interest rates and loan terms, emphasizing the impact of higher rates post-proposal.)

Beyond the Sticker Price: Unmasking Hidden Fees and Add-ons

The car's price is just one component. Dealerships often offer various add-ons that can significantly inflate your total loan amount. Always question their necessity:

- Extended Warranties: Can be useful, but compare coverage and price with third-party providers. Are they truly necessary for a reliable used car?

- Rust Proofing/Undercoating: Often overpriced and sometimes unnecessary, especially for newer vehicles with factory rust protection.

- Credit Insurance (Life/Disability): Covers payments if you can't work. Evaluate if you already have adequate insurance coverage elsewhere.

- Fabric Protection/Paint Sealants: Usually high-margin items with questionable long-term value.

- Administrative/Documentation Fees: These are common, but ensure they are reasonable and disclosed upfront.

Don't be afraid to decline add-ons you don't need or want. Every extra dollar financed means more interest paid.

Crafting Your Irresistible Application: More Than Just Numbers

An application isn't just a form; it's your opportunity to present yourself as a reliable borrower. After a consumer proposal, you need to go above and beyond to showcase your financial stability and commitment to rebuilding.

The Art of Presentation: What to Bring to the Table

Being prepared is half the battle. Having all your documents organized and ready will streamline the application process and demonstrate your seriousness to the lender. Here’s a comprehensive checklist:

- Proof of Income: Recent pay stubs (3-4), employment letter, or tax returns/bank statements if self-employed.

- Proof of Residency: Utility bills, lease agreement, or mortgage statement with your current address.

- Identification: Valid Canadian driver’s licence and another piece of government-issued ID.

- Bank Statements: Recent statements (3-6 months) to show financial activity and stability.

- Consumer Proposal Documents: Proof of filing and, if applicable, proof of discharge.

- References: Sometimes required, typically non-family members.

- Trade-in Documents: If applicable, vehicle ownership, lien release (if paid off), and service records.

Leveraging Your Assets: The Strategic Trade-In

If you currently own a vehicle, even one with some issues, consider using it as a trade-in. The value of your trade-in directly reduces the amount you need to finance, which lowers your monthly payments and overall interest paid. A trade-in acts much like a down payment, making your application more attractive to lenders. Ensure you get a fair valuation for your vehicle; research its market value beforehand.

The Co-Signer Conundrum: A Double-Edged Sword?

A co-signer with good credit can significantly improve your chances of approval and potentially secure a lower interest rate. They essentially guarantee the loan if you default.

When a co-signer might help: If your income is borderline, or your credit score is still very low, a co-signer can provide the additional security a lender needs.

The risks involved: For the co-signer, it’s a serious commitment. The loan will appear on their credit report, and they are legally responsible for the full debt if you can't pay. This can strain relationships if things go wrong. For you, it means you're relying on someone else's credit, which, while helpful, doesn't build your own credit independently as strongly as a solo loan would.

Alternatives: If a co-signer isn't available or desirable, focus on building up a larger down payment, proving income stability, and selecting a more affordable vehicle.

Choosing the Right Vehicle: Affordability as Your Anchor

This is perhaps the most critical decision. After a consumer proposal, your priority should be credit rebuilding and financial stability, not luxury.

- Reliability Over Flash: Opt for a reliable used vehicle that will get you where you need to go without constant, expensive repairs.

- Budget Alignment: Choose a car that comfortably fits within your budget, allowing you to make payments without stress. Remember, you want to build positive credit, and that means never missing a payment.

- Consider the Total Cost: Factor in insurance, fuel, maintenance, and registration when calculating affordability, not just the monthly loan payment.

Beyond the Car: Your Roadmap to a Stronger Score and Financial Freedom

Getting the car loan is a huge step, but it's just the beginning of your credit rebuilding journey. The real magic happens with how you manage this new responsibility.

Maximizing Your Credit Building Potential

Once approved, ensure your loan is reported correctly and consistently to both Equifax and TransUnion, Canada’s primary credit bureaus. Most reputable lenders will do this automatically, but it doesn't hurt to confirm. Your regular, on-time payments are the fuel for your credit score's engine. Each month you pay on time, your credit report gains another positive mark, steadily improving your score and demonstrating your reliability.

Complementary Credit Building: The Power of a Secured Credit Card (or Two)

While your car loan is a significant credit builder, don't put all your eggs in one basket. A secured credit card is an excellent complementary tool. You provide a deposit (e.g., $300-$500), which becomes your credit limit. Using it for small, regular purchases (like groceries or gas) and paying the balance in full *before* the due date each month can rapidly accelerate your credit rebuilding efforts. It shows lenders you can manage both installment credit (car loan) and revolving credit (credit card) responsibly.

Monitoring Your Progress: The Importance of Regular Credit Checks

Your credit report and score are not static. They change based on your financial activity. Regularly checking your credit report (you're entitled to a free copy annually from each bureau) allows you to:

- Monitor your progress and see your score improve.

- Spot any errors or fraudulent activity.

- Understand what factors are impacting your score.

Knowing where you stand helps you make informed financial decisions. For specific insights into credit scores, consider reading The Truth About the Minimum Credit Score for Ontario Car Loans.

Refinancing Your Way to Savings: The Mid-Journey Upgrade

Once you've made 12-24 months of consistent, on-time payments on your car loan and your consumer proposal is discharged (or well on its way), your credit score will likely have improved significantly. This is when you can consider refinancing your car loan. Refinancing involves taking out a new loan, typically at a much lower interest rate, to pay off your original, higher-interest loan. This can save you thousands of dollars over the remaining term of your loan and further solidify your credit standing. This is a powerful strategy for long-term savings. Our article on Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit offers more details.

Your Next Steps to Approval: An Actionable Plan for the Road Ahead

You have the knowledge; now it's time for action. Securing a car loan after a consumer proposal is entirely achievable with the right strategy and mindset.

Step 1: Assess Your Readiness

- Financial Stability Checklist: Ensure you have stable employment, a consistent income, and a clear budget that allows for car payments, insurance, and maintenance.

- Document Gathering: Collect all necessary documents (ID, proof of income, residency, bank statements, consumer proposal documents) to be ready for your application.

Step 2: Research and Compare Lenders

- Find Reputable Alternative Lenders: Look for dealerships and finance companies that specialize in non-prime auto loans and have positive customer reviews.

- Compare Offers: Don't jump at the first offer. Apply with 2-3 lenders (within a short timeframe to minimize credit score impact) and compare interest rates, terms, and fees.

Step 3: Prepare Your Application

- Tailor Your Story: Be honest and upfront about your consumer proposal. Explain your current financial stability and your commitment to rebuilding credit.

- Highlight Your Strengths: Emphasize your stable income, down payment (if applicable), and consistent employment history.

Step 4: Negotiate Like a Pro

- Leverage Pre-Approval: Use any pre-approval offers to negotiate better terms.

- Question Add-ons: Be firm about declining unnecessary add-ons.

- Focus on Total Cost: Consider the total cost of the loan (principal + interest + fees), not just the monthly payment.

Step 5: Drive Off with Confidence

- Understand Your New Responsibilities: Know your payment schedule, interest rate, and all terms of your loan agreement.

- Maintain Momentum: Commit to making every payment on time, exploring secured credit cards, and monitoring your credit score.