Edmonton Essential: Your Bankruptcy's Discharged. Your Drive Isn't.

Table of Contents

- Key Takeaways

- The Edmonton Pulse: Why an Essential Worker's Car Loan is Different Post-Bankruptcy Discharge

- Beyond the Bus Route: The Essential Worker's Imperative in Alberta

- Dispelling the Myth: Bankruptcy Discharge as a New Beginning, Not an End

- Navigating the New Landscape: What Lenders Really Look For After Discharge

- Beyond the Score: The Power of Your Post-Bankruptcy Financial Story

- The Document Dossier: Preparing Your Ironclad Case for Approval

- The 'Urgent' Factor: Expediting Your Application Without Sacrificing Due Diligence

- Express Lane or Careful Consideration? Balancing Speed and Smart Choices

- The Edmonton Connection: Local Lenders vs. National Chains & Dealerships

- Decoding the Numbers: Rates, Terms, and the True Cost of Your Post-Bankruptcy Car Loan

- The Reality of Rates: Expecting Higher, Planning for Better

- Hidden Costs & Fees: What to Scrutinize in Your Loan Agreement

- Loan Terms & Affordability: Striking the Right Balance

- Your Vehicle, Your Re-Establishment: Smart Choices for Long-Term Success

- Beyond the Showroom Floor: Practical Vehicle Selection for Edmonton Winters and Essential Work

- The Trade-In Dilemma: When to Keep, When to Let Go

- The Road Ahead: Building Back Credit and Future Financial Freedom

- Your Car Loan as a Credit-Building Powerhouse

- Refinancing Opportunities: Lowering Your Payments, Saving on Interest

- Beyond the Car: Holistic Financial Wellness in Alberta

- Your Next Steps to Approval: An Action Plan for Essential Workers in Edmonton

- Frequently Asked Questions (FAQ): Your Post-Bankruptcy Car Loan Queries Answered

Bankruptcy. The word itself can feel like a heavy weight, suggesting an end to financial possibilities. But for essential workers in Edmonton, Alberta, facing a discharged bankruptcy, it's crucial to understand that this isn't a dead end for your driving future. In fact, it's often the very catalyst for a powerful new beginning. Life in a sprawling city like Edmonton, particularly when you're on the front lines, demands reliable transportation. Whether you're a healthcare professional navigating shift work, a tradesperson commuting to remote job sites, or a first responder needing to be ready at a moment's notice, your vehicle isn't a luxury; it's an essential tool for your livelihood and your contribution to the community.

At SkipCarDealer.com, we understand the unique challenges and immense potential of individuals who have successfully navigated bankruptcy. We know that a discharged bankruptcy signifies a commitment to a fresh financial start, and for essential workers, that commitment is often backed by stable employment and a critical role in the community. This article will be your comprehensive guide to securing a car loan in Edmonton after your bankruptcy has been discharged, transforming what might seem like a barrier into a stepping stone towards renewed financial health and the dependable drive you deserve.

Key Takeaways

- Bankruptcy discharge isn't a dead end for car financing; it's a powerful new beginning, especially for essential workers in Edmonton.

- Specialized lenders in Alberta understand post-bankruptcy scenarios and prioritize stable income and employment over past credit struggles.

- Preparation is paramount: gather all discharge documents, understand your new credit landscape, and meticulously budget for affordability.

- Expect initial interest rates to be higher, but a strategic approach can lead to refinancing opportunities and significant savings within 12-18 months.

- A responsibly managed car loan is a potent tool for rapidly rebuilding your credit score and establishing a positive financial track record.

The Edmonton Pulse: Why an Essential Worker's Car Loan is Different Post-Bankruptcy Discharge

Beyond the Bus Route: The Essential Worker's Imperative in Alberta

In Alberta, particularly in a dynamic city like Edmonton, being an 'essential worker' carries significant weight, both for your community and for potential lenders. Your stable employment, consistent income, and vital community role build a compelling case that differentiates you from other applicants with past credit challenges. Lenders aren't just looking at a credit score; they're assessing risk, and a steady job in a high-demand sector significantly mitigates that risk.

Consider the unique transportation challenges faced by essential workers in sprawling Canadian cities. Edmonton's winters are legendary, and relying on public transit for early morning shifts at the hospital or late-night calls to a construction site can be impractical, uncomfortable, and even unsafe. The vast geographical spread of Edmonton and its surrounding areas, coupled with the demands of shift work, often makes a personal vehicle an absolute necessity. For nurses, tradespeople, first responders, teachers, and other vital professionals, a reliable vehicle directly links to job security, earning potential, and overall quality of life. It ensures you can get to work on time, transport necessary tools or equipment, and respond to emergencies, all while maintaining your well-being.

Dispelling the Myth: Bankruptcy Discharge as a New Beginning, Not an End

For many, the aftermath of bankruptcy feels like a financial prison sentence. However, understanding what 'discharged' truly means is the first step towards realizing your renewed borrowing capacity in Canada. A bankruptcy discharge is a legal release from the debts that were included in your bankruptcy. It signifies that you have fulfilled your obligations, and the slate has been wiped clean. This isn't just psychological relief; it's a legal reset that re-establishes your ability to engage in new financial agreements.

Lenders, especially those specializing in non-prime financing, differentiate significantly between an active bankruptcy, a recent default, and a fully discharged bankruptcy. An active bankruptcy presents higher risk due to ongoing legal obligations. A discharged bankruptcy, however, signals a fresh start. Lenders will now focus on your current capacity to pay, your employment stability, and your commitment to rebuilding your financial future, rather than solely dwelling on past struggles. This is where your status as an essential worker truly shines, providing tangible evidence of your current financial health and reliability.

Navigating the New Landscape: What Lenders Really Look For After Discharge

Beyond the Score: The Power of Your Post-Bankruptcy Financial Story

After a bankruptcy discharge, your traditional credit score will be significantly impacted. While it will begin to recover, it won't be the primary factor for immediate car loan approval. Instead, lenders are far more interested in your post-bankruptcy financial story. This means your current income stability, the length of time at your current essential job, and your post-discharge debt-to-income ratio now hold immense weight. Lenders want to see that you have a steady, reliable source of income that can comfortably cover a new car payment.

The 'fresh start' principle is paramount here. Lenders understand that people make mistakes or face unforeseen circumstances. They are primarily interested in your current ability and willingness to pay, not just your past financial challenges. A new, well-managed car loan strategically positions you within what's known as the 're-establishment period'. This is your opportunity to demonstrate responsible borrowing and timely payments, which will be meticulously reported to credit bureaus and rapidly improve your credit profile over time. Remember, your 'bad credit' isn't an insurmountable wall; it's a speed bump to your new car. For more on this, check out Your 'Bad Credit' Isn't a Wall. It's a Speed Bump to Your New Car, Toronto.

The Document Dossier: Preparing Your Ironclad Case for Approval

Preparation is key. To present an ironclad case for approval, you'll need to gather a comprehensive set of documents. This dossier tells your new financial story and proves your current capacity to lenders:

- Official Bankruptcy Discharge Papers: This is your golden ticket. It's the absolute proof of your fresh start and legal release from past debts. Ensure you have the official certificate.

- Proof of Stable Income: Lenders need to verify your ability to pay. Provide recent pay stubs (typically 3-6 months), official employment letters from your employer confirming your position and salary, and if you're self-employed, Canada Revenue Agency (CRA) Notices of Assessment (T4s or T1 Generals) or bank statements showing consistent business deposits. For more on how various income sources can qualify, read Your Income's a Playlist, Not a Single. Get Your Car, Edmonton.

- Proof of Residency: A valid Alberta driver's license with your current Edmonton address is ideal. Supplement this with recent utility bills (electricity, gas, internet) or a current lease agreement to confirm your stable living situation.

- Bank Statements: Recent bank statements (often 3-6 months) can demonstrate responsible money management post-discharge. Lenders look for consistent income deposits, regular bill payments, and an absence of frequent overdrafts.

- Down Payment Evidence: Even a modest down payment (e.g., 10-20% of the vehicle value) significantly improves your approval odds. It reduces the lender's risk, decreases the total amount borrowed, and shows your commitment and ability to save. Provide bank statements showing the funds.

For a detailed breakdown of all the paperwork you might need, refer to our comprehensive guide: Approval Secrets: Exactly What Paperwork You Need for Alberta Car Financing.

The 'Urgent' Factor: Expediting Your Application Without Sacrificing Due Diligence

Express Lane or Careful Consideration? Balancing Speed and Smart Choices

After bankruptcy, the urgency to regain normalcy, which often includes reliable transportation, is palpable. Many lenders advertise 'fast approval' or 'instant decisions,' and while these can be appealing, it's crucial to deconstruct what they truly entail. Often, 'fast approval' refers to an initial pre-qualification, not a final loan offer. Rushing into an agreement without proper research can lead to unfavourable terms, excessively high interest rates, or hidden fees that will cost you significantly in the long run.

The strategic advantage of pre-approval cannot be overstated. By understanding your borrowing power and budget before stepping onto a dealership lot, you gain control. Pre-approval allows you to shop for a vehicle with confidence, knowing exactly what you can afford, thus preventing overspending or being pressured into a deal that doesn't serve your long-term financial recovery. It also helps you identify and avoid predatory lenders who capitalize on your urgency by offering excessively high rates or unfavourable terms that are designed to keep you in debt.

The Edmonton Connection: Local Lenders vs. National Chains & Dealerships

When seeking a post-bankruptcy car loan, you have several avenues to explore. Specialized auto loan providers in Edmonton and across Alberta often have more flexible lending criteria than traditional banks. This includes local credit unions like Servus Credit Union, dealership finance departments that work with a network of subprime lenders, and dedicated finance companies that specialize in helping individuals rebuild credit.

Working with local experts can offer distinct advantages. They often understand the nuances of the provincial economy, specific employment sectors common in Edmonton, and regional lending practices. They might also be more willing to consider your individual story beyond just a credit score. While large national banks like Royal Bank of Canada, TD Canada Trust, or CIBC certainly operate in Alberta, their lending criteria for post-bankruptcy scenarios can be very stringent. Smaller, niche finance companies and in-house financing programs at dealerships, however, are often more equipped and willing to work with your unique situation.

Decoding the Numbers: Rates, Terms, and the True Cost of Your Post-Bankruptcy Car Loan

The Reality of Rates: Expecting Higher, Planning for Better

Let's be realistic: after a bankruptcy discharge, your initial interest rates will be elevated. This is a reflection of the lender's perceived risk. You'll likely be in the subprime lending market in Alberta, where typical Annual Percentage Rates (APR) can range from 9.99% to 29.99%. Understanding APR (Annual Percentage Rate) is crucial, as it provides a more accurate picture of the total cost of borrowing, including interest and certain fees, compared to simple interest.

Several key factors will influence your specific rate: your post-bankruptcy credit profile (even if low, any recent positive activity helps), your income stability, the size of your down payment, the chosen vehicle's age and value, and the loan term. A larger down payment, a newer vehicle, and a shorter loan term generally lead to lower interest rates because they reduce the lender's risk.

Hidden Costs & Fees: What to Scrutinize in Your Loan Agreement

Beyond the interest rate, a car loan agreement can contain various fees that add to the total cost. Be diligent in scrutinizing all aspects of your loan agreement. Common fees you might encounter include:

- Origination Fees: A charge for processing the loan.

- Administrative Charges: Fees for handling paperwork and setting up the account.

- PPSA (Personal Property Security Act) Registration Fees: Specific to Alberta, this fee registers the lender's security interest in your vehicle, ensuring they have a claim to it if you default.

- Documentation Fees: For preparing the sales contract and other necessary documents.

You might also be offered optional add-ons like extended warranties, rustproofing, or GAP insurance. While some of these can offer value, critically evaluate if they are necessary now. It's often wiser to prioritize securing the loan and a reliable vehicle, then consider adding these extras later once your financial footing is stronger. Also, understand prepayment penalties. A good loan agreement should allow for early repayment or refinancing without prohibitive fees, which will be crucial for your credit rebuilding strategy.

Loan Terms & Affordability: Striking the Right Balance

The loan term is a critical trade-off. Longer terms (e.g., 72-84 months) lead to lower monthly payments, making the vehicle seem more affordable. However, they significantly increase the overall interest paid over the life of the loan. Shorter terms mean higher monthly payments but result in substantially less interest paid and faster equity building in your vehicle.

Setting a realistic monthly budget is paramount. This budget must comprehensively include not just the loan payments, but also insurance (which can be higher post-bankruptcy), fuel, and essential maintenance. This is especially crucial for Edmonton's varying climate, which can necessitate more frequent maintenance or specific tire changes. Choosing a reliable, affordable vehicle (e.g., specific brands known for durability and lower maintenance costs like Honda Civic, Toyota Corolla, Hyundai Elantra, Mazda 3) is a smarter financial move than overextending for a luxury model immediately post-discharge. This pragmatic approach supports your financial recovery.

| Loan Term (Months) | Monthly Payment (Approx.) | Total Interest Paid (Approx.) | Pros | Cons |

|---|---|---|---|---|

| 48 | $450 | $3,600 | Lower total interest, faster equity, quicker path to refinancing. | Higher monthly payment, requires more immediate cash flow. |

| 60 | $370 | $4,200 | Balanced payments, moderate interest. | Still significant interest, longer repayment period. |

| 72 | $320 | $4,800 | Lower monthly payment, easier on budget. | Higher total interest, slower equity, potential for negative equity longer. |

| 84 | $280 | $5,400+ | Lowest monthly payment, maximum budget flexibility. | Highest total interest, very slow equity building, increased risk of negative equity. |

Your Vehicle, Your Re-Establishment: Smart Choices for Long-Term Success

Beyond the Showroom Floor: Practical Vehicle Selection for Edmonton Winters and Essential Work

When selecting a vehicle after bankruptcy, practicality and reliability should trump desire for luxury. Focus on cars with strong track records for durability, readily available and affordable parts, and reasonable maintenance costs. For an essential worker in Edmonton, fuel efficiency is also a critical consideration, directly impacting your overall monthly budget, especially with daily commutes across the city and surrounding areas.

Furthermore, appropriate features for Alberta driving are non-negotiable. All-wheel drive or four-wheel drive can provide invaluable traction during our harsh winters. Robust heating systems are a must, and investing in quality winter tires is an absolute necessity, not an option. A certified pre-owned (CPO) vehicle or a well-inspected used car often represents the wisest choice for your first post-bankruptcy loan. These options minimize depreciation, lower the initial cost, and still provide the reliability you need without the premium price tag of a brand-new vehicle.

The Trade-In Dilemma: When to Keep, When to Let Go

If you currently own a vehicle, you might face the 'trade-in dilemma.' If your existing vehicle has negative equity (meaning you owe more than it's worth), understanding your options is crucial. Rolling negative equity into a new loan will increase your new loan amount, leading to higher monthly payments and extending your debt. In some cases, selling your current vehicle privately, even at a slight loss, or exploring alternatives might be a better financial move than burdening your fresh start with old debt.

How trading in a vehicle impacts your new loan amount, monthly payments, and overall debt load needs careful consideration. Always get an independent valuation of your trade-in to ensure you're getting a fair offer. Sometimes, the best strategy is to simplify and aim for a clean start with your new post-bankruptcy loan.

The Road Ahead: Building Back Credit and Future Financial Freedom

Your Car Loan as a Credit-Building Powerhouse

This is where your car loan truly becomes a strategic asset. Every consistent, on-time payment you make on your auto loan is meticulously reported to credit bureaus (Equifax and TransUnion). This positive payment history will rapidly improve your credit score. Lenders want to see a pattern of responsible behaviour, and a car loan is an excellent way to demonstrate that. After establishing a solid payment history with your car loan, consider strategically diversifying your credit mix with a secured credit card or a small personal loan, but only if you can manage them responsibly. Regularly monitoring your credit score and report using free services available in Canada will allow you to track your progress and identify any errors promptly.

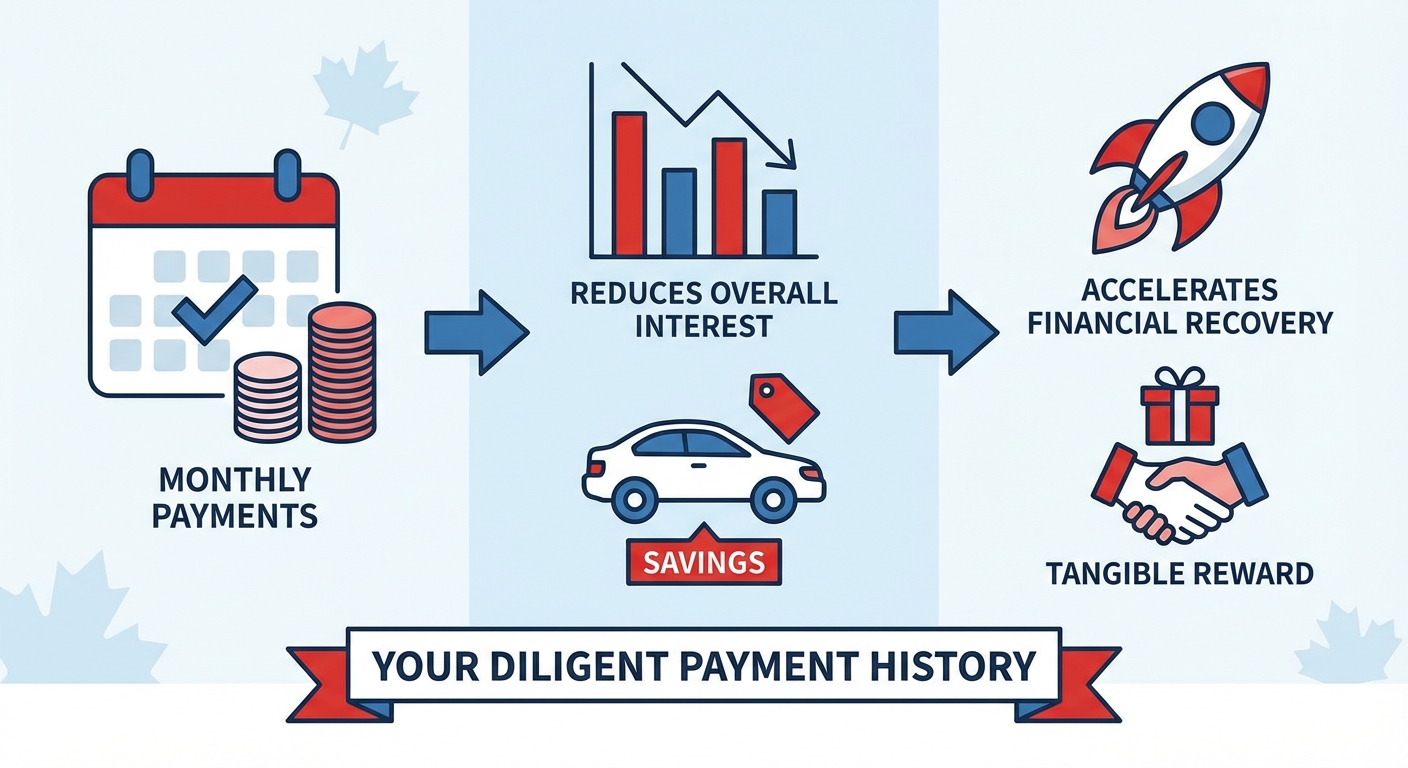

Refinancing Opportunities: Lowering Your Payments, Saving on Interest

The elevated interest rate on your initial post-bankruptcy car loan is not necessarily a permanent fixture. A key part of your financial recovery strategy should be to aim for refinancing. Typically, after 12-18 months of consistent, on-time payments, your credit score will show a noticeable improvement. This is the ideal time to consider refinancing. The process involves shopping for better rates with your improved credit profile, potentially with a prime lender.

Refinancing can significantly free up monthly cash flow by lowering your interest rate and reducing your monthly payments. It also reduces your overall interest paid over the life of the loan, accelerating your financial recovery and making your vehicle more affordable in the long term. This is a tangible reward for your diligent payment history.

Beyond the Car: Holistic Financial Wellness in Alberta

Acquiring a car after bankruptcy is a significant milestone, but it's part of a larger journey towards comprehensive financial recovery. Mastering budgeting strategies is essential. Create a sustainable financial plan that meticulously accounts for loan payments, insurance, fuel, savings, emergency funds, and other essential expenses. Many financial literacy resources and credit counselling services are available in Edmonton and across Alberta to strengthen your long-term financial health.

The ultimate goal isn't just to acquire a car; it's to achieve future stability, peace of mind, and lasting financial freedom. Your car loan is a powerful tool in this journey, but it's the disciplined financial habits you build around it that will ensure your long-term success.

Your Next Steps to Approval: An Action Plan for Essential Workers in Edmonton

Ready to get back on the road with confidence? Here's your clear action plan:

- Step 1: Get Organized – Compile all necessary documents, including your official bankruptcy discharge papers, proof of income, and identification. Having everything ready saves time and demonstrates your seriousness.

- Step 2: Know Your Budget Intimately – Determine precisely what you can realistically afford for monthly payments. Factor in not just the loan, but also insurance (which can be higher post-bankruptcy), fuel, and essential maintenance costs for Edmonton's climate.

- Step 3: Research Lenders Wisely – Seek out reputable lenders and auto loan specialists in Edmonton and Alberta who have proven experience with post-bankruptcy financing. Read testimonials and reviews to gauge their transparency and customer service.

- Step 4: Maximize Your Down Payment – Even a modest down payment can dramatically improve your approval odds, reduce your overall loan amount, and secure better loan terms by lowering the lender's risk.

- Step 5: Apply Strategically – Utilize pre-approvals to understand your borrowing power and minimize multiple hard credit inquiries. Only submit full applications to a select few, well-researched lenders that understand your situation.

- Step 6: Choose Your Vehicle Smartly – Prioritize reliability, affordability, and practical features over luxury or excessive bells and whistles. A practical vehicle supports your financial recovery, especially for essential work.

- Step 7: Read the Fine Print Meticulously – Before signing, thoroughly understand all loan terms, interest rates, repayment schedules, and any associated fees. Ask questions until you are completely clear on every detail.