Get Car Loan After Debt Program Completion: 2026 Guide

Table of Contents

- Your Quick Path to Approval: Key Takeaways

- Phase 1: Setting the Stage for Success (Before You Even Apply)

- Your Post-DMP Credit Report: What Lenders Actually See

- Gathering Your 'Approval Toolkit': The Documents You'll Need

- Budgeting for Reality: How Much Car Can You *Sustainably* Afford?

- Phase 2: Navigating the Lender Landscape: Who Will Say 'Yes'?

- Big Banks (RBC, TD, etc.) vs. Credit Unions: A Tale of Two Approaches

- The Specialists: In-House Dealership Financing & Non-Prime Lenders

- Phase 3: The Mechanics of Your Loan: Decoding Rates, Terms, and Costs

- Why Your Interest Rate Will Be Higher (And How to Mitigate It)

- Loan Term vs. Monthly Payment: Finding the Right Balance

- Phase 4: Execution: From Application to Driving Away Responsibly

- Building Your Bulletproof Car Loan Application

- Your New Loan: Turning a Liability into a Credit-Building Asset

- Your Roadmap to the Driver's Seat: A Final Checklist

- Frequently Asked Questions About Post-DMP Car Loans

Congratulations. You did it. You navigated the challenging path of a Debt Management Program (DMP) and emerged on the other side with control over your finances. That is a monumental achievement worth celebrating. Now, as you look towards the future, a reliable vehicle is often the next critical piece of the puzzle—for work, for family, for reclaiming your independence.

But the thought of applying for a car loan can be daunting. You might be wondering: Will anyone approve me? Am I destined for a sky-high interest rate? How do I avoid the same debt traps that got me into trouble before?

This is not just another article with vague advice. This is your comprehensive, strategic guide for 2026. At SkipCarDealer.com, we specialize in helping Canadians in your exact situation. We understand the nuances of post-DMP financing, and we're here to give you the exact playbook to not only get approved but to secure a fair deal that builds your credit and drives you forward.

Your Quick Path to Approval: Key Takeaways

- Prove It's Over: Your Debt Management Program (DMP) Completion Certificate is your golden ticket. It's non-negotiable proof for lenders.

- Time is Your Ally: The more time between DMP completion and your loan application, the better. Use this time to build a positive payment history.

- Think Beyond Big Banks: Specialized non-prime lenders and credit unions are often more receptive to post-DMP applicants than the major banks.

- Your Income is King: Lenders will focus heavily on your current, stable, and provable income to ensure you can handle the new payment.

- Pre-Approval is Power: Get pre-approved before you step into a dealership. This gives you negotiating power and sets a realistic budget.

Phase 1: Setting the Stage for Success (Before You Even Apply)

Getting a car loan after a DMP is a strategic process. The most critical work happens before you even speak to a lender. This prep work dramatically increases your odds of approval and ensures you get a fair rate, not a predatory one.

To get a car loan after completing a debt management program, you must first obtain your DMP Completion Certificate and verify its notation on your Equifax and TransUnion credit reports. Next, gather proof of stable income and create a strict budget. Finally, seek pre-approval from a specialized non-prime lender or credit union who understands your financial history.

Your Post-DMP Credit Report: What Lenders Actually See

Your credit report tells the story of your financial past. After a DMP, that story has a unique chapter that lenders need to understand correctly.

- Deep Dive: When you were in a DMP, the accounts included were likely coded as 'R7' on your credit report. This code signifies that you are making consolidated payments under a special arrangement. It's a negative mark, but it's significantly better than the 'R9' code associated with bankruptcy or accounts sent to collections. Completing the DMP successfully shows lenders you fulfilled your obligation, which is a major point in your favour.

- Get Your Reports: In Canada, you have the right to access your credit reports for free. Pull both your Equifax and TransUnion reports. Lenders may use one or the other, so you need to see what both are reporting.

- Scrutinize Every Line: Your mission is to ensure the story is accurate. Look for two key things:

- All accounts that were part of the DMP should be marked as "Paid in full" or "Settled."

- There should be an official notation or public record on your report indicating the Debt Management Program is complete.

PRO TIP: Dispute Errors *Before* Applying

In our experience, mistakes are common. An old creditor might have failed to update an account's status. If you find an error, dispute it immediately with the credit bureau. Applying for a loan with an inaccurate report that shows an open collection account from your DMP is a recipe for instant denial. A clean, accurate report is the foundation of your comeback story.

Gathering Your 'Approval Toolkit': The Documents You'll Need

Lenders need to verify everything. Walking in prepared with a complete "Approval Toolkit" shows you're serious, organized, and transparent. It builds trust from the very first interaction.

- The Essential List:

- DMP Completion Certificate: This is non-negotiable. It's the official proof that your past debts are resolved.

- Recent Pay Stubs: Have at least 3 months of your most recent pay stubs ready. This is how lenders calculate your Debt-to-Income (DTI) ratio.

- Letter of Employment: A simple letter from your employer on company letterhead confirming your position, start date, and annual salary or hourly wage. This proves stability.

- Utility Bills or Bank Statements: These are used to verify your address. Make sure the name and address match your driver's license exactly.

- Why Each Document Matters: From a lender's perspective, your credit score is only part of the puzzle. They are primarily concerned with your ability to repay the new loan. Pay stubs prove income, the employment letter proves stability, and the DMP certificate proves the past is truly in the past.

- Scenario: Calgary Freelancer vs. Toronto Salaried Employee: A salaried employee in Toronto can easily provide pay stubs. But what about a freelance graphic designer in Calgary? They'll need more. This could include Notices of Assessment from the CRA for the past two years, bank statements showing consistent client deposits, and signed contracts for upcoming work. If you're self-employed, providing thorough documentation is key. For a deeper dive, our guide on Self-Employed? Your Bank Account *Is* Your Proof. Get Approved. can be incredibly helpful.

Budgeting for Reality: How Much Car Can You *Sustainably* Afford?

A lender might approve you for a $400 monthly payment, but that doesn't mean you can actually afford it. The biggest mistake you can make is letting a lender's approval number dictate your budget. To avoid repeating past debt cycles, you must do the opposite.

- The 20/4/10 Rule (Adapted): The classic rule is 20% down, a 4-year (48-month) loan term, and ensuring the total monthly car cost (payment + insurance + gas) is no more than 10% of your gross monthly income. For a post-DMP situation, we suggest a more conservative approach:

- 10% Down Payment: Aim for at least 10% down. It shows commitment and reduces the loan amount.

- 4-5 Year Term: Try to stick to a 60-month term at the absolute maximum.

- 15% of *Net* Income: Base your calculation on your take-home pay, not your gross pay. And cap your total vehicle expenses at 15% of that number.

- Factor in the 'Hidden' Costs: Your car payment is just the beginning.

- Insurance: Call your insurance broker with the Vehicle Identification Number (VIN) of a car you're considering. Post-DMP, your insurance rates may be higher. Get a real quote, not a guess.

- Fuel: Estimate your daily commute in kilometres and use current gas prices to get a realistic monthly fuel budget.

- Maintenance: A good rule of thumb is to set aside $50-$100 per month for routine maintenance like oil changes, tires, and unexpected repairs.

PRO TIP: Budget First, Shop Second

Create a detailed spreadsheet of all your post-DMP monthly income and expenses. See exactly what you have left over. Let that number—and only that number—determine the maximum car payment you will consider. This single act of discipline will protect you from sweet-talking salespeople and prevent you from ever falling back into a debt spiral.

Phase 2: Navigating the Lender Landscape: Who Will Say 'Yes'?

After a DMP, the front door of a major bank might feel locked. The key is knowing which doors to knock on. Not all lenders are created equal, and understanding their different appetites for risk is critical to your success.

Big Banks (RBC, TD, etc.) vs. Credit Unions: A Tale of Two Approaches

These institutions are typically the first place people think of for a loan, but their processes can be unforgiving for anyone with a blemish on their credit report.

- Big Banks: Canada's 'Big 5' banks often rely on automated, algorithm-based approval systems. If your credit score doesn't meet a certain threshold, the computer says "no" before a human even sees your file. The R7 rating from your DMP can be an automatic disqualifier for these systems. Your best chance is if you have a long-standing, positive relationship with the bank (like a chequing account for 10+ years) and it has been at least 2-3 years since you completed your DMP.

- Credit Unions: As member-owned, community-focused institutions, credit unions can be more flexible. They are often more willing to perform a manual review of your application. They'll look at your whole story: your stable job, your connection to the community, and the fact you successfully completed your DMP.

- Real-World Example: Imagine an applicant who works at a major factory in a smaller Ontario town. A large national bank's algorithm in Toronto might just see a low credit score. But the local credit union manager knows that factory provides stable, long-term employment. They're more likely to consider that local context and approve the loan, seeing you as a neighbour, not just a number.

The Specialists: In-House Dealership Financing & Non-Prime Lenders

This is where most post-DMP applicants find success. Companies like SkipCarDealer.com work directly with a network of lenders who specialize in what the industry calls 'non-prime' or 'subprime' credit situations.

- What Does 'Non-Prime' Mean? It simply means your credit profile falls outside the ideal 'prime' range that big banks look for. It's not a judgment; it's a risk category. These lenders have built their entire business model around evaluating and approving applicants with histories that include things like DMPs, consumer proposals, or bankruptcies.

- The Pros: The single biggest advantage is a much higher chance of approval. These lenders understand your situation. They know what a DMP completion certificate means and are willing to focus on your current income and stability rather than dwelling on the past.

- The Cons: There's no sugar-coating it: the interest rates will be higher. This is the trade-off. The lender is taking on more perceived risk by lending to you, and the higher interest rate is their compensation for that risk. You must also be vigilant about extra fees or mandatory warranties.

PRO TIP: Compare, Compare, Compare

Specialist lenders are your most likely path to driving away in a new car, but you hold the power. Never accept the first offer you receive. Getting pre-approved from a trusted source like SkipCarDealer.com allows you to walk into any dealership with a firm offer in hand. This forces them to compete for your business and ensures you get the best possible rate available for your situation.

Phase 3: The Mechanics of Your Loan: Decoding Rates, Terms, and Costs

This is where we get into the numbers. Understanding these concepts isn't just important—it's your primary defense against a bad deal. This knowledge can save you thousands of dollars over the life of your loan.

Why Your Interest Rate Will Be Higher (And How to Mitigate It)

It's crucial to understand the 'why' behind your interest rate. It's not personal; it's just business.

- Expertise Deep Dive: Risk-Based Pricing: Lenders use a model called risk-based pricing. A borrower with an 800 credit score and a perfect payment history is a very low risk, so they get a low "prime" interest rate. Your completed DMP, while a positive step, still signals a history of financial difficulty. To the lender, this represents a higher risk of default. The higher interest rate acts as their insurance policy against that elevated risk.

- Typical Rate Ranges: While rates fluctuate with the market, here's a realistic snapshot for 2026:

- Prime Borrower (Score 750+): 5% to 8%

- Post-DMP Applicant (Score 550-650): 10% to 29%+

- The Power of a Down Payment: A substantial down payment (10-20% of the vehicle's price) is the single most effective tool you have. It lowers the total amount you need to borrow (the 'loan-to-value' ratio), which directly reduces the lender's risk. In many cases, a strong down payment can help you secure a lower interest rate.

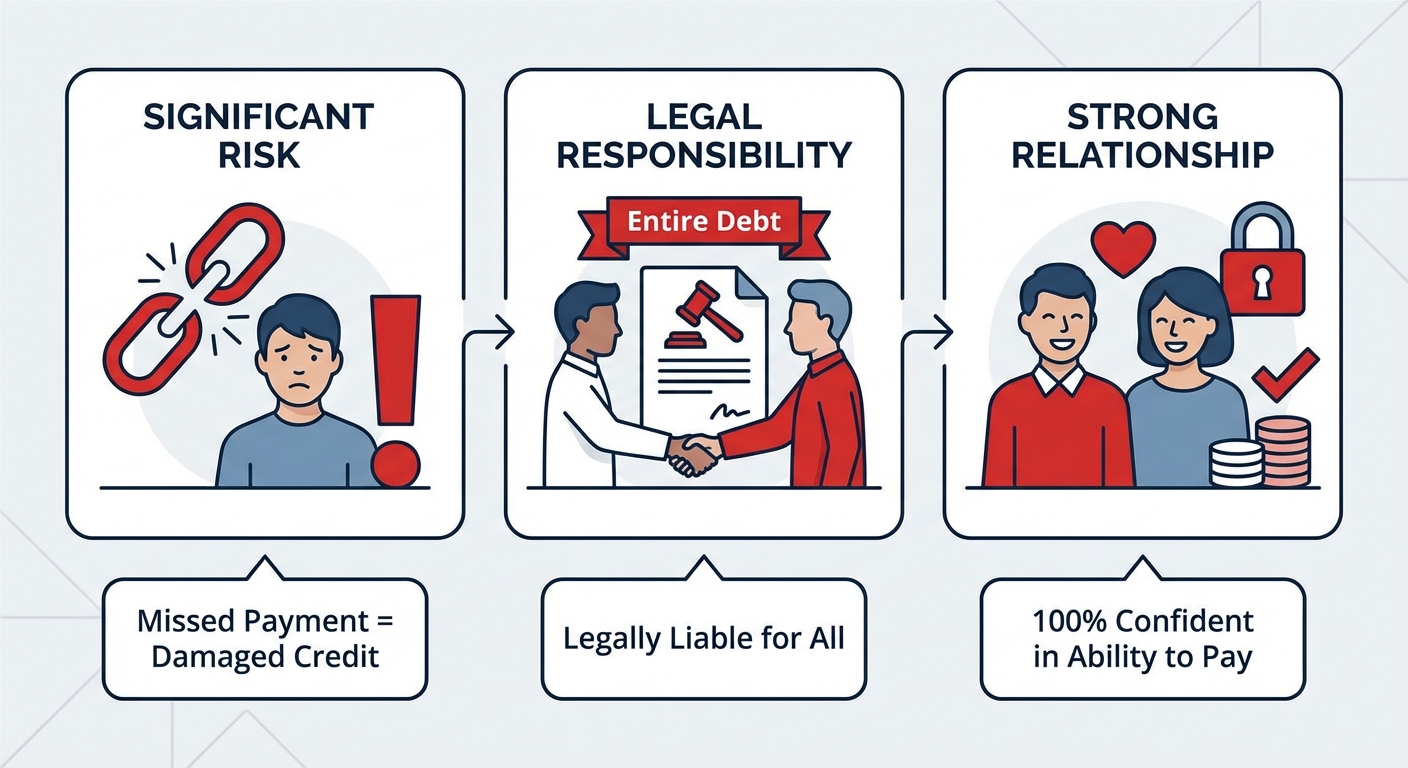

- The Co-Signer Question: Bringing on a co-signer with strong credit can help you get approved and secure a better rate. However, this is a significant risk for them. If you miss a payment, their credit is damaged, and they are legally responsible for the entire debt. Only consider this option if you have an incredibly strong relationship and are 100% confident in your ability to pay.

| Metric | Prime Borrower | Post-DMP Borrower |

|---|---|---|

| Interest Rate | 7% | 18% |

| Monthly Payment | $401 | $508 |

| Total Interest Paid | $4,038 | $10,488 |

| Total Cost of Car | $24,038 | $30,488 |

Loan Term vs. Monthly Payment: Finding the Right Balance

Finance managers are masters at focusing your attention on the monthly payment. They might say, "We can get you into this truck for just $200 bi-weekly!" What they don't emphasize is that to achieve that payment, they've stretched your loan term to 84 or even 96 months (7-8 years).

- The Long-Term Loan Trap: A lower monthly payment feels good in the short term, but it's a dangerous trap. Over a longer term, you pay thousands, sometimes tens of thousands, more in interest. Worse, cars depreciate quickly. On a long-term loan, you can easily end up in a "negative equity" situation, where you owe more on the car than it's worth. This makes it impossible to sell or trade in the vehicle without paying out of pocket.

- Scenario: The Edmonton F-150: Let's say a buyer in Edmonton wants a used Ford F-150 for $30,000. At a 15% interest rate:

- 60-Month Term: Monthly payment is ~$715. Total interest paid is ~$12,900.

- 84-Month Term: Monthly payment is ~$580. It looks more affordable! But the total interest paid balloons to ~$18,700.

Aim for the shortest loan term you can comfortably afford based on the budget you already created. The goal is to become debt-free again, not to sign up for another decade of payments.

Phase 4: Execution: From Application to Driving Away Responsibly

You've done the prep work. You understand the landscape and the numbers. Now it's time to execute the plan and secure your vehicle.

Building Your Bulletproof Car Loan Application

Follow this process to maintain control and ensure you get the best deal possible.

- Get Pre-Approved Online: Before you even think about a specific car, get a pre-approval from a specialist like SkipCarDealer.com. This tells you exactly how much you can borrow and at what interest rate. It's your baseline.

- Use the Pre-Approval to Set Your Budget: Your pre-approved amount is your maximum ceiling. Stick to it. Remember to leave room for taxes and fees.

- Shop for the *Car*, Not the Financing: With a pre-approval in your pocket, you can walk into a dealership as a cash buyer. Negotiate the price of the vehicle confidently, knowing your financing is already arranged.

- Compare the Dealer's Offer: The dealership's finance office will almost certainly offer to beat your pre-approval. Let them try! If they can offer a lower interest rate or better terms, great. If not, you can stick with your original, solid offer. You win either way.

When talking to finance managers, be polite but firm. Watch out for "payment packing," where they sneak in extras like extended warranties, rust-proofing, or life insurance without clearly breaking down the cost. Ask for an itemized bill of sale and question every single line item. If you don't want it, say "no thank you."

Your New Loan: Turning a Liability into a Credit-Building Asset

This car loan is more than just a way to get from A to B. It's your single best opportunity to rebuild your credit score and prove to the financial world that you are a responsible borrower.

- The #1 Rule: Never, Ever Miss a Payment. This is the most important rule. Set up automatic withdrawals from your bank account to align with your paydays. One late payment can set your credit-rebuilding journey back by months.

- Making Bi-Weekly Payments: If you get paid bi-weekly, setting up bi-weekly payments can be a smart move. You'll make 26 payments a year, which is equivalent to 13 full monthly payments. This simple trick helps you pay the loan off faster and save on total interest.

- The 12-18 Month Plan: After a year of perfect, on-time payments, your credit score will have improved significantly. At the 12 to 18-month mark, you should explore refinancing your loan. With a better credit score, you may be able to secure a much lower interest rate, which will reduce your monthly payment and save you a substantial amount of money for the remainder of the term.

Your Roadmap to the Driver's Seat: A Final Checklist

You've come a long way. Getting a car loan after a DMP is entirely possible with the right strategy. Before you start, run through this final checklist to ensure you're ready for success.

- Confirm: Your DMP is officially complete and this is accurately reflected on both your Equifax and TransUnion credit reports.

- Budget: You know exactly what you can afford for a total monthly vehicle cost, including the payment, insurance, and fuel.

- Prepare: You have gathered all your documents—your DMP certificate, pay stubs, and employment letter—into your 'Approval Toolkit'.

- Pre-Approve: You have a solid pre-approval from a specialized lender or credit union to use as your negotiating tool.

- Compare: You are committed to not accepting the first offer and will let lenders compete for your business.

- Execute: You will stick to your budget at the dealership, scrutinize the final bill, and manage your new loan perfectly to rebuild your credit.